Reports

Reports

LNG engine market is growing substantially as people are increasingly becoming environmentally concerned, as along with the overall trend of utilization of cleaner fuel. No matter what, Liquefied Natural Gas (LNG) engines are picking traction, all the more due to marine industries, power generation, and transportation industries pressing for reduced carbon emissions and IMO criteria adherence. The use of these engines in the fields of commercial shipping and ferries is increasing as they cut down on sulfur oxide (SOx), nitrogen oxide (NOx), and particulate emissions.

The concentration of key players is on increasing their investment in research and development activities to improve engine efficiency, dual-fueling, and LNG infrastructure compatibility. Moreover, partnership efforts with the shipping companies and suppliers of energy are increasing LNG bunker capacity.

Some governments are also encouraging the use of LNG by offering regulations and funding in terms of emissions. The increased emphasis on cleaner energy sources and sustainable shipping with seemingly slower development times are promoting LNG engines toward being a fundamental alternative in the repackaging to low-energy operation.

LNG (Liquefied Natural Gas) engine market is fast developing as LNG plays an essential role in the process of the global shift to cleaner and more sustainable energy sources. The increasing use of liquefied natural gas in the form of a primary or secondary fuel is witnessed around the major sectors such as marine transport, power sector, and heavy mobility.

One of the factors stimulating the LNG engine market is the growing need to have high-efficiency and low-emission propulsion as well as power systems. The maritime applications are the major segment, and it is growing as the LNG-powered vessels are on the increase and existing fleets are being retrofitted to comply with the International Maritime Organization (IMO) decarbonization requirements. Furthermore, the expansion of LNG facilities such as bunkering locations and storage facilities is bolstering its readiness and scaling up the market.

| Attributes | Details |

|---|---|

| LNG Engine Market Drivers |

|

One of the strongest forces that is influencing the way the LNG engine market is currently heading is the gradual tightening of the global emission regulations. With the shifting effects of climate change, urban air pollution and environmental degradation taking a toll in every nation, the regulatory agencies around the globe are resorting to increasingly stricter emission control policy to allow reduction in the adverse outcomes of fossil fuels combustion.

Conventional diesel and heavy fuel oil (HFO) boilers, once regarded as the stalwart of all transportation, marine and industrial power generation, are presently incurring an increasingly intense regulatory burden, owing in great part to their excessive nitrogen oxide (NOx), sulfur oxide (SOx), particulate matter (PM), and carbon dioxide (CO2) emissions.

The governments and international organizations responding to these concerns over the environment and their effect on the health of population have come up with stringent environmental standards that are supposed to drive the shift in the market economy to more environmentally-friendly products. Liquefied natural gas (LNG) engines are amongst the new solutions that have already appeared and can be considered viable, scalable, and ecologically superior.

The high cost benefit of liquefied natural gas (LNG) over traditional diesel fuels is one of the most influential reasons behind LNG engines increasingly being adopted by many people in the economy.

Difference in charges coupled with the other secondary economic advantages that include reduced maintenance, engine life, and be specified to green incentives is improving LNG value pitch in a variety of areas.

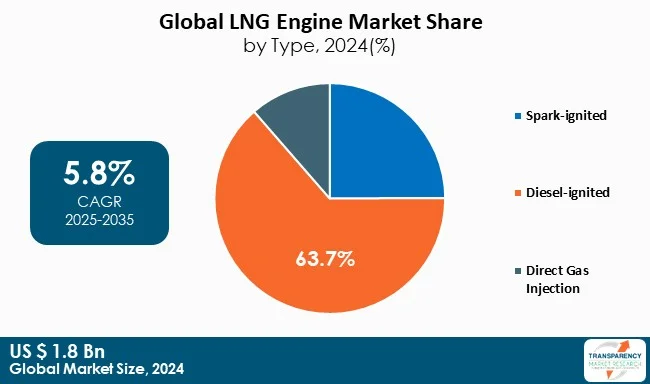

The LNG engines are expected to dominate LNG engine market due to their higher flexibility in operation, fuel consumption, and high reliability in diverse end-uses.

Diesel-ignited engines are dominant even in the shipping market, where ships sailing at long distances entail dependable and versatile engine systems. The engines will provide a convenient transition roadmap to the fleet operators by enabling future use of the available diesel infrastructure alongside integration of the LNG gradually. They also offer a decisive benefit in areas where there is fluctuation in LNG supply, which guarantees the operations to be unhindered.

It is expected that the marine sector will dominate the LNG engine market due to the increasing environmental control and global demand to find alternative sources to cleaner maritime fuel. Reductions in emission of sulfur oxides (SOx), nitrogen oxides (NOₓ) carbon dioxide (CO2), and particulate matter are highly achieved in LNG engines, such that vessels using it can meet global and regional emissions level and at the same time the fuel efficiency is improved.

Active conversion to LNG as a method of propulsion exists in the maritime industry especially in container freight, bulk carrier, ferries, and cruise vessels. The strength of LNG engines is the flexibility of operations and a lower operating cost throughout the lifecycle.

Additionally, the increase in LNG bunkering network in Asia, Europe, and the other large ports of the world and the subsequent growth in investments into the green shipping routes contribute to the implementation of LNG engines.

| Attribute | Detail |

|---|---|

| Leading Region |

|

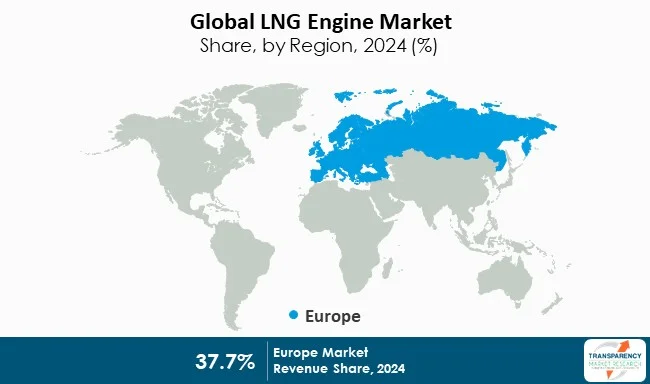

Europe is expected to emerge as the leader of global market on the basis of increasing energy demand, stringent emission standards, and fast infrastructure growth. Having strict environmental laws and a pro-clean maritime transport policy motivates Europe to be one of the leading nations to adopt LNG engines.

The area has established comprehensive LNG bunkering ports in the major ports like Rotterdam, Hamburg, and Barcelona. Norway, The Netherlands, and Finland are at the forefront to deploy LNG vessels and dual fuel engines. The FuelEU Maritime law and the implementation of the EU Green Deal are speeding the transition to using LNG propulsion systems. Although LNG engines need high initial capital, Europe still appears as a potential market for LNG engine since it has promised to remain sustainable.

The companies that lead the LNG engine market are paying attention to the advancements of the dual-fuel systems, emission abuse technologies, and the digital engine governance. The potential to strengthen the market position and cope with increasing demand is a significant aspect of industries across which strategic alliances, expansion of the production facilities on the international scale, and research and development investments should be listed.

The major players like Cummins Inc., Fairbanks Morse Defense, Caterpillar, Wärtsilä Corporation, Rolls-Royce plc, MITSUBISHI HEAVY INDUSTRIES, LTD, and Hyundai Heavy Industries dominate the market with a diverse portfolio. The other players like Everllence SE, Anglo Belgian Corporation, Daihatsu Infinearth Manufacturing Co., Ltd., and Scania AB are contributing to the growth of LNG engine market.

| Attribute | Details |

|---|---|

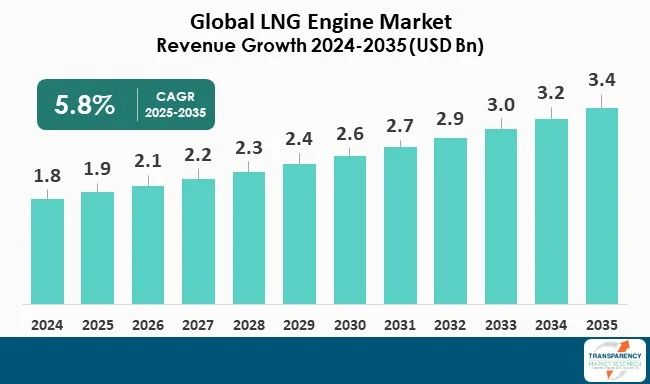

| Market Size Value in 2024 | US$ 1.8 Bn |

| Market Forecast Value in 2035 | US$ 3.4 Bn |

| Growth Rate(CAGR) | 5.8 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 1.8 Mn in 2024

The market is expected to grow at a CAGR of 5.8% from 2025 to 2035

Stringent emission regulations driving clean fuel alternatives and cost advantage of LNG over conventional diesel fuels

Diesel-ignited held the largest share under type segment in 2024

Europe was the most lucrative region of the LNG engine industry in 2024

Wärtsilä Corporation, Caterpillar Inc., Rolls-Royce plc, Hyundai Heavy Industries, Mitsubishi Heavy Industries, Ltd., Fairbanks Morse Defense, Everllence SE, Anglo Belgian Corporation, Daihatsu Infinearth Manufacturing Co., Ltd., and Scania AB

Table 1 Global LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 2 Global LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 3 Global LNG Engine Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 4 Global LNG Engine Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 5 North America LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 6 North America LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 7 North America LNG Engine Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 8 North America LNG Engine Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 9 USA LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 10 USA LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 11 USA LNG Engine Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 12 Canada LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 13 Canada LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 14 Canada LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 15 Europe LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 16 Europe LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 17 Europe LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 18 Europe LNG Engine Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 19 Germany LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 20 Germany LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 21 Germany LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 22 France LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 23 France LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 24 France LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 25 UK LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 26 UK LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 27 UK LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 28 Italy LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 29 Italy LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 30 Italy LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 31 Spain LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 32 Spain LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 33 Spain LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 34 Russia & CIS LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 35 Russia & CIS LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 36 Russia & CIS LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 37 Rest of Europe LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 38 Rest of Europe LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 39 Rest of Europe LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 40 Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 41 Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 42 Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 43 Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 44 China LNG Engine Market Value (US$ Mn) Forecast, by Type 2020 to 2035

Table 45 China LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 46 China LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 47 Japan LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 48 Japan LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 49 Japan LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 50 India LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 51 India LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 52 India LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 53 ASEAN LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 54 ASEAN LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 55 ASEAN LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 56 Rest of Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 57 Rest of Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 58 Rest of Asia Pacific LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 59 Latin America LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 60 Latin America LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 61 Latin America LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 62 Latin America LNG Engine Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 63 Brazil LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 64 Brazil LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 65 Brazil LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 66 Mexico LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 67 Mexico LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 68 Mexico LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 69 Rest of Latin America LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 70 Rest of Latin America LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 71 Rest of Latin America LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 72 Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 73 Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 74 Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 75 Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 76 GCC LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 77 GCC LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 78 GCC LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 79 South Africa LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 80 South Africa LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 81 South Africa LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 82 Rest of Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 83 Rest of Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by Power Range, 2020 to 2035

Table 84 Rest of Middle East & Africa LNG Engine Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Figure 1 Global LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global LNG Engine Market Attractiveness, by Type

Figure 3 Global LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 4 Global LNG Engine Market Attractiveness, by Power Range

Figure 5 Global LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 Global LNG Engine Market Attractiveness, by End-use

Figure 7 Global LNG Engine Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global LNG Engine Market Attractiveness, by Region

Figure 9 North America LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 10 North America LNG Engine Market Attractiveness, by Type

Figure 11 North America LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 12 North America LNG Engine Market Attractiveness, by Power Range

Figure 13 North America LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 14 North America LNG Engine Market Attractiveness, by End-use

Figure 15 North America LNG Engine Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 16 North America LNG Engine Market Attractiveness, by Country and Sub-region

Figure 17 Europe LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 18 Europe LNG Engine Market Attractiveness, by Type

Figure 19 Europe LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 20 Europe LNG Engine Market Attractiveness, by Power Range

Figure 21 Europe LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 Europe LNG Engine Market Attractiveness, by End-use

Figure 23 Europe LNG Engine Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe LNG Engine Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 26 Asia Pacific LNG Engine Market Attractiveness, by Type

Figure 27 Asia Pacific LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 28 Asia Pacific LNG Engine Market Attractiveness, by Power Range

Figure 29 Asia Pacific LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 30 Asia Pacific LNG Engine Market Attractiveness, by End-use

Figure 31 Asia Pacific LNG Engine Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific LNG Engine Market Attractiveness, by Country and Sub-region

Figure 33 Latin America LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 34 Latin America LNG Engine Market Attractiveness, by Type

Figure 35 Latin America LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 36 Latin America LNG Engine Market Attractiveness, by Power Range

Figure 37 Latin America LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38 Latin America LNG Engine Market Attractiveness, by End-use

Figure 39 Latin America LNG Engine Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America LNG Engine Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa LNG Engine Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 42 Middle East & Africa LNG Engine Market Attractiveness, by Type

Figure 43 Middle East & Africa LNG Engine Market Volume Share Analysis, by Power Range, 2024, 2028, and 2035

Figure 44 Middle East & Africa LNG Engine Market Attractiveness, by Power Range

Figure 45 Middle East & Africa LNG Engine Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Middle East & Africa LNG Engine Market Attractiveness, by End-use

Figure 47 Middle East & Africa LNG Engine Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa LNG Engine Market Attractiveness, by Country and Sub-region