Reports

Reports

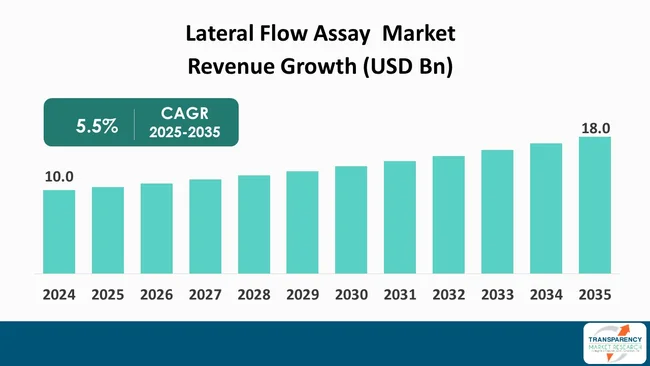

The global lateral-flow-assay market size was valued at US$ 10.0 billion in 2024 and is projected to reach US$ 18.0 billion by 2035, expanding at a CAGR of 5.5% from 2025 to 2035. The market growth is driven by increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The global market for lateral-flow-assay (LFA) is a response to the increasing demand for point-of-care diagnostics, materials innovation, and decentralized delivery of healthcare. LFA components - mainly membranes, sample/conjugate/absorbent pads, labels, backing cards, and reagents - are the main determinants of the sensitivity, reproducibility, and cost of LFAs as a product. Therefore, the quality and reliability of component supply, specifically led by the diagnostic original-equipment manufacturers (OEMs) and contract-development manufacturers (CDMOs), will guide purchasers' decisions.

Major growth factors are: adoption of infectious-disease testing; scaling routine screening programmes; increasing point-of-care testing in primary care and pharmacies; and demand for multiplex and quantitative LFAs, which will require next-level membranes and advanced labels. Major manufacturers of membranes, nanoparticles/labels, and contract manufacturing have good materials supply chains, influence market dynamics via product innovation, scale of economy, and technical best practices - e.g. membranes with more control of flow (more consistent results) or conjugate pads that improve stabilization reduce variability of test results, and the number of components phase development programs for kit manufacturers.

The lateral flow assay (LFA) market is largely driven by the demand for easy-to-use diagnostics that can produce rapid results without the need for a central lab infrastructure. The primary catalysts for growth include increased infectious disease testing programs, greater consumer acceptance of home-testing, and the desire to decentralize screening in low-resource environments. In response to increased demand, the manufacturing processes have been scaled and the quality assurance improved, resulting in lower per test costs and enhanced economic viability of LFAs for screening and surveillance.

The increased use case applications beyond infectious disease, as well as the basic biology of cardiac marker, fertility tests, drug residue screening and some oncology biomarkers, are increasing addressable markets and cross-industry adoption. Furthermore, funding from public and private sector partners for epidemic preparedness and procurement structures favoring rapid technologies common in procurement are creating recurring demand streams. Collectively, these factors have shifted LFAs from episodic, disease outbreak-based usage to implementing LFAs in more established roles in testing pathways of care in primary care and community health programs.

| Attribute | Detail |

|---|---|

| Lateral Flow Assay Market Drivers |

|

The sustained need for rapid, decentralized infectious disease screening is a major driver to the LFA market. Health systems and public health agencies are drawn to technologies that let rapid triage and mass screening without the requirement of laboratory capacity, especially in outbreak and resource-limited settings. Demand for such technologies peaked during the COVID-19 pandemic but has continued even as institutions align rapid testing to routine surveillance for managing emerging and seasonal pathogens.

The economic model of LFAs — low unit cost, low training, rapid time-to-result — makes them well-suited to mass screening campaigns, workplace testing, travel screening, and community clinics. For example, global procurements of rapid antigen tests during the COVID-19 pandemic highlighted the advantages of LFAs in terms of scalability and logistics advantages, and industry analysts have attributed much of the market growth figures to those procurements.

In addition, continuing use of LFAs for influenza, RSV, and multiplex infectious panels is anticipated to drive ongoing volume demand for rapid tests while continuing public health procurement frameworks increasingly include rapid tests in pandemic preparedness stockpiles, thereby creating an ongoing market for manufacturers and suppliers.

Technological innovation is potentially the most important catalyst for growth, with developments in membrane chemistry, labeling systems, reader technologies, and assay formats increasing analytical sensitivity, providing quantitative readouts, and detecting multiple analytes on a single specimen.

Developments in fluorescent and up-converting nanoparticle labels, specialized cellulose and nitrocellulose membranes, and new portable optical reader approaches have closed some of the performance gaps between LFAs and central laboratory assays for specific biomarkers.

These enhancements further expand LFA’s clinical value into areas thought inappropriate for rapid testing, such as some cardiac and inflammatory markers. For example, a recent investigation demonstrating cellulose paper-based fluorescent LFAs for quantitative detection of cardiac troponin, underscore how, with alternative substrates and labeling methods, clinically-relevant sensitivity may also be reached for point-of-care cardiac triage, specifically outside the hospital laboratory. Manufacturers are likely to meet a growing demand for these combinations of biomarkers and digital readers that offer traceable, quantitative outputs (especially among clinical users looking for rapid information at the point of care) as these are licensed out commercially.

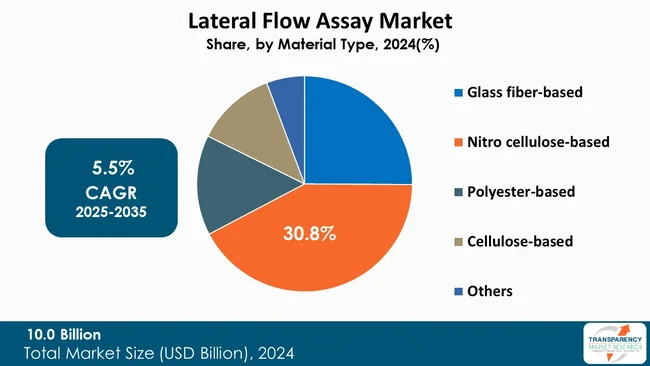

As a material category, Nitrocellulose-based membranes are the dominant solid substrate in the global lateral flow assay (LFA) market because they combine strong protein binding with rapid capillary flow. Manufacturers adjust membranes by treating pore size and the surface to regulate the rate of flow, sensitivity and volume of sample. Routine pore sizes range from about 3-15µm. Types of products include high-binding membrane for low-concentration analytes, fast-flow membranes for tests intended to be fast, and hydrophobic/hydrophilic-treated membranes for difficult sample matrices.

For example, pregnancy tests and many rapid infectious-disease tests utilize nitrocellulose membranes with a medium pore size to simultaneously achieve maximum speed and sensitivity (binding capacities of tacky nitrocellulose membranes can vary from low tens to a few hundred µg/cm² depending on the treatment). There are multiple sources for specialized membranes and OEM components from biotechnological vendors that provide test manufacturers with sufficient designs to mix-and-match membrane type, conjugate pad and sample pad to get performance criteria. This is the modularity that allows nitrocellulose membranes for commercial LFA manufacturing to be the material of choice for the vast majority of practical applications.

| Attribute | Detail |

|---|---|

| Leading Region |

|

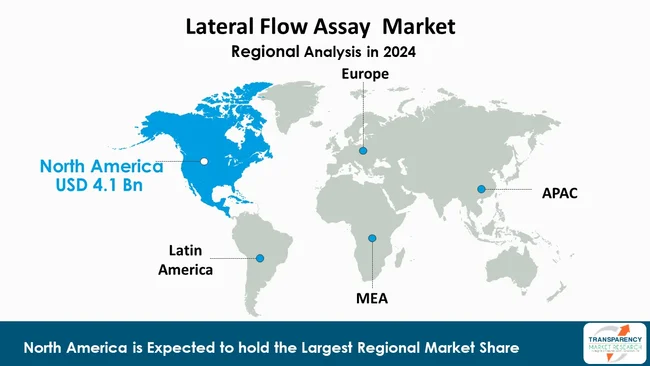

North America is the leading Lateral flow assay market having 41.1% market share in 2024, owing to its advanced healthcare infrastructure, investment from the private sector in R&D, established diagnostics companies, and reimbursement and procurement systems that enable rapid adoption. The largest market in the region, the United States - generates a large percentage of global revenue and facilitates the increased demand through considerable public health testing programs, the commercial adoption of home tests, and high use of point-of-care diagnostics in outpatient and emergency care.

North America recently claimed the largest regional share of the market, and the U.S. alone is worth multiple billions of dollars, with future increase in size and scope over the next decade characterized by manufacturers introducing more capable and multiplexed tests.

The regulatory path for emergency use authorization had enabled market uptake during outbreaks, and helped nurture companies and maintain or expand LFA portfolios post-emergency use authorization. Additionally, the geographic concentration of leading LFA vendors and suppliers of components generally located in the U.S. fosters localized supply chains and commercialization cycles, which adds to the competitive advantage and maintains market dominance in North America.

Companies operating in the lateral flow assay market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D pertaining to cutting-edge microfluidic and non-invasive techniques, broaden their distribution channels, and provide integrated service solutions to have a strong market presence and a high customer loyalty.

Merck KGaA, Sartorius AG, MilliporeSigma, Cobetter Filtration Equipment Co., Ltd., Ahlstrom Corporation, Advanced Microdevices Pvt. Ltd. (India), Axiva Sichem Pvt. Ltd. (India), DCN Dx, Fortis Life Sciences LLC, BioAssay Works LLC, ProGnosis Biotech Pvt. Ltd., Cytodiagnostics Inc., NanoComposix, Whatman (Cytiva), Pall Corporation and Others, are some of the leading players operating in the global lateral flow assay market.

Each of these players has been profiled in the lateral flow assay industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 10.0 Bn |

| Forecast Value in 2035 | US$ 18.0 Bn |

| CAGR | 5.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Lateral Flow Assay Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global lateral flow assay market was valued at US$ 10.0 Bn in 2024

The global lateral flow assay industry is projected to reach more than US$ 18.0 Bn by the end of 2035

Increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing

The CAGR is anticipated to be 5.5% from 2025 to 2035

Merck KGaA, Sartorius AG, MilliporeSigma, Cobetter Filtration Equipment Co., Ltd., Ahlstrom Corporation, Advanced Microdevices Pvt. Ltd. (India), Axiva Sichem Pvt. Ltd. (India), DCN Dx, Fortis Life Sciences LLC, BioAssay Works LLC, ProGnosis Biotech Pvt. Ltd., Cytodiagnostics Inc., NanoComposix, Whatman (Cytiva), Pall Corporation, and Others

Table 01: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 02: Global Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 03: Global Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 04: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 05: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 06: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 07: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 08: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 09: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 10: North America Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 11: North America Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 12: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 13: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 14: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 17: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 18: Europe Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 19: Europe Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 20: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 21: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 22: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 23: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 24: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 25: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 26: Asia Pacific Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 27: Asia Pacific Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 28: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 29: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 30: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 33: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 34: Latin America Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 35: Latin America Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 36: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 37: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 38: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 41: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 42: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn), by Gene Therapy, 2020 to 2035

Table 43: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn), by Nucleic Acid-Based Therapies, 2020 to 2035

Table 44: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by Assay Type, 2020 to 2035

Table 45: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 46: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 01: Global Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 03: Global Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 04: Global Lateral Flow Assay Market Revenue (US$ Bn), by Membranes, 2020 to 2035

Figure 05: Global Lateral Flow Assay Market Revenue (US$ Bn), by Sample Pads, 2020 to 2035

Figure 06: Global Lateral Flow Assay Market Revenue (US$ Bn), by Conjugate Pads, 2020 to 2035

Figure 07: Global Lateral Flow Assay Market Revenue (US$ Bn), by Absorbent Pads (WickPads), 2020 to 2035

Figure 08: Global Lateral Flow Assay Market Revenue (US$ Bn), by Backing Cards & Adhesives, 2020 to 2035

Figure 09: Global Lateral Flow Assay Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 11: Global Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 12: Global Lateral Flow Assay Market Revenue (US$ Bn), by Lateral Flow Immunoassay (LFIA), 2020 to 2035

Figure 13: Global Lateral Flow Assay Market Revenue (US$ Bn), by Nucleic Acid Lateral Flow Assay (NALFA), 2020 to 2035

Figure 14: Global Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 15: Global Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 16: Global Lateral Flow Assay Market Revenue (US$ Bn), by Glass fiber-based components, 2020 to 2035

Figure 17: Global Lateral Flow Assay Market Revenue (US$ Bn), by Cellulose-based components, 2020 to 2035

Figure 18: Global Lateral Flow Assay Market Revenue (US$ Bn), by Polyester-based components, 2020 to 2035

Figure 19: Global Lateral Flow Assay Market Revenue (US$ Bn), by Nitrocellulose-based components, 2020 to 2035

Figure 20: Global Lateral Flow Assay Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 22: Global Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 23: Global Lateral Flow Assay Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 24: Global Lateral Flow Assay Market Revenue (US$ Bn), by Veterinary Medicine, 2020 to 2035

Figure 25: Global Lateral Flow Assay Market Revenue (US$ Bn), by Food Safety, 2020 to 2035

Figure 26: Global Lateral Flow Assay Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 28: Global Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 29: Global Lateral Flow Assay Market Revenue (US$ Bn), by Diagnostic Test Kit Manufacturers, 2020 to 2035

Figure 30: Global Lateral Flow Assay Market Revenue (US$ Bn), by Research Laboratories, 2020 to 2035

Figure 31: Global Lateral Flow Assay Market Revenue (US$ Bn), by Veterinary Diagnostics, 2020 to 2035

Figure 32: Global Lateral Flow Assay Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 33: Global Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 34: Global Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 35: North America Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: North America Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 37: North America Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 38: North America Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 39: North America Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 40: North America Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 41: North America Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 42: North America Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 43: North America Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 44: North America Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: North America Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: North America Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 47: North America Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 48: Europe Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Europe Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 50: Europe Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 51: Europe Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 52: Europe Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 53: Europe Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 54: Europe Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 55: Europe Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 56: Europe Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 57: Europe Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 58: Europe Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 59: Europe Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 60: Europe Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 61: Asia Pacific Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 63: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 64: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 65: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 66: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 67: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 68: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 69: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 70: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 71: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 72: Asia Pacific Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 73: Asia Pacific Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 74: Latin America Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 75: Latin America Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 76: Latin America Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 77: Latin America Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 78: Latin America Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 79: Latin America Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 80: Latin America Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 81: Latin America Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 82: Latin America Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 83: Latin America Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 84: Latin America Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: Latin America Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 86: Latin America Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 87: Middle East and Africa Lateral Flow Assay Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 89: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 90: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by Assay Type, 2024 and 2035

Figure 91: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by Assay Type, 2025 to 2035

Figure 92: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 93: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 94: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by Application, 2024 and 2035

Figure 95: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 96: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by End-user, 2024 and 2035

Figure 97: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 98: Middle East and Africa Lateral Flow Assay Market Value Share Analysis, by Region, 2024 and 2035

Figure 99: Middle East and Africa Lateral Flow Assay Market Attractiveness Analysis, by Region, 2025 to 2035