Reports

Reports

Global Laboratory Centrifuge Market: Overview

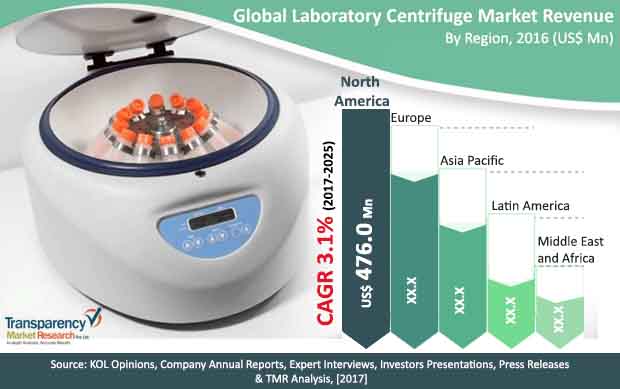

Multiple types of laboratory centrifuge are available to meet the specific requirement of component separation. These are usually classified as the microcentrifuge, medium capacity centrifuge, and large capacity centrifuge. The widening applications of laboratory centrifuges are expected to drive the global market in the coming years. The growing number of diagnostic centers is expected to be the key growth driver for the global market. According to the research report, the global laboratory centrifuge market is expected to be worth US$1,833.29 mn by the end of 2025 as it climbs up from US$1,400.00 mn in 2016. During the forecast years of 2017 and 2025, the global laboratory centrifuge market is expected to rise at a CAGR of 3.1%.

Microcentrifuge to Remain Popular as Hospitals and Diagnostic Centers Show Steady Uptake

The global laboratory centrifuge market is segmented into five broad segments on the basis of capacity, components, temperature, end-user and geography. By capacity, the market is segmented into microcentrifuge, medium capacity centrifuge and large capacity centrifuge. Microcentrifuge segment accounted for leading share and is projected to slightly lose its market share to medium capacity centrifuge by the end of 2025. Hospitals and diagnostic centers are the key shareholders of microcentrifuges. Medium capacity centrifuge segment is anticipated to record highest growth rate during the forecast period owing to multiple applications of these equipments in the life science industry and its ability to accommodate different types, sizes and volume of centrifuge tubes. Large capacity centrifuges are widely used by the biopharmaceutical companies for batch production, sample preparation, cell harvesting and microfiltration of aqueous solutions. Also large capacity centrifuges are being frequently used by the blood banks for blood component separation.

The global laboratory centrifuge market by component is segmented into instruments and rotors. Instruments segment dominated the market and is projected to lose its market share to rotors segment. The rotors are further sub-segmented into fixed angle rotors, swing out rotors and fixed angle rotors. The swing out rotors segment is projected to record highest growth rate during the forecast period and is anticipated to marginally gain its market share by the end of 2025. By temperature, market is segmented into refrigerated centrifuge and non-refrigerated centrifuge. The end-user for laboratory centrifuge includes the hospitals and diagnostic centers, pharmaceutical and biotechnology companies, blood banks and academic and research institutes.

Investments in Healthcare Segment of Asia Pacific to Boost Regional Market

Geographically, the global laboratory centrifuge market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The developed regions such as North America and Europe accounted for leading share of global laboratory centrifuge market in 2016. The large base of biopharmaceutical industry and diagnostics laboratories in these regions led to leading share of these regions. Moreover rapid expansion and increasing number of diagnostics labs in these regions would propel the demand for laboratory centrifuge during the forecast period. Asia Pacific region is projected to expand at exponential growth rate owing rapidly improving healthcare facilities in the countries like India, China, South Korea, and Malaysia. Japan dominated the Asia Pacific laboratory centrifuge market whereas China is anticipated to record exponential growth rate during the forecast period. Latin America and Middle East & Africa regions are projected to maintain steady growth rates during the forecast period.

Major players operating in the laboratory centrifuge market include Sartorius AG, Thermo Fisher Scientific Inc., Eppendorf Group, Andreas Hettich GmbH & Co.KG, QIAGEN N.V., Hitachi Koki Co., Ltd. (Subsidiary of Hitachi, Ltd.), Beckman Coulter, Inc. (Subsidiary of Danaher Corporation), Sigma Laborzentrifugen GmbH, KUBOTA Corporation, and Cole-Parmer Instrument Company, LLC.( Subsidiary of GTCR firm).

Global Laboratory Centrifuge Market to Grow with Advancements in the Field of Chemical Testing and Analysis

The demand within the global laboratory centrifuge market is expected to reach new heights in the times to come by. The domain of chemical research and analysis has gained traction across the world as several entities invest in nascent lines of experimentation. The presence of a seamless industry that focuses on research excellence is also an important dynamic of market growth. Several ancillary research entities have also contacted inspection authorities to get a seal of credibility for their services. In view of these trends and opportunities, it is safe to predict that the global laboratory centrifuge market would attract new load of revenues.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary: Global Laboratory Centrifuge market

Chapter 4. Market Overview

4.1. Introduction

4.2. Key Industry Developments

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.3.4. Trends

4.4. Porter’s five forces analysis

4.5. PEST Analysis

4.6. Applied Industry SWOT Analysis

4.7. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, 2015–2025

4.8. Global Laboratory Centrifuge Market Outlook

Chapter 5. Global Laboratory Centrifuge Market Analysis and Forecast, by Capacity

5.1. Key Findings

5.2. Introduction

5.3. Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Capacity, 2016 and 2025

5.4. Global Laboratory Centrifuge Market Attractiveness Analysis, by Capacity, 2017–2025

5.5. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2015–2025

5.5.1. Microcentrifuge

5.5.2. Medium Capacity Centrifuge

5.5.3. Large Capacity Centrifuge

5.6. Key Trends

Chapter 6. Global Laboratory Centrifuge Market Analysis and Forecasts, by Component

6.1. Key Findings

6.2. Introduction

6.3. Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Component, 2016 and 2025

6.4. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2015–2025

6.4.1. Instruments

6.4.2. Rotors

6.4.2.1. Fixed Angle Rotors

6.4.2.2. Swing Out Rotors

6.4.2.3. Vertical Rotors

6.5. Key Trends

Chapter 7. Global Laboratory Centrifuge Market Analysis and Forecasts, by Temperature

7.1. Key Findings

7.2. Introduction

7.3. Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Temperature, 2016 and 2025

7.4. Global Laboratory Centrifuge Market Attractiveness Analysis, by Temperature, 2017–2025

7.5. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2015–2025

7.5.1. Refrigerated Centrifuge

7.5.2. Non-refrigerated Centrifuge

Chapter 8. Global Laboratory Centrifuge Market Analysis and Forecasts, by End-user Channel

8.1. Key Findings

8.2. Introduction

8.3. Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Temperature, 2016 and 2025

8.4. Global Laboratory Centrifuge Market Attractiveness Analysis, by Temperature, 2017–2025

8.5. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2015–2025

8.5.1. Hospitals & Diagnostics Centers

8.5.2. Pharmaceutical & Biotechnology Companies

8.5.3. Blood Banks

8.5.4. Academic & Research Institutes

Chapter 9. Global Laboratory Centrifuge market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Global Market Scenario

9.3. Global Laboratory Centrifuge Market Value Share Analysis, by Region, 2016 and 2025

9.4. Global Laboratory Centrifuge Market Attractiveness Analysis, by Region, 2017–2025

9.5. Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of Units) Forecast, by Region, 2015–2025

9.5.1. North America

9.5.2. Europe

9.5.3. Asia Pacific

9.5.4. Latin America

9.5.5. Middle East & Africa

9.6. Key Trends, Region

9.6.1. North America

9.6.2. Europe

9.6.3. Asia Pacific

9.6.4. Latin America

9.6.5. Middle East & Africa

Chapter 10. North America Laboratory Centrifuge market Analysis and Forecast

10.1. Key Findings

10.2. North America Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

10.3. North America Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

10.4. North America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2017-2025

10.4.1. Microcentrifuge

10.4.2. Medium Capacity Centrifuge

10.4.3. Large Capacity Centrifuge

10.5. North America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Component, 2017-2025

10.5.1. Instruments

10.5.2. Rotors

10.5.2.1. Fixed Angle Rotors

10.5.2.2. Swing Out Rotors

10.5.2.3. Vertical Rotors

10.6. North America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2017-2025

10.6.1. Refrigerated Centrifuge

10.6.2. Non-refrigerated Centrifuge

10.7. North America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2017-2025

10.7.1. Hospitals & Diagnostics Centers

10.7.2. Pharmaceutical & Biotechnology Companies

10.7.3. Blood Banks

10.7.4. Academic & Research Institutes

10.8. North America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Country/Sub-region, 2017-2025

10.8.1. U.S.

10.8.2. Canada

10.9. Market Attractiveness Analysis

10.9.1. By Capacity

10.9.2. By Component

10.9.3. By Temperature

10.9.4. By End-user

10.9.5. By Country/Sub-region

Chapter 11. Europe Laboratory Centrifuge market Analysis and Forecast

11.1. Key Findings

11.2. Europe Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

11.3. Europe Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

11.4. Europe Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2017-2025

11.4.1. Microcentrifuge

11.4.2. Medium Capacity Centrifuge

11.4.3. Large Capacity Centrifuge

11.5. Europe Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Component, 2017-2025

11.5.1. Instruments

11.5.2. Rotors

11.5.2.1. Fixed Angle Rotors

11.5.2.2. Swing Out Rotors

11.5.2.3. Vertical Rotors

11.6. Europe Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2017-2025

11.6.1. Refrigerated Centrifuge

11.6.2. Non-refrigerated Centrifuge

11.7. Europe Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2017-2025

11.7.1. Hospitals & Diagnostics Centers

11.7.2. Pharmaceutical & Biotechnology Companies

11.7.3. Blood Banks

11.7.4. Academic & Research Institutes

11.8. Europe Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Country/Sub-region, 2017-2025

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Rest of Europe

11.9. Market Attractiveness Analysis

11.9.1. By Capacity

11.9.2. By Component

11.9.3. By Temperature

11.9.4. By End-user

11.9.5. By Country/Sub-region

Chapter 12. Asia Pacific Laboratory Centrifuge market Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

12.3. Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

12.4. Asia Pacific Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2017-2025

12.4.1. Microcentrifuge

12.4.2. Medium Capacity Centrifuge

12.4.3. Large Capacity Centrifuge

12.5. Asia Pacific Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Component, 2017-2025

12.5.1. Instruments

12.5.2. Rotors

12.5.2.1. Fixed Angle Rotors

12.5.2.2. Swing Out Rotors

12.5.2.3. Vertical Rotors

12.6. Asia Pacific Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2017-2025

12.6.1. Refrigerated Centrifuge

12.6.2. Non-refrigerated Centrifuge

12.7. Asia Pacific Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2017-2025

12.7.1. Hospitals & Diagnostics Centers

12.7.2. Pharmaceutical & Biotechnology Companies

12.7.3. Blood Banks

12.7.4. Academic & Research Institutes

12.8. Asia Pacific Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Country/Sub-region, 2017-2025

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Australia & New Zealand

12.8.5. Rest of APAC

12.9. Market Attractiveness Analysis

12.9.1. By Capacity

12.9.2. By Component

12.9.3. By Temperature

12.9.4. By End-user

12.9.5. By Country/Sub-region

Chapter 13. Latin America Laboratory Centrifuge market Analysis and Forecast

13.1. Key Findings

13.2. Latin America Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

13.3. Latin America Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

13.4. Latin America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2017-2025

13.4.1. Microcentrifuge

13.4.2. Medium Capacity Centrifuge

13.4.3. Large Capacity Centrifuge

13.5. Latin America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Component, 2017-2025

13.5.1. Instruments

13.5.2. Rotors

13.5.2.1. Fixed Angle Rotors

13.5.2.2. Swing Out Rotors

13.5.2.3. Vertical Rotors

13.6. Latin America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2017-2025

13.6.1. Refrigerated Centrifuge

13.6.2. Non-refrigerated Centrifuge

13.7. Latin America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2017-2025

13.7.1. Hospitals & Diagnostics Centers

13.7.2. Pharmaceutical & Biotechnology Companies

13.7.3. Blood Banks

13.7.4. Academic & Research Institutes

13.8. Latin America Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Country/Sub-region, 2017-2025

13.8.1. Brazil

13.8.2. Mexico

13.8.3. Rest of LATAM

13.9. Market Attractiveness Analysis

13.9.1. By Capacity

13.9.2. By Component

13.9.3. By Temperature

13.9.4. By End-user

13.9.5. By Country/Sub-region

Chapter 14. Middle East and Africa Laboratory Centrifuge market Analysis and Forecast

14.1. Key Findings

14.2. Middle East & Africa Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

14.3. Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

14.4. Middle East & Africa Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Capacity, 2017-2025

14.4.1. Microcentrifuge

14.4.2. Medium Capacity Centrifuge

14.4.3. Large Capacity Centrifuge

14.5. Middle East & Africa Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Component, 2017-2025

14.5.1. Instruments

14.5.2. Rotors

14.5.2.1. Fixed Angle Rotors

14.5.2.2. Swing Out Rotors

14.5.2.3. Vertical Rotors

14.6. Middle East & Africa Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Temperature, 2017-2025

14.6.1. Refrigerated Centrifuge

14.6.2. Non-refrigerated Centrifuge

14.7. Middle East & Africa Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by End-user, 2017-2025

14.7.1. Hospitals & Diagnostics Centers

14.7.2. Pharmaceutical & Biotechnology Companies

14.7.3. Blood Banks

14.7.4. Academic & Research Institutes

14.8. Middle East & Africa Laboratory Centrifuge market size (US$ Mn) & Volume (Number of units) Forecast, by Country/Sub-region, 2017-2025

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of MEA

14.9. Market Attractiveness Analysis

14.9.1. By Capacity

14.9.2. By Component

14.9.3. By Temperature

14.9.4. By End-user

14.9.5. By Country/Sub-region

Chapter 15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

15.2.1. Sartorius AG

15.2.1.1. Company Overview

15.2.1.2. Financial Overview

15.2.1.3. Strategic Overview

15.2.1.4. Recent Developments

15.2.1.5. SWOT Analysis

15.2.2. Thermo Fisher Scientific Inc.

15.2.2.1. Company Overview

15.2.2.2. Financial Overview

15.2.2.3. Strategic Overview

15.2.2.4. Recent Developments

15.2.2.5. SWOT Analysis

15.2.3. Eppendorf Group

15.2.3.1. Company Overview

15.2.3.2. Financial Overview

15.2.3.3. Strategic Overview

15.2.3.4. Recent Developments

15.2.3.5. SWOT Analysis

15.2.4. Andreas Hettich GmbH & Co.KG

15.2.4.1. Company Overview

15.2.4.2. Strategic Overview

15.2.4.3. Recent Developments

15.2.4.4. SWOT Analysis

15.2.5. Labnet International, Inc.

15.2.5.1. Company Overview

15.2.5.2. Strategic Overview

15.2.5.3. Recent Developments

15.2.5.4. SWOT Analysis

15.2.6. QIAGEN N.V.

15.2.6.1. Company Overview

15.2.6.2. Financial Overview

15.2.6.3. Strategic Overview

15.2.6.4. SWOT Analysis

15.2.7. Hitachi Koki Co., Ltd. (Subsidiary of Hitachi, Ltd.)

15.2.7.1. Company Overview

15.2.7.2. Financial Overview

15.2.7.3. Recent Developments

15.2.7.4. SWOT Analysis

15.2.8. Beckman Coulter, Inc. (Subsidiary of Danaher Corporation)

15.2.8.1. Company Overview

15.2.8.2. Financial Overview

15.2.8.3. Strategic Overview

15.2.8.4. Recent Developments

15.2.8.5. SWOT Analysis

15.2.9. Sigma Laborzentrifugen GmbH

15.2.9.1. Company Overview

15.2.9.2. Strategic Overview

15.2.9.3. Recent Developments

15.2.9.4. SWOT Analysis

15.2.10. KUBOTA Corporation

15.2.10.1. Company Overview

15.2.10.2. Financial Overview

15.2.10.3. Strategic Overview

15.2.10.4. SWOT Analysis

15.2.11. Cole-Parmer Instrument Company, LLC. (Subsidiary of GTCR)

15.2.11.1. Company Overview

15.2.11.2. Financial Overview

15.2.11.3. Strategic Overview

15.2.11.4. SWOT Analysis

15.2.12. REMI GROUP

15.2.12.1. Company Overview

15.2.12.2. Financial Overview

15.2.12.3. Strategic Overview

15.2.12.4. Recent Developments

15.2.12.5. SWOT Analysis

List of Tables

Table 01: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 02: Global laboratory centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 03: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Component, 2015–2025

Table 04: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Rotors, 2015–2025

Table 05: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Temperature, 2015–2025

Table 06: Global Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 07: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 08: Global laboratory centrifuge Market Volume (Number of units) Forecast, by End-user, 2015–2025

Table 09: Global Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 10: Global Laboratory Centrifuge Market Volume (Number of units) Forecast, by Region, 2015–2025

Table 11: North America Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 12: North America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 13: North America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Component, 2015–2025

Table 14: North America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Rotors, 2015–2025

Table 15: North America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Temperature, 2015–2025

Table 16: North America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 17: North America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 18: North America Laboratory Centrifuge Market Volume (Number of units) Forecast, by End-user, 2015–2025

Table 19: North America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 20: North America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Country/Sub-region, 2015–2025

Table 21: Europe Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 22: Europe Laboratory Centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 23: Europe Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Component, 2015–2025

Table 24: Europe Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Rotors, 2015–2025

Table 25: Europe Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Temperature, 2015–2025

Table 26: Europe Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 27: Europe Laboratory Centrifuge Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 28: Europe Laboratory Centrifuge Market Volume (Units) Forecast, by End-user, 2015–2025

Table 29: Europe Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 30: Europe Laboratory Centrifuge Market Volume (Number of units) Forecast, by Country/Sub-region, 2015–2025

Table 31: Asia Pacific Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 32: Asia Pacific Laboratory Centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 33: Asia Pacific Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Component, 2015–2025

Table 34: Asia Pacific Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Rotors, 2015–2025

Table 35: Asia Pacific Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Temperature, 2015–2025

Table 36: Asia Pacific Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 37: Asia Pacific Laboratory Centrifuge Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 38: Asia Pacific Laboratory Centrifuge Market Volume (Units) Forecast, by End-user, 2015–2025

Table 39: Asia Pacific Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 40: Asia Pacific Laboratory Centrifuge Market Volume (Number of units) Forecast, by Country/Sub-region, 2015–2025

Table 41: Latin America Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 42: Latin America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 43: Latin America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Component, 2015–2025

Table 44: Latin America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Rotors, 2015–2025

Table 45: Latin America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Temperature, 2015–2025

Table 46: Latin America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 47: Latin America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 48: Latin America Laboratory Centrifuge Market Volume (Units) Forecast, by End-user, 2015–2025

Table 49: Latin America Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 50: Latin America Laboratory Centrifuge Market Volume (Number of units) Forecast, by Country/Sub-region, 2015–2025

Table 51: Middle East & Africa Laboratory Centrifuge Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 52: Middle East & Africa Laboratory Centrifuge Market Volume (Number of units) Forecast, by Capacity, 2015–2025

Table 53: Middle East & Africa Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Component, 2015–2025

Table 54: Middle East & Africa Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Rotors, 2015–2025

Table 55: Middle East & Africa Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Temperature, 2015–2025

Table 56: Middle East & Africa Laboratory Centrifuge Market Volume (Number of units) Forecast, by Temperature, 2015–2025

Table 57: Middle East & Africa Laboratory Centrifuge Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 58: Middle East & Africa Laboratory Centrifuge Market Volume (Units) Forecast, by End-user, 2015–2025

Table 59: Middle East & Africa Laboratory Centrifuge Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 60: Middle East & Africa Laboratory Centrifuge Market Volume (Number of units) Forecast, by Country/Sub-region, 2015–2025

List of Figures

Figure 01: Global Laboratory Centrifuge Market Size (US$ Mn) & Volume (Number of units) Forecast, 2015–2025

Figure 02: Market Value Share by Capacity (2016)

Figure 03: Market Value Share by Component (2016)

Figure 04: Market Value Share by Temperature (2016)

Figure 05: Market Value Share by End-user (2016)

Figure 06: Market Value Share by Region (2016)

Figure 07: Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Capacity, 2016 and 2025

Figure 08: Global Laboratory Centrifuge Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 09: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Microcentrifuge, 2015–2025

Figure 10: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Medium Capacity Centrifuge, 2015–2025

Figure 11: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Large Capacity Centrifuge, 2015–2025

Figure 12: Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Component, 2016 and 2025

Figure 13: Global Laboratory Centrifuge Market Attractiveness Analysis, by Component, 2017–2025

Figure 14: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Instruments, 2015–2025

Figure 15: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Rotors, 2015–2025

Figure 16: Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by Temperature, 2016 and 2025

Figure 17: Global Laboratory Centrifuge Market Attractiveness Analysis, by Temperature, 2017–2025

Figure 18: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Refrigerated Centrifuge, 2015–2025

Figure 19: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Non-refrigerated Centrifuge, 2015–2025

Figure 20: Global Laboratory Centrifuge Market Value Share Analysis (US$ Mn), by End-user, 2016 and 2025

Figure 21: Global Laboratory Centrifuge Market Attractiveness Analysis, by End-user, 2017–2025

Figure 22: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals & Diagnostic Centers, 2015–2024

Figure 23: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmaceutical & Biotechnology Companies, 2015–2024

Figure 24: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Blood Banks, 2015–2024

Figure 25: Global Laboratory Centrifuge Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Academic & Research Institutes, 2015–2024

Figure 26: Global Laboratory Centrifuge Market Value Share Analysis, by Region, 2016 and 2025

Figure 27: Global Laboratory Centrifuge Market Attractiveness Analysis, by Region, 2017–2025

Figure 28: North America Laboratory Centrifuge Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 29: North America Laboratory Centrifuge Market Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 30: North America Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

Figure 31: North America Laboratory Centrifuge Market Value Share Analysis, by Component, 2016 and 2025

Figure 32: North America Laboratory Centrifuge Market Value Share Analysis, by Temperature, 2016 and 2025

Figure 33: North America Laboratory Centrifuge Market Value Share Analysis, by End-user, 2016 and 2025

Figure 34: North America Laboratory Centrifuge Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 35: North America Laboratory Centrifuge Market Attractiveness Analysis, by Capacity

Figure 36: North America Laboratory Centrifuge Market Attractiveness Analysis, by Component

Figure 37: North America Laboratory Centrifuge Market Attractiveness Analysis, by Temperature

Figure 38: North America Laboratory Centrifuge Market Attractiveness Analysis, by End-user

Figure 39: North America Laboratory Centrifuge Market Attractiveness Analysis, by Country/Sub-region

Figure 40: Europe Laboratory Centrifuge Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 41: Europe Laboratory Centrifuge Market Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 42: Europe Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

Figure 43: Europe Laboratory Centrifuge Market Value Share Analysis, by Component, 2016 and 2025

Figure 44: Europe Laboratory Centrifuge Market Value Share Analysis, by Temperature, 2016 and 2025

Figure 45: Europe Laboratory Centrifuge Market Value Share Analysis, by End-user, 2016 and 2025

Figure 46: Europe Laboratory Centrifuge Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 47: Europe Laboratory Centrifuge Market Attractiveness Analysis, by Capacity

Figure 48: Europe Laboratory Centrifuge Market Attractiveness Analysis, by Component

Figure 49: Europe Laboratory Centrifuge Market Attractiveness Analysis, by Temperature

Figure 50: Europe Laboratory Centrifuge Market Attractiveness Analysis, by End-user

Figure 51: Europe Laboratory Centrifuge Market Attractiveness Analysis, by Country/Sub-region

Figure 52: Asia Pacific Laboratory Centrifuge Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 53: Asia Pacific Laboratory Centrifuge Market Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 54: Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

Figure 55: Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by Component, 2016 and 2025

Figure 56: Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by Temperature, 2016 and 2025

Figure 57: Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by End-user, 2016 and 2025

Figure 58: Asia Pacific Laboratory Centrifuge Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 59: Asia Pacific Laboratory Centrifuge Market Attractiveness Analysis, by Capacity

Figure 60: Asia Pacific Laboratory Centrifuge Market Attractiveness Analysis, by Component

Figure 61: Asia Pacific Laboratory Centrifuge Market Attractiveness Analysis, by Temperature

Figure 62: Asia Pacific Laboratory Centrifuge Market Attractiveness Analysis, by End-user

Figure 63: Asia Pacific Laboratory Centrifuge Market Attractiveness Analysis, by Country/Sub-region

Figure 64: Latin America Laboratory Centrifuge Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 65: Latin America Laboratory Centrifuge Market Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 66: Latin America Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

Figure 67: Latin America Laboratory Centrifuge Market Value Share Analysis, by Component, 2016 and 2025

Figure 68: Latin America Laboratory Centrifuge Market Value Share Analysis, by Temperature, 2016 and 2025

Figure 69: Latin America Laboratory Centrifuge Market Value Share Analysis, by End-user, 2016 and 2025

Figure 70: Latin America Laboratory Centrifuge Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 71: Latin America Laboratory Centrifuge Market Attractiveness Analysis, by Capacity

Figure 72: Latin America Laboratory Centrifuge Market Attractiveness Analysis, by Component

Figure 73: Latin America Laboratory Centrifuge Market Attractiveness Analysis, by Temperature

Figure 74: Latin America Laboratory Centrifuge Market Attractiveness Analysis, by End-user

Figure 75: Latin America Laboratory Centrifuge Market Attractiveness Analysis, by Country/Sub-region

Figure 76: Middle East & Africa Laboratory Centrifuge Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 77: Middle East & Africa Laboratory Centrifuge Market Volume (Number of units) and Y-o-Y Growth (%) Forecast, 2017–2025

Figure 78: Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by Capacity, 2016 and 2025

Figure 79: Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by Component, 2016 and 2025

Figure 80: Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by Temperature, 2016 and 2025

Figure 81: Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by End-user, 2016 and 2025

Figure 82: Middle East & Africa Laboratory Centrifuge Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 83: Middle East & Africa Laboratory Centrifuge Market Attractiveness Analysis, by Capacity

Figure 84: Middle East & Africa Laboratory Centrifuge Market Attractiveness Analysis, by Component

Figure 85: Middle East & Africa Laboratory Centrifuge Market Attractiveness Analysis, by Temperature

Figure 86: Middle East & Africa Laboratory Centrifuge Market Attractiveness Analysis, by End-user

Figure 87: Middle East & Africa Laboratory Centrifuge Market Attractiveness Analysis, by Country/Sub-region