Reports

Reports

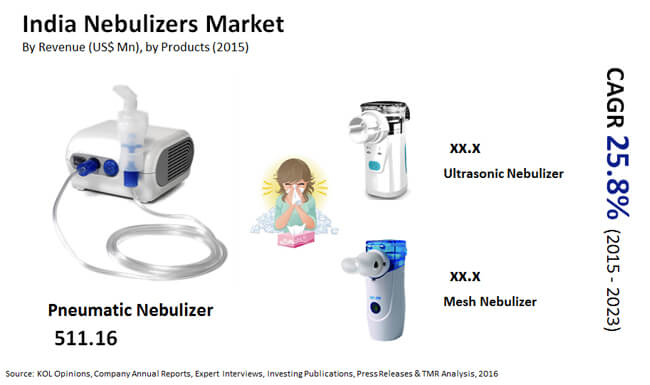

Thanks to growing pollution levels, the incidence of respiratory disorders is on the rise in India. This has fueled the demand for nebulizers remarkably in the country. In 2014, the India nebulizers market stood at INR575.6 mn. The dramatic growth in the cases of asthma, cystic fibrosis, and chronic obstructive pulmonary diseases is anticipated to boost the adoption of nebulizers among Indian citizens in the coming years. According to experts, the demand for these instruments will rise at a CAGR of 25.80% between 2015 and 2023 and reach an opportunity of INR4,703.4 mn by the end of 2023.

Aptness for all Types of Medications Drive Demand for Pneumatic Nebulizers

In India, the nebulizers market comprises pneumatic nebulizer, mesh nebulizer, ultra-sonic nebulizer, and nebulizer kits. Among these, pneumatic nebulizers are the most demanded product, owing to their aptness for almost all types of medications. In 2014, the pneumatic nebulizers segment held a share of more than 68% in the overall market, reaching to an opportunity worth INR393.53 mn. Expanding at a CAGR of 25.40% between 2015 and 2023, this opportunity is likely to increase to INR3,118.3 mn by 2023.

Mesh nebulizers emerged second in 2014 with a share of nearly 17% in the overall market. Equipped with latest technologies, these nebulizers are highly efficient and perform fast drug delivery, which is why their demand is reported to be increasing significantly. The segment is projected to register a CAGR of 27.1% between 2015 and 2023.

North Zone to Remain Dominant Regional Market for Nebulizers

The India nebulizers market is studied on the basis of its performance in the north zone, east zone, central zone, south zone, and the west zone. In 2014, north zone emerged as the market leader with a share of 35.10%. The increasing prevalence of acute respiratory diseases and chronic obstructive pulmonary disorders, triggered by the escalating level of pollution, has fueled the demand for nebulizers significantly in this zone. Analysts expect a gradual increase in this demand at a CAGR of 27.50% over the period from 2014 to 2023, ensuring the dominance of the north zone during this period.

Nebulizers are also witnessing a high demand in the east zone. According to the department of environment in West Bengal, 70% of people in Kolkata suffer from one or the other form of respiratory conditions, owing the immense environmental pollution. As the pollution continues to rise, the prevalence of respiratory diseases in this zone is projected to witness a considerable increase in the near future, boosting the demand for nebulizers.

Large Participant Pool Makes for Fragmented Competitive Landscape

The nebulizers market in India demonstrates a highly fragmented structure, thanks to the presence of a large pool of participants. Omron Healthcare, Nulife, and Philips Healthcare are at the forefront of this market. Resipirotech Med Solutions Pvt. Ltd., Becton, Dickinson and Co., PARI Respiratory Equipment Inc., Medicare Equipments (India) Pvt. Ltd., Bhasin Sons Private Ltd., Agilent Technologies, Inc., and DeVilbiss Healthcare LLC are some of the other prominent companies operating in this market.

Table of Content

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

1.4. Assumptions

2. Executive Summary

2.1. Market Snapshot: India Nebulizers Market, 2014 & 2023

2.2. Comparative Analysis: India Nebulizers Market, by Type (%), 2014 & 2023

2.3. India Nebulizers Market, by Type, 2014 (INR Mn)

2.4. India Nebulizers Market, by Zone, 2014 (INR Mn)

3. India Nebulizers Market – Industry Analysis

3.1. Introduction

3.2. Average Pricing Analysis

3.3. Market Dynamics

3.4. Value Chain Analysis

3.5. Drivers

3.5.1. Driver 1: Increasing prevalence of asthma, cystic fibrosis, and COPD

3.5.2. Driver 2: Rising geriatric population to drive the nebulizers market in India

3.6. Restraints

3.6.1. Restraint 1: Drug loss during dosage delivery

3.7. Opportunities

3.7.1. Opportunity 1: Innovative Products Expected to Boost Utilization in New Clinical Applications

3.8. Porter’s Five Forces Analysis

3.9. Market Attractiveness Analysis

3.10. Competitive Analysis

3.10.1. Market Share Analysis

3.10.2. Market Revenue, by Company (2013-2015)

4. Market Segmentation – By Product Type

4.1. Introduction

4.1.1. India Nebulizers Market, by Type, 2013–2023, (INR Mn)

4.2. Pneumatic Nebulizers Market Revenue in India, 2013–2023, (INR Mn)

4.2.1. Pneumatic Nebulizers Market in India, 2013–2023 (No. of Units in Thousand)

4.3. Ultrasonic Nebulizers Market in India, 2013–2023 (INR Mn)

4.3.1. Ultrasonic Nebulizers Market in India, 2013–2023 (No. of Units in Thousand)

4.4. Mesh Nebulizers Market in India Nebulizers Market, 2013–2023 (INR Mn)

4.4.1. Mesh Nebulizers Market in India Nebulizers Market, 2013–2023 (No. of Units in Thousand)

4.5. Nebulizers Kits Market in India, 2013–2023 (INR Mn)

4.5.1. Nebulizers Kits Market in India, 2013–2023 (No. of Units in Thousand)

5. Market Segmentation – By Zone

5.1. Introduction

5.2. North Zone Nebulizers Market, 2013–2023 (INR Mn)

5.2.1. North Zone Nebulizers Market, 2013–2023 (No. of Units in Thousand)

5.3. South Zone Nebulizers Market, 2013–2023 (INR Mn)

5.3.1. South Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

5.4. East Zone Nebulizers Market, 2013–2023 (INR Mn)

5.4.1. East Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

5.5. West Zone Nebulizers Market, 2013–2023 (INR Mn)

5.5.1. West Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

5.6. Central Zone Nebulizers Market, 2013–2023 (INR Mn)

5.6.1. Central Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

6. Recommendations

7. Company Profiles

7.1. Agilent Technologies, Inc.

7.2. Becton, Dickinson and Company (CareFusion Corporation)

7.3. Bhasin Sons Private Limited

7.4. DeVilbiss Healthcare LLC

7.5. Nulife (MRK Healthcare Pvt. Ltd.)

7.6. Medicare Equipments (India) Pvt. Ltd

7.7. OMRON Healthcare, Inc.

7.8. Philips Healthcare

7.9. PARI Respiratory Equipment, Inc.

7.10. Resipirotech Med Solutions Pvt. Ltd

List of Tables

TABLE 1 India Nebulizers Market: Market Snapshot

TABLE 2 India Nebulizers Market Revenue, by Company, 2013 - 2015 (INR Mn)

TABLE 3 India Nebulizers Market Revenue, by Type, 2013–2023 (INR Mn)

TABLE 4 India Nebulizers Market Revenue, by Regional Zone, 2013–2023 (INR Mn)

TABLE 5 India Nebulizers Market Volume, by Regional Zone, 2013–2023 (No. of Units in thousand)

List of Figures

FIG. 1 India Nebulizers Market Share, by Type, 2014 (Value %)

FIG. 2 India Nebulizers Market, by Type, 2014 (INR Mn)

FIG. 3 India Nebulizers Market, by Zone, 2014 (INR Mn)

FIG. 4 India Nebulizers Market: Market Share, by Key Players, 2014 (Value %)

FIG. 5 North Zone Nebulizers Market, 2013–2023 (INR Mn)

FIG. 6 North Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

FIG. 7 South Zone Nebulizers Market, 2013–2023 (INR Mn)

FIG. 8 South Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

FIG. 9 East Zone Nebulizers Market, 2013–2023 (INR Mn)

FIG. 10 East Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

FIG. 11 West Zone Nebulizers Market, 2013–2023 (INR Mn)

FIG. 12 West Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

FIG. 13 Central Zone Nebulizers Market, 2013–2023 (INR Mn)

FIG. 14 Central Zone Nebulizers Market, 2013–2023 (No. of Units in thousand)

FIG. 15 Agilent , Annual Revenue, 2012–2014 (INR Mn)

FIG. 16 Becton, Dickinson and Company, Annual Revenue, 2012–2014 (INR Mn)

FIG. 17 Omron Healthcare, Inc., Annual Revenue, 2012–2014 (INR Mn)

FIG. 18 Philips Healthcare, Annual Revenue, 2012–2014 (INR Mn)