Reports

Reports

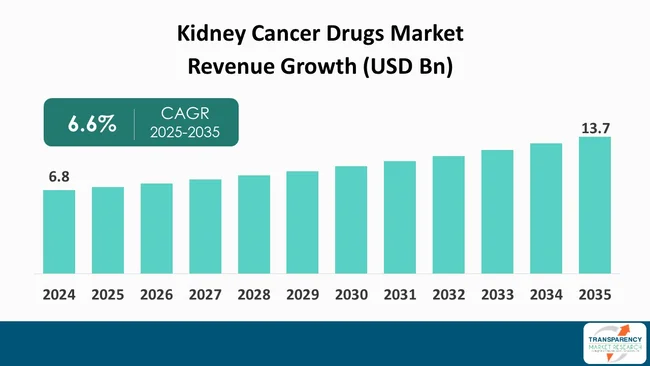

The global kidney cancer drugs market size was valued at US$ 6.8 Bn in 2024 and is projected to reach US$ 13.7 Bn by 2035, expanding at a CAGR of 6.6 % from 2025 to 2035. The global kidney cancer drugs industry is projected to expand at a strong compound annual growth rate (CAGR 6.6%) over the forecast period, leading by the factors such as increasing cases of the disease, the variety of the therapy available to patients and the improvements in the healthcare sector.

The global kidney cancer drugs market is expected to go steady due to the continuous development in targeted therapies and immuno-oncology, increasing aging population, and wider access to diagnostic testing, which make it possible to give the patients earlier and more personalized treatment.

Also, reduction in prices due to competition, differences in reimbursement from one region to another, and complex regulatory procedures could limit the expansion of sales in certain markets. Generally, consensus projections indicate a gradual growth ahead in the forecast period, this being a result of continued scientific development, expanding utilization of treatment lines, and a raised focus on biomarker-guided care.

The global kidney cancer drugs market involves the production, manufacturing, and marketing of pharmaceutical agents that are used for the treatment of renal cell carcinoma and the other types of kidney cancer. The market has changed substantially over the last couple of years and is gradually moving away from the use of classic chemotherapies toward more advanced targeted therapies as well as immuno-oncology treatments that provide patients with longer survival and better quality of life.

The demand for effective treatment options has been greatly amplified by the increasing prevalence of diseases, which, in turn, is a consequence of the aging population, changes in lifestyle, and better diagnostic capabilities. In order to address this issue, pharmaceutical companies are escalating their expenditures on research and development activities with the view of delivering novel drug classes, combination therapies, and personalized treatment regimens.

This market is thus kept vibrant with various clinical innovations, poly favorable regulatory frameworks, and the growing healthcare infrastructure in developing countries. As such, it is displaying an impressive upward trend in its volumes and values considerably over the coming years.

For instance, as stated by Kidney Cancer Association, in March 2025, the U.S. House of Representatives made a decision to decrease by 57% the budget for the Congressionally Directed Medical Research Programs (CDMRP), a program that comprises the funding used for kidney cancer research (~US$50 Mn per year).

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the major causes of the global kidney cancer drugs market expansion is the rising number of kidney cancer cases all over the world. The surge in the number of cases is primarily explained by demographic and lifestyle factors, such as an aging population that is getting larger, increasing rates of obesity, smoking and alcohol consumption, and the rising prevalence of chronic kidney diseases.

For instance, the American Cancer Society, based on data from the U.S. disease burden, estimates that around 81,610 new cases of cancer of the kidney and renal-pelvis will be recorded in the United States in 2024. The numbers indicate that the rate of the cancer is rising and, therefore, this becomes a major health issue for the general population as well as for the military/veteran sub-population.

Advancements in diagnostic imaging and screening have resulted in better detection rates, which have added to the increase in the number of cases that have been diagnosed. The rising number of patients has caused a desire for efficient and precise treatment methods to become very strong.

For instance, the combined use of lenvatinib (Lenvima) and pembrolizumab (Keytruda) has gained approval from the U.S. Food & Drug Administration (FDA) as the first-line treatment in adult patients with advanced renal cell carcinoma (RCC). The main evidence for the regulator's decision was the Phase 3 trial (CLEAR/KEYNOTE-581) where a very significant improvement in progression-free survival vs. sunitinib was reported.

The increasing healthcare expenses at a global scale is one of the major factors that is contributing to the expansion of the market for kidney cancer drugs globally. The rising investments in medical infrastructure, the widening of access to advanced treatments, and the provision of funds for cancer research by governments and healthcare systems have created a favorable environment for the development and use of novel kidney cancer therapies.

For instance, the government of New Zealand, through Pharmac, declared that it will finance the combination of nivolumab and ipilimumab as the first-line therapy for metastatic clear-cell renal cell carcinoma, starting from 1 April 2025, in addition to expanding the access to sunitinib.

An expanded focus on research pertaining to kidney diseases in both - public and private sectors has been the major driver to the significant change in the field through the identification of novel drug targets, the adoption of precision medicine strategies increases.

Additionally, increased healthcare expenditure in developing countries is breaking down the barriers to diagnostic and therapeutic services, thus facilitating early detection and efficient disease management. According to Organization for Economic Co-operation and Development, after consistent annual growth of around 3% (in real terms) during the pre‑COVID period, health spending increased substantially across the OECD in 2020 (5.0%) and 2021 (8.2%) as a result of the inflow of additional financial resources for cancer and SARS-CoV-2 treatment.

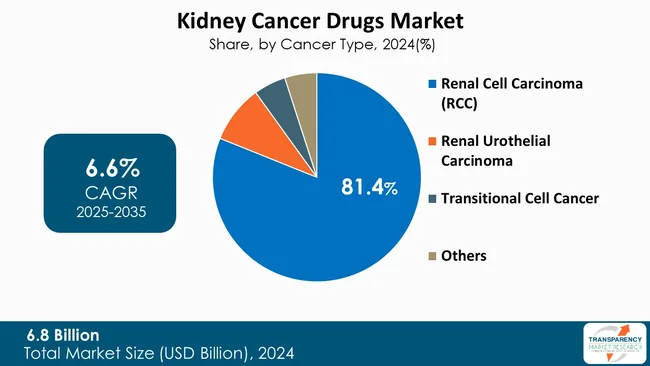

Renal Cell Carcinoma (RCC) constitutes the main cancer type with market share of 81.4% in the ensemble of renal cancers, making it the most frequent cause of kidney cancer that has been diagnosed globally. The situation where this disease is the main contributor to the problem, i.e., the overall increasing number of cases, together with the frequent detection of RCC in imaging examinations and its being well known among clinicians, makes RCC still the leading area of therapeutic development and research.

Moreover, the availability of targeted therapies and immunotherapies, which are specifically designed for RCC, is the main reason why it is in the leading position for a long time. As a result of increasing incidence rates and rapidly innovative treatment strategies, RCC will probably keep being more prevalent than other renal cancer subtypes.

In addition, RCC is a beneficiary of a plethora of clinical trials that are predominantly focused on next-generation checkpoint inhibitors as well as combination regimens. Its dominance in international cancer guidelines and therapeutic schemas keeps on being the main factor of its consolidating power in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

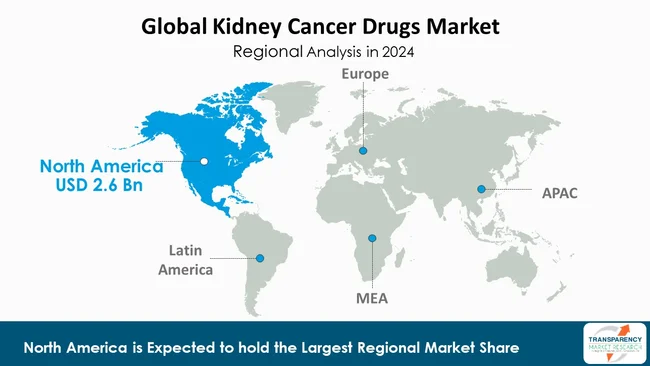

North America has the largest market share of 37.5% of global kidney cancer drugs market. The dominance of North America in the global kidney cancer drugs Industry is largely due to a robust healthcare system, the high incidence of kidney cancer, and many top pharmaceutical organizations being located there. Besides, the region is witnessing rapid adoption of advanced treatment modalities, numerous clinical research projects, and supportive regulatory environment, which facilitates the approval and commercialization of new therapies.

Consequently, significant healthcare spending, broad insurance coverage, and an increasing awareness of the value of early cancer detection are some of the factors that have led to a higher treatment uptake rate. The U.S., especially, is responsible for the major part of the market volume as a result of the intense investment in oncology research as well as the availability of state-of-the-art immunotherapies and targeted drugs.

For instance, the U.S. Food and Drug Administration approved belzutifan (Welireg, Merck & Co., Inc.) for patients battling advanced renal cell carcinoma (RCC) following a programmed death receptor-1 (PD-1) or programmed death-ligand 1 (PD-L1) inhibitor and a vascular endothelial growth factor tyrosine kinase inhibitor (VEGF-TKI).

AstraZeneca, Bayer AG, Bristol-Myers Squibb Company, Eisai Co., Ltd., F. Hoffmann-La Roche Ltd, GSK plc., Fresenius SE & Co. KGaA, Johnson & Johnson, Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., Endo, Inc., Exelixis, Inc., Lupin, Cipla, and others are some of the leading manufacturers operating in the global kidney cancer drugs market.

Each of these companies has been profiled in the kidney cancer drugs Industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 6.8 Bn |

| Forecast Value in 2035 | More than US$ 13.7 Bn |

| CAGR | 6.6 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Cancer Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global kidney cancer drugs market was valued at US$ 6.8 Bn in 2024

The global kidney cancer drugs industry is projected to reach more than US$ 13.7 Bn by the end of 2035

Rising incidence of kidney cancer and higher healthcare expenditure are some of the factors driving the expansion of kidney cancer drugs market.

The CAGR is anticipated to be 6.6% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

AstraZeneca, Bayer AG, Bristol-Myers Squibb Company, Eisai Co., Ltd., F. Hoffmann-La Roche AG, GSK plc., Helsinn Healthcare SA, Johnson & Johnson, Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., Endo, Inc., Exelixis, Inc., Lupin, Cipla, and other prominent players.

Table 01: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 02: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, By Therapy, 2020 to 2035

Table 03: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 04: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 05: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 06: Global Kidney Cancer Drugs Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 09: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Therapy, 2020 to 2035

Table 10: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 11: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Route of Administration, 2020 to 2035

Table 12: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 13: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 15: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Therapy, 2020 to 2035

Table 16: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 17: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Route of Administration, 2020 to 2035

Table 18: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 19: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 21: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Therapy, 2020 to 2035

Table 22: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 23: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Route of Administration, 2020 to 2035

Table 24: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 25: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 27: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Therapy, 2020 to 2035

Table 28: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 29: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Route of Administration, 2020 to 2035

Table 30: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 31: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Cancer Type, 2020 to 2035

Table 33: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Therapy, 2020 to 2035

Table 34: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Drug Class, 2020 to 2035

Table 35: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Route of Administration, 2020 to 2035

Table 36: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Figure 01: Global Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 02: Global Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 03: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Renal Cell Carcinoma (RCC), 2020 to 2035

Figure 04: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Renal Urothelial Carcinoma, 2020 to 2035

Figure 05: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Transitional Cell Cancer, 2020 to 2035

Figure 06: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Kidney Cancer Drugs Market Value Share Analysis, by Therapy, 2024 and 2035

Figure 08: Global Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 09: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Targeted Therapy, 2020 to 2035

Figure 10: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Immunotherapy, 2020 to 2035

Figure 11: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Chemotherapy, 2020 to 2035

Figure 12: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2024 and 2035

Figure 14: Global Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 15: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Angiogenesis Inhibitors, 2020 to 2035

Figure 16: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Monoclonal Antibodies, 2020 to 2035

Figure 17: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by mTOR Inhibitors, 2020 to 2035

Figure 18: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Cytokine Immunotherapy (IL-2), 2020 to 2035

Figure 19: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Kidney Cancer Drugs Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 21: Global Kidney Cancer Drugs Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 22: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 23: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Intravenous, 2020 to 2035

Figure 24: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 26: Global Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2024 and 2035

Figure 27: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Hospital Pharmacies, 2025 to 2035

Figure 28: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 29: Global Kidney Cancer Drugs Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 30: Global Kidney Cancer Drugs Market Value Share Analysis, By Region, 2024 and 2035

Figure 31: Global Kidney Cancer Drugs Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 32: North America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America Kidney Cancer Drugs Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: North America Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 36: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 37: North America Kidney Cancer Drugs Value Share Analysis, by Therapy, 2025 to 2035

Figure 38: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 39: North America Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2025 to 2035

Figure 40: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 41: North America Kidney Cancer Drugs Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 42: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 43: North America Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 44: North America Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 45: Europe Kidney Cancer Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Europe Kidney Cancer Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: Europe Kidney Cancer Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: Europe Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 49: Europe Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 50: Europe Kidney Cancer Drugs Market Value Share Analysis, by Therapy, 2024 and 2035

Figure 51: Europe Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 52: Europe Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2025 to 2035

Figure 53: Europe Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 54: Europe Kidney Cancer Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 55: Europe Kidney Cancer Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 56: Europe Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 57: Europe Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 58: Asia Pacific Kidney Cancer Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 62: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 63: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, by Therapy, 2024 and 2035

Figure 64: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 65: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2025 to 2035

Figure 66: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 67: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 68: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 69: Asia Pacific Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 70: Asia Pacific Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 71: Latin America Kidney Cancer Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Latin America Kidney Cancer Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 73: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 74: Latin America Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 75: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 76: Latin America Kidney Cancer Drugs Market Value Share Analysis, by Therapy, 2024 and 2035

Figure 77: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 78: Latin America Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2025 to 2035

Figure 79: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 80: Latin America Kidney Cancer Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 81: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 82: Latin America Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 83: Latin America Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 84: Middle East and Africa Kidney Cancer Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 86: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 87: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Cancer Type, 2024 and 2035

Figure 88: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, by Cancer Type, 2025 to 2035

Figure 89: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Therapy, 2024 and 2035

Figure 90: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, by Therapy, 2025 to 2035

Figure 91: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Drug Class, 2025 to 2035

Figure 92: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, by Drug Class, 2025 to 2035

Figure 93: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 94: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 95: Middle East and Africa Kidney Cancer Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 96: Middle East and Africa Kidney Cancer Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035