Reports

Reports

Analysts’ Viewpoint

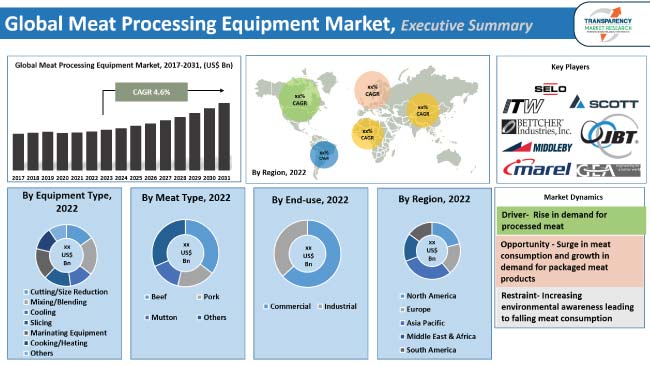

Growth in consumer demand for processed meat products, surge in disposable income in emerging economies, and expansion of processed meat technologies are key factors fueling the meat processing equipment market growth. Consumer trend of following a protein-rich diet further boosts market development. Meat processing equipment improves food safety standards, enables better efficiency in meat processing, and reduces labor costs.

Increase in awareness regarding food safety and hygiene, and technological innovations in meat processing equipment are further market catalysts. Manufacturers of meat processing equipment are allocating a major portion of their revenue to R&D activities to develop cutting-edge materials. They are also involved in strategic collaborations which strengthen their influence across the meat processing equipment landscape.

Meat processing equipment refers to machinery and systems used in the slaughtering, cutting, and further processing of meat products. These tools are designed to increase efficiency, safety, and product quality in meat production industries.

The equipment includes stunners, shackles, butchers' hooks, hoists, and cutting machines, besides meat grinders, mixers, tenderizers, and stuffers. These tools are crucial in ensuring that the meat is prepared efficiently and safely, meeting food safety standards and maintaining product consistency.

They help streamline the process, minimize the risk of contamination, and improve the overall consistency and appearance of the meat products.

By automating repetitive tasks and increasing efficiency, meat processing equipment reduces the reliance on manual labor, enabling meat producers to meet the growing demand for safe and high-quality products.

Meat processing involves a wide range of chemical and physical treatment methods, usually combining a variety of methods. Meat processing is one of the major applications of food processing equipment.

In the last decade, the busy and changing lifestyles of consumers due to rapid urbanization led to high demand for processed and convenient meat technologies, which is propelling the meat processing equipment market value. This demand is expected to continue in the future, further bolstering the meat processing equipment industry growth.

Companies are investing in new and advanced technologies to meet the surge in demand for processed meat technologies. This has led to an increase in demand for automation in meat processing, offering lucrative opportunities for market expansion.

Automation is expected to reduce labor costs associated with meat processing, making it more economically viable. Automation is also expected to improve safety and hygiene in meat processing.

Companies are focusing their efforts on developing more efficient, cost-effective, and energy-efficient meat processing equipment to meet the future demand. Additionally, the surge in number of restaurants and food chains is also a major market catalyst. Companies are focusing on providing innovative solutions for meat processing and packaging automation in order to stay ahead of the competition.

Companies are increasingly investing in software and other technologies to make meat processing more efficient and cost-effective. AI-driven automation is also being utilized to automate processes such as cutting, packaging, and distribution. Furthermore, the use of sensors and data analytics is allowing for improved safety, quality, and traceability. This improved efficiency has resulted in a decrease in costs, making meat processing more accessible to a wider range of consumers.

These technologies are helping to reduce labor requirements and waste, resulting in a more sustainable industry. The technologies are helping to create a more sustainable and cost-effective way of producing meat. They are also helping to reduce the risk of foodborne illnesses and ensure the safety of consumers.

AI-driven automation is being used in the meat industry to detect and prevent contamination. It optimizes the efficiency of slaughterhouses. AI-driven automation is being used to automate processes such as packaging, sorting, and labelling, as well as to monitor and track inventory.

This helps to reduce costs and reduce waste. AI-driven automation is also used to predict demand. This allows companies to better plan their operations and reduce waste. Thus, the advancement of technology is offering lucrative meat processing equipment market opportunities.

According to the latest meat processing equipment market forecast, the Asia Pacific region is expected to dominate the landscape. Increase in consumer preference for processed and convenience foods, rise in disposable incomes, and the growth in demand for halal meat products are driving market dynamics in the region.

Furthermore, technological advancements and innovations in the food processing industry are increasing the meat processing equipment market share in Asia Pacific.

As per the meat processing equipment market analysis, the business model of prominent companies includes R&D activities, product expansions, and mergers & acquisitions. Product development is a major marketing strategy. The market is highly competitive due to a large number of global and regional players.

Marel, GEA Group Aktiengesellschaft, JBT, The Middleby Corporation, Illinois Tool Works Inc., Scott Technology Limited, Bettcher Industries, Inc., and Minerva Omega group s.r.l. are the prominent meat processing equipment manufacturers.

Key players have been profiled in the meat processing equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 1.9 Bn |

| Market Forecast Value in 2031 | US$ 2.9 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, demographic overview, and key supplier analysis. |

| Competition Landscape |

|

| Format |

|

| Market Segmentation |

|

| Regions Covered |

|

| Companies Profiled |

|

| Customization Scope |

Available upon request |

| Pricing |

Available upon request |

It was valued at US$ 1.9 Bn 2022

The CAGR is projected to be 4.6% from 2023 to 2031

Rise in demand for processed meat and advances in technology

Based on equipment type, the cutting/size reduction segment is dominant

Asia Pacific is a more attractive region for vendors

Marel, GEA Group Aktiengesellschaft, JBT, The Middleby Corporation, Illinois Tool Works Inc., Scott Technology Limited, Bettcher Industries, Inc., and Minerva Omega group s.r.l.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Regulations & Guidelines

5.5. Key Market Indicators

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Analysis

5.9. Industry SWOT Analysis

5.10. Global Meat Processing Equipment Market Analysis and Forecast, 2020 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Meat Processing Equipment Market Analysis and Forecast, By Equipment Type

6.1. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

6.1.1. Cutting/Size Reduction

6.1.2. Mixing/Blending

6.1.3. Cooling

6.1.4. Slicing

6.1.5. Marinating Equipment

6.1.6. Cooking/Heating

6.1.7. Others

6.2. Incremental Opportunity, By Equipment Type

7. Global Meat Processing Equipment Market Analysis and Forecast, By Meat Type

7.1. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

7.1.1. Beef

7.1.2. Pork

7.1.3. Mutton

7.1.4. Others

7.2. Incremental Opportunity, By Meat Type

8. Global Meat Processing Equipment Market Analysis and Forecast, By End-use

8.1. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

8.1.1. Commercial

8.1.2. Industrial

8.2. Incremental Opportunity, By End-use

9. Global Meat Processing Equipment Market Analysis and Forecast, by Region

9.1. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Region, 2020 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Incremental Opportunity, by Region

10. North America Meat Processing Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trend Analysis

10.4. Price Trend Analysis

10.5. Weighted Average Price

10.6. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

10.6.1. Cutting/Size Reduction

10.6.2. Mixing/Blending

10.6.3. Cooling

10.6.4. Slicing

10.6.5. Marinating Equipment

10.6.6. Cooking/Heating

10.6.7. Others

10.7. Incremental Opportunity, By Equipment Type

10.8. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

10.8.1. Beef

10.8.2. Pork

10.8.3. Mutton

10.8.4. Others

10.9. Incremental Opportunity, By Meat Type

10.10. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

10.10.1. Commercial

10.10.2. Industrial

10.11. Incremental Opportunity, By End-use

10.12. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Country, 2020 - 2031

10.12.1. U.S

10.12.2. Canada

10.12.3. Rest of North America

10.13. Incremental Opportunity Analysis

11. Europe Meat Processing Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trend Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

11.5.1. Cutting/Size Reduction

11.5.2. Mixing/Blending

11.5.3. Cooling

11.5.4. Slicing

11.5.5. Marinating Equipment

11.5.6. Cooking/Heating

11.5.7. Others

11.6. Incremental Opportunity, By Equipment Type

11.7. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

11.7.1. Beef

11.7.2. Pork

11.7.3. Mutton

11.7.4. Others

11.8. Incremental Opportunity, By Meat Type

11.9. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

11.9.1. Commercial

11.9.2. Industrial

11.10. Incremental Opportunity, By End-use

11.11. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Country, 2020 - 2031

11.11.1. U.K

11.11.2. Germany

11.11.3. France

11.11.4. Rest of Europe

11.12. Incremental Opportunity Analysis

12. Asia Pacific Meat Processing Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

12.5.1. Cutting/Size Reduction

12.5.2. Mixing/Blending

12.5.3. Cooling

12.5.4. Slicing

12.5.5. Marinating Equipment

12.5.6. Cooking/Heating

12.5.7. Others

12.6. Incremental Opportunity, By Equipment Type

12.7. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

12.7.1. Beef

12.7.2. Pork

12.7.3. Mutton

12.7.4. Others

12.8. Incremental Opportunity, By Meat Type

12.9. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

12.9.1. Commercial

12.9.2. Industrial

12.10. Incremental Opportunity, By End-use

12.11. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Country, 2020 - 2031

12.11.1. India

12.11.2. China

12.11.3. Japan

12.11.4. Rest of Asia Pacific

12.12. Incremental Opportunity Analysis

13. Middle East & Africa Meat Processing Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

13.5.1. Cutting/Size Reduction

13.5.2. Mixing/Blending

13.5.3. Cooling

13.5.4. Slicing

13.5.5. Marinating Equipment

13.5.6. Cooking/Heating

13.5.7. Others

13.6. Incremental Opportunity, By Equipment Type

13.7. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

13.7.1. Beef

13.7.2. Pork

13.7.3. Mutton

13.7.4. Others

13.8. Incremental Opportunity, By Meat Type

13.9. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

13.9.1. Commercial

13.9.2. Industrial

13.10. Incremental Opportunity, By End-use

13.11. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Country, 2020 - 2031

13.11.1. GCC

13.11.2. South Africa

13.11.3. Rest of MEA

13.12. Incremental Opportunity Analysis

14. South America Meat Processing Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Equipment Type, 2020 - 2031

14.5.1. Cutting/Size Reduction

14.5.2. Mixing/Blending

14.5.3. Cooling

14.5.4. Slicing

14.5.5. Marinating Equipment

14.5.6. Cooking/Heating

14.5.7. Others

14.6. Incremental Opportunity, By Equipment Type

14.7. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By Meat Type, 2020 - 2031

14.7.1. Beef

14.7.2. Pork

14.7.3. Mutton

14.7.4. Others

14.8. Incremental Opportunity, By Meat Type

14.9. Meat Processing Equipment Market Size (US$ Mn, Thousand Units) Forecast, By End-use, 2020 - 2031

14.9.1. Commercial

14.9.2. Industrial

14.10. Incremental Opportunity, By End-use

14.11. Meat Processing Equipment Market Size (US$ Mn, Thousand Units), by Country, 2020 - 2031

14.11.1. Brazil

14.11.2. Rest of South America

14.12. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%)-2022

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

15.3.1. Marel

15.3.1.1. Company Overview

15.3.1.2. Sales Area

15.3.1.3. Geographical Presence

15.3.1.4. Manufacturing Location

15.3.1.5. Revenue

15.3.1.6. Strategy & Business Process Overview

15.3.2. GEA Group Aktiengesellschaft

15.3.2.1. Company Overview

15.3.2.2. Sales Area

15.3.2.3. Geographical Presence

15.3.2.4. Manufacturing Location

15.3.2.5. Revenue

15.3.2.6. Strategy & Business Process Overview

15.3.3. JBT

15.3.3.1. Company Overview

15.3.3.2. Sales Area

15.3.3.3. Geographical Presence

15.3.3.4. Manufacturing Location

15.3.3.5. Revenue

15.3.3.6. Strategy & Business Process Overview

15.3.4. The Middleby Corporation

15.3.4.1. Company Overview

15.3.4.2. Sales Area

15.3.4.3. Geographical Presence

15.3.4.4. Manufacturing Location

15.3.4.5. Revenue

15.3.4.6. Strategy & Business Process Overview

15.3.5. Illinois Tool Works Inc.

15.3.5.1. Company Overview

15.3.5.2. Sales Area

15.3.5.3. Geographical Presence

15.3.5.4. Manufacturing Location

15.3.5.5. Revenue

15.3.5.6. Strategy & Business Process Overview

15.3.6. Scott Technology Limited

15.3.6.1. Company Overview

15.3.6.2. Sales Area

15.3.6.3. Geographical Presence

15.3.6.4. Manufacturing Location

15.3.6.5. Revenue

15.3.6.6. Strategy & Business Process Overview

15.3.7. Bettcher Industries, Inc.

15.3.7.1. Company Overview

15.3.7.2. Sales Area

15.3.7.3. Geographical Presence

15.3.7.4. Manufacturing Location

15.3.7.5. Revenue

15.3.7.6. Strategy & Business Process Overview

15.3.8.Minerva Omega group s.r.l.

15.3.8.1. Company Overview

15.3.8.2. Sales Area

15.3.8.3. Geographical Presence

15.3.8.4. Manufacturing Location

15.3.8.5. Revenue

15.3.8.6. Strategy & Business Process Overview

15.3.9. Other Key Players

15.3.9.1. Company Overview

15.3.9.2. Sales Area

15.3.9.3. Geographical Presence

15.3.9.4. Manufacturing Location

15.3.9.5. Revenue

15.3.9.6. Strategy & Business Process Overview

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Equipment Type

16.1.2. By Meat Type

16.1.3. By End-use

16.1.4. By Region

16.2. Understanding the Procurement Process of Equipment Type

16.3. Prevailing Market Risks

16.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 2: Global Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 3: Global Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 4: Global Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Table 5: Global Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 6: Global Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 7: Global Meat Processing Equipment Market Value (US$ Mn), by Region, 2017 - 2031

Table 8: Global Meat Processing Equipment Market Volume (Thousand Units), by Region 2017 - 2031

Table 9: North America Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 10: North America Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 11: North America Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 12: North America Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Table 13: North America Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 14: North America Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 15: North America Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Table 16: North America Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Table 17: Europe Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 18: Europe Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 19: Europe Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 20: Europe Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Table 21: Europe Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 22: Europe Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 23: Europe Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Table 24: Europe Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Table 25: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 26: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 27: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 28: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Meat Type2017 - 2031

Table 29: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 30: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 31: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Table 32: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Table 33: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 34: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 35: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 36: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Table 37: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 38: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 39: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Table 40: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Table 41: South America Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Table 42: South America Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Table 43: South America Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Table 44: South America Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Table 45: South America Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Table 46: South America Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Table 47: South America Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Table 48: South America Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

List of Figures

Figure 1: Global Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 2: Global Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 3: Global Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 4: Global Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 5: Global Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Figure 6: Global Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type, 2023 - 2031

Figure 7: Global Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 8: Global Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 9: Global Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 10: Global Meat Processing Equipment Market Value (US$ Mn), by Region, 2017 - 2031

Figure 11: Global Meat Processing Equipment Market Volume (Thousand Units), by Region 2017 - 2031

Figure 12: Global Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023 - 2031

Figure 13: North America Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 14: North America Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 15: North America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 16: North America Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 17: North America Meat Processing Equipment Market Volume (Thousand Units), by Meat Type2017 - 2031

Figure 18: North America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type, 2023 - 2031

Figure 19: North America Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 20: North America Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 21: North America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 22: North America Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Figure 23: North America Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Figure 24: North America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023 - 2031

Figure 25: Europe Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 26: Europe Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 27: Europe Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 28: Europe Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 29: Europe Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Figure 30: Europe Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type, 2023 - 2031

Figure 31: Europe Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 32: Europe Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 33: Europe Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 34: Europe Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Figure 35: Europe Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Figure 36: Europe Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023 - 2031

Figure 37: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 38: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 39: Asia Pacific Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 40: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 41: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Meat Type2017 - 2031

Figure 42: Asia Pacific Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type, 2023 - 2031

Figure 43: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 44: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 45: Asia Pacific Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 46: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 47: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017 - 2031

Figure 48: Asia Pacific Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023 - 2031

Figure 49: Asia Pacific Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Figure 50: Asia Pacific Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Figure 51: Asia Pacific Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023 - 2031

Figure 52: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 53: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 54: Middle East & Africa Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 55: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 56: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Meat Type 2017 - 2031

Figure 57: Middle East & Africa Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type,2023 - 2031

Figure 58: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 59: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 60: Middle East & Africa Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 61: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 62: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017 - 2031

Figure 63: Middle East & Africa Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023 - 2031

Figure 64: Middle East & Africa Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Figure 65: Middle East & Africa Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Figure 66: Middle East & Africa Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023 - 2031

Figure 67: South America Meat Processing Equipment Market Value (US$ Mn), by Equipment Type, 2017 - 2031

Figure 68: South America Meat Processing Equipment Market Volume (Thousand Units), by Equipment Type 2017 - 2031

Figure 69: South America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Equipment Type, 2023 - 2031

Figure 70: South America Meat Processing Equipment Market Value (US$ Mn), by Meat Type, 2017 - 2031

Figure 71: South America Meat Processing Equipment Market Volume (Thousand Units), by Meat Type, 2017 - 2031

Figure 72: South America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Meat Type, 2023 - 2031

Figure 73: South America Meat Processing Equipment Market Value (US$ Mn), by End-use, 2017 - 2031

Figure 74: South America Meat Processing Equipment Market Volume (Thousand Units), by End-use 2017 - 2031

Figure 75: South America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by End-use, 2023 - 2031

Figure 76: South America Meat Processing Equipment Market Volume (Thousand Units), by Distribution Channel 2017 - 2031

Figure 77: South America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023 - 2031

Figure 78: South America Meat Processing Equipment Market Value (US$ Mn), by Distribution Channel, 2017 - 2031

Figure 79: South America Meat Processing Equipment Market Value (US$ Mn), by Country, 2017 - 2031

Figure 80: South America Meat Processing Equipment Market Volume (Thousand Units), by Country 2017 - 2031

Figure 81: South America Meat Processing Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023 - 2031