Reports

Reports

The coronavirus outbreak has disrupted business activities globally. This is being reflected in the India copper clad laminates market. Poor market sentiments are lowering the demand for electronic products. This has naturally dipped the demand for copper clad laminates that are used in electronic products and for embedded capacitance among other applications. Despite logistics and transportation challenges, manufacturers are strengthening their sales through eCommerce and company-owned websites to keep the revenue flowing.

In order to ensure business continuity, companies in the India copper clad laminates market are providing remote customer support. They are focusing on mission-critical projects and applications by ensuring steady supply of products. Medical devices, building & construction projects, and other essential electronics applications are helping manufacturers to gain buoyancy during the pandemic.

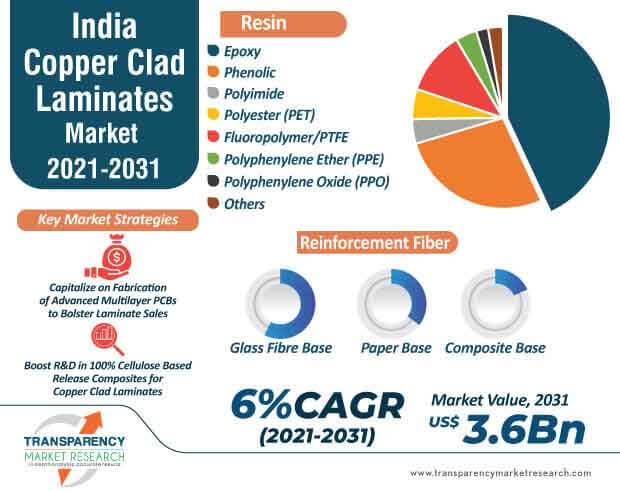

The India copper clad laminates market is expected to exceed US$ 3.6 Bn by 2031. However, the competition is intensifying in the India copper clad laminates market to adopt sustainable practices to ensure future resource utilization and waste reduction in the market and in the printed circuit board (PCB) industries. Ahlstrom-Munksjö - a global provider of sustainable and innovative fiber-based solutions, is gaining awareness of this opportunity within a challenge and has introduced OptiLayup™, a 100% cellulose-based release composite for copper clad laminate applications.

There is a growing demand for biodegradable release composites for use in copper clad laminate and PCB applications. This is evident since consumable release sheets are an important aid for many demanding lamination processes, including copper clad laminate and PCB pressing.

Thin copper clad laminates are being specifically designed for use as embedded capacitance materials in multilayer rigid PCBs. Companies in the India copper clad laminates market are increasing their production capabilities in these products to offer the best mechanical strength, reliability, and capacitance stability in PCBs. With the help of thin copper clad laminates between the power and ground planes in a power distribution network (PDN), manufacturers and designers can reduce the modal resonances and lower the inductance between power and ground planes.

Thin copper clad laminates help reduce the impedance in the system and decrease the number of required surface mount capacitors. This is being achieved since these type of laminates are low-profile electrodeposited (ED) copper laminated and are thin polyimide-based dielectric products. This dielectric is engineered to have a superior adhesion to copper than conventional glass-reinforced materials utilized in rigid boards.

Electronic component manufacturers are facing a crisis in the supply of PCBs due to the ongoing COVID-19 outbreak. This is impacting the price of raw materials and affecting the lead-time of end-use products. Such trends are affecting growth of the India copper clad laminates market. In 2020, it has been found that copper output from the mines has witnessed a year-on-year drop due to the pandemic. Though annual copper demand is projected to surge, declining rate of copper deposit recovery poses a long-term threat to copper supply.

Companies in the India copper clad laminates market are facing a stiff competition from China-based copper suppliers, since these suppliers are more aggressive on price increase. Due to the ongoing crisis and poor market sentiments, many laminate vendors in India have stopped the supply of laminates for 2 layer PCB. Hence, stakeholders in India are adopting contingency planning to strategically allocate their investments, manpower, and other resources.

Manufacturers in the India copper clad laminates market are bolstering their output capacities in rigid PCB copper clad laminates. FR-4 (flame retardant) copper clad laminate is a type of rigid PCB substrate composed of woven fiberglass cloth with an epoxy resin binder.

The fabrication of advanced multilayer PCBs is creating stable revenue streams for manufacturers in the India copper clad laminates market. Manufacturers are increasing awareness that high frequency PCB designs require extremely precise controls on dielectric constant, trace widths, and dielectric thickness, which is being achieved with the help of copper clad laminates.

The rapidly growing 5G network infrastructure in Asia is creating lucrative opportunities for companies in the India copper clad laminates market. SABIC (Saudi Basic Industries Corporation) has announced to boost production capacity of its specialty NORYL™ SA9000 resin to support the rapid growth of PCBs used in 5G base stations of Asia. The increased availability of specialty resins is benefitting manufacturers in the India copper clad laminates market to help reduce lead times. Such trends are helping laminate manufacturers to achieve greater flexibility to meet client requests for quick turnarounds.

Specialty resins are in important component in copper clad laminates used in PCBs for the 5G infrastructure segment. Stakeholders are increasing their investment in specialized materials and resins to support the global adoption of 5G network.

The ultra-connected world is anticipated to make future life easier at homes, in cars, and to expand virtual environments. It has been found that low-loss materials play a crucial role in high frequency applications. Since substances with high dielectric constants break down more easily when subjected to intense electric fields, manufacturers are increasing the availability of low dielectric constants involving copper clad laminates. Hence, companies in the India copper clad laminates market are unlocking growth opportunities in autonomous vehicles.

Automotive radar and automated driver-assistance systems (ADAS) are fueling the demand for copper clad laminates. Crash avoidance systems are dependent on radar, which requires high frequency PCBs, and is translating into revenue opportunities for copper clad laminate manufacturers. Manufacturers are adhering to stringent PCB requirements for automotive applications by avoiding the use of anodic filaments in PCBs to prevent shorts between copper clad laminates and conductive traces.

Analysts’ Viewpoint

Stakeholders in the market are witnessing a year-on-year drop in copper output from mines due to COVID-related issues. Moreover, besides India, Taiwan-based copper foil suppliers are facing a stiff competition from China to increase the prices of copper clad laminates and related products & materials.

The India copper clad laminates market is estimated to clock a favorable CAGR of ~6% during the forecast period. However, copper clad laminates are subject to stringent requirements in automotive applications. Manufacturers should avoid anodic filaments in PCBs, as defects in the dielectric can lead to shorts between copper clad laminates and conductive traces.

India Copper Clad Laminates Market: Overview

Key Drivers of India Copper Clad Laminates Market

Major Challenges for India Copper Clad Laminates Market

Lucrative Opportunities for Players Operating in India Copper Clad Laminates Market

Leading Players in India Copper Clad Laminates Market

1. Executive Summary

1.1. India Copper Clad Laminates Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

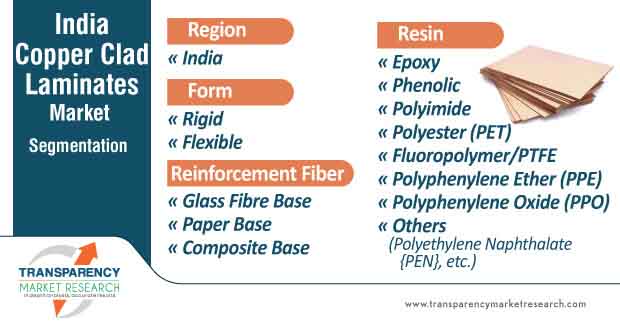

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. India Copper Clad Laminates Market Production Outlook

5. India Copper Clad Laminates Market Price Trend Analysis, 2020-2031

5.1. By Resin Type

6. India Copper Clad Laminates Market Analysis and Forecast, 2020-2031

6.1. Key Findings

6.2. India Copper Clad Laminates Market Volume (Sq. meter) and Value (US$ Mn) Forecast, by Resin Type, 2020-2031

6.3. India Copper Clad Laminates Market Volume (Sq. meter) and Value (US$ Mn) Forecast, Reinforcement Fiber, 2020-2031

6.4. India Copper Clad Laminates Market Volume (Sq. meter) and Value (US$ Mn) Forecast, Form, 2020-2031

6.5. India Copper Clad Laminates Market Attractiveness Analysis

7. Competition Landscape

7.1. India Copper Clad Laminates Market Share Analysis, 2019

7.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

7.2.1. Comet Impreglam LLP

7.2.1.1. Company Description

7.2.1.2. Business Overview

7.2.1.3. Financial Overview

7.2.1.4. Strategic Overview

7.2.2. Signour Laminates (India) Pvt. Ltd.

7.2.2.1. Company Description

7.2.2.2. Business Overview

7.2.2.3. Financial Overview

7.2.2.4. Strategic Overview

7.2.3. Sumitomo Bakelite Company Limited (SBHPP)

7.2.3.1. Company Description

7.2.3.2. Business Overview

7.2.3.3. Financial Overview

7.2.3.4. Strategic Overview

7.2.4. Chang Chun Plastics

7.2.4.1. Company Description

7.2.4.2. Business Overview

7.2.5. Shanghai Nanya Copper Clad Laminate Co. Ltd.

7.2.5.1. Company Description

7.2.5.2. Business Overview

7.2.5.3. Financial Overview

7.2.5.4. Strategic Overview

7.2.6. Hangzhou Liansheng Insulation Co. Ltd

7.2.6.1. Company Description

7.2.6.2. Business Overview

7.2.6.3. Financial Overview

7.2.6.4. Strategic Overview

7.2.7. Klueber Lubrication

7.2.7.1. Company Description

7.2.7.2. Business Overview

7.2.7.3. Financial Overview

7.2.7.4. Strategic Overview

8. Primary Research: Key Insights

9. Appendix

List of Tables

Table 1. India Copper Clad Laminates Market Volume (Sq. meter) Forecast, by Resin Type, 2020–2031

Table 2. India Copper Clad Laminates Market Value (US$ Mn) Forecast, by Resin Type, 2020–2031

Table 3. India Copper Clad Laminates Market Volume (Sq. meter) Forecast, by Reinforcement Material

Table 4. India Copper Clad Laminates Market Value (US$ Mn) Forecast, by Reinforcement Material, 2020-2031

Table 5. India Copper Clad Laminates Market Volume (Sq. meter) Forecast, by Form, 2020-2031

Table 6. India Copper Clad Laminates Market Value (US$ Mn) Forecast, by Form, 2020-2031

List of Figures

Figure 1. India Copper Clad Laminates Market Value Share, by Resin Type, 2020, 2025, and 2031

Figure 2. India Copper Clad Laminates Market Attractiveness, by Resin Type

Figure 3. India Copper Clad Laminates Market Value Share, by Reinforcement Material, 2020, 2025, and 2031

Figure 4. India Copper Clad Laminates Market Attractiveness, by Reinforcement Material

Figure 5. India Copper Clad Laminates Market Value Share, by Form, 2020, 2025, and 2031

Figure 6. India Copper Clad Laminates Market Attractiveness, by Form

Figure 7. India Copper Clad Laminates Market Value Share, by Application, 2020, 2025, and 2031

Figure 8. India Copper Clad Laminates Market Attractiveness, by Application