Reports

Reports

Analysts’ Viewpoint

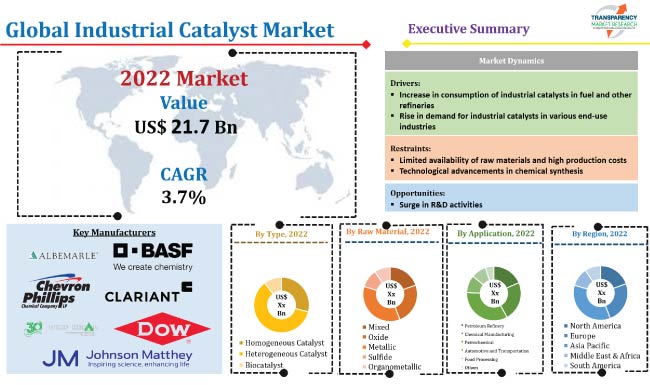

Rise in adoption of industrial catalysts in various end-use industries such as petrochemical, refinery, chemical manufacturing, agriculture, automotive, and transportation is driving market growth. Demand for chemical catalysts is increasing due to rapid industrialization, surge in number of chemical companies, and growth in demand for petroleum products across the globe.

Key manufacturers are investing in research and development activities to introduce innovative, cost-efficient, and high-quality catalyst products in order to generate lucrative industrial catalyst market opportunities. These players are following industrial catalyst market trends to broaden their revenue streams. However, the production cost of industrial catalyst is high. This is the key factor that is hampering market development.

Catalyst is a substance that increases the rate of a chemical reaction without any physical or chemical changes. It enhances the chemical process by reducing wastes, and minimizing production time, energy consumption, and operating costs. Catalyst helps improve air quality by controlling emissions and reducing volatile organic compounds (VOCs).

Industrial catalysts are widely used in petroleum refining, petrochemical production, environmental protection reaction, organic synthesis, polymer processing, bulk chemical synthesis, and other fields.

Industrial catalysts can be used in petroleum refineries and petrochemical industries for process optimization, cost savings, and energy saving benefits. Additionally, environmentally-friendly catalysts help manufacturers meet the stringent requirements related to nitrogen oxide, sulfur oxide, and carbon dioxide emissions.

Increase in trend of using alternative fuels, including biodiesel and shale gas fuel, is anticipated to drive the demand for catalysts. Manufacturers are striving to add value to their feedstock or refineries by producing value-added petrochemicals and chemicals such as methanol and polyolefin. This is expected to fuel market progress during the forecast period.

As per the industrial catalyst market analysis, industrial catalysts can be used as raw materials in several applications, as they help facilitate chemical reaction without changing any chemical or physical properties.

Catalysts are widely adopted in the food industry. They are also used in the production of glass, soap, carbonated drinks, etc. Catalysts are essential for the production of preservatives in fruits and vegetables. They play an important role in rapid ripening of fruits.

Polluting chemical processes can be stopped or replaced with less harmful ones by using catalysts. Hence, industrial catalyst market demand is rising in various end-use industries.

Based on type, the heterogeneous catalyst segment is likely to dominate the global market during the forecast period. This can be ascribed to the robustness and lower operational costs of heterogeneous catalysts. Sulfated zirconia, sulfonated silica materials, sulfonated carbon materials, and sulfonated MOF materials are some of the common examples of heterogeneous catalysts.

Heterogeneous catalysts are increasingly used in various applications due to their ease of usage. Furthermore, rise in adoption of heterogeneous catalyst in biodiesel production is likely to augment industrial catalyst business growth during the forecast period.

According to the global industrial catalyst market forecast report, the global market has been segmented into petroleum refinery, chemical manufacturing, petrochemical, food processing, automotive and transportation, and others in terms of application.

The petroleum refinery segment is expected to account for major market share in the near future. This can be primarily ascribed to the rise in demand for petroleum products across the globe. Increase in demand for various commodity and specialty chemicals and rise in consumption of crude oil-based products are projected to boost the demand for refining catalysts in the next few years. Furthermore, expansion of petroleum and related industries is driving the global industrial catalyst market share.

Surge in crude oil production in major oil-producing countries is anticipated to be an important factor augmenting industrial catalyst market statistics. Rapid industrialization coupled with rise in gross domestic product (GDP) in emerging economies is also estimated to drive market expansion during the forecast period.

Asia Pacific accounted for the largest market share in 2022, primarily due to the increase in demand for industrial catalysts in rapidly growing chemical and food processing industries. Implementation of favorable government policies against environmental pollution is also boosting the industrial catalyst market growth in the region.

The industrial catalyst market size in North America is anticipated to increase during the forecast period due to the rise in demand for industrial catalysts in environmental and process applications.

Europe is another vital regional market, primarily driven by the increase in demand for industrial catalysts in the chemical industry in the region. The market in Latin America and Middle East & Africa is expected to witness considerable growth during the forecast period, owing to the expansion in petroleum and chemical industries in these regions.

According to the industrial catalyst industry report, key players operating across the globe are investing significantly in R&D activities to create innovative products. Several major players are focusing on developing strategic alliances with other players to increase their market share.

Albemarle Corporation, Johnson Matthey, BASF SE, Dow Chemical Company, Clariant AG, Chevron Phillips Chemical Company LLC, Exxonmobil Corporation, Dorf Ketal Chemicals (I) Pvt. Ltd., Evonik Industries AG, and W.R. Grace and Co are some of the major industrial catalyst companies operating in the global market.

Key players have been profiled in the industrial catalyst industry research report based on parameters such as financial overview, product portfolio, company overview, business segments, recent developments, and business strategies.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 21.7 Bn |

|

Market Forecast Value in 2031 |

US$ 30.1 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 21.7 Bn in 2022

The CAGR is estimated to be 3.7% during 2023 to 2031

Increase in usage of industrial catalysts in fuel refineries and rise in demand for industrial catalysts in various end-use industries

The heterogeneous catalyst segment accounted for the largest share in 2022

Asia Pacific is likely to be one of the most lucrative regions in the next few years

Albemarle Corporation, Johnson Matthey, BASF SE, Chevron Phillips Chemical Company LLC, Clariant AG, Dorf Ketal Chemicals (I) Pvt. Ltd., Dow Chemical Company, Evonik Industries AG, Exxonmobil Corporation, and W.R. Grace and Co

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Technological Roadmap

5.8. Raw Material Analysis

5.9. Global Industrial Catalyst Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Kilo Tons)

6. Global Industrial Catalyst Market Analysis and Forecast, By Type

6.1. Global Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

6.1.1. Homogeneous Catalyst

6.1.2. Heterogeneous Catalyst

6.1.3. Biocatalyst

6.2. Incremental Opportunity, By Type

7. Global Industrial Catalyst Market Analysis and Forecast, By Raw Material

7.1. Global Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

7.1.1. Mixed

7.1.2. Oxide

7.1.3. Metallic

7.1.4. Sulfide

7.1.5. Organometallic

7.2. Incremental Opportunity, By Raw Material

8. Global Industrial Catalyst Market Analysis and Forecast, By Application

8.1. Global Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

8.1.1. Petroleum Refinery

8.1.2. Chemical Manufacturing

8.1.3. Petrochemical

8.1.4. Automotive and Transportation

8.1.5. Food Processing

8.1.6. Others

8.2. Incremental Opportunity, By Application

9. Global Industrial Catalyst Market Analysis and Forecast, Region

9.1. Global Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, By Region

10. North America Industrial Catalyst Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Key Trends Analysis

10.4.1. Demand Side Analysis

10.4.2. Supply Side Analysis

10.5. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

10.5.1. Homogeneous Catalyst

10.5.2. Heterogeneous Catalyst

10.5.3. Biocatalyst

10.6. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

10.6.1. Mixed

10.6.2. Oxide

10.6.3. Metallic

10.6.4. Sulfide

10.6.5. Organometallic

10.7. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

10.7.1. Petroleum Refinery

10.7.2. Chemical Manufacturing

10.7.3. Petrochemical

10.7.4. Automotive and Transportation

10.7.5. Food Processing

10.7.6. Others

10.8. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Country, 2017 - 2031

10.8.1. The U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Industrial Catalyst Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

11.5.1. Homogeneous Catalyst

11.5.2. Heterogeneous Catalyst

11.5.3. Biocatalyst

11.6. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

11.6.1. Mixed

11.6.2. Oxide

11.6.3. Metallic

11.6.4. Sulfide

11.6.5. Organometallic

11.7. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

11.7.1. Petroleum Refinery

11.7.2. Chemical Manufacturing

11.7.3. Petrochemical

11.7.4. Automotive and Transportation

11.7.5. Food Processing

11.7.6. Others

11.8. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Country, 2017 - 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Italy

11.8.5. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Industrial Catalyst Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

12.5.1. Homogeneous Catalyst

12.5.2. Heterogeneous Catalyst

12.5.3. Biocatalyst

12.6. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

12.6.1. Mixed

12.6.2. Oxide

12.6.3. Metallic

12.6.4. Sulfide

12.6.5. Organometallic

12.7. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

12.7.1. Petroleum Refinery

12.7.2. Chemical Manufacturing

12.7.3. Petrochemical

12.7.4. Automotive and Transportation

12.7.5. Food Processing

12.7.6. Others

12.8. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Country, 2017 - 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Industrial Catalyst Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

13.5.1. Homogeneous Catalyst

13.5.2. Heterogeneous Catalyst

13.5.3. Biocatalyst

13.6. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

13.6.1. Mixed

13.6.2. Oxide

13.6.3. Metallic

13.6.4. Sulfide

13.6.5. Organometallic

13.7. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

13.7.1. Petroleum Refinery

13.7.2. Chemical Manufacturing

13.7.3. Petrochemical

13.7.4. Automotive and Transportation

13.7.5. Food Processing

13.7.6. Others

13.8. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Country, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Industrial Catalyst Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Type, 2017 - 2031

14.5.1. Homogeneous Catalyst

14.5.2. Heterogeneous Catalyst

14.5.3. Biocatalyst

14.6. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Raw Material, 2017 - 2031

14.6.1. Mixed

14.6.2. Oxide

14.6.3. Metallic

14.6.4. Sulfide

14.6.5. Organometallic

14.7. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Application, 2017 - 2031

14.7.1. Petroleum Refinery

14.7.2. Chemical Manufacturing

14.7.3. Petrochemical

14.7.4. Automotive and Transportation

14.7.5. Food Processing

14.7.6. Others

14.8. Industrial Catalyst Market Size (US$ Bn and Kilo Tons), By Country, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis (%), 2022

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

15.3.1. Albemarle Corporation Johnson Matthey

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Size Portfolio

15.3.2. BASF SE

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Size Portfolio

15.3.3. Chevron Phillips Chemical Company LLC

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Size Portfolio

15.3.4. Clariant AG

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Size Portfolio

15.3.5. Dorf Ketal Chemicals (I) Pvt. Ltd.

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Size Portfolio

15.3.6. Dow Chemical Company

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Size Portfolio

15.3.7. Evonik Industries AG

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Size Portfolio

15.3.8. Exxonmobil Corporation

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Size Portfolio

15.3.9. Johnson Matthey

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Size Portfolio

15.3.10. W.R. Grace and Co

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Size Portfolio

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Type

16.1.2. Raw Material

16.1.3. Application

16.1.4. Geography

16.2. Understanding the Buying Process of the Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 2: Global Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 3: Global Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 4: Global Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 5: Global Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 6: Global Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 7: Global Industrial Catalyst Market, By Region, Kilo Tons, 2017-2031

Table 8: Global Industrial Catalyst Market, By Region, US$ Bn, 2017-2031

Table 9: North America Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 10: North America Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 11: North America Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 12: North America Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 13: North America Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 14: North America Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 15: North America Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Table 16: North America Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Table 17: Europe Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 18: Europe Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 19: Europe Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 20: Europe Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 21: Europe Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 22: Europe Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 23: Europe Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Table 24: Europe Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Table 25: Asia Pacific Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 26: Asia Pacific Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 27: Asia Pacific Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 28: Asia Pacific Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 29: Asia Pacific Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 30: Asia Pacific Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 31: Asia Pacific Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Table 32: Asia Pacific Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Table 33: Middle East & Africa Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 34: Middle East & Africa Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 35: Middle East & Africa Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 36: Middle East & Africa Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 37: Middle East & Africa Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 38: Middle East & Africa Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 39: Middle East & Africa Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Table 40: Middle East & Africa Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Table 41: South America Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Table 42: South America Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Table 43: South America Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Table 44: South America Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Table 45: South America Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Table 46: South America Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Table 47: South America Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Table 48: South America Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

List of Figures

Figure 1: Global Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 2: Global Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 3: Global Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 4: Global Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 5: Global Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 6: Global Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 7: Global Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 8: Global Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 9: Global Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 10: Global Industrial Catalyst Market, By Region, Kilo Tons, 2017-2031

Figure 11: Global Industrial Catalyst Market, By Region, US$ Bn, 2017-2031

Figure 12: Global Industrial Catalyst Market Incremental Opportunity, By Region, US$ Bn, 2017-2031

Figure 13: North America Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 14: North America Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 15: North America Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 16: North America Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 17: North America Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 18: North America Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 19: North America Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 20: North America Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 21: North America Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 22: North America Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Figure 23: North America Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Figure 24: North America Industrial Catalyst Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 25: Europe Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 26: Europe Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 27: Europe Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 28: Europe Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 29: Europe Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 30: Europe Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 31: Europe Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 32: Europe Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 33: Europe Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 34: Europe Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Figure 35: Europe Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Figure 36: Europe Industrial Catalyst Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 37: Asia Pacific Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 38: Asia Pacific Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 39: Asia Pacific Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 40: Asia Pacific Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 41: Asia Pacific Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 42: Asia Pacific Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 43: Asia Pacific Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 44: Asia Pacific Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 45: Asia Pacific Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 46: Asia Pacific Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Figure 47: Asia Pacific Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Figure 48: Asia Pacific Industrial Catalyst Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 49: Middle East & Africa Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 50: Middle East & Africa Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 51: Middle East & Africa Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 52: Middle East & Africa Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 53: Middle East & Africa Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 54: Middle East & Africa Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 55: Middle East & Africa Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 56: Middle East & Africa Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 57: Middle East & Africa Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 58: Middle East & Africa Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Figure 59: Middle East & Africa Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Figure 60: Middle East & Africa Industrial Catalyst Market Incremental Opportunity, By Country, US$ Bn, 2017-2031

Figure 61: South America Industrial Catalyst Market, By Product Type, Kilo Tons, 2017-2031

Figure 62: South America Industrial Catalyst Market, By Product Type, US$ Bn, 2017-2031

Figure 63: South America Industrial Catalyst Market Incremental Opportunity, By Product Type, US$ Bn, 2017-2031

Figure 64: South America Industrial Catalyst Market, By Raw Material, Kilo Tons, 2017-2031

Figure 65: South America Industrial Catalyst Market, By Raw Material, US$ Bn, 2017-2031

Figure 66: South America Industrial Catalyst Market Incremental Opportunity, By Raw Material, US$ Bn, 2017-2031

Figure 67: South America Industrial Catalyst Market, By Application, Kilo Tons, 2017-2031

Figure 68: South America Industrial Catalyst Market, By Application, US$ Bn, 2017-2031

Figure 69: South America Industrial Catalyst Market Incremental Opportunity, By Application, US$ Bn, 2017-2031

Figure 70: South America Industrial Catalyst Market, By Country, Kilo Tons, 2017-2031

Figure 71: South America Industrial Catalyst Market, By Country, US$ Bn, 2017-2031

Figure 72: South America Industrial Catalyst Market Incremental Opportunity, By Country, US$ Bn, 2017-2031