Reports

Reports

Analysts’ Viewpoint

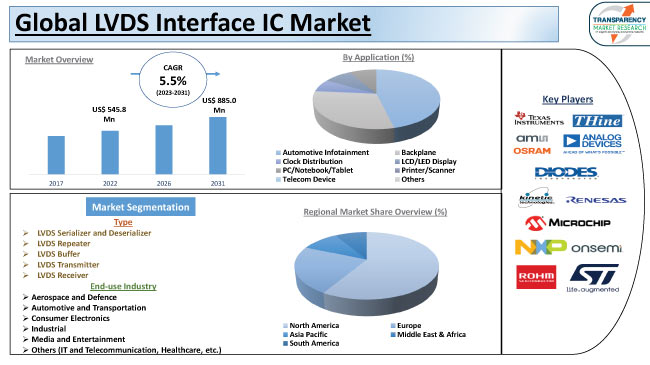

Surge in demand for high-speed data communication is a key factor fueling LVDS interface IC market growth. Digitization in industrial automation is also contributing to market progress. LVDS interface IC is a reliable choice for industries such as automotive and aerospace and defense due to its low noise emission property.

Low-voltage differential signaling (LVDS) is used in a range of image and video applications. It is commonly employed in LCD televisions, peripherals for machines, infotainment systems, and notebook/tablet computers. Technological advancements in LVDS ICs are projected to fuel market statistics during the forecast period. The global market faces intense competition from other interface technology providers.

Low-voltage differential signaling (LVDS) is a communication method that utilizes a small voltage swing through a differential signal. The technology enables data transmission over backplanes, printed circuit boards, or cables.

LVDS stands out for its capability to achieve high data rates, reaching gigabit-per-second speeds, while consuming minimal power. Therefore, LVDS has become the preferred interface technology in various systems. It is standardized as ANSI/EIA/TIA-644 and has support from semiconductor vendors. This is leading to widespread adoption of the technology.

High-speed data transmission, low power consumption, and noise immunity are some of the factors driving the LVDS IC demand in various end-use industries such as consumer electronics, automotive, aerospace and defense, and telecommunication. Increase in automation across industries is creating value-grab LVDS interface IC market opportunities for manufacturers.

Of late, LVDS (low-voltage differential signaling) interfaces have become increasingly prevalent in industrial applications due to their numerous advantages. LVDS offers high-speed data transmission with low power consumption, making it ideal for industrial settings where efficiency and reliability are paramount.

Its noise immunity and robustness against electromagnetic interference ensure stable communication in harsh environments, which are commonly experienced in industrial settings. The usage of LVDS transmitter and receiver ICs for industrial applications is projected to increase in the next few years due to digitalization in industrial automation.

LVDS interfaces support long-distance transmission, enabling seamless connectivity between various industrial components. LVDS interfaces have emerged as a trusted choice for critical applications such as factory automation, robotics, machine vision, and data acquisition due to their ability to handle data rates required for modern industrial systems.

Demand for high-speed automotive onboard interfaces is rising across the globe. There exists a growing need for faster and more reliable communication between various onboard systems and components, as modern vehicles have become technologically advanced.

High-speed interfaces facilitate the seamless exchange of data and information, thus enabling critical functionalities such as advanced driver assistance systems (ADAS), infotainment systems, telematics, and vehicle-to-vehicle (V2V) communication. Thus, demand for LVDS serializer/deserializer ICs for automotive displays is increasing significantly across the globe.

The automotive sector is witnessing a surge in the adoption of cutting-edge technologies such as cameras, LiDAR, radar sensors, and advanced navigation systems. These systems require rapid data transfer and real-time processing, thus driving the need for high-speed onboard interfaces.

Technologies such as Ethernet, HDMI, USB, and LVDS are increasingly being utilized in modern vehicles to meet the rise in demand for high-speed data transmission and connectivity. These interfaces not only enhance the overall driving experience, but also play a crucial role in improving safety, efficiency, and comfort on roads. Low-voltage differential signaling IC is an ideal choice for connecting onboard electronics in automobiles.

The U.S. Department of Transportation (USDOT) and the National Highway Traffic Safety Administration (NHTSA) mandate all cars, SUVs, trucks, and vans to be equipped with rear-view visibility systems since May 1, 2018. These systems aim to enhance safety by providing drivers with improved visibility of the area behind their vehicles. Such regulations are fueling the demand for LVDS interface ICs.

Demand for SerDes (serializer/deserializer) ICs is rising due to growth in the automotive sector. The automotive sector has been rapidly evolving, with the integration of advanced technologies such as autonomous driving, connected vehicles, and high-definition infotainment systems. Vehicles are becoming more data-driven and connected, thus augmenting the demand for high-speed interface ICs.

Rise in need for LVDS SerDes can also be ascribed to advancements in industrial automation and robotics. LVDS SerDes ICs are required to handle real-time data transfer between sensors, controllers, and actuators in industrial machinery and automation systems.

Growth in demand for high-resolution displays and professional displays in consumer electronics and medical imaging is fueling the need for LVDS SerDes to transmit data between graphics processors and display panels.

Technological advancements and emergence of new applications are likely to influence the demand for LVDS IC in the near future. In October 2022, ROHM Semiconductor introduced full-HD compatible SerDes ICs for multi-screen vehicle displays. Development of Serializer BU18TL82-M and Deserializer BU18RL82-M is creating lucrative revenue opportunities for the company.

According to the latest LVDS interface IC market forecast, Asia Pacific is projected to lead the global landscape during the forecast period. The region dominated the industry in 2022. Increase in production and consumption of LVDS interface ICs in China, Japan, South Korea, and Taiwan is contributing to market development in Asia Pacific.

Rise in presence of several electronics manufacturing companies and increase in demand for consumer electronics are also boosting LVDS interface IC industry growth in Asia Pacific.

The LVDS interface IC market size in North America is anticipated to rise at a steady pace during the forecast period, owing to the increase in demand for semiconductors and electronics products in the region. Demand for low-voltage differential signaling interface IC for high-speed data transmission is rising in industries such as automotive, consumer electronics, and IT and communication in North America.

The global landscape is highly consolidated, with the presence of several leading players controlling majority of the LVDS interface IC market share. As per the LVDS interface IC market research analysis, key companies are investing significantly in comprehensive R&D activities. These players are known for their expertise in designing and manufacturing LVDS interface ICs as well as other semiconductor products.

LVDS ICs may vary in terms of data transmission rate, signal integrity, common-mode rejection, and power dissipation. Some manufacturers may prioritize high-speed performance for specific applications, while others may focus on lower power consumption.

Prominent players operating in the market are Texas Instruments, Analog Devices/Maxim Integrated, Microchip Technology, Onsemi, Diodes Incorporated, NXP, Renesas Electronics, STMicroelectronics, Rohm Semiconductor, THine Electronics, ams AG, Skyworks Solutions, Inc., and Kinetic Technologies. These players are following the latest LVDS interface IC market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the LVDS interface IC market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 545.8 Mn |

|

Market Forecast Value in 2031 |

US$ 885.0 Mn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Number of Pages |

168 |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 545.8 Mn in 2022

It is likely to grow at a CAGR of 5.5% by 2031

It would be worth US$ 885.0 Mn by 2031

Texas Instruments, Analog Devices/Maxim Integrated, Microchip Technology, Onsemi, Diodes Incorporated, NXP, Renesas Electronics, STMicroelectronics, Rohm Semiconductor, THine Electronics, ams AG, Skyworks Solutions, Inc., and Kinetic Technologies

Surge in demand for high-speed data communication and digitization in industrial automation and automotive systems

Asia Pacific is projected to record the highest demand during the forecast period

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global LVDS Interface IC Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Interface IC Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global LVDS Interface IC Market Analysis, by Type

5.1. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

5.1.1. LVDS Serializer and Deserializer

5.1.2. LVDS Repeater

5.1.3. LVDS Buffer

5.1.4. LVDS Transmitter

5.1.5. LVDS Receiver

5.2. Market Attractiveness Analysis, By Type

6. Global LVDS Interface IC Market Analysis, By Application

6.1. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

6.1.1. Automotive Infotainment

6.1.2. Backplane

6.1.3. Clock Distribution

6.1.4. LCD/LED Display

6.1.5. PC/Notebook/Tablet

6.1.6. Printer/Scanner

6.1.7. Telecom Device

6.1.8. Others

6.2. Market Attractiveness Analysis, By Application

7. Global LVDS Interface IC Market Analysis, by End-use Industry

7.1. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

7.1.1. Aerospace and Defense

7.1.2. Automotive and Transportation

7.1.3. Consumer Electronics

7.1.4. Industrial

7.1.5. Media and Entertainment

7.1.6. Others (IT and Telecommunication, Healthcare, etc.)

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global LVDS Interface IC Market Analysis and Forecast by Region

8.1. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America LVDS Interface IC Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

9.3.1. LVDS Serializer and Deserializer

9.3.2. LVDS Repeater

9.3.3. LVDS Buffer

9.3.4. LVDS Transmitter

9.3.5. LVDS Receiver

9.4. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

9.4.1. Automotive Infotainment

9.4.2. Backplane

9.4.3. Clock Distribution

9.4.4. LCD/LED Display

9.4.5. PC/Notebook/Tablet

9.4.6. Printer/Scanner

9.4.7. Telecom Device

9.4.8. Others

9.5. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

9.5.1. Aerospace and Defense

9.5.2. Automotive and Transportation

9.5.3. Consumer Electronics

9.5.4. Industrial

9.5.5. Media and Entertainment

9.5.6. Others

9.6. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe LVDS Interface IC Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

10.3.1. LVDS Serializer and Deserializer

10.3.2. LVDS Repeater

10.3.3. LVDS Buffer

10.3.4. LVDS Transmitter

10.3.5. LVDS Receiver

10.4. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.4.1. Automotive Infotainment

10.4.2. Backplane

10.4.3. Clock Distribution

10.4.4. LCD/LED Display

10.4.5. PC/Notebook/Tablet

10.4.6. Printer/Scanner

10.4.7. Telecom Device

10.4.8. Others

10.5. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

10.5.1. Aerospace and Defense

10.5.2. Automotive and Transportation

10.5.3. Consumer Electronics

10.5.4. Industrial

10.5.5. Media and Entertainment

10.5.6. Others

10.6. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific LVDS Interface IC Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

11.3.1. LVDS Serializer and Deserializer

11.3.2. LVDS Repeater

11.3.3. LVDS Buffer

11.3.4. LVDS Transmitter

11.3.5. LVDS Receiver

11.4. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.4.1. Automotive Infotainment

11.4.2. Backplane

11.4.3. Clock Distribution

11.4.4. LCD/LED Display

11.4.5. PC/Notebook/Tablet

11.4.6. Printer/Scanner

11.4.7. Telecom Device

11.4.8. Others

11.5. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

11.5.1. Aerospace and Defense

11.5.2. Automotive and Transportation

11.5.3. Consumer Electronics

11.5.4. Industrial

11.5.5. Media and Entertainment

11.5.6. Others

11.6. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa LVDS Interface IC Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

12.3.1. LVDS Serializer and Deserializer

12.3.2. LVDS Repeater

12.3.3. LVDS Buffer

12.3.4. LVDS Transmitter

12.3.5. LVDS Receiver

12.4. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.4.1. Automotive Infotainment

12.4.2. Backplane

12.4.3. Clock Distribution

12.4.4. LCD/LED Display

12.4.5. PC/Notebook/Tablet

12.4.6. Printer/Scanner

12.4.7. Telecom Device

12.4.8. Others

12.5. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

12.5.1. Aerospace and Defense

12.5.2. Automotive and Transportation

12.5.3. Consumer Electronics

12.5.4. Industrial

12.5.5. Media and Entertainment

12.5.6. Others

12.6. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America LVDS Interface IC Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017-2031

13.3.1. LVDS Serializer and Deserializer

13.3.2. LVDS Repeater

13.3.3. LVDS Buffer

13.3.4. LVDS Transmitter

13.3.5. LVDS Receiver

13.4. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.4.1. Automotive Infotainment

13.4.2. Backplane

13.4.3. Clock Distribution

13.4.4. LCD/LED Display

13.4.5. PC/Notebook/Tablet

13.4.6. Printer/Scanner

13.4.7. Telecom Device

13.4.8. Others

13.5. LVDS Interface IC Market (US$ Mn) Analysis & Forecast, By End-use Industry, 2017-2031

13.5.1. Aerospace and Defense

13.5.2. Automotive and Transportation

13.5.3. Consumer Electronics

13.5.4. Industrial

13.5.5. Media and Entertainment

13.5.6. Others

13.6. LVDS Interface IC Market (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global LVDS Interface IC Market Competition Matrix - a Dashboard View

14.1.1. Global LVDS Interface IC Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ams AG

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Analog Devices/Maxim Integrated

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Diodes Incorporated

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Kinetic Technologies

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Microchip Technology

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. NXP

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. onsemi

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Renesas Electronics

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Rohm Semiconductor

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Skyworks Solutions, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. STMicroelectronics

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Texas Instruments

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. THine Electronics

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Others

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region/Country/Sub-region

List of Tables

Table 1: Global LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 2: Global LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 3: Global LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 4: Global LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 5: Global LVDS Interface IC Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 6: Global LVDS Interface IC Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 7: North America LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 8: North America LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 9: North America LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 10: North America LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 11: North America LVDS Interface IC Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 12: North America LVDS Interface IC Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 13: Europe LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 14: Europe LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 15: Europe LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 16: Europe LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 17: Europe LVDS Interface IC Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 18: Europe LVDS Interface IC Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 19: Asia Pacific LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 20: Asia Pacific LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 21: Asia Pacific LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 22: Asia Pacific LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 23: Asia Pacific LVDS Interface IC Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 24: Asia Pacific LVDS Interface IC Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 25: Middle East & Africa LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 26: Middle East & Africa LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 27: Middle East & Africa LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 28: Middle East & Africa LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 29: Middle East & Africa LVDS Interface IC Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 30: Middle East & Africa LVDS Interface IC Market Volume (Million Units) & Forecast, by Country, 2017-2031

Table 31: South America LVDS Interface IC Market Value (US$ Mn) & Forecast, by Type, 2017-2031

Table 32: South America LVDS Interface IC Market Volume (Million Units) & Forecast, by Type, 2017-2031

Table 33: South America LVDS Interface IC Market Value (US$ Mn) & Forecast, By Application , 2017-2031

Table 34: South America LVDS Interface IC Market Value (US$ Mn) & Forecast, by End-use Industry , 2017-2031

Table 35: South America LVDS Interface IC Market Value (US$ Mn) & Forecast, by Country, 2017-2031

Table 36: South America LVDS Interface IC Market Volume (Million Units) & Forecast, by Country, 2017-2031

List of Figures

Figure 01: Global LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 02: Global LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 03: Global LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 04: Global LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 05: Global LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 06: Global LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 08: Global LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 09: Global LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 10: Global LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 11: Global LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 12: Global LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 13: Global LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 14: Global LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 15: Global LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 16: Global LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 17: North America LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 18: North America LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 19: North America LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 20: North America LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 21: North America LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 22: North America LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 23: North America LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 24: North America LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 25: North America LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 26: North America LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 27: North America LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 28: North America LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 29: North America LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 30: North America LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 31: North America LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 32: North America LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 33: Europe LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 34: Europe LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 35: Europe LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 36: Europe LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 37: Europe LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 38: Europe LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 39: Europe LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 40: Europe LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 41: Europe LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 42: Europe LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 43: Europe LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 44: Europe LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 45: Europe LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 46: Europe LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 47: Europe LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 48: Europe LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 49: Asia Pacific LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 50: Asia Pacific LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 51: Asia Pacific LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 52: Asia Pacific LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 53: Asia Pacific LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 54: Asia Pacific LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 55: Asia Pacific LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 56: Asia Pacific LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 57: Asia Pacific LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 58: Asia Pacific LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 59: Asia Pacific LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 60: Asia Pacific LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 61: Asia Pacific LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 62: Asia Pacific LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 63: Asia Pacific LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 64: Asia Pacific LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 65: Middle East & Africa LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 66: Middle East & Africa LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 67: Middle East & Africa LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 68: Middle East & Africa LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 69: Middle East & Africa LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 70: Middle East & Africa LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 71: Middle East & Africa LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 72: Middle East & Africa LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 73: Middle East & Africa LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 74: Middle East & Africa LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 75: Middle East & Africa LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 76: Middle East & Africa LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 77: Middle East & Africa LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 78: Middle East & Africa LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 79: Middle East & Africa LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 80: Middle East & Africa LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 81: South America LVDS Interface IC Market Value & Forecast, Value (US$ Mn), 2017-2031

Figure 82: South America LVDS Interface IC Market Value & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 83: South America LVDS Interface IC Market Value & Forecast, Volume (Million Units), 2017-2031

Figure 84: South America LVDS Interface IC Market Value & Forecast, Y-O-Y, Volume (Million Units), 2017-2031

Figure 85: South America LVDS Interface IC Market Projections by Type, Value (US$ Mn), 2017-2031

Figure 86: South America LVDS Interface IC Market Share Analysis, by Type, 2021 and 2031

Figure 87: South America LVDS Interface IC Market, Incremental Opportunity, by Type, 2021-2031

Figure 88: South America LVDS Interface IC Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 89: South America LVDS Interface IC Market Share Analysis, by Application, 2021 and 2031

Figure 90: South America LVDS Interface IC Market, Incremental Opportunity, by Application, 2021-2031

Figure 91: South America LVDS Interface IC Market Projections by End-use Industry, Value (US$ Mn), 2017-2031

Figure 92: South America LVDS Interface IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: South America LVDS Interface IC Market, Incremental Opportunity, by End-use Industry, 2021-2031

Figure 94: South America LVDS Interface IC Market Projections by Country and sub-region, Value (US$ Mn), 2017-2031

Figure 95: South America LVDS Interface IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 96: South America LVDS Interface IC Market, Incremental Opportunity, by Country and sub-region, 2021-2031