Reports

Reports

Analysts’ Viewpoint

The maritime industry is undergoing digital transformation where technologies such as IoT, AI, and data analytics play a crucial role as these allow real-time data monitoring and optimization of marine operations. Advanced analytics and AI-driven insights are leveraged in maritime digitization to unlock the potential of data. Through data analytics, valuable insights related to vessel performance, fuel efficiency, route optimization, and predictive maintenance is obtained.

Integration of AI and ML plays a crucial role in maritime digitization, providing predictive insights, automation, optimized routing, and enhanced safety and maintenance operations. However, the increase in digitization has resulted in increased cyber security challenges and data privacy concerns.

In the coming years, vendors are expected to focus on strengthening their portfolio of cybersecurity and data encryption measures to protect sensitive information and ensure safe operations. Investment in digital technologies is expected to remain buoyant to improve operational efficiency, safety, sustainability, and cost effectiveness in the maritime industry.

The maritime industry is a crucial backbone of global trade that facilitates the movement of goods and resources across continents. Maritime digitization is the process of applying digital technologies to maritime industry processes, to improve operations, increase efficiency, and reduce costs.

Some of the technologies that are used for maritime digitization include IoT, AI, blockchain, big data analytics, and cloud computing. These technologies enable data collection, sharing, and analysis across the maritime supply chain, as well as automation, remote monitoring & control, and optimization of fuel consumption and emissions.

Maritime digitization is essential to enhance the performance and resilience of the maritime sector, especially in the face of global challenges such as COVID-19 and climate change. It involves several aspects of the marine industry, such as shipping, ports, logistics, and supply chain management.

The adoption of blockchain technology is expected to accelerate in the next few years, which facilitates further growth in maritime digitalization. Blockchain in the maritime industry provides secure, transparent, and immutable records of transactions, contracts, and supply chain processes.

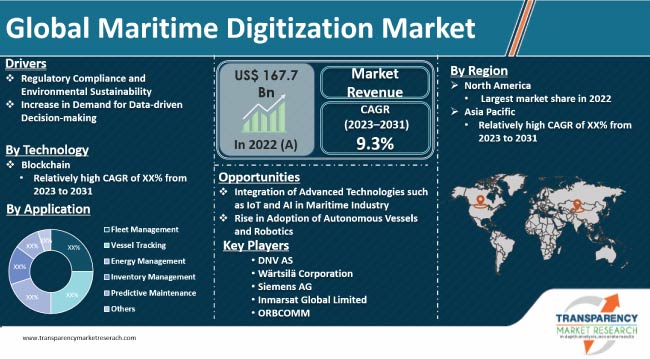

The global maritime digitization market is expected to grow at a high pace in the next few years due to the availability of innovative solutions and platforms that enable connectivity, interoperability, and collaboration among different stakeholders in the maritime ecosystem. The rise in need to improve operational efficiency and reduce costs in a competitive and complex market is expected to influence maritime digitization market statistics during the forecast period.

Regulatory compliance is one of the key reasons for the digital revolution in the maritime industry. It refers to the adherence to laws, regulations, standards, and guidelines that affect the maritime sector. Some of these regulations aim to ensure the safety, security, and environmental sustainability of maritime operations and trade.

The International Maritime Organization (IMO) has adopted several conventions and resolutions that require the exchange of electronic data and information between ships and ports, such as the FAL convention and the e-navigation strategy. These regulations encourage the adoption of digital technologies that facilitate data sharing, communication, coordination, and automation across the maritime supply chain.

Environmental sustainability is a key factor that is driving maritime digitalization for a more sustainable future. The maritime industry is responsible for a significant proportion of global greenhouse gas emissions and faces increasing pressure from regulators and stakeholders to reduce its environmental impact.

Digital technologies and solutions help the maritime industry achieve high efficiency, resilience, and decarbonization by enabling better data collection, analysis, sharing, and management across the supply chain. Some examples of digital technologies and solutions that can enhance environmental sustainability in the maritime industry are:

The development and adoption of autonomous vessels is increasing in the maritime industry. These vessels leverage robotics, AI, cameras, and advanced sensors to navigate and operate without human intervention.

Autonomous vessels offer various benefits such as increased operational efficiency, reduced human error, enhanced safety, and optimized fuel consumption. The trend toward autonomy is expected to transform various aspects of the maritime industry, including shipping, port operations, and logistics.

Autonomous vessels eliminate the risk of human errors such as fatigue, distraction, or misjudgment. They navigate, detect obstacles, and make informed decisions in real-time, as these vessels depend on advanced sensors, computer vision systems, and AI algorithms.

Fuel consumption is a significant expense for the maritime industry, and reducing emissions is a growing priority due to environmental concerns. Autonomous vessels leverage AI and data analytics to optimize their operations and reduce fuel consumption. Shipping operations become more efficient, reliable, and cost-effective due to the integration of autonomous vessels.

Port operations are optimized by integrating autonomous vessels into port logistics, such as automated cargo handling and berthing processes. The logistics sector benefits from improved supply chain visibility and streamlined operations, as autonomous vessels provide more accurate tracking and reduced dependency on human intervention.

Regulatory frameworks, international standards, and industry collaborations are likely to be established to address the legal, safety, and security aspects of autonomous vessels, as the maritime industry actively explores the potential of this technology in the next few years.

Thus, ongoing developments and adoption of autonomous vessels are expected to bring considerable advancements and reshape the future of digitalization in shipping industry.

According to the latest maritime digitization industry research report, North America is anticipated to hold dominant share of the global industry during the forecast period. North America dominated the global market in 2022. Presence of advanced technological infrastructure and growth in adoption of advanced technologies drives the regional market progress.

Presence of robust and advanced technological infrastructure, such as advanced telecommunications networks and data centers, enables efficient implementation and integration of digitalization & security in maritime logistics sector in the region.

Maritime digitization market growth in Asia Pacific is expected rise notably during the forecast period. Some of the largest and busiest ports have a presence in the region, leading to significant market development. Ports such as Shanghai (in China), Singapore, Hong Kong, and Busan (in South Korea), handle massive volumes of cargo and facilitate a significant portion of global maritime trade. These ports serve as crucial hubs for connecting various regions and enable the movement of goods through the sea route.

The maritime digitization market report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Prominent providers are investing in R&D activities to introduce advanced computing and IoT solutions that can meet the growing maritime digitization market demand. These service providers are tapping into the latest maritime digitization market trends to gain new opportunities and stay ahead of the competitive curve.

Inmarsat Global Limited, Windward Ltd., SparkCognition, ORBCOMM, Iridium Communications Inc., Envision Enterprise Solutions Pvt. Ltd., xyzt.ai, Wärtsilä Corporation, DNV AS, and Siemens AG are some of the key maritime digitization companies.

Key players have been profiled in the maritime digitization market forecast report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 167.7 Bn |

|

Market Forecast Value in 2031 |

US$ 367.7 Bn |

|

Growth Rate (CAGR) |

9.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. The qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 167.7 Bn in 2022

It is anticipated to reach US$ 367.7 Bn by the end of 2031

It is estimated to expand at a CAGR of 9.3% from 2023 to 2031

Regulatory compliance and environmental sustainability, and increase in demand for data-driven decision-making

North America was the leading region in 2022

Inmarsat Global Limited, Windward Ltd., SparkCognition, ORBCOMM, Iridium Communications Inc., Envision Enterprise Solutions Pvt. Ltd., xyzt.ai, Wärtsilä Corporation, DNV AS, and Siemens AG

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Maritime Digitization Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Maritime Digitization Market

4.5. Porter’s Analysis

4.6. PEST Analysis

4.7. Market Opportunity Assessment – by Region (North America/ Europe/Asia Pacific/Middle East & Africa/South America)

4.7.1. By Technology

4.7.2. By Application

4.7.3. By Vessel Type

4.7.4. By Solution Type

4.7.5. By Application per Vessel Type

4.7.6. By End-user

5. Global Maritime Digitization Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2018-2031

5.1.1. Historic Growth Trends, 2018-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Maritime Digitization Market Analysis, by Technology

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Technology, 2018 - 2031

6.3.1. AI

6.3.2. IoT

6.3.3. Blockchain

6.3.4. Others

7. Global Maritime Digitization Market Analysis, by Application

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Application, 2018 - 2031

7.3.1. Fleet Management

7.3.2. Vessel Tracking

7.3.3. Energy Management

7.3.4. Inventory Management

7.3.5. Predictive Maintenance

7.3.6. Others

8. Global Maritime Digitization Market Analysis, by Vessel Type

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

8.3.1. Dry Cargo Ships

8.3.1.1. Bulk Carriers

8.3.1.2. General Cargo Vessels

8.3.1.3. Container Vessels

8.3.1.4. Others

8.3.2. Liquid Cargo Ships

8.3.2.1. Crude Carriers

8.3.2.2. Product Carriers

8.3.2.3. Others

8.3.3. Specialized Cargo Ships

8.3.3.1. Passenger Vessels

8.3.3.2. Livestock Carriers

8.3.3.3. Others

9. Global Maritime Digitization Market Analysis, by Solution Type

9.1. Overview and Definitions

9.2. Key Segment Analysis

9.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Solution Type, 2018 - 2031

9.3.1. Cargo Management

9.3.2. Vessel Performance

9.3.3. Voyage Optimization

9.3.4. Sustainability & Compliance Management

9.3.5. Others

10. Global Maritime Digitization Market Analysis, by Application per Vessel Type

10.1. Maritime Digitization Market Size (US$ Bn) Forecast, by Application Per Vessel Type, 2018 - 2031

10.1.1. Dry Cargo Ships

10.1.1.1. Bulk Carriers

10.1.1.1.1. Fleet Management

10.1.1.1.2. Vessel Tracking

10.1.1.1.3. Energy Management

10.1.1.1.4. Inventory Management

10.1.1.1.5. Predictive Maintenance

10.1.1.1.6. Others

10.1.1.2. General Cargo Vessels

10.1.1.2.1. Fleet Management

10.1.1.2.2. Vessel Tracking

10.1.1.2.3. Energy Management

10.1.1.2.4. Inventory Management

10.1.1.2.5. Predictive Maintenance

10.1.1.2.6. Others

10.1.1.3. Container Vessels

10.1.1.3.1. Fleet Management

10.1.1.3.2. Vessel Tracking

10.1.1.3.3. Energy Management

10.1.1.3.4. Inventory Management

10.1.1.3.5. Predictive Maintenance

10.1.1.3.6. Others

10.1.2. Liquid Cargo Ships

10.1.2.1. Crude Carriers

10.1.2.1.1. Fleet Management

10.1.2.1.2. Vessel Tracking

10.1.2.1.3. Energy Management

10.1.2.1.4. Inventory Management

10.1.2.1.5. Predictive Maintenance

10.1.2.1.6. Others

10.1.2.2. Product Carriers

10.1.2.2.1. Fleet Management

10.1.2.2.2. Vessel Tracking

10.1.2.2.3. Energy Management

10.1.2.2.4. Inventory Management

10.1.2.2.5. Predictive Maintenance

10.1.2.2.6. Others

10.1.3. Specialized Cargo Ships

10.1.3.1. Passenger Vessels

10.1.3.1.1. Fleet Management

10.1.3.1.2. Vessel Tracking

10.1.3.1.3. Energy Management

10.1.3.1.4. Inventory Management

10.1.3.1.5. Predictive Maintenance

10.1.3.1.6. Others

10.1.3.2. Livestock Carriers

10.1.3.2.1. Fleet Management

10.1.3.2.2. Vessel Tracking

10.1.3.2.3. Energy Management

10.1.3.2.4. Inventory Management

10.1.3.2.5. Predictive Maintenance

10.1.3.2.6. Others

11. Global Maritime Digitization Market Analysis, by End-user

11.1. Key Segment Analysis

11.2. Maritime Digitization Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

11.2.1. Ports & Terminals

11.2.2. Shipping Companies

11.2.3. Maritime Freight Forwarders

11.2.4. Others

12. Global Maritime Digitization Market Analysis and Forecasts, by Region

12.1. Key Findings

12.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Maritime Digitization Market Analysis and Forecast

13.1. Regional Outlook

13.2. Maritime Digitization Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Technology

13.2.2. By Application

13.2.3. By Vessel Type

13.2.4. By Solution Type

13.2.5. By Application per Vessel Type

13.2.6. By End-user

13.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

13.3.1. U.S.

13.3.2. Canada

13.3.3. Mexico

14. Europe Maritime Digitization Market Analysis and Forecast

14.1. Regional Outlook

14.2. Maritime Digitization Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Technology

14.2.2. By Application

14.2.3. By Vessel Type

14.2.4. By Solution Type

14.2.5. By Application per Vessel Type

14.2.6. By End-user

14.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Germany

14.3.2. U.K.

14.3.3. France

14.3.4. Italy

14.3.5. Spain

14.3.6. Rest of Europe

15. Asia Pacific Maritime Digitization Market Analysis and Forecast

15.1. Regional Outlook

15.2. Maritime Digitization Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

15.2.1. By Technology

15.2.2. By Application

15.2.3. By Vessel Type

15.2.4. By Solution Type

15.2.5. By Application per Vessel Type

15.2.6. By End-user

15.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

15.3.1. China

15.3.2. India

15.3.3. Japan

15.3.4. ASEAN

15.3.5. Rest of Asia Pacific

16. Middle East & Africa Maritime Digitization Market Analysis and Forecast

16.1. Regional Outlook

16.2. Maritime Digitization Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

16.2.1. By Technology

16.2.2. By Application

16.2.3. By Vessel Type

16.2.4. By Solution Type

16.2.5. By Application per Vessel Type

16.2.6. By End-user

16.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

16.3.1. Saudi Arabia

16.3.2. United Arab Emirates

16.3.3. South Africa

16.3.4. Rest of Middle East & Africa

17. South America Maritime Digitization Market Analysis and Forecast

17.1. Regional Outlook

17.2. Maritime Digitization Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

17.2.1. By Technology

17.2.2. By Application

17.2.3. By Vessel Type

17.2.4. By Solution Type

17.2.5. By Application per Vessel Type

17.2.6. By End-user

17.3. Maritime Digitization Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

17.3.1. Brazil

17.3.2. Argentina

17.3.3. Rest of South America

18. Competition Landscape

18.1. Market Competition Matrix, by Leading Players

18.2. Competitive Landscape by Tier Structure of Companies

18.3. Scale of Competition, 2022

18.4. Market Revenue Share/Ranking Analysis, by Leading Players (2022)

18.5. List of Startups

18.6. Competition Evolution

18.7. Major Mergers & Acquisitions, Expansions, Partnerships, etc.

19. Company Profiles

19.1. Perle

19.1.1. Business Overview

19.1.2. Company Revenue

19.1.3. Product Portfolio

19.1.4. Geographic Footprint

19.1.5. Recent Developments

19.1.6. Impact of COVID-19

19.1.7. TMR View

19.1.7.1. Competitive Threats and Weakness

19.2. SparkCognition

19.2.1. Business Overview

19.2.2. Company Revenue

19.2.3. Product Portfolio

19.2.4. Geographic Footprint

19.2.5. Recent Developments

19.2.6. Impact of COVID-19

19.2.7. TMR View

19.2.7.1. Competitive Threats and Weakness

19.3. MariApps Marine Solutions

19.3.1. Business Overview

19.3.2. Company Revenue

19.3.3. Product Portfolio

19.3.4. Geographic Footprint

19.3.5. Recent Developments

19.3.6. Impact of COVID-19

19.3.7. TMR View

19.3.7.1. Competitive Threats and Weakness

19.4. Prime Marine

19.4.1. Business Overview

19.4.2. Company Revenue

19.4.3. Product Portfolio

19.4.4. Geographic Footprint

19.4.5. Recent Developments

19.4.6. Impact of COVID-19

19.4.7. TMR View

19.4.7.1. Competitive Threats and Weakness

19.5. Spire Global

19.5.1. Business Overview

19.5.2. Company Revenue

19.5.3. Product Portfolio

19.5.4. Geographic Footprint

19.5.5. Recent Developments

19.5.6. Impact of COVID-19

19.5.7. TMR View

19.5.7.1. Competitive Threats and Weakness

19.6. Iridium Communications Inc.

19.6.1. Business Overview

19.6.2. Company Revenue

19.6.3. Product Portfolio

19.6.4. Geographic Footprint

19.6.5. Recent Developments

19.6.6. Impact of COVID-19

19.6.7. TMR View

19.6.7.1. Competitive Threats and Weakness

19.7. Lockheed Martin Corporation

19.7.1. Business Overview

19.7.2. Company Revenue

19.7.3. Product Portfolio

19.7.4. Geographic Footprint

19.7.5. Recent Developments

19.7.6. Impact of COVID-19

19.7.7. TMR View

19.7.7.1. Competitive Threats and Weakness

19.8. ORBCOMM

19.8.1. Business Overview

19.8.2. Company Revenue

19.8.3. Product Portfolio

19.8.4. Geographic Footprint

19.8.5. Recent Developments

19.8.6. Impact of COVID-19

19.8.7. TMR View

19.8.7.1. Competitive Threats and Weakness

19.9. Windward Ltd.

19.9.1. Business Overview

19.9.2. Company Revenue

19.9.3. Product Portfolio

19.9.4. Geographic Footprint

19.9.5. Recent Developments

19.9.6. Impact of COVID-19

19.9.7. TMR View

19.9.7.1. Competitive Threats and Weakness

19.10. Inmarsat Global Limited

19.10.1. Business Overview

19.10.2. Company Revenue

19.10.3. Product Portfolio

19.10.4. Geographic Footprint

19.10.5. Recent Developments

19.10.6. Impact of COVID-19

19.10.7. TMR View

19.10.7.1. Competitive Threats and Weakness

19.11. Envision Enterprise Solutions

19.11.1. Business Overview

19.11.2. Company Revenue

19.11.3. Product Portfolio

19.11.4. Geographic Footprint

19.11.5. Recent Developments

19.11.6. Impact of COVID-19

19.11.7. TMR View

19.11.7.1. Competitive Threats and Weakness

19.12. xyzt.ai

19.12.1. Business Overview

19.12.2. Company Revenue

19.12.3. Product Portfolio

19.12.4. Geographic Footprint

19.12.5. Recent Developments

19.12.6. Impact of COVID-19

19.12.7. TMR View

19.12.7.1. Competitive Threats and Weakness

19.13. Others

19.13.1. Business Overview

19.13.2. Company Revenue

19.13.3. Product Portfolio

19.13.4. Geographic Footprint

19.13.5. Recent Developments

19.13.6. Impact of COVID-19

19.13.7. TMR View

19.13.7.1. Competitive Threats and Weakness

20. Key Takeaways

List of Tables

Table 1: Acronyms Used in Maritime Digitization Market

Table 2: North America Maritime Digitization Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 3: Europe Maritime Digitization Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 4: Asia Pacific Maritime Digitization Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 5: Middle East & Africa Maritime Digitization Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 6: South America Maritime Digitization Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 11: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 12: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 13: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 14: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 15: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 16: Global Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 17: Global Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 18: Global Maritime Digitization Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 19: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 20: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 21: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 22: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 23: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 24: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 25: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 26: North America Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 27: North America Maritime Digitization Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 28: U.S. Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Canada Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Mexico Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 32: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 33: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 34: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 35: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 36: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 37: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 38: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 39: Europe Maritime Digitization Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 40: Germany Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: U.K. Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: France Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: Italy Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Spain Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 46: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 47: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 48: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 49: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 50: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 51: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 52: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 53: Asia Pacific Maritime Digitization Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 54: China Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 55: India Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 56: Japan Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 57: ASEAN Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 58: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 59: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 60: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 61: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 62: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 63: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 64: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 65: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 66: Middle East & Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 67: Saudi Arabia Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 68: United Arab Emirates Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 69: South Africa Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 70: South America Maritime Digitization Market Value (US$ Bn) Forecast, by Technology, 2018 - 2031

Table 71: South America Maritime Digitization Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 72: South Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Vessel Type, 2018 - 2031

Table 73: South Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Solution Type, 2018 - 2031

Table 74: South Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Dry Cargo Ships, 2018 - 2031

Table 75: South Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Liquid Cargo Ships, 2018 - 2031

Table 76: South Africa Maritime Digitization Market Value (US$ Bn) Forecast, by Application per Vessel Type - Specialized Cargo Ships, 2018 - 2031

Table 77: South America Maritime Digitization Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 78: South America Maritime Digitization Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 79: Brazil Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 80: Argentina Maritime Digitization Market Revenue CAGR Breakdown (%), by Growth Term

Table 81: Mergers & Acquisitions, Partnerships (1/2)

Table 82: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Maritime Digitization Market Size (US$ Bn) Forecast, 2018-2031

Figure 2: Global Maritime Digitization Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Maritime Digitization Market

Figure 4: Global Maritime Digitization Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Maritime Digitization Market Attractiveness Assessment, by Technology

Figure 6: Global Maritime Digitization Market Attractiveness Assessment, by Application

Figure 7: Global Maritime Digitization Market Attractiveness Assessment, by Vessel Type

Figure 8: Global Maritime Digitization Market Attractiveness Assessment, by Solution Type

Figure 9: Global Maritime Digitization Market Attractiveness Assessment, by Application per Vessel Type

Figure 10: Global Maritime Digitization Market Attractiveness Assessment, by End-user

Figure 11: Global Maritime Digitization Market Attractiveness Assessment, by Region

Figure 12: Global Maritime Digitization Market Revenue (US$ Bn) Historic Trends, 2017 - 2022

Figure 13: Global Maritime Digitization Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 - 2022

Figure 14: Global Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 15: Global Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 16: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 17: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 18: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 19: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 20: Global Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 21: Global Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 22: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 23: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 24: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 25: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 26: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 27: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 28: Global Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 29: Global Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 30: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 31: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 32: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 33: Global Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 34: Global Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 35: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 36: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 37: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 38: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 39: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 40: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 41: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 42: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 43: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 44: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 45: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 46: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 47: Global Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 48: Global Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 49: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 50: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 51: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 52: Global Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 53: Global Maritime Digitization Market Opportunity (US$ Bn), by Region

Figure 54: Global Maritime Digitization Market Opportunity Share (%), by Region, 2023-2031

Figure 55: Global Maritime Digitization Market Size (US$ Bn), by Region, 2023 & 2031

Figure 56: Global Maritime Digitization Market Value Share Analysis, by Region, 2023

Figure 57: Global Maritime Digitization Market Value Share Analysis, by Region, 2031

Figure 58: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 59: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 60: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 61: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 62: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 63: North America Maritime Digitization Market Revenue Opportunity Share, by Technology

Figure 64: North America Maritime Digitization Market Revenue Opportunity Share, by Application

Figure 65: North America Maritime Digitization Market Revenue Opportunity Share, by Vessel Type

Figure 66: North America Maritime Digitization Market Revenue Opportunity Share, by Solution Type

Figure 67: North America Maritime Digitization Market Revenue Opportunity Share, by Application per Vessel Type

Figure 68: North America Maritime Digitization Market Revenue Opportunity Share, by End-user

Figure 69: North America Maritime Digitization Market Revenue Opportunity Share, by Country

Figure 70: North America Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 71: North America Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 72: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 73: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 74: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 75: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 76: North America Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 77: North America Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 78: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 79: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 80: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 81: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 82: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 83: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 84: North America Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 85: North America Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 86: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 87: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 88: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 89: North America Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 90: North America Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 91: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 92: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 93: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 94: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 95: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 96: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 97: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 98: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 99: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 100: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 101: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 102: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 103: Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 104: North America Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 105: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 106: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 107: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 108: North America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 109: North America Maritime Digitization Market Value Share Analysis, by Country, 2023

Figure 110: North America Maritime Digitization Market Value Share Analysis, by Country, 2031

Figure 111: U.S. Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 112: Canada Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 113: Mexico Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 114: Europe Maritime Digitization Market Revenue Opportunity Share, by Technology

Figure 115: Europe Maritime Digitization Market Revenue Opportunity Share, by Application

Figure 116: Europe Maritime Digitization Market Revenue Opportunity Share, by Vessel Type

Figure 117: Europe Maritime Digitization Market Revenue Opportunity Share, by Solution Type

Figure 118: Europe Maritime Digitization Market Revenue Opportunity Share, by Application per Vessel Type

Figure 119: Europe Maritime Digitization Market Revenue Opportunity Share, by End-user

Figure 120: Europe Maritime Digitization Market Revenue Opportunity Share, by Country

Figure 121: Europe Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 122: Europe Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 123: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 124: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 125: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 126: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 127: Europe Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 128: Europe Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 129: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 130: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 131: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 132: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 133: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 134: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 135: Europe Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 136: Europe Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 137: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 138: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 139: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 140: Europe Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 141: Europe Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 142: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 143: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 144: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 145: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 146: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 147: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 148: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 149: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 150: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 151: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 152: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 153: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 154: Europe Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 155: Europe Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 156: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 157: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 158: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 159: Europe Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 160: Europe Maritime Digitization Market Value Share Analysis, by Country, 2023

Figure 161: Europe Maritime Digitization Market Value Share Analysis, by Country, 2031

Figure 162: Germany Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 163: U.K. Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 164: France Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 165: Italy Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 166: Spain Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 167: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Technology

Figure 168: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Application

Figure 169: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Vessel Type

Figure 170: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Solution Type

Figure 171: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Application per Vessel Type

Figure 172: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by End-user

Figure 173: Asia Pacific Maritime Digitization Market Revenue Opportunity Share, by Country

Figure 174: Asia Pacific Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 175: Asia Pacific Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 176: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 177: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 178: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 179: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 180: Asia Pacific Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 181: Asia Pacific Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 182: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 183: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 184: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 185: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 186: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 187: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 188: Asia Pacific Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 189: Asia Pacific Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 190: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 191: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 192: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 193: Asia Pacific Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 194: Asia Pacific Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 195: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 196: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 197: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 198: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 199: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 200: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 201: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 202: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 203: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 204: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 205: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 206: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 207: Asia Pacific Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 208: Asia Pacific Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 209: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 210: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 211: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 212: Asia Pacific Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 213: Asia Pacific Maritime Digitization Market Value Share Analysis, by Country, 2023

Figure 214: Asia Pacific Maritime Digitization Market Value Share Analysis, by Country, 2031

Figure 215: China Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 216: India Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 217: Japan Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 218: ASEAN Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 219: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Technology

Figure 220: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Application

Figure 221: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Vessel Type

Figure 222: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Solution Type

Figure 223: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Application per Vessel Type

Figure 224: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by End-user

Figure 225: Middle East & Africa Maritime Digitization Market Revenue Opportunity Share, by Country

Figure 226: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 227: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 228: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 229: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 230: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 231: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 232: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 233: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 234: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 235: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 236: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 237: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 238: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 239: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 240: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 241: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 242: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 243: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 244: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 245: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 246: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 247: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 248: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 249: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 250: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 251: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 252: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 253: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 254: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 255: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 256: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 257: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 258: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 259: Middle East & Africa Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 260: Middle East & Africa Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 261: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 262: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 263: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 264: Middle East & Africa Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 265: Middle East & Africa East & Africa East & Africa Maritime Digitization Market Value Share Analysis, by Country, 2023

Figure 266: Middle East & Africa Maritime Digitization Market Value Share Analysis, by Country, 2031

Figure 267: Saudi Arabia Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 268: United Arab Emirates Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 269: South Africa Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 270: South America Maritime Digitization Market Revenue Opportunity Share, by Technology

Figure 271: South America Maritime Digitization Market Revenue Opportunity Share, by Application

Figure 272: South America Maritime Digitization Market Revenue Opportunity Share, by Vessel Type

Figure 273: South America Maritime Digitization Market Revenue Opportunity Share, by Solution Type

Figure 274: South America Maritime Digitization Market Revenue Opportunity Share, by Application per Vessel Type

Figure 275: South America Maritime Digitization Market Revenue Opportunity Share, by End-user

Figure 276: South America Maritime Digitization Market Revenue Opportunity Share, by Country

Figure 277: South America Maritime Digitization Market Value Share Analysis, by Technology, 2023

Figure 278: South America Maritime Digitization Market Value Share Analysis, by Technology, 2031

Figure 279: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by AI, 2023 - 2031

Figure 280: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by IoT, 2023 - 2031

Figure 281: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Blockchain, 2023 - 2031

Figure 282: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 283: South America Maritime Digitization Market Value Share Analysis, by Application, 2023

Figure 284: South America Maritime Digitization Market Value Share Analysis, by Application, 2031

Figure 285: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Fleet Management, 2023 - 2031

Figure 286: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Tracking, 2023 - 2031

Figure 287: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Energy Management, 2023 - 2031

Figure 288: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Inventory Management, 2023 - 2031

Figure 289: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2023 - 2031

Figure 290: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 291: South America Maritime Digitization Market Value Share Analysis, by Vessel Type, 2023

Figure 292: South America Maritime Digitization Market Value Share Analysis, by Vessel Type, 2031

Figure 293: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Dry Cargo Ships, 2023 - 2031

Figure 294: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Liquid Cargo Ships, 2023 - 2031

Figure 295: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Specialized Cargo Ships, 2023 - 2031

Figure 296: South America Maritime Digitization Market Value Share Analysis, by Solution Type, 2023

Figure 297: South America Maritime Digitization Market Value Share Analysis, by Solution Type, 2031

Figure 298: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Cargo Management, 2023 - 2031

Figure 299: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Vessel Performance, 2023 - 2031

Figure 300: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Voyage Optimization, 2023 - 2031

Figure 301: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Sustainability & Compliance Management, 2023 - 2031

Figure 302: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 303: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Bulk Carriers, 2023 - 2031

Figure 304: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Cargo Vessels, 2023 - 2031

Figure 305: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Container Vessels, 2023 - 2031

Figure 306: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Crude Carriers, 2023 - 2031

Figure 307: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by General Product Carriers, 2023 - 2031

Figure 308: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Passenger Vessels, 2023 - 2031

Figure 309: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Livestock Carriers, 2023 - 2031

Figure 310: South America Maritime Digitization Market Value Share Analysis, by End-user, 2023

Figure 311: South America Maritime Digitization Market Value Share Analysis, by End-user, 2031

Figure 312: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Ports & Terminals, 2023 - 2031

Figure 313: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Shipping Companies, 2023 - 2031

Figure 314: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Maritime Freight Forwarders, 2023 - 2031

Figure 315: South America Maritime Digitization Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 316: South America Maritime Digitization Market Value Share Analysis, by Country, 2023

Figure 317: South America Maritime Digitization Market Value Share Analysis, by Country, 2031

Figure 318: Brazil Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 319: Argentina Maritime Digitization Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031