Reports

Reports

Analysts’ Viewpoint

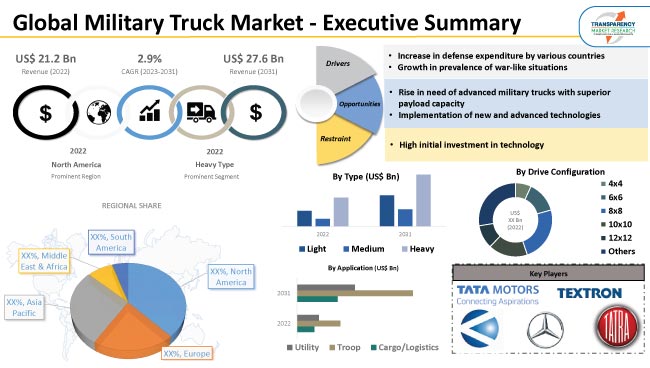

Rise in geopolitical tensions among certain countries and the resultant growth in defense spending is driving the global military truck market size. According to a report published by Stockholm International Peace Research Institute (SIPRI), the global military expenditure increased by 0.7% to reach around US$ 2.1 Trn in 2021. Furthermore, certain developing countries have increased their military budget to combat cross-border terrorism activities. This is also fueling market progress. Growth in adoption of electric heavy military vehicles and electric army trucks is also likely to augment market statistics.

In line with the latest military truck market trends, manufacturers are working on innovations to enhance the payload and towing capacity of their vehicles. Manufacturers are also entering into contracts, agreements, and partnerships with key players to increase their military truck market share.

Military truck is a rigid vehicle that is designed to transport equipment and troops from one location to another. These trucks possess off-roading capabilities and can be armored if required. Military trucks can operate in challenging weather conditions; hence, they are designed with advanced capabilities.

Military light utility vehicles are equipped with high-end technologies such as military grade navigation satellite system, radar vision, and LIDAR. Thus, implementation of the latest technologies is expected to boost the military truck market dynamics.

Military trucks play a key role in supply of troops to combat-prone regions, especially in hard-to-reach areas. Rise in investment in safety features of military vehicles is boosting military truck market demand. Increase in demand for bulletproof vehicles and militarization of law enforcement agencies are also fueling market development.

Many countries across the globe are increasing their military budget to enhance national security. They are investing significantly in various types of military trucks such as heavy, light, and medium in this endeavor. Several countries are also engaged in cross-border disputes, which has led to heavy deployment of military troops and equipment. This is driving military truck market growth.

Focus on safety of military personnel in harsh weather conditions or combat situations is driving the demand for robust military trucks.

Geopolitical tensions among certain countries are prompting the governments of these countries to enhance and improve their defense systems. For instance, military conflict in the Russia-Ukraine war and simmering border tension between India and China are driving the demand for military transportation and logistics. In turn, this is fueling the military truck market growth.

Need for superior speed, decrease in risk of engine stop, and higher fuel efficiency are also anticipated to boost investments in modernization of military trucks. This is likely to significantly impact market growth.

According to the latest military truck market analysis, the heavy type segment accounted for significant share in 2022. Demand for heavy military trucks is high, as these vehicles are equipped with capabilities to operate across all conditions, including off-roading, deep water, snow, and soft wet areas of low-lying land. These trucks also possess superior payload and towing capacity.

Governments of various countries are engaged in strategic agreements with key market players for the procurement of advanced military trucks. In August 2022, AM General signed a strategic firm-fixed-price requirement contract with the U.S. Department of Defense for High Mobility Multipurpose Wheeled Vehicles (HVVWV) worth US$ 732.7 Mn.

Military truck market regional insights indicate North America’s dominance of the global landscape during the forecast period. This can be ascribed to the rise in the U.S. Government’s defense budget. The U.S. has the largest military budget of more than 37%.

The U.S. is involved in various global transnational issues, especially in the Middle East. It is striving to empower its presence in the region by increasing its military troops. Thus, demand for military trucks is expected to rise significantly in the region.

Asia Pacific is estimated to follow North America in terms of market share. China, India, and Japan are likely to account for major share of the industry in the region. China is the second largest spender on defense budget (after the U.S.).

Established companies constitute significant share of the global landscape. Military truck market players are actively engaged in development of new and advanced military trucks, with programmable ammunition, active protection systems, reactive armor technology, and advanced autoloaders.

Key players are strengthening their market position through partnerships, mergers, acquisitions, and development of product portfolios. DAF Trucks, Daimler, General Dynamics Corporation, Hyundai Rotem, IVECO, Krauss-Maffei Wegmann, Mercedes-Benz, Mitsubishi Heavy Industries, Oshkosh Corporation, Rheinmetall AG, TATA Motors, TATRA Trucks A.S., Textron Inc., and The Kalyani Group are the leading players operating in the industry.

The military truck industry report summarizes prominent companies in terms of parameters such as financial overview, company overview, product portfolio, business strategies, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 21.2 Bn |

|

Market Forecast Value in 2031 |

US$ 27.6 Bn |

|

Growth Rate (CAGR) |

2.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiles |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 21.2 Bn in 2022

It is anticipated to grow at a CAGR of 2.9% by 2031

It would be worth US$ 27.6 Bn in 2031

Increase in defense expenditure by various countries and growth in prevalence of war-like situations

Based on type, the heavy segment accounts for major share

North America is anticipated to be a highly lucrative region during the forecast period

Oshkosh Corporation, General Dynamics Corporation, Rheinmetall AG, TATA Motors, Krauss-Maffei Wegmann, Mercedes-Benz, TATRA Trucks A.S., Hyundai Rotem, Textron Inc., IVECO, DAF Trucks, Daimler, The Kalyani Group, and Mitsubishi Heavy Industries

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Military Truck Market

4. Global Military Truck Market, By Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Military Truck Market Size & Forecast, 2017-2031, By Type

4.2.1. Light

4.2.2. Medium

4.2.3. Heavy

5. Global Military Truck Market, By Drive Configuration

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

5.2.1. 4x4

5.2.2. 6x6

5.2.3. 8x8

5.2.4. 10x10

5.2.5. 12x12

5.2.6. Others

6. Global Military Truck Market, By Application

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Military Truck Market Size & Forecast, 2017-2031, By Application

6.2.1. Cargo/Logistics

6.2.2. Troop

6.2.3. Utility

7. Global Military Truck Market, By Transmission Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

7.2.1. Automatic

7.2.2. Semi-automatic

7.2.3. Manual

8. Global Military Truck Market, By Propulsion Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

8.2.1. IC Engine

8.2.2. Gasoline

8.2.3. Diesel

8.2.4. Electric

9. Global Military Truck Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Military Truck Market Size & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Military Truck Market

10.1. Market Snapshot

10.2. North America Military Truck Market Size & Forecast, 2017-2031, By Type

10.2.1. Light

10.2.2. Medium

10.2.3. Heavy

10.3. North America Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

10.3.1. 4x4

10.3.2. 6x6

10.3.3. 8x8

10.3.4. 10x10

10.3.5. 12x12

10.3.6. Others

10.4. North America Military Truck Market Size & Forecast, 2017-2031, By Application

10.4.1. Cargo/Logistics

10.4.2. Troop

10.4.3. Utility

10.5. North America Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

10.5.1. Automatic

10.5.2. Semi-automatic

10.5.3. Manual

10.6. North America Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

10.6.1. IC Engine

10.6.1.1. Gasoline

10.6.1.2. Diesel

10.6.2. Electric

10.7. North America Military Truck Market Size & Forecast, 2017-2031, By Country

10.7.1. The U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Military Truck Market

11.1. Market Snapshot

11.2. Europe Military Truck Market Size & Forecast, 2017-2031, By Type

11.2.1. Light

11.2.2. Medium

11.2.3. Heavy

11.3. Europe Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

11.3.1. 4x4

11.3.2. 6x6

11.3.3. 8x8

11.3.4. 10x10

11.3.5. 12x12

11.3.6. Others

11.4. Europe Military Truck Market Size & Forecast, 2017-2031, By Application

11.4.1. Cargo/Logistics

11.4.2. Troop

11.4.3. Utility

11.5. Europe Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

11.5.1. Automatic

11.5.2. Semi-automatic

11.5.3. Manual

11.6. Europe Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

11.6.1. IC Engine

11.6.1.1. Gasoline

11.6.1.2. Diesel

11.6.2. Electric

11.7. Europe Military Truck Market Size & Forecast, 2017-2031, By Country

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Military Truck Market

12.1. Market Snapshot

12.2. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Type

12.2.1. Light

12.2.2. Medium

12.2.3. Heavy

12.3. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

12.3.1. 4x4

12.3.2. 6x6

12.3.3. 8x8

12.3.4. 10x10

12.3.5. 12x12

12.3.6. Others

12.4. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Application

12.4.1. Cargo/Logistics

12.4.2. Troop

12.4.3. Utility

12.5. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

12.5.1. Automatic

12.5.2. Semi-automatic

12.5.3. Manual

12.6. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

12.6.1. IC Engine

12.6.1.1. Gasoline

12.6.1.2. Diesel

12.6.2. Electric

12.7. Asia Pacific Military Truck Market Size & Forecast, 2017-2031, By Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Military Truck Market

13.1. Market Snapshot

13.2. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Type

13.2.1. Light

13.2.2. Medium

13.2.3. Heavy

13.3. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

13.3.1. 4x4

13.3.2. 6x6

13.3.3. 8x8

13.3.4. 10x10

13.3.5. 12x12

13.3.6. Others

13.4. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Application

13.4.1. Cargo/Logistics

13.4.2. Troop

13.4.3. Utility

13.5. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

13.5.1. Automatic

13.5.2. Semi-automatic

13.5.3. Manual

13.6. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

13.6.1. IC Engine

13.6.1.1. Gasoline

13.6.1.2. Diesel

13.6.2. Electric

13.7. Middle East & Africa Military Truck Market Size & Forecast, 2017-2031, By Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Military Truck Market

14.1. Market Snapshot

14.2. South America Military Truck Market Size & Forecast, 2017-2031, By Type

14.2.1. Light

14.2.2. Medium

14.2.3. Heavy

14.3. South America Military Truck Market Size & Forecast, 2017-2031, By Drive Configuration

14.3.1. 4x4

14.3.2. 6x6

14.3.3. 8x8

14.3.4. 10x10

14.3.5. 12x12

14.3.6. Others

14.4. South America Military Truck Market Size & Forecast, 2017-2031, By Application

14.4.1. Cargo/Logistics

14.4.2. Troop

14.4.3. Utility

14.5. South America Military Truck Market Size & Forecast, 2017-2031, By Transmission Type

14.5.1. Automatic

14.5.2. Semi-automatic

14.5.3. Manual

14.6. South America Military Truck Market Size & Forecast, 2017-2031, By Propulsion Type

14.6.1. IC Engine

14.6.1.1. Gasoline

14.6.1.2. Diesel

14.6.2. Electric

14.7. South America Military Truck Market Size & Forecast, 2017-2031, By Country

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profiles/Key Players

16.1. DAF Trucks

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Daimler

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. General Dynamics Corporation

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Hyundai Rotem

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. IVECO

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Krauss-Maffei Wegmann

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Mercedes-Benz

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Mitsubishi Heavy Industries

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Oshkosh Corporation

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Rheinmetall AG

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. TATA Motors

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. TATRA Trucks A.S.

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Textron Inc.

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. The Kalyani Group

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Other Key Players

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

List of Tables

Table 1: Global Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 2: Global Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 4: Global Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 5: Global Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 6: Global Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 7: Global Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 8: Global Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 9: Global Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 10: Global Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 11: Global Military Truck Market Volume (Units) Forecast, by Region, 2017-2031

Table 12: Global Military Truck Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 14: North America Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 15: North America Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 16: North America Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 17: North America Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 18: North America Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 19: North America Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 20: North America Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 21: North America Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 22: North America Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 23: North America Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: North America Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 26: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 27: Europe Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 28: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 29: Europe Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 30: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 31: Europe Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 32: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 33: Europe Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 34: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 35: Europe Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 38: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 39: Asia Pacific Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 40: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 41: Asia Pacific Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 42: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 43: Asia Pacific Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 44: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 45: Asia Pacific Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 46: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 47: Asia Pacific Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 50: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 51: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 52: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 53: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 54: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 55: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 56: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 57: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 58: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 59: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Table 62: South America Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 63: South America Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Table 64: South America Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Table 65: South America Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Table 66: South America Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 67: South America Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Table 68: South America Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Table 69: South America Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 70: South America Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 71: South America Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Table 72: South America Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 2: Global Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 4: Global Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 5: Global Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 6: Global Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 7: Global Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 8: Global Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 11: Global Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 12: Global Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 13: Global Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 14: Global Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 15: Global Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 16: Global Military Truck Market Volume (Units) Forecast, by Region, 2017-2031

Figure 17: Global Military Truck Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Military Truck Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 20: North America Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 21: North America Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 22: North America Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 23: North America Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 24: North America Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 25: North America Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 26: North America Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 27: North America Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 28: North America Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 29: North America Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 30: North America Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 31: North America Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 32: North America Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 33: North America Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 34: North America Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: North America Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Military Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 38: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 39: Europe Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 41: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 42: Europe Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 43: Europe Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 44: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 45: Europe Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 46: Europe Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 47: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 48: Europe Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 49: Europe Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 50: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 51: Europe Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 52: Europe Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: Europe Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Military Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 56: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 57: Asia Pacific Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 59: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 60: Asia Pacific Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 62: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 63: Asia Pacific Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 65: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 66: Asia Pacific Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 68: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 69: Asia Pacific Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Military Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 74: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 75: Middle East & Africa Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 77: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 78: Middle East & Africa Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 80: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 81: Middle East & Africa Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 83: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 84: Middle East & Africa Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 86: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 87: Middle East & Africa Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Military Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Military Truck Market Volume (Units) Forecast, by Type, 2017-2031

Figure 92: South America Military Truck Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 93: South America Military Truck Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 94: South America Military Truck Market Volume (Units) Forecast, by Drive Configuration, 2017-2031

Figure 95: South America Military Truck Market Revenue (US$ Bn) Forecast, by Drive Configuration, 2017-2031

Figure 96: South America Military Truck Market, Incremental Opportunity, by Drive Configuration, Value (US$ Bn), 2023-2031

Figure 97: South America Military Truck Market Volume (Units) Forecast, by Application, 2017-2031

Figure 98: South America Military Truck Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 99: South America Military Truck Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 100: South America Military Truck Market Volume (Units) Forecast, by Transmission Type, 2017-2031

Figure 101: South America Military Truck Market Revenue (US$ Bn) Forecast, by Transmission Type, 2017-2031

Figure 102: South America Military Truck Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 103: South America Military Truck Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 104: South America Military Truck Market Revenue (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 105: South America Military Truck Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 106: South America Military Truck Market Volume (Units) Forecast, by Country, 2017-2031

Figure 107: South America Military Truck Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Military Truck Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031