Reports

Reports

Analyst Viewpoint

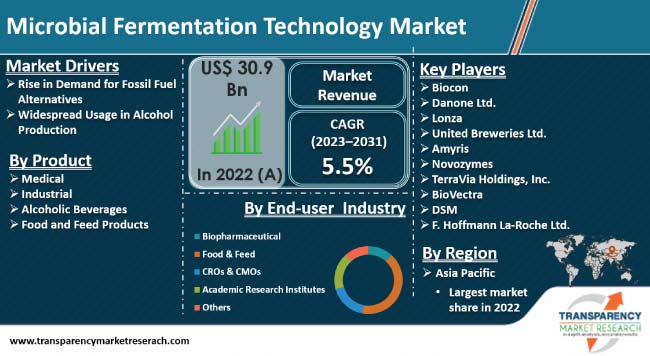

Rise in demand for fossil fuel alternatives is a prominent factor that is driving the global microbial fermentation technology market size. Microbial fermentation is an effective and sustainable method to produce biofuels. Adoption of the process is rising at a rapid pace in the global energy sector. Widespread usage of the technology in alcohol production is also augmenting market progress.

Governments worldwide have recognized the efficiency of microbial fermentation processes in sustainable biofuel production and are striving to create a supportive regulatory framework around it. Thus, government focus on streamlining of standards and processes to facilitate greater trade and commerce is projected to provide novel microbial fermentation technology market opportunities for companies operating in the sector in the near future.

Microbial fermentation technology is a promising, rapidly growing, revolutionary field that entails the usage of microbes for the production of diverse compounds. These compounds are used extensively in the production of biofuels, pharmaceuticals, environmentally-friendly materials, energy, and fine chemicals. The technology is also used widely in the food sector.

Microbial fermentation is the breakdown of nutrients, mostly sugars and carbohydrates, by metabolic enzymes from microbes in the absence of oxygen. Generally, several types of microorganisms are present during the fermentation process; each of them has a distinct set of enzymes. This leads to the formation of complex mixture byproducts that characterize the smell and texture of fermented products.

The technology has been used in the manufacture of highly valued products in various sectors for decades, but there is an urgent need to significantly accelerate its advancement. The microbial fermentation technology industry has been expanding at a steady pace owing to the rise in demand for bio-based energy across the globe.

Demand for the production of new industrial microbial fermentation processes for certain essential purposes, such as generation of novel molecules, is rising at a rapid pace across the globe.

The world is currently experiencing a significant energy crisis as a result of the limited availability of conventional energy and the accelerating depletion of non-renewable fossil fuels. As a result, there is an urgent need to investigate alternative renewable fuels that can meet the energy needs of the rising population while overcoming daunting environmental challenges such as greenhouse gas emissions, global warming, and air pollution.

Of late, there has been significant interest in using microorganisms such as bacteria to convert the chemical energy stored in organic substances into electrical energy. The ability of microorganisms to create renewable energy fuels from a wide range of biological and biomass substrates can alleviate many of the environmental challenges.

Inefficient waste management adds to environmental degradation, adversely affects human health, and has a detrimental impact on the global economy. Biohydrogen (Bio-H2) generated from waste biomass by dark fermentation is a valuable green fuel for addressing clean energy generation and waste management challenges.

Bio-H2 offers various benefits over other biofuels, including carbon-neutral production, simplicity of manufacture, minimal CO2 emissions, and significant energy efficiency. Furthermore, the usage of biowaste to make bio-H2 reduces global warming and CO2 emissions connected with biowaste incineration.

Despite the fact that dark fermentation provides the most efficient and pure bio-H2, producers are attempting to boost the process yield and pace of production. Development in the production process is anticipated to be a major contributor to a positive microbial fermentation technology market forecast.

Microbial fermentation is the predominant method to produce alcohol of certain types. The alcoholic fermentation process, which converts sugars into ethanol, is often carried out by yeasts, mostly Saccharomyces cerevisiae, which can grow directly on fruit sugars, such as those found in grapes for wine or apples for cider, or on previously hydrolyzed cereal starch, as in beers.

Some of these drinks as well as grain worts can be distilled to produce spirits. Other microbes can be found in alcoholic drinks than S. cerevisiae, notably in spontaneous fermentation when starting cultures are not employed. These other microorganisms are largely lactic acid bacteria and yeasts that are not Saccharomyces. As in any naturally occurring ecosystem, including food fermentations, the interactions between all of these microbes are diverse and complicated.

In alcoholic drinks, the principal interactions are between S. cerevisiae and non-Saccharomyces as well as between yeasts and lactic acid bacteria. These interactions can be connected to fermentation metabolites such as ethanol and secondary metabolites such as proteinaceous toxins.

Manufacturers are exploring interactions between various yeasts and lactic acid bacteria in wine, cider, beer, and spirits such as tequila, mezcal, and cachaça, with a focus on alcoholic drinks created by spontaneous fermentations. Thus, increase in usage of the technology in alcohol production is fueling microbial fermentation technology market demand.

Asia Pacific is anticipated to record significant microbial fermentation technology market share in the near future. The region also dominated the worldwide landscape in 2022.

Chronic diseases have become more common as the elderly population has grown in Asia Pacific. As a result, demand for microbial fermentation technology to enable the introduction of novel treatments is anticipated to rise in the near future. Growth in incidence of diabetes and cancer is also leading to an increase in the need for various pharmaceutical drugs in Asia Pacific. Microbial fermentation technology industry analysis reveals that these factors are projected help the regional market thrive in the near future.

Companies in the microbial fermentation technology market are primarily focusing on increasing the efficiency of the microbial fermentation production process. They are also adopting Artificial Intelligence and Machine Learning technologies to control the fermentation process in real time.

Some of the leading companies operating in the global microbial fermentation technology market are Biocon, Danone Ltd., Lonza, United Breweries Ltd., Amyris, Novozymes, TerraVia Holdings, Inc., BioVectra, DSM, and F. Hoffmann La-Roche Ltd.

Each of these players has been profiled in the market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 30.9 Bn |

| Market Forecast Value in 2031 | US$ 49.6 Bn |

| Growth Rate (CAGR) | 5.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 30.9 Bn in 2022

It is likely to grow at a CAGR of 5.5% from 2023 to 2031

Rise in demand for fossil fuel alternatives and biofuels, and widespread usage in alcohol production

The alcoholic beverages segment commands a bulk of the share

Asia Pacific was the leading region in 2022

Biocon, Danone Ltd., Lonza, United Breweries Ltd., Amyris, Novozymes, TerraVia Holdings, Inc., BioVectra, DSM, and F. Hoffmann La-Roche Ltd.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Microbial Fermentation Technology Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Microbial Fermentation Technology Market Analysis and Forecast, 2022-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. Microbial Fermentation Technology Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Medical

6.3.1.1. Antibiotics

6.3.1.2. Probiotics

6.3.1.3. Monoclonal Antibodies

6.3.1.4. Recombinant Proteins

6.3.1.5. Other Biosimilars

6.3.2. Industrial

6.3.2.1. Acetone, Ethanol & Butanol

6.3.2.2. Enzymes & Amino Acids

6.3.3. Alcoholic Beverages

6.3.3.1. Beer

6.3.3.2. Spirits

6.3.3.3. Wine

6.3.3.4. Others

6.3.4. Food & Feed Products

6.4. Market Attractiveness, by Product

7. Global Microbial Fermentation Technology Market Analysis and Forecast, by End-user Industry

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user Industry, 2017–2031

7.3.1. Biopharmaceutical

7.3.2. Food & Feed

7.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

7.3.4. Academic Research Institutes

7.3.5. Others

7.4. Market Attractiveness, by End-user Industry

8. Global Microbial Fermentation Technology Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Microbial Fermentation Technology Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2022–2031

9.2.1. Medical

9.2.1.1. Antibiotics

9.2.1.2. Probiotics

9.2.1.3. Monoclonal Antibodies

9.2.1.4. Recombinant Proteins

9.2.1.5. Other Biosimilars

9.2.2. Industrial

9.2.2.1. Acetone, Ethanol & Butanol

9.2.2.2. Enzymes & Amino Acids

9.2.3. Alcoholic Beverages

9.2.3.1. Beer

9.2.3.2. Spirits

9.2.3.3. Wine

9.2.3.4. Others

9.2.4. Food & Feed Products

9.3. Market Value Forecast, by End-user Industry, 2022–2031

9.3.1. Biopharmaceutical

9.3.2. Food & Feed

9.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

9.3.4. Academic Research Institutes

9.3.5. Others

9.4. Market Value Forecast, by Country, 2022–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user Industry

9.5.3. By Country

10. Europe Microbial Fermentation Technology Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2022–2031

10.2.1. Medical

10.2.1.1. Antibiotics

10.2.1.2. Probiotics

10.2.1.3. Monoclonal Antibodies

10.2.1.4. Recombinant Proteins

10.2.1.5. Other Biosimilars

10.2.2. Industrial

10.2.2.1. Acetone, Ethanol & Butanol

10.2.2.2. Enzymes & Amino Acids

10.2.3. Alcoholic Beverages

10.2.3.1. Beer

10.2.3.2. Spirits

10.2.3.3. Wine

10.2.3.4. Others

10.2.4. Food & Feed Products

10.3. Market Value Forecast, by End-user Industry, 2022–2031

10.3.1. Biopharmaceutical

10.3.2. Food & Feed

10.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

10.3.4. Academic Research Institutes

10.3.5. Others

10.4. Market Value Forecast, by Country/Sub-region, 2022–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user Industry

10.5.3. By Country/Sub-region

11. Asia Pacific Microbial Fermentation Technology Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2022–2031

11.2.1. Medical

11.2.1.1. Antibiotics

11.2.1.2. Probiotics

11.2.1.3. Monoclonal Antibodies

11.2.1.4. Recombinant Proteins

11.2.1.5. Other Biosimilars

11.2.2. Industrial

11.2.2.1. Acetone, Ethanol & Butanol

11.2.2.2. Enzymes & Amino Acids

11.2.3. Alcoholic Beverages

11.2.3.1. Beer

11.2.3.2. Spirits

11.2.3.3. Wine

11.2.3.4. Others

11.2.4. Food & Feed Products

11.3. Market Value Forecast, by End-user Industry, 2022–2031

11.3.1. Biopharmaceutical

11.3.2. Food & Feed

11.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

11.3.4. Academic Research Institutes

11.3.5. Others

11.4. Market Value Forecast, by Country/Sub-region, 2022–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user Industry

11.5.3. By Country/Sub-region

12. Latin America Microbial Fermentation Technology Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2022–2031

12.2.1. Medical

12.2.1.1. Antibiotics

12.2.1.2. Probiotics

12.2.1.3. Monoclonal Antibodies

12.2.1.4. Recombinant Proteins

12.2.1.5. Other Biosimilars

12.2.2. Industrial

12.2.2.1. Acetone, Ethanol & Butanol

12.2.2.2. Enzymes & Amino Acids

12.2.3. Alcoholic Beverages

12.2.3.1. Beer

12.2.3.2. Spirits

12.2.3.3. Wine

12.2.3.4. Others

12.2.4. Food & Feed Products

12.3. Market Value Forecast, by End-user Industry, 2022–2031

12.3.1. Biopharmaceutical

12.3.2. Food & Feed

12.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

12.3.4. Academic Research Institutes

12.3.5. Others

12.4. Market Value Forecast, by Country/Sub-region, 2022–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user Industry

12.5.3. By Country/Sub-region

13. Middle East & Africa Microbial Fermentation Technology Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2022–2031

13.2.1. Medical

13.2.1.1. Antibiotics

13.2.1.2. Probiotics

13.2.1.3. Monoclonal Antibodies

13.2.1.4. Recombinant Proteins

13.2.1.5. Other Biosimilars

13.2.2. Industrial

13.2.2.1. Acetone, Ethanol & Butanol

13.2.2.2. Enzymes & Amino Acids

13.2.3. Alcoholic Beverages

13.2.3.1. Beer

13.2.3.2. Spirits

13.2.3.3. Wine

13.2.3.4. Others

13.2.4. Food & Feed Products

13.3. Market Value Forecast, by End-user Industry, 2022–2031

13.3.1. Biopharmaceutical

13.3.2. Food & Feed

13.3.3. Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs)

13.3.4. Academic Research Institutes

13.3.5. Others

13.4. Market Value Forecast, by Country/Sub-region, 2022–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user Industry

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Biocon

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Danone Limited

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Lonza

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. United Breweries Ltd.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Amyris

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Novozymes

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. TerraVia Holdings, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. BioVectra

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. DSM

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. F. Hoffmann La-Roche Ltd.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 1: Global Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031:

Table 2: Global Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry, 2017–2031:

Table 3: Global Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Region, 2017–2031:

Table 4: North America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Country, 2017–2031

Table 5: North America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031

Table 6: North America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry, 2017–2031

Table 7: Europe Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 8: Europe Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031:

Table 9: Europe Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry 2017–2031:

Table 10: Asia Pacific Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry, 2017–2031:

Table 13: Latin America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031

Table 15: Latin America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry 2017–2031

Table 16: Middle East & Africa Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by Product, 2017–2031

Table 18: Middle East & Africa Microbial Fermentation Technology Market Value (US$ Bn) Forecast, by End-user Industry 2017–2031

List of Figures

Figure 1: Global Microbial Fermentation Technology Market Value (US$ Bn) Forecast, 2017–2031

Figure 2: Global Microbial Fermentation Technology Market Value Share, by Product, 2022

Figure 3: Global Microbial Fermentation Technology Market Value Share, by End-user Industry, 2022

Figure 4: Global Microbial Fermentation Technology Market Value Share Analysis, by Product, 2022 and 2031

Figure 5: Global Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 6: Global Microbial Fermentation Technology Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 7: Global Microbial Fermentation Technology Market Attractiveness Analysis, by End-user Industry 2023–2031

Figure 8: Global Microbial Fermentation Technology Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Global Microbial Fermentation Technology Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, 2017–2031

Figure 11: North America Microbial Fermentation Technology Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Microbial Fermentation Technology Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America Microbial Fermentation Technology Market Value Share Analysis, by Product, 2022 and 2031

Figure 14: North America Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 15: North America Microbial Fermentation Technology Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 16: North America Microbial Fermentation Technology Market Attractiveness Analysis, by End-user Industry 2023–2031

Figure 17: Europe Microbial Fermentation Technology Market Value (US$ Bn) Forecast, 2017–2031

Figure 18: Europe Microbial Fermentation Technology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Microbial Fermentation Technology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe Microbial Fermentation Technology Market Value Share Analysis, by Product, 2022 and 2031

Figure 21: Europe America Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 22: Europe Microbial Fermentation Technology Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 23: Europe Microbial Fermentation Technology Market Attractiveness Analysis, by End-user Industry 2023–2031

Figure 24: Asia Pacific Microbial Fermentation Technology Market Value (US$ Bn) Forecast, 2017–2031

Figure 25: Asia Pacific Microbial Fermentation Technology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Microbial Fermentation Technology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Microbial Fermentation Technology Market Value Share Analysis, by Product, 2022 and 2031

Figure 28: Asia Pacific America Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 29: Asia Pacific Microbial Fermentation Technology Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 30: Asia Pacific Microbial Fermentation Technology Market Attractiveness Analysis, by End-user Industry 2023–2031

Figure 31: Latin America Microbial Fermentation Technology Market Value (US$ Bn) Forecast, 2017–2031

Figure 32: Latin America Microbial Fermentation Technology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Microbial Fermentation Technology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America Microbial Fermentation Technology Market Value Share Analysis, by Product, 2022 and 2031

Figure 35: Latin America Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 36: Middle East & Africa Microbial Fermentation Technology Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa Microbial Fermentation Technology Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Middle East & Africa America Microbial Fermentation Technology Market Value Share Analysis, by Product, 2023–2031

Figure 39: Middle East & Africa America Microbial Fermentation Technology Market Attractiveness Analysis, by Product, 2023–2031

Figure 40: Middle East & Africa Microbial Fermentation Technology Market Value Share Analysis, by End-user Industry, 2022 and 2031

Figure 41: Middle East & Africa Microbial Fermentation Technology Market Attractiveness Analysis, by End-user Industry 2023–2031

Figure 42: Global Microbial Fermentation Technology Market Share Analysis, by Company (2022)