Reports

Reports

A multitude of factors are helping the Global Molded Plastics Market chart a notable growth trajectory over the forecast period of 2016 to 2024. Some of the industries that are growing, driving the demand for molded plastics, are consumable and electronics, building and construction, and automotive and transportation. And, as the Global Molded Plastics Market grows, the landscape would be market by new growth opportunities that players who are active and aggressive will leave no stone unturned to make the most of.

Some of the notable developments and factors that are helping the Global Molded Plastics Market chart the projected growth over the forecast period are elaborated below.

Increased oil and gas production activity and associated industrial development, as well as rapid expansion in the construction and packaging industries have contributed significantly to the rise in demand for molded plastic products. Collaboration with multinational players has helped plastic converters develop molded plastics that comply with world-class quality requirements and over the decades, plastics have replaced key materials such as metals, glass, and paper to become an integral part of our everyday life.

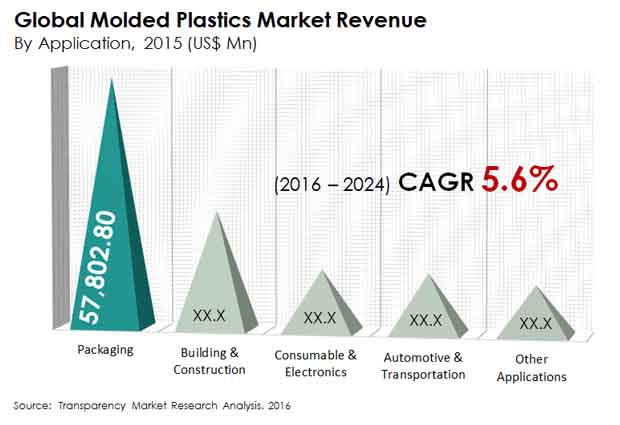

The global molded plastics market was valued at US$124.8 bn in 2015 and is projected to reach US$202.2 bn by 2024 at a CAGR of 5.6% therein. In terms of volume, the market is expected expand at a 4.3% CAGR from 2016 to 2024.

Molded plastics find application in various end-use industries, including packaging, consumables and electronics, automotive and transportation, and building and construction.

The packaging application leads the molded plastics market in terms of volume as well as value. This industry is anticipated to remain the most prominent consumer of molded plastics during the forecast period, with the consumption volume amounting to almost 30% more than any other application. The price of molded plastics used for packaging has been slightly higher than that for any other application and this is also contributing to the growth of the packaging segment by value.

The commercialization of advanced polymers is supporting the demand for molded plastics in the building and construction sector. Transparency Market Research has observed that molded plastic products used for building and construction have been witnessing increased growth and the emerging markets in Asia Pacific are significant contributors to this growth.

Geographically, the molded plastics market has been segmented into five regions: North America, Asia Pacific, Europe, the Middle East and Africa, and Latin America. Asia Pacific, with countries such as India and China, led the global molded plastics market by volume, and is anticipated to account for a share of 49% by the end of 2016. This is followed by Europe and North America and the total revenue in these two regions together will constitute around 29% of the total market value by 2016 end.

Asia Pacific is expected to remain the most attractive region for the molded plastics market given that more than half the global population and emerging markets are in Asia Pacific. As a result, international players have increased their focus on the region.

The Middle East and Africa is a fast-growing region, with the GCC leading the market for molded plastics in terms of volume. This regional market is anticipated to expand at a CAGR of 6.5% between 2016 and 2024. Companies such as SABIC in Saudi Arabia are rapidly increasing their capacity for polypropylene, polyethylene, and other polymers to take advantage of untapped avenues.

The markets for molded plastics in North America and Europe are rather mature and provide limited opportunities in terms of untapped potential. However, the CIS region in Europe is a bright spot where the molded plastics market is expected to expand at a faster pace than in other parts of the region.

Key players in the molded plastics market include BASF SE, Eastman Chemical Company, SABIC, Huntsman Corporation, LyondellBasell Industries N.V., INEOS Group AG, Chevron Phillips Chemical Company LLC, Reliance Industries Limited, Harwal Group, Al Watania Plastics, Obeikan Investment Group (OIG), and Takween Advanced Industries.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

1.3 Research Objectives

1.4 Key Questions Answered

Section 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

Section 3 Executive Summary

3.1 Global Molded Plastics Market Size, By Market Value (US$ Bn) and Market Value Share, By Region

3.2 Market Size, Indicative (US$ Bn)

3.3 Top 3 Trends

Section 4 Market Overview

4.1 Segregation Overview

4.2 Plastic Production – Global Scenario

4.3 Drivers and Restraints Snapshot Analysis

4.4 Drivers

4.5 Restraints

4.6 Opportunity Analysis

4.7 Porter’s Analysis

4.7.1 Threat of Substitutes

4.7.2 Threat of Buyers

4.7.3 Threat of New Entrants

4.7.4 Threat of Suppliers

4.7.5 Degree of Competition

4.8 Value Chain Analysis

4.9 Global Molded Plastics Market Analysis and Forecasts, 2015 – 2024

4.10 Key Insights

Section 5 Global Molded Plastics Market Analysis and Forecasts, By Material

5.1 Key Findings

5.2 Introduction

5.3 Key Trends

5.4 Market Size (Kilo Tons) (US$ Mn) Forecast, By Material

5.4.1 Polypropylene

5.4.2 Polyethylene

5.4.3 Polyvinyl Chloride

5.4.4 Polystyrene

5.4.5 Polyethylene Terephthalate (Preforms)

5.4.6 Polyethylene Terephthalate (Others)

5.4.7 Others

5.5 Molded Plastics Market Attractiveness Analysis, By Material Type

Section 6 Global Molded Plastics Market Analysis, By Technology

6.1 Key Findings

6.2 Introduction

6.3 Key Trends

6.4 Market Size (Kilo Tons) (US$ Mn) Forecast, By Technology

6.4.1 Injection Molding (Preforms)

6.4.2 Injection Molding (Others)

6.4.3 Blow Molding

6.4.4 Thermoforming

6.4.5 Others

6.5 Molded Plastics Market Attractiveness Analysis, By Technology Type 5.11 Bajaj Electricals Ltd.

Section 7 Global Molded Plastics Market Analysis and Forecasts, By Application

7.1 Key Findings

7.2 Introduction (2/2)

7.3 Key Trends

7.4 Market Size (Kilo Tons) (US$ Mn) Forecast, By Application

7.4.1 Packaging

7.4.2 Consumable & Electronics

7.4.3 Automotive & Transportation

7.4.4 Building & Construction

7.4.5 Other Applications

7.5 Molded Plastics Market Attractiveness Analysis, By Application

7.6 Application Comparison Matrix

Section 8 Global Molded Plastics Market Analysis, By Region

8.1 Global Regulatory Scenario

8.2 Molded Plastics Market Forecast By Region

8.3 Molded Plastics Market Attractiveness Analysis, By Region Type

Section 9 North America Molded Plastics Market Analysis

9.1 Key Findings

9.2 North America Molded Plastics Market Overview

9.3 North America Market Value Share Analysis, By Material

9.4 North America Molded Plastics Market Forecast By Material Type

9.5 North America Market Value Share Analysis, By Technology

9.6 North America Market Value Share Analysis, By Application

9.7 North America Market Value Share Analysis, By Country

9.7.1 U.S. Molded Plastics Market Analysis

9.7.2 Canada Molded Plastics Market Analysis

9.8 North America Market Attractiveness Analysis

9.8.1 By Material

9.8.2 By Technology

9.8.3 By Application

9.9 North America Market Trends

Section 10 Europe Molded Plastics Market Analysis

10.1 Key Findings

10.2 Europe Molded Plastics Market Overview

10.3 Europe Market Value Share Analysis, By Material

10.4 Europe Molded Plastics Market Forecast By Material Type

10.5 Europe Market Value Share Analysis, By Technology

10.6 Europe Market Value Share Analysis, By Application

10.7 Europe Market Value Share Analysis, By Country

10.7.1 Germany Molded Plastics Market Analysis

10.7.2 France Molded Plastics Market Analysis

10.7.3 U.K. Molded Plastics Market Analysis

10.7.4 Italy Molded Plastics Market Analysis

10.7.5 Spain Molded Plastics Market Analysis

10.7.6 Rest of Europe Molded Plastics Market Analysis

10.8 Europe Market Attractiveness Analysis

10.8.1 By Material

10.8.2 By Technology

10.8.3 By Application

10.9 Europe Market Trends

Section 11 Asia Pacific Molded Plastics Market Analysis

11.1 Key Findings

11.2 Asia Pacific Molded Plastics Market Overview

11.3 Asia Pacific Market Value Share Analysis, By Material

11.4 Asia Pacific Molded Plastics Market Forecast By Material Type

11.5 Asia Pacific Market Value Share Analysis, By Technology

11.6 Asia Pacific Market Value Share Analysis, By Application

11.7 Asia Pacific Market Value Share Analysis, By Country

11.7.1 China Molded Plastics Market Analysis

11.7.2 Japan & South Korea Molded Plastics Market Analysis

11.7.3 India Molded Plastics Market Analysis

11.7.4 ASEAN Molded Plastics Market Analysis

11.7.5 Rest of Asia Pacific Molded Plastics Market Analysis

11.8 Asia Pacific Market Attractiveness Analysis

11.8.1 By Material

11.8.2 By Technology

11.8.3 By Application

11.9 Asia Pacific Market Trends

Section 12 Middle East & Africa (MEA) Molded Plastics Market Analysis

12.1 Key Findings

12.2 MEA Molded Plastics Market Overview

12.3 MEA Market Value Share Analysis, By Material

12.4 MEA Molded Plastics Market Forecast By Material Type

12.5 MEA Market Value Share Analysis, By Technology

12.6 MEA Market Value Share Analysis, By Application

12.7 MEA Market Value Share Analysis, By Country

12.7.1 GCC Molded Plastics Market Analysis

12.7.2 Egypt Molded Plastics Market Analysis

12.7.3 South Africa Molded Plastics Market Analysis

12.7.4 Italy Molded Plastics Market Analysis

12.7.5 Rest of MEA Molded Plastics Market Analysis

12.8 Asia Pacific Market Attractiveness Analysis

12.8.1 By Material

12.8.2 By Technology

12.8.3 By Application

12.9 Asia Pacific Market Trends

Section 13 Latin America Molded Plastics Market Analysis

13.1 Key Findings

13.2 Latin America Molded Plastics Market Overview

13.3 Latin America Market Value Share Analysis, By Material

13.4 Latin America Molded Plastics Market Forecast By Material Type

13.5 Latin America Market Value Share Analysis, By Technology

13.6 Latin America Market Value Share Analysis, By Application

13.7 Latin America Market Value Share Analysis, By Country

13.7.1 Brazil Molded Plastics Market Analysis

13.7.2 Egypt Molded Plastics Market Analysis

13.7.3 Rest of Latin America Molded Plastics Market Analysis

13.8 Latin America Market Attractiveness Analysis

13.8.1 By Material

13.8.2 By Technology

13.8.3 By Application

13.9 Latin America Market Trends

13.8 Latin America Market Attractiveness Analysis

13.8.1 By Material

13.8.2 By Technology

13.8.3 By Application

13.9 Latin America Market Trends

Section 14 Company Profile

14.1 Molded Plastics Market Share Analysis By Company (2015)

14.2 Competition Matrix

14.3 Key Global Players

14.3.1 BASF SE

14.3.1.1 Company Details

14.3.1.2 Company Description

14.3.1.3 SWOT Analysis

14.3.1.4 Strategic Overview

14.3.2 Eastman Chemical Company

14.3.2.1 Company Details

14.3.2.2 Company Description

14.3.2.3 SWOT Analysis

14.3.2.4 Strategic Overview

14.3.3 SABIC

14.3.3.1 Company Details

14.3.3.2 Company Description

14.3.3.3 SWOT Analysis

14.3.3.4 Strategic Overview

14.3.4 Huntsman Corporation

14.3.4.1 Company Details

14.3.4.2 Company Description

14.3.4.3 SWOT Analysis

14.3.4.4 Strategic Overview

14.3.5 LyondellBasell Industries N.V.

14.3.5.1 Company Details

14.3.5.2 Company Description

14.3.5.3 SWOT Analysis

14.3.5.4 Strategic Overview

14.3.6 INEOS Group AG

14.3.6.1 Company Details

14.3.6.2 Company Description

14.3.6.3 SWOT Analysis

14.3.6.4 Strategic Overview

14.3.7 Chevron Phillips Chemical Company LLC

14.3.7.1 Company Details

14.3.7.2 Company Description

14.3.7.3 SWOT Analysis

14.3.7.4 Strategic Overview

14.3.8 Reliance Industries Limited

14.3.8.1 Company Details

14.3.8.2 Company Description

14.3.8.3 SWOT Analysis

14.3.8.4 Strategic Overview

14.4 Key Regional Players

14.4.1 Harwal Group

14.4.1.1 Company Details

14.4.1.2 Company Description

14.4.1.3 SWOT Analysis

14.4.1.4 Strategic Overview

14.4.2 Rowad Plastic Group

14.4.2.1 Company Details

14.4.2.2 Company Description

14.4.2.3 SWOT Analysis

14.4.2.4 Strategic Overview

14.4.3 Al Watania Plastics

14.4.3.1 Company Details

14.4.3.2 Company Description

14.4.3.3 SWOT Analysis

14.4.3.4 Strategic Overview

14.4.4 Obeikan Investment Group (OIG)

14.4.4.1 Company Details

14.4.4.2 Company Description

14.4.4.3 SWOT Analysis

14.4.4.4 Strategic Overview

14.4.5 Takween Advanced Industries

14.4.5.1 Company Details

14.4.5.2 Company Description

14.4.5.3 SWOT Analysis

14.4.5.4 Strategic Overview

14.4.6 Vishal Beverages Pvt. Ltd.

14.4.6.1 Company Details

14.4.6.2 Company Description

14.4.6.3 SWOT Analysis

14.4.6.4 Strategic Overview

14.4.7 THAI PET INDUSTRIAL COMPANY LIMITED

14.4.7.1 Company Details

14.4.7.2 Company Description

14.4.8 Oriyon Molding

14.4.8.1 Company Details

14.4.8.2 Company Description

14.4.9 Tech Plaastic Industrie Private Limited

14.4.9.1 Company Details

14.4.9.2 Company Description

List of Figures

Figure 1: Global Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 2: Global Plastics Average Price (US$/ Ton) 2015–2024

Figure 3: Global Molded Plastics Market Value Share Analysis, By Material Type, 2016 and 2024

Figure 4: Polypropylene, 2015 – 2024 (US$ Mn)

Figure 5: Polyethylene, 2015 – 2024 (US$ Mn)

Figure 6: Polyvinyl Chloride, 2015 – 2024 (US$ Mn)

Figure 7: Polystyrene, 2015 – 2024 (US$ Mn)

Figure 8: Polyethylene Terephthalate (Preforms), 2015 – 2024 (US$ Mn)

Figure 9: Polyethylene Terephthalate (Others), 2015 – 2024 (US$ Mn)

Figure 10: Other Materials, 2015 – 2024 (US$ Mn)

Figure 11: Molded Plastics Market Attractiveness Analysis, By Product Type

Figure 13: Injection Molding (Preforms), 2015 – 2024 (US$ Mn)

Figure 14: Injection Molding (Others), 2015 – 2024 (US$ Mn)

Figure 15: Blow Molding, 2015 – 2024 (US$ Mn)

Figure 16: Thermoforming, 2015 – 2024 (US$ Mn)

Figure 17: Others, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 18: Molded Plastics Market Attractiveness Analysis By Technology

Figure 19: Packaging, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 20: Consumable & Electronics, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 21: Automotive & Transportation, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 22: Building & Construction, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 23: Others, 2015 – 2024 (Kilo Tons) (US$ Mn)

Figure 24: Molded Plastics Market Attractiveness Analysis, By Application

Figure 25: Molded Plastics Market Attractiveness Analysis, By Region Type

Figure 26: North America Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 27: North America Molded Plastics Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 28: North America Market Attractiveness Analysis, By Country

Figure 29: North America Market Value Share Analysis, By Material, 2016 and 2024

Figure 30: North America Market Value Share Analysis, By Technology, 2016 and 2024

Figure 31: North America Market Value Share Analysis, By Application Type, 2016 and 2024

Figure 32: North America Market Value Share Analysis, By Country, 2016 and 2024

Figure 33: U.S. Molded Plastics Market Analysis

Figure 34: Canada Molded Plastics Market Analysis

Figure 35: By Material

Figure 36: By Technology

Figure 37: By Application

Figure 38: Europe Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 39: Nor Europe Molded Plastics Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 40: Europe Market Attractiveness Analysis, By Country

Figure 41: Europe Market Value Share Analysis, By Material, 2016 and 2024

Figure 42: Europe Market Value Share Analysis, By Technology, 2016 and 2024

Figure 43: Europe Market Value Share Analysis, By Application Type, 2016 and 2024

Figure 44: Europe Market Value Share Analysis, By Country, 2016 and 2024

Figure 45: Germany Molded Plastics Market Analysis

Figure 46: France Molded Plastics Market Analysis

Figure 47: U.K. Molded Plastics Market Analysis

Figure 48: Italy Molded Plastics Market Analysis

Figure 49: Spain Molded Plastics Market Analysis

Figure 50: Rest of Europe Molded Plastics Market Analysis

Figure 51: By Material

Figure 52: By Technology

Figure 53: By Application

Figure 54: Asia Pacific Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 55: Asia Pacific Molded Plastics Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 56: Asia Pacific Market Attractiveness Analysis, By Country

Figure 57: Asia Pacific Market Value Share Analysis, By Material, 2016 and 2024

Figure 58: Asia Pacific Market Value Share Analysis, By Technology, 2016 and 2024

Figure 59: Asia Pacific Market Value Share Analysis, By Application Type, 2016 and 2024

Figure 60: Asia Pacific Market Value Share Analysis, By Country, 2016 and 2024

Figure 61: China Molded Plastics Market Analysis

Figure 62: Japan and South Korea Molded Plastics Market Analysis

Figure 63: India Molded Plastics Market Analysis

Figure 63: ASEAN Molded Plastics Market Analysis

Figure 65: Rest of Asia Pacific Molded Plastics Market Analysis

Figure 66: By Material

Figure 67: By Technology

Figure 68: By Application

Figure 69: MEA Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 70: MEA Molded Plastics Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 71: MEA Market Attractiveness Analysis, By Country

Figure 72: MEA Market Value Share Analysis, By Material, 2016 and 2024

Figure 73: MEA Market Value Share Analysis, By Technology, 2016 and 2024

Figure 74: MEA Market Value Share Analysis, By Application Type, 2016 and 2024

Figure 75: North America Market Value Share Analysis, By Country, 2016 and 2024

Figure 76: GCC Molded Plastics Market Analysis

Figure 77: Egypt Molded Plastics Market Analysis

Figure 78: South Africa Molded Plastics Market Analysis

Figure 79: Rest of Middle East and Africa Molded Plastics Market Analysis

Figure 80: By Material

Figure 81: By Technology

Figure 82: By Application

Figure 83: Latin America Molded Plastics Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 84: Latin America Molded Plastics Market Size and Volume Y-o-Y Growth Projections, 2015–2024

Figure 85: Latin America Market Attractiveness Analysis, By Country

Figure 86: Latin America Market Value Share Analysis, By Material, 2016 and 2024

Figure 87: Latin America Market Value Share Analysis, By Technology, 2016 and 2024

Figure 88: Latin America Market Value Share Analysis, By Application Type, 2016 and 2024

Figure 89: Latin America Market Value Share Analysis, By Country, 2016 and 2024

Figure 90: Brazil Molded Plastics Market Analysis

Figure 91: Mexico Molded Plastics Market Analysis

Figure 92: Rest of Latin America Pacific Molded Plastics Market Analysis

Figure 93: By Material

Figure 94: By Technology

Figure 95: By Application

Figure 96: Global Molded Plastics Market Share Analysis, By Company (2015)