Reports

Reports

Analysts’ Viewpoint on Mined Anthracite Coal Market Scenario

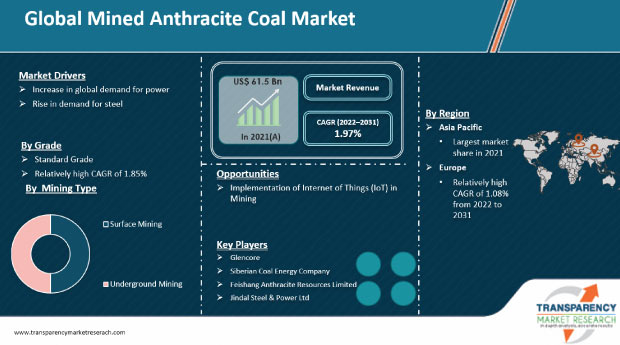

The global anthracite coal mining industry has been evolving, with new alliances, acquisitions, and entry of new players. Manufacturers and suppliers are redirecting supply to domestic users and concentrating on imports, which represents a fundamental shift in the anthracite coal mining market for mineral resources. Anthracite coal is often used in the production of steel due to its high carbon content and low cost. Rise in demand for anthracite coal in construction, infrastructure, and industrial sectors is a primary factor driving the mined anthracite coal market size. Furthermore, rapid growth in demand for anthracite coal among steel manufacturers is augmenting the mined anthracite coal market. Steel manufacturers are focusing on using anthracite coal more than coke due to its similar carbon content and low price, which results in economical steel production.

Anthracite coal is a dense hard rock of jet black color. It is also referred to as hard coal. It is generally a non-clinkering, non-agglomerating, and free-burning coal that does not coke or expand when ignited and fused together. Anthracite coal also has low percentage of ash and high ash fusion temperature. Anthracite is considered the cleanest burning coal. Anthracite coal generates less smoke and more heat than other coals. It is extensively employed in hand-fired furnaces. Some residential home heating stove systems still use anthracite, which burns longer than wood.

Governments and regulatory authorities across the globe are striving to promote renewable energy and increase its share in the energy mix. However, coal continues to account for major share of global power generation sources. Demand for coal has increased in the power generation sector in the last few years, especially in Asia Pacific.

The renewable energy sector is growing at a significant pace across the globe. However, it is unable to meet the rising demand for power. This has resulted in a supply-demand gap (gap between demand for power and its generation), which countries, especially in developing regions, are striving to cover up with coal-based generation. This is expected to drive the usage of coal in power generation in the near future. Coal accounted for approximately 38% of the total electricity generated in 2018. This percentage has remained almost unchanged in the last 20 years, although renewable energy is gaining momentum. Developed economies in North America and Europe have announced plans to phase out coal-based power generation in the near future; however, coal-based generation has increased in countries in other regions. Thus, rise in demand for power is expected to drive the demand for coal in the power industry. This is likely to augment the scope for mined anthracite coal market.

Global steel production stood at approximately 1,800 million tons in 2018; of this, India, China, Brazil, Mexico, and Iran accounted for prominent share. Consumption of steel has been rising at a rapid pace, especially in infrastructure projects such as highways, commercial and residential buildings, airports, and railways. The manufacturing sector also acts as a major demand center for the steel industry. Rapid industrialization and urbanization, especially in developing economies such as India, China, and Brazil, is likely to boost the demand for iron and steel across the globe.

High and ultra-high grade anthracite coal are primarily used in steel manufacturing due to their high carbon and low ash content. Demand for these grades of coal has increased consistently in the steel manufacturing sector over the last few years. Rise in demand for steel is expected to encourage steel manufacturers to increase their production. This, in turn, is anticipated to open new growth frontiers for mined anthracite coal market.

In terms of grade, the global mined anthracite coal market has been segregated into standard grade, high grade, and ultra-high grade. The standard grade segment held major share of 91.4% of the global market in 2021. It is estimated to dominate the market during the forecast period. Standard grade anthracite coal has carbon content of around 86% to 92% and volatile matter (VM) content in the range of 8% to 14%. Standard grade anthracite coal is primarily used for power generation applications due to its lower purity among the three grades. This is the lowest grade of anthracite and is also known as semi-anthracite coal. There are large reserves of standard grade anthracite coal vis-à-vis other grades. It is also an extensively mined grade of coal. Increase in demand for coal in the power generation sector to cater to the rise in power consumption is projected to be a major driver of the standard grade segment.

Based on mining type, the global mined anthracite coal market has been classified into surface mining and underground mining. The underground mining segment dominated the global mined anthracite coal market with 85.4% share in 2021. Underground mining is adopted when an ore or a mineral lies at a considerable distance below the surface and the amount of waste that has to be removed in order to uncover the ore through surface mining becomes prohibitive. In underground mining, the overlying rock is left behind, and the required mineral deposits are removed through anthracite coal shaft mines. The segment is expected to grow in the near future owing to the decline in coal reserves near the Earth’s surface and discovery of new reserves deep under the Earth’s crust. These can be extracted by employing underground mining equipment and techniques. Thus, adoption of underground mining techniques is higher than that in anthracite coal surface mines.

Asia Pacific accounted for prominent share of 92.7% of the global market in 2021. Countries such as China, India, and Indonesia are expected to witness rapid increase in industrial activities along with expansion of the manufacturing sector and rise in investments in coal mining due to the growth in demand for anthracite coal in steel and power sectors. Anthracite coal mined in Europe and North America regions is also high. These regions held 6.1% and 0.6% share of the global market, respectively, in 2021. Increase in focus on renewable energy generation, phase-out of coal fired power plants to achieve net-zero emission by 2050, and rise in number of environment-related regulations on coal are key factors behind the slowdown of the coal mining sector in Europe and North America.

The global mined anthracite coal market comprises several small and large-scale service providers that control majority of the share. Most of these firms are adopting new technologies and strategies with comprehensive research and development activities. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. Thus, sales forecast for mined anthracite coal market players appears promising. Glencore, Siberian Coal Energy Company, Feishang Anthracite Resources Limited, Jindal Steel & Power Ltd., Coal India Ltd., Reading Anthracite Coal, Blaschak Coal Corporation, Atrum Coal Limited, Shanxi Jincheng Anthracit Coal Mining Group Co., Ltd., Celtic Energy Ltd., Sadovaya Group, Zululand Anthracite Colliery (Pty) Ltd., and Carbones Holding GmbH are the prominent entities operating in the market.

Each of these players has been profiled in the mined anthracite coal market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 61.5 Bn |

|

Market Forecast Value in 2031 |

US$ 74.3 Bn |

|

Growth Rate (CAGR) |

1.97% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

Kilo Tons for Volume and US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The mined anthracite coal market stood at US$ 61.5 Bn in 2021

The market is expected to grow at a CAGR of 1.97% from 2022 to 2031

Increase in global demand for power and rise in demand for steel are key drivers of the mined anthracite coal market

Standard grade was the largest type segment that held 91.4% share in 2021

Asia Pacific was the most lucrative region of the mined anthracite coal market in 2021

Glencore, Siberian Coal Energy Company, Feishang Anthracite Resources Limited, Jindal Steel & Power Ltd., Coal India Ltd., Reading Anthracite Coal, and Blaschak Coal Corporation

1. Executive Summary

1.1. Mined Anthracite Coal Market Industry Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Manufacturers

2.6.2. Lis of Dealers/Distributers

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis

6. Price Trend Analysis and Forecast, 2022-2031

7. Global Mined Anthracite Coal Market Industry Analysis and Forecast, by Grade, 2022–2031

7.1. Introduction and Definitions

7.2. Global Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

7.2.1. Standard Grade

7.2.2. High Grade

7.2.3. Ultra-high Grade

7.3. Global Mined Anthracite Coal Market Industry Attractiveness, by Grade

8. Global Mined Anthracite Coal Market Industry Analysis and Forecast, by Mining Type, 2022–2031

8.1. Introduction and Definitions

8.2. Global Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

8.2.1. Surface Mining

8.2.2. Underground Mining

9. Global Mined Anthracite Coal Market Industry Attractiveness, by Mining Type

10. Global Mined Anthracite Coal Market Industry Analysis and Forecast, by Application, 2022–2031

10.1. Introduction and Definitions

10.2. Global Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.2.1. Power Generation

10.2.2. Steel Production

10.2.3. Fertilizer Production

10.2.4. Others

10.3. Global Mined Anthracite Coal Market Industry Attractiveness, by Application

11. Global Mined Anthracite Coal Market Industry Analysis and Forecast, by Region, 2022–2031

11.1. Key Findings

11.2. Global Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. Latin America

11.3. Global Mined Anthracite Coal Market Industry Attractiveness, by Region

12. North America Mined Anthracite Coal Market Industry Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. North America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

12.3. North America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

12.4. North America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.5. North America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

12.5.1. U.S. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

12.5.2. U.S. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

12.5.3. U.S. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.5.4. Canada Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

12.5.5. Canada Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

12.5.6. Canada Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.6. North America Mined Anthracite Coal Market Industry Attractiveness Analysis

13. Europe Mined Anthracite Coal Market Industry Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.3. Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.4. Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5. Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. Germany Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.5.2. Germany Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.5.3. Germany Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.4. U.K. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.5.5. U.K. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.5.6. U.K. Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.7. Turkey Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.5.8. Turkey Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.5.9. Turkey Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.10. Russia & CIS Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.5.11. Russia & CIS Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.5.12. Russia & CIS Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5.13. Rest of Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

13.5.14. Rest of Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

13.5.15. Rest of Europe Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.6. Europe Mined Anthracite Coal Market Industry Attractiveness Analysis

14. Asia Pacific Mined Anthracite Coal Market Industry Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade

14.3. Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

14.4. Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5. Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. China Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

14.5.2. China Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

14.5.3. China Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.4. South Korea Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

14.5.5. South Korea Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn)) Forecast, by Mining Type, 2022–2031

14.5.6. South Korea Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.7. Australia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

14.5.8. Australia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

14.5.9. Australia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.10. Vietnam Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

14.5.11. Vietnam Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

14.5.12. Vietnam Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.5.13. Rest of Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

14.5.14. Rest of Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

14.5.15. Rest of Asia Pacific Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

14.6. Asia Pacific Mined Anthracite Coal Market Industry Attractiveness Analysis

15. Latin America Mined Anthracite Coal Market Industry Analysis and Forecast, 2022–2031

15.1. Key Findings

15.2. Latin America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

15.3. Latin America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

15.4. Latin America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.5. Latin America Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

15.5.1. Colombia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

15.5.2. Colombia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

15.5.3. Colombia Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.5.4. Mexico Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

15.5.5. Mexico Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn)) Forecast, by Mining Type, 2022–2031

15.5.6. Mexico Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn)) Forecast, by Application, 2022–2031

15.5.7. Peru Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

15.5.8. Peru Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

15.5.9. Peru Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

15.6. Latin America Mined Anthracite Coal Market Industry Attractiveness Analysis

16. Middle East & Africa Mined Anthracite Coal Market Industry Analysis and Forecast, 2022–2031

16.1. Key Findings

16.2. Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

16.3. Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

16.4. Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5. Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

16.5.1. Iran Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

16.5.2. Iran Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

16.5.3. Iran Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn)) Forecast, by Application, 2022–2031

16.5.4. South Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

16.5.5. South Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

16.5.6. South Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

16.5.7. Rest of Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Grade, 2022–2031

16.5.8. Rest of Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Mining Type, 2022–2031

16.5.9. Rest of Middle East & Africa Mined Anthracite Coal Market Industry Volume (Kilo Tons) and Value (US$ Mn)) Forecast, by Application, 2022–2031

16.6. Middle East & Africa Mined Anthracite Coal Market Industry Attractiveness Analysis

17. Competition Landscape

17.1. Global Tire Recycling Downstream Mining Types Company Market Share Analysis, 2021

17.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

17.2.1. Glencore

17.2.1.1. Company Description

17.2.1.2. Business Overview

17.2.1.3. Strategic Overview

17.2.2. Siberian Coal Energy Company

17.2.2.1. Company Description

17.2.2.2. Business Overview

17.2.2.3. Strategic Overview

17.2.3. Feishang Anthracite Resources Limited

17.2.3.1. Company Description

17.2.3.2. Business Overview

17.2.3.3. Strategic Overview

17.2.4. Jindal Steel & Power Ltd.

17.2.4.1. Company Description

17.2.4.2. Business Overview

17.2.4.3. Strategic Overview

17.2.5. Coal India Ltd.

17.2.5.1. Company Description

17.2.5.2. Business Overview

17.2.5.3. Strategic Overview

17.2.6. Reading Anthracite Coal

17.2.6.1. Company Description

17.2.6.2. Business Overview

17.2.6.3. Strategic Overview

17.2.7. Blaschak Coal Limited

17.2.7.1. Company Description

17.2.7.2. Business Overview

17.2.7.3. Strategic Overview

17.2.8. Atrum Coal Limited

17.2.8.1. Company Description

17.2.8.2. Business Overview

17.2.8.3. Strategic Overview

17.2.9. Shanxi Jincheng Anthracite Coal Mining Group Co., Ltd.

17.2.9.1. Company Description

17.2.9.2. Business Overview

17.2.9.3. Strategic Overview

17.2.10. Celtic Energy Ltd.

17.2.10.1. Company Description

17.2.10.2. Business Overview

17.2.10.3. Strategic Overview

17.2.11. Sadovaya Group

17.2.11.1. Company Description

17.2.11.2. Business Overview

17.2.11.3. Strategic Overview

17.2.12. Zululand Anthracite Colliery (pty) Ltd.

17.2.12.1. Company Description

17.2.12.2. Business Overview

17.2.12.3. Strategic Overview

17.2.13. Carbones Holding Gmbh

17.2.13.1. Company Description

17.2.13.2. Business Overview

17.2.13.3. Strategic Overview

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 01: Global Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 02: Global Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 03: Global Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 04: Global Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 05: Global Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 06: Global Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 07: Global Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Region, 2022-2031

Table 08: Global Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Region, 2022-2031

Table 09: North America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 10: North America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 11: North America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 12: North America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 13: North America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 14: North America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 15: North America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Country, 2022-2031

Table 16: North America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Country, 2022-2031

Table 17: U.S. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 18: U.S. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 19: U.S. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 20: U.S. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 21: U.S. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 22: U.S. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 23: Canada Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 24: Canada Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 25: Canada Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 26: Canada Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 27: Canada Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 28: Canada Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 29: Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 30: Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 31: Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 32: Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 33: Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 34: Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 35: Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 36: Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 37: Germany Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 38: Germany Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 39: Germany Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 40: Germany Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 41: Germany Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 42: Germany Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 43: U.K. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 44: U.K. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 45: U.K. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 46: U.K. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 47: U.K. Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 48: U.K. Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 49: Turkey Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 50: Turkey Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 51: Turkey Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 52: Turkey Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 53: Turkey Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 54: Turkey Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 55: Russia & CIS Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 56: Russia & CIS Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 57: Russia & CIS Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 58: Russia & CIS Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 59: Russia & CIS Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 60: Russia & CIS Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 61: Rest of Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 62: Rest of Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 63: Rest of Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 64: Rest of Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 65: Rest of Europe Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 66: Rest of Europe Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 67: Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 68: Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 69: Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 70: Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 71: Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 72: Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 73: Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 74: Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 75: China Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 76: China Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 77: China Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 78: China Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 79: China Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 80: China Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 81: South Korea Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 82: South Korea Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 83: South Korea Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 84: South Korea Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 85: South Korea Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 86: South Korea Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 87: Australia Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 88: Australia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 89: Australia Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 90: Australia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 91: Australia Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 92: Australia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 93: Vietnam Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 94: Vietnam Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 95: Vietnam Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 96: Vietnam Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 97: Vietnam Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 98: Vietnam Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 99: Rest of Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 100: Rest of Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 101: Rest of Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 102: Rest of Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 103: Rest of Asia Pacific Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 104: Rest of Asia Pacific Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 105: Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 106: Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 107: Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 108: Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 109: Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 110: Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 111: Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 112: Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 113: Iran Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 114: Iran Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 115: Iran Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 116: Iran Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 117: Iran Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 118: Iran Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 119: South Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 120: South Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 121: South Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 122: South Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 123: South Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 124: South Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 125: Rest of Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 126: Rest of Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 127: Rest of Middle East & Africa Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2028-2027

Table 128: Rest of Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 129: Rest of Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 130: Rest of Middle East & Africa Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 131: Latin America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 132: Latin America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 133: Latin America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 134: Latin America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 135: Latin America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 136: Latin America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 137: Latin America Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 138: Latin America Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 139: Colombia Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 140: Colombia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 141: Colombia Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 142: Colombia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 143: Colombia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 144: Colombia Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 145: Mexico Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 146: Mexico Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 147: Mexico Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 148: Mexico Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 149: Mexico Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 150: Mexico Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 151: Peru Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Grade, 2022-2031

Table 152: Peru Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Grade, 2022-2031

Table 153: Peru Mined Anthracite Coal Market Volume (Kilo Tons) Forecast, by Mining Type, 2022-2031

Table 154: Peru Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Mining Type, 2022-2031

Table 155: Peru Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 156: Peru Mined Anthracite Coal Market Value (US$ Mn) Forecast, by Application, 2022-2031

List of Figures

Figure 01: Global Mined Anthracite Coal Market Volume (Kilo Tons) & Value (US$ Mn) Forecast, 2022-2031

Figure 02: Global Mined Anthracite Coal Market Pricing Analysis, 2022-2031

Figure 03: Global Mined Anthracite Coal Market Value Share Analysis, by Grade, 2022-2031

Figure 04: Global Mined Anthracite Coal Market Attractiveness Analysis, by Grade, 2022-2031

Figure 05: Global Mined Anthracite Coal Market Value Share Analysis by Mining Type, 2022-2031 and 2027

Figure 06: Global Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type, 2022-2031

Figure 07: Global Mined Anthracite Coal Market Value Share Analysis by Application, 2022-2031 and 2027

Figure 08: Global Mined Anthracite Coal Market Attractiveness, by Application, 2022-2031

Figure 09: Global Mined Anthracite Coal Market Value Share, by Region, 2022-2031 and 2027

Figure 10: Global Mined Anthracite Coal Market Attractiveness, by Region, 2022-2031

Figure 11: North America Mined Anthracite Coal Market Value Share Analysis, by Country, 2022-2031

Figure 12: North America Mined Anthracite Coal Market Attractiveness Analysis, by Grade, 2022-2031

Figure 13: North America Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type, 2022-2031

Figure 14: North America Mined Anthracite Coal Market Attractiveness Analysis, by Application, 2022-2031

Figure 15: North America Mined Anthracite Coal Market Attractiveness Analysis, by Country, 2022-2031

Figure 16: Europe Mined Anthracite Coal Market Value Share Analysis, by Country and Sub-region, 2022-2031 and 2027

Figure 17: Europe Mined Anthracite Coal Market Attractiveness Analysis, by Grade, 2022-2031

Figure 18: Europe Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type, 2022-2031

Figure 19: Europe Mined Anthracite Coal Market Attractiveness Analysis, by Application, 2022-2031

Figure 20: Europe Mined Anthracite Coal Market Attractiveness Analysis, by Country and Sub-region, 2022-2031

Figure 21: Asia Pacific Mined Anthracite Coal Market Value Share Analysis, by Country and Sub-region, 2022-2031

Figure 22: Asia Pacific Mined Anthracite Coal Market Attractiveness Analysis, by Grade, 2022-2031

Figure 23: Asia Pacific Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type, 2022-2031

Figure 24: Asia Pacific Mined Anthracite Coal Market Attractiveness Analysis, by Application, 2022-2031

Figure 25: Asia Pacific Mined Anthracite Coal Market Attractiveness Analysis, by Country and Sub-region, 2022-2031

Figure 26: Middle East & Africa Mined Anthracite Coal Market Value Share Analysis, by Country and Sub-region, 2022-2031

Figure 27: Middle East & Africa Mined Anthracite Coal Market Attractiveness Analysis, by Grade

Figure 28: Middle East & Africa Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type

Figure 29: Middle East & Africa Mined Anthracite Coal Market Attractiveness Analysis, by Application

Figure 30: Middle East & Africa Mined Anthracite Coal Market Attractiveness Analysis, by Region

Figure 31: Latin America Mined Anthracite Coal Market Value Share Analysis, by Country and Sub-region, 2022-2031

Figure 32: Latin America Mined Anthracite Coal Market Attractiveness Analysis, by Grade

Figure 33: Latin America Mined Anthracite Coal Market Attractiveness Analysis, by Mining Type

Figure 34: Latin America Mined Anthracite Coal Market Attractiveness Analysis, by Application

Figure 35: Latin America Mined Anthracite Coal Market Attractiveness Analysis, by Country and Sub-region

Figure 36: Global Mined Anthracite Coal Market Share Analysis, by Company (2022-2031)