Reports

Reports

The knitwear is an important part of the global apparel market. It deals with designing, production, and selling of garments that are knitted and further appreciated due to their comfortability, elasticity, and flexibility. Global knitwear market has been resilient and flexible due to the broad product range, and the continuous demand and capacity to meet functional and fashion needs among its consumers.

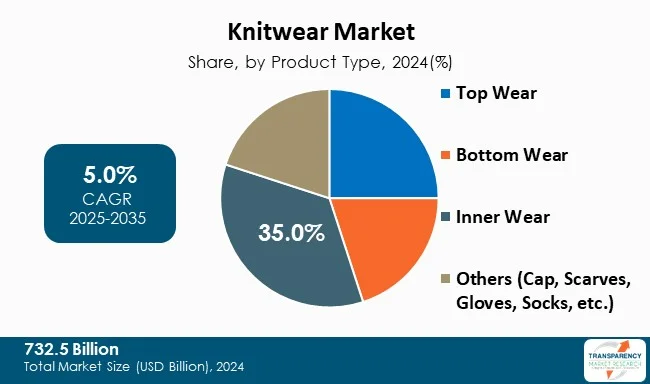

The dominant product line is innerwear that is not seasonal but a daily necessity and has high rate of replacement as compared to the other products that are highly sensitive to seasons and fashion such as outerwear and accessories.

Meanwhile, as fabric technologies such as 3D knitting, seamless production, and smart clothes emerge, the popularity of knitwear is growing into more performance-oriented fields such as sportswear and athleisure and is solidifying its status in the daily fashion.

Asia-Pacific dominates the market owing to its mass-market adoption of casual wear, luxury goods, and online stores due to factors like low- cost production and increasing demand from the younger consumer base. Due to the growing number of manufacturers such as Nike, Adidas, H&M, Gap, and Loro Pana, they are increasing production volumes, investing in sustainable and high-performance materials, and relying on digital retail solutions to assert their position in the global market. Knitwear market is expanding as it is aligned to the changing lifestyles of the customers in terms of comfort, innovation, and sustainability.

Knitwear market describes the global business of manufacturing and selling garments comprising knitted material, with intertwined yarns that make the garments stretchable and comfortable. Unlike fabrics, knitwear is characterized by being elastic, breathable, and flexible and, thus, fit in different climates and living conditions.

The market is broad, covers a variety of products such as sweaters, cardigans, dresses, T-shirts, active wear, socks, and accessories, and provides products to both - men, women, and children of different age groups and all kinds of fashion orientations.

The knitwear is popular in the two segments: functional and fashion-oriented. It is used as per seasonal demands. When in the colder environment they require warmers such as sweaters made out of wool and thermals and it is used in year round casual wear, sportswear, and higher end fashion-wear due to the neutral nature of cotton and the stretch provided by synthetic fabrics.

Its flexibility has made it a success in various segments of casual wear, athleisure, formal wear, and designer lines. Features such as flexibility, comfort, durability, and insulation make consumers demand it.

The growth of the market is favourable due to rising fashion sensibility, and growing demand for comfortable yet fashionable clothes. The boom of e-Commerce platforms has expanded the reach of customers even more, and sustainability discussions have put pressure on clothing brands to rely on eco-friendly, environmentally friendly fibers, and the other ethical methods. Due to innovation in material and the increasing trend of athleisure and luxury knitwear, the global knitwear market will continue to expand at a steady pace.

| Attribute | Detail |

|---|---|

| Knitwear Market Drivers |

|

Consumer trend towards well-performing and lightweight garments is making a difference to the demand for high-tech knitwear. Contemporary lifestyles prioritize comfort, convenience, and multifunction features and thus individuals want garments that are practical along with being fashionable.

Knitwear with innovative fibers and combinations is stretchable, moisture absorbing, and breathable, thereby enabling their use for sportswear, the athleisure business and casual wear daily. The active lifestyle movement in the world and the growth of fitness culture have added to the demand for knitted tops that can support the body during tough physical experiences and be comfortable to wear every day.

Seamless knitting, 3D knitting, and incorporation of the use of smart fabrics have boosted functionalities of knitwear. Such advancements are not only helping in cutting down the amount of waste in a fabric but also making these garments lighter, stronger, and more conducive to body movement.

To illustrate, light fabrics made out of wool blends and synthetic fibers give customers comfort of insulating clothing in the winter without wearing heavy clothes. Subsequently, the pressure to have lightweight premium apparel has made knitwear a convenient, fashionable, and multitasking apparel in the global clothing industry.

Sustainability is one of the leading forces affecting the knitwear industry with consumers paying attention to fashion that has been produced with more sustainable and ethical purchasing options. The concerns regarding climate change, fast fashion's impact on the environment, and overconsumption increase the need for sustainable eco-knitwear made with organic, recycled or biodegradable fibers. Now brands are getting ways to utilize organic cotton, bamboo yarn, hemp, recycled polyester, responsibly sourced wool, and materials that are naturally more attractive to responsible consumers. The shift does not only fit the sustainability ideals, but is elevating brand equity and customer loyalty as well.

Along with using environmental friendly raw materials, brands also introduce circular fashion concepts like recycling programs, slow-fashion clothes, and low impact dyes. For example, sustainable knitwear is being designed to be long lasting and produce minimum waste, which takes place in the context of global regulations striving to promote the sustainable production of clothes.

With consumers increasingly insisting on accountability on fashion brands, the knitwear is becoming an area of growth following need for sustainable products, with sustainability moving out of a niche market preference to become a mainstream in the market.

The category of innerwear is dominant over the other knitwear due to its lack of seasonal attributes as opposed to the sweaters, jackets, or scarves, which cannot be demanded for in summer seasons. Innerwear is the most steadfast category of consumer goods as every consumer, irrespective of age, gender, or where they are, needs innerwear every single day. It also sells at a higher replacement rate than the outerwear or accessories hence guarantees re-purchases in order to make the sales volumes higher and more stable.

Conversely, the top wear or bottom wear and accessories are subject to such changes as fashion changes, seasonal changes and discretional spending, which results in changing demand. Outerwear and accessory might be bought only occasionally, whereas innerwear is bought repeatedly, which provides it with a stable market share. The value, comfortability, and usability of knitted fabrics in innerwear also contributes to its stand and it becomes more dominant than the other segments of knitwear.

| Attribute | Detail |

|---|---|

| Leading Region | Asia-Pacific |

The Asia-Pacific region leads the global knitwear market chiefly as it is densely populated, highly urbanized, and the people are increasingly becoming fashion conscious. Knitwear is highly and widely consumed in countries such as China, India, Japan, and South Korea where the preference towards casual and premium knitwear seems to be going up.

The availability of large manufacturing centers in China, Bangladesh, and India also enhances production cost due to easy access of knitwear in the region, a factor that promotes consumption of the product. Moreover, e-Commerce adoption in the Asia-Pacific is also high with platforms such as Shopee, Flipkart, thereby making it convenient to access a large number of knitwear products thereby increasing its sales

Asia-Pacific’s dominance as compared to the other regions is enhanced by the fact that it has a younger population and rapidly growing fashion trends as compared to more matured regions such as North America and Europe, which are going slow due to high demand in premium and sustainable fashion.

Although the North American market is more inclined towards high end and seasonal knitwear and Europe is more oriented to sustainability and luxury knitwear, Asia-Pacific offers stability in terms of volume consumption on top of affordable knitwear production processes, which means brands can target mass markets as well. Moreover, the increase in online penetration and social media influence in Asia-Pacific enhance the online sales of knitwear, giving the region a competitive advantage over others.

A number of firms in the knitwear sector is expanding the knitwear industry’s scope in order to build up international networks pertaining to distribution and supply. This involves augmenting manufacturing capacities, investing in materials that are eco-friendly and of high performances, increasing efficiency of supplying chains and developing strategic partnerships and trade agreements to meet the increased consumer demand in various geographical locations.

Nike Inc., Adidas AG, Gap Inc., Fast Retailing Co., Ltd., Marks and Spencer Group plc. Gildan Activewear Inc., Hackett Ltd, Abercrombie & Fitch Co., Loro Piana S.P.A., Ralph Lauren Corp., Lacoste, The Nautical Company (UK) Ltd., Victoria’s Secret, YOOX NET-A-PORTER GROUP, H&M group are the key players in knitwear market.

Each of these players has been profiled in the knitwear market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

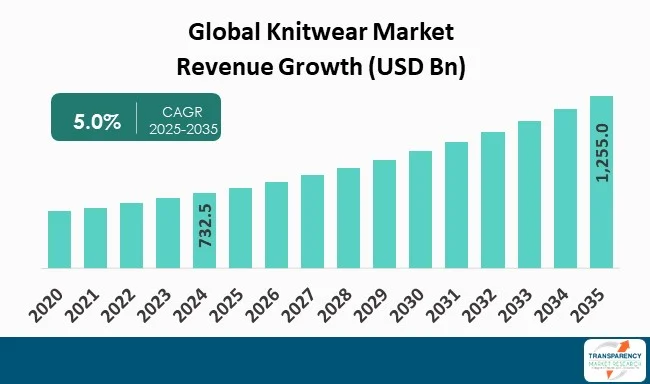

| Size in 2024 | US$ 732.5 Bn |

| Forecast Value in 2035 | US$ 1,255.0 Bn |

| CAGR | 5.0% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume. |

| Knitwear Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Company Profiles |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global knitwear market was valued at US$ 732.5 Bn in 2024

The global knitwear industry is projected to reach more than US$ 1,255.0 Bn by the end of 2035

Demand for lightweight and high-performance knitwear, and increasing demand for sustainability & eco-friendly fashion are some of the factors driving the expansion of knitwear industry.

The CAGR is anticipated to be 5.0% from 2025 to 2035

Nike Inc., Adidas AG, Gap Inc., Fast Retailing Co., Ltd., Marks and Spencer Group plc. Gildan Activewear Inc., Hackett Ltd, Abercrombie & Fitch Co., Loro Piana S.P.A., Ralph Lauren Corp., Lacoste, The Nautical Company (UK) Ltd., Victoria’s Secret, YOOX NET-A-PORTER GROUP, H&M group.

Table 1: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 2: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 3: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 4: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 5: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 6: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 7: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 8: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 9: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 10: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 11: Global Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 12: Global Market Volume (Thousand Units) Projection, 2020 to 2035 By Region

Table 13: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 14: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 15: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 16: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 17: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 18: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 19: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 20: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 21: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 22: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 23: North America Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 24: North America Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 25: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 26: U.S. Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 27: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 28: U.S. Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 29: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 30: U.S. Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 31: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 32: U.S. Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 33: U.S. Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 34: U.S. Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 35: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 36: Canada Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 37: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 38: Canada Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 39: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 40: Canada Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 41: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 42: Canada Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 43: Canada Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Canada Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 46: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 47: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 48: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 49: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 50: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 51: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 52: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 53: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 54: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 55: Europe Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 56: Europe Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 57: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 58: U.K. Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 59: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 60: U.K. Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 61: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 62: U.K. Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 63: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 64: U.K. Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 65: U.K. Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 66: U.K. Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 67: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 68: Germany Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 69: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 70: Germany Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 71: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 72: Germany Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 73: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 74: Germany Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 75: Germany Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 76: Germany Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 77: France Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 78: France Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 79: France Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 80: France Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 81: France Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 82: France Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 83: France Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 84: France Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 85: France Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 86: France Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 87: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 88: Italy Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 89: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 90: Italy Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 91: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 92: Italy Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 93: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 94: Italy Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 95: Italy Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 96: Italy Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 97: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 98: Spain Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 99: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 100: Spain Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 101: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 102: Spain Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 103: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 104: Spain Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 105: Spain Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 106: Spain Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 107: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 108: The Netherlands Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 109: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 110: The Netherlands Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 111: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 112: The Netherlands Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 113: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 114: The Netherlands Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 115: The Netherlands Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 116: The Netherlands Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 117: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 118: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 119: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 120: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 121: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 122: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 123: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 124: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 125: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 126: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 127: Asia Pacific Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 128: Asia Pacific Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 129: China Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 130: China Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 131: China Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 132: China Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 133: China Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 134: China Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 135: China Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 136: China Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 137: China Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 138: China Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 139: India Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 140: India Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 141: India Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 142: India Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 143: India Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 144: India Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 145: India Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 146: India Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 147: India Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 148: India Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 149: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 150: Japan Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 151: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 152: Japan Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 153: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 154: Japan Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 155: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 156: Japan Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 157: Japan Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 158: Japan Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 159: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 160: Australia Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 161: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 162: Australia Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 163: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 164: Australia Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 165: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 166: Australia Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 167: Australia Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 168: Australia Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 169: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 170: South Korea Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 171: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 172: South Korea Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 173: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 174: South Korea Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 175: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 176: South Korea Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 177: South Korea Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Korea Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 179: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 180: ASEAN Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 181: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 182: ASEAN Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 183: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 184: ASEAN Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 185: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 186: ASEAN Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 187: ASEAN Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 188: ASEAN Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 189: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 190: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 191: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 192: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 193: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 194: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 195: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 196: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 197: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 198: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 199: Middle East & Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 200: Middle East & Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 201: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 202: GCC Countries Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 203: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 204: GCC Countries Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 205: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 206: GCC Countries Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 207: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 208: GCC Countries Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 209: GCC Countries Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 210: GCC Countries Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 211: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 212: South Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 213: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 214: South Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 215: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 216: South Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 217: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 218: South Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 219: South Africa Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 220: South Africa Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 221: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 222: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 223: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 224: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 225: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 226: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 227: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 228: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 229: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 230: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 231: Latin America Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 232: Latin America Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 233: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 234: Brazil Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 235: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 236: Brazil Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 237: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 238: Brazil Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 239: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 240: Brazil Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 241: Brazil Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 242: Brazil Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 243: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 244: Argentina Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 245: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 246: Argentina Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 247: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 248: Argentina Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 249: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 250: Argentina Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 251: Argentina Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 252: Argentina Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 253: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 254: Mexico Market Volume (Thousand Units) Projection, 2020 to 2035 By Product Type

Table 255: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Consumer Group

Table 256: Mexico Market Volume (Thousand Units) Projection, 2020 to 2035 By Consumer Group

Table 257: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Knit Type

Table 258: Mexico Market Volume (Thousand Units) Projection, 2020 to 2035 By Knit Type

Table 259: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Material

Table 260: Mexico Market Volume (Thousand Units) Projection, 2020 to 2035 By Material

Table 261: Mexico Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 262: Mexico Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 2: Global Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 3: Global Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 4: Global Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 5: Global Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 6: Global Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 7: Global Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 8: Global Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 9: Global Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 10: Global Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 11: Global Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 12: Global Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 13: Global Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 16: Global Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 17: Global Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 18: Global Market Incremental Opportunities (US$ Bn) Forecast, By Region 2020 to 2035

Figure 19: North America Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 20: North America Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 21: North America Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 22: North America Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 23: North America Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 24: North America Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 25: North America Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 26: North America Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 27: North America Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 28: North America Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 29: North America Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 30: North America Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 31: North America Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 34: North America Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 35: North America Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 36: North America Market Incremental Opportunities (US$ Bn) Forecast, By Country 2020 to 2035

Figure 37: U.S. Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 38: U.S. Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 39: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 40: U.S. Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 41: U.S. Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 42: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 43: U.S. Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 44: U.S. Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 45: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 46: U.S. Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 47: U.S. Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 48: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 49: U.S. Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 52: Canada Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 53: Canada Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 54: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 55: Canada Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 56: Canada Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 57: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 58: Canada Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 59: Canada Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 60: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 61: Canada Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 62: Canada Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 63: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 64: Canada Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 67: Europe Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 68: Europe Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 69: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 70: Europe Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 71: Europe Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 72: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 73: Europe Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 74: Europe Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 75: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 76: Europe Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 77: Europe Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 78: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 79: Europe Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 82: Europe Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 83: Europe Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 84: Europe Market Incremental Opportunities (US$ Bn) Forecast, By Country 2020 to 2035

Figure 85: U.K. Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 86: U.K. Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 87: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 88: U.K. Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 89: U.K. Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 90: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 91: U.K. Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 92: U.K. Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 93: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 94: U.K. Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 95: U.K. Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 96: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 97: U.K. Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 100: Germany Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 101: Germany Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 102: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 103: Germany Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 104: Germany Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 105: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 106: Germany Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 107: Germany Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 108: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 109: Germany Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 110: Germany Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 111: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 112: Germany Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 115: France Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 116: France Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 117: France Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 118: France Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 119: France Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 120: France Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 121: France Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 122: France Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 123: France Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 124: France Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 125: France Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 126: France Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 127: France Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 130: Italy Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: Italy Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 133: Italy Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 134: Italy Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 135: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 136: Italy Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 137: Italy Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 138: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 139: Italy Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 140: Italy Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 141: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 142: Italy Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 145: Spain Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 146: Spain Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 147: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 148: Spain Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 149: Spain Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 150: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 151: Spain Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 152: Spain Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 153: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 154: Spain Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 155: Spain Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 156: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 157: Spain Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 160: The Netherlands Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 161: The Netherlands Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 162: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 163: The Netherlands Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 164: The Netherlands Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 165: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 166: The Netherlands Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 167: The Netherlands Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 168: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 169: The Netherlands Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 170: The Netherlands Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 171: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 172: The Netherlands Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 175: Asia Pacific Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 176: Asia Pacific Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 177: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 178: Asia Pacific Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 179: Asia Pacific Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 180: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 181: Asia Pacific Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 182: Asia Pacific Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 183: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 184: Asia Pacific Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 185: Asia Pacific Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 186: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 187: Asia Pacific Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 190: Asia Pacific Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Market Incremental Opportunities (US$ Bn) Forecast, By Country 2020 to 2035

Figure 193: China Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 194: China Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 195: China Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 196: China Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 197: China Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 198: China Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 199: China Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 200: China Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 201: China Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 202: China Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 203: China Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 204: China Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 205: China Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 208: India Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 209: India Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 210: India Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 211: India Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 212: India Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 213: India Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 214: India Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 215: India Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 216: India Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 217: India Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 218: India Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 219: India Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 220: India Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 223: Japan Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 224: Japan Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 225: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 226: Japan Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 227: Japan Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 228: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 229: Japan Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 230: Japan Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 231: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 232: Japan Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 233: Japan Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 234: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 235: Japan Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 238: Australia Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 239: Australia Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 240: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 241: Australia Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 242: Australia Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 243: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 244: Australia Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 245: Australia Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 246: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 247: Australia Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 248: Australia Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 249: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 250: Australia Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 253: South Korea Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 254: South Korea Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 255: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 256: South Korea Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 257: South Korea Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 258: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 259: South Korea Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 260: South Korea Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 261: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 262: South Korea Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 263: South Korea Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 264: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 265: South Korea Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 268: ASEAN Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 269: ASEAN Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 270: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 271: ASEAN Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 272: ASEAN Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 273: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 274: ASEAN Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 275: ASEAN Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 276: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 277: ASEAN Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 278: ASEAN Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 279: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 280: ASEAN Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 283: Middle East & Africa Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 284: Middle East & Africa Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 285: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 286: Middle East & Africa Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 287: Middle East & Africa Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 288: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 289: Middle East & Africa Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 290: Middle East & Africa Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 291: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 292: Middle East & Africa Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 293: Middle East & Africa Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 294: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 295: Middle East & Africa Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 298: Middle East & Africa Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Market Incremental Opportunities (US$ Bn) Forecast, By Country 2020 to 2035

Figure 301: GCC Countries Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 302: GCC Countries Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 303: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 304: GCC Countries Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 305: GCC Countries Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 306: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 307: GCC Countries Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 308: GCC Countries Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 309: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 310: GCC Countries Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 311: GCC Countries Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 312: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 313: GCC Countries Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 316: South Africa Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 317: South Africa Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 318: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 319: South Africa Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 320: South Africa Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 321: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 322: South Africa Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 323: South Africa Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 324: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 325: South Africa Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 326: South Africa Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 327: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 328: South Africa Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 331: Latin America Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 332: Latin America Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 333: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 334: Latin America Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 335: Latin America Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 336: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 337: Latin America Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 338: Latin America Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 339: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 340: Latin America Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 341: Latin America Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 342: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 343: Latin America Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 346: Latin America Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 347: Latin America Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 348: Latin America Market Incremental Opportunities (US$ Bn) Forecast, By Country 2020 to 2035

Figure 349: Brazil Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 350: Brazil Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 351: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 352: Brazil Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 353: Brazil Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 354: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 355: Brazil Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 356: Brazil Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 357: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 358: Brazil Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 359: Brazil Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 360: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 361: Brazil Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 362: Brazil Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 363: Brazil Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 364: Argentina Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 365: Argentina Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 366: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 367: Argentina Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 368: Argentina Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 369: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 370: Argentina Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 371: Argentina Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 372: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 373: Argentina Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 374: Argentina Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 375: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 376: Argentina Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 377: Argentina Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 378: Argentina Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035

Figure 379: Mexico Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 380: Mexico Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 381: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2020 to 2035

Figure 382: Mexico Market Value (US$ Bn) Projection, By Consumer Group 2020 to 2035

Figure 383: Mexico Market Volume (Thousand Units) Projection, By Consumer Group 2020 to 2035

Figure 384: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Consumer Group 2020 to 2035

Figure 385: Mexico Market Value (US$ Bn) Projection, By Knit Type 2020 to 2035

Figure 386: Mexico Market Volume (Thousand Units) Projection, By Knit Type 2020 to 2035

Figure 387: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Knit Type 2020 to 2035

Figure 388: Mexico Market Value (US$ Bn) Projection, By Material 2020 to 2035

Figure 389: Mexico Market Volume (Thousand Units) Projection, By Material 2020 to 2035

Figure 390: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Material 2020 to 2035

Figure 391: Mexico Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 392: Mexico Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 393: Mexico Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2020 to 2035