Reports

Reports

Analysts’ Viewpoint

IoT devices can collect and send data via sensors and actuators, scalable cloud solutions, and user-friendly communication networks. The advantages of IoT technologies for the logistics sector include monitoring the state of a driver and vehicle, and real-time product identification and tracking.

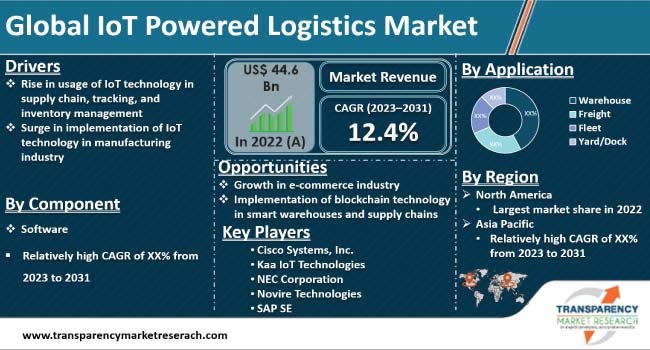

Rise in usage of IoT in supply chain management and tracking & inventory management is playing a key role in IoT powered logistics market development. However, complexities in integrating Internet of Things in logistics legacy systems can hinder the market growth.

Growth in the e-commerce industry is opening up several IoT powered logistics market opportunities. Market distributors are investing in R&D to be able to improve the performance of their services and develop new technologies for technology integration.

Application of IoT in logistics involves the use of Internet of Things (IoT) devices and sensors to collect, transmit, and analyze data from various stages of the supply chain. IoT powered logistics can help optimize operations, reduce costs, improve customer service, and enhance security. It can enable real-time visibility, traceability, and automation of processes, such as inventory management, fleet management, warehouse management, and delivery management.

Organizations worldwide are implementing IoT to operate more efficiently, and to better understand their consumers to enhance service delivery. The supply chain and logistics sector is likely to undergo a revolution due to the numerous IoT-based solutions being developed in this area.

IoT can be highly helpful in supply chain, tracking, authenticating products, and shipping commodities. One of the most significant advantages of IoT in the supply chain is machine intelligence. IoT has the capacity to identify problems, such as resource leakage, inefficiencies, and potential machine malfunction that humans fail to notice.

IoT technology is used in automating inventory management. For instance, logistics organizations attach RFID tags to products stored in warehouses so that they are tracked in real-time for location and inventory levels. Businesses may enhance forecasting and optimize stock levels with the help of the automatically collected data on inventory levels from smart shelves and IoT sensors.

Some IoT devices also monitor humidity, temperature, atmosphere exposure, and other environmental parameters. They help store goods, such as food and chemicals, in the best conditions to preserve their quality. This can be accomplished with the use of Wi-Fi transceiver modules and other environmental sensors such as SHT11 temperature and relative humidity sensors.

The supply chain process is optimized by using route planning through IoT devices to identify where and when items are delayed. This would enable future planning and the consideration of alternate routes, as needed. IoT is playing a major role in enhancing the smart supply chain and logistics sector. According to Schulze, around 76% of companies are using IoT in transportation and logistics sectors.

According to a survey conducted by Harvard Business Review, 58% of companies have experienced increased collaboration with IoT devices. Sensors and IoT devices are used to track and safeguard cargo, vehicles, and warehouses. Logistics firms stop theft, track stolen items, and secure their supply chain by deploying IoT-based security technologies.

The e-commerce share of retail sales has grown in recent years given the surge in popularity of online shopping. According to OBERLO, the online retail market share was 19.2% in 2021, which means that every US$100 spent by consumers, US$19.20 was online. In 2022, this figure grew by 19.3%, to a total US$ 5.4 Trn in global e-commerce sales. The e-commerce market share is expected to increase given the improved accessibility and affordability of mobile devices, and the rise in usage and access to the internet globally.

Logistics of several e-commerce companies face a number of issues as many companies try to attract their customers with steep discounts, low delivery costs, next-day delivery (or faster delivery), and simple returns. These brands need a strong strategy to master their logistics and transport processes at an optimized cost to remain profitable, obtain a competitive edge, and develop a sustainable business model. E-commerce companies save costs by using IoT technology in smart logistics, inventory management, personalization, and website development.

IoT makes it easier to store items and control stock levels along with offering fleet management services. In a logistics ecosystem, it allows a business to have unmistakable transparency in all of its operations, thus assisting in efficient inventory management.

Companies may simply track their inventory products' status and location using RFID tags and sensors. In other words, IoT enables the creation of a smart warehouse system that enables a business to stop losses, guarantee secure storage of goods, and quickly find the items required. Additionally, it aids businesses in modernizing their warehouse operations, which lowers labor costs and boosts productivity because there are fewer human handling errors.

According to OBERLO, e-commerce share of retail sales in the U.S. was 15.0% in 2022 while it is expected to rise to 16.4% in 2023. The coronavirus pandemic, which compelled customers to stay at home and make their purchases online, is partly responsible for the growth in popularity of e-commerce, particularly in the last three years. Leading online merchants, especially those who offer quick delivery and click-and-collect options, are likely to account for majority of this gain in the U.S. e-commerce market share.

The e-commerce sector is expected to benefit from implementing IoT technology in its operations in a number of ways, including improved inventory management, increased income, improved logistics tracking, and simple tracking of security concerns. IoT integration in retail and e-commerce provides sellers many advantages while also offering a comprehensive client experience. Hence, growth in the e-commerce industry is eventually opening up IoT powered logistics business opportunities.

According to the latest IoT powered logistics industry research report, North America is anticipated to hold dominant share of the global market during the forecast period. The U.S. is at the forefront of technological advancements, ascribed to the strong digital infrastructure, large logistics industry, and healthy ecosystem in the country.

The IoT powered logistics market growth in Asia Pacific is expected to be at the highest CAGR during the forecast period. Rapid economic growth, expansion in the e-commerce industry, increase in manufacturing activities, large population, and urbanization in countries such as China and India, are expected to accelerate the IoT powered logistics business growth in the Asia Pacific region.

The IoT powered logistics market report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Cisco Systems Inc., NEC Corporation, Intel Corporation, Honeywell International, Oracle Corporation, PTC, SAP SE, Microsoft Corporation, Amazon Web Services, IBM Corporation, Octonion SA, Kaa IoT Technologies, and Novire Technologies are the key companies in IoT powered logistics market.

Prominent providers are investing in R&D activities to introduce advanced edge computing and IoT solutions that can meet the growing Internet of Things powered logistics market demand. These service providers are tapping into the latest Internet of Things powered logistics market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the IoT powered logistics market forecast report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 44.6 Bn |

|

Market Forecast Value in 2031 |

US$ 125.9 Bn |

|

Growth Rate (CAGR) |

12.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, The qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 44.6 Bn in 2022

It is anticipated to reach US$ 125.9 Bn by the end of 2031

The CAGR is projected to be 12.4% from 2023 to 2031

Growth in e-commerce industry and implementation of blockchain technology in smart warehouses and supply chain

North America accounted for leading share in 2022

Cisco Systems Inc., NEC Corporation, Intel Corporation, Honeywell International, Oracle Corporation, PTC, SAP SE, Microsoft Corporation, Amazon Web Services, IBM Corporation, Kaa IoT Technologies, and Novire Technologies

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global IoT Powered Logistics Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on IoT Powered Logistics Market

4.5. PEST Analysis

4.6. Porter’s Analysis

4.7. Market Opportunity Assessment - by Region (North America/ Europe/Asia Pacific/Middle East & Africa/South America)

4.7.1. By Component

4.7.2. By Application

5. Global IoT Powered Logistics Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

5.2. Pricing Model Analysis/Price Trend Analysis

6. Global IoT Powered Logistics Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Software

6.3.1.1. Traffic & Fleet Management

6.3.1.2. Resource & Energy Monitoring

6.3.1.3. Safety & Security

6.3.1.4. Others

6.3.2. Hardware

6.3.2.1. RFID Tags

6.3.2.2. IoT Sensors (Beacons)

6.3.2.3. Screen/Display

6.3.2.4. Others

7. Global IoT Powered Logistics Market Analysis, by Application

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Application, 2018 - 2031

7.3.1. Fleet

7.3.2. Freight

7.3.3. Warehouse

7.3.4. Yard/Dock

8. Global IoT Powered Logistics Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America IoT Powered Logistics Market Analysis and Forecast

9.1. Regional Outlook

9.2. IoT Powered Logistics Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

9.2.1. By Component

9.2.2. By Application

9.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe IoT Powered Logistics Market Analysis and Forecast

10.1. Regional Outlook

10.2. IoT Powered Logistics Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Application

10.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

11. Asia Pacific IoT Powered Logistics Market Analysis and Forecast

11.1. Regional Outlook

11.2. IoT Powered Logistics Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Application

11.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa IoT Powered Logistics Market Analysis and Forecast

12.1. Regional Outlook

12.2. IoT Powered Logistics Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Application

12.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa

13. South America IoT Powered Logistics Market Analysis and Forecast

13.1. Regional Outlook

13.2. IoT Powered Logistics Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Application

13.3. IoT Powered Logistics Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Competitive Landscape by Tier Structure of Companies

14.3. Scale of Competition, 2022

14.4. Scale of Competition at Regional Level, 2022

14.5. Market Revenue Share Analysis/Ranking, by Leading Players (2022)

14.6. List of Startups

14.7. Competition Evolution

14.8. Major Mergers & Acquisitions, Expansions, Partnership, Contracts, Deals, etc.

15. Company Profiles

15.1. Cisco Systems Inc.

15.1.1. Business Overview

15.1.2. Company Revenue

15.1.3. Product Portfolio

15.1.4. Geographic Footprint

15.1.5. Recent Developments

15.1.6. Impact of COVID-19

15.1.7. TMR View

15.1.8. Competitive Threats and Weakness

15.2. NEC Corporation

15.2.1. Business Overview

15.2.2. Company Revenue

15.2.3. Product Portfolio

15.2.4. Geographic Footprint

15.2.5. Recent Developments

15.2.6. Impact of COVID-19

15.2.7. TMR View

15.2.8. Competitive Threats and Weakness

15.3. Intel Corporation

15.3.1. Business Overview

15.3.2. Company Revenue

15.3.3. Product Portfolio

15.3.4. Geographic Footprint

15.3.5. Recent Developments

15.3.6. Impact of COVID-19

15.3.7. TMR View

15.3.8. Competitive Threats and Weakness

15.4. Honeywell International

15.4.1. Business Overview

15.4.2. Company Revenue

15.4.3. Product Portfolio

15.4.4. Geographic Footprint

15.4.5. Recent Developments

15.4.6. Impact of COVID-19

15.4.7. TMR View

15.4.8. Competitive Threats and Weakness

15.5. Oracle Corporation

15.5.1. Business Overview

15.5.2. Company Revenue

15.5.3. Product Portfolio

15.5.4. Geographic Footprint

15.5.5. Recent Developments

15.5.6. Impact of COVID-19

15.5.7. TMR View

15.5.8. Competitive Threats and Weakness

15.6. PTC

15.6.1. Business Overview

15.6.2. Company Revenue

15.6.3. Product Portfolio

15.6.4. Geographic Footprint

15.6.5. Recent Developments

15.6.6. Impact of COVID-19

15.6.7. TMR View

15.6.8. Competitive Threats and Weakness

15.7. SAP SE

15.7.1. Business Overview

15.7.2. Company Revenue

15.7.3. Product Portfolio

15.7.4. Geographic Footprint

15.7.5. Recent Developments

15.7.6. Impact of COVID-19

15.7.7. TMR View

15.7.8. Competitive Threats and Weakness

15.8. Microsoft Corporation

15.8.1. Business Overview

15.8.2. Company Revenue

15.8.3. Product Portfolio

15.8.4. Geographic Footprint

15.8.5. Recent Developments

15.8.6. Impact of COVID-19

15.8.7. TMR View

15.8.8. Competitive Threats and Weakness

15.9. Amazon Web Services

15.9.1. Business Overview

15.9.2. Company Revenue

15.9.3. Product Portfolio

15.9.4. Geographic Footprint

15.9.5. Recent Developments

15.9.6. Impact of COVID-19

15.9.7. TMR View

15.9.8. Competitive Threats and Weakness

15.10. IBM Corporation

15.10.1. Business Overview

15.10.2. Company Revenue

15.10.3. Product Portfolio

15.10.4. Geographic Footprint

15.10.5. Recent Developments

15.10.6. Impact of COVID-19

15.10.7. TMR View

15.10.8. Competitive Threats and Weakness

15.11. Kaa IoT Technologies

15.11.1. Business Overview

15.11.2. Company Revenue

15.11.3. Product Portfolio

15.11.4. Geographic Footprint

15.11.5. Recent Developments

15.11.6. Impact of COVID-19

15.11.7. TMR View

15.11.8. Competitive Threats and Weakness

15.12. Novire Technologies

15.12.1. Business Overview

15.12.2. Company Revenue

15.12.3. Product Portfolio

15.12.4. Geographic Footprint

15.12.5. Recent Developments

15.12.6. Impact of COVID-19

15.12.7. TMR View

15.12.8. Competitive Threats and Weakness

15.13. Others

15.13.1. Business Overview

15.13.2. Company Revenue

15.13.3. Product Portfolio

15.13.4. Geographic Footprint

15.13.5. Recent Developments

15.13.6. Impact of COVID-19

15.13.7. TMR View

15.13.8. Competitive Threats and Weakness

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in IoT Powered Logistics Market

Table 2: North America IoT Powered Logistics Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 3: Europe IoT Powered Logistics Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 4: Asia Pacific IoT Powered Logistics Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 5: Middle East & Africa IoT Powered Logistics Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 6: South America IoT Powered Logistics Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 11: Global IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 12: Global IoT Powered Logistics Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 13: North America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 14: North America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 15: North America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 16: U.S. IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Canada IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Mexico IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Europe IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 20: Europe IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 21: Europe IoT Powered Logistics Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 22: Germany IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: U.K. IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: France IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Italy IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Spain IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Asia Pacific IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 28: Asia Pacific IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 29: Asia Pacific IoT Powered Logistics Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 30: China IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: India IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Japan IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: ASEAN IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Middle East & Africa IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 35: Middle East & Africa IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 36: Middle East & Africa IoT Powered Logistics Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 37: Saudi Arabia IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: United Arab Emirates IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: South Africa IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: South America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 41: South America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 42: South America IoT Powered Logistics Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 43: Brazil IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Argentina IoT Powered Logistics Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: Mergers & Acquisitions, Partnerships (1/2)

Table 46: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global IoT Powered Logistics Market Size (US$ Bn) Forecast, 2018 - 2031

Figure 2: Global IoT Powered Logistics Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of IoT Powered Logistics Market

Figure 4: Global IoT Powered Logistics Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global IoT Powered Logistics Market Attractiveness Assessment, by Component

Figure 6: Global IoT Powered Logistics Market Attractiveness Assessment, by Application

Figure 7: Global IoT Powered Logistics Market Attractiveness Assessment, by Region

Figure 8: Global IoT Powered Logistics Market Revenue (US$ Bn) Historic Trends, 2017 - 2022

Figure 9: Global IoT Powered Logistics Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 - 2022

Figure 10: Global IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 11: Global IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 12: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 13: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 14: Global IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 15: Global IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 16: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 17: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 18: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 19: Global IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 20: Global IoT Powered Logistics Market Opportunity (US$ Bn), by Region

Figure 21: Global IoT Powered Logistics Market Opportunity Share (%), by Region, 2023-2031

Figure 22: Global IoT Powered Logistics Market Size (US$ Bn), by Region, 2023 & 2031

Figure 23: Global IoT Powered Logistics Market Value Share Analysis, by Region, 2023

Figure 24: Global IoT Powered Logistics Market Value Share Analysis, by Region, 2031

Figure 25: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 26: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 27: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 28: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 29: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 30: North America IoT Powered Logistics Market Revenue Opportunity Share, by Component

Figure 31: North America IoT Powered Logistics Market Revenue Opportunity Share, by Application

Figure 32: North America IoT Powered Logistics Market Revenue Opportunity Share, by Country

Figure 33: North America IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 34: North America IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 35: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 36: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 37: North America IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 38: North America IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 39: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 40: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 41: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 42: North America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 43: North America IoT Powered Logistics Market Value Share Analysis, by Country, 2023

Figure 44: North America IoT Powered Logistics Market Value Share Analysis, by Country, 2031

Figure 45: U.S. IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 46: Canada IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 47: Mexico IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 48: Europe IoT Powered Logistics Market Revenue Opportunity Share, by Component

Figure 49: Europe IoT Powered Logistics Market Revenue Opportunity Share, by Application

Figure 50: Europe IoT Powered Logistics Market Revenue Opportunity Share, by Country

Figure 51: Europe IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 52: Europe IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 53: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 54: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 55: Europe IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 56: Europe IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 57: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 58: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 59: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 60: Europe IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 61: Europe IoT Powered Logistics Market Value Share Analysis, by Country, 2023

Figure 62: Europe IoT Powered Logistics Market Value Share Analysis, by Country, 2031

Figure 63: Germany IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 64: U.K. IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 65: France IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 66: Italy IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 67: Spain IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 68: Asia Pacific IoT Powered Logistics Market Revenue Opportunity Share, by Component

Figure 69: Asia Pacific IoT Powered Logistics Market Revenue Opportunity Share, by Application

Figure 70: Asia Pacific IoT Powered Logistics Market Revenue Opportunity Share, by Country

Figure 71: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 72: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 73: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 74: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 75: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 76: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 77: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 78: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 79: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 80: Asia Pacific IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 81: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Country, 2023

Figure 82: Asia Pacific IoT Powered Logistics Market Value Share Analysis, by Country, 2031

Figure 83: China IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 84: India IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 85: Japan IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 86: ASEAN IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 87: Middle East & Africa IoT Powered Logistics Market Revenue Opportunity Share, by Component

Figure 88: Middle East & Africa IoT Powered Logistics Market Revenue Opportunity Share, by Application

Figure 89: Middle East & Africa IoT Powered Logistics Market Revenue Opportunity Share, by Country

Figure 90: Middle East & Africa IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 91: Middle East & Africa IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 92: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 93: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 94: Middle East & Africa IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 95: Middle East & Africa IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 96: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 97: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 98: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 99: Middle East & Africa IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 100: Middle East & Africa East & Africa East & Africa IoT Powered Logistics Market Value Share Analysis, by Country, 2023

Figure 101: Middle East & Africa IoT Powered Logistics Market Value Share Analysis, by Country, 2031

Figure 102: Saudi Arabia IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 103: United Arab Emirates IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 104: South Africa IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 105: South America IoT Powered Logistics Market Revenue Opportunity Share, by Component

Figure 106: South America IoT Powered Logistics Market Revenue Opportunity Share, by Application

Figure 107: South America IoT Powered Logistics Market Revenue Opportunity Share, by Country

Figure 108: South America IoT Powered Logistics Market Value Share Analysis, by Component, 2023

Figure 109: South America IoT Powered Logistics Market Value Share Analysis, by Component, 2031

Figure 110: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 111: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 112: South America IoT Powered Logistics Market Value Share Analysis, by Application, 2023

Figure 113: South America IoT Powered Logistics Market Value Share Analysis, by Application, 2031

Figure 114: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Fleet, 2023 - 2031

Figure 115: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Freight, 2023 - 2031

Figure 116: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Warehouse, 2023 - 2031

Figure 117: South America IoT Powered Logistics Market Absolute Opportunity (US$ Bn), by Yard/Dock, 2023 - 2031

Figure 118: South America IoT Powered Logistics Market Value Share Analysis, by Country, 2023

Figure 119: South America IoT Powered Logistics Market Value Share Analysis, by Country, 2031

Figure 120: Brazil IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 121: Argentina IoT Powered Logistics Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031