Reports

Reports

Industrial artificial intelligence (AI) market is driven by the demand for enhanced operational efficiency in manufacturing, energy, automobile, and the other industrial fields. The organizations are always eager to maximize production flow, minimize downtime, and enhance resource utilization. AI-based predictive maintenance, quality inspection solutions, and process automation are increasingly being integrated into industrial processes to optimize production.

The capability of AI to detect anomalies, optimize energy usage, and enhance production lines helps enterprises to drive important cost reductions and business resilience, thereby driving industrial artificial intelligence [AI] market growth across the globe.

Growing demand for workplace safety and risk management is yet another key driver to the industrial artificial intelligence [AI] market. There are hazardous operations witnessed in industrial facilities, and AI-driven solutions help in prevention of accidents and assure of regulatory compliance. Computer vision and ML technologies are being implemented for detecting unsafe conditions, monitoring worker behavior, and enabling real-time safety inspections. In addition, the ability of AI to ensure process consistency and quality control in complex production processes does eliminate risk of human errors, which further solidifies the implementation. Sustainability and environmental responsibility concern also align with the application of AI-driven industrial solutions.

Industrial artificial intelligence [AI] market trends have recently been characterized by the increasing change of attitude toward cloud-edge integration and digital twin adoption. The edge AI solutions are coming to the forefront as they are able to analyze data close to the source, thereby ensuring instant decision-making and lower latency.

The use of artificial intelligence-powered digital twin technology is gaining traction as it helps to simulate, monitor, and optimize industrial assets throughout their lifecycle. Besides, the advancements in computer vision have made it possible for some industries to automate visual inspection while self-learning algorithms have made it possible for systems to adapt automatically to ever-changing production environments.

The competitive environment of the industrial artificial intelligence [AI] market is known for the fast-paced dynamic characterized by the supply of new products and services, forming strategic alliances, and investments in research and development. The companies are not only committing themselves to upgrading their AI capabilities but also introducing new platforms that integrate data analytics, machine learning, and automation.

Artificial Intelligence (AI) in industries implies the application of cutting-edge AI technologies such as ML, natural language processing, computer vision, and predictive analytics in the manufacturing sector. Standard AI aims at optimizing various aspects in a general way, whereas industrial AI emphasizes the optimization of production, improvement of operational efficiency, and the maintenance of accuracy of complex industrial systems.

It is essentially employed for handling large industrial data for easier decision making, predicting, and automating. Through AI integration in machines, robots, and control systems, industrial AI is changing traditional factories to smart, self-adjusting ecosystems that can cater to the unexpected needs.

Predictive maintenance and process optimization exemplify the key capabilities of industrial AI. By facilitating real-time monitoring of equipment performance and identifying subtle patterns, AI systems can forecast potential equipment failures, thereby cutting down on downtime and extending asset life while significantly lowering the maintenance costs. Industrial AI also assists in optimizing the production scheduling and energy utilization. Its ability to detect inefficiencies and anomalies in real time makes industrial operations cost-effective and disruption-resistant.

Industrial AI has also been identified as a critical aid in quality assurance and inspection. The AI systems with computer vision and sophisticated image recognition can find minute defects that are invisible to human eyes. One of the benefits of automated inspection is that it not only raises the quality of products but also eliminates manual checks, thereby shortening the production cycles. Also, industrial AI facilitates continuous process improvement by drawing lessons from historical production data and making process changes accordingly.

Additionally, Industrial AI continues to transform the process of sustainability and safety. AI-based monitoring systems improve workplace safety by warning workers in advance about prevalent hazards. These systems are capable of even identifying where the fires are being ignited, thereby detecting leaks of harmful gases and indicating safety device failure.

In the same manner, AI, with its tools and methods, makes it possible to decrease energy usage and emissions through clean and green production processes. Digital transformation among industries has led to the rise of industrial AI as the front-runner in achieving that goal, still leading the way for innovation, safety, and efficiency, while also making the future of industrial operations smarter and more sustainable.

| Attribute | Detail |

|---|---|

| Industrial Artificial Intelligence [AI] Market Drivers |

|

Growing applications of industry 4.0 technologies is the key growth driver to the industrial artificial intelligence (AI) market as it focuses on industry and production digitalization. Industry 4.0 brings together automation, cyber-physical systems, and large data analytics, wherein there is a high demand for AI-based solutions to process as well as interpret sophisticated data. Industrial AI does provide the intelligence essential for integrating machines, systems, and processes so that factories can operate smoothly. Convergence ensures smooth integration between industrial networks and fuels innovation in automation and process optimization.

One of the ways in which Industry 4.0 accelerates industrial AI adoption is through intelligent manufacturing systems. AI does facilitate autonomous decision-making through processing networked devices' real-time data, thereby improving production efficiency and minimizing downtime. AI-driven predictive models guarantee machinery reliability, while sophisticated algorithms improve production scheduling and planning.

Mass customization and personalization are the other essential factors contributing to market expansion. The technologies that come with the fourth industry revolution give the manufacturers the capability to create unique products that can be sold in large quantities. However, such a business model demands the use of AI to take care of complex supply chains and a multitude of product lines.

Moreover, the conjunction of AI and Industry 4.0 results in the development of self-learning and adaptive systems that can evolve on their own. These systems have knowledge of the past and present learned data, so they can offer the industries a feasible and quick approach to the growth process. Thus, companies become more competitive, leading to greater efficiency, use of fewer resources, and supporting sustainable practices.

The increasing amount of information available via Internet of Things (IoT) devices is one of the principal drivers to the industrial artificial intelligence (AI) market. Sophisticated industrial installations have large numbers of sensors, networked equipment, and smart devices that are continuously generating information. In combination with AI devices, such data offers deep insights into operation of machines, its production ability, and process related risks. Industrial AI exploits these insights to facilitate decision making, which allows industries to move from reactionary to predictive and prescriptive strategies.

One of the main grounds for use of industrial AI is the predictive maintenance powered by the IoT data. IoT sensors keep a constant, real-time check on the condition of the equipment and track temperature, vibration, pressure, and the other performance indicators. AI algorithms use this data to predict failure of machines in advance. This approach tends to asset’s longevity and minimizes downtime. Preventive maintenance not only lowers the cost of maintenance but also improves the reliability of industrial processes.

Moreover, IoT data combined with AI leads to the strengthening of the quality control system.

Additionally, data gathered through IoT can make the operational efficiency better as a whole. The set of solutions that include efficient use of energy, management of supply chain, and the safety at workplace are only a few of the areas in which the decision-making of AI relies on the datasets which are further furnished by machine-to-machine communication technologies. This cooperation between IoT and AI leads to the development of smart, connected industrial ecosystems, which have the features of automation, adaptability, and sustainable growth.

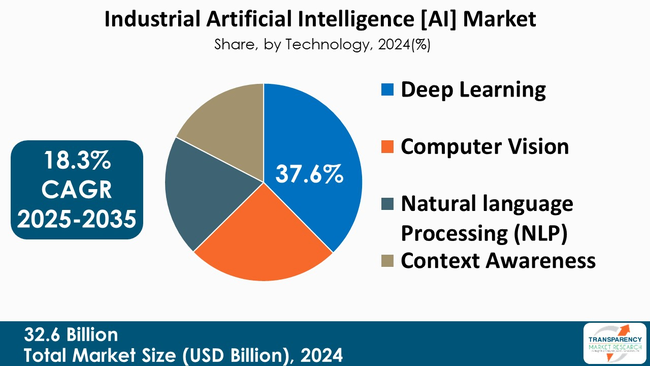

Deep learning is the leading segment in the industrial artificial intelligence [AI] market, due to its capability to handle big and complex datasets. Industrial settings typically generate large volumes of structured and unstructured data, which are a result of the different processes, machines, and sensors. Deep learning models that come equipped with multiple-layered neural networks can discover the underlining patterns of the data, to notify if there are any abnormalities, and also make very accurate predictions.

Moreover, deep learning provides the basis for development of advanced computer vision and automation functionalities, which are the main features of quality inspection, the utilization of robotics, and safety monitoring. Its characteristics enable industrial systems to keep on adapting from new data streams and to become more efficient with the passage of time. Through on-the-spot decision-making, scalability, and precision, deep learning has become the critical to industrial AI.

| Attribute | Detail |

|---|---|

| Leading Region |

|

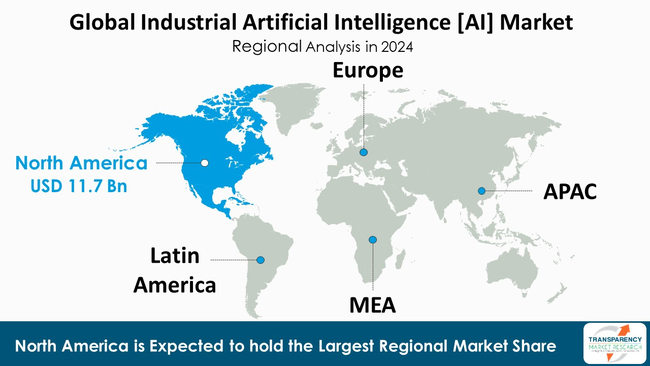

As per the latest industrial artificial intelligence [AI] market analysis, North America dominated in 2024. This is mainly due to the region's solid technological infrastructure and its fast adoption of advanced digital solutions. The area boasts an established industrial base that is inclusive of the sectors such as manufacturing, automotive, aerospace, and energy, where the implementation of AI is leading to drastic increase in efficiency and output. Furthermore, North America is known for the presence of well-established research institutions and technology providers, which further nourishes AI innovation. The supportive government measures together with the high R&D investments give the region a further advantage to be at the forefront of industrial AI adoption.

Businesses propelling the industrial artificial intelligence [AI] market use tactics like creating sophisticated AI platforms, investing heavily into R&D, and signing strategic partnerships. Firms are also focusing on hybrid cloud-edge installations, flexible solutions, and compatibility with currently used systems.

Siemens, General Electric Company, ABB, Honeywell International Inc., Bosch Rexroth Kft., Schneider Electric, Mitsubishi Electric Europe B.V., Hitachi Vantara LLC, Emerson Electric Co., IBM, Microsoft, Amazon Web Services, Inc., Oracle, SAP SE, and Intel Corporation are some of the leading players operating in the global market.

Each of these players has been profiled in the industrial artificial intelligence [AI] market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

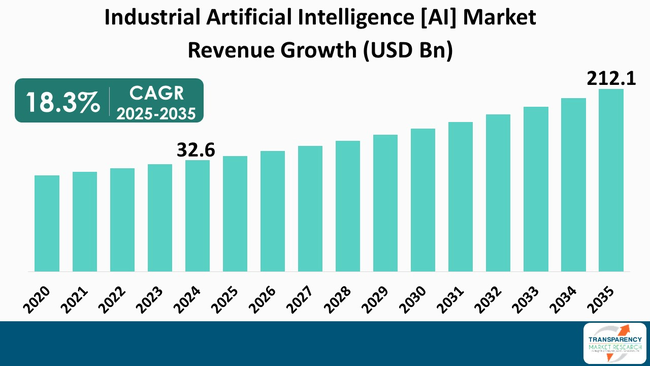

| Size in 2024 | US$ 32.6 Bn |

| Forecast Value in 2035 | US$ 212.1 Bn |

| CAGR | 18.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Industrial Artificial Intelligence [AI] Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global industrial artificial intelligence [AI] market was valued at US$ 32.6 Bn in 2024

The global industrial artificial intelligence [AI] industry is projected to reach more than US$ 212.1 Bn by the end of 2035

Technological advancements, increased data availability from IoT devices and digital transformation, the need for automation to improve efficiency and productivity, the push for Industry 4.0 and the increasing investment in AI infrastructure are some of the factors driving the expansion of industrial artificial intelligence [AI] market.

The CAGR is anticipated to be 18.3% from 2025 to 2035

Siemens, General Electric Company, ABB, Honeywell International Inc., Bosch Rexroth Kft., Schneider Electric, Mitsubishi Electric Europe B.V., Hitachi Vantara LLC, Emerson Electric Co., IBM, Microsoft, Amazon Web Services, Inc., Oracle, SAP SE, and Intel Corporation

Table 01: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 02: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 03: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 04: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 05: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 07: Global Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 10: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 11: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 12: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 13: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 15: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 16: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 17: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 18: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 19: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 21: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 22: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 23: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 24: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 25: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 26: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 27: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 28: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 29: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 30: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 31: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 32: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 33: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 34: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 35: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 36: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 37: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 38: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 39: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 40: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 41: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 42: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 43: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 44: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 46: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 47: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 48: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 49: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 50: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 51: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 52: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 53: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 54: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 55: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 56: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 57: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 58: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 59: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 60: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 61: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 62: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 63: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 64: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 65: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 66: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 67: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 68: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 69: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 70: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 71: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 72: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 73: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 74: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 75: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 76: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 77: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 78: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 79: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 80: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 81: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 82: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 83: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 84: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 85: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 86: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 87: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 88: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 89: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 90: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 91: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 92: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 93: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 94: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 95: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 96: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 97: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 98: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 99: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 100: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 101: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 102: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 103: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 104: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 105: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 106: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 107: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 108: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 109: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 110: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 111: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 112: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 113: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 114: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 115: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 116: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 117: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 118: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 119: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 120: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 121: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 122: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 123: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 124: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 125: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 126: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 127: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 128: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 129: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 130: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 131: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 132: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 133: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 134: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 135: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 136: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 137: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 138: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 139: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 140: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 141: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 142: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 143: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 144: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 145: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 146: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 147: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 148: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 149: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 150: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 151: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 152: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 153: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 154: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 155: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 156: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 157: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 158: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 159: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 160: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 161: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 162: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 163: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 164: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 165: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 166: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 167: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 168: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 169: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 170: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 171: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 172: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 173: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 174: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 175: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 176: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 177: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 178: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 179: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 180: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Figure 01: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 02: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 03: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 04: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 06: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 07: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Deep Learning, 2020 to 2035

Figure 08: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Computer Vision, 2020 to 2035

Figure 09: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Natural Language Processing (NLP), 2020 to 2035

Figure 10: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Context Awareness, 2020 to 2035

Figure 11: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 12: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 13: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by On-premises, 2020 to 2035

Figure 14: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Cloud-based, 2020 to 2035

Figure 15: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Predictive Maintenance & Machinery Inspection, 2020 to 2035

Figure 18: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Material Movement, 2020 to 2035

Figure 19: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Production Planning, 2020 to 2035

Figure 20: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Field Services, 2020 to 2035

Figure 21: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Quality Control, 2020 to 2035

Figure 22: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 24: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 25: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Energy & Power, 2020 to 2035

Figure 26: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Automobile, 2020 to 2035

Figure 27: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Pharmaceuticals, 2020 to 2035

Figure 28: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Food & Beverages, 2020 to 2035

Figure 29: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Heavy Metals & Machine Manufacturing, 2020 to 2035

Figure 30: Global Industrial Artificial Intelligence [AI] Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 31: Global Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 33: North America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 36: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 37: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 38: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 39: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 40: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 41: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 42: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: North America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 45: North America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 46: U.S. Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: U.S. Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 48: U.S. Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 49: U.S. Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 50: U.S. Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 51: U.S. Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 52: U.S. Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 53: U.S. Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 54: U.S. Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 55: U.S. Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 56: U.S. Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 57: Canada Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Canada Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 59: Canada Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 60: Canada Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 61: Canada Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 62: Canada Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 63: Canada Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 64: Canada Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 65: Canada Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 66: Canada Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 67: Canada Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 68: Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 71: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 72: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 73: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 74: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 75: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 76: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 77: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 78: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 79: Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 80: Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 81: UK Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: UK Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 83: UK Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 84: UK Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 85: UK Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 86: UK Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 87: UK Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 88: UK Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 89: UK Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 90: UK Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 91: UK Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 92: Germany Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 93: Germany Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 94: Germany Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 95: Germany Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 96: Germany Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 97: Germany Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 98: Germany Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 99: Germany Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 100: Germany Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 101: Germany Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 102: Germany Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 103: France Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: France Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 105: France Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 106: France Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 107: France Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 108: France Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 109: France Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 110: France Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 111: France Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 112: France Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 113: France Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 114: Italy Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 115: Italy Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 116: Italy Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 117: Italy Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 118: Italy Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 119: Italy Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 120: Italy Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 121: Italy Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 122: Italy Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 123: Italy Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 124: Italy Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 125: Spain Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 126: Spain Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 127: Spain Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 128: Spain Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 129: Spain Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 130: Spain Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 131: Spain Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 132: Spain Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 133: Spain Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 134: Spain Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 135: Spain Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 136: The Netherlands Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 137: The Netherlands Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 138: The Netherlands Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 139: The Netherlands Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 140: The Netherlands Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 141: The Netherlands Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 142: The Netherlands Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 143: The Netherlands Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 144: The Netherlands Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 145: The Netherlands Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 146: The Netherlands Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 147: Rest of Europe Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 148: Rest of Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 149: Rest of Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 150: Rest of Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 151: Rest of Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 152: Rest of Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 153: Rest of Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 154: Rest of Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 155: Rest of Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 156: Rest of Europe Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 157: Rest of Europe Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 158: Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 160: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 161: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 162: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 163: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 164: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 165: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 166: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 167: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 168: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 169: Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 170: Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 171: China Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 172: China Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 173: China Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 174: China Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 175: China Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 176: China Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 177: China Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 178: China Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 179: China Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 180: China Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 181: China Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 182: India Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 183: India Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 184: India Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 185: India Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 186: India Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 187: India Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 188: India Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 189: India Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 190: India Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 191: India Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 192: India Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 193: Japan Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 194: Japan Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 195: Japan Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 196: Japan Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 197: Japan Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 198: Japan Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 199: Japan Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 200: Japan Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 201: Japan Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 202: Japan Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 203: Japan Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 204: Australia Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: Australia Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 206: Australia Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 207: Australia Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 208: Australia Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 209: Australia Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 210: Australia Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 211: Australia Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 212: Australia Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 213: Australia Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 214: Australia Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 215: South Korea Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: South Korea Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 217: South Korea Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 218: South Korea Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 219: South Korea Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 220: South Korea Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 221: South Korea Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 222: South Korea Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 223: South Korea Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 224: South Korea Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 225: South Korea Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 226: ASEAN Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 227: ASEAN Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 228: ASEAN Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 229: ASEAN Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 230: ASEAN Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 231: ASEAN Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 232: ASEAN Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 233: ASEAN Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 234: ASEAN Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 235: ASEAN Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 236: ASEAN Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 237: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 238: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 239: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 240: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 241: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 242: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 243: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 244: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 245: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 246: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 247: Rest of Asia Pacific Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 248: Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 249: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 250: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 251: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 252: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 253: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 254: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 255: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 256: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 257: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 258: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 259: Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 260: Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 261: Brazil Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: Brazil Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 263: Brazil Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 264: Brazil Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 265: Brazil Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 266: Brazil Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 267: Brazil Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 268: Brazil Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 269: Brazil Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 270: Brazil Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 271: Brazil Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 272: Argentina Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 273: Argentina Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 274: Argentina Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 275: Argentina Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 276: Argentina Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 277: Argentina Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 278: Argentina Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 279: Argentina Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 280: Argentina Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 281: Argentina Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 282: Argentina Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 283: Mexico Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 284: Mexico Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 285: Mexico Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 286: Mexico Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 287: Mexico Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 288: Mexico Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 289: Mexico Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 290: Mexico Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 291: Mexico Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 292: Mexico Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 293: Mexico Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 294: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 295: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 296: Rest of Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 297: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 298: Rest of Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 299: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 300: Rest of Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 301: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 302: Rest of Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 303: Rest of Latin America Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 304: Rest of Latin America Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 305: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 306: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 307: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 308: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 309: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 310: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 311: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 312: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 313: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 314: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 315: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 316: Middle East & Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 317: Middle East & Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 318: GCC Countries Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 319: GCC Countries Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 320: GCC Countries Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 321: GCC Countries Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 322: GCC Countries Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 323: GCC Countries Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 324: GCC Countries Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 325: GCC Countries Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 326: GCC Countries Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 327: GCC Countries Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 328: GCC Countries Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 329: South Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 330: South Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Offering, 2024 and 2035

Figure 331: South Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Offering, 2025 to 2035

Figure 332: South Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Technology, 2024 and 2035

Figure 333: South Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 334: South Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 335: South Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 336: South Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By Application, 2024 and 2035

Figure 337: South Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 338: South Africa Industrial Artificial Intelligence [AI] Market Value Share Analysis, By End-use Industry, 2024 and 2035

Figure 339: South Africa Industrial Artificial Intelligence [AI] Market Attractiveness Analysis, By End-use Industry, 2025 to 2035

Figure 340: Rest of Middle East & Africa Industrial Artificial Intelligence [AI] Market Value (US$ Bn) Forecast, 2020 to 2035