Reports

Reports

Analysts’ Viewpoint on Industrial Protective Footwear Market Scenario

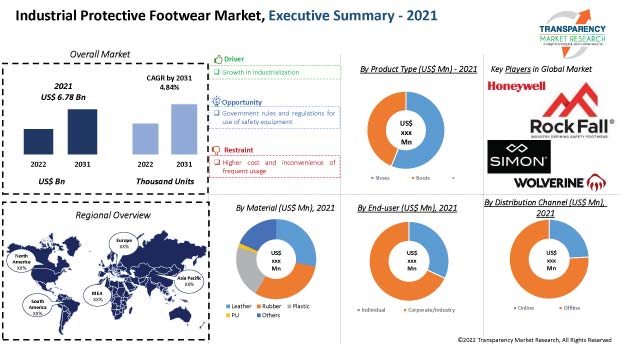

Companies in the industrial protective footwear market are focusing on high growth applications such as construction, manufacturing, mining, oil & gas, and chemical industries to keep their business growing post the peak of the COVID-19 pandemic. The industrial protective footwear market is estimated to grow at a decent pace, due to the steady rise in demand for lightweight protective footwear in various industries. Industrial footwear has integrated digital sensors and actuators that decipher the information sent by sensors to avoid slipping or loss of control in industrial facilities. Developing countries have been implementing regulations for workers’ safety, which is increasing the demand for safety shoes for industrial use. Thus, companies in the industrial protective footwear market should increase their R&D in industrial safety footwear and electrical safety footwear that are used in most of the industries. Manufacturers should tap into incremental opportunities in slip-resistant and puncture-resistant soles in industrial footwear to broaden their revenue streams.

The global industrial protective footwear market is primarily driven by rapid industrialization; growth in end-use industries such as construction, mining, food, pharmaceutical, and oil & gas; and rise in government initiatives to enhance employee safety at workplaces. Digital technology integration in personal protective equipment (PPE) is the current trend in the market. For instance, industrial electrical safety shoes are being developed with the use of the digital technology for the safety of workers. UVEX Group, a major producer of industrial protective footwear with headquarters in Germany, is incorporating digital sensors and actuators into its line of industrial protective footwear. The safety footwear can interpret the information sent by sensors and actuators and take the appropriate action to prevent sliding or losing control. Work boot electrical safety shoes are used in sectors such as mining and construction to guard against potential job dangers such as falling items and sharp nails. Protective footwear reduces the intensity of the impact of falling items and cuts from sharp objects.

Leather is used in the production of safety shoes due to its non-conductivity. It also provides protection from electric shocks. Real leather offers defense against abrasions, punctures, falling items, and burns. This is expected to drive the demand for leather footwear in the industrial protective footwear market during the forecast period.

Rise in awareness about safety among industrial workers and enactment of strict safety regulations for workers by governments are augmenting the demand for industrial protective leather shoes and boots across the world.

Protective shoes and boots are used in the construction industry to safeguard against several occupational risks including foot injuries, overturns, and getting locked in machinery. Industrial safety shoes must be resistant to chemicals, impermeable, resistant to concrete, casting oils, and fuels. Furthermore, they should be water resistant and have no resistance loss. They also require a special sole that is anti-slip, shock-absorbing, and ensures excellent grip on wet, greasy, slippery, and steeply sloping floors and surfaces. The OSHA mandates that construction workers put on protective work boots or shoes with slip- and puncture-resistant soles. Safety-toed footwear is used while working around heavy machinery or falling items to avoid crushing toes. Thus, governments of countries across the globe have implemented stringent regulations to reduce workplace hazards. This is expected to boost the demand for industrial protective footwear during the forecast period.

In terms of product type, the industrial protective footwear market has been bifurcated into shoes and boots. Boots is likely to be a highly attractive segment of the global market during the forecast period, as boots protect the toes from falling objects or any kind of compression. Fatigue can be a major issue for workers who stand all day, especially on hard surfaces such as concrete. Muscles in the feet, legs, back, and other important parts of the body can grow tired, especially when the employees does not wear appropriate footwear. Safety boots provide adequate cushioning and arch support. This alleviates strain on muscles. Thus, employees feel less fatigued and more alert. Wearing proper work boots can also help prevent lower back pain caused by muscle strain.

Based on material, the industrial protective footwear market has been segmented into leather, rubber, plastic, and PU. Rubber and PU are likely to be the most attractive segments during the forecast period. PU is considered the best all-round material for boot soles, as it is lightweight, slip-resistant, durable, and widely used throughout the footwear industry.

Asia Pacific is expected to hold major share of the global industrial protective footwear market during the forecast period due to the rise in awareness about occupational safety and increase in industrial safety regulations. It offers significant growth opportunities for the global industrial protective footwear market owing to the large presence of contract labor. Furthermore, Asia Pacific has the highest rate of work-related fatalities in the world.

The global industrial protective footwear market is consolidated, with a few large-scale vendors controlling majority of the share. Most of the firms are spending significantly on comprehensive research and development activities. Expansion of product portfolios and mergers and acquisitions are the major strategies adopted by key players. Honeywell International Inc., Dunlop Protective Footwear, VF Corporation, Bata Industrial, UVEX WINTER HOLDING GmbH & Co. KG, Elten GmbH, Rock Fall (UK) Ltd, Simon Corporation, Wolverine, and Rahman Industries Ltd. are the prominent players in the global industrial protective footwear market.

Each of these players has been profiled in the industrial protective footwear market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 6.78 Bn |

| Market Forecast Value in 2031 | US$ 10.87 Bn |

| CAGR | 4.84% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2018-2020 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market size of the industrial protective footwear market stood at US$ 6.78 Bn in 2021.

The industrial protective footwear market is estimated to expand at a CAGR of 4.84%.

Rise in usage of industrial safety footwear in the construction sector and government regulations on worker safety are the major factors driving the market.

Boots product type segment contributed the largest share in the industrial protective footwear market in 2021.

Asia Pacific is a more attractive region for vendors in the industrial protective footwear market.

Honeywell International Inc., Dunlop Protective Footwear, VF Corporation, Bata Industrial, UVEX WINTER HOLDING GmbH & Co. KG, Elten GmbH, Rock Fall (UK) Ltd, Simon Corporation, Wolverine, and Rahman Industries Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Regulations & Guidelines

5.5. Key Market Indicators

5.5.1. Overall Shoes Market Overview

5.5.2. Overall Industry safety Wear Overview

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Regulatory Framework

5.11. Covid-19 Impact Analysis

5.12. Global Industrial Protective Footwear Market Analysis and Forecast, 2017-2031

5.12.1. Market Value Projections (US$ Mn)

5.12.2. Market Volume Projections (Thousand Units)

6. Global Industrial Protective Footwear Market Analysis and Forecast, By Product Type

6.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

6.1.1. Shoes

6.1.2. Boots

6.2. Incremental Opportunity, By Product Type

7. Global Industrial Protective Footwear Market Analysis and Forecast, By Density

7.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

7.1.1. Single Density

7.1.2. Double Density

7.2. Incremental Opportunity, By Density

8. Global Industrial Protective Footwear Market Analysis and Forecast, By Material

8.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

8.1.1. Leather

8.1.2. Rubber

8.1.3. Plastic

8.1.4. PU

8.1.5. Others

8.2. Incremental Opportunity, By Material

9. Global Industrial Protective Footwear Market Analysis and Forecast, By Gender

9.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

9.1.1. Male

9.1.2. Female

9.1.3. Unisex

9.2. Incremental Opportunity, By Gender

10. Global Industrial Protective Footwear Market Analysis and Forecast, By Application

10.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

10.1.1. Construction

10.1.2. Manufacturing

10.1.3. Mining

10.1.4. Oil & Gas

10.1.5. Chemicals

10.1.6. Food

10.1.7. Pharmaceuticals

10.1.8. Transportation

10.1.9. Others

10.2. Incremental Opportunity, By Application

11. Global Industrial Protective Footwear Market Analysis and Forecast, By End-User

11.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

11.1.1. Individual

11.1.2. Corporate/ Industry

11.2. Incremental Opportunity, By End-user

12. Global Industrial Protective Footwear Market Analysis and Forecast, By Distribution Channel

12.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

12.1.1. Online

12.1.2. Offline

12.2. Incremental Opportunity, By Distribution Channel

13. Global Industrial Protective Footwear Market Analysis and Forecast, By Region

13.1. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017-2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, By Region

14. North America Industrial Protective Footwear Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Consumer Buying Behavior

14.3. Brand Analysis

14.4. Covid-19 Impact Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Price

14.6. Key Trends Analysis

14.6.1. Demand Side

14.6.2. Supplier Side

14.7. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

14.7.1. Shoes

14.7.2. Boots Style

14.8. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

14.8.1. Single Density

14.8.2. Double Density

14.9. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

14.9.1. Leather

14.9.2. Rubber

14.9.3. Plastic

14.9.4. PU

14.9.5. Others

14.10. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

14.10.1. Male

14.10.2. Female

14.10.3. Unisex

14.11. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

14.11.1. Construction

14.11.2. Manufacturing

14.11.3. Mining

14.11.4. Oil & Gas

14.11.5. Chemicals

14.11.6. Food

14.11.7. Pharmaceuticals

14.11.8. Transportation

14.11.9. Others

14.12. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

14.12.1. Individual

14.12.2. Corporate/ Industry.

14.13. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

14.13.1. Online

14.13.2. Offline

14.14. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017-2031

14.14.1. U.S

14.14.2. Canada

14.14.3. Rest of North America

14.15. Incremental Opportunity Analysis

15. Europe Industrial Protective Footwear Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Consumer Buying Behavior

15.3. Brand Analysis

15.4. Covid-19 Impact Analysis

15.5. Price Trend Analysis

15.5.1. Weighted Average Price

15.6. Key Trends Analysis

15.6.1. Demand Side

15.6.2. Supplier Side

15.7. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

15.7.1. Shoes

15.7.2. Boots Style

15.8. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

15.8.1. Single Density

15.8.2. Double Density

15.9. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

15.9.1. Leather

15.9.2. Rubber

15.9.3. Plastic

15.9.4. PU

15.9.5. Others

15.10. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

15.10.1. Male

15.10.2. Female

15.10.3. Unisex

15.11. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

15.11.1. Construction

15.11.2. Manufacturing

15.11.3. Mining

15.11.4. Oil & Gas

15.11.5. Chemicals

15.11.6. Food

15.11.7. Pharmaceuticals

15.11.8. Transportation

15.11.9. Others

15.12. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

15.12.1. Individual

15.12.2. Corporate/ Industry.

15.13. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

15.13.1. Online

15.13.2. Offline

15.14. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017-2031

15.14.1. U.K

15.14.2. Germany

15.14.3. France

15.14.4. Rest of Europe

15.15. Incremental Opportunity Analysis

16. Asia Pacific Industrial Protective Footwear Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Consumer Buying Behavior

16.3. Brand Analysis

16.4. Covid-19 Impact Analysis

16.5. Price Trend Analysis

16.5.1. Weighted Average Price

16.6. Key Trends Analysis

16.6.1. Demand Side

16.6.2. Supplier Side

16.7. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

16.7.1. Shoes

16.7.2. Boots Style

16.8. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

16.8.1. Single Density

16.8.2. Double Density

16.9. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

16.9.1. Leather

16.9.2. Rubber

16.9.3. Plastic

16.9.4. PU

16.9.5. Others

16.10. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

16.10.1. Male

16.10.2. Female

16.10.3. Unisex

16.11. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

16.11.1. Construction

16.11.2. Manufacturing

16.11.3. Mining

16.11.4. Oil & Gas

16.11.5. Chemicals

16.11.6. Food

16.11.7. Pharmaceuticals

16.11.8. Transportation

16.11.9. Others

16.12. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

16.12.1. Individual

16.12.2. Corporate/ Industry

16.13. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

16.13.1. Online

16.13.2. Offline

16.14. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017-2031

16.14.1. India

16.14.2. China

16.14.3. Japan

16.14.4. Rest of Asia Pacific

16.15. Incremental Opportunity Analysis

17. Middle East & Africa Industrial Protective Footwear Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Consumer Buying Behavior

17.3. Brand Analysis

17.4. Covid-19 Impact Analysis

17.5. Price Trend Analysis

17.5.1. Weighted Average Price

17.6. Key Trends Analysis

17.6.1. Demand Side

17.6.2. Supplier Side

17.7. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

17.7.1. Shoes

17.7.2. Boots Style

17.8. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

17.8.1. Single Density

17.8.2. Double Density

17.9. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

17.9.1. Leather

17.9.2. Rubber

17.9.3. Plastic

17.9.4. PU

17.9.5. Others

17.10. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

17.10.1. Male

17.10.2. Female

17.10.3. Unisex

17.11. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

17.11.1. Construction

17.11.2. Manufacturing

17.11.3. Mining

17.11.4. Oil & Gas

17.11.5. Chemicals

17.11.6. Food

17.11.7. Pharmaceuticals

17.11.8. Transportation

17.11.9. Others

17.12. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

17.12.1. Individual

17.12.2. Corporate/ Industry.

17.13. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

17.13.1. Online

17.13.2. Offline

17.14. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017-2031

17.14.1. GCC

17.14.2. South Africa

17.14.3. Rest of Middle East and Africa

17.15. Incremental Opportunity Analysis

18. South America Industrial Protective Footwear Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Consumer Buying Behavior

18.3. Brand Analysis

18.4. Covid-19 Impact Analysis

18.5. Price Trend Analysis

18.5.1. Weighted Average Price

18.6. Key Trends Analysis

18.6.1. Demand Side

18.6.2. Supplier Side

18.7. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

18.7.1. Shoes

18.7.2. Boots Style

18.8. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Density, 2017-2031

18.8.1. Single Density

18.8.2. Double Density

18.9. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Material, 2017-2031

18.9.1. Leather

18.9.2. Rubber

18.9.3. Plastic

18.9.4. PU

18.9.5. Others

18.10. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Gender, 2017-2031

18.10.1. Male

18.10.2. Female

18.10.3. Unisex

18.11. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017-2031

18.11.1. Construction

18.11.2. Manufacturing

18.11.3. Mining

18.11.4. Oil & Gas

18.11.5. Chemicals

18.11.6. Food

18.11.7. Pharmaceuticals

18.11.8. Transportation

18.11.9. Others

18.12. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By End-user, 2017-2031

18.12.1. Individual

18.12.2. Corporate/ Industry.

18.13. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

18.13.1. Online

18.13.2. Offline

18.14. Industrial Protective Footwear Market Size (US$ Mn and Thousand Units) Forecast, By Country & Sub-region, 2017-2031

18.14.1. Brazil

18.14.2. Rest of South America

18.15. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player – Competition Dashboard

19.2. Market Share Analysis (%), by Company, (2021)

19.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

19.3.1. Honeywell International Inc.

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.2. Dunlop Protective Footwear

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.3. VF Corporation

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.4. Bata Industrial

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.5. UVEX WINTER HOLDING GmbH & Co. KG

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.6. Elten GmbH

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.7. Rock Fall (UK) Ltd

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.8. Simon Corporation

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.9. Wolverine

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.10. Rahman Industries Ltd

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.1.1. By Product Type

20.1.2. By Density

20.1.3. By Material

20.1.4. By Gender

20.1.5. By Application

20.1.6. By End-user

20.1.7. By Distribution Channel

20.1.8. By Region

20.2. Understanding the Buying Process of Customers

20.3. Prevailing Market Risks

20.4. Preferred Sales & Marketing Strategy

List of Table

Table 1: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 2: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 3: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 4: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 5: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 6: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 7: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 8: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 9: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 10: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 11: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 12: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 13: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 14: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 15: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 16: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 17: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 18: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 19: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 20: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 21: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 22: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 23: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 24: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 25: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 26: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 27: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 28: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 29: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 30: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 31: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 32: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 33: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 34: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 35: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 36: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 37: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 38: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 39: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 40: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 41: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 42: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 43: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 44: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 45: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 46: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 47: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 48: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 49: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 50: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 51: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 52: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 53: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 54: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 55: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 56: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 57: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 58: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 59: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 60: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 61: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 62: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 63: Asia Pacific Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 64: Asia Pacific Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 65: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 66: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 67: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 68: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 69: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 70: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 71: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 72: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 73: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 74: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 75: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 76: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 77: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 78: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 79: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 80: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 81: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Product Type

Table 82: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Product Type

Table 83: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Table 84: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Table 85: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Table 86: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Table 87: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Table 88: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Table 89: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Table 90: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Table 91: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End- User

Table 92: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End- User

Table 93: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 94: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 95: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 96: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

List of Figure

Figure 1: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 2: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, by Product Type

Figure 3: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, by Product Type

Figure 3: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Figure 4: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Figure 6: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Density

Figure 7: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Figure 8: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Figure 9: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Material

Figure 10: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Figure 11: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Figure 12: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Gender

Figure 13: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 14: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Figure 15: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 16: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End-User

Figure 17: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By End-User

Figure 18: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End-User

Figure 19: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 20: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Distribution Channel

Figure 21: Global Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 22: Global Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 23: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region

Figure 24: Global Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region

Figure 25: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 26: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, by Product Type

Figure 27: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, by Product Type

Figure 28: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Figure 29: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Figure 30: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Density

Figure 31: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Figure 32: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Figure 33: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Material

Figure 34: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Figure 35: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Figure 36: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Gender

Figure 37: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 38: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Figure 39: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Application

Figure 40: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End-User

Figure 41: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End-User

Figure 42: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By End-User

Figure 43: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 44: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 45: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Distribution Channel

Figure 46: North America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Figure 47: North America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 48: North America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region

Figure 49: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 50: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, by Product Type

Figure 51: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, by Product Type

Figure 52: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Figure 53: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Figure 54: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Density

Figure 55: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Figure 56: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Figure 57: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Material

Figure 58: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Figure 59: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Figure 60: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Gender

Figure 61: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 62: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Figure 63: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Application

Figure 64: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End-User

Figure 65: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End-User

Figure 66: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By End-User

Figure 67: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 68: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 69: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Distribution Channel

Figure 70: Europe Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Figure 71: Europe Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 72: Europe Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region

Figure 73: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 74: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, by Product Type

Figure 75: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, by Product Type

Figure 76: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Figure 77: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Figure 78: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Density

Figure 79: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Figure 80: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Figure 81: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Material

Figure 82: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Figure 83: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Figure 84: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Gender

Figure 85: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 86: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Figure 87: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Application

Figure 88: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End-User

Figure 89: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End-User

Figure 90: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By End-User

Figure 91: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 92: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 93: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Distribution Channel

Figure 94: Middle East & Africa Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Figure 95: Middle East & Africa Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 96: Middle East & Africa Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region

Figure 97: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, by Product Type

Figure 98: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, by Product Type

Figure 99: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, by Product Type

Figure 100: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Density

Figure 101: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Density

Figure 102: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Density

Figure 103: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Material

Figure 104: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Material

Figure 105: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Material

Figure 106: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Gender

Figure 107: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Gender

Figure 108: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Gender

Figure 109: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Application

Figure 110: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Application

Figure 111: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Application

Figure 112: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By End-User

Figure 113: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By End-User

Figure 114: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By End-User

Figure 115: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 116: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 117: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Distribution Channel

Figure 118: South America Industrial Protective Footwear Market Value (US$ Mn) Forecast, 2017-2031, By Region

Figure 119: South America Industrial Protective Footwear Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 120: South America Industrial Protective Footwear Market, Incremental Opportunities (US$ Mn), Forecast, 2017-2031, By Region