Reports

Reports

Analysts’ Viewpoint

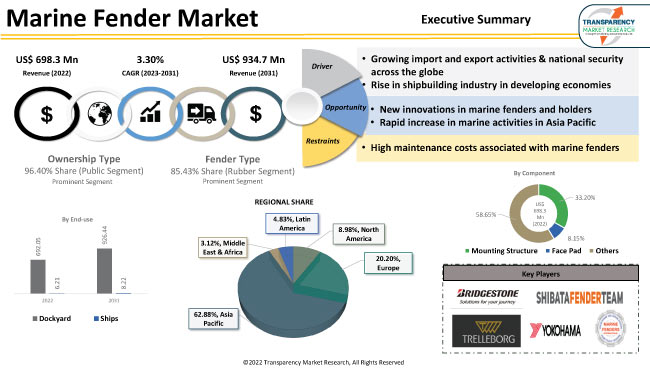

Significant growth of maritime infrastructure and increase in trade through sea route are expected to drive the global marine fender market during the forecast period. Surge in consumer expenditure on online goods & services has spiked container shipping. The growing trend of private cruise for various recreational activities, events, and travelling is boosting the shipbuilding industry, which demands better equipped dockyards. This is likely to propel the global marine fender market size during the forecast period.

Mergers, acquisitions, new product developments, and partnerships offer lucrative opportunities to market players. Participants such as ports, shipping companies and transport operators are focusing on infrastructural development and revamping their capacities.

Marine fenders are collision prevention marine equipment designed primarily to prevent ships, boats, ferries, and other marine vessels from colliding and crashing against each other or at dockyards or terminals.

Marine fenders are tied to the vessel head or hull in order to prevent and curtail any accidental collision or damage and enable safe and efficient port operations. Marine fenders are generally made of rubber, foam elastomer, or plastics material.

This marine equipment is utilized on a permanent operational basis in wharves, piers, ports & harbors, and other terminals to prevent damage and deformation of the vessel hull in addition to other berthing structures such as quay wall, jetty, and other vessels.

New innovations in marine fenders and holders are bolstering the global marine fender market growth.

Around 80% of the world's cargo is transported by ship. Rise of the agriculture and manufacturing industries has fueled the demand for water transportation activities to transfer goods and materials from one port to another, since it has a major port-based import and export operations. Marine fenders, which protect ships, boats, and terminals from damage, are expected to witness robust demand as a result of these circumstances.

Growing concern toward safety and security is another factor driving the global marine fender market development. Naval services (NAVY) plays a crucial role in defense services of any country, which requires compact to large ship in their fleet equipped with various technological advanced features and equipment.

The shipbuilding industry is responsible for the construction of ships and other floating boats, which is usually done in a shipyard. Ship repairs are a necessary part of the maintenance operation and must be done under the supervision of a classification society. This maintenance can be carried out at sea or in port, but substantial repairs can only be carried out at ship repair yards or docks, which necessitates the use of fenders.

Increase in investment by major ship manufacturers in the development of more efficient methods is likely to drive the global marine fender market demand. Rise in marine tourism across the globe is also propelling the marine fender industry.

In terms of fender type, the rubber segment accounted for the largest global marine fender market share of 85.43% in 2022. The segment is expected to grow at a CAGR of 3.22% during the forecast period. Rubber marine fenders are preferred due to characteristics such as flexibility, and high life expectancy, which are required to resist the force applied on the mooring of the port. Rubber marine fenders can also withstand high pressure load from marine vessels.

As per global marine fender market trends, Asia Pacific accounted for the leading share in 2022. This is ascribed to availability of natural rubber in adequate amount in the region and expansion of ports in ASEAN and China as a result of rise in trade. Moreover, Asia Pacific comprises developing economies that are focusing on strengthening their economy through international trade, thus investing significantly in port development. This, in turn, has led to high demand for marine fenders in the region.

Europe and North America held 20.20% and 8.98% share of the global market, respectively, in 2022. Countries in Europe use the sea route for most of the trade activities in the region. Furthermore, growing offshore construction and development due to increased trade across the region is expected to propel the market in the region during the forecast period.

The global marine fender market is fragmented, with the presence of several large and small scale entities. Majority of players are investing significantly in comprehensive research and development to cater to innovative and enhanced products in the market.

Anchor Marine & Supply, Inc., Bridgestone Corporation, Doshin Rubber Products (M) SDN. BHD, Eltech Rubber (INDIA) Pvt. Ltd., Horizon Marine Construction, INMARE, J.C. MacElroy Company, Inc., James Fisher and Sons plc, Lalizas Italia s.r.l., Lankhorst Recycling Products, Malaysian Consortium of Rubber Products Sdn. Bhd., Marine Fenders International, Inc., Max Groups Marine Corporation, Prosertek Group S.L., Qingdao Jier Engineering Rubber Co., Ltd., SINOCHEM GROUP CO., LTD., Sri Trang Agro-Industry plc, Sumitomo Rubber Industries, Ltd., Thai Rubber Corporation, The Rubber Company, The Yokohama Rubber Co., Ltd., Trelleborg Marine Systems, Von Bundit Co., Ltd., and Yantai Defender Maritime Co., Ltd. are the prominent players in the market.

Each of these players has been profiled in the marine fender market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 698.3 Mn |

| Forecast (Value) in 2031 | US$ 934.7 Mn |

| Growth Rate (CAGR) | 3.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 698.3 Mn in 2022

It is projected to expand at a CAGR of 3.30% by 2031.

It is anticipated to reach US$ 934.7 Mn in 2031.

Growing import & export activities & national security and rise in shipbuilding industry in developing economies.

The rubber fender type segment accounted for major share in 2022.

Asia Pacific is anticipated to be a highly lucrative region for manufacturers.

ANCHOR MARINE & SUPPLY, INC., Bridgestone Corporation, DOSHIN RUBBER PRODUCTS (M) SDN. BHD, ELTECH RUBBER (INDIA) PVT. LTD., Horizon Marine Construction, INMARE, J.C. MacElroy Company, Inc., James Fisher and Sons plc, Lalizas Italia s.r.l., Lankhorst Recycling Products, Malaysian Consortium of Rubber Products Sdn. Bhd., MARINE FENDERS INTERNATIONAL, INC., MAX GROUPS MARINE CORPORATION, Prosertek Group S.L., Qingdao Jier Engineering Rubber Co., Ltd., SINOCHEM GROUP CO., LTD.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Marine Fender Market: World Association for Waterborne Transport Infrastructure (PIANC) Guidelines

2.8. Marine Fender Market: Different Types of Rubber and Their Characteristics

3. Components Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Vendor Matrix

3.3. Gross Margin Analysis

4. Pricing Analysis

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. COVID-19 Impact Analysis - Marine Fender

6. Global Marine Fender Market, By Ownership Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

6.2.1. Public

6.2.2. Private

7. Global Marine Fender Market, By Fender Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By Fender Type

7.2.1. Rubber

7.2.1.1. Cell Type

7.2.1.2. Cone Type

7.2.1.3. Arch Type

7.2.1.4. Cylindrical Type

7.2.1.5. D Fenders

7.2.1.6. Others

7.2.2. Foam

7.2.3. Pneumatic

7.2.4. Timber

7.2.5. Others

8. Global Marine Fender Market, By End-use

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

8.2.1. Dockyard

8.2.2. Ships

9. Global Marine Fender Market, By Manufacturing Process

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

9.2.1. Molding

9.2.2. Extrusion

9.2.3. Others

10. Global Marine Fender Market, By Component

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

10.2.1. Mounting Structure

10.2.2. Face Pad

10.2.3. Others

11. Global Marine Fender Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Marine Fender Market Size Analysis & Forecast, 2017-2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. Latin America

12. North America Marine Fender Market

12.1. Market Snapshot

12.2. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

12.2.1. Public

12.2.2. Private

12.3. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Fender Type

12.3.1. Rubber

12.3.1.1. Cell Type

12.3.1.2. Cone Type

12.3.1.3. Arch Type

12.3.1.4. Cylindrical Type

12.3.1.5. D Fenders

12.3.1.6. Others

12.3.2. Foam

12.3.3. Pneumatic

12.3.4. Timber

12.3.5. Others

12.4. Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

12.4.1. Dockyard

12.4.2. Ships

12.5. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

12.5.1. Molding

12.5.2. Extrusion

12.5.3. Others

12.6. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

12.6.1. Mounting Structure

12.6.2. Face Pad

12.6.3. Others

12.7. Key Country Analysis - North America Marine Fender Market Size Analysis & Forecast, 2017-2031

12.7.1. U.S.

12.7.2. Canada

13. Europe Marine Fender Market

13.1. Market Snapshot

13.2. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

13.2.1. Public

13.2.2. Private

13.3. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Fender Type

13.3.1. Rubber

13.3.1.1. Cell Type

13.3.1.2. Cone Type

13.3.1.3. Arch Type

13.3.1.4. Cylindrical Type

13.3.1.5. D Fenders

13.3.1.6. Others

13.3.2. Foam

13.3.3. Pneumatic

13.3.4. Timber

13.3.5. Others

13.4. Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

13.4.1. Dockyard

13.4.2. Ships

13.5. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

13.5.1. Molding

13.5.2. Extrusion

13.5.3. Others

13.6. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

13.6.1. Mounting Structure

13.6.2. Face Pad

13.6.3. Others

13.7. Key Country Analysis - Europe Marine Fender Market Size Analysis & Forecast, 2017-2031

13.7.1. Germany

13.7.2. U. K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Nordic Countries

13.7.7. Russia & CIS

13.7.8. Rest of Europe

14. Asia Pacific Marine Fender Market

14.1. Market Snapshot

14.2. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

14.2.1. Public

14.2.2. Private

14.3. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Fender Type

14.3.1. Rubber

14.3.1.1. Cell Type

14.3.1.2. Cone Type

14.3.1.3. Arch Type

14.3.1.4. Cylindrical Type

14.3.1.5. D Fenders

14.3.1.6. Others

14.3.2. Foam

14.3.3. Pneumatic

14.3.4. Timber

14.3.5. Others

14.4. Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

14.4.1. Dockyard

14.4.2. Ships

14.5. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

14.5.1. Molding

14.5.2. Extrusion

14.5.3. Others

14.6. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

14.6.1. Mounting Structure

14.6.2. Face Pad

14.6.3. Others

14.7. Key Country Analysis - Asia Pacific Marine Fender Market Size Analysis & Forecast, 2017-2031

14.7.1. China

14.7.2. India

14.7.3. Japan

14.7.4. ASEAN Countries

14.7.5. South Korea

14.7.6. ANZ

14.7.7. Rest of Asia Pacific

15. Middle East & Africa Marine Fender Market

15.1. Market Snapshot

15.2. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

15.2.1. Public

15.2.2. Private

15.3. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Fender Type

15.3.1. Rubber

15.3.1.1. Cell Type

15.3.1.2. Cone Type

15.3.1.3. Arch Type

15.3.1.4. Cylindrical Type

15.3.1.5. D Fenders

15.3.1.6. Others

15.3.2. Foam

15.3.3. Pneumatic

15.3.4. Timber

15.3.5. Others

15.4. Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

15.4.1. Dockyard

15.4.2. Ships

15.5. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

15.5.1. Molding

15.5.2. Extrusion

15.5.3. Others

15.6. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

15.6.1. Mounting Structure

15.6.2. Face Pad

15.6.3. Others

15.7. Key Country Analysis - Middle East & Africa Marine Fender Market Size Analysis & Forecast, 2017-2031

15.7.1. GCC

15.7.2. South Africa

15.7.3. Turkey

15.7.4. Rest of Middle East & Africa

16. Latin America Marine Fender Market

16.1. Market Snapshot

16.2. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Ownership Type

16.2.1. Public

16.2.2. Private

16.3. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Process Type

16.3.1. Rubber

16.3.1.1. Cell Type

16.3.1.2. Cone Type

16.3.1.3. Arch Type

16.3.1.4. Cylindrical Type

16.3.1.5. D Fenders

16.3.1.6. Others

16.3.2. Foam

16.3.3. Pneumatic

16.3.4. Timber

16.3.5. Others

16.4. Marine Fender Market Size Analysis & Forecast, 2017-2031, By End-use

16.4.1. Dockyard

16.4.2. Ships

16.5. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Manufacturing Process

16.5.1. Molding

16.5.2. Extrusion

16.5.3. Others

16.6. Marine Fender Market Size Analysis & Forecast, 2017-2031, By Component

16.6.1. Mounting Structure

16.6.2. Face Pad

16.6.3. Others

16.7. Key Country Analysis - Latin America Marine Fender Market Size Analysis & Forecast, 2017-2031

16.7.1. Brazil

16.7.2. Mexico

16.7.3. Argentina

16.7.4. Rest of Latin America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Pricing comparison among key players

17.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1.1. ANCHOR MARINE & SUPPLY, INC.

18.1.1.1. Company Overview

18.1.1.2. Company Footprints

18.1.1.3. Production Locations

18.1.1.4. Product Portfolio

18.1.1.5. Competitors & Customers

18.1.1.6. Subsidiaries & Parent Organization

18.1.1.7. Recent Developments

18.1.1.8. Financial Analysis

18.1.1.9. Profitability

18.1.1.10. Revenue Share

18.1.2. Bridgestone Corporation

18.1.2.1. Company Overview

18.1.2.2. Company Footprints

18.1.2.3. Production Locations

18.1.2.4. Product Portfolio

18.1.2.5. Competitors & Customers

18.1.2.6. Subsidiaries & Parent Organization

18.1.2.7. Recent Developments

18.1.2.8. Financial Analysis

18.1.2.9. Profitability

18.1.2.10. Revenue Share

18.1.3. DOSHIN RUBBER PRODUCTS (M) SDN. BHD

18.1.3.1. Company Overview

18.1.3.2. Company Footprints

18.1.3.3. Production Locations

18.1.3.4. Product Portfolio

18.1.3.5. Competitors & Customers

18.1.3.6. Subsidiaries & Parent Organization

18.1.3.7. Recent Developments

18.1.3.8. Financial Analysis

18.1.3.9. Profitability

18.1.3.10. Revenue Share

18.1.4. ELTECH RUBBER (INDIA) PVT. LTD.

18.1.4.1. Company Overview

18.1.4.2. Company Footprints

18.1.4.3. Production Locations

18.1.4.4. Product Portfolio

18.1.4.5. Competitors & Customers

18.1.4.6. Subsidiaries & Parent Organization

18.1.4.7. Recent Developments

18.1.4.8. Financial Analysis

18.1.4.9. Profitability

18.1.4.10. Revenue Share

18.1.5. Horizon Marine Construction

18.1.5.1. Company Overview

18.1.5.2. Company Footprints

18.1.5.3. Production Locations

18.1.5.4. Product Portfolio

18.1.5.5. Competitors & Customers

18.1.5.6. Subsidiaries & Parent Organization

18.1.5.7. Recent Developments

18.1.5.8. Financial Analysis

18.1.5.9. Profitability

18.1.5.10. Revenue Share

18.1.6. INMARE

18.1.6.1. Company Overview

18.1.6.2. Company Footprints

18.1.6.3. Production Locations

18.1.6.4. Product Portfolio

18.1.6.5. Competitors & Customers

18.1.6.6. Subsidiaries & Parent Organization

18.1.6.7. Recent Developments

18.1.6.8. Financial Analysis

18.1.6.9. Profitability

18.1.6.10. Revenue Share

18.1.7. J.C. MacElroy Company, Inc.

18.1.7.1. Company Overview

18.1.7.2. Company Footprints

18.1.7.3. Production Locations

18.1.7.4. Product Portfolio

18.1.7.5. Competitors & Customers

18.1.7.6. Subsidiaries & Parent Organization

18.1.7.7. Recent Developments

18.1.7.8. Financial Analysis

18.1.7.9. Profitability

18.1.7.10. Revenue Share

18.1.8. James Fisher and Sons plc

18.1.8.1. Company Overview

18.1.8.2. Company Footprints

18.1.8.3. Production Locations

18.1.8.4. Product Portfolio

18.1.8.5. Competitors & Customers

18.1.8.6. Subsidiaries & Parent Organization

18.1.8.7. Recent Developments

18.1.8.8. Financial Analysis

18.1.8.9. Profitability

18.1.8.10. Revenue Share

18.1.9. Lalizas Italia s.r.l.

18.1.9.1. Company Overview

18.1.9.2. Company Footprints

18.1.9.3. Production Locations

18.1.9.4. Product Portfolio

18.1.9.5. Competitors & Customers

18.1.9.6. Subsidiaries & Parent Organization

18.1.9.7. Recent Developments

18.1.9.8. Financial Analysis

18.1.9.9. Profitability

18.1.9.10. Revenue Share

18.1.10. Lankhorst Recycling Products

18.1.10.1. Company Overview

18.1.10.2. Company Footprints

18.1.10.3. Production Locations

18.1.10.4. Product Portfolio

18.1.10.5. Competitors & Customers

18.1.10.6. Subsidiaries & Parent Organization

18.1.10.7. Recent Developments

18.1.10.8. Financial Analysis

18.1.10.9. Profitability

18.1.10.10. Revenue Share

18.1.11. Malaysian Consortium of Rubber Products Sdn. Bhd.

18.1.11.1. Company Overview

18.1.11.2. Company Footprints

18.1.11.3. Production Locations

18.1.11.4. Product Portfolio

18.1.11.5. Competitors & Customers

18.1.11.6. Subsidiaries & Parent Organization

18.1.11.7. Recent Developments

18.1.11.8. Financial Analysis

18.1.11.9. Profitability

18.1.11.10. Revenue Share

18.1.12. MARINE FENDERS INTERNATIONAL, INC.

18.1.12.1. Company Overview

18.1.12.2. Company Footprints

18.1.12.3. Production Locations

18.1.12.4. Product Portfolio

18.1.12.5. Competitors & Customers

18.1.12.6. Subsidiaries & Parent Organization

18.1.12.7. Recent Developments

18.1.12.8. Financial Analysis

18.1.12.9. Profitability

18.1.12.10. Revenue Share

18.1.13. MAX GROUPS MARINE CORPORATION

18.1.13.1. Company Overview

18.1.13.2. Company Footprints

18.1.13.3. Production Locations

18.1.13.4. Product Portfolio

18.1.13.5. Competitors & Customers

18.1.13.6. Subsidiaries & Parent Organization

18.1.13.7. Recent Developments

18.1.13.8. Financial Analysis

18.1.13.9. Profitability

18.1.13.10. Revenue Share

18.1.14. Prosertek Group S.L.

18.1.14.1. Company Overview

18.1.14.2. Company Footprints

18.1.14.3. Production Locations

18.1.14.4. Product Portfolio

18.1.14.5. Competitors & Customers

18.1.14.6. Subsidiaries & Parent Organization

18.1.14.7. Recent Developments

18.1.14.8. Financial Analysis

18.1.14.9. Profitability

18.1.14.10. Revenue Share

18.1.15. Qingdao Jier Engineering Rubber Co., Ltd.

18.1.15.1. Company Overview

18.1.15.2. Company Footprints

18.1.15.3. Production Locations

18.1.15.4. Product Portfolio

18.1.15.5. Competitors & Customers

18.1.15.6. Subsidiaries & Parent Organization

18.1.15.7. Recent Developments

18.1.15.8. Financial Analysis

18.1.15.9. Profitability

18.1.15.10. Revenue Share

18.1.16. SINOCHEM GROUP CO., LTD.

18.1.16.1. Company Overview

18.1.16.2. Company Footprints

18.1.16.3. Production Locations

18.1.16.4. Product Portfolio

18.1.16.5. Competitors & Customers

18.1.16.6. Subsidiaries & Parent Organization

18.1.16.7. Recent Developments

18.1.16.8. Financial Analysis

18.1.16.9. Profitability

18.1.16.10. Revenue Share

18.1.17. Sri Trang Agro-Industry Plc.

18.1.17.1. Company Overview

18.1.17.2. Company Footprints

18.1.17.3. Production Locations

18.1.17.4. Product Portfolio

18.1.17.5. Competitors & Customers

18.1.17.6. Subsidiaries & Parent Organization

18.1.17.7. Recent Developments

18.1.17.8. Financial Analysis

18.1.17.9. Profitability

18.1.17.10. Revenue Share

18.1.18. Sumitomo Rubber Industries, Ltd.

18.1.18.1. Company Overview

18.1.18.2. Company Footprints

18.1.18.3. Production Locations

18.1.18.4. Product Portfolio

18.1.18.5. Competitors & Customers

18.1.18.6. Subsidiaries & Parent Organization

18.1.18.7. Recent Developments

18.1.18.8. Financial Analysis

18.1.18.9. Profitability

18.1.18.10. Revenue Share

18.1.19. THAI RUBBER CORPORATION

18.1.19.1. Company Overview

18.1.19.2. Company Footprints

18.1.19.3. Production Locations

18.1.19.4. Product Portfolio

18.1.19.5. Competitors & Customers

18.1.19.6. Subsidiaries & Parent Organization

18.1.19.7. Recent Developments

18.1.19.8. Financial Analysis

18.1.19.9. Profitability

18.1.19.10. Revenue Share

18.1.20. The Rubber Company

18.1.20.1. Company Overview

18.1.20.2. Company Footprints

18.1.20.3. Production Locations

18.1.20.4. Product Portfolio

18.1.20.5. Competitors & Customers

18.1.20.6. Subsidiaries & Parent Organization

18.1.20.7. Recent Developments

18.1.20.8. Financial Analysis

18.1.20.9. Profitability

18.1.20.10. Revenue Share

18.1.21. THE YOKOHAMA RUBBER CO., LTD.

18.1.21.1. Company Overview

18.1.21.2. Company Footprints

18.1.21.3. Production Locations

18.1.21.4. Product Portfolio

18.1.21.5. Competitors & Customers

18.1.21.6. Subsidiaries & Parent Organization

18.1.21.7. Recent Developments

18.1.21.8. Financial Analysis

18.1.21.9. Profitability

18.1.21.10. Revenue Share

18.1.22. Trelleborg Marine Systems

18.1.22.1. Company Overview

18.1.22.2. Company Footprints

18.1.22.3. Production Locations

18.1.22.4. Product Portfolio

18.1.22.5. Competitors & Customers

18.1.22.6. Subsidiaries & Parent Organization

18.1.22.7. Recent Developments

18.1.22.8. Financial Analysis

18.1.22.9. Profitability

18.1.22.10. Revenue Share

18.1.23. VON BUNDIT CO., LTD.

18.1.23.1. Company Overview

18.1.23.2. Company Footprints

18.1.23.3. Production Locations

18.1.23.4. Product Portfolio

18.1.23.5. Competitors & Customers

18.1.23.6. Subsidiaries & Parent Organization

18.1.23.7. Recent Developments

18.1.23.8. Financial Analysis

18.1.23.9. Profitability

18.1.23.10. Revenue Share

18.1.24. Yantai Defender Maritime Co., Ltd.

18.1.24.1. Company Overview

18.1.24.2. Company Footprints

18.1.24.3. Production Locations

18.1.24.4. Product Portfolio

18.1.24.5. Competitors & Customers

18.1.24.6. Subsidiaries & Parent Organization

18.1.24.7. Recent Developments

18.1.24.8. Financial Analysis

18.1.24.9. Profitability

18.1.24.10. Revenue Share

18.1.25. Other Key Players

18.1.25.1. Company Overview

18.1.25.2. Company Footprints

18.1.25.3. Production Locations

18.1.25.4. Product Portfolio

18.1.25.5. Competitors & Customers

18.1.25.6. Subsidiaries & Parent Organization

18.1.25.7. Recent Developments

18.1.25.8. Financial Analysis

18.1.25.9. Profitability

18.1.25.10. Revenue Share

List of Tables

Table 1: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 2: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 3: Global Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 4: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 5: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 6: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 7: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 8: North America Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 9: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 10: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 11: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 12: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 13: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 14: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 15: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 17: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 18: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 19: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 20: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 22: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 23: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 24: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 25: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 26: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Table 27: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Table 28: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Table 29: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Table 30: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 2: Global Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 3: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 4: Global Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 5: Global Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 6: Global Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 7: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 8: Global Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 9: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Figure 10: Global Marine Fender Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 11: Global Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 12: Global Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 13: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 14: North America Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 15: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 16: North America Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 17: North America Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 18: North America Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 19: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 20: North America Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 21: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 22: North America Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 23: North America Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: North America Marine Fender Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 25: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 26: Europe Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 27: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 28: Europe Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 29: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 30: Europe Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 31: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 32: Europe Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 33: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 34: Europe Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 35: Europe Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 36: Europe Marine Fender Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 37: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 38: Asia Pacific Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 39: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 40: Asia Pacific Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 41: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 42: Asia Pacific Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 43: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 44: Asia Pacific Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 45: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 46: Asia Pacific Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 47: Asia Pacific Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Marine Fender Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 49: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 50: Middle East & Africa Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 51: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 52: Middle East & Africa Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 53: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 54: Middle East & Africa Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 55: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 56: Middle East & Africa Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 57: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 58: Middle East & Africa Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 59: Middle East & Africa Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Marine Fender Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 61: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Fender Type, 2017-2031

Figure 62: Latin America Marine Fender Market, Incremental Opportunity, by Fender Type, Value (US$ Mn), 2023-2031

Figure 63: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Ownership Type, 2017-2031

Figure 64: Latin America Marine Fender Market, Incremental Opportunity, by Ownership Type, Value (US$ Mn), 2023-2031

Figure 65: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by End-use, 2017-2031

Figure 66: Latin America Marine Fender Market, Incremental Opportunity, by End-use, Value (US$ Mn), 2023-2031

Figure 67: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Component, 2017-2031

Figure 68: Latin America Marine Fender Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 69: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Manufacturing Process, 2017-2031

Figure 70: Latin America Marine Fender Market, Incremental Opportunity, by Manufacturing Process, Value (US$ Mn), 2023-2031

Figure 71: Latin America Marine Fender Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 72: Latin America Marine Fender Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031