Reports

Reports

The microcontrollers market’s growth is driven by an increased demand for consumer electronics, Internet of Things (IoT), automotive, and healthcare industries. Consumer preference for smarter and interconnected devices drives the market for microcontrollers. Microcontrollers have adopted the wireless technology such as Wi-Fi, Bluetooth, and LoRa (long-range) to support device-to-device communication.

Also, microcontrollers are energy-efficient and long-lasting battery powered solutions that allow to extend operation in IoT devices, wearables, and remote monitoring systems while reducing energy consumption. For example - MSP432 microcontrollers from Texas Instruments.

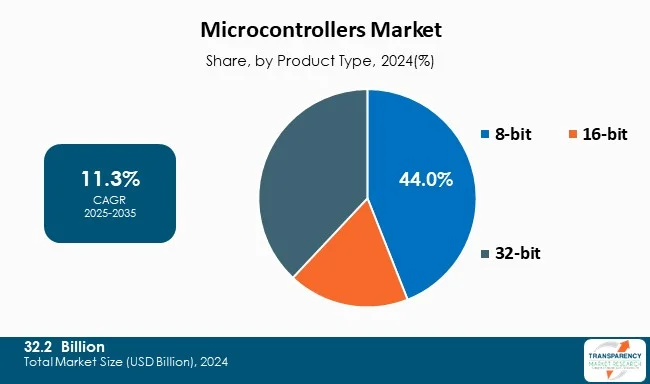

Additionally, Advanced driver-assistance systems (ADAS), in-vehicle infotainment systems, power management in EVs, and safety electronics demand MCUs that have more power, more reliability, and more security. The market shares of 32-bit MCUs, which dominate current revenue share and continue to expect strong growth in automotive applications and other more advanced applications. Hence, the market of microcontrollers is rapidly growing with several factor and emerging trends.

The microcontrollers Market falls in the category of semiconductor industry, particularly as a part of microelectronic components used in embedded system. Industry 4.0 revolution and the increasing automation of manufacturing processes require sophisticated control system, thus making microcontrollers indispensable in these applications.

The rising focus on renewable energy solutions and energy-efficient devices is leading the development of microcontrollers. As a result, the companies are expected to invest heavily in smart microcontroller design that can cater to the needs in multiple operations.

Technologies like Artificial Intelligence (AI) and Machine Learning (ML) play a crucial role in transforming the market for microcontrollers. The massive growth of smart devices including electronics, wearables, and appliances creates a huge demand for automotive, consumer electronics, healthcare etc. for instance- In medical scenarios, microcontrollers can regulate the operations of an artificial heart, kidney or other organs. They can also be instrumental in the functioning of prosthetic devices.

With advancements in technologies such as AI integration, ultra-low power Microcontrollers, and connectivity options (e.g., 5G, Wi-Fi, Bluetooth), firms are aiming to leverage these innovations to gain a competitive edge.

| Attribute | Detail |

|---|---|

| Microcontrollers Market Drivers |

|

Wireless Connectivity Integration and AI-Enabled Microcontrollers to Drive Microcontrollers Market Size

The rising technological advancements in microcontrollers market imply incorporation of Artificial intelligence, Wi-Fi, Bluetooth, LoRa, and smart appliances that analyze the data in real time.

AI-enabled microcontrollers are used for localized, high-speed decision-making that might improve efficiency in autonomous vehicles, robotics, and new consumer electronics, thereby augmenting the microcontroller demand growth.

For example- The ESP32 is powered by a Tensilica Xtensa LX6 dual-core 32-bit microprocessor with a clock speed of up to 240 MHz, offering high performance for complex applications. It includes 520 KB of SRAM, 448 KB of ROM, and up to 4 MB of flash memory. It supports Wi-Fi 802.11 b/g/n with speeds up to 150 Mbps and Bluetooth v4.2, including BLE. This hybrid connectivity renders it suitable for a broad range of wireless applications.

Additionally, AI has numerous applications across various industries, including healthcare, finance, transportation, and education. Today, manufacturers are more focused on building MCUs with AI accelerators, NPUs, and optimized software libraries to enable on-device intelligence with energy efficiency. Hence, several key players in the market are investing in strategic collaboration, key launches, and technological advancement research to take the market forward.

Energy-efficient microcontrollers are widely used in various appliances such as medical devices, industrial sensors, and IoT devices that are designed by smart technologies. Microcontrollers in these devices helps to extend battery life and improve the overall efficiency of electronic systems.

Low power consumption microcontrollers often feature various techniques such as dynamic voltage and frequency scaling, optimized code execution and advance power management. These are a few techniques that allow the microcontroller to adjust its algorithms, voltage, and power gating to minimize the energy waste.

These days, consumers are looking for energy-efficient devices that can operate for extended periods without frequent battery replacements, thereby improving reliability and cutting down on maintenance costs. They pay more attention to energy use—spurred by escalating electricity rates, environmental issues, and government regulations—consumers are seeking smart, low-power electronics that will intelligently use less energy. Smart thermostats, lighting systems with LED bulbs, energy-efficient washing machines, air conditioners, and refrigerators, all use microcontrollers, maximizing the monitoring, controlling, and optimizing of operation and energy use.

32-bit has the largest market share in microcontrollers market due to increasing demand for high-performance computing across various sectors such as automotive, healthcare, consumer electronics and others. These sectors are using advanced technologies to upgrade the microcontrollers in devices.

Technological advancements such as integrated AI and IoT create a huge market demand for microcontrollers for their smart devices. 32-Bit Microcontrollers Industry expansion is steady due to rise of automation in sectors like manufacturing, healthcare, and automation. with the presence of rich development ecosystems and scalable architectures (e.g., ARM Cortex-M cores), have made them much more appealing for developers and manufacturers.

Also, 32-bit microcontrollers market capabilities and energy-efficiency is far better than the rest of the segment. Microcontrollers are highly energy-efficient with multiple integrated feature. Hence, with industry-wide demand for smarter, connected, and more efficient devices continuing to rise, the 32-bit MCU segment will likely continue to maintain its dominance in the global microcontroller market.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

Asia-Pacific region leads the global market for microcontrollers and capturing significant market share. due to its mature electronics manufacturing ecosystem, fast industrialization, and increasing demands across major application segments. Also, the rapid urbanization and growing economy drives the market for Asia-Pacific.

The region is surrounded by the major countries such as China, Japan, India with propelling demand for microcontrollers. China the Asia-Pacific region due highly developed supply chain infrastructure and semi-conductor manufacturing base. Also, several key players are working toward innovating advance product such as cutting-edge innovation, AI, IoT, and ML, which cater to this demand. Additionally, the region benefits from low-cost skilled labor, government support for manufacturing, and infrastructure in place for semiconductors which includes foundries like TSMC and Samsung. As electric vehicle (EV) production is increasing globally and taller IoT applications emerge, along with the use of smart devices in urban and rural environments, the demand for advanced, energy-efficient MCUs will continue to rise.

Key players operating in the microcontrollers market are investing into innovation, strategic partnerships, and technological advancements. They focus on improving imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Microchip Technology, Nuvoton Technology Corporation, Infineon Technologies AG, NXP Semiconductors, Analog Devices Inc., Broadcom Inc., Intel Corporation, Onsemi, Renesas Electronics Corporation, ROHM Co., Ltd., STMicroelectronics N.V, Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation) are the key players in the microcontrollers market.

Each of these players has been profiled in the microcontrollers market research report based on parameters such as company overview, financial overview, SWOT analysis, and business overview.

Key Developments in Microcontrollers Market

| Attribute | Detail |

|---|---|

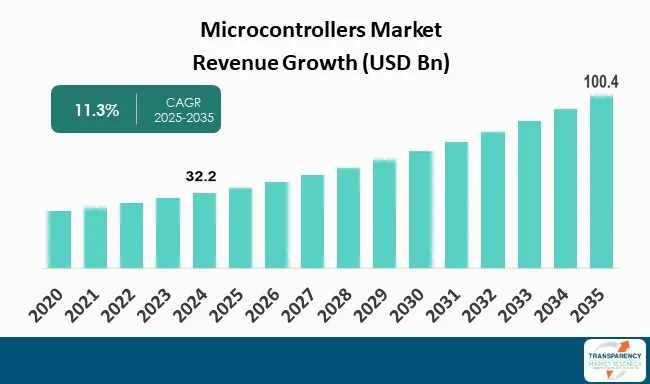

| Size in 2024 | US$ 32.2 Bn |

| Forecast Value in 2035 | US$ 100.4 Bn |

| CAGR | 11.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global microcontrollers market was valued at US$ 32.2 Bn in 2024

The global microcontrollers industry is projected to reach US$ 100.4 Bn by 2035

Increasing demand for flexible consumer electronics, cost–effectiveness, and save material waste with environmentally-friendly approach are some of the factors driving the expansion of microcontrollers market.

The CAGR is anticipated to be 11.3% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Microchip Technology, Nuvoton Technology Corporation, Infineon Technologies AG, NXP Semiconductors, Analog Devices Inc., Broadcom Inc., Intel Corporation, Onsemi, Reneas Electronics Corporation, ROHM Co., Ltd., STMicroelectronics N.V, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation) among others

Table 01: Global Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 02: Global Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 03: Global Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 04: Global Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 05: North America Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 06: North America Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 07: North America Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 08: North America Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 09: U.S. Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 10: U.S. Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 11: U.S. Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 12: Canada Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 13: Canada Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 14: Canada Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 15: Europe Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 16: Europe Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 17: Europe Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 18: Europe Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 19: Germany Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 20: Germany Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 21: Germany Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 22: U.K. Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 23: U.K. Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 24: U.K. Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 25: France Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 26: France Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 27: France Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 28: Italy Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 29: Italy Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 30: Italy Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 31: Spain Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 32: Spain Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 33: Spain Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 34: Switzerland Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 35: Switzerland Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 36: Switzerland Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 37: The Netherlands Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 38: The Netherlands Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 39: The Netherlands Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 40: Rest of Europe Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 41: Rest of Europe Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 42: Rest of Europe Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 43: Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 44: Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 45: Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 46: Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 47: China Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 48: China Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 49: China Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 50: Japan Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 51: Japan Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 52: Japan Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 53: India Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 54: India Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 55: India Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 56: South Korea Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 57: South Korea Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 58: South Korea Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 59: Australia and New Zealand Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 60: Australia and New Zealand Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 61: Australia and New Zealand Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 62: Rest of Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 63: Rest of Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 64: Rest of Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 65: Latin America Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 66: Latin America Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 67: Latin America Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 68: Latin America Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 69: Brazil Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 70: Brazil Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 71: Brazil Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 72: Mexico Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 73: Mexico Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 74: Mexico Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 75: Argentina Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 76: Argentina Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 77: Argentina Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 78: Rest of Latin America Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 79: Rest of Latin America Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 80: Rest of Latin America Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 81: Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 82: Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 83: Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 84: Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, by Country/Sub-region, 2025 to 2035

Table 85: GCC Countries Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 86: GCC Countries Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 87: GCC Countries Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 88: South Africa Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 89: South Africa Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 90: South Africa Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Table 91: Rest of Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, by Product Type, 2025 to 2035

Table 92: Rest of Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, By Application, 2025 to 2035

Table 93: Rest of Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, by Architecture Type, 2025 to 2035

Figure 01: Global Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 02: Global Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 03: Global Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 04: Global Microcontrollers Market Revenue (US$ Bn), by 8-bit, 2025 to 2035

Figure 05: Global Microcontrollers Market Revenue (US$ Bn), by 16-bit, 2025 to 2035

Figure 06: Global Microcontrollers Market Revenue (US$ Bn), by 32-bit, 2025 to 2035

Figure 07: Global Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 08: Global Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 09: Global Microcontrollers Market Revenue (US$ Bn), by Automotive, 2025 to 2035

Figure 10: Global Microcontrollers Market Revenue (US$ Bn), by Consumer Electronics, 2025 to 2035

Figure 11: Global Microcontrollers Market Revenue (US$ Bn), by Industrial, 2025 to 2035

Figure 12: Global Microcontrollers Market Revenue (US$ Bn), by Healthcare, 2025 to 2035

Figure 13: Global Microcontrollers Market Revenue (US$ Bn), by Aerospace, 2025 to 2035

Figure 14: Global Microcontrollers Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 15: Global Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 16: Global Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 17: Global Microcontrollers Market Revenue (US$ Bn), by 8051 Architecture, 2025 to 2035

Figure 18: Global Microcontrollers Market Revenue (US$ Bn), by AVR Architecture, 2025 to 2035

Figure 19: Global Microcontrollers Market Revenue (US$ Bn), by PIC Architecture, 2025 to 2035

Figure 20: Global Microcontrollers Market Revenue (US$ Bn), by ARM Architecture, 2025 to 2035

Figure 21: Global Microcontrollers Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 22: Global Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 23: Global Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 24: North America Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 25: North America Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 26: North America Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 27: North America Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 28: North America Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 29: North America Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 30: North America Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 31: North America Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: North America Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: U.S. Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 34: U.S. Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 35: U.S. Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 36: U.S. Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: U.S. Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: U.S. Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 39: U.S. Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 40: Canada Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 41: Canada Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 42: Canada Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 43: Canada Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Canada Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Canada Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 46: Canada Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 47: Europe Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 48: Europe Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 49: Europe Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 50: Europe Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 51: Europe Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 52: Europe Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 53: Europe Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 54: Europe Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Europe Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Germany Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 57: Germany Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 58: Germany Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 59: Germany Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 60: Germany Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 61: Germany Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 62: Germany Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 63: U.K. Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 64: U.K. Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 65: U.K. Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 66: U.K. Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 67: U.K. Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 68: U.K. Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 69: U.K. Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 70: France Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 71: France Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 72: France Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 73: France Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: France Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: France Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 76: France Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 77: Italy Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 78: Italy Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 79: Italy Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 80: Italy Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 81: Italy Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 82: Italy Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 83: Italy Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 84: Spain Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 85: Spain Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 86: Spain Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 87: Spain Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 88: Spain Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 89: Spain Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 90: Spain Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 91: Switzerland Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 92: Switzerland Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 93: Switzerland Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 94: Switzerland Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 95: Switzerland Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 96: Switzerland Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 97: Switzerland Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 98: The Netherlands Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 99: The Netherlands Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 100: The Netherlands Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 101: The Netherlands Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 102: The Netherlands Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 103: The Netherlands Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 104: The Netherlands Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 105: Rest of Europe Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 106: Rest of Europe Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 107: Rest of Europe Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 108: Rest of Europe Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 109: Rest of Europe Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 110: Rest of Europe Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 111: Rest of Europe Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 112: Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 113: Asia Pacific Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 114: Asia Pacific Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 115: Asia Pacific Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 116: Asia Pacific Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 117: Asia Pacific Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 118: Asia Pacific Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 119: Asia Pacific Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 120: Asia Pacific Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 121: China Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 122: China Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 123: China Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 124: China Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 125: China Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 126: China Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 127: China Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 128: Japan Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 129: Japan Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 130: Japan Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 131: Japan Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 132: Japan Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 133: Japan Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 134: Japan Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 135: India Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 136: India Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 137: India Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 138: India Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 139: India Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 140: India Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 141: India Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 142: South Korea Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 143: South Korea Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 144: South Korea Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 145: South Korea Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 146: South Korea Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 147: South Korea Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 148: South Korea Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 149: Australia and New Zealand Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 150: Australia and New Zealand Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 151: Australia and New Zealand Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 152: Australia and New Zealand Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 153: Australia and New Zealand Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 154: Australia and New Zealand Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 155: Australia and New Zealand Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 156: Rest of Asia Pacific Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 157: Rest of Asia Pacific Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 158: Rest of Asia Pacific Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 159: Rest of Asia Pacific Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 160: Rest of Asia Pacific Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 161: Rest of Asia Pacific Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 162: Rest of Asia Pacific Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 163: Latin America Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 164: Latin America Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 165: Latin America Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 166: Latin America Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 167: Latin America Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 168: Latin America Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 169: Latin America Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 170: Latin America Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 171: Latin America Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 172: Brazil Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 173: Brazil Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 174: Brazil Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 175: Brazil Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 176: Brazil Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 177: Brazil Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 178: Brazil Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 179: Mexico Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 180: Mexico Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 181: Mexico Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 182: Mexico Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 183: Mexico Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 184: Mexico Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 185: Mexico Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 186: Argentina Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 187: Argentina Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 188: Argentina Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 189: Argentina Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 190: Argentina Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 191: Argentina Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 192: Argentina Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 193: Rest of Latin America Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 194: Rest of Latin America Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 195: Rest of Latin America Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 196: Rest of Latin America Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 197: Rest of Latin America Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 198: Rest of Latin America Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 199: Rest of Latin America Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 200: Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 201: Middle East and Africa Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 202: Middle East and Africa Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 203: Middle East and Africa Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 204: Middle East and Africa Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 205: Middle East and Africa Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 206: Middle East and Africa Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 207: Middle East and Africa Microcontrollers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 208: Middle East and Africa Microcontrollers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 209: GCC Countries Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 210: GCC Countries Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 211: GCC Countries Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 212: GCC Countries Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 213: GCC Countries Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 214: GCC Countries Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 215: GCC Countries Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 216: South Africa Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 217: South Africa Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 218: South Africa Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 219: South Africa Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 220: South Africa Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 221: South Africa Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035

Figure 222: South Africa Microcontrollers Market Attractiveness Analysis, by Architecture Type, 2025 to 2035

Figure 223: Rest of Middle East and Africa Microcontrollers Market Value (US$ Bn) Forecast, 2025 to 2035

Figure 224: Rest of Middle East and Africa Microcontrollers Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 225: Rest of Middle East and Africa Microcontrollers Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 226: Rest of Middle East and Africa Microcontrollers Market Value Share Analysis, By Application, 2024 and 2035

Figure 227: Rest of Middle East and Africa Microcontrollers Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 228: Rest of Middle East and Africa Microcontrollers Market Value Share Analysis, by Architecture Type, 2024 and 2035