Reports

Reports

mHealth services market is witnessing steadiness fueled by technological innovation, consumer behavior change, and an emerging need for proper healthcare. The major factor that is driving the market is increased use of smartphones and mobile phones. With the continued growth of smartphone penetration around the world, people are using health applications to track their health, view medical resources and information, and manage chronic diseases.

This ability to access and take control of their health has driven a significant demand for mHealth solutions. The strong level of consumer awareness in health and wellness is additionally fueling the continued growth.

.webp)

Technological progress is another driving factor for the mHealth industry. Wearable technology, fitness trackers and smartwatches are revolutionizing the way people engage with their health. Wearable technology not only monitors physical exercise but also essential vital signs, giving users a better picture of their health.

Cost-effectiveness is another compelling driver to developing mHealth services. With the rising cost of healthcare, consumers and providers are looking for solutions that are more affordable. mHealth care is an economic proposition, reducing the reliance on onsite consultations and facilitating enhanced disease control. Government policy and initiatives to foster digital health further reinforce this sector.

mHealth, also called mobile health, refers to the use of mobile devices and technology for delivering healthcare services and information, thereby revolutionizing how individuals interact with their health and wellness. mHealth uses smartphones, tablets, and wearables for creating a wide array of applications to support healthcare delivery, improve outcome, and promote overall health and wellbeing.

In the area of healthcare and fitness, mHealth lets people use various health apps for tracking physical activity, daily vital signs, and managing their nutritional input. These applications allow users to set personal health and wellbeing goals and receive feedback instantaneously, thereby letting them take charge of their health by receiving timely feedback.

Remote monitoring and consultation is also one of the most distinguishing features of mHealth services. With telemedicine, patients are capable of accessing healthcare providers via video calls, messages, or chat, crossing geographical barriers. This is particularly helpful for those living in rural areas or facing mobility issues. Remote monitoring devices provide healthcare professionals with the potential to track the patient's health parameters such as blood glucose, heart rate, etc., in real time, which could serve as a trigger for possible intervention or individualized therapy.

Additionally, mHealth apps provide critical information regarding medications, helping patients to understand their medications, potential side-effects, and how to take them. Reminders for taking medication are available in most apps, which alert patients to take medication on time, a very crucial part of effective treatment outcomes. This feature is particularly beneficial for patients on multiple prescriptions because it eliminates medication errors and enhances patient adherence to treatment guidelines.

| Attribute | Detail |

|---|---|

| mHealth Services Market Drivers |

|

Continuous technological advancements in the area of mobile technology have been the key driving force in developing and maintaining the mHealth services market, and transformed the access or delivery of healthcare. The availability of wearable technology and advancements in advanced health monitoring programs are among those developments.

Wearable technology including smartwatches, fitness bands, and health-monitors have revolutionized personal health management by tracking vital signs and physical activities. Most wearable devices have sensors that assess heart-rate, blood pressure, oxygen saturation, and even sleeping patterns while they provide real-time updates regarding individual health monitoring. Through continued monitoring, patients can initiate proactive measures toward maintaining their health, pushing them toward healthier lifestyle and triggering early detection of possible diseases.

Health monitor apps provide a simple data visualization and interpretation frontend for wearables. Apps collect data sampled from wearables and provide users with comprehensive health reports. For instance, there are applications that review user activity levels, caloric consumption, and sleep patterns to provide tailored advice on diet and exercise, and ensure a healthy management of health. In addition, the apps include goal setting, reminders, and social sharing features, thereby keeping users engaged with their health program.

The integration of telehealth and mobile technology has opened doors to increased telehealth services with remote consultation and monitoring. Patients are now able to see healthcare providers on mobile platforms without needing face-to-face consultations. It is very useful for chronic patients who need constant check-ups and monitoring. Telehealth systems with mobile technology enable simple and accessible communication between healthcare professionals and patients, thereby enabling real-time intervention and adjustment in the treatment plan.

Additionally, growing adoption of artificial intelligence (AI) and machine learning in cellular technology propels mHealth services. The technologies can handle high quantities of health data, recognize patterns, and predict potential health risk, with the vision to educate customers with customized and actionable recommendations.

As more number of people become cognizant of preventive care, lifestyle diseases, and chronic condition management, they are seeking more tools and services to self-manage their health. The awareness is the result of a combination of health education activities, globally shared information on the internet, and the realities created in, by, and for social media. Individuals are increasingly aware of the impact of their daily choices on their general wellbeing, and this leads them to look for solutions that enable them to make the right choices.

Another area of expanded health consciousness is the awareness of the position of mental health within overall health. Advancements in mHealth technology are broadening the scope of application, particularly regarding mental health resources and web-based apps for mindfulness practice, stress management, or online therapy (eHealth).

The growing awareness of mental health means that consumers are seeking a more holistic approach to their health as they begin to understand that physical wellness impacts their mental and emotional wellness. Therefore, by allowing readily accessible mental health resources, mHealth services are lowering the barrier to more available services for a growing population of consumers with a holistic health mindset.

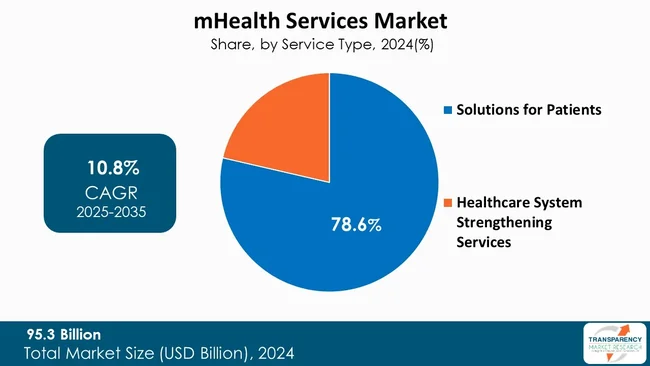

Solutions for patients’ segment captures majority share in the global mHealth services market. These services include a broad spectrum of applications directly affiliated with the completion of personal health requirements, including fitness monitoring, drug surveillance and home monitoring. These services enable patients to assume responsibility for their health, thereby promoting an active stance toward health that is particularly appealing to a growing health-aware public.

Additionally, the increasing prevalence of chronic diseases has accelerated demand for personalized health management solutions. Patients are increasingly fascinated by technology that enables them to track their conditions in real-time and interact with doctors and medical professionals efficiently. Convenience with which individuals can access health information and services via the mobile phone also improves the appeal of such solutions.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

As per the latest mHealth services market analysis, North America dominated in 2024 due to several key factors that provide a favorable environment for the application and expansion of mobile health technologies. Firstly, the region has high smartphone usage and adoption of sophisticated mobile technology that has made it simpler to utilize a variety of health apps. The population is technology literate and therefore more likely to leverage mHealth services, contributing to expansion in this sector.

Furthermore, having well-developed healthcare infrastructure and strong emphasis on health technology innovation are some of the aspects for which North America takes the lead in controlling the mHealth market. There are numerous healthcare organizations, research centers, and technology companies in this region that come together to create innovative mHealth technologies, such as telemedicine software and wearable health devices.

Several companies engaged in the mHealth services industry are broadening their telehealth services to include mental health support, chronic disease management, and preventive care. This includes offering virtual consultations, therapy sessions, and wellness programs.

Apple Inc., Google Inc., Koninklijke Philips N.V., Medtronic, OMRON Healthcare Co., Ltd., Johnson & Johnson, AT&T, Qualcomm Technologies, Inc., Veradigm LLC, Samsung Electronics Co. Ltd., Cisco Systems, Inc., AirStrip Technologies, Inc, Practo, HealthifyMe Wellness Private Limited, and Netmeds are some of the leading players operating in the global market.

Each of these players has been profiled in the mHealth services market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 95.3 Bn |

| Forecast Value in 2035 | US$ 294.5 Bn |

| CAGR | 10.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| mHealth Services Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Service Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global mHealth services market was valued at US$ 95.3 Bn in 2024

The global mHealth services industry is projected to reach more than US$ 294.5 Bn by the end of 2035

Increasing smartphone penetration, increased awareness about health and wellness, Innovations in mobile technology, including wearable devices and health monitoring apps, and rising prevalence of chronic diseases are some of the factors driving the expansion of mHealth services market.

The CAGR is anticipated to be 10.8% from 2025 to 2035

Apple Inc., Google Inc., Koninklijke Philips N.V., Medtronic, OMRON Healthcare Co., Ltd., Johnson & Johnson, AT&T, Qualcomm Technologies, Inc., Veradigm LLC, Samsung Electronics Co. Ltd., Cisco Systems, Inc., AirStrip Technologies, Inc, Practo, HealthifyMe Wellness Private Limited and Netmeds

Table 01: Global mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 02: Global mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 03: Global mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 04: Global mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global mHealth Services Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America mHealth Services Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 09: North America mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 10: North America mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 11: North America mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe mHealth Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Europe mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 15: Europe mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 16: Europe mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 17: Europe mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 20: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 21: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 22: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 23: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America mHealth Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 26: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 27: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 28: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 29: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa mHealth Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 32: Middle East & Africa mHealth Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 33: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Solutions for Patients, 2020 to 2035

Table 34: Latin America mHealth Services Market Value (US$ Bn) Forecast, By Healthcare System Strengthening Services, 2020 to 2035

Table 35: Middle East & Africa mHealth Services Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East & Africa mHealth Services Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 02: Global mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 03: Global mHealth Services Market Revenue (US$ Bn), by Solutions for Patients, 2020 to 2035

Figure 04: Global mHealth Services Market Revenue (US$ Bn), by Healthcare System Strengthening Services, 2020 to 2035

Figure 05: Global mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 06: Global mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 07: Global mHealth Services Market Revenue (US$ Bn), by General Healthcare and Fitness, 2020 to 2035

Figure 08: Global mHealth Services Market Revenue (US$ Bn), by Remote Consultation and Monitoring, 2020 to 2035

Figure 09: Global mHealth Services Market Revenue (US$ Bn), by Medication Information, 2020 to 2035

Figure 10: Global mHealth Services Market Revenue (US$ Bn), by Health Data and Record Access, 2020 to 2035

Figure 11: Global mHealth Services Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 13: Global mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 14: Global mHealth Services Market Revenue (US$ Bn), by Public Healthcare Institutions, 2020 to 2035

Figure 15: Global mHealth Services Market Revenue (US$ Bn), by Private Healthcare Institutions, 2020 to 2035

Figure 16: Global mHealth Services Market Revenue (US$ Bn), by Patients, 2020 to 2035

Figure 17: Global mHealth Services Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global mHealth Services Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global mHealth Services Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America mHealth Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America mHealth Services Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America mHealth Services Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 24: North America mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 25: North America mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 26: North America mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 27: North America mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: North America mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Europe mHealth Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe mHealth Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe mHealth Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 32: Europe mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 33: Europe mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 34: Europe mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: Europe mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: Europe mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Europe mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Asia Pacific mHealth Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific mHealth Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific mHealth Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 42: Asia Pacific mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 43: Asia Pacific mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Asia Pacific mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Asia Pacific mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Asia Pacific mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Latin America mHealth Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America mHealth Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Latin America mHealth Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Latin America mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 52: Latin America mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 53: Latin America mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Latin America mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Latin America mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 56: Latin America mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 57: Middle East & Africa mHealth Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Middle East & Africa mHealth Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 59: Middle East & Africa mHealth Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 60: Middle East & Africa mHealth Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 61: Middle East & Africa mHealth Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 62: Middle East & Africa mHealth Services Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Middle East & Africa mHealth Services Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Middle East & Africa mHealth Services Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Middle East & Africa mHealth Services Market Attractiveness Analysis, By End-user, 2025 to 2035