Reports

Reports

The global lubricant packaging market is predicted to witness steady growth rate over the tenure of assessment. Rising demand for lubricants particularly from the automotive industry is expected to amplify growth of the global lubricant packaging market in the years to come. Rapid industrialization in several countries, particularly in the developing countries of India and China are likely to drive the demand for lubricant packaging over the years of assessment.

Several end-use industries make use of mechanical machines such as compressors, turbines, gearboxes, and pumps. These mechanical components need lubrication quite often for their hassle-free functioning. As such, increased demand from these end-use sectors is further estimated to boost the global lubricant packaging market over the period of analysis.

Lubricant packaging solutions find ample use in several industries including the following

In addition, the flourishing sector of power generation together with growing sales of passenger as well as commercial vehicles is likely to add fuel to the global lubricant packaging market in the years to come. Besides, growing investment particularly in sectors like power generation, oil and gas are anticipated to bolster expansion of the global lubricant packaging market.

The GCC lubricant packaging market is characterized by the high preference for plastic packaging solutions for lubricants, such as engine oil, transmission and hydraulic fluid, process oil, metal-working fluids, general industrial oil, and greases. On account of the key traits of plastic, such as rigidity, strength, and chemical resistance, the demand for plastic material for the packaging of lubricants has increased substantially, impelling the GCC market for lubricant packaging.

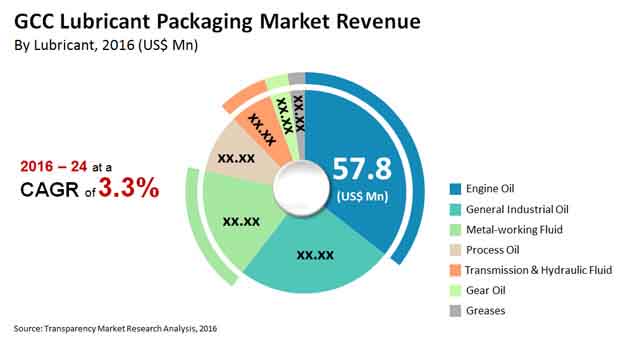

With the increasing government initiatives and spending on non-oil industries, the growth in this market is likely to rocket in the years to come. In 2016, the market stood at US$162.7 mn. Proliferating at a CAGR of 3.30% between 2016 and 2024, its value is likely to shoot up to US$210.4 mn by the end of 2024.

Stand-up pouches, bottles, drums, pails, cans, tubes, kegs, bag-in-box, and intermediate bulk containers are the main packaging types utilized for the packaging of lubricants in GCC countries. In terms of value, the pails segment has been leading the market is expected to retain its position over next few years. However, the demand for flexible lubricant packaging, such as bag-in-box and stand-up pouches, is also projected to gain momentum in the near future.

The key types of lubricants utilized in GCC market are engine oil, transmission and hydraulic fluids, process oil, metal-working fluid, general industrial oil, gear oil, and greases. Engine oil has been reporting the most prominent demand for lubricant packaging in GCC countries. Thanks to the high demand for engine oil in the automotive sector, it is likely to continue registering a strong demand for lubricant packaging in the years to come.

On the basis of the type of material, the GCC market for lubricant packaging is classified into metal and plastics, of which metal is sub-segmented into steel and tin. The plastic segment is also sub-segmented into polyethylene terephthalate (PET), polyvinyl chloride (PVC), polyamide (PA), polypropylene (PP), polystyrene, and polyethylene. LDPE and HDPE are the main categories in the polyethylene segment. The demand for PET packaging is higher at present and is expected to witness a strong rise in its demand over the forthcoming years, thanks to the increasing preference for PET over PP and PVC materials. The demand for HDPE is also projected to rise considerably in the near future due to the growing knowledge about its multiple usages in various industrial and consumer applications.

The automotive, metal-working, oil and gas, power generation, machine, chemicals, and various other manufacturing sectors are the prime end users of lubricant packaging. The automotive sector surfaced as the key end user of lubricant packaging with a share of 36.1% in 2016 and is anticipated to gain maximum incremental opportunity in terms of market revenue over the next few years. However, the chemical industry is projected to offer the most promising growth opportunities to market players in the years to come.

Some of the key players operating in the GCC lubricant packaging market are Duplas Al Sharq, Takween Advanced Industries, Saudi Can Manufacturing Company Ltd, Zamil Plastics Industries Ltd, Mold Tek Packaging Ltd, Neelkamal Plastics Factory LLC, First Press Plastic Moulders Ltd.

The global lubricant packaging market is projected to register a moderate CAGR of 3.30% during the assessed period 2016 – 2024.

The plastic segment is slated to expand as the fastest-growing segment.

The bottle segment is slated to expand as the fastest-growing segment.

Some of the major players in the GCC lubricant packaging market are Saudi Can Manufacturing Company Ltd, Mold Tek Packaging Ltd, First Press Plastic Moulders Ltd., Neelkamal Plastics Factory LLC., and Duplas Al Sharq.

The increasing demand for lubricants and therefore of convenient lubricant packaging solutions is driving the growth of the global lubricant packaging market.

1. GCC Lubricant Packaging Market - Executive Summary

2. Research Methodology

3. Assumptions and Acronyms Used

4. MEA Lubricant Packaging Market Overview

4.1. Introduction

4.1.1. GCC Lubricant Packaging Market Taxonomy

4.1.2. GCC Lubricant Packaging Market Definition

4.2. GCC Lubricant Packaging Market Size and Forecast

4.2.1. GCC Lubricant Packaging Market Y-o-Y Growth

4.2.2. GCC Lubricant Packaging Market Size

4.3. GCC Lubricant Packaging Market Overview

4.3.1. Value Chain

4.3.2. Profitability Margins

4.3.3. List of Active Participants

4.3.3.1. Raw Material Suppliers

4.3.3.2. Manufacturers

4.3.3.3. Distributors

4.4. GCC Lubricant Packaging Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Market Trends

4.4.4. Opportunities

5. GCC Lubricant Packaging Market Analysis and Forecast, By Packaging Type

5.1. Introduction

5.1.1. Market Share and BPS Analysis, By Packaging Type

5.1.2. Y-o-Y Growth Projections, By Packaging Type

5.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Packaging Type

5.2.1. Stand-Up pouches

5.2.2. Bottles

5.2.3. Drums

5.2.4. Pails

5.2.5. Cans

5.2.6. Tubes

5.2.7. Kegs

5.2.8. Bag-in-box

5.2.9. Intermediate Bulk Containers

5.3. Market Attractiveness Analysis, By Packaging Type

6. GCC Lubricant Packaging Market Analysis and Forecast, By Lubricant Type

6.1. Introduction

6.1.1. Market Share and BPS Analysis, By Lubricant Type

6.1.2. Y-o-Y Growth Projections, By Lubricant Type

6.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Lubricant Type

6.2.1. Engine Oils

6.2.2. Transmission & Hydraulic Fluids

6.2.3. Process Oils

6.2.4. Metal-working Fluids

6.2.5. General Industrial Oils

6.2.6. Gear Oils

6.2.7. Greases

6.3. Market Attractiveness Analysis, By Lubricant Type

7. GCC Lubricant Packaging Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Market Share and BPS Analysis, By Material

7.1.2. Y-o-Y Growth Projections, By Material

7.2. Market Size (US$ Mn) and Volume (Tons) Forecast, By Material

7.2.1. Metal

7.2.1.1. Steel

7.2.1.2. Tin

7.2.2. Plastic

7.2.3. Polyethylene

7.2.3.1. LDPE

7.2.3.2. HDPE

7.2.4. Polyethylene terephthalate (PET)

7.2.5. Polyvinyl Chloride (PVC)

7.2.6. Polyamide (PA)

7.2.7. Polypropylene (PP)

7.2.8. Polystyrene (PS)

7.3. Market Attractiveness Analysis, By Material Type

8.GCC Lubricant Packaging Market Analysis and Forecast, By End Use

8.1. Introduction

8.1.1. Market Share and BPS Analysis, By End Use

8.1.2. Y-o-Y Growth Projections, By End Use

8.2. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

8.2.1. Automotive

8.2.2. Metal-working

8.2.3. Oil & Gas

8.2.4. Power Generation

8.2.5. Machine Industry

8.2.6. Chemicals

8.2.7. Other Manufacturing (Textiles, Electrical, etc)

8.3. Market Attractiveness Analysis, By End Use

9. GCC Lubricant Packaging Market Analysis and Forecast, By Country

9.1. Introduction

9.1.1. Market Share and BPS Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

9.2.1. Kingdom of Saudi Arabia (K.S.A)

9.2.2. United Arab Emirates (U.A.E)

9.2.3. Kuwait

9.2.4. Qatar

9.2.5. Bahrain

9.2.6. Oman

9.3. Market Attractiveness Analysis By Region

10. Competitive Landscape

10.1. Competition Dashboard

10.2. Company Market Share Analysis

10.3. Company Names (GCC Based Companies)

10.3.1. Pampa Industries International (Corp)

10.3.1.1. Company Overview

10.3.1.2. Financials

10.3.1.3. Recent Developments

10.3.1.4. SWOT

10.3.2. Siddco Plastics Industries Ltd

10.3.2.1. Company Overview

10.3.2.2. Financials

10.3.2.3. Recent Developments

10.3.2.4. SWOT

10.3.3. Neelkamal Plastics Factory LLC

10.3.3.1. Company Overview

10.3.3.2. Financials

10.3.3.3. Recent Developments

10.3.3.4. SWOT

10.3.4. First Press Plastic Moulders

10.3.4.1. Company Overview

10.3.4.2. Financials

10.3.4.3. Recent Developments

10.3.4.4. SWOT

10.3.5. Mold Tek Packaging Ltd

10.3.5.1. Company Overview

10.3.5.2. Financials

10.3.5.3. Recent Developments

10.3.5.4. SWOT

10.3.6. Rising Plastics Industry LLC

10.3.6.1. Company Overview

10.3.6.2. Financials

10.3.6.3. Recent Developments

10.3.6.4. SWOT

10.3.7. National Plastic Factory

10.3.7.1. Company Overview

10.3.7.2. Financials

10.3.7.3. Recent Developments

10.3.7.4. SWOT

10.3.8. Duplas Al Sharq LLC

10.3.8.1. Company Overview

10.3.8.2. Financials

10.3.8.3. Recent Developments

10.3.8.4. SWOT

10.3.9. Emirates Polystyrene Industries

10.3.9.1. Company Overview

10.3.9.2. Financials

10.3.9.3. Recent Developments

10.3.9.4. SWOT

10.4. Company Names (KSA Based Companies)

10.4.1. Saudi Can Manufacturing Company Ltd

10.4.1.1. Company Overview

10.4.1.2. Financials

10.4.1.3. Recent Developments

10.4.1.4. SWOT

10.4.2. Saudi Plastic Factory

10.4.2.1. Company Overview

10.4.2.2. Financials

10.4.2.3. Recent Developments

10.4.2.4. SWOT

10.4.3. Zamil Plastics Industries Ltd

10.4.3.1 .Company Overview

10.4.3.2. Financials

10.4.3.3. Recent Developments

10.4.3.4. SWOT

10.4.4 .Al Watania Plastics

10.4.4.1. Company Overview

10.4.4.2. Financials

10.4.4.3. Recent Developments

10.4.4.4. SWOT

10.4.5. Arabian Gulf Manufacturers Ltd

10.4.5.1. Company Overview

10.4.5.2. Financials

10.4.5.3. Recent Developments

10.4.5.4. SWOT

10.4.6. Takween Advanced Industries

10.4.6.1. Company Overview

10.4.6.2. Financials

10.4.6.3. Recent Developments

10.4.6.4. SWOT

List of Tables

Table 01: KSA Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 02: U.A.E Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 03: KUWAIT Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 04: Qatar Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 05: BAHRAIN Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 06: OMAN Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 08: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Packaging Type, 2014–2024

Table 08: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Lubricant Type, 2014–2024

Table 09: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Material Type, 2014–2024

Table 10: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast, by Lubricant Type, 2014–2024

List of Figures

Figure 01: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 02: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figures above represent the GCC Lubricant Packaging market value (US$ Mn) and absolute $ opportunity for the forecast period

Figure 03: GCC Lubricant Packaging Market, BPS Analysis by Region,

Figure 04: GCC Lubricant Packaging Market Revenue Y-o-Y Growth by Region, 2015–2024

Figure 05: GCC Lubricant Packaging Market Attractiveness Index by Region, 2016–2024

Figure 06: GCC Lubricant Packaging Market, BPS Analysis by Packaging Type, 2016 & 2024

Figure 07: GCC Lubricant Packaging Market Revenue Y-o-Y Growth by Packaging Type, 2015–2024

Figure 08: GCC Lubricant Packaging Market Attractiveness Index by Packaging Type, 2016–2024

Figure 09: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by stand up pouches Segment, 2016–2024

Figure 10: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Bottles Segment, 2016–2024

Figure 11: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Drums Segment, 2016–2024

Figure 12: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Pails Segment, 2016–2024

Figure 13: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Cans Segment, 2016–2024

Figure 14: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Tubes Segment, 2016–2024

Figure 15: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Kegs Segment, 2016–2024

Figure 16: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Bag-in-box Segment, 2016–2024

Figure 17: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by IBC Segment, 2016–2024

Figure 18: GCC Lubricant Packaging Market, BPS Analysis by Lubricant Type, 2016 & 2024

Figure 19: GCC Lubricant Packaging Market Revenue Y-o-Y Growth by Lubricant Type, 2015–2024

Figure 20: GCC Lubricant Packaging Market Attractiveness Index by Lubricant Type, 2016–2024

Figure 21: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Engine Oil segment, 2016–2024

Figure 22: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Transmission & Hydraulic segment, 2016–2024

Figure 23: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Process Oil segment, 2016–2024

Figure 24: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Metal Working Fluid sub-segment, 2016–2024

Figure 25: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Industrial Oil segment, 2016–2024

Figure 26: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Gear Oil segment, 2016–2024

Figure 27: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Greases segment, 2016–2024

Figure 28: GCC Lubricant Packaging Market, BPS Analysis by Material Type, 2016 & 2024

Figure 29: GCC Lubricant Packaging Market Revenue Y-o-Y Growth by Material Type, 2015–2024

Figure 30: GCC Lubricant Packaging Market Attractiveness Index by Material Type, 2016–2024

Figure 31: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast By Metal Segment, 2015–2024

Figure 32: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) By Metal Segment, 2016?2024

Figure above highlights GCC Lubricant Packaging Market value (US$ Mn) and volume (Units) forecast and Absolute $ Opportunity (US$ Mn) by Metal Segment for the forecast period

Figure 33: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Steel sub-segment, 2016–2024

Figure 34: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Tin sub-segment, 2016–2024

Figure 24: GCC Lubricant Packaging Market Value (US$ Mn) and Volume (Mn Units) Forecast by Plastic Segment, 2015–2024

Figure 35: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) By Plastic Segment, 2016?2024

Figure above highlights GCC Lubricant Packaging Market value (US$ Mn) and volume (Mn units) forecast and Absolute $ Opportunity (US$ Mn) by Plastic Segment for the forecast period

Figure 36: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Polyethylene sub-segment, 2016–2024

Figure 37: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) HDPE Category segment, 2016–2024

Figure 38: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) LDPE Category segment, 2016–2024

Figure 39: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) PET sub-segment, 2016–2024

Figure 40: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Polyvinyl Chloride sub-segment, 2016–2024

Figure 41: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Polyamide sub-segment, 2016–2024

Figure 42: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Polypropylene sub-segment, 2016–2024

Figure 43: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Polystyrene sub-segment, 2016–2024

Figure 44: GCC Lubricant Packaging Market, BPS Analysis By End-use, 2016 & 2024

Figure 45: GCC Lubricant Packaging Market Revenue Y-o-Y Growth By End-use, 2015–2024

Figure 46: GCC Lubricant Packaging Market Attractiveness Index By End-use, 2016–2024

Figure 47: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Automotive segment, 2016–2024

Figure 48: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Metal working segment, 2016–2024

Figure 49: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Oil & Gas segment, 2016–2024

Figure 50: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Power generation segment, 2016–2024

Figure 51: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Machine industry segment, 2016–2024

Figure 52: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) Chemical segment, 2016–2024

Figure 53: GCC Lubricant Packaging Market Absolute $ Opportunity (US$ Mn) by Other Manufacturing Segment, 2016–2024