Reports

Reports

Analyst Viewpoint

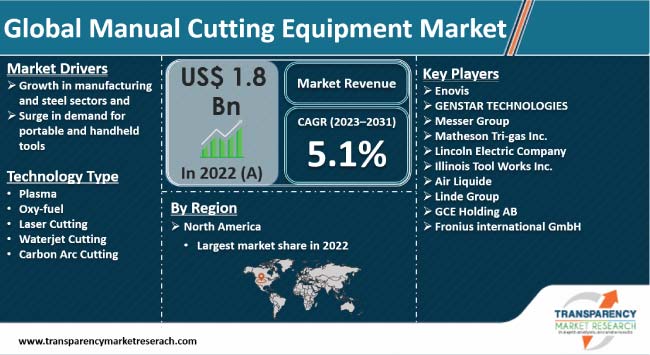

Growth in manufacturing and steel sectors and surge in demand for portable and handheld tools are fueling the manual cutting equipment market development. Manual cutting tools are employed in industries to achieve quick, cost-effective, and accurate cutting. Rise in preference for new technologies, such as waterjet cutting, carbon arc cutting, and laser cutting, in the automotive sector is also boosting the market landscape.

Vendors in the manual cutting equipment market are launching new products and partnering with other companies to expand their product portfolio. They are also developing efficient cutting tools for various processes including shaping and resizing materials.

Manual cutting equipment refers to tools and devices used for cutting various materials such as metal, wood, plastic, and fabric. These cutting equipment are operated manually, without the aid of automated systems or power sources.

They are commonly used in industries such as manufacturing, construction, automotive, and arts and crafts to cut various materials. Plasma, oxy-fuel, laser cutting, waterjet cutting, and carbon arc cutting are various types of manual cutting equipment employed in the global market.

Expansion in manufacturing and steel industries around the world is significantly increasing the demand for manual cutting equipment and consumables. According to the American Iron and Steel Institute, raw steel production was 1.84 million net tons while the capability utilization rate was 83% in June 2021. Thus, growth in steel production is augmenting the manual cutting equipment market demand.

The steel sector converts iron ore into various grades of steel by eliminating impurities such as nitrogen and silicon from the iron. Manual cutting is used in certain situations or for smaller-scale operations in steel manufacturing Angle grinders are employed to cut small sections of steel and oxy-fuel cutting torches are utilized to cut thicker sections of steel. Handheld cutting tools allow industries to achieve quick, cost-effective, and accurate cutting.

Rise in focus on precision cutting in vehicle manufacturing is expected to spur the manual cutting equipment market growth in the near future. Automotive manufacturing mainly depends on manual precision cutting devices as they are a major component of automation. Conventional procedures have been replaced with new technologies, such as waterjet cutting, carbon arc cutting, and laser cutting, to achieve high-quality edges and precisely develop car parts, frames, and other items.

Portable cutting instruments are easy to use and offer long service life. These instruments are highly efficient and enable safe usage. Most portable cutting equipment are non-corrosive and provide optimum performance. They are available with variable cutting speeds. Portable cutting instruments are suitable for cutting materials in different shapes and sizes. They are compact in design, thereby facilitating easy installation. Portable cutting equipment provide neat finishing, accurate dimensions, and smooth edges to the final product.

Rise in trend of automation is projected to limit the manual cutting equipment market progress.

Automation refers to the utilization of huge automatic equipment in manufacturing and or production. It can remotely monitor and control cutting equipment. These qualities are highly beneficial for large-scale manufacturing or production sectors. Thus, these sectors are shifting to automation. In 2022, according to the McKinsey Global Industrial Robotics survey, industrial companies are set to spend heavily on robotics and automation with automated systems accounting for 25% of capital spending in companies over the next five years.

According to the latest manual cutting equipment market analysis, North America held largest share in 2022. Increase in demand for cutting equipment, rise in popularity of DIY trends, consumer preference toward independent services, shortage of skilled labor, and high labor costs are fueling the market dynamics of the region.

The modern trend of nuclear families in the U.S. has led to significant household ownership around the country, thereby boosting the demand for manual cutting tools for renovating houses and gardening activities. The significantly developed economy and the presence of key market players that are actively working to develop and introduce innovative products are bolstering the manual cutting equipment market share in North America.

Increase in customization of automobiles and shipbuilding is driving market revenue in North America. In February 2021, the Association for Manufacturing Technology (AMT) and the U.S. Cutting Tool Institute (USCTI) reported that the U.S. consumed almost US$ 157.3 million worth of cutting tools in December 2020, an increase of 4% from November 2020.

Key players are investing in research and development to expand their product portfolio. They are also broadening their global footprint with the help of new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. Vendors are focusing on the integration of the latest technological advancements in their offerings to cater to a wide range of end-users.

Enovis, GENSTAR TECHNOLOGIES, Messer Group, Matheson Tri-gas Inc., Lincoln Electric Company, Illinois Tool Works Inc., Air Liquide, Linde Group, GCE Holding AB, and Fronius International GmbH are some of the key vendors in the manual cutting equipment business.

Each of these companies has been profiled in the manual cutting equipment market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.8 Bn |

| Market Forecast (Value) in 2031 | US$ 2.8 Bn |

| Growth Rate (CAGR) | 5.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.8 Bn in 2022

It is anticipated to grow at a CAGR of 5.1% from 2023 to 2031

Growth in manufacturing and steel sectors and surge in demand for portable and handheld tools

North America was the leading region in 2022

Enovis, GENSTAR TECHNOLOGIES, Messer Group, Matheson Tri-gas Inc., Lincoln Electric Company, Illinois Tool Works Inc., Air Liquide, Linde Group, GCE Holding AB, and Fronius International GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Technological Overview Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Regulatory Framework

5.10. Global Manual Cutting Equipment Market Analysis and Forecast, 2017–2031

5.10.1. Market Value Projections (US$ Mn)

6. Global Manual Cutting Equipment Market Analysis and Forecast, by Technology Type

6.1. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

6.1.1. Plasma

6.1.2. Oxy-fuel

6.1.3. Laser Cutting

6.1.4. Waterjet Cutting

6.1.5. Carbon Arc Cutting

6.2. Incremental Opportunity, by Technology Type

7. Global Manual Cutting Equipment Market Analysis and Forecast, by Application

7.1. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

7.1.1. Construction

7.1.2. Heavy Equipment Fabrication

7.1.3. Shipbuilding and Offshore

7.1.4. Automotive and Transportation

7.1.5. Others

7.2. Incremental Opportunity, by Application

8. Global Manual Cutting Equipment Market Analysis and Forecast, by Region

8.1. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, by Region

9. North America Manual Cutting Equipment Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Brand Analysis

9.3. Price Trend Analysis

9.3.1. Weighted Average Price

9.4. Key Trends Analysis

9.4.1. Demand Side

9.4.2. Supplier Side

9.5. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

9.5.1. Plasma

9.5.2. Oxy-fuel

9.5.3. Laser Cutting

9.5.4. Waterjet Cutting

9.5.5. Carbon Arc Cutting

9.6. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

9.6.1. Construction

9.6.2. Heavy Equipment Fabrication

9.6.3. Shipbuilding and Offshore

9.6.4. Automotive and Transportation

9.6.5. Others

9.7. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe Manual Cutting Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Brand Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supplier Side

10.5. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

10.5.1. Plasma

10.5.2. Oxy-fuel

10.5.3. Laser Cutting

10.5.4. Waterjet Cutting

10.5.5. Carbon Arc Cutting

10.6. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

10.6.1. Construction

10.6.2. Heavy Equipment Fabrication

10.6.3. Shipbuilding and Offshore

10.6.4. Automotive and Transportation

10.6.5. Others

10.7. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

10.7.1. U.K.

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific Manual Cutting Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supplier Side

11.5. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

11.5.1. Plasma

11.5.2. Oxy-fuel

11.5.3. Laser Cutting

11.5.4. Waterjet Cutting

11.5.5. Carbon Arc Cutting

11.6. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

11.6.1. Construction

11.6.2. Heavy Equipment Fabrication

11.6.3. Shipbuilding and Offshore

11.6.4. Automotive and Transportation

11.6.5. Others

11.7. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

11.7.1. India

11.7.2. China

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & Africa Manual Cutting Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

12.5.1. Plasma

12.5.2. Oxy-fuel

12.5.3. Laser Cutting

12.5.4. Waterjet Cutting

12.5.5. Carbon Arc Cutting

12.6. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

12.6.1. Construction

12.6.2. Heavy Equipment Fabrication

12.6.3. Shipbuilding and Offshore

12.6.4. Automotive and Transportation

12.6.5. Others

12.7. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

12.7.1. GCC

12.7.2. Rest of Middle East & Africa

12.8. Incremental Opportunity Analysis

13. South America Manual Cutting Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Technology Type, 2017–2031

13.5.1. Plasma

13.5.2. Oxy-fuel

13.5.3. Laser Cutting

13.5.4. Waterjet Cutting

13.5.5. Carbon Arc Cutting

13.6. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Application, 2017–2031

13.6.1. Construction

13.6.2. Heavy Equipment Fabrication

13.6.3. Shipbuilding and Offshore

13.6.4. Automotive and Transportation

13.6.5. Others

13.7. Manual Cutting Equipment Market Size (US$ Mn) Forecast, by Country, 2017–2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), by Company, (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Enovis

14.3.1.1. Company Overview

14.3.1.2. Sales Area

14.3.1.3. Geographical Presence

14.3.1.4. Revenue

14.3.1.5. Strategy & Business Overview

14.3.2. GENSTAR TECHNOLOGIES

14.3.2.1. Company Overview

14.3.2.2. Sales Area

14.3.2.3. Geographical Presence

14.3.2.4. Revenue

14.3.2.5. Strategy & Business Overview

14.3.3. Messer Group

14.3.3.1. Company Overview

14.3.3.2. Sales Area

14.3.3.3. Geographical Presence

14.3.3.4. Revenue

14.3.3.5. Strategy & Business Overview

14.3.4. Matheson Tri-gas Inc.

14.3.4.1. Company Overview

14.3.4.2. Sales Area

14.3.4.3. Geographical Presence

14.3.4.4. Revenue

14.3.4.5. Strategy & Business Overview

14.3.5. Lincoln Electric Company

14.3.5.1. Company Overview

14.3.5.2. Sales Area

14.3.5.3. Geographical Presence

14.3.5.4. Revenue

14.3.5.5. Strategy & Business Overview

14.3.6. Illinois Tool Works Inc.

14.3.6.1. Company Overview

14.3.6.2. Sales Area

14.3.6.3. Geographical Presence

14.3.6.4. Revenue

14.3.6.5. Strategy & Business Overview

14.3.7. Air Liquide

14.3.7.1. Company Overview

14.3.7.2. Sales Area

14.3.7.3. Geographical Presence

14.3.7.4. Revenue

14.3.7.5. Strategy & Business Overview

14.3.8. Linde Group

14.3.8.1. Company Overview

14.3.8.2. Sales Area

14.3.8.3. Geographical Presence

14.3.8.4. Revenue

14.3.8.5. Strategy & Business Overview

14.3.9. GCE Holding AB

14.3.9.1. Company Overview

14.3.9.2. Sales Area

14.3.9.3. Geographical Presence

14.3.9.4. Revenue

14.3.9.5. Strategy & Business Overview

14.3.10. Fronius International GMBH

14.3.10.1. Company Overview

14.3.10.2. Sales Area

14.3.10.3. Geographical Presence

14.3.10.4. Revenue

14.3.10.5. Strategy & Business Overview

15. Go to Market Strategy

16. Identification of Potential Market Spaces

17. Prevailing Market Risks

18. Understanding Buying Process of Customers

19. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 2: Global Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 3: Global Manual Cutting Equipment Market Value (US$ Mn), by Region, 2017-2031

Table 4: North America Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 5: North America Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 6: North America Manual Cutting Equipment Market Value (US$ Mn), by Country, 2017-2031

Table 7: Europe Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 8: Europe Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 9: Europe Manual Cutting Equipment Market Value (US$ Mn), by Country and Sub-region, 2017-2031

Table 10: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 11: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 12: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Country and Sub-region, 2017-2031

Table 13: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 14: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 15: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Country and Sub-region, 2017-2031

Table 16: South America Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Table 17: South America Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Table 18: South America Manual Cutting Equipment Market Value (US$ Mn), by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 2: Global Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 3: Global Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 4: Global Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 5: Global Manual Cutting Equipment Market Value (US$ Mn), by Region, 2017-2031

Figure 6: Global Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 7: North America Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 8: North America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 9: North America Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 10: North America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 11: North America Manual Cutting Equipment Market Value (US$ Mn), by Country, 2017-2031

Figure 12: North America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 13: Europe Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 14: Europe Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 15: Europe Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 16: Europe Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 17: Europe Manual Cutting Equipment Market Value (US$ Mn), by Country and Sub-region, 2017-2031

Figure 18: Europe Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 19: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 20: Asia Pacific Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 21: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 22: Asia Pacific Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 23: Asia Pacific Manual Cutting Equipment Market Value (US$ Mn), by Region, 2017-2031

Figure 24: Asia Pacific Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country and Sub-region, 2023-2031

Figure 25: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 26: Middle East & Africa Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 27: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 28: Middle East & Africa Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 29: Middle East & Africa Manual Cutting Equipment Market Value (US$ Mn), by Region, 2017-2031

Figure 30: Middle East & Africa Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country and Sub-region, 2023-2031

Figure 31: South America Manual Cutting Equipment Market Value (US$ Mn), by Technology Type, 2017-2031

Figure 32: South America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Technology Type, 2023-2031

Figure 33: South America Manual Cutting Equipment Market Value (US$ Mn), by Application, 2017-2031

Figure 34: South America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 35: South America Manual Cutting Equipment Market Value (US$ Mn), by Region, 2017-2031

Figure 36: South America Manual Cutting Equipment Market Incremental Opportunity (US$ Mn), Forecast, by Country and Sub-region, 2023-2031