Reports

Reports

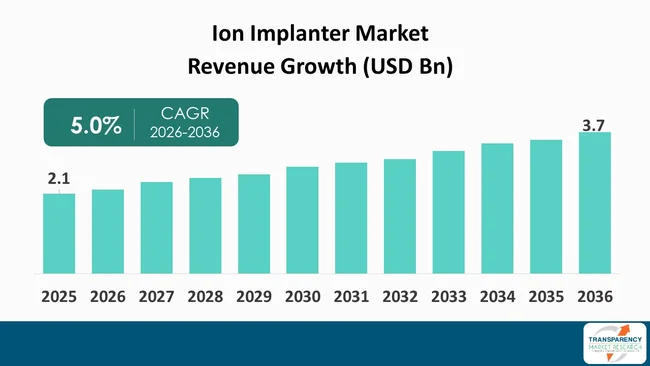

The global ion implanter market was valued at US$ 2.1 Bn in 2025 and is projected to reach US$ 3.7 Bn by 2036, expanding at a CAGR of 5.0% from 2026 to 2036. The market growth is driven by expansion of semiconductor manufacturing capacity and technology node advancement, and rising demand for consumer electronics, automotive electronics, and power semiconductors.

The ion implanter market is robust and driven by the rising semiconductor capacity expansion, advanced node migration, and device complexity. The Asia Pacific’s market continues to be the leading driver, boosted by massive wafer fab production and continued investment in memory, logic, and power semiconductors. The North American and European markets are gaining traction through select government-supported capital investment and an increasing interest in SiC and GaN power devices for electric vehicles, solar, and industrial applications.

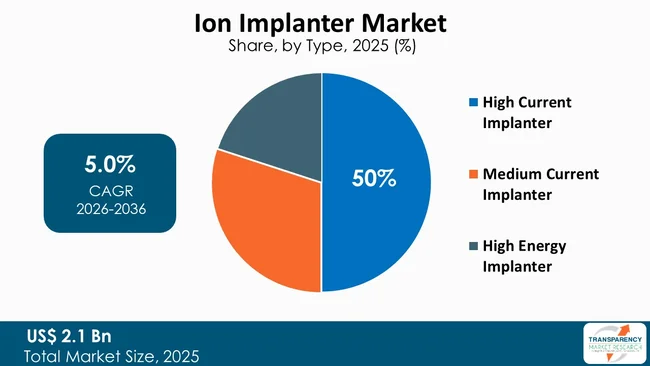

The high current implanter has maintained its biggest market share due to their need in production. High energy implanters remain of interest due to increasing production of wide-bandgap semiconductors. The demand for equipment in electronics, automotive, and power devices keeps gaining momentum, driven by increased silicon content per device and reliability requirements.

Axcelis Technologies, Applied Materials, and the other leaders continue to build their competitive platforms through innovative technological and aftermarket leadership, driven by fab requirements for process throughput, accuracy, and reliability in ion implanter technology.

Ion implanters are sophisticated semiconductor manufacturing tools that can alter the electrical, structural, and physical characteristics of materials by bombarding ionized dopants at high velocity into the surface of a substrate material. Technology enables controlled doses of implantation of high-purity ions like boron, phosphorus, arsenic, or specialized varieties into silicon, SiC, GaN semiconductors, and the other semiconductor materials to create custom-made junctions, control conductivity levels, and optimize performance in semiconductor devices.

Ion implanters involve sophisticated processes like ion generation, mass separation, acceleration of ion beams to desired energy levels using fusion technology, followed by raster scanning of beams controlled by precision dosing systems to deliver highly accurate implant depth, concentration, and uniformity to semiconductor materials during the implanting procedure. Their application areas extend to logic chips, memory chips production, power semiconductors, image sensors, LEDs, display panels, semiconductor materials that require highly sophisticated, advanced semiconductor devices to be designed in chips during high current, medium current, high energy implanting procedures using modern ion implanters designed in sophisticated ways to address ultra-clean processes during semiconductor production cycles.

| Attribute | Detail |

|---|---|

| Ion implanter Market Drivers |

|

Increasing the global fab capacities and developments toward more sophisticated technology scales are the major propellers of the ion implanter market. Leading volume fabs are increasingly investing in new capacity additions, with new fabs being set up by multiple companies, especially in the Asia Pacific, North American, and European regions. Examples include the announcement of more than 20 major fab expansions and new installations worldwide since 2022, with many targeting advanced technology scales at or below 10 nm, power electronics, and special devices.

More advanced semiconductor technology scales necessitate dozens of ion implantation steps per wafer with much higher resolution, dose accuracy, and uniformity, causing the overall requirement to enhance high-current, medium current, and high-energy implant equipment. Besides, the additional volume growth through power devices, SiC, GaN semiconductors, logic ICs, image sensors, and memory devices directly fuels equipment installations.

Technological shifts toward AI computing, HPC, electric vehicles, and 5G also collectively accelerate the spending curve on implanter technology. Taken together, new wafer fab capacity expansions and new technology scaling developments greatly enhance the overall need for highly advanced high-throughput implanter equipment installations worldwide.

Increasing demand from consumer electronics, automotive electronics, and power semiconductors is a significant driving force in the ion implanter market. Smartphones, wearable devices, gaming consoles, and home appliances combined support billions of semiconductors in a single year, with sophisticated devices featuring complex chips requiring complex doping and implantation techniques involving a large number of precision ion implantation steps.

In automotive electronics, a significant boost in electric vehicles and ADAS technology using semiconductors to a large extent leads to over 2,000 to 3,000 semiconductors being used in a single electric vehicle, whereas power semiconductors demand is rising exponentially with the advent of new SiC and GaN semiconductors, leading to efficient energy conversion in electric vehicles and renewable energy power stations worldwide.

SiC production is rising at an annual compounding rate of over 25%, thus directly triggering a demand for precise ion implantation equipment. Increasing complexity in modern electronics is triggering demand for advanced ion implant equipment in fabs to support complex semantics in semiconductors confirms the demand for ion implanters in semiconductors.

The high current implanter type is currently exhibiting the largest market share within the global ion implanter market, with an approximate share of 50% or more, due to its prime importance in volume semiconductor production. High current implanters are commonly employed in shallow junction dosing, source/drain, and contact doping applications and thus play an important part in volume production of logic ICs, memory, power semiconductors, and image sensors.

These implanters may have high beam currents above tens of milliamperes. This is necessary in high-volume production within modern fabrication facilities with annual handling capacity of hundreds of thousands of wafers. At present, these implanters are widely distributed across large fabrication facilities in Asia Pacific, North America, and mainland Europe. These developments are credited to an increasing requirement within these regions for consumable electronics that include smartphones, data centers, electric vehicle electronics, and industrial power electronics.

High current implanters thus have applications within next-generation semiconductor technology below 10 nm with a prime requirement within SiC or GaN technology, where dose accuracy is an essential criterion. Increasing semiconductor production worldwide renders these implanters necessary in overall imperatively driven semiconductor manufacturing.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific’s ion implanter market is at forefront in terms of global presence due to its leading role in global semiconductor production in China, Taiwan, South Korea, and Japan. These four nations alone contribute over 50% of global semiconductor production. The region is home to world-leading foundries and memory manufacturers with multiple multi-billion-dollar expansion initiatives of existing fabs in progress. Such a trend fuels the ever-increasing demand in the market for high-current, medium-current, and high-energy ion implanters.

Next comes North America, with substantial investments in the U.S. semiconductors industry aided by efforts such as the CHIPS and Science Act, which has spurred over US$ 200 Bn in the form of new fab investments. This, in turn, fuels demand in the global ion implanter market for advanced ion implant equipment used in logic chips, AI chips, and HPC chips.

Europe follows in terms of demand in this global market due to its rapid automotive electronics, power semiconductors, and industrial semiconductor manufacturing, most of which occurs in Germany, The Netherlands, and France. Europe is particularly a leader in world SiC and GaN power electronics in electric vehicles, renewable energy, and power grid applications, ensuring a pivotal role in ion implanter demand within the global ion implanter market.

Axcelis Technologies has emerged as one of the prominent players in the ion implanter market, with leading shares in high current, medium current, and high energy ion implanter segments. The company has been aided by its huge existing installed base of products in many prominent fabs across Asia Pacific, North America, and Europe, especially for logic, memory, and power device production. Axcelis Technologies is competitive in SiC power devices, for which growth rates are rising sharply.

Applied Materials, through its Varian Semiconductor Equipment division, holds one of the most commanding market shares within the global ion implanter market. It serves most top-tier international foundries and IDMs. The company retains significant inroads into advanced node fabrication, specialized device platforms, and high-performance semiconductor manufacturing. In addition, its implanter systems are highly deployed in both logic and memory, as well as power semiconductor fabrication.

Some of the deployments include high-volume installations across key regional semiconductor strongholds. The broad-based system capabilities, reliability, and deep integration with key global semiconductor manufacturing systems underpin Applied Materials' market strength in many respects.

Nissin Ion Equipment Co. Ltd, Sumitomo Heavy Industries Ion Technology Co., Ltd., INTEVAC, Inc, Kingstone Semiconductor Joint Stock Company Ltd, ULVAC, High Voltage Engineering Europa B.V., Advanced Ion Beam Technology Inc., and Amtech Systems Inc are some of the other companies in the global Ion implanter industry. Each of these players has been profiled in the Ion implanter market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 | US$ 2.1 Bn |

| Market Forecast Value in 2035 | US$ 3.7 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value & Units for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, ion implanter market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The ion implanter market was valued at US$ 2.1 Bn in 2025

The ion implanter industry is expected to grow at a CAGR of 5.0% from 2026 to 2036

Expansion of semiconductor manufacturing capacity and technology node advancement, and rising demand for consumer electronics, automotive electronics, and power semiconductors

High current implanter was the largest type segment in the ion implanter market.

Asia Pacific was the most lucrative region in 2025

Axcelis, Applied Materials, Inc, Nissin Ion Equipment Co. Ltd, Sumitomo Heavy Industries Ion Technology Co., Ltd., INTEVAC, Inc, Kingstone Semiconductor Joint Stock Company Ltd, ULVAC, High Voltage Engineering Europa B.V., Advanced Ion Beam Technology Inc., and Amtech Systems Inc are the major companies in the global ion implanter market.

Table 1 Global Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 2 Global Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 3 Global Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 4 Global Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 5 Global Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 6 Global Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 7 Global Ion Implanter Market Volume (Units) Forecast, by Region, 2026 to 2036

Table 8 Global Ion Implanter Market Value (US$ Bn) Forecast, by Region, 2026 to 2036

Table 9 North America Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 10 North America Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 11 North America Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 12 North America Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 13 North America Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 14 North America Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 15 North America Ion Implanter Market Volume (Units) Forecast, by Country, 2026 to 2036

Table 16 North America Ion Implanter Market Value (US$ Bn) Forecast, by Country, 2026 to 2036

Table 17 U.S. Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 18 U.S. Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 19 U.S. Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 20 U.S. Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 21 U.S. Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 22 U.S. Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 23 Canada Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 24 Canada Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 25 Canada Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 26 Canada Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 27 Canada Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 28 Canada Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 29 Europe Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 30 Europe Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 31 Europe Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 32 Europe Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 33 Europe Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 34 Europe Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 35 Europe Ion Implanter Market Volume (Units) Forecast, by Country and Sub-region, 2026 to 2036

Table 36 Europe Ion Implanter Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 37 Germany Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 38 Germany Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 39 Germany Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 40 Germany Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 41 Germany Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 42 Germany Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 43 France Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 44 France Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 45 France Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 46 France Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 47 France Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 48 France Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 49 U.K. Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 50 U.K. Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 51 U.K. Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 52 U.K. Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 53 U.K. Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 54 U.K. Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 55 Italy Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 56 Italy Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 57 Italy Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 58 Italy Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 59 Italy Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 60 Italy Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 61 Spain Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 62 Spain Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 63 Spain Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 64 Spain Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 65 Spain Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 66 Spain Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 67 Russia & CIS Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 68 Russia & CIS Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 69 Russia & CIS Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 70 Russia & CIS Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 71 Russia & CIS Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 72 Russia & CIS Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 73 Rest of Europe Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 74 Rest of Europe Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 75 Rest of Europe Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 76 Rest of Europe Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 77 Rest of Europe Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 78 Rest of Europe Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 79 Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 80 Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 81 Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 82 Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 83 Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 84 Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 85 Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Country and Sub-region, 2026 to 2036

Table 86 Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 87 China Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 88 China Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 89 China Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 90 China Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 91 China Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 92 China Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 93 Japan Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 94 Japan Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 95 Japan Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 96 Japan Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 97 Japan Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 98 Japan Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 99 India Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 100 India Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 101 India Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 102 India Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 103 India Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 104 India Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 105 India Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 106 India Ion Implanter Market Value (US$ Bn) Forecast, by Application 2026 to 2036

Table 107 ASEAN Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 108 ASEAN Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 109 ASEAN Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 110 ASEAN Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 111 ASEAN Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 112 ASEAN Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 113 Rest of Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 114 Rest of Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 115 Rest of Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 116 Rest of Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 117 Rest of Asia Pacific Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 118 Rest of Asia Pacific Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 119 Latin America Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 120 Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 121 Latin America Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 122 Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 123 Latin America Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 124 Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 125 Latin America Ion Implanter Market Volume (Units) Forecast, by Country and Sub-region, 2026 to 2036

Table 126 Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 127 Brazil Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 128 Brazil Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 129 Brazil Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 130 Brazil Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 131 Brazil Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 132 Brazil Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 133 Mexico Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 134 Mexico Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 135 Mexico Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 136 Mexico Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 137 Mexico Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 138 Mexico Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 139 Rest of Latin America Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 140 Rest of Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 141 Rest of Latin America Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 142 Rest of Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 143 Rest of Latin America Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 144 Rest of Latin America Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 145 Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 146 Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 147 Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 148 Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 149 Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 150 Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 151 Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Country and Sub-region, 2026 to 2036

Table 152 Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 153 GCC Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 154 GCC Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 155 GCC Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 156 GCC Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 157 GCC Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 158 GCC Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 159 South Africa Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 160 South Africa Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 161 South Africa Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 162 South Africa Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 163 South Africa Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 164 South Africa Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 165 Rest of Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Technology, 2026 to 2036

Table 166 Rest of Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Technology, 2026 to 2036

Table 167 Rest of Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Type, 2026 to 2036

Table 168 Rest of Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Type, 2026 to 2036

Table 169 Rest of Middle East & Africa Ion Implanter Market Volume (Units) Forecast, by Application, 2026 to 2036

Table 170 Rest of Middle East & Africa Ion Implanter Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Figure 1 Global Ion Implanter Market Value Share Analysis, by Technology, 2025, 2029, and 2036

Figure 2 Global Ion Implanter Market Attractiveness, by Technology,

Figure 3 Global Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 4 Global Ion Implanter Market Attractiveness, by Type

Figure 5 Global Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 6 Global Ion Implanter Market Attractiveness, by Application

Figure 7 Global Ion Implanter Market Value Share Analysis, by Region, 2025, 2029, and 2036

Figure 8 Global Ion Implanter Market Attractiveness, by Region

Figure 9 North America Ion Implanter Market Value Share Analysis, by Technology, , 2025, 2029, and 2036

Figure 10 North America Ion Implanter Market Attractiveness, by Technology,

Figure 11 North America Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 12 North America Ion Implanter Market Attractiveness, by Type

Figure 13 North America Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 14 North America Ion Implanter Market Attractiveness, by Application

Figure 15 North America Ion Implanter Market Attractiveness, by Country and Sub-region

Figure 16 Europe Ion Implanter Market Value Share Analysis, by Technology, , 2025, 2029, and 2036

Figure 17 Europe Ion Implanter Market Attractiveness, by Technology,

Figure 18 Europe Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 19 Europe Ion Implanter Market Attractiveness, by Type

Figure 20 Europe Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 21 Europe Ion Implanter Market Attractiveness, by Application

Figure 22 Europe Ion Implanter Market Value Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 23 Europe Ion Implanter Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Ion Implanter Market Value Share Analysis, by Technology, , 2025, 2029, and 2036

Figure 25 Asia Pacific Ion Implanter Market Attractiveness, by Technology,

Figure 26 Asia Pacific Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 27 Asia Pacific Ion Implanter Market Attractiveness, by Type

Figure 28 Asia Pacific Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 29 Asia Pacific Ion Implanter Market Attractiveness, by Application

Figure 30 Asia Pacific Ion Implanter Market Value Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 31 Asia Pacific Ion Implanter Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Ion Implanter Market Value Share Analysis, by Technology, , 2025, 2029, and 2036

Figure 33 Latin America Ion Implanter Market Attractiveness, by Technology,

Figure 34 Latin America Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 35 Latin America Ion Implanter Market Attractiveness, by Type

Figure 36 Latin America Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 37 Latin America Ion Implanter Market Attractiveness, by Application

Figure 38 Latin America Ion Implanter Market Value Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 39 Latin America Ion Implanter Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Ion Implanter Market Value Share Analysis, by Technology, , 2025, 2029, and 2036

Figure 41 Middle East & Africa Ion Implanter Market Attractiveness, by Technology,

Figure 42 Middle East & Africa Ion Implanter Market Value Share Analysis, by Type, 2025, 2029, and 2036

Figure 43 Middle East & Africa Ion Implanter Market Attractiveness, by Type

Figure 44 Middle East & Africa Ion Implanter Market Value Share Analysis, by Application, 2025, 2029, and 2036

Figure 45 Middle East & Africa Ion Implanter Market Attractiveness, by Application

Figure 46 Middle East & Africa Ion Implanter Market Value Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 47 Middle East & Africa Ion Implanter Market Attractiveness, by Country and Sub-region