Reports

Reports

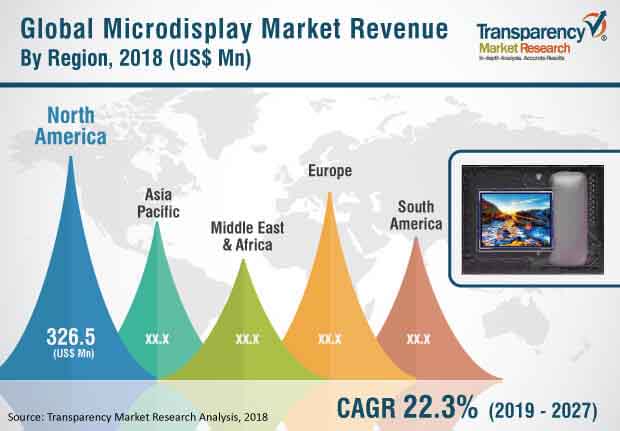

Microdisplays are microminiaturized displays with the screen size of less than 50 mm when measured diagonally. These high-density, high-resolution screens are used in magnified display systems. Microdisplay systems first appeared around two decades ago and over the time, they have evolved in terms of technology and application. Currently, they are increasingly used in camcorder viewfinders, head mounted displays, and cinema projectors. Various industries across the globe including automotive and consumer electronics are witnessing high demand for micro display systems. The global microdisplay market is projected to expand at a CAGR of 22.3% during the forecast period and reach value of US$ 5,782.6 Mn by 2027.

The global market for microdisplays has witnessed substantial growth over the last two decades. This is primarily attributable to growing popularity of the AR/VR (augmented reality/virtual reality) technology and rising demand for smart glasses across the globe. AR and VR headsets require highly advanced microdisplays, as they need to offer peak performance at close physical proximity to the user, who would address concerns about overheating of devices. Primarily, lightweight and compact VR glasses made by using large-area microdisplays are estimated to drive the global microdisplay market during the forecast period.

Furthermore, increasing demand for the AR/VR technology in the gaming & entertainment sector is projected to drive the global microdisplay market during the forecast period. This can be attributed to the compatibility of headsets equipped with the VR technology with smartphones and other smart electronics devices used for superior gaming experience. AR and VR technology-based products, such as AR HMDs, HUDs, and VR HMDs, are expected to witness significant demand during the forecast period. This factor is estimated to augment the market for microdisplays in end-use industry segments such as industrial, automotive, and military, defense and aerospace in the next few years.

Furthermore, adoption of HMDs (head-mounted displays) in multiple end-use industries is becoming a major trend in the global microdisplay market. AR and VR head-mounted displays are major applications of microdisplays. The compact size of microdisplays enable their deployment in HMDs, wherein space is a key constraint. Head-mounted displays offer high resolution and comparatively compact size. These displays are designed to be employed in different applications across several industries including health care, education, automotive, consumer electronics, and sports & entertainment. Thus, increasing demand of head-mounted displays from different industry verticals is anticipated to create new opportunities for the global microdisplay market in the next few years.

However, complex nature of the manufacturing process and high production costs of microdisplays are likely to hamper the global microdisplay market during the forecast period. This is supported by limited availability of raw materials required for the manufacture of microdisplays. Nevertheless, rising demand for microdisplays for use in VR/AR systems presents significant growth opportunities for the global microdisplay market.

With the objective of expanding their business, several players are expanding their offerings through strategic mergers and acquisitions as well as partnerships. Furthermore, an increasing number of players are spending significantly on R&D activities to develop innovative and technologically advanced microdisplay products. Some of the prominent players operating in the global microdisplay market are AU Optronics Corp, eMagin Corporation, Himax Technology Inc., KopIn Corporation Inc., LG Display Co. Ltd, Microvision Inc., Omnivision Technologies, Inc., Sony Corporation, Syndiant Inc., and Universal Display Corporation.

Rising Innovations in Gaming Sector to Propel Growth of Microdisplay Market

The increasing popularity of virtual reality and augmented reality technology especially in the gaming sector is also expected to aid in expansion of the global microdisplay market. Another key factor boosting the growth of this market is the increasing demand for high resolution and better image quality among users. Microdisplays are microminiaturized shows with the screen size of under 50 mm when estimated slantingly. These high-thickness, high-goal screens are utilized in amplified show frameworks. Microdisplay frameworks initially showed up around twenty years prior and throughout the time, they have developed regarding innovation and application. At present, they are progressively utilized in camcorder viewfinders, head mounted showcases, and film projectors. Different enterprises across the globe including car and customer hardware are seeing popularity for miniature showcase frameworks.

Microdisplays are microminiaturized shows with the screen size of under 50 mm when estimated askew. These high-thickness, high-goal screens are utilized in amplified show frameworks. Microdisplay frameworks initially showed up around twenty years back and throughout the time, they have advanced as far as innovation and application. Right now, they are progressively utilized in camcorder viewfinders, head mounted showcases, and film projectors. Different enterprises across the globe including auto and buyer hardware are seeing popularity for miniature presentation frameworks.

High-goal microdisplays offer brilliant review insight to clients, which brings about the expanding ubiquity of high-goal show gadgets. These highlights permit the sending of microdisplays in numerous applications going from purchaser hardware to military, guard and aviation. This, thus, brings about expanding notoriety of microdisplays among makers. This factor is probably going to drive the worldwide microdisplay market.

Demographically, North America held the largest share on account of the early adoption of technologies, coupled with the rising adoption of consumer electronics sector. However, Asia Pacific is likely to witness lucartive growth opportunities owing to the increasing number of players operating in the microdisplay market such as Sony Corporation, LG Display., and others.

1. Preface

1.1. Global Microdisplay Market Definition and Scope

1.2. Global Microdisplay Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Microdisplay Market

4. Market Overview

4.1. Introduction

4.2. Global Microdisplay Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Key Market Indicators

4.5. Global Microdisplay Market Analysis and Forecast, 2017-2027

4.5.1. Global Microdisplay Market Revenue Projection (US$ Mn)

4.6. Porter’s Five Forces Analysis

4.7. Global Microdisplay Market Value Chain Analysis

4.8. Global Microdisplay Market Outlook

5. Global Microdisplay Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Global Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

5.2.1. Reflective

5.2.2. Transmissive

5.3. Type Comparison Matrix

5.4. Global Microdisplay Market Attractiveness, by Type

6. Global Microdisplay Market Analysis and Forecast, by Technology

6.1. Overview & Definitions

6.2. Global Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

6.2.1. Liquid Crystal on Silicon (LCoS)

6.2.2. Liquid Crystal Displays (LCDs)

6.2.3. Digital Light Processing (DLP)

6.2.4. Organic Light-emitting Diodes (OLEDs)

6.2.5. Others (Including DMD and Holographic Displays)

6.3. Technology Comparison Matrix

6.4. G0lobal Microdisplay Market Attractiveness, by Technology

7. Global Microdisplay Market Analysis and Forecast, by Projection Type

7.1. Overview & Definitions

7.2. Global Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

7.2.1. Projection

7.2.2. Near-to-eye Displays (NEDs)

7.3. Projection Type Comparison Matrix

7.4. Global Microdisplay Market Attractiveness, by Projection Type

8. Global Microdisplay Market Analysis and Forecast, by End-use Industry

8.1. Overview & Definition

8.2. Global Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

8.2.1. Consumer Electronics

8.2.2. Healthcare

8.2.3. Military, Defense and Aerospace

8.2.4. Automotive

8.2.5. Sports & Entertainment

8.2.6. Retail & Hospitality

8.2.7. Industrial

8.2.8. Others

8.3. End-use Industry Comparison Matrix

8.4. Global Microdisplay Market Attractiveness, by End-use Industry

9. Global Microdisplay Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Microdisplay Market Revenue (US$ Mn) Forecast, by Region, 2017-2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

9.3. Global Microdisplay Market Attractiveness, by Region

10. North America Microdisplay Market Analysis and Forecast

10.1. Key Findings

10.2. North America Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

10.2.1. Reflective

10.2.2. Transmissive

10.3. North America Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

10.3.1. Liquid Crystal on Silicon (LCoS)

10.3.2. Liquid Crystal Displays (LCDs)

10.3.3. Digital Light Processing (DLP)

10.3.4. Organic Light-emitting Diodes (OLEDs)

10.3.5. Others (Including DMD and Holographic Displays)

10.4. North America Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

10.4.1. Projection

10.4.2. Near-to-eye Displays (NEDs)

10.5. North America Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

10.5.1. Consumer Electronics

10.5.2. Healthcare

10.5.3. Military, Defense and Aerospace

10.5.4. Automotive

10.5.5. Sports & Entertainment

10.5.6. Retail & Hospitality

10.5.7. Industrial

10.5.8. Others

10.6. North America Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. North America Microdisplay Market Attractiveness Analysis

10.7.1. by Type

10.7.2. by Projection Type

10.7.3. by Technology

10.7.4. by End-use Industry

10.7.5. by Country/Sub-region

11. Europe Microdisplay Market Analysis and Forecast

11.1. Key Findings

11.2. Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

11.2.1. Reflective

11.2.2. Transmissive

11.3. Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

11.3.1. Liquid Crystal on Silicon (LCoS)

11.3.2. Liquid Crystal Displays (LCDs)

11.3.3. Digital Light Processing (DLP)

11.3.4. Organic Light-emitting Diodes (OLEDs)

11.3.5. Others (Including DMD and Holographic Displays)

11.4. Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

11.4.1. Projection

11.4.2. Near-to-eye Displays (NEDs)

11.5. Europe Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

11.5.1. Consumer Electronics

11.5.2. Healthcare

11.5.3. Military, Defense and Aerospace

11.5.4. Automotive

11.5.5. Sports & Entertainment

11.5.6. Retail & Hospitality

11.5.7. Industrial

11.5.8. Others

11.6. Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Rest of Europe

11.7. Europe Microdisplay Market Attractiveness Analysis

11.7.1. by Type

11.7.2. by Projection Type

11.7.3. by Technology

11.7.4. by End-use Industry

11.7.5. by Country/Sub-region

12. Asia Pacific Microdisplay Market Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

12.2.1. Reflective

12.2.2. Transmissive

12.3. Asia Pacific Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

12.3.1. Liquid Crystal on Silicon (LCoS)

12.3.2. Liquid Crystal Displays (LCDs)

12.3.3. Digital Light Processing (DLP)

12.3.4. Organic Light-emitting Diodes (OLEDs)

12.3.5. Others (Including DMD and Holographic Displays)

12.4. Asia Pacific Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

12.4.1. Projection

12.4.2. Near-to-eye Displays (NEDs)

12.5. Asia Pacific Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

12.5.1. Consumer Electronics

12.5.2. Healthcare

12.5.3. Military, Defense and Aerospace

12.5.4. Automotive

12.5.5. Sports & Entertainment

12.5.6. Retail & Hospitality

12.5.7. Industrial

12.5.8. Others

12.6. Asia Pacific Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. Taiwan

12.6.6. Rest of APAC

12.7. Asia Pacific Microdisplay Market Attractiveness Analysis

12.7.1. by Type

12.7.2. by Projection Type

12.7.3. by Technology

12.7.4. by End-use Industry

12.7.5. by Country/Sub-region

13. Middle East & Africa (MEA) Microdisplay Market Analysis and Forecast

13.1. Key Findings

13.2. Middle East & Africa (MEA) Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

13.2.1. Reflective

13.2.2. Transmissive

13.3. Middle East & Africa (MEA) Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

13.3.1. Liquid Crystal on Silicon (LCoS)

13.3.2. Liquid Crystal Displays (LCDs)

13.3.3. Digital Light Processing (DLP)

13.3.4. Organic Light-emitting Diodes (OLEDs)

13.3.5. Others (Including DMD and Holographic Displays)

13.4. Middle East & Africa (MEA) Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

13.4.1. Projection

13.4.2. Near-to-eye Displays (NEDs)

13.5. Middle East & Africa (MEA) Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

13.5.1. Consumer Electronics

13.5.2. Healthcare

13.5.3. Military, Defense and Aerospace

13.5.4. Automotive

13.5.5. Sports & Entertainment

13.5.6. Retail & Hospitality

13.5.7. Industrial

13.5.8. Others

13.6. Middle East & Africa (MEA) Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of MEA

13.7. Middle East & Africa (MEA) Microdisplay Market Attractiveness Analysis

13.7.1. by Type

13.7.2. by Projection Type

13.7.3. by Technology

13.7.4. by End-use Industry

13.7.5. by Country/Sub-region

14. South America Microdisplay Market Analysis and Forecast

14.1. Key Findings

14.2. South America Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

14.2.1. Reflective

14.2.2. Transmissive

14.3. South America Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

14.3.1. Liquid Crystal on Silicon (LCoS)

14.3.2. Liquid Crystal Displays (LCDs)

14.3.3. Digital Light Processing (DLP)

14.3.4. Organic Light-emitting Diodes (OLEDs)

14.3.5. Others (Including DMD and Holographic Displays)

14.4. South America Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

14.4.1. Projection

14.4.2. Near-to-eye Displays (NEDs)

14.5. South America Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

14.5.1. Consumer Electronics

14.5.2. Healthcare

14.5.3. Military, Defense and Aerospace

14.5.4. Automotive

14.5.5. Sports & Entertainment

14.5.6. Retail & Hospitality

14.5.7. Industrial

14.5.8. Others

14.6. South America Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

14.6.1. Brazil

14.6.2. Rest of South America

14.7. South America Microdisplay Market Attractiveness Analysis

14.7.1. by Type

14.7.2. by Projection Type

14.7.3. by Technology

14.7.4. by End-use Industry

14.7.5. by Country/Sub-region

15. Competition Landscape

15.1. Global Microdisplay Market Players – Competition Matrix

15.2. Global Microdisplay Market Share Analysis, by Company (2018)

15.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Development, Strategy)

15.3.1. AU Optronics Corp

15.3.2. eMagin Corporation

15.3.3. Himax Technology Inc.

15.3.4. KopIn Corporation Inc.

15.3.5. LG Display Co. Ltd

15.3.6. Microvision Inc.

15.3.7. Omnivision Technologies, Inc.

15.3.8. Sony Corporation

15.3.9. Syndiant Inc.

15.3.10. Universal Display Corporation

16. Key Takeaways

List of Tables

Table 01: Global Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 02: Global Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 03: Global Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 04: Global Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 05: Global Microdisplay Market Revenue (US$ Mn) Forecast, by Region, 2017-2027

Table 06: North America Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 07: North America Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 08: North America Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 09: North America Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 10: North America Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 11: Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 12: Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 13: Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 14: Europe Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 15: Europe Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 16: APAC Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 17: APAC Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 18: APAC Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 19: APAC Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 20: APAC Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 21: MEA Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 22: MEA Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 23: MEA Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 24: MEA Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 25: MEA Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

Table 26: South America Microdisplay Market Revenue (US$ Mn) Forecast, by Type, 2017-2027

Table 27: South America Microdisplay Market Revenue (US$ Mn) Forecast, by Technology, 2017-2027

Table 28: South America Microdisplay Market Revenue (US$ Mn) Forecast, by Projection Type, 2017-2027

Table 29: South America Microdisplay Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017-2027

Table 30: South America Microdisplay Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017-2027

List of Figures

Figure 01: Global Microdisplay Market Size, Historical and Forecast, 2017-2027

Figure 02: Global Microdisplay Market Size, Historical and Forecast, 2017-2027

Figure 03: North America Microdisplay Market CAGR

Figure 04: Europe Microdisplay Market CAGR

Figure 05: Asia Pacific Microdisplay Market CAGR

Figure 06: Middle East & Africa Microdisplay Market CAGR

Figure 07: South America Microdisplay Market CAGR

Figure 08: Global Microdisplay Market Value Share, by Region, 2018

Figure 09: Global Microdisplay Market Revenue (US$ Mn) Forecast, 2017-2027

Figure 10 : Porter’s Five Forces Analysis

Figure 11 : Value Chain Analysis – Global Microdisplay Market

Figure 12: Global Microdisplay Market Value Share, by Type (2018)

Figure 13: Global Microdisplay Market Value Share, by Projection Type (2018)

Figure 14: Global Microdisplay Market Value Share, by Technology (2018)

Figure 15: Global Microdisplay Market Value Share, by End-use Industry (2018)

Figure 16: Global Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 17: Global Microdisplay Market, by Type, Reflective

Figure 18: Global Microdisplay Market, by Type, Transmissive

Figure 19: Global Microdisplay Market Comparison Matrix, by Type

Figure 20: Global Microdisplay Market Attractiveness Analysis, by Type

Figure 21: Global Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 22: Global Microdisplay Market, by Technology, LCoS

Figure 23: Global Microdisplay Market, by Technology, LCD

Figure 24: Global Microdisplay Market, by Technology, DLP

Figure 25: Global Microdisplay Market, by Technology, OLED

Figure 26: Global Microdisplay Market, by Technology, Others

Figure 27: Global Microdisplay Market Comparison Matrix, by Technology

Figure 28: Global Microdisplay Market Attractiveness Analysis, by Technology

Figure 29: Global Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 30: Global Microdisplay Market, by Projection Type, Projection

Figure 31: Global Microdisplay Market, by Projection Type, Near-to-eye Displays (NEDs)

Figure 32: Global Microdisplay Market Comparison Matrix, by Projection Type

Figure 33: Global Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 34: Global Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 35: Global Microdisplay Market, by End-use Industry, Consumer Electronics

Figure 36: Global Microdisplay Market, by End-use Industry, Healthcare

Figure 37: Global Microdisplay Market, by End-use Industry, Military, Defense and Aerospace

Figure 38: Global Microdisplay Market, by End-use Industry, Automotive

Figure 39: Global Microdisplay Market, by End-use Industry, Sports & Entertainment

Figure 40: Global Microdisplay Market, by End-use Industry, Retail & Hospitality

Figure 41: Global Microdisplay Market, by End-use Industry, Industrial

Figure 42: Global Microdisplay Market, by End-use Industry, Others

Figure 43: Global Microdisplay Market Comparison Matrix, by End-use Industry

Figure 44: Global Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 45: Global Microdisplay Market, by Region, North America

Figure 46: Global Microdisplay Market, by Region, Europe

Figure 47: Global Microdisplay Market, by Region, APAC

Figure 48: Global Microdisplay Market, by Region, MEA

Figure 49: Global Microdisplay Market, by Region, South America

Figure 50: Global Microdisplay Market Attractiveness Analysis, by Region

Figure 51: North America Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 52: North America Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 53: North America Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 54: North America Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 55: North America Microdisplay Market Value Share Analysis, by Country/Sub-region, 2019-2027

Figure 56: North America Microdisplay Market Attractiveness Analysis, by Type

Figure 57: North America Microdisplay Market Attractiveness Analysis, by Technology

Figure 58: North America Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 59 : North America Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 60: North America Microdisplay Market Attractiveness Analysis, by Country/Sub-region

Figure 61: Europe Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 62: Europe Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 63: Europe Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 64: Europe Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 65: Europe Microdisplay Market Value Share Analysis, by Country/Sub-region, 2019-2027

Figure 66: Europe Microdisplay Market Attractiveness Analysis, by Type

Figure 67: Europe Microdisplay Market Attractiveness Analysis, by Technology

Figure 68: Europe Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 69: Europe Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 70: Europe Microdisplay Market Attractiveness Analysis, by Country/Sub-region

Figure 71: APAC Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 72: APAC Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 73: APAC Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 74: APAC Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 75: APAC Microdisplay Market Value Share Analysis, by Country/Sub-region, 2019-2027

Figure 76: APAC Microdisplay Market Attractiveness Analysis, by Type

Figure 77: APAC Microdisplay Market Attractiveness Analysis, by Technology

Figure 78: APAC Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 79: APAC Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 80: APAC Microdisplay Market Attractiveness Analysis, by Country/Sub-region

Figure 81: MEA Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 82: MEA Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 83: MEA Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 84: MEA Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 85: MEA Microdisplay Market Value Share Analysis, by Country/Sub-region, 2019-2027

Figure 86: MEA Microdisplay Market Attractiveness Analysis, by Type

Figure 87: MEA Microdisplay Market Attractiveness Analysis, by Technology

Figure 88: MEA Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 89: MEA Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 90: MEA Microdisplay Market Attractiveness Analysis, by Country/Sub-region

Figure 91: South America Microdisplay Market Value Share Analysis, by Type, 2019-2027

Figure 92: South America Microdisplay Market Value Share Analysis, by Technology, 2019-2027

Figure 93: South America Microdisplay Market Value Share Analysis, by Projection Type, 2019-2027

Figure 94: South America Microdisplay Market Value Share Analysis, by End-use Industry, 2019-2027

Figure 95: South America Microdisplay Market Value Share Analysis, by Country/Sub-region, 2019-2027

Figure 96: South America Microdisplay Market Attractiveness Analysis, by Type

Figure 97: South America Microdisplay Market Attractiveness Analysis, by Technology

Figure 98: South America Microdisplay Market Attractiveness Analysis, by Projection Type

Figure 99: South America Microdisplay Market Attractiveness Analysis, by End-use Industry

Figure 100: South America Microdisplay Market Attractiveness Analysis, by Country/Sub-region