Reports

Reports

Analyst Viewpoint

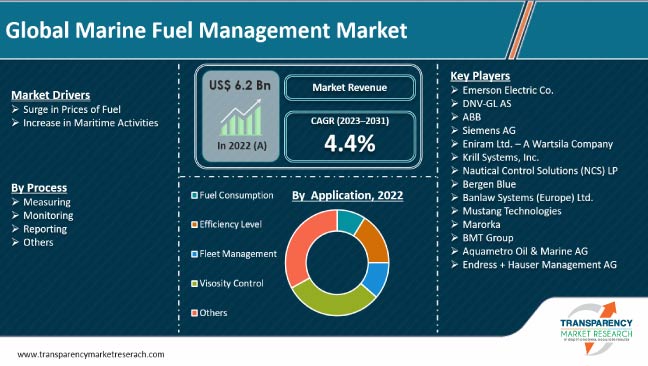

Increase in prices of fuel and enactment of stringent regulations on the shipping industry about emission control are estimated to boost the marine fuel management market growth in the next few years. Marine fuel accounts for a major share of operation costs in the shipping industry. Therefore, need to monitor fuel costs has led to the development of highly efficient fuel management systems.

Advancements in technology regarding fuel monitoring and optimization, including real-time data analytics, are estimated to boost the demand for fuel-efficiency solutions for the maritime industry. Rise in demand for fuel-efficient vessels and increase in focus on reducing operational costs are likely to offer significant marine fuel management market opportunities for key players specializing in marine energy conservation.

Marine fuel management systems help reduce fuel usage, increase operational efficiency, and improve fleet management. These systems track inventory and idling periods across the fleet to detect bottlenecks in fuel utilization. Surge in price of marine fuel and increasing government regulations on the pollution generated by the world’s shipping fleets are anticipated to boost the demand for maritime fuel efficiency management systems.

High initial costs of implementing fuel management systems, challenges in integrating modern fuel monitoring solutions in older vessels, and the potential impact of volatile fuel prices are key factors that are expected to restrain the marine fuel management market progress in the near future.

One of the latest marine fuel management market trends witnessed in the maritime industry is the emphasis on sustainability and operational efficiency. Therefore, it is essential to employ fuel optimization technologies in order to mitigate the financial impact. Operators could enable cost reduction by implementation of fuel optimization technology and practices.

Rise in price of fuel is driving focus on innovation and research for the development of more effective propulsion systems, engines, and fuel-saving systems. Additionally, integration of advanced sensors and IoT technologies for accurate fuel measurement and reporting are propelling the adoption of vessel fuel optimization solutions. Data analytics and machine learning have further enhanced fuel-efficiency and operational effectiveness. These factors are projected to boost the demand for green shipping fuel solutions in the next few years.

Maritime activities are the backbone of global trade, playing a crucial role in the supply chain for most industries. An estimated 80% of goods around the world are transported by ships. The volume of seaborne trade has been showing a growing trend since 1990. According to the UNCTAD Review of Maritime Transport, the volume of cargo transported by ships between 1990 and 2021 more than doubled, from 4 billion to nearly 11 billion tons. Furthermore, the capacity of merchant fleets worldwide grew by about 43% between 2013 and 2021, reaching almost 2.1 million deadweight tons in 2021.

Marine fuel management systems provide the accurate amount of fuel oil burnt at any particular vessel speed or engine rpm. This helps the ship’s crew to continuously measure and monitor the fuel. Therefore, increase in maritime activities is propelling the marine fuel management market development.

The number of merchant vessels and offshore support vessels operating across North America and Europe is significantly high. Therefore, the shipping industry in these regions is witnessing considerable investments for effective utilization of available resources. This is estimated to drive the marine fuel management market during the forecast period. Furthermore, growing concerns about global warming and pollution along with stringent environmental regulations in Europe are expected to propel the demand for marine fuel management systems.

China, India, Korea, and Singapore, in Asia Pacific, are witnessing considerable maritime trade and movement of merchant vessels. This is leading to heavy investment in maritime technologies, such as navigation automation, ballast water management, fuel consumption meters, viscosity meters, which in turn is boosting the marine fuel management market in the region.

Prominent companies operating in the marine fuel management industry are focusing on the development of advanced systems in order to cater to the demand of customers. Key players are also integrating latest technologies to develop effective fuel management systems, which in turn is likely to consolidate their position in the market.

Emerson Electric Co., DNV-GL AS, ABB, Siemens AG, Eniram Ltd. – A Wartsila Company, Krill Systems, Inc., Nautical Control Solutions (NCS) LP, Bergen Blue, Banlaw Systems (Europe) Ltd., Mustang Technologies, Marorka, BMT Group, Aquametro Oil & Marine AG, and Endress + Hauser Management AG are a few of the prominent players operating in the marine fuel management market.

Key players in the marine fuel management market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 6.2 Bn |

| Forecast (Value) in 2031 | US$ 9.2 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 6.2 Bn in 2022

It is projected to grow at a CAGR of 4.4% from 2023 to 2031

Rise in prices of fuel and increase in maritime activities

In terms of application, the fuel consumption segment held largest share in 2022

Emerson Electric Co., DNV-GL AS, ABB, Siemens AG, Eniram Ltd. – A Wartsila Company, Krill Systems, Inc., Nautical Control Solutions (NCS) LP, Bergen Blue, Banlaw Systems (Europe) Ltd., Mustang Technologies, Marorka, BMT Group, Aquametro Oil & Marine AG, and Endress + Hauser Management AG

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Marine Fuel Management Market Analysis and Forecast, 2022-2031

2.6.1. Global Marine Fuel Management Market Volume (Kilo Tons)

2.6.2. Global Marine Fuel Management Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Marine Fuel Management

3.2. Impact on the Demand of Marine Fuel Management– Pre & Post Crisis

4. Production Output Analysis(Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Trend Analysis by Process

6.2. Price Trend Analysis by Region

7. Marine Fuel Management Market Analysis and Forecast, by Process, 2022–2031

7.1. Introduction and Definitions

7.2. Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

7.2.1. Measuring

7.2.2. Monitoring

7.2.3. Reporting

7.2.4. Others

7.3. Global Marine Fuel Management Market Attractiveness, by Process

8. Global Marine Fuel Management Market Analysis and Forecast, Application, 2022–2031

8.1. Introduction and Definitions

8.2. Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

8.2.1. Fuel Consumption

8.2.2. Efficiency Level

8.2.3. Fleet Management

8.2.4. Viscosity Control

8.2.5. Others

8.3. Global Marine Fuel Management Market Attractiveness, by Application

9. Global Marine Fuel Management Market Analysis and Forecast, by Region, 2022–2031

9.1. Key Findings

9.2. Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Region, 2022–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Marine Fuel Management Market Attractiveness, by Region

10. North America Marine Fuel Management Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

10.3. North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Country, 2022–2031

10.4.1. U.S. Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

10.4.2. U.S. Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

10.4.3. Canada Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

10.4.4. Canada Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

10.5. North America Marine Fuel Management Market Attractiveness Analysis

11. Europe Marine Fuel Management Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.3. Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.4. Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Marine Fuel Management Market Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.2. Germany Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.4.3. France Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.4.4. France Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.4.5. U.K. Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.4.6. U.K. Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.4.7. Italy Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.4.8. Italy Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.4.9. Russia & CIS Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.4.10. Russia & CIS Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.4.11. Rest of Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

11.4.12. Rest of Europe Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

11.5. Europe Marine Fuel Management Market Attractiveness Analysis

12. Asia Pacific Marine Fuel Management Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Process

12.3. Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4. Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

12.4.2. China Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

12.4.3. Japan Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

12.4.4. Japan Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

12.4.5. India Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

12.4.6. India Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

12.4.7. ASEAN Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

12.4.8. ASEAN Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

12.4.9. Rest of Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

12.4.10. Rest of Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

12.5. Asia Pacific Marine Fuel Management Market Attractiveness Analysis

13. Latin America Marine Fuel Management Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

13.3. Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

13.4. Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

13.4.2. Brazil Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

13.4.3. Mexico Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

13.4.4. Mexico Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

13.4.5. Rest of Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

13.4.6. Rest of Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

13.5. Latin America Marine Fuel Management Market Attractiveness Analysis

14. Middle East & Africa Marine Fuel Management Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

14.3. Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

14.4. Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

14.4.2. GCC Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

14.4.3. South Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

14.4.4. South Africa Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

14.4.5. Rest of Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

14.4.6. Rest of Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, Application, 2022–2031

14.5. Middle East & Africa Marine Fuel Management Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Marine Fuel Management Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Emerson Electric Co

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. DNV-GL AS

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. ABB

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. Siemens AG

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Eniram Ltd – A Wartsila Company

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. Krill Systems, Inc.

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Nautical Control Solutions (NCS) LP

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. Bergen Blue

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Banlaw Systems (Europe) Ltd.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. Kaminco

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.11. Mustang Technologies

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.12. Marorka

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.13. BMT Group

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.14. Aquametro Oil & Marine AG

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.15. Endress + Hauser Management AG

15.2.15.1. Company Revenue

15.2.15.2. Business Overview

15.2.15.3. Product Segments

15.2.15.4. Geographic Footprint

15.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 2: Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 3: Global Marine Fuel Management Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 4: North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 5: North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 6: North America Marine Fuel Management Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 7: U.S. Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 8: U.S. Marine Fuel Management Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 9: Canada Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 10: Canada Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 11: Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 12: Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 13: Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 14: Germany Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 15: Germany Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 16: France Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 17: France Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 18: U.K. Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 19: U.K. Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 20: Italy Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 21: Italy Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 22: Spain Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 23: Spain Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 24: Russia & CIS Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 25: Russia & CIS Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 26: Rest of Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 27: Rest of Europe Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 28: Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 29: Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 30: Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 31: China Marine Fuel Management Market Value (US$ Mn) Forecast, by Process 2022–2031

Table 32: China Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 33: Japan Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 34: Japan Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 35: India Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 36: India Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 37: ASEAN Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 38: ASEAN Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 39: Rest of Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 40: Rest of Asia Pacific Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 41: Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 42: Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 43: Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 44: Brazil Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 45: Brazil Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 46: Mexico Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 47: Mexico Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 48: Rest of Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 49: Rest of Latin America Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 50: Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 51: Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 52: Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 53: GCC Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 54: GCC Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 55: South Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 56: South Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 57: Rest of Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Process, 2022–2031

Table 58: Rest of Middle East & Africa Marine Fuel Management Market Value (US$ Mn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 2: Global Marine Fuel Management Market Attractiveness, by Process

Figure 3: Global Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Marine Fuel Management Market Attractiveness, by Application

Figure 5: Global Marine Fuel Management Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Marine Fuel Management Market Attractiveness, by Region

Figure 7: North America Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 8: North America Marine Fuel Management Market Attractiveness, by Process

Figure 9: North America Marine Fuel Management Market Attractiveness, by Process

Figure 10: North America Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 11: North America Marine Fuel Management Market Attractiveness, by Application

Figure 12: North America Marine Fuel Management Market Attractiveness, by Country and Sub-region

Figure 13: Europe Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 14: Europe Marine Fuel Management Market Attractiveness, by Process

Figure 15: Europe Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Marine Fuel Management Market Attractiveness, by Application

Figure 17: Europe Marine Fuel Management Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Marine Fuel Management Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 20: Asia Pacific Marine Fuel Management Market Attractiveness, by Process

Figure 21: Asia Pacific Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Marine Fuel Management Market Attractiveness, by Application

Figure 23: Asia Pacific Marine Fuel Management Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Marine Fuel Management Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 26: Latin America Marine Fuel Management Market Attractiveness, by Process

Figure 27: Latin America Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Marine Fuel Management Market Attractiveness, by Application

Figure 29: Latin America Marine Fuel Management Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Marine Fuel Management Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Marine Fuel Management Market Value Share Analysis, by Process, 2022, 2027, and 2031

Figure 32: Middle East & Africa Marine Fuel Management Market Attractiveness, by Process

Figure 33: Middle East & Africa Marine Fuel Management Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Marine Fuel Management Market Attractiveness, by Application

Figure 35: Middle East & Africa Marine Fuel Management Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Marine Fuel Management Market Attractiveness, by Country and Sub-region