Reports

Reports

Analysts’ Viewpoint

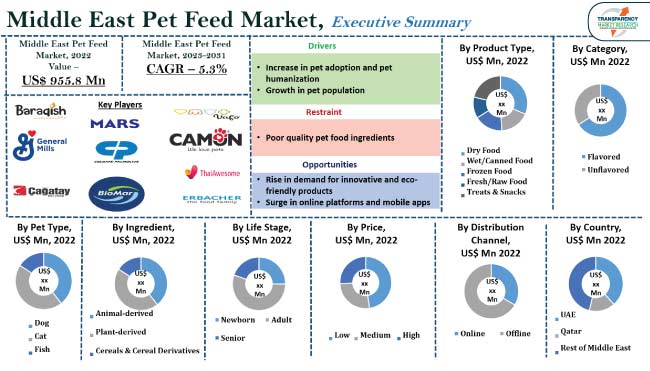

Increase in pet adoption, rise in phenomena of pet humanization, and growth in pet population are key factors that are projected to boost the Middle East pet feed market value. Surge in online platforms and expansion in the e-commerce sector are also contributing to market development. E-commerce platforms allow pet feed suppliers to reach a broader customer base, even in remote areas of the Middle East where it might be challenging to establish physical stores.

Online shopping offers pet owners the convenience to browse and purchase pet feed from the comfort of their homes. This can attract more customers to explore a wider range of pet feed products. Rise in usage of sustainable and eco-friendly pet feed products is anticipated to boost the pet feed market demand in the near future. In line with the latest pet feed market trends, companies are focusing on producing innovative and sustainable pet feed products to increase their industry share.

Pet food is animal feed designed specifically for ingestion by pets. It is commonly available at pet stores and supermarkets and is particular to the animal such as dog food or cat food. Pet food is a specialized diet for domesticated animals that is designed to meet their nutritional requirements.

Meat, meat byproducts, cereals, grains, vitamins, and minerals are common ingredients in pet food. Dogs and cats require a balanced diet that has just the correct quantity of proteins, fat, carbohydrates, and important vitamins and minerals to stay in peak form.

The number of pet owners has been rising in the Middle East since the last few years owing to changes in cultural and socioeconomic conditions. This is influencing the pet care product industry. Furthermore, growth in awareness about pet nutrition among pet owners is boosting market dynamics of the region.

The phenomenon of pet humanization, which involves treating pets as family members and providing them with the same care and attention as humans, is positively impacting the demand for pet feed in the Middle East.

Pet owners who treat their pets as family members are more likely to invest in products that contribute to their pets' health, longevity, and overall well-being. Pet food that helps relieve stress, anxiety, or cognitive decline among pets is particularly appealing to pet owners.

The Middle East has been witnessing a remarkable increase in pet population since the last few years. As the region continues to develop and modernize, its attitude towards animals and pets has also been evolving.

According to the Qatar Ministry of Municipality and Environment, the number of registered pets in the country has been rising at a steady pace. This upward trend is a testament to the growing recognition of the positive impact that pets have on their owners’ lives.

Veterinarians and pet nutritionists often advise pet owners to use dietary pet food to preserve the general health of their pets. Therefore, owners are adopting a more proactive approach to avoid unfavorable health conditions in their pets. This, in turn, is likely to improve pet health and well-being and boost the Middle East pet feed business in the near future.

According to the latest Middle East pet feed market analysis, the UAE accounts for major share in the region in terms of volume and value. This can be ascribed to high population of pets in the country. Emerging trends in the Middle East pet feed market, such as pet humanization and rise in demand for eco-friendly products, have led to a surge in demand for pet care products in the UAE.

The pet feed business in Qatar is expected to grow significantly during the forecast period, led by expansion in the e-commerce sector. This growth in online platforms in the region is creating lucrative pet feed market opportunities for manufacturers and distributors.

Manufacturers and suppliers of pet feed products are focusing on selling their products on various e-commerce websites in order to cater to a comprehensive range of customers across the region. Furthermore, pet ownership is increasing in Qatar, especially among expatriates. This rise in pet population is fueling the demand for pet feed in the country.

Companies operating in the pet feed business in the Middle East are investing significantly in comprehensive R&D activities, primarily to develop innovative and eco-friendly products. They are adopting strategies such as expansion of product portfolios and mergers & acquisitions to increase their customer base.

Baraqish, BioMar, General Mills Inc., Çağatay Pet Feed, Mars, Incorporated, Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.), ERBACHER the food family, Vafo Praha s.r.o, CAMON SPA, and, ThaiAwesome are the top key companies in the Middle East pet feed market.

These players have been summarized in the Middle East pet feed market research report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 955.8 Mn |

| Market Forecast Value in 2031 | US$ 1.5 Bn |

| Growth Rate (CAGR) | 5.3% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn/Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Reques |

It was valued at US$ 955.8 Mn in 2022

It is likely to grow at a CAGR of 5.3% from 2023 to 2031

Increase in pet adoption, rise in pet humanization, and growth in pet population

The dry food segment accounted for the largest share in 2022

The UAE held around 34.0% share in 2022

Baraqish, BioMar, General Mills Inc., Çağatay Pet Feed, Mars, Incorporated, Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.), ERBACHER the food family, Vafo Praha s.r.o, CAMON SPA, and ThaiAwesome

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Material Analysis

6. Middle East Pet Feed Market Analysis and Forecast, By Product Type

6.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

6.1.1. Dry Food

6.1.2. Wet/Canned Food

6.1.3. Frozen Food

6.1.4. Fresh/Raw Food

6.1.5. Treats & Snacks

6.2. Incremental Opportunity Analysis, By Product Type

7. Middle East Pet Feed Market Analysis and Forecast, By Category

7.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

7.1.1. Flavored

7.1.2. Unflavored

7.2. Incremental Opportunity Analysis, By Category

8. Middle East Pet Feed Market Analysis and Forecast, By Pet Type

8.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Pet Type, 2017 - 2031

8.1.1. Dog

8.1.2. Cat

8.1.3. Fish

8.2. Incremental Opportunity Analysis, By Pet Type

9. Middle East Pet Feed Market Analysis and Forecast, By Ingredient

9.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Ingredient, 2017 - 2031

9.1.1. Animal-derived

9.1.2. Plant-derived

9.1.3. Cereals & Cereal Derivatives

9.2. Incremental Opportunity Analysis, By Ingredient

10. Middle East Pet Feed Market Analysis and Forecast, By Life Stage

10.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Life Stage, 2017 - 2031

10.1.1. Newborn

10.1.2. Adult

10.1.3. Senior

10.2. Incremental Opportunity Analysis, By Life Stage

11. Middle East Pet Feed Market Analysis and Forecast, By Price

11.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

11.1.1. Low

11.1.2. Medium

11.1.3. High

11.2. Incremental Opportunity Analysis, By Price

12. Middle East Pet Feed Market Analysis and Forecast, by Distribution Channel

12.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

12.1.1. Online

12.1.1.1. Company-owned Websites

12.1.1.2. E-Commerce Websites

12.1.2. Offline

12.1.2.1. Supermarkets/Hypermarkets

12.1.2.2. Specialty Stores

12.1.2.3. Other Retail Stores

12.2. Incremental Opportunity Analysis, by Distribution Channel

13. Middle East Pet Feed Market Analysis and Forecast, by Country

13.1. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Region, 2017 - 2031

13.1.1. UAE

13.1.2. Qatar

13.1.3. Rest of Middle East

13.2. Incremental Opportunity Analysis, by Region

14. UAE Middle East Pet Feed Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Key Trend Analysis

14.4. Market Share Analysis

14.4.1. Local Manufactures vs Import

14.5. Consumer Buying Behavior Analysis

14.6. Pricing Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

14.7.1. Dry Food

14.7.2. Wet/Canned Food

14.7.3. Frozen Food

14.7.4. Fresh/Raw Food

14.7.5. Treats & Snacks

14.8. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

14.8.1. Flavored

14.8.2. Unflavored

14.9. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Pet Type, 2017 - 2031

14.9.1. Dog

14.9.2. Cat

14.9.3. Fish

14.10. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Ingredient, 2017 - 2031

14.10.1. Animal-derived

14.10.2. Plant-derived

14.10.3. Cereals & Cereal Derivatives

14.11. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Life Stage, 2017 - 2031

14.11.1. Newborn

14.11.2. Adult

14.11.3. Senior

14.12. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

14.12.1. Low

14.12.2. Medium

14.12.3. High

14.13. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

14.13.1. Online

14.13.1.1. Company-owned Websites

14.13.1.2. E-Commerce Websites

14.13.2. Offline

14.13.2.1. Supermarkets/Hypermarkets

14.13.2.2. Specialty Stores

14.13.2.3. Other Retail Stores

14.14. Incremental Opportunity Analysis

15. Qatar Middle East Pet Feed Market Analysis and Forecast

15.1. Country Snapshot

15.2. Demographic Overview

15.3. Key Trend Analysis

15.4. Market Share Analysis

15.4.1. Local Manufactures vs Import

15.5. Consumer Buying Behavior Analysis

15.6. Pricing Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Product Type, 2017 - 2031

15.7.1. Dry Food

15.7.2. Wet/Canned Food

15.7.3. Frozen Food

15.7.4. Fresh/Raw Food

15.7.5. Treats & Snacks

15.8. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Category, 2017 - 2031

15.8.1. Flavored

15.8.2. Unflavored

15.9. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Pet Type, 2017 - 2031

15.9.1. Dog

15.9.2. Cat

15.9.3. Fish

15.10. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Ingredient, 2017 - 2031

15.10.1. Animal-derived

15.10.2. Plant-derived

15.10.3. Cereals & Cereal Derivatives

15.11. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Life Stage, 2017 - 2031

15.11.1. Newborn

15.11.2. Adult

15.11.3. Senior

15.12. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Price, 2017 - 2031

15.12.1. Low

15.12.2. Medium

15.12.3. High

15.13. Middle East Pet Feed Market Size (US$ Mn and Million Units), By Distribution Channel, 2017 - 2031

15.13.1. Online

15.13.1.1. Company-owned Websites

15.13.1.2. E-Commerce Websites

15.13.2. Offline

15.13.2.1. Supermarkets/Hypermarkets

15.13.2.2. Specialty Stores

15.13.2.3. Other Retail Stores

15.14. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Baraqish

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. BioMar

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Çağatay Pet Feed

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. CAMON SPA

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. ERBACHER the food family

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. General Mills Inc.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Mars, Incorporated

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. ThaiAwesome

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Vafo Praha s.r.o

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Middle East Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Table 2: Middle East Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Table 3: Middle East Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Table 4: Middle East Pet Feed Market Volume, by Category, Million Units, 2017-2031

Table 5: Middle East Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Table 6: Middle East Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Table 7: Middle East Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Table 8: Middle East Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Table 9: Middle East Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Table 10: Middle East Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Table 11: Middle East Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Table 12: Middle East Pet Feed Market Volume, by Price, Million Units, 2017-2031

Table 13: Middle East Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 14: Middle East Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

Table 15: Middle East Pet Feed Market Value, by Country, US$ Mn, 2017-2031

Table 16: Middle East Pet Feed Market Volume, by Country, Million Units, 2017-2031

Table 17: Middle East Pet Feed Market Incremental Opportunity, by Country, 2021-2031

Table 18: UAE Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Table 19: UAE Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Table 20: UAE Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Table 21: UAE Pet Feed Market Volume, by Category, Million Units, 2017-2031

Table 22: UAE Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Table 23: UAE Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Table 24: UAE Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Table 25: UAE Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Table 26: UAE Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Table 27: UAE Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Table 28: UAE Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Table 29: UAE Pet Feed Market Volume, by Price, Million Units, 2017-2031

Table 30: UAE Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 31: UAE Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

Table 32: Qatar Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Table 33: Qatar Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Table 34: Qatar Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Table 35: Qatar Pet Feed Market Volume, by Category, Million Units, 2017-2031

Table 36: Qatar Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Table 37: Qatar Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Table 38: Qatar Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Table 39: Qatar Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Table 40: Qatar Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Table 41: Qatar Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Table 42: Qatar Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Table 43: Qatar Pet Feed Market Volume, by Price, Million Units, 2017-2031

Table 44: Qatar Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 45: Qatar Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

List of Figures

Figure 1: Middle East Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Figure 2: Middle East Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Figure 3: Middle East Pet Feed Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: Middle East Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Figure 5: Middle East Pet Feed Market Volume, by Category, Million Units, 2017-2031

Figure 6: Middle East Pet Feed Market Incremental Opportunity, by Category, 2021-2031

Figure 7: Middle East Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Figure 8: Middle East Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Figure 9: Middle East Pet Feed Market Incremental Opportunity, by Pet Type, 2021-2031

Figure 10: Middle East Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Figure 11: Middle East Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Figure 12: Middle East Pet Feed Market Incremental Opportunity, by Ingredient, 2021-2031

Figure 13: Middle East Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Figure 14: Middle East Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Figure 15: Middle East Pet Feed Market Incremental Opportunity, by Life Stage, 2021-2031

Figure 16: Middle East Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Figure 17: Middle East Pet Feed Market Volume, by Price, Million Units, 2017-2031

Figure 18: Middle East Pet Feed Market Incremental Opportunity, by Price, 2021-2031

Figure 19: Middle East Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 20: Middle East Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 21: Middle East Pet Feed Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 22: Middle East Pet Feed Market Value, by Country, US$ Mn, 2017-2031

Figure 23: Middle East Pet Feed Market Volume, by Country, Million Units, 2017-2031

Figure 24: Middle East Pet Feed Market Incremental Opportunity, by Country,2021-2031

Figure 25: UAE Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Figure 26: UAE Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Figure 27: UAE Pet Feed Market Incremental Opportunity, by Product Type, 2021-2031

Figure 28: UAE Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Figure 29: UAE Pet Feed Market Volume, by Category, Million Units, 2017-2031

Figure 30: UAE Pet Feed Market Incremental Opportunity, by Category, 2021-2031

Figure 31: UAE Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Figure 32: UAE Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Figure 33: UAE Pet Feed Market Incremental Opportunity, by Pet Type, 2021-2031

Figure 34: UAE Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Figure 35: UAE Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Figure 36: UAE Pet Feed Market Incremental Opportunity, by Ingredient, 2021-2031

Figure 37: UAE Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Figure 38: UAE Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Figure 39: UAE Pet Feed Market Incremental Opportunity, by Life Stage, 2021-2031

Figure 40: UAE Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Figure 41: UAE Pet Feed Market Volume, by Price, Million Units, 2017-2031

Figure 42: UAE Pet Feed Market Incremental Opportunity, by Price, 2021-2031

Figure 43: UAE Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 44: UAE Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 45: UAE Pet Feed Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 46: Qatar Pet Feed Market Value, by Product Type, US$ Mn, 2017-2031

Figure 47: Qatar Pet Feed Market Volume, by Product Type, Million Units, 2017-2031

Figure 48: Qatar Pet Feed Market Incremental Opportunity, by Product Type, 2021-2031

Figure 49: Qatar Pet Feed Market Value, by Category, US$ Mn, 2017-2031

Figure 50: Qatar Pet Feed Market Volume, by Category, Million Units, 2017-2031

Figure 51: Qatar Pet Feed Market Incremental Opportunity, by Category, 2021-2031

Figure 52: Qatar Pet Feed Market Value, by Pet Type, US$ Mn, 2017-2031

Figure 53: Qatar Pet Feed Market Volume, by Pet Type, Million Units, 2017-2031

Figure 54: Qatar Pet Feed Market Incremental Opportunity, by Pet Type, 2021-2031

Figure 55: Qatar Pet Feed Market Value, by Ingredient, US$ Mn, 2017-2031

Figure 56: Qatar Pet Feed Market Volume, by Ingredient, Million Units, 2017-2031

Figure 57: Qatar Pet Feed Market Incremental Opportunity, by Ingredient, 2021-2031

Figure 58: Qatar Pet Feed Market Value, by Life Stage, US$ Mn, 2017-2031

Figure 59: Qatar Pet Feed Market Volume, by Life Stage, Million Units, 2017-2031

Figure 60: Qatar Pet Feed Market Incremental Opportunity, by Life Stage, 2021-2031

Figure 61: Qatar Pet Feed Market Value, by Price, US$ Mn, 2017-2031

Figure 62: Qatar Pet Feed Market Volume, by Price, Million Units, 2017-2031

Figure 63: Qatar Pet Feed Market Incremental Opportunity, by Price, 2021-2031

Figure 64: Qatar Pet Feed Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 65: Qatar Pet Feed Market Volume, by Distribution Channel, Million Units, 2017-2031

Figure 66: Qatar Pet Feed Market Incremental Opportunity, by Distribution Channel, 2021-2031