Reports

Reports

Analysts’ Viewpoint

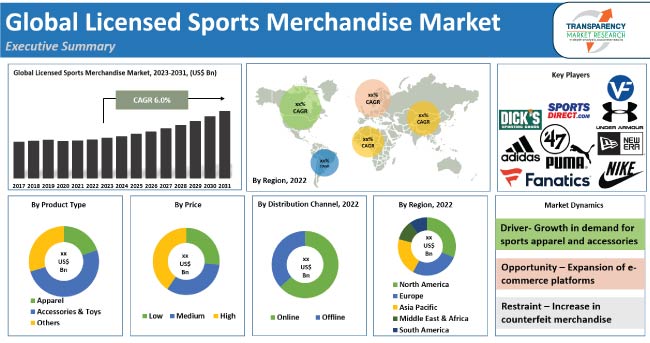

Increase in demand for licensed sports merchandise from fans, driven by the surge in popularity of professional and collegiate sports leagues, as well as the growth in number of e-commerce channels offering licensed merchandise is projected to fuel the licensed sports merchandise market size in the next few years. Demand is further bolstered by the introduction of new technologies such as 3D printing for personalized items.

Increase in disposable income, especially in developing countries, also contributes to the growth of this market, resulting in a surge in demand for sports franchise merchandise. Companies are investing considerably in research and development activities to launch innovative and attractive licensed products that appeal to customers. This is likely to offer lucrative opportunities to vendors in the market.

Licensed sports merchandise refers to products that have been officially licensed by a team, league, or other associated organization. The products typically feature the team's logo or branding and are often sold at stadiums and other official venues. They are also available online and in retail stores.

Licensed products are popular among fans of a team or sport, as they provide a way to show support. It includes hats, jerseys, t-shirts, and apparel, as well as collectibles, toys, and other memorabilia. It is often a lucrative source of income for the teams and organizations that license the products. These products are sold at a premium as fans are willing to pay more for items that bear their favorite team's logo. This, in turn, helps to fund the teams and organizations, allowing them to continue to provide a quality product. It also gives fans the opportunity to connect with their team in a meaningful manner.

The market is expected to grow steadily as more people recognize the value of buying licensed products. Companies are utilizing innovative marketing strategies to increase the visibility of their products, which is likely to contribute to market progress.

The global licensed sports merchandise market consists of officially licensed apparel and accessories from professional, collegiate, and Olympic sports teams. It includes a wide range of products, such as clothing, footwear, headwear, and accessories that feature team logos, colors, and mascots. Licensed sports merchandise has become increasingly popular due to the rise of sports fandom and nostalgia for classic teams and players. It is expected to continue to grow in the coming years due to the surge in demand for licensed sports apparel and accessories.

Latest licensed sports merchandise market trends include the availability of licensed merchandise online, further supported by celebrity endorsements and influencers. As a result, the industry continues to grow with new and innovative products being released every year.

Licensed sports merchandise market growth looks highly positive as more athletes and celebrities join the trend and use their influence to promote their favorite products. Fans are increasingly turning to sports apparel and accessories as a way to express their individual styles and show their support for their revered teams and athletes. Furthermore, these products are becoming more affordable and easily accessible to the public.

Many sports leagues, such as the NFL and NBA, have partnered with popular merchandise companies to create exclusive lines of merchandise. This has resulted in increased sales and a larger share for the licensed sports merchandise industry. Furthermore, the partnerships allow sports leagues to expand their product lines and increase their visibility in the market, consequently increasing the licensed sports merchandise market value. As a result, the official sports merchandise market has seen significant growth during the past few years.

This growth is likely to continue in the next few years as more sports leagues sign partnerships with merchandise companies. Additionally, the partnerships enable sports leagues to expand their fan base and reach new audiences.

Fans of sports leagues can purchase quality merchandise officially licensed by the team or league. This creates a sense of loyalty and connection to a team, boosting the league's popularity, and boosting the revenue of the sports league. This revenue can be used to improve the quality of the team, attract new players, and invest in new technology to enhance the fan experience. This is a mutually beneficial relationship for both the fan and the sports league. Fans can show their support through merchandise, and the sports league can benefit from increased revenue.

According to the latest licensed sports merchandise market forecast, North America is anticipated to hold largest share from 2023 to 2031 and dominate the market. Presence of well-developed retail infrastructure and the rise in number of sports fans is fueling market development in the region. Additionally, North American consumers have high disposable income, which allows them to purchase more licensed sports merchandise. This has enabled the growth of the retail sports merchandise industry in the region.

Asia Pacific is another leading region with substantial licensed sports merchandise market share. Rapid growth of the market is attributed to the presence of major players, rise in disposable income, and increasing popularity of sports in countries such as India, China, and Japan. Furthermore, the increasing number of sports leagues and tournaments in the region is creating high demand for licensed sports merchandise.

Detailed profiles of companies in the licensed sports merchandise market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Expansion of product portfolios, and mergers & acquisitions are the key strategies adopted by manufacturers.

Nike, Inc., Fanatics, Inc., Adidas, PUMA SE, New Era, 47 Brand, Under Armour, Inc., DICK's Sporting Goods, Sports Direct International plc, and VF Corporation are the key players in the licensed sports merchandise market.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 35.7 Bn |

|

Market Forecast Value in 2031 |

US$ 63.7 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2023 - 2031 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 35.7 Bn in 2022

The CAGR is projected to be 6.0% from 2023 to 2031

Growth in demand for sports apparel and accessories, and increasing partnerships between sports leagues and merchandise companies

Apparel product type dominates the industry

North America is a more attractive region for vendors

Nike, Inc., Fanatics, Inc., Adidas, PUMA SE, New Era, 47 Brand, Under Armour, Inc., DICK's Sporting Goods, Sports Direct International plc, and VF Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Global Licensed Sports Merchandise Market Analysis and Forecast, 2017- 2031

5.7.1. Market Value Projections (US$ Mn)

5.7.2. Market Volume Projections (Thousand Units)

6. Global Licensed Sports Merchandise Market Analysis and Forecast, by Product Type

6.1. Global Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Apparel

6.1.1.1. Top Wear

6.1.1.1.1. Jerseys

6.1.1.1.2. T-Shirt & Tops

6.1.1.1.3. Sweatshirts & Hoodies

6.1.1.1.4. Jackets

6.1.1.1.5. Others

6.1.1.2. Bottom Wear

6.1.1.2.1. Track Pants

6.1.1.2.2. Leggings

6.1.1.2.3. Shorts

6.1.1.2.4. Others

6.1.2. Accessories & Toys

6.1.2.1. Sunglasses Sunglasses

6.1.2.2. Backpack Backpack

6.1.2.3. Fishing Lure Fishing Lure

6.1.2.4. Others

6.1.3. Others

6.2. Incremental Opportunity, by Product Type

7. Global Licensed Sports Merchandise Market Analysis and Forecast, by Price

7.1. Global Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

7.1.1. Low

7.1.2. Medium

7.1.3. High

7.2. Incremental Opportunity, by Price

8. Global Licensed Sports Merchandise Market Analysis and Forecast, by Distribution Channel

8.1. Global Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

8.1.1. Online

8.1.1.1. Company-Owned Website

8.1.1.2. E-Commerce Website

8.1.2. Offline

8.1.2.1. Hypermarket/ Supermarket

8.1.2.2. Specialty Stores

8.1.2.3. Other Retail Stores

8.2. Incremental Opportunity, by Distribution Channel

9. Global Licensed Sports Merchandise Market Analysis and Forecast, by Region

9.1. Global Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Licensed Sports Merchandise Market Analysis and Forecast

10.1. Demographic overview

10.2. Key Supplier Analysis

10.3. Key Trends Analysis

10.3.1. Supply side

10.3.2. Demand Side

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

10.5.1. Apparel

10.5.1.1. Top Wear

10.5.1.1.1. Jerseys

10.5.1.1.2. T-Shirt & Tops

10.5.1.1.3. Sweatshirts & Hoodies

10.5.1.1.4. Jackets

10.5.1.1.5. Others

10.5.1.2. Bottom Wear

10.5.1.2.1. Track Pants

10.5.1.2.2. Leggings

10.5.1.2.3. Shorts

10.5.1.2.4. Others

10.5.2. Accessories & Toys

10.5.2.1. Sunglasses

10.5.2.2. Backpack

10.5.2.3. Fishing Lure

10.5.2.4. Others

10.5.3. Others

10.6. Incremental Opportunity, by Product Type

10.7. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

10.7.1. Low

10.7.2. Medium

10.7.3. High

10.8. Incremental Opportunity, by Price

10.9. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.9.1. Online

10.9.1.1. Company-owned Website

10.9.1.2. E-commerce Website

10.9.2. Offline

10.9.2.1. Hypermarket/ Supermarket

10.9.2.2. Specialty Stores

10.9.2.3. Other Retail Stores

10.10. Incremental Opportunity, by Distribution Channel

10.11. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017- 2031

10.11.1. U.S.

10.11.2. Canada

10.11.3. Rest of North America

10.12. Incremental Opportunity Analysis

11. Europe Licensed Sports Merchandise Market Analysis and Forecast

11.1. Demographic overview

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

11.5.1. Apparel

11.5.1.1. Top Wear

11.5.1.1.1. Jerseys

11.5.1.1.2. T-Shirt & Tops

11.5.1.1.3. Sweatshirts & Hoodies

11.5.1.1.4. Jackets

11.5.1.1.5. Others

11.5.1.2. Bottom Wear

11.5.1.2.1. Track Pants

11.5.1.2.2. Leggings

11.5.1.2.3. Shorts

11.5.1.2.4. Others

11.5.2. Accessories & Toys

11.5.2.1. Sunglasses

11.5.2.2. Backpack

11.5.2.3. Fishing Lure

11.5.2.4. Others

11.5.3. Others

11.6. Incremental Opportunity, by Product Type

11.7. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

11.7.1. Low

11.7.2. Medium

11.7.3. High

11.8. Incremental Opportunity, by Price

11.9. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

11.9.1. Online

11.9.1.1. Company-owned Website

11.9.1.2. E-commerce Website

11.9.2. Offline

11.9.2.1. Hypermarket/ Supermarket

11.9.2.2. Specialty Stores

11.9.2.3. Other Retail Stores

11.10. Incremental Opportunity, by Distribution Channel

11.11. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017- 2031

11.11.1. U.K.

11.11.2. Germany

11.11.3. France

11.11.4. Rest of Europe

11.12. Incremental Opportunity Analysis

12. Asia Pacific Licensed Sports Merchandise Market Analysis and Forecast

12.1. Demographic overview

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

12.5.1. Apparel

12.5.1.1. Top Wear

12.5.1.1.1. Jerseys

12.5.1.1.2. T-Shirt & Tops

12.5.1.1.3. Sweatshirts & Hoodies

12.5.1.1.4. Jackets

12.5.1.1.5. Others

12.5.1.2. Bottom Wear

12.5.1.2.1. Track Pants

12.5.1.2.2. Leggings

12.5.1.2.3. Shorts

12.5.1.2.4. Others

12.5.2. Accessories & Toys

12.5.2.1. Sunglasses

12.5.2.2. Backpack

12.5.2.3. Fishing Lure

12.5.2.4. Others

12.5.3. Others

12.6. Incremental Opportunity, by Product Type

12.7. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

12.7.1. Low

12.7.2. Medium

12.7.3. High

12.8. Incremental Opportunity, by Price

12.9. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.9.1. Online

12.9.1.1. Company-owned Website

12.9.1.2. E-commerce Website

12.9.2. Offline

12.9.2.1. Hypermarket/ Supermarket

12.9.2.2. Specialty Stores

12.9.2.3. Other Retail Stores

12.10. Incremental Opportunity, by Distribution Channel

12.11. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017- 2031

12.11.1. China

12.11.2. India

12.11.3. Japan

12.11.4. Rest of Asia Pacific

12.12. Incremental Opportunity Analysis

13. Middle East & Africa Licensed Sports Merchandise Market Analysis and Forecast

13.1. Demographic overview

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

13.5.1. Apparel

13.5.1.1. Top Wear

13.5.1.1.1. Jerseys

13.5.1.1.2. T-Shirt & Tops

13.5.1.1.3. Sweatshirts & Hoodies

13.5.1.1.4. Jackets

13.5.1.1.5. Others

13.5.1.2. Bottom Wear

13.5.1.2.1. Track Pants

13.5.1.2.2. Leggings

13.5.1.2.3. Shorts

13.5.1.2.4. Others

13.5.2. Accessories & Toys

13.5.2.1. Sunglasses

13.5.2.2. Backpack

13.5.2.3. Fishing Lure

13.5.2.4. Others

13.5.3. Others

13.6. Incremental Opportunity, by Product Type

13.7. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

13.7.1. Low

13.7.2. Medium

13.7.3. High

13.8. Incremental Opportunity, by Price

13.9. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.9.1. Online

13.9.1.1. Company-owned Website

13.9.1.2. E-commerce Website

13.9.2. Offline

13.9.2.1. Hypermarket/ Supermarket

13.9.2.2. Specialty Stores

13.9.2.3. Other Retail Stores

13.10. Incremental Opportunity, by Distribution Channel

13.11. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017- 2031

13.11.1. GCC

13.11.2. South Africa

13.11.3. Rest of Middle East & Africa

13.12. Incremental Opportunity Analysis

14. South America Licensed Sports Merchandise Market Analysis and Forecast

14.1. Demographic overview

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Product Type, 2017- 2031

14.5.1. Apparel

14.5.1.1. Top Wear

14.5.1.1.1. Jerseys

14.5.1.1.2. T-Shirt & Tops

14.5.1.1.3. Sweatshirts & Hoodies

14.5.1.1.4. Jackets

14.5.1.1.5. Others

14.5.1.2. Bottom Wear

14.5.1.2.1. Track Pants

14.5.1.2.2. Leggings

14.5.1.2.3. Shorts

14.5.1.2.4. Others

14.5.2. Accessories & Toys

14.5.2.1. Sunglasses

14.5.2.2. Backpack

14.5.2.3. Fishing Lure

14.5.2.4. Others

14.5.3. Others

14.6. Incremental Opportunity, by Product Type

14.7. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

14.7.1. Low

14.7.2. Medium

14.7.3. High

14.8. Incremental Opportunity, by Price

14.9. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.9.1. Online

14.9.1.1. Company-owned Website

14.9.1.2. E-commerce Website

14.9.2. Offline

14.9.2.1. Hypermarket/ Supermarket

14.9.2.2. Specialty Stores

14.9.2.3. Other Retail Stores

14.10. Incremental Opportunity, by Distribution Channel

14.11. Licensed Sports Merchandise Market Size (US$ Mn) (Thousand Units) Forecast, by Country/Sub-region, 2017- 2031

14.11.1. Brazil

14.11.2. Rest of South America

14.12. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2022)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. Nike, Inc.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information, (Subject to Data Availability)

15.3.1.4. Business Strategies / Recent Developments

15.3.2. Fanatics, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information, (Subject to Data Availability)

15.3.2.4. Business Strategies / Recent Developments

15.3.3. Adidas

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information, (Subject to Data Availability)

15.3.3.4. Business Strategies / Recent Developments

15.3.4. PUMA SE

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information, (Subject to Data Availability)

15.3.4.4. Business Strategies / Recent Developments

15.3.5. New Era

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information, (Subject to Data Availability)

15.3.5.4. Business Strategies / Recent Developments

15.3.6. 47 Brand

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information, (Subject to Data Availability)

15.3.6.4. Business Strategies / Recent Developments

15.3.7. Under Armour, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information, (Subject to Data Availability)

15.3.7.4. Business Strategies / Recent Developments

15.3.8. DICK's Sporting Goods

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information, (Subject to Data Availability)

15.3.8.4. Business Strategies / Recent Developments

15.3.9. Sports Direct International plc

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information, (Subject to Data Availability)

15.3.9.4. Business Strategies / Recent Developments

15.3.10. Fanatics, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information, (Subject to Data Availability)

15.3.10.4. Business Strategies / Recent Developments

15.3.11. Other Key Players

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. Financial Information, (Subject to Data Availability)

15.3.11.4. Business Strategies / Recent Developments

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. Product Type

16.1.2. Price

16.1.3. Distribution Channel

16.1.4. Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 2: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 4: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 5: Global Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 6: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Licensed Sports Merchandise Market Value (US$ Mn), by Region, 2017-2031

Table 8: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 10: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 11: North America Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 12: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 13: North America Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 14: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Licensed Sports Merchandise Market Value (US$ Mn), by country, 2017-2031

Table 16: North America Licensed Sports Merchandise Market Volume (Thousand Units), by country 2017-2031

Table 17: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 18: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 19: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 20: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 21: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 22: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Licensed Sports Merchandise Market Value (US$ Mn), by country, 2017-2031

Table 24: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Table 25: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 26: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 27: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 28: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 29: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by country, 2017-2031

Table 32: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by country 2017-2031

Table 33: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 34: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 35: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 36: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 37: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by country, 2017-2031

Table 40: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Table 41: South America Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Table 42: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Table 43: South America Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Table 44: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Table 45: South America Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 46: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South America Licensed Sports Merchandise Market Value (US$ Mn), by country, 2017-2031

List of Figures

Figure 1: Global Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 2: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 3: Global Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 4: Global Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 5: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 6: Global Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 7: Global Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 8: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 10: Global Licensed Sports Merchandise Market Value (US$ Mn), by Region, 2017-2031

Figure 11: Global Licensed Sports Merchandise Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 13: North America Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 14: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 15: North America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 16: North America Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 17: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 18: North America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 19: North America Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 20: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 22: North America Licensed Sports Merchandise Market Value (US$ Mn), by Country, 2017-2031

Figure 23: North America Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Figure 24: North America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 25: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 26: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 27: Europe Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 28: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 29: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 30: Europe Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 31: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 32: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 34: Europe Licensed Sports Merchandise Market Value (US$ Mn), by Country, 2017-2031

Figure 35: Europe Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Figure 36: Europe Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 37: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 38: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 39: Asia Pacific Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 40: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 41: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 42: Asia Pacific Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 43: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 44: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 46: Asia Pacific Licensed Sports Merchandise Market Value (US$ Mn), by Country, 2017-2031

Figure 47: Asia Pacific Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Figure 48: Asia Pacific Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 49: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 50: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 51: Middle East & Africa Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 52: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 53: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 54: Middle East & Africa Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 55: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 56: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 58: Middle East & Africa Licensed Sports Merchandise Market Value (US$ Mn), by Country, 2017-2031

Figure 59: Middle East & Africa Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Figure 60: Middle East & Africa Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 61: South America Licensed Sports Merchandise Market Value (US$ Mn), by Product Type, 2017-2031

Figure 62: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Product Type 2017-2031

Figure 63: South America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 64: South America Licensed Sports Merchandise Market Value (US$ Mn), by Price, 2017-2031

Figure 65: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Price 2017-2031

Figure 66: South America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Price, 2023-2031

Figure 67: South America Licensed Sports Merchandise Market Value (US$ Mn), by Distribution Channel 2017-2031

Figure 68: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel 2023-2031

Figure 70: South America Licensed Sports Merchandise Market Value (US$ Mn), by Country, 2017-2031

Figure 71: South America Licensed Sports Merchandise Market Volume (Thousand Units), by Country 2017-2031

Figure 72: South America Licensed Sports Merchandise Market Incremental Opportunity (US$ Mn), Forecast, by country, 2023-2031