Reports

Reports

Analysts’ Viewpoint

The global industrial metaverse market has gained rapid attention and momentum in recent years as businesses seek ways to improve their processes and increase efficiency.

The metaverse industry 4.0 emphasizes the integration of digital technologies and automation in industrial processes. As a result, the adoption of industrial metaverse surged as it provides a virtual environment to monitor, control, and optimize manufacturing processes, supply chains, and logistics. It facilitates real-time data analysis, predictive maintenance, remote monitoring, and other capabilities that enhance operational efficiency and productivity.

Several major technology companies and industrial conglomerates are actively investing in the development of the industrial metaverse. Players are focusing on creating metaverse platforms, software solutions, and hardware devices specifically for industrial applications.

The industrial metaverse is the fusion of physical and digital elements, along with human augmentation, to serve industrial purposes. It encompasses virtual representations of physical industrial settings, systems, assets, and spaces, enabling individuals to manipulate, communicate, and engage with them.

Ongoing digital transformation of industries across the globe is significantly boosting industrial metaverse market size. Businesses are increasingly seeking ways to integrate and visualize data, optimize processes, and enhance collaboration as they leverage technologies such as IoT, AI, VR, and augmented reality (AR).

The COVID-19 pandemic accelerated the adoption of remote work and collaboration tools across various industries. This has also led to the industrial metaverse market growth.

The industrial metaverse is the convergence of digital and physical worlds where humans, machines, data, and processes are seamlessly integrated and interact in real-time across virtual and physical environments. Digital twins function as dynamic alternatives to real-world systems, processes, and assets in the industrial metaverse.

Digital twin technology is the creation of virtual representations of physical objects or systems that are used for modeling, design, analysis, and optimization purposes. The popularity of the technology surged due to the advancement of artificial intelligence (AI), Internet of Things (IoT), extended reality (ER), and cloud computing. These technologies allow digital twins to collect real-time data from sensors, communicate with their physical counterparts, and learn from their performance and behavior.

The adoption of digital twin technology is increasing due to the benefits it provides for various industries and applications. For example, in manufacturing, digital twin technology helps engineers to test and improve prototypes, optimize supply chains and production processes, enhance product quality, and reduce costs.

In engineering, digital twin technology helps teams to understand how products are being used in the field and then use that data to build better products. In architecture, digital twin technology helps designers to create realistic and immersive simulations of buildings and environments, as well as monitor and maintain them throughout their lifecycle.

Businesses are increasingly adopting digital twins to replicate industrial operations, systems, and processes to optimize their R&D and production management of the product life cycle. For instance, in March 2023, BMW AG announced that it is operating a new manufacturing plant virtually. The factory situated in Debrecen, Hungary would start its actual operation in 2025.

BMW is utilizing Nvidia's Omniverse Enterprise, an industrial metaverse platform for conducting real-time 3D digital twin simulations to optimize the factory's layout, robotics, and logistic systems.

The emergence of 5G technology increasingly facilitates the development of the industrial metaverse. In the industrial metaverse, real-time data and virtual representations of physical objects are seamlessly integrated to create immersive and interactive experiences.

5G offers significantly faster data transfer speeds compared to previous generations of wireless technology. The high-speed connectivity enables real-time streaming and processing of large amounts of data. For example, real-time monitoring and control of industrial processes is achieved with minimal latency, which allows for more efficient and responsive operations.

5G networks provide ultra-low latency, the time taken for data to travel between devices and networks. The near-instantaneous communication is crucial for the industrial metaverse, where real-time interactions between physical and virtual elements are essential. Low latency enables precise control and synchronization of virtual objects with their physical counterparts, enhancing the overall user experience and enabling applications, such as remote robotics and augmented reality (AR) maintenance.

5G supports massive device connectivity, allowing for a significant number of devices to be connected simultaneously. This capability is essential for the industrial metaverse, where numerous sensors, devices, and objects need to communicate and interact with each other. With 5G, a vast network of interconnected devices can share real-time data, facilitating seamless collaboration and coordination between physical and virtual elements.

AR and VR are crucial components of the industrial metaverse that provide immersive and interactive experiences. 5G's high-speed and low-latency connections enable seamless streaming of high-resolution AR and VR content to deliver realistic and engaging experiences. It helps employees to interact in real-time through virtual elements during design simulations, remote collaboration, and industrial training.

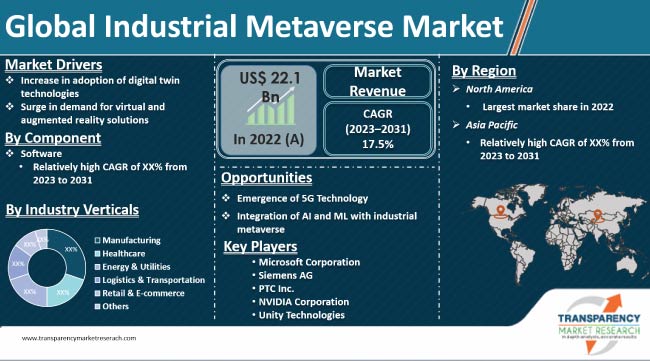

According to the latest industrial metaverse industry research report, North America is anticipated to hold a dominant global industrial metaverse market share during the forecast period due to the presence of leading technology companies, such as Unity Technologies, Microsoft Corporation, PTC Inc., NVIDIA Corporation, and HTC Corporation, which provide the platforms, tools, and solutions for creating and operating industrial metaverses.

Industrial metaverse industry growth in Asia Pacific is expected to rise at the highest CAGR during the forecast period. The presence of large and emerging economies such as China, India, Japan, and South Korea, which have a strong manufacturing sector and a high potential for digital transformation, are accelerating the growth of the market in the region.

The industrial metaverse market research report profiles major providers based on parameters such as financials, key product offerings, recent developments, and strategies.

Microsoft Corporation, Siemens AG, PTC Inc., NVIDIA Corporation, Unity Technologies, HTC Corporation, Dassault Systèmes, Magic Leap, Inc., AVEVA Group Limited, GE Digital, ANSYS, Inc., and Bentley Systems, Incorporated are the key industrial metaverse companies.

Prominent providers are investing in R&D activities to introduce industrial metaverse technologies that can meet the growing industrial metaverse market demand. These service providers are tapping into the latest industrial metaverse market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the industrial metaverse market report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 22.1 Bn |

|

Market Forecast Value in 2031 |

US$ 93.5 Bn |

|

Growth Rate (CAGR) |

17.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 22.1 Bn in 2022

It is anticipated to reach US$ 93.5 Bn by the end of 2031

The CAGR is estimated to be 17.5% from 2023 to 2031

Increase in adoption of digital twin technologies and increasing demand for virtual and augmented reality solutions

North America accounted for leading share in 2022

Microsoft Corporation, Siemens AG, PTC Inc., NVIDIA Corporation, Unity Technologies, HTC Corporation, Dassault Systèmes, Magic Leap, Inc., AVEVA Group Limited, GE Digital, ANSYS, Inc., and Bentley Systems

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Industrial Metaverse Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Industrial Metaverse Market

4.5. Porter’s Five Forces Analysis

4.6. PEST Analysis

4.7. Market Opportunity Assessment - by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.7.1. By Component

4.7.2. By Industry Verticals

5. Global Industrial Metaverse Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Industrial Metaverse Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global Industrial Metaverse Market Analysis, by Industry Verticals

7.1. Key Segment Analysis

7.2. Industrial Metaverse Market Size (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

7.2.1. Manufacturing

7.2.2. Healthcare

7.2.3. Energy & Utilities

7.2.4. Logistics & Transportation

7.2.5. Retail & E-commerce

7.2.6. Other

8. Global Industrial Metaverse Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Industrial Metaverse Market Analysis and Forecast

9.1. Regional Outlook

9.2. Industrial Metaverse Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

9.2.1. By Component

9.2.2. By Industry Verticals

9.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe Industrial Metaverse Market Analysis and Forecast

10.1. Regional Outlook

10.2. Industrial Metaverse Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Industry Verticals

10.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

10.3.1. Germany

10.3.2. UK

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

11. Asia Pacific Industrial Metaverse Market Analysis and Forecast

11.1. Regional Outlook

11.2. Industrial Metaverse Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Industry Verticals

11.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Country Sub-region, 2018 - 2031

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa Industrial Metaverse Market Analysis and Forecast

12.1. Regional Outlook

12.2. Industrial Metaverse Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Industry Verticals

12.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Country Sub-region, 2018 - 2031

12.3.1. Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa

13. South America Industrial Metaverse Market Analysis and Forecast

13.1. Regional Outlook

13.2. Industrial Metaverse Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Industry Verticals

13.3. Industrial Metaverse Market Size (US$ Bn) Forecast, by Country Sub-region, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Competitive Landscape by Tier Structure of Companies

14.3. Scale of Competition, 2022

14.4. Scale of Competition at Regional Level, 2022

14.5. Market Revenue Share Analysis/Ranking, by Leading Players (2022)

14.6. List of Startups

14.7. Competition Evolution

14.8. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

15. Company Profiles

15.1. Microsoft Corporation

15.1.1. Business Overview

15.1.2. Company Revenue

15.1.3. Product Portfolio

15.1.4. Geographic Footprint

15.1.5. Recent Developments

15.1.6. Impact of COVID-19

15.1.7. TMR View

15.1.8. Competitive Threats and Weakness

15.2. Siemens AG

15.2.1. Business Overview

15.2.2. Company Revenue

15.2.3. Product Portfolio

15.2.4. Geographic Footprint

15.2.5. Recent Developments

15.2.6. Impact of COVID-19

15.2.7. TMR View

15.2.8. Competitive Threats and Weakness

15.3. PTC Inc.

15.3.1. Business Overview

15.3.2. Company Revenue

15.3.3. Product Portfolio

15.3.4. Geographic Footprint

15.3.5. Recent Developments

15.3.6. Impact of COVID-19

15.3.7. TMR View

15.3.8. Competitive Threats and Weakness

15.4. NVIDIA Corporation

15.4.1. Business Overview

15.4.2. Company Revenue

15.4.3. Product Portfolio

15.4.4. Geographic Footprint

15.4.5. Recent Developments

15.4.6. Impact of COVID-19

15.4.7. TMR View

15.4.8. Competitive Threats and Weakness

15.5. Unity Technologies

15.5.1. Business Overview

15.5.2. Company Revenue

15.5.3. Product Portfolio

15.5.4. Geographic Footprint

15.5.5. Recent Developments

15.5.6. Impact of COVID-19

15.5.7. TMR View

15.5.8. Competitive Threats and Weakness

15.6. HTC Corporation

15.6.1. Business Overview

15.6.2. Company Revenue

15.6.3. Product Portfolio

15.6.4. Geographic Footprint

15.6.5. Recent Developments

15.6.6. Impact of COVID-19

15.6.7. TMR View

15.6.8. Competitive Threats and Weakness

15.7. Dassault Systèmes

15.7.1. Business Overview

15.7.2. Company Revenue

15.7.3. Product Portfolio

15.7.4. Geographic Footprint

15.7.5. Recent Developments

15.7.6. Impact of COVID-19

15.7.7. TMR View

15.7.8. Competitive Threats and Weakness

15.8. Magic Leap, Inc.

15.8.1. Business Overview

15.8.2. Company Revenue

15.8.3. Product Portfolio

15.8.4. Geographic Footprint

15.8.5. Recent Developments

15.8.6. Impact of COVID-19

15.8.7. TMR View

15.8.8. Competitive Threats and Weakness

15.9. AVEVA Group Limited

15.9.1. Business Overview

15.9.2. Company Revenue

15.9.3. Product Portfolio

15.9.4. Geographic Footprint

15.9.5. Recent Developments

15.9.6. Impact of COVID-19

15.9.7. TMR View

15.9.8. Competitive Threats and Weakness

15.10. GE DIGITAL

15.10.1. Business Overview

15.10.2. Company Revenue

15.10.3. Product Portfolio

15.10.4. Geographic Footprint

15.10.5. Recent Developments

15.10.6. Impact of COVID-19

15.10.7. TMR View

15.10.8. Competitive Threats and Weakness

15.11. ANSYS, Inc.

15.11.1. Business Overview

15.11.2. Company Revenue

15.11.3. Product Portfolio

15.11.4. Geographic Footprint

15.11.5. Recent Developments

15.11.6. Impact of COVID-19

15.11.7. TMR View

15.11.8. Competitive Threats and Weakness

15.12. Bentley Systems, Incorporated

15.12.1. Business Overview

15.12.2. Company Revenue

15.12.3. Product Portfolio

15.12.4. Geographic Footprint

15.12.5. Recent Developments

15.12.6. Impact of COVID-19

15.12.7. TMR View

15.12.8. Competitive Threats and Weakness

15.13. Others

15.13.1. Business Overview

15.13.2. Company Revenue

15.13.3. Product Portfolio

15.13.4. Geographic Footprint

15.13.5. Recent Developments

15.13.6. Impact of COVID-19

15.13.7. TMR View

15.13.8. Competitive Threats and Weakness

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in Industrial Metaverse Market

Table 2: North America Industrial Metaverse Market Revenue Analysis, by Country, 2023 - 2031 (US$ Bn)

Table 3: Europe Industrial Metaverse Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 4: Asia Pacific Industrial Metaverse Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 5: Middle East & Africa Industrial Metaverse Market Revenue Analysis, by Country/Sub-region, 2023 and 2031 (US$ Bn)

Table 6: South America Industrial Metaverse Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 11: Global Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 12: Global Industrial Metaverse Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 13: North America Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 14: North America Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 15: North America Industrial Metaverse Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 16: U.S. Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 17: Canada Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Mexico Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Europe Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 20: Europe Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 21: Europe Industrial Metaverse Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 22: Germany Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: U.K. Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: France Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Italy Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Spain Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Asia Pacific Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 28: Asia Pacific Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 29: Asia Pacific Industrial Metaverse Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 30: China Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 31: India Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: Japan Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: ASEAN Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Middle East & Africa Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 35: Middle East & Africa Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 36: Middle East & Africa Industrial Metaverse Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 37: Saudi Arabia Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: U.A.E Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: South Africa Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: South America Industrial Metaverse Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 41: South America Industrial Metaverse Market Value (US$ Bn) Forecast, by Industry Verticals, 2018 - 2031

Table 42: South America Industrial Metaverse Market Value (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

Table 43: Brazil Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Argentina Industrial Metaverse Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: Mergers & Acquisitions, Partnerships (1/2)

Table 46: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Industrial Metaverse Market Size (US$ Bn) Forecast, 2018-2031

Figure 2: Global Industrial Metaverse Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Industrial Metaverse Market

Figure 4: Global Industrial Metaverse Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Industrial Metaverse Market Attractiveness Assessment, by Component

Figure 6: Global Industrial Metaverse Market Attractiveness Assessment, by Industry Verticals

Figure 7: Global Industrial Metaverse Market Attractiveness Assessment, by Region

Figure 8: Global Industrial Metaverse Market Revenue (US$ Bn) Historic Trends, 2017 - 2022

Figure 9: Global Industrial Metaverse Market Revenue Opportunity (US$ Bn) Historic Trends, 2017 - 2022

Figure 10: Global Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 11: Global Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 12: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 13: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 14: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 15: Global Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 16: Global Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 17: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 18: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 19: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 20: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 21: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 22: Global Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 23: Global Industrial Metaverse Market Opportunity (US$ Bn), by Region

Figure 24: Global Industrial Metaverse Market Opportunity Share (%), by Region, 2023-2031

Figure 25: Global Industrial Metaverse Market Size (US$ Bn), by Region, 2023 & 2031

Figure 26: Global Industrial Metaverse Market Value Share Analysis, by Region, 2023

Figure 27: Global Industrial Metaverse Market Value Share Analysis, by Region, 2031

Figure 28: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 29: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 30: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 31: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 32: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 33: North America Industrial Metaverse Market Revenue Opportunity Share, by Component

Figure 34: North America Industrial Metaverse Market Revenue Opportunity Share, by Industry Verticals

Figure 35: North America Industrial Metaverse Market Revenue Opportunity Share, by Country

Figure 36: North America Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 37: North America Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 38: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 39: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 40: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 41: North America Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 42: North America Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 43: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 44: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 45: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 46: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 47: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 48: North America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 49: North America Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2023

Figure 50: North America Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2031

Figure 51: U.S. Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 52: Canada Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 53: Mexico Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 54: Europe Industrial Metaverse Market Revenue Opportunity Share, by Component

Figure 55: Europe Industrial Metaverse Market Revenue Opportunity Share, by Industry Verticals

Figure 56: Europe Industrial Metaverse Market Revenue Opportunity Share, by Country

Figure 57: Europe Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 58: Europe Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 59: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 60: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 61: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 62: Europe Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 63: Europe Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 64: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 65: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 66: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 67: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 68: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 69: Europe Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 70: Europe Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2023

Figure 71: Europe Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2031

Figure 72: Germany Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 73: U.K. Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 74: France Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 75: Italy Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 76: Spain Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 77: Asia Pacific Industrial Metaverse Market Revenue Opportunity Share, by Component

Figure 78: Asia Pacific Industrial Metaverse Market Revenue Opportunity Share, by Industry Verticals

Figure 79: Asia Pacific Industrial Metaverse Market Revenue Opportunity Share, by Country

Figure 80: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 81: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 82: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 83: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 84: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 85: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 86: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 87: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 88: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 89: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 90: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 91: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 92: Asia Pacific Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 93: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2023

Figure 94: Asia Pacific Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2031

Figure 95: China Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 96: India Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 97: Japan Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 98: ASEAN Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 99: Middle East & Africa Industrial Metaverse Market Revenue Opportunity Share, by Component

Figure 100: Middle East & Africa Industrial Metaverse Market Revenue Opportunity Share, by Industry Verticals

Figure 101: Middle East & Africa Industrial Metaverse Market Revenue Opportunity Share, by Country

Figure 102: Middle East & Africa Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 103: Middle East & Africa Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 104: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 105: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 106: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 107: Middle East & Africa Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 108: Middle East & Africa Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 109: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 110: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 111: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 112: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 113: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 114: Middle East & Africa Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 115: Middle East & Africa East & Africa East & Africa Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2023

Figure 116: Middle East & Africa Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2031

Figure 117: Saudi Arabia Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 118: U.A.E Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 119: South Africa Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 120: South America Industrial Metaverse Market Revenue Opportunity Share, by Component

Figure 121: South America Industrial Metaverse Market Revenue Opportunity Share, by Industry Verticals

Figure 122: South America Industrial Metaverse Market Revenue Opportunity Share, by Country

Figure 123: South America Industrial Metaverse Market Value Share Analysis, by Component, 2023

Figure 124: South America Industrial Metaverse Market Value Share Analysis, by Component, 2031

Figure 125: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Hardware, 2023 - 2031

Figure 126: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Software, 2023 - 2031

Figure 127: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 128: South America Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2023

Figure 129: South America Industrial Metaverse Market Value Share Analysis, by Industry Verticals, 2031

Figure 130: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Manufacturing, 2023 - 2031

Figure 131: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Healthcare, 2023 - 2031

Figure 132: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Energy & Utilities, 2023 - 2031

Figure 133: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Logistics & Transportation, 2023 - 2031

Figure 134: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2023 - 2031

Figure 135: South America Industrial Metaverse Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 136: South America Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2023

Figure 137: South America Industrial Metaverse Market Value Share Analysis, by Country/Sub-region, 2031

Figure 138: Brazil Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 139: Argentina Industrial Metaverse Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031