Reports

Reports

Static synchronous compensator (STATCOM) is a regulating device prominently used for power factor correction and voltage regulation across electricity transmission networks. India has witnessed large-scale industrialization for a long time. Hence, high-scale industrialization requires high scale measures. Hence, regulating devices are necessary for uninterrupted power supply. Therefore, STATCOM UPS is necessary for the same. STATCOM UPS is also used for power distribution, mining, automobile industry, oil and gas offshore platforms, and long-distance power transmission. UPS STATCOMs also lessen the voltage variations and helps the manufacturers to incur less power-related costs during the manufacturing process.

Relaxations in Economic Policies Boost STATCOM UPS Market

The economic liberalization of 1991 accelerated the pace of industrialization in India, setting the manufacturing activities in a notable momentum. This change has been the primary growth driver for the whopping energy demand in the country. However, the inconsistency in the supply of energy and the growing pressure of conserving has led to a high adoption of static synchronous compensator STATCOM UPS. The units help in the regulation of voltage and correction of power factor, both of which are essential to the smooth functioning of manufacturing units.

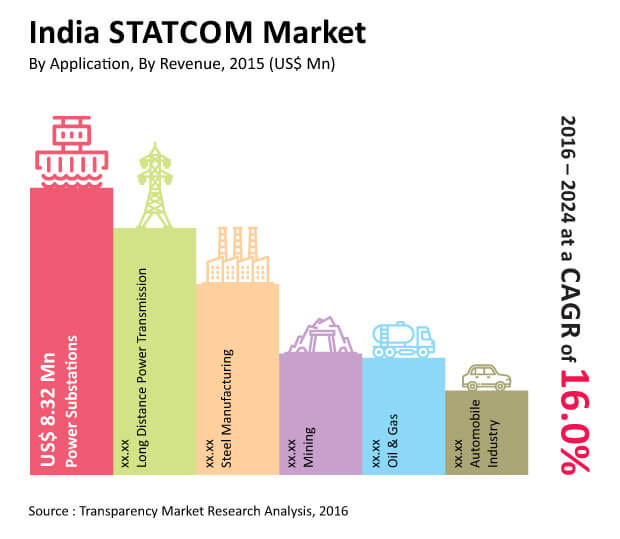

A research report published by Transparency Market Research suggests that the opportunity in the India STATCOM UPS market will be worth US$113.9 mn by 2024 from US$27 mn in 2014, expanding at an impressive CAGR of 16.0% from 2016 to 2024. The rise in the India STATCOM UPS market will be due to the power deficit in the country and the need to save on overall energy consumption.

IGBT-Based STATCOM UPS to Lead Market

Analysts predict that the ability of STATCOM UPS units to manage voltage fluctuations and harmonic distortions seen in power supplies will boost their demand amongst various industries. For instance, utilities are deploying STATCOM for compensating refining power factor and reactive power in the transmission and distribution network.

The most popular product in the overall market is the insulated gate bipolar transistors (IGBT) STATCOM UPS. By the end of 2024, this product segment is anticipated to hold a share of 88.8% in the India STATCOM UPS market from 78.0% in 2014. The impressive growth of IGBT-based STATCOM UPS will be due to its increasing usage in real and reactive power. Furthermore, it is also being acknowledged as an acceptable technology across various industrial platforms.

Government Initiatives Make a Big Impact

STATCOM UPS systems are used for a wide range of applications such as offshore oil and gas, power distribution, power transmission, steel manufacturing, mining, and automobile manufacturing. The report suggests that long distance power transmission and power substations are significant users of STATCOM UPS as the Indian government is pumping in money to improve power transmission and distribution channels across the country. Furthermore, initiatives such as Make in India will also push the manufacturing movement in India, thereby creating a positive impact on the growth of the India STATCOM UPS market.

The presence of heavy industries such as mining and steel industries is propelling the demand for STATCOM UPS in the eastern and western states of India. Though these regions have been using static VAR compensator (SVC) UPS technology for regulating voltages and power factor correction, they are making a gradual shift towards STATCOM UPS due to the reliable and stable power solutions it offers.

The key players in the India STATCOM UPS market are General Electric India Ltd., Bharat Heavy Electricals Limited (BHEL), NR Energy Solutions India Pvt. Ltd., ABB India Limited, Crompton Greaves Limited, Schneider Electric India Pvt. Ltd., Mitsubishi Electric India Pvt. Ltd., Signotron India Pvt. Ltd., Veeral Controls Pvt. Ltd., and Power One Micro Systems Pvt. Ltd. Research indicates that these players will have to build stronger brand images and make meaningful investments to bring their research and development to fruition to gain a substantial revenue share.

Table of Content

Section 01: Preface

Section 02: Executive Summary

Section 03: Industry Analysis

Section 04: STATCOM UPS Product Segment Analysis

Section 05: STATCOM UPS Application Segment Analysis

Section 06: SVC UPS Product Segment Analysis

Section 07: Geographical Segment Analysis

Section 08: Company Profiles

List of Tables

Table 1 Indian STATCOM UPS and SVC Market: Snapshot

List of Figures

Figure 1 Indian STATCOM UPS Revenue (US$ Mn), 2014–2024

Figure 2 Indian SVC UPS Revenue (US$ Mn), 2014–2024

Figure 3 Industrial Production Index of Major Industries, India (2010-2016)

Figure 4 Power supply position in India (2009-16), in MU

Figure 5 FDI flow in Manufacturing Sector (US$ Bn)

Figure 6 Sector-wise FDI flow in 2014

Figure 7 Company Market Share, STATCOM UPS Market (%) (2014)

Figure 8 Market Attractiveness Analysis of STATCOM UPS Market

Figure 9 STATCOM UPS Market, Product Segment, By Revenue (US$ Mn), 2014

Figure 10 STATCOM UPS Market, Product Segment, By Revenue (US$ Mn), 2024

Figure 11 Gate Turn-Off Thyristors (GTO) STATCOM, By Revenue (US$ Mn), 2014–2024

Figure 12 Insulated Gate Bipolar Transistors (IGBT) STATCOM, By Revenue (US$ Mn), 2014–2024

Figure 13 STATCOM UPS Market: Application Segment, By Revenue (US$ Mn), 2014

Figure 14 STATCOM UPS Market: Application Segment, By Revenue (US$ Mn), 2024

Figure 15 Long distance power transmission, By Revenue (US$ Mn), 2014–2024

Figure 16 Power substations, By Revenue (US$ Mn), 2014–2024

Figure 17 Oil & gas, By Revenue (US$ Mn), 2014–2024

Figure 18 Steel manufacturing, By Revenue (US$ Mn), 2014–2024

Figure 19 Mining, By Revenue (US$ Mn), 2014–2024

Figure 20 Automobile industry, By Revenue (US$ Mn), 2014–2024

Figure 21 SVC UPS Market: Product Segment, By Revenue (US$ Mn), 2014

Figure 22 SVC UPS Market: Product Segment, By Revenue (US$ Mn), 2024

Figure 23 Thyristors-Based SVC, By Revenue (US$ Mn), 2014–2024

Figure 24 Fixed capacitor-thyristor controlled reactor (FC-TCR), By Revenue (US$ Mn), 2014–2024

Figure 25 Thyristor switched capacitor - thyristor controlled reactor (TSC-TCR), By Revenue (US$ Mn), 2014–2024

Figure 26 Magnetically Controlled Reactor (Mcr) Based SVC, By Revenue (US$ Mn), 2014–2024

Figure 27 India’s STATCOM UPS Market: 2014–2024 (US$ Mn)

Figure 28 India’s SVC UPS Market: 2014–2024 (US$ Mn)

Figure 29 East India STATCOM UPS Market: 2014–2024 (US$ Mn)

Figure 30 East India SVC UPS Market: 2014–2024 (US$ Mn)

Figure 31 East India STATCOM Market, By Revenue (US$ Mn)

Figure 32 East India SVC Market, By Revenue (US$ Mn)

Figure 33 East India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2014

Figure 34 East India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2024

Figure 35 West India STATCOM UPS Market: 2014–2024 (US$ Mn)

Figure 36 West India SVC UPS Market: 2014–2024 (US$ Mn)

Figure 37 West India STATCOM Market, By Revenue (US$ Mn)

Figure 38 West India SVC Market, By Revenue (US$ Mn)

Figure 39 West India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2014

Figure 40 West India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2024

Figure 41 North India STATCOM UPS Market: 2014–2024 (US$ Mn)

Figure 42 North India SVC UPS Market: 2014–2024 (US$ Mn)

Figure 43 North India STATCOM Market, By Revenue (US$ Mn)

Figure 44 North India SVC Market, By Revenue (US$ Mn)

Figure 45 North India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2014

Figure 46 North India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2024

Figure 47 South India STATCOM UPS Market: 2014–2024 (US$ Mn)

Figure 48 South India SVC UPS Market: 2014–2024 (US$ Mn)

Figure 49 South India STATCOM Market, By Revenue (US$ Mn)

Figure 50 South India SVC Market, By Revenue (US$ Mn)

Figure 51 South India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2014

Figure 52 South India STATCOM UPS Market: Market Share, By Revenue (US$ Mn), 2024