Reports

Reports

Analysts’ Viewpoint on Global IoT in Construction Market

Construction companies are increasingly adopting the IoT technology to successfully address common workplace challenges and streamline operations to benefit from enhanced efficiency and improved responsiveness to the increasing demands of the industry. Flat productivity, reduced margins, more schedule overruns, and increased competition are some of the obvious challenges due to which, construction companies are considering implementing the IoT technology and digitalization. Benefits of IoT in construction include offers benefits such as better productivity, maintenance, security, and safety. Moreover, many prominent companies are producing and launching new IoT solutions for the construction industry, which is expected to propel the global market further.

Internet of Things (IoT) is important for digitalization in the construction industry. The term IoT in construction refers to the usage of technical equipment or IoT and modern-day Internet software in the construction process in order to enhance project efficiency. It uses connected sensors and actuators to manage and monitor the environment. The IoT is extremely beneficial to the construction industry. It enables the monitoring and accounting of various assets and people across a traditionally fragmented sector. The integration of IoT with construction equipment, machinery, and devices helps to perform operations efficiently to reduce construction time and effectively utilize resources.

Construction IoT sensors refer to the use of Internet-connected sensors by workers and are placed around project sites. IoT in construction allows for the collection of many types of data regarding activity, conditions, performance on the construction site, and transmission of these information to a central dashboard where data is evaluated to help take informed decisions.

Technology is fast developing. Digital technologies, such as IoT, is transforming the construction industry by providing information that allows more timely maintenance, better parts management, and better machine utilization. As the IoT technology is beginning to mature, the management of construction sites is likely to undergo fundamental changes. IoT has already achieved significant progress in the construction industry, and is expected to significantly improve productivity and safety at work site.

IoT is frequently used with wearable devices to monitor the health and safety of a wide range of people, including elderly, at-risk patients, and employees. Construction workers/employees can be monitored on the job remotely due to IoT. These devices provide construction managers with automatic headcounts, mapping the position of all employees, identifying risks, and transmitting safety alerts. For instance, according to OSHA, in 2018, 21% of worker fatalities occurred in construction. In 2019, 107 employees died at construction sites in France, and over 90,000 accidents occurred. Furthermore, as per the Bureau of Labor Statistics (BLS), a federal agency that collects and disseminates data about the U.S. economy and labor market, in 2020, 1,008 construction workers died in the United States. In 2020, there were 174,100 cases of injuries in the construction sector.

Construction IoT sensors can be embedded in wearables and modified to particular use cases, such as detecting changes in air quality to warn employees that they are approaching a harmful environment; monitoring vitals such as heart rate; warning about malfunctioning equipment before use; and informing about maintenance requirements to avoid accidents and putting construction workers’ at risk.

The construction industry is regulated through deadlines and targets. Construction projects require constant progress to be effective, and experience huge delays and cost overruns when productivity is disrupted. Project delays result in inactive equipment and laborers, which incur expenses even during downtime. IoT solutions for construction can improve productivity by increasing readiness and efficiency.

The late supply of materials often occurs at the site, owing to poor scheduling caused by human error. When an IoT supply unit is equipped with an appropriate sensor, it is possible to automatically estimate the quantity and place orders or raise alarms. Moreover, IoT data aids in scheduling by allowing work activities to be planned and executed in a logical order, thereby, reducing time spent between construction phases.

The applications of IoT in the construction industry offers contractors and supervisors with real-time information about productivity. It can detect periods of high productivity as well as periods of idleness. This data must be collected throughout since it allows managers to make informed decisions about project schedules and scope. Data insights assist managers in scheduling jobs during peak productivity hours to achieve consistent, high-quality outputs, particularly on time-consuming or detail-intensive projects. Therefore, improvement of productivity and safety on site by IoT is expected to increase the demand for IoT in the construction market.

In the global construction industry, government policies are emphasizing on smart construction technologies such as IoT, concerning smartization, productivity improvements, and automation technologies. Additionally, under the initiative of the private sector, smart construction safety technologies (SCSTs) have been developed to ensure worker safety. In terms of international occupational safety, IoT wearable technologies for the construction industry have been developed, and the integrated platform developments required to connect them have become mainstream. For instance, the Indian Government aims to develop connected smart cities using the IoT technology solutions to provide a clean and sustainable environment, core infrastructure, and a better quality of life for its citizens through initiatives such as the Smart City Mission and Digital India.

Moreover, IoT solutions have been developed in India, with emphasis on addressing India-specific issues, necessitating investment to establish an appropriate ecosystem for talent development, capacity building, network and domain-specific standards, and R&D activities. Similar to India, other countries such as the United States, Australia, and Japan have developed IoT technologies in order to accelerate the adoption of smart cities. On the other hand, governments foster an environment wherein InfraTech can thrive. They can encourage innovation and adoption of smart transportation and construction, green energy, and digital governance by implementing a coordinated, national and regional strategy driven by IoT, drones, and other technologies. Thus, government approach toward smart city development is likely to aid in the growth of the market.

The market in North America is anticipated to hold a prominent share by the end of 2022. The penetration of advanced technologies and IoT devices in the construction sector is high in North America as compared to other regions. Additionally, the presence of prominent companies such as Caterpillar, Oracle Corporation, Autodesk, Trimble, Giatec Scientific, Inc., KORE Wireless Group, Losant IoT, and CalAmp is projected to promote IoT technology deployment in the construction industry during the forecast period. Moreover, increasing use of IoT in modular construction and prefabricated buildings in U.S. construction activities is propelling the IoT in construction market in the region.

The market in Europe is expected to grow at the highest CAGR over the forecast period, due to technological developments and increased recovery of residential construction. The market in Europe is projected to hold the largest incremental potential among all regional markets during the forecast period.

The Asia Pacific IoT in construction market is predicated to rise during the forecast period, owing to the significant adoption of new technologies. In addition, rapid urbanization and growth of the construction industry in developing countries such as China, India, Japan, and Singapore are anticipated to drive adoption of IoT technology in the construction industry.

The global market is consolidated with a few large-scale vendors controlling majority of the market share. Most of the firms are spending significant sums of money on comprehensive research and development. Diversification of product portfolios and mergers & acquisitions are the key strategies adopted by market players. AgileVision Sp. Z O.O., Autodesk Inc., CalAmp, DIGITEUM, Giatec Scientific, Inc., Pillar Technologies, Inc., Kore Wireless, Losant IoT, Oracle Corporation, PlanRadar, SIGFOX, Triax Technologies, Trimble Inc., Unearth Technologies, Inc., and Worldsensing, among others are the prominent entities operating in the market. The future of smart construction is bright, as companies such as Trimble, Pillar Technologies, and ES Track, are introducing new IoT solutions for the construction industry in the IoT in construction market.

Each of these players have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.6 Bn |

|

Market Forecast Value in 2031 |

US$ 34 Bn |

|

Growth Rate (CAGR) |

16.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

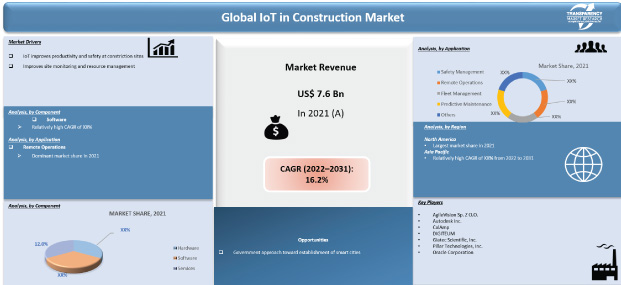

The global market stood over US$ US$ 7.6 Bn in 2021.

The global industry is estimated to grow at a CAGR of 16.2% during the forecast period.

IoT improves productivity and safety at construction sites.

Remote operations application segment accounts for the largest share of the market.

North America is more attractive for vendors in the market.

AgileVision Sp. Z O.O., Autodesk Inc., CalAmp, DIGITEUM, Giatec Scientific, Inc., Pillar Technologies, Inc., Kore Wireless, Losant IoT, Oracle Corporation, PlanRadar, SIGFOX, Triax Technologies, Trimble Inc., Unearth Technologies, Inc., and Worldsensing.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global IoT in Construction Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on IoT in Construction Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Project Type

4.5.3. By Application

5. Global IoT in Construction Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global IoT in Construction Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. IoT in Construction Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global IoT in Construction Market Analysis, by Project Type

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. IoT in Construction Market Size (US$ Bn) Forecast, by Project Type, 2018 - 2031

7.3.1. Commercial

7.3.2. Residential

8. Global IoT in Construction Market Analysis, by Application

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. IoT in Construction Market Size (US$ Bn) Forecast, by Application, 2018 - 2031

8.3.1. Safety Management

8.3.2. Remote Operations

8.3.3. Fleet Management

8.3.4. Predictive Maintenance

8.3.5. Others

9. Global IoT in Construction Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (Tons) (US$ Bn) Forecast by Region, 2018-2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America IoT in Construction Market Analysis and Forecast

10.1. Regional Outlook

10.2. IoT in Construction Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By Project Type

10.2.3. By Application

10.3. IoT in Construction Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe IoT in Construction Market Analysis and Forecast

11.1. Regional Outlook

11.2. IoT in Construction Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Project Type

11.2.3. By Application

11.3. IoT in Construction Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific IoT in Construction Market Analysis and Forecast

12.1. Regional Outlook

12.2. IoT in Construction Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Project Type

12.2.3. By Application

12.3. IoT in Construction Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa IoT in Construction Market Analysis and Forecast

13.1. Regional Outlook

13.2. IoT in Construction Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Project Type

13.2.3. By Application

13.3. IoT in Construction Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. The United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America IoT in Construction Market Analysis and Forecast

14.1. Regional Outlook

14.2. IoT in Construction Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Project Type

14.2.3. By Application

14.3. IoT in Construction Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. AgileVision Sp. Z O.O.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership

16.1.6. Merger & Acquisition

16.1.7. Business Expansion

16.1.8. New Product Launch

16.1.9. Innovation etc.

16.2. Autodesk Inc.

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership

16.2.6. Merger & Acquisition

16.2.7. Business Expansion

16.2.8. New Product Launch

16.2.9. Innovation etc.

16.3. CalAmp

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership

16.3.6. Merger & Acquisition

16.3.7. Business Expansion

16.3.8. New Product Launch

16.3.9. Innovation etc.

16.4. DIGITEUM

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership

16.4.6. Merger & Acquisition

16.4.7. Business Expansion

16.4.8. New Product Launch

16.4.9. Innovation etc.

16.5. Giatec Scientific, Inc.

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership

16.5.6. Merger & Acquisition

16.5.7. Business Expansion

16.5.8. New Product Launch

16.5.9. Innovation etc.

16.6. Pillar Technologies, Inc.

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership

16.6.6. Merger & Acquisition

16.6.7. Business Expansion

16.6.8. New Product Launch

16.6.9. Innovation etc.

16.7. Kore Wireless

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership

16.7.6. Merger & Acquisition

16.7.7. Business Expansion

16.7.8. New Product Launch

16.7.9. Innovation etc.

16.8. Losant IoT

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership

16.8.6. Merger & Acquisition

16.8.7. Business Expansion

16.8.8. New Product Launch

16.8.9. Innovation etc.

16.9. Oracle Corporation

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership

16.9.6. Merger & Acquisition

16.9.7. Business Expansion

16.9.8. New Product Launch

16.9.9. Innovation etc.

16.10. PlanRadar

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership

16.10.6. Merger & Acquisition

16.10.7. Business Expansion

16.10.8. New Product Launch

16.10.9. Innovation etc.

16.11. SIGFOX

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership

16.11.6. Merger & Acquisition

16.11.7. Business Expansion

16.11.8. New Product Launch

16.11.9. Innovation etc.

16.12. Triax Technologies

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership

16.12.6. Merger & Acquisition

16.12.7. Business Expansion

16.12.8. New Product Launch

16.12.9. Innovation etc.

16.13. Trimble Inc.

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership

16.13.6. Merger & Acquisition

16.13.7. Business Expansion

16.13.8. New Product Launch

16.13.9. Innovation etc.

16.14. Unearth Technologies, Inc.

16.14.1. Business Overview

16.14.2. Company Revenue

16.14.3. Product Portfolio

16.14.4. Geographic Footprint

16.14.5. Strategic Partnership

16.14.6. Merger & Acquisition

16.14.7. Business Expansion

16.14.8. New Product Launch

16.14.9. Innovation etc.

16.15. Worldsensing

16.15.1. Business Overview

16.15.2. Company Revenue

16.15.3. Product Portfolio

16.15.4. Geographic Footprint

16.15.5. Strategic Partnership

16.15.6. Merger & Acquisition

16.15.7. Business Expansion

16.15.8. New Product Launch

16.15.9. Innovation etc.

16.16. Others

16.16.1. Business Overview

16.16.2. Company Revenue

16.16.3. Product Portfolio

16.16.4. Geographic Footprint

16.16.5. Strategic Partnership

16.16.6. Merger & Acquisition

16.16.7. Business Expansion

16.16.8. New Product Launch

16.16.9. Innovation etc.

17. Key Takeaways

List of Table

Table 1: Acronyms Used in IoT in Construction Market

Table 2: North America IoT in Construction Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 3: Europe IoT in Construction Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 4: Asia Pacific IoT in Construction Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 5: Middle East & Africa IoT in Construction Market Revenue Analysis, by Country, 2022 and 2031 (US$ Bn)

Table 6: South America IoT in Construction Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 7: Global IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 8: Global IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 9: Global IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 10: Global IoT in Construction Market Volume (US$ Bn) Forecast, by Region, 2018 – 2031

Table 11: North America IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 12: North America IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 13: North America IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 14: North America IoT in Construction Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 15: U.S. IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 16: Canada IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Mexico IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Europe IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 19: Europe IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 20: Europe IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 21: Europe IoT in Construction Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 22: Germany IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: U.K. IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: France IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Italy IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Spain IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Asia Pacific IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 28: Asia Pacific IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 29: Asia Pacific IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 30: Asia Pacific IoT in Construction Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 31: China IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: India IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: Japan IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: ASEAN IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Middle East & Africa IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 36: Middle East & Africa IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 37: Middle East & Africa IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 38: Middle East & Africa IoT in Construction Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 39: Saudi Arabia IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: The United Arab Emirates IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: South Africa IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: South America IoT in Construction Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 43: South America IoT in Construction Market Value (US$ Bn) Forecast, by Project Type, 2018 – 2031

Table 44: South America IoT in Construction Market Value (US$ Bn) Forecast, by Application, 2018 – 2031

Table 45: South America IoT in Construction Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 46: Brazil IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

Table 47: Argentina IoT in Construction Market Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global IoT in Construction Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global IoT in Construction Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of IoT in Construction Market

Figure 4: Global IoT in Construction Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global IoT in Construction Market Attractiveness Assessment, by Component

Figure 6: Global IoT in Construction Market Attractiveness Assessment, by Project Type

Figure 7: Global IoT in Construction Market Attractiveness Assessment, by Application

Figure 8: Global IoT in Construction Market Attractiveness Assessment, by Region

Figure 9: Global IoT in Construction Market Revenue (US$ Bn) Historic Trends, 2016 - 2021

Figure 10: Global IoT in Construction Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 - 2021

Figure 11: Global IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 12: Global IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 13: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 14: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 15: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 16: Global IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 17: Global IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 18: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 19: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 20: Global IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 21: Global IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 22: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 23: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 24: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 25: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 26: Global IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 27: Global IoT in Construction Market Opportunity (US$ Bn), by Region

Figure 28: Global IoT in Construction Market Opportunity Share (%), by Region, 2022–2031

Figure 29: Global IoT in Construction Market Size (US$ Bn), by Region, 2022 & 2031

Figure 30: Global IoT in Construction Market Value Share Analysis, by Region, 2022

Figure 31: Global IoT in Construction Market Value Share Analysis, by Region, 2031

Figure 32: North America IoT in Construction Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 33: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 34: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 35: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 36: South America IoT in Construction Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 37: North America IoT in Construction Market Revenue Opportunity Share, by Component

Figure 38: North America IoT in Construction Market Revenue Opportunity Share, by Project Type

Figure 39: North America IoT in Construction Market Revenue Opportunity Share, by Application

Figure 40: North America IoT in Construction Market Revenue Opportunity Share, by Region

Figure 41: North America IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 42: North America IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 43: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 44: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 45: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 46: North America IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 47: North America IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 48: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 49: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 50: North America IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 51: North America IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 52: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 53: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 54: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 55: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 56: North America IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 57: North America IoT in Construction Market Value Share Analysis, by Country, 2022

Figure 58: North America IoT in Construction Market Value Share Analysis, by Country, 2031

Figure 59: U.S. IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 60: Canada IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 61: Mexico IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 62: Europe IoT in Construction Market Revenue Opportunity Share, by Component

Figure 63: Europe IoT in Construction Market Revenue Opportunity Share, by Project Type

Figure 64: Europe IoT in Construction Market Revenue Opportunity Share, by Application

Figure 65: Europe IoT in Construction Market Revenue Opportunity Share, by Region

Figure 66: Europe IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 67: Europe IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 68: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 69: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 70: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 71: Europe IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 72: Europe IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 73: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 74: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 75: Europe IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 76: Europe IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 77: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 78: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 79: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 80: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 81: Europe IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 82: Europe IoT in Construction Market Value Share Analysis, by Country, 2022

Figure 83: Europe IoT in Construction Market Value Share Analysis, by Country, 2031

Figure 84: Germany IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 85: U.K. IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 86: France IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 87: Italy IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 88: Spain IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 89: Asia Pacific IoT in Construction Market Revenue Opportunity Share, by Component

Figure 90: Asia Pacific IoT in Construction Market Revenue Opportunity Share, by Project Type

Figure 91: Asia Pacific IoT in Construction Market Revenue Opportunity Share, by Application

Figure 92: Asia Pacific IoT in Construction Market Revenue Opportunity Share, by Region

Figure 93: Asia Pacific IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 94: Asia Pacific IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 95: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 96: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 97: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 98: Asia Pacific IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 99: Asia Pacific IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 100: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 101: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 102: Asia Pacific IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 103: Asia Pacific IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 104: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 105: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 106: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 107: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 108: Asia Pacific IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 109: Asia Pacific IoT in Construction Market Value Share Analysis, by Country, 2022

Figure 110: Asia Pacific IoT in Construction Market Value Share Analysis, by Country, 2031

Figure 111: China IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 112: India IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 113: Japan IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 114: ASEAN IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 115: Middle East & Africa IoT in Construction Market Revenue Opportunity Share, by Component

Figure 116: Middle East & Africa IoT in Construction Market Revenue Opportunity Share, by Project Type

Figure 117: Middle East & Africa IoT in Construction Market Revenue Opportunity Share, by Application

Figure 118: Middle East & Africa IoT in Construction Market Revenue Opportunity Share, by Region

Figure 119: Middle East & Africa IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 120: Middle East & Africa IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 121: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 122: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 123: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 124: Middle East & Africa IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 125: Middle East & Africa IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 126: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 127: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 128: Middle East & Africa IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 129: Middle East & Africa IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 130: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 131: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 132: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 133: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 134: Middle East & Africa IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 135: Middle East & Africa IoT in Construction Market Value Share Analysis, by Country, 2022

Figure 136: Middle East & Africa IoT in Construction Market Value Share Analysis, by Country, 2031

Figure 137: Saudi Arabia IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 138: The United Arab Emirates IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 139: South Africa IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 140: South America IoT in Construction Market Revenue Opportunity Share, by Component

Figure 141: South America IoT in Construction Market Revenue Opportunity Share, by Project Type

Figure 142: South America IoT in Construction Market Revenue Opportunity Share, by Application

Figure 143: South America IoT in Construction Market Revenue Opportunity Share, by Region

Figure 144: South America IoT in Construction Market Value Share Analysis, by Component, 2022

Figure 145: South America IoT in Construction Market Value Share Analysis, by Component, 2031

Figure 146: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 147: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 148: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 149: South America IoT in Construction Market Value Share Analysis, by Project Type, 2022

Figure 150: South America IoT in Construction Market Value Share Analysis, by Project Type, 2031

Figure 151: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Commercial, 2022 – 2031

Figure 152: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Residential, 2022 – 2031

Figure 153: South America IoT in Construction Market Value Share Analysis, by Application, 2022

Figure 154: South America IoT in Construction Market Value Share Analysis, by Application, 2031

Figure 155: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Safety Management, 2022 – 2031

Figure 156: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Remote Operations, 2022 – 2031

Figure 157: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Fleet Management, 2022 – 2031

Figure 158: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Predictive Maintenance, 2022 – 2031

Figure 159: South America IoT in Construction Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 160: South America IoT in Construction Market Value Share Analysis, by Country, 2022

Figure 161: South America IoT in Construction Market Value Share Analysis, by Country, 2031

Figure 162: Brazil IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 163: Argentina IoT in Construction Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031