Reports

Reports

Analysts’ Viewpoint on Mainframe Modernization Services Market Scenario

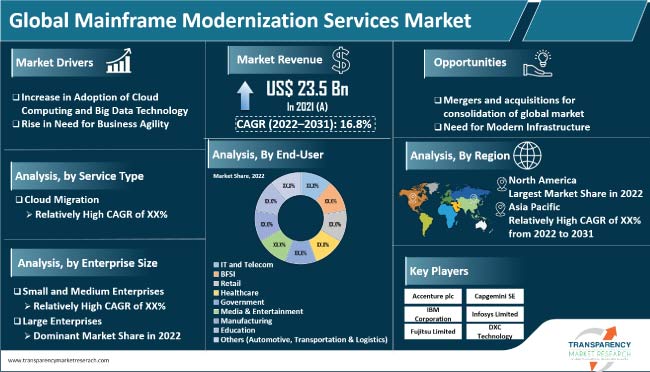

Mainframe modernization services help organizations to integrate applications with modern platforms and technologies after the migration of the legacy code. BFSI, IT & telecom, healthcare, and manufacturing sectors are increasingly adopting mainframe modernization solutions and services to manage mainframe operations in-house. Growth in digital economy of various countries has played a key role in driving the demand for mainframe technology among end-users. The COVID-19 pandemic has positively impacted the global mainframe modernization services market due to the rise in need for transformation of IT infrastructure by enterprises to create highly efficient, flexible, and agile IT systems and processes. Companies are increasingly focusing on R&D programs in cloud-based and big data analytics to create opportunities in the global mainframe modernization services market.

Mainframe modernization services help improve process efficiencies and system performance of organizations to meet the evolving business needs. Mainframe modernization refers to the method of improving a company's existing mainframe footprint in a variety of ways such as code, interface, performance, cost, and maintainability. It is the process of adopting and upgrading legacy or current mainframe systems rather than completely operating or replacing them with outdated mainframe applications. Mainframe modernization technology service providers offer complete solutions for system integration and upgrade process. Mainframe modernization tools providers take precautions to minimize downtime, avoid loss of applications or data, and continuously update the central system.

The modernization process provides mobility access to an organization's systems. It also provides access to the cloud platform. Rise in demand for mainframe modernization services is creating lucrative opportunities for solution providers. Customers are increasingly using digital devices to manage and handle data, and financial information of business and industrial sectors. This is anticipated to boost the adoption of mainframe modernization services. Mainframe modernization challenges include identifying and reducing shadow IT projects, improving tool standardization, and avoiding poorly directed modernization efforts.

The mainframe modernization services market is estimated to advance significantly in the near future, led by the rise in demand for cloud services, increase in demand for upgrade of legacy applications and systems, growth in remote working culture, and improvement in customer experience through applications. Wide usage of the Internet and scalability of cloud-native applications are estimated to offer significant opportunities for the mainframe modernization services market in the near future. The cloud can offer new capabilities and economies of scale not accessible over mainframe computing. The profits of technologies of cloud and the law of diminishing returns on mainframes are driving the demand for migration strategies.

Companies in the U.S. have historically been the leaders in investing in new technology adoption with cloud strategies. Currently, Australia, New Zealand, the U.K., Brazil, China, and the Netherlands lead in terms of cloud adoption along with the U.S. Australia and New Zealand moved 43% of IT systems to the cloud in 2020; the number is estimated to rise to 52% by the end of 2022. Greater cloud performance demands high levels of orchestration and adoption to achieve cloud-driven growth. Organizations that excel in the cloud exhibit strong motivation to use the cloud to expand their business, increase speed to market, add features, and drive scalability.

In the current competitive business world, companies need business agility to survive and grow. This can be achieved through the adoption of cutting-edge technologies, and development and deployment of cutting-edge application technologies. Organizational agility is about adapting to the changing needs of customers, the market, and the business world. A successful company is one that knows when to be flexible and when to pivot as different situations arise. Business agility makes many of these measures possible. Agility across the enterprise combines stability and speed. It helps with role clarity, operational discipline, innovation, and can produce positive results for the health and performance of an organization.

Modernizing mainframe environments by migrating to the cloud can offer users the benefits and capabilities of the new system, which ensures greater agility, cost efficiency, and scalability. For instance, in February 2020, Consolidated Edison Co. of New York Inc. (CECONY) selected Cognizant to modernize its IT infrastructure to enable greater agility and increased operational efficiencies, and provide better customer experience. The approach of focusing on user experience creates additional business value, which translates into greater productivity, collaboration, and revenue. This is likely to drive the data modernization market size in the near future.

Modern infrastructure is the next-generation technology and service stack that is used to develop highly scalable, agile, and flexible organization environments. A modern, diverse, dynamic, and resilient infrastructure enables companies to constantly deliver optimized user experience through hybrid cloud and multi-cloud deployments, containerized workloads, and server-less computing. Mainframe application modernization services is one of the ways to modernize the infrastructure of an organization.

Companies operating in the current digital economy demand maximum performance and agility from infrastructure in order to offer high-performance user experience. In most cases, upgrading to modern infrastructure is more beneficial than investing in a private data center. Public cloud platforms, such as Azure and AWS, provide companies with the flexibility to increase or decrease their computing and storage requirements without having to invest in static server skills that can be rendered useless.

Reliable infrastructure is required to connect supply chains and efficiently transport services and goods across borders. Modern infrastructure can expand quickly and become even more complex, leading to a rapid increase in the amount of monitoring data that is generated. It can often be difficult to manually correlate all of these different types of data. This limitation can be remedied by AIOps or artificial intelligence for IT operations. Therefore, rise in need for modern infrastructure is expected to provide lucrative opportunities for the mainframe modernization services market.

North America dominated the global mainframe modernization services market in 2021. It is expected to hold major share of the global mainframe modernization services market during the forecast period, led by the rise in demand for modernization solutions among various sectors.

In Asia Pacific, small and medium enterprises are expected to adopt mainframe modernization solutions at a significant rate during the forecast period. Highly competitive business scenario in Asia Pacific offers lucrative opportunities for the mainframe modernization services market in the region.

South America and Middle East & Africa are also expected to be lucrative regions of the global mainframe modernization services market during the forecast period. Increase in government initiatives and growth in digitalization in industries are projected to drive the adoption of mainframe modernization services in these regions.

The global mainframe modernization services market is fragmented, with a few large-scale vendors controlling majority of the share. Key companies are investing significantly in comprehensive R&D activities to enhance their market share. Expansion of product portfolios and mergers and acquisitions are the prominent marketing strategies adopted by mainframe modernization companies. Leading players in the global mainframe modernization services market are Accenture plc, Atos Syntel Inc., IBM Corporation, Capgemini SE, Infosys Limited, Mphasis Ltd., Dell EMC, Oracle Corporation, Software AG, TATA Consultancy Services, Wipro, DXC Technology, EPAM Systems, Fujitsu Limited, Cognizant, Innova Solutions, Microsoft Corporation, and Hexaware.

Each of these players has been profiled in the mainframe modernization services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 23.5 Bn |

|

Market Forecast Value in 2031 |

US$ 108.9 Bn |

|

Growth Rate(CAGR) |

16.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global mainframe modernization services market was valued at US$ 23.5 Bn by 2021.

The global mainframe modernization services market is estimated to grow at a CAGR of 16.8% during the forecast period.

Deployment of modern infrastructure.

Increase in adoption of cloud computing and big data technology; and rise in need for business agility.

Asia Pacific is a more attractive region for vendors in the global mainframe modernization services market.

The global mainframe modernization services market is expected to reach US$ 108.9 Bn by 2031.

Accenture Plc, Atos SE, Capgemini SE, Cognizant, Dell Inc., DXC Technology, Microsoft Corporation, IBM Corporation, FUJITSU Limited, Hexaware Technologies, and Infosys Limited.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Mainframe Modernization Services Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on the Mainframe Modernization Services Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Overview of Mainframe Modernization Services, by Approaches

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Service Type

4.6.2. By Enterprise Size

4.6.3. By End-user

4.7. Competitive Scenario

4.7.1. List of Emerging, Prominent and Leading Players

4.7.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, Etc.

5. Global Mainframe Modernization Services Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

6. Global Mainframe Modernization Services Market Analysis, by Service Type

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Service Type, 2018 - 2031

6.3.1. Application Modernization

6.3.1.1. Transformation Consulting

6.3.1.2. Business Re-architecture

6.3.1.3. Automated Migration

6.3.1.4. Others (IT Re-architecture & Point Solutions)

6.3.2. Cloud Migration

6.3.2.1. Cloud Advisory

6.3.2.2. Cloud Engineering

6.3.2.3. Cloud Migration & Modernization

6.3.3. Data Modernization

6.3.3.1. Data Migration

6.3.3.2. Data Consolidation

6.3.3.3. Data Transformation

6.3.3.4. Data Governance

7. Global Mainframe Modernization Services Market Analysis, by Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

7.3.1. Small and Medium Enterprises (SMEs)

7.3.2. Large Enterprises

8. Global Mainframe Modernization Services Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.2.1. IT and Telecom

8.2.2. Banking, Financial Services, and Insurance (BFSI)

8.2.3. Retail

8.2.4. Healthcare

8.2.5. Government

8.2.6. Media & Entertainment

8.2.7. Manufacturing

8.2.8. Education

8.2.9. Others (Automotive, Transportation & Logistics)

9. Global Mainframe Modernization Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Region, 2018 - 2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Mainframe Modernization Services Market Analysis

10.1. Regional Outlook

10.2. Mainframe Modernization Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Service Type

10.2.2. By Enterprise Size

10.2.3. By End-user

10.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Mainframe Modernization Services Market Analysis and Forecast

11.1. Regional Outlook

11.2. Mainframe Modernization Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Service Type

11.2.2. By Enterprise Size

11.2.3. By End-user

11.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Spain

11.3.5. Italy

11.3.6. Rest of Europe

12. Asia Pacific Mainframe Modernization Services Market Analysis and Forecast

12.1. Regional Outlook

12.2. Mainframe Modernization Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Service Type

12.2.2. By Enterprise Size

12.2.3. By End-user

12.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa (MEA) Mainframe Modernization Services Market Analysis and Forecast

13.1. Regional Outlook

13.2. Mainframe Modernization Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Service Type

13.2.2. By Enterprise Size

13.2.3. By End-user

13.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. The United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa (MEA)

14. South America Mainframe Modernization Services Market Analysis and Forecast

14.1. Regional Outlook

14.2. Mainframe Modernization Services Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Service Type

14.2.2. By Enterprise Size

14.2.3. By End-user

14.3. Mainframe Modernization Services Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

16. Company Profiles

16.1. Accenture plc

16.1.1. Business Overview

16.1.2. Product Portfolio

16.1.3. Geographical Footprint

16.1.4. Revenue and Strategy

16.2. Atos Syntel Inc.

16.2.1. Business Overview

16.2.2. Product Portfolio

16.2.3. Geographical Footprint

16.2.4. Revenue and Strategy

16.3. Capgemini SE

16.3.1. Business Overview

16.3.2. Product Portfolio

16.3.3. Geographical Footprint

16.3.4. Revenue and Strategy

16.4. Cognizant

16.4.1. Business Overview

16.4.2. Product Portfolio

16.4.3. Geographical Footprint

16.4.4. Revenue and Strategy

16.5. Dell EMC

16.5.1. Business Overview

16.5.2. Product Portfolio

16.5.3. Geographical Footprint

16.5.4. Revenue and Strategy

16.6. DXC Technology

16.6.1. Business Overview

16.6.2. Product Portfolio

16.6.3. Geographical Footprint

16.6.4. Revenue and Strategy

16.7. EPAM Systems

16.7.1. Business Overview

16.7.2. Product Portfolio

16.7.3. Geographical Footprint

16.7.4. Revenue and Strategy

16.8. Fujitsu Limited

16.8.1. Business Overview

16.8.2. Product Portfolio

16.8.3. Geographical Footprint

16.8.4. Revenue and Strategy

16.9. Hexaware

16.9.1. Business Overview

16.9.2. Product Portfolio

16.9.3. Geographical Footprint

16.9.4. Revenue and Strategy

16.10. IBM Corporation

16.10.1. Business Overview

16.10.2. Product Portfolio

16.10.3. Geographical Footprint

16.10.4. Revenue and Strategy

16.11. Infosys Limited

16.11.1. Business Overview

16.11.2. Product Portfolio

16.11.3. Geographical Footprint

16.11.4. Revenue and Strategy

16.12. Innova Solutions

16.12.1. Business Overview

16.12.2. Product Portfolio

16.12.3. Geographical Footprint

16.12.4. Revenue and Strategy

16.13. Microsoft Corporation

16.13.1. Business Overview

16.13.2. Product Portfolio

16.13.3. Geographical Footprint

16.13.4. Revenue and Strategy

16.14. Mphasis Ltd.

16.14.1. Business Overview

16.14.2. Product Portfolio

16.14.3. Geographical Footprint

16.14.4. Revenue and Strategy

16.15. Oracle Corporation

16.15.1. Business Overview

16.15.2. Product Portfolio

16.15.3. Geographical Footprint

16.15.4. Revenue and Strategy

16.16. Software AG

16.16.1. Business Overview

16.16.2. Product Portfolio

16.16.3. Geographical Footprint

16.16.4. Revenue and Strategy

16.17. TATA Consultancy Services

16.17.1. Business Overview

16.17.2. Product Portfolio

16.17.3. Geographical Footprint

16.17.4. Revenue and Strategy

16.18. Wipro

16.18.1. Business Overview

16.18.2. Product Portfolio

16.18.3. Geographical Footprint

16.18.4. Revenue and Strategy

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Mainframe Modernization Services Market

Table 2: North America Mainframe Modernization Services Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 3: Europe Mainframe Modernization Services Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 4: Asia Pacific Mainframe Modernization Services Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 5: Middle East & Africa Mainframe Modernization Services Market Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America Mainframe Modernization Services Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact

Table 9: Impact Analysis of Drivers & Restraint

Table 10: List of Emerging, Prominent and Leading Players

Table 11: Mergers & Acquisitions, Expansions, Partnerships

Table 12: Mergers & Acquisitions, Expansions, Partnerships

Table 13: Mergers & Acquisitions, Expansions, Partnerships

Table 14: Global Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 15: Global Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 16: Global Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 17: Global Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 18: Global Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 19: Global Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 20: Global Mainframe Modernization Services Market Volume (US$ Bn) Forecast, by Region, 2018 – 2031

Table 21: North America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 22: North America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 23: North America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 24: North America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 25: North America Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 26: North America Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 27: North America Mainframe Modernization Services Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 28: U.S. Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Canada Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Mexico Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: Europe Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 32: Europe Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 33: Europe Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 34: Europe Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 35: Europe Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 36: Europe Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 37: Europe Mainframe Modernization Services Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 38: Germany Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: U.K. Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: France Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: Spain Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: Italy Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 44: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 45: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 46: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 47: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 48: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 49: Asia Pacific Mainframe Modernization Services Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 50: China Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: India Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 52: Japan Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: ASEAN Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 54: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 55: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 56: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 57: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 58: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 59: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 60: Middle East & Africa Mainframe Modernization Services Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 61: Saudi Arabia Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 62: The United Arab Emirates Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 63: South Africa Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 64: South America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, 2018 – 2031

Table 65: South America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Application Modernization, 2018 – 2031

Table 66: South America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Cloud Migration, 2018 – 2031

Table 67: South America Mainframe Modernization Services Market Value (US$ Bn), by Service Type, by Data Modernization, 2018 – 2031

Table 68: South America Mainframe Modernization Services Market Value (US$ Bn), by Enterprise Size, 2018 – 2031

Table 69: South America Mainframe Modernization Services Market Value (US$ Bn), by End-user, 2018 – 2031

Table 70: South America Mainframe Modernization Services Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 71: Brazil Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

Table 72: Argentina Mainframe Modernization Services Market Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global Mainframe Modernization Services Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Mainframe Modernization Services Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Mainframe Modernization Services Market

Figure 4: Global Mainframe Modernization Services (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Major Drivers for Adoption of Cloud for Mainframe Modernization

Figure 6: Global Mainframe Modernization Services Market Attractiveness Assessment, by Service Type

Figure 7: Global Mainframe Modernization Services Market Attractiveness Assessment, by Enterprise Size

Figure 8: Global Mainframe Modernization Services Market Attractiveness Assessment, by End-user

Figure 9: Global Mainframe Modernization Services Market Attractiveness Assessment, by Region

Figure 10: Global Mainframe Modernization Services Market Revenue (US$ Bn) Historic Trends, 2016 - 2021

Figure 11: Global Mainframe Modernization Services Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2021

Figure 12: Global Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 13: Global Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 14: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 15: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 16: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 17: Global Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 18: Global Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 19: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 20: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 21: Global Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 22: Global Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 23: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 24: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI, 2022 – 2031

Figure 25: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 26: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 27: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 28: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 29: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 30: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 31: Global Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 32: Global Mainframe Modernization Services Market Opportunity (US$ Bn), by Region

Figure 33: Global Mainframe Modernization Services Market Opportunity Share (%), by Region, 2021–2031

Figure 34: Global Mainframe Modernization Services Market Size (US$ Bn), by Region, 2021 & 2031

Figure 35: Global Mainframe Modernization Services Market Value Share Analysis, by Region, 2021

Figure 36: Global Mainframe Modernization Services Market Value Share Analysis, by Region, 2031

Figure 37: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 38: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 39: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 40: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 41: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 44: North America Mainframe Modernization Services Revenue Opportunity Share, by End-user

Figure 45: North America Mainframe Modernization Services Revenue Opportunity Share, by Country

Figure 42: North America Mainframe Modernization Services Revenue Opportunity Share, by Service Type

Figure 43: North America Mainframe Modernization Services Revenue Opportunity Share, by Enterprise Size

Figure 46: North America Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 47: North America Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 48: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 49: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 50: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 51: North America Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 52: North America Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 53: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 54: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 55: North America Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 56: North America Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 57: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 58: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI, 2022 – 2031

Figure 59: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 60: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 61: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 62: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 63: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 64: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 65: North America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 66: North America Mainframe Modernization Services Market Value Share Analysis, by Country, 2021

Figure 67: North America Mainframe Modernization Services Market Value Share Analysis, by Country, 2031

Figure 68: U.S. Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 69: Canada Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 70: Mexico Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 71: Europe Mainframe Modernization Services Revenue Opportunity Share, by Service Type

Figure 72: Europe Mainframe Modernization Services Revenue Opportunity Share, by Enterprise Size

Figure 73: Europe Mainframe Modernization Services Revenue Opportunity Share, by End-user

Figure 74: Europe Mainframe Modernization Services Revenue Opportunity Share, by Country

Figure 75: Europe Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 76: Europe Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 77: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 78: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 79: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 80: Europe Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 81: Europe Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 82: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 83: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 84: Europe Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 85: Europe Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 86: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 87: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI), 2022 – 2031

Figure 88: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 89: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 90: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 91: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 92: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 93: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 94: Europe Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 95: Europe Mainframe Modernization Services Market Value Share Analysis, by Country, 2021

Figure 96: Europe Mainframe Modernization Services Market Value Share Analysis, by Country, 2031

Figure 97: Germany Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 98: U.K. Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 99: France Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 100: Spain Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 101: Italy Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 104: Asia Pacific Mainframe Modernization Services Revenue Opportunity Share, by End-user

Figure 105: Asia Pacific Mainframe Modernization Services Revenue Opportunity Share, by Country

Figure 102: Asia Pacific Mainframe Modernization Services Revenue Opportunity Share, by Service Type

Figure 103: Asia Pacific Mainframe Modernization Services Revenue Opportunity Share, by Enterprise Size

Figure 106: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 107: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 108: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 109: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 110: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 111: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 112: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 113: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 114: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 115: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 116: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 117: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 118: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI, 2022 – 2031

Figure 119: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 120: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 121: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 122: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 123: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 124: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 125: Asia Pacific Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 126: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Country, 2021

Figure 127: Asia Pacific Mainframe Modernization Services Market Value Share Analysis, by Country, 2031

Figure 128: China Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 129: India Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 130: ASEAN Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 131: Middle East & Africa Mainframe Modernization Services Revenue Opportunity Share, by End-user

Figure 132: Middle East & Africa Mainframe Modernization Services Revenue Opportunity Share, by Country

Figure 133: Middle East & Africa Mainframe Modernization Services Revenue Opportunity Share, by Service Type

Figure 134: Middle East & Africa Mainframe Modernization Services Revenue Opportunity Share, by Enterprise Size

Figure 135: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 136: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 137: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 138: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 139: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 140: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 141: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 142: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 143: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 144: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 145: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 146: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 147: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI, 2022 – 2031

Figure 148: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 149: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 150: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 151: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 152: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 153: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 154: Middle East & Africa Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 155: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Country, 2021

Figure 156: Middle East & Africa Mainframe Modernization Services Market Value Share Analysis, by Country, 2031

Figure 157: Saudi Arabia Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 158: The United Arab Emirates Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 159: South Africa Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 160: South America Mainframe Modernization Services Revenue Opportunity Share, by End-user

Figure 161: South America Mainframe Modernization Services Revenue Opportunity Share, by Country

Figure 162: South America Mainframe Modernization Services Revenue Opportunity Share, by Service Type

Figure 163: South America Mainframe Modernization Services Revenue Opportunity Share, by Enterprise Size

Figure 164: South America Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2021

Figure 165: South America Mainframe Modernization Services Market Value Share Analysis, by Service Type, 2031

Figure 166: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Application Modernizations, 2022 – 2031

Figure 167: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Cloud Migration, 2022 – 2031

Figure 168: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Data Modernization, 2022 – 2031

Figure 169: South America Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2021

Figure 170: South America Mainframe Modernization Services Market Value Share Analysis, by Enterprise Size, 2031

Figure 171: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Small and Medium Enterprises, 2022 – 2031

Figure 172: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2022 – 2031

Figure 173: South America Mainframe Modernization Services Market Value Share Analysis, by End-user, 2021

Figure 174: South America Mainframe Modernization Services Market Value Share Analysis, by End-user, 2031

Figure 175: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by IT and Telecom, 2022 – 2031

Figure 176: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Banking, Financial Services, and Insurance (BFSI, 2022 – 2031

Figure 177: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 178: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 179: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Government, 2022 – 2031

Figure 180: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2022 – 2031

Figure 181: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 182: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Education, 2022 – 2031

Figure 183: South America Mainframe Modernization Services Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 184: South America Mainframe Modernization Services Market Value Share Analysis, by Country, 2021

Figure 185: South America Mainframe Modernization Services Market Value Share Analysis, by Country, 2031

Figure 186: Brazil Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 187: Argentina Mainframe Modernization Services Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031