Reports

Reports

Analysts’ Viewpoint

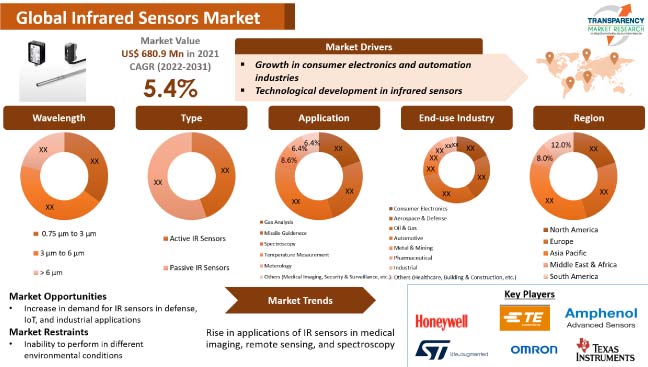

Increase in application of infrared sensors in various end-use industries such as consumer electronics, aerospace & defense, oil & gas, automotive, metal & mining, and pharmaceutical is fueling market statistics. Infrared sensors are widely used in consumer electronic products such as smartphones and cameras. Rise in adoption of reliable and flexible IR sensors in healthcare devices, spectroscopes, and thermal meters is augmenting the demand for these devices.

Growth in penetration of technologies such as Industry 4.0, additive manufacturing, 3D printing, Internet of Things (IoT), and nanotechnology is contributing to the infrared sensors market growth. Key players are launching new products based on recent innovations in technology in order to gain lucrative opportunities.

IR (infrared) sensor specifications include its type, package/case, mounting style, and minimum & maximum operating temperature. Several infrared sensor manufacturers and suppliers are engaged in the manufacture of infrared sensor components such as IR LED, photodiode, wires, and PCBs. IR sensors can be used in appliances such as televisions, air conditioners, and vacuum cleaners.

Rise in application of infrared sensors in smartphones, smart cameras, and autonomous vehicles is anticipated to positively impact market progress in the near future. Key companies are developing innovative products to gain revenue benefits. In June 2021, TAKEX EUROPE LTD, a leading Japan-based manufacturer of active and passive infrared perimeter intruder detection sensors, announced the launch of a new 12m x 180° triple detection outdoor PIR and microwave sensor based on the anti-masking technology.

High humidity, constantly changing temperature, and dusty atmosphere cause issues in infrared sensors. Infrared sensors detect images that are often based on the temperature variants of the object. They cannot detect differences in objects that have a similar temperature range. Often, this leads to inaccuracy.

Infrared sensors cannot work efficiently if the emitter’s photocell directly faces the sunlight. They are more suitable with short-range communications and have lower data transmission rate compared to their wired counterparts. Thus, inability to perform in different environmental conditions is a key market limitation.

Infrared sensors are extensively used in military & defense and IoT applications, owing to their flexibility, low power consumption, cost-efficiency, and lightweight properties. They help detect infrared light from far away. These sensors operate in real-time and detect movements. Therefore, they are ideal for security purposes.

Infrared sensors help increase situational awareness of the operator by providing the ability to recognize sea, land, and waterway features and contact patrol craft and small boats near shore environments, where surface radar performance is limited.

IoT applications for these devices include medical equipment, home appliances with temperature control, non-contact temperature measurements, movement detection, and body temperature measurement. Additionally, IR sensors are significantly used in smart home applications.

Infrared sensors are used to detect motion and measure heat when integrated with smart electronic devices. Growth in demand for consumer electronics products, including smart televisions, smartphones, and tablets, is projected to propel the market in the next few years. Increase in usage of passive infrared motion sensors in consumer electronics is also driving the global IR sensors market.

Rise in popularity of wearable technology is expected to fuel the demand for infrared sensors in the consumer electronics segment during the forecast period. Increase in application of IR sensors in the automation industry is another significant factor driving the infrared sensors market share. Pyroelectric integrated circuit sensors are widely used in motion sensing, industrial climate control, and temperature-change sensor applications.

North America is expected to dominate the global infrared sensors market during the forecast period, owing to the rise in demand for infrared sensors in medical imaging, consumer electronic appliances, and security and surveillance systems in the region. Furthermore, digitalization and industrialization; increase in penetration of Internet of Things (IoT); and rise in investment in industry 4.0 & 5.0 and advanced factory automation are some of the key factors projected to fuel infrared sensors market development in North America.

IR sensors are also employed in research labs and businesses for simulation and modeling in diverse applications, including autonomous driving and product design & manufacturing. This is further augmenting market expansion in North America.

The infrared sensors market in Asia Pacific is expected to grow at a rapid pace during the forecast period. IR sensors are widely used in medical devices, electronic home appliances, and electronic toys in the region. Asia Pacific infrared sensors industry growth can be ascribed to the rise in demand for IR sensors in motion sensing applications such as intruder alarms, automatic ticket gates, entryway lighting, security lighting, and automated sinks/toilet flusher.

The market for infrared sensors is fragmented, with a small number of large-scale vendors controlling majority of the share. Most of the companies are focusing on developing innovative products such as passive infrared sensors, IR temperature sensors, infrared motion sensors, and infrared proximity sensors. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players.

Leading players operating in the global infrared sensors market include Amphenol Corporation, Excelitas Technologies, Flir Systems, Inc., Hamamatsu Photonics K.K., Honeywell International Inc., InfraTec GmbH, KEMET Electronics Corporation (Yageo Group), Murata Manufacturing Co., Ltd, Omron Corporation, Raytheon Company, Teledyne Technologies, Texas Instruments Incorporated, and STMicroelectronics.

The global infrared sensors market research report profiles key players in terms of product portfolio, recent developments, company overview, financial overview, business strategies, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 680.9 Mn |

|

Market Forecast Value in 2031 |

US$ 1.1 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 680.9 Mn in 2021

It is expected to grow at a CAGR of 5.4% from 2022 to 2031

It is likely to reach 1.1 Bn by 2031

Growth in consumer electronics and automation industries, and technological development in infrared sensors

North America was a more lucrative region for vendors in 2021

Honeywell International Inc., InfraTec GmbH, KEMET Electronics Corporation (Yageo Group), Murata Manufacturing Co., Ltd, Omron Corporation, Raytheon Company, and Teledyne Technologies

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Infrared Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Sensor Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Infrared Sensors Market Analysis By Wavelength

5.1. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

5.1.1. 0.75 µm to 3 µm

5.1.2. 3 µm to 6 µm

5.1.3. > 6 µm

5.2. Market Attractiveness Analysis, By Wavelength

6. Global Infrared Sensors Market Analysis By Type

6.1. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2017–2031

6.1.1. Passive IR Sensors

6.1.2. Active IR Sensors

6.2. Market Attractiveness Analysis, By Type

7. Global Infrared Sensors Market Analysis By Mounting

7.1. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

7.1.1. Through-hole

7.1.2. SMT

7.2. Market Attractiveness Analysis, By Mounting

8. Global Infrared Sensors Market Analysis By Application

8.1. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

8.1.1. Gas Analysis

8.1.2. Missile Guidance

8.1.3. Spectroscopy

8.1.4. Temperature Measurement

8.1.5. Meteorology

8.1.6. Remote Sensing

8.1.7. Others

8.2. Market Attractiveness Analysis, By Application

9. Global Infrared Sensors Market Analysis By End-use Industry

9.1. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

9.1.1. Consumer Electronics

9.1.2. Aerospace & Defense

9.1.3. Oil & Gas

9.1.4. Automotive

9.1.5. Metal & Mining

9.1.6. Pharmaceutical

9.1.7. Industrial

9.1.8. Others

9.2. Market Attractiveness Analysis, By End-use Industry

10. Global Infrared Sensors Market Analysis and Forecast, By Region

10.1. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Infrared Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

11.3.1. 0.75 µm to 3 µm

11.3.2. 3 µm to 6 µm

11.3.3. > 6 µm

11.4. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

11.4.1. Passive IR Sensors

11.4.2. Active IR Sensors

11.5. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

11.5.1. Through-hole

11.5.2. SMT

11.6. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.6.1. Gas Analysis

11.6.2. Missile Guidance

11.6.3. Spectroscopy

11.6.4. Temperature Measurement

11.6.5. Meteorology

11.6.6. Others

11.7. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

11.7.1. Consumer Electronics

11.7.2. Aerospace & Defense

11.7.3. Oil & Gas

11.7.4. Automotive

11.7.5. Metal & Mining

11.7.6. Pharmaceutical

11.7.7. Industrial

11.7.8. Others

11.8. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Wavelength

11.9.2. By Type

11.9.3. By Mounting

11.9.4. By Application

11.9.5. By End-use Industry

11.9.6. By Country/Sub-region

12. Europe Infrared Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

12.3.1. 0.75 µm to 3 µm

12.3.2. 3 µm to 6 µm

12.3.3. > 6 µm

12.4. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

12.4.1. Passive IR Sensors

12.4.2. Active IR Sensors

12.5. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

12.5.1. Through-hole

12.5.2. SMT

12.6. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.6.1. Gas Analysis

12.6.2. Missile Guidance

12.6.3. Spectroscopy

12.6.4. Temperature Measurement

12.6.5. Meteorology

12.6.6. Others

12.7. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

12.7.1. Consumer Electronics

12.7.2. Aerospace & Defense

12.7.3. Oil & Gas

12.7.4. Automotive

12.7.5. Metal & Mining

12.7.6. Pharmaceutical

12.7.7. Industrial

12.7.8. Others

12.8. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.8.1. The U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Wavelength

12.9.2. By Type

12.9.3. By Mounting

12.9.4. By Application

12.9.5. By End-use Industry

12.9.6. By Country/Sub-region

13. Asia Pacific Infrared Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

13.3.1. 0.75 µm to 3 µm

13.3.2. 3 µm to 6 µm

13.3.3. > 6 µm

13.4. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

13.4.1. Passive IR Sensors

13.4.2. Active IR Sensors

13.5. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

13.5.1. Through-hole

13.5.2. SMT

13.6. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.6.1. Gas Analysis

13.6.2. Missile Guidance

13.6.3. Spectroscopy

13.6.4. Temperature Measurement

13.6.5. Meteorology

13.6.6. Others

13.7. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

13.7.1. Consumer Electronics

13.7.2. Aerospace & Defense

13.7.3. Oil & Gas

13.7.4. Automotive

13.7.5. Metal & Mining

13.7.6. Pharmaceutical

13.7.7. Industrial

13.7.8. Others

13.8. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Wavelength

13.9.2. By Type

13.9.3. By Mounting

13.9.4. By Application

13.9.5. By End-use Industry

13.9.6. By Country/Sub-region

14. Middle East & Africa Infrared Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

14.3.1. 0.75 µm to 3 µm

14.3.2. 3 µm to 6 µm

14.3.3. > 6 µm

14.4. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

14.4.1. Passive IR Sensors

14.4.2. Active IR Sensors

14.5. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

14.5.1. Through-hole

14.5.2. SMT

14.6. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

14.6.1. Gas Analysis

14.6.2. Missile Guidance

14.6.3. Spectroscopy

14.6.4. Temperature Measurement

14.6.5. Meteorology

14.6.6. Others

14.7. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

14.7.1. Consumer Electronics

14.7.2. Aerospace & Defense

14.7.3. Oil & Gas

14.7.4. Automotive

14.7.5. Metal & Mining

14.7.6. Pharmaceutical

14.7.7. Industrial

14.7.8. Others

14.8. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Wavelength

14.9.2. By Type

14.9.3. By Mounting

14.9.4. By Application

14.9.5. By End-use Industry

14.9.6. By Country/Sub-region

15. South America Infrared Sensors Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Wavelength, 2017–2031

15.3.1. 0.75 µm to 3 µm

15.3.2. 3 µm to 6 µm

15.3.3. > 6 µm

15.4. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Type, 2017–2031

15.4.1. Passive IR Sensors

15.4.2. Active IR Sensors

15.5. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Mounting, 2017–2031

15.5.1. Through-hole

15.5.2. SMT

15.6. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

15.6.1. Gas Analysis

15.6.2. Missile Guidance

15.6.3. Spectroscopy

15.6.4. Temperature Measurement

15.6.5. Meteorology

15.6.6. Others

15.7. Infrared Sensors Market Size (US$ Mn) Analysis & Forecast, By End-use Industry, 2017–2031

15.7.1. Consumer Electronics

15.7.2. Aerospace & Defense

15.7.3. Oil & Gas

15.7.4. Automotive

15.7.5. Metal & Mining

15.7.6. Pharmaceutical

15.7.7. Industrial

15.7.8. Others

15.8. Infrared Sensors Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Wavelength

15.9.2. By Type

15.9.3. By Mounting

15.9.4. By Application

15.9.5. By End-use Industry

15.9.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Infrared Sensors Market Competition Matrix - a Dashboard View

16.1.1. Global Infrared Sensors Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Amphenol Corporation

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Excelitas Technologies

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Flir Systems, Inc.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Hamamatsu Photonics K.K.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Honeywell International Inc.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. InfraTec GmbH

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. KEMET Electronics Corporation (Yageo Group)

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Murata Manufacturing Co., Ltd

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Omron Corporation

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Raytheon Company

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Teledyne Technologies

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Texas Instruments Incorporated

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. STMicroelectronics

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Wavelength

18.1.2. By Type

18.1.3. By Mounting

18.1.4. By Application

18.1.5. By End-use Industry

18.1.6. By Country/Sub-region

List of Tables

Table 01: Global Infrared Sensors Market Size & Forecast, by Wavelength, Value (US$ Mn), 2017–2031

Table 02: Global Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 03: Global Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 04: Global Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 05: Global Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 06: Global Infrared Sensors Market Size & Forecast, by Region, Value (US$ Mn), 2017–2031

Table 07: North America Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 08: North America Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 09: North America Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 10: North America Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 11: North America Infrared Sensors Market Size & Forecast, by Country, Value (US$ Mn), 2017–2031

Table 12: Europe Infrared Sensors Market Size & Forecast, by Wavelength, Value (US$ Mn), 2017–2031

Table 13: Europe Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 14: Europe Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 15: Europe Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 16: Europe Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 17: Europe Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 18: Asia Pacific Infrared Sensors Market Size & Forecast, by Wavelength, Value (US$ Mn), 2017–2031

Table 19: Asia Pacific Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 20: Asia Pacific Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 21: Asia Pacific Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 22: Asia Pacific Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 23: Asia Pacific Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 24: Middle East & Africa Infrared Sensors Market Size & Forecast, by Wavelength, Value (US$ Mn), 2017–2031

Table 25: Middle East & Africa Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 26: Middle East & Africa Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 27: Middle East & Africa Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 28: Middle East & Africa Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 29: Middle East & Africa (MEA) Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

Table 30: South America Infrared Sensors Market Size & Forecast, by Wavelength, Value (US$ Mn), 2017–2031

Table 31: South America Infrared Sensors Market Size & Forecast, by Wavelength, Volume (Million Units), 2017–2031

Table 32: South America Infrared Sensors Market Size & Forecast, by Type (US$ Mn), 2017–2031

Table 33: South America Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2017–2031

Table 34: South America Infrared Sensors Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017–2031

Table 35: South America Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017–2031

List of Figures

Figure 01: Global Infrared Sensors Price Trend Analysis (Average Price, US$) (Million Units)

Figure 02: Global Infrared Sensors Market, Y-O-Y Growth 2017–2031

Figure 03: Global Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 04: Global Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 05: Global Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 06: Global Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 07: Global Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 08: Global Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 09: Global Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 10: Global Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 11: Global Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 12: Global Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 13: Global Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 14: Global Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 15: Global Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 16: Global Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Infrared Sensors Market Size & Forecast, by Region, Revenue (US$ Mn), 2017–2031

Figure 18: Global Infrared Sensors Market Attractiveness, by Region, Value (US$ Mn), 2022 – 2031

Figure 19: Global Infrared Sensors Market Size & Forecast, by Region, Value (US$ Mn), 2022 – 2031

Figure 20: North America Infrared Sensors Market, Y-O-Y Growth, 2017–2031

Figure 21: North America Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 22: North America Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 23: North America Infrared Sensors Market, Price Trend, 2017–2031

Figure 24: North America Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 25: North America Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 26: North America Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 27: North America Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 28: North America Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 29: North America Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 30: North America Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 31: North America Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 32: North America Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 33: North America Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 34: North America Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 35: North America Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 36: North America Infrared Sensors Market Size & Forecast, by Country, Revenue (US$ Mn), 2017–2031

Figure 37: North America Infrared Sensors Market Attractiveness, by Country, Value (US$ Mn), 2022 – 2031

Figure 38: North America Infrared Sensors Market Size & Forecast, by Country, Value (US$ Mn), 2022 – 2031

Figure 39: Europe Infrared Sensors Market, Y-O-Y Growth, 2017–2031

Figure 40: Europe Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 41: Europe Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 42: Europe Infrared Sensors Market, Price Trend

Figure 43: Europe Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 44: Europe Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 45: Europe Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 46: Europe Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 47: Europe Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 48: Europe Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 49: Europe Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 50: Europe Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 51: Europe Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 52: Europe Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 53: Europe Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 54: Europe Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 55: Europe Infrared Sensors Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 56: Europe Infrared Sensors Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 57: Europe Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 58: Asia Pacific Infrared Sensors Market, Y-O-Y Growth, 2017–2031

Figure 59: Asia Pacific Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 60: Asia Pacific Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 61: Asia Pacific Infrared Sensors Market, Price Trend

Figure 62: Asia Pacific Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 63: Asia Pacific Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 64: Asia Pacific Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 65: Asia Pacific Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 66: Asia Pacific Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 67: Asia Pacific Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 68: Asia Pacific Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 69: Asia Pacific Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 70: Asia Pacific Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 71: Asia Pacific Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 72: Asia Pacific Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 73: Asia Pacific Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 74: Asia Pacific Infrared Sensors Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 75: Asia Pacific Infrared Sensors Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 76: Asia Pacific Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 77: Middle East & Africa Infrared Sensors Market, Y-O-Y Growth, 2017–2031

Figure 78: Middle East & Africa Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 79: Middle East & Africa Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 80: Middle East & Africa Infrared Sensors Market, Price Trend

Figure 81: Middle East & Africa Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 82: Middle East & Africa Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 83: Middle East & Africa Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 84: Middle East & Africa Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 85: Middle East & Africa Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 86: Middle East & Africa Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 87: Middle East & Africa Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 88: Middle East & Africa Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 89: Middle East & Africa Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 90: Middle East & Africa Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 91: Middle East & Africa Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 92: Middle East & Africa Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: Middle East & Africa (MEA) Infrared Sensors Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 94: Middle East & Africa (MEA)Infrared Sensors Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 95: Middle East & Africa (MEA) Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 96: South America Infrared Sensors Market, Y-O-Y Growth, 2017–2031

Figure 97: South America Infrared Sensors Market, Value (US$ Mn), 2017–2031

Figure 98: South America Infrared Sensors Market, Volume (Million Units), 2017–2031

Figure 99: South America Infrared Sensors Market, Price Trend

Figure 100: South America Infrared Sensors Market Projections, by Wavelength, Value (US$ Mn), 2017–2031

Figure 101: South America Infrared Sensors Market, Incremental Opportunity, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 102: South America Infrared Sensors Market Share, by Wavelength, Value (US$ Mn), 2022 – 2031

Figure 103: South America Infrared Sensors Market Projections, by Type, Value (US$ Mn), 2017–2031

Figure 104: South America Infrared Sensors Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022 – 2031

Figure 105: South America Infrared Sensors Market Share, by Type, Value (US$ Mn), 2022 – 2031

Figure 106: South America Infrared Sensors Market Size & Forecast, by Application, Revenue (US$ Mn), 2017–2031

Figure 107: South America Infrared Sensors Market Attractiveness, by Application, Value (US$ Mn), 2022 – 2031

Figure 108: South America Infrared Sensors Market Size & Forecast, by Application, Value (US$ Mn), 2022 – 2031

Figure 109: South America Infrared Sensors Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017–2031

Figure 110: South America Infrared Sensors Market Attractiveness, by End-use Industry, Value (US$ Mn), 2022 – 2031

Figure 111: South America Infrared Sensors Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 112: South America Infrared Sensors Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017–2031

Figure 113: South America Infrared Sensors Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022 – 2031

Figure 114: South America Infrared Sensors Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022 – 2031