Reports

Reports

Rising Prevalence of Hematological Disorders Fosters Growth in Immunohematology Market

Some of the most notable and prominent factors influencing the demand dynamics in the global immunohematology market include increasing awareness among the global population pertaining to the importance of blood donation as well as rising requirement for effective detection and diagnosis of blood related diseases. Various public as well as private entities, along with various non-governmental organizations or NGOs are organizing awareness campaigns to underscore the importance of blood donation. Several organizations are also promoting awareness regarding to the usage of safe blood and blood products. These trends are anticipated to work favorably for the enhancement of the global immunohematology market in coming years.

Rising prevalence of various hematological disorders i.e. diseases associated with blood as well as blood forming organs, is also expected to fuel the demand in the global immunohematology market in coming years. Some of the most notable types of hematological disorders are thalassemia, leukemia, sickle cell anemia, lymphoma, and hemophilia, among others. For example, as per the study by the World Health Organization in 2020, around 4,74,519 new cases of leukemia were reported in 2020. Furthermore, more than 3,11,594 deaths were caused by leukemia in 2020. This rise in the prevalence of leukemia is anticipated to drive the demand for effective treatment and testing solutions in the global immunohematology market within the next few years.

Moreover, rising healthcare infrastructure upgradation, increase in expenditure on research and development for advancing the diagnosis as well as treatment of various hematological diseases, and favorable government policies and initiatives are also expected to foster the development in the global immunohematology market in the next few years. Advancements in the global immunohematology market have paved way for automated hematological devices, high volume sample output, enhanced patient data management, software upgradation, and increase in the storage capacities. However, these technological advancements have also surged the costs of various devices and software tools in the global immunohematology market. The high cost associated with hematology equipment such as software and devices may hamper the growth in the global immunohematology market in coming years.

Global Immunohematology Market: Snapshot

Rapid increase in the global disease burden and rise in the demand for blood- and plasma-derived products such as platelets, immunoglobulin, and plasma factors are augmenting the demand for immunohematology testing instruments and reagents. The number of patients with different hematological and other chronic diseases is also increasing rapidly across the world. This is likely to raise the number of surgical procedures in the near future, consequently propelling the demand for blood transfusions. Demand for advanced immunohematology tests in also anticipated to increase during the forecast period in order to maintain the quality standards and safety profiles during blood transfusions.

Awareness among the general public regarding the importance of blood compatibility and transfusion-related diseases is increasing due to the development of health care infrastructure, government campaigns, and increasing per capita income in developed as well as developing countries. Awareness among patients about proper compatibility tests for transfusion is also increasing. Increasing health care expenditure and rising worldwide concerns about medical safety are also driving the global immunohematology market. Moreover, government reimbursement programs in developed as well as developing countries are likely to provide growth opportunities to the immunohematology market in the near future. Demand–supply gap of safe and adequate human blood and plasma is a major bottleneck in the blood transfusion & blood typing industry. According to the World Health Organization, there is a significant difference between the blood demand–supply gap in developing countries and that in developed countries. Developed countries account for more than 50% of the global blood collections. These countries represent only 19% of the global population. Supply disorders in both source materials and finished products, if not managed properly, can hamper the global immunohematology market during the forecast period.

Advancements in the immunohematology technology have led to rapid development in the diagnostic approach toward in vitro study of the antigen–antibody interaction, facilitating improvement in the compatibility reaction between the donor’s blood and the recipient’s blood. Technological improvements in devices and reagents available for immunohematology testing have enabled clinicians to provide proper emergency assistance to patients. These technological advancements include development of automated systems which make the identification process easier and provide more accurate results as compared to manual systems.

Based on product, the global immunohematology market has been segmented into analyzers and reagents. The analyzers segment has been sub-segmented into automatic analyzers and semi-automatic/non-automatic analyzers. Based on application, the global immunohematology market has been divided into blood typing and antibody screening. Based on end-user, the market has been classified into hospitals, academic & research institutes, diagnostic & reference laboratories, and blood banks. The hospitals segment is expected to remain dominant during the forecast period, due to increasing usage of automated analyzers with high throughput in hospitals.

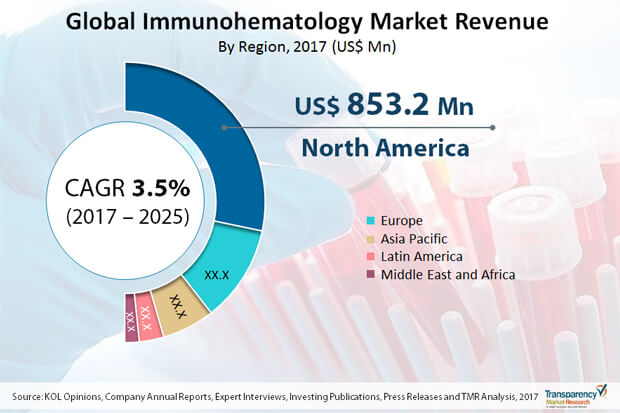

Geographically, the global immunohematology market has been segmented into five regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the global market in 2016 and is projected to continue its dominance between 2017 and 2025. Growth of the market in North America is primarily attributable to the increased funding by governments and the private sector and large volumes of blood transfusions. In addition, increased focus on research by pharmaceutical companies and well-established health care infrastructure are major factors driving the market in the region. The market in Europe is projected to expand at a significant CAGR from 2017 to 2025. Europe held the second-largest market share in 2016. High adoption and usage of superior-quality diagnostics and treatments is one of the major factors driving the market in the region. This can be attributed to increasing number of diagnostic laboratories and blood banks, rising government funding for research activities, and growing application of immunohematology in transfusion safety in the region. Asia Pacific is one of the rapidly developing regions in the world. High per capita income has increased the consumption of blood products in the region.

Key companies profiled in the report are Bio-Rad Laboratories, Inc., Grifols, S.A., Ortho Clinical Diagnostics, IMMUCOR, INC., Abbott Laboratories, Beckman Coulter, Inc., Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, Merck KGaA, and Siemens Healthineers. These players are adopting organic and inorganic growth strategies to expand their product offerings, enhance their geographical reach, widen their customer base, and gain market share. In 2016, Grifols, S.A. won a contract for supplying blood-typing solutions to the Red Cross of South Korea. The Malaysian National Blood Bank renewed its contract for Grifols’s NAT technology that analyzes about 450,000 blood donations every year.

Immunohematology market to reach value of US$ 1,991.8 Mn by 2025

Immunohematology market is projected to expand at a CAGR of 3.5% from 2017 to 2025

Immunohematology market is driven by rising awareness among people in developed as well as developing countries and increasing health care expenditure and rising worldwide concerns about medical safety

North America is projected to be the largest share in the global immunohematology market during the forecast period

Key players in the immunohematology market include Bio-Rad Laboratories, Inc., Grifols S.A., Ortho Clinical Diagnostics, IMMUCOR, INC., Abbott Laboratories, Beckman Coulter, Inc., Thermo Fisher Scientific, Inc.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2 Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Section 3 Executive Summary

3.1 Global Immunohematology Market Snapshot

3.2 Market Share Analysis, by Region, 2016

3.3 Market Opportunity Map

Section 4 Market Overview

4.1 Immunohematology Market Taxonomy

4.2 Key Market Advancements

4.3 Global Immunohematology Market Size (US$ Mn) Forecast, 2015–2025

4.4 Global Immunohematology Market Outlook

Section 5 Market Dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.2 Drivers

5.3 Restraints

5.4 Opportunities

5.5 Immunohematology Market: Porter’s Five Forces Analysis

5.6 Key Success Factors of Top 3 Companies

5.7 Estimated blood donations by WHO region , 2013

5.8 Healthcare Sector Overview

Section 6 Immunohematology Market Analysis, by Product

6.1 Introduction

6.2 Global Immunohematology Market Value Share Analysis, by Product

6.3 Global Immunohematology Market Forecast, by Product

6.3.1 Analyzers

6.3.1.1 Automatic

6.3.1.2 Semi-automatic/Non-automatic

6.3.2 Reagents

6.4 Market Attractiveness Analysis, by Product

6.5 Key Trends

Section 7 Immunohematology Market Analysis, by Application

7.1 Introduction

7.2 Global Immunohematology Market Value Share Analysis, by Application

7.3 Global Immunohematology Market Forecast, by Application

7.3.1 Blood Typing

7.3.2 Antibody Screening

7.4 Market Attractiveness Analysis, by Application

7.5 Key Trends

Section 8 Immunohematology Market Analysis, by End-user

8.1 Introduction

8.2 Global Immunohematology Market Value Share Analysis, by End-user

8.3 Global Immunohematology Market Forecast, by End-user

8.3.1 Hospitals

8.3.1.1 500+ Beds

8.3.1.2 200–499 Beds

8.3.1.3 Less Than 200 Beds

8.3.2 Academic & Research Institutes

8.3.3 Diagnostic & Reference Laboratories

8.3.4 Blood Banks

8.4 Market Attractiveness Analysis, by End-user

Section 9 Immunohematology Market Analysis, by Region

9.1 Global Immunohematology Market Scenario

9.2 Global Immunohematology Market Value Share Analysis, by Region

9.3 Global Immunohematology Market Forecast, by Region

9.4 Market Attractiveness Analysis, by Region

Section 10 North America Immunohematology Market Analysis

10.1 Regional Outlook

10.2 Market Overview

10.3 Market Analysis, by Product

10.3.1 Market Value Share Analysis, by Product

10.3.2 Market Size (US$ Mn) Forecast, by Product

10.3.2.1 Analyzers

10.3.2.1.1 Automatic

10.3.2.1.2 Semi-automatic/Non-automatic

10.3.2.2 Reagents

10.4 Market Analysis, by Application

10.4.1 Market Value Share Analysis, by Application

10.4.2 Market Size (US$ Mn) Forecast, by Application

10.4.2.1 Blood Typing

10.4.2.2 Antibody Screening

10.5 Market Analysis, by End-user

10.5.1 Market Value Share Analysis, by End-user

10.5.2 Market Size (US$ Mn) Forecast, by End-user

10.5.2.1 Hospitals

10.5.2.1.1 500+ Beds

10.5.2.1.2 200–499 Beds

10.5.2.1.3 Less Than 200 Beds

10.5.2.2 Academic & Research Institutes

10.5.2.3 Diagnostic & Reference Laboratories

10.5.2.4 Blood Banks

10.6 Market Analysis, by Country

10.6.1 Market Value Share Analysis, by Country

10.6.2. Market Size (US$ Mn) Forecast, by Country, 2017–2025

10.6.2.1 U.S.

10.6.2.1.1 U.S. Market Size (US$ Mn) Forecast, by Product

10.6.2.1.2 U.S. Market Size (US$ Mn) Forecast, by Application

10.6.2.1.3 U.S. Market Size (US$ Mn) Forecast, by End-user

10.6.2.2 Canada

10.7 Market Attractiveness Analysis

10.7.1 by Country

10.7.2 by Product

10.7.3 by Application

10.7.4 by End-user

Section 11 Europe Immunohematology Market Analysis

11.1 Regional Outlook

11.2 Market Overview

11.3 Market Analysis, by Product

11.3.1 Market Value Share Analysis, by Product

11.3.2 Market Size (US$ Mn) Forecast, by Product

11.3.2.1 Analyzers

11.3.2.1.1 Automatic

11.3.2.1.2 Semi-automatic/Non-automatic

11.3.2.2 Reagents

11.4 Market Analysis, by Application

11.4.1 Market Value Share Analysis, by Application

11.4.2 Market Size (US$ Mn) Forecast, by Application

11.4.2.1 Blood Typing

11.4.2.2 Antibody Screening

11.5 Market Analysis, by End-user

11.5.1 Market Value Share Analysis, by End-user

11.5.2 Market Size (US$ Mn) Forecast, by End-user

11.5.2.1 Hospitals

11.5.2.1.1 500+ Beds

11.5.2.1.2 200–499 Beds

11.5.2.1.3 Less Than 200 Beds

11.5.2.2 Academic & Research Institutes

11.5.2.3 Diagnostic & Reference Laboratories

11.5.2.4 Blood Banks

11.6 Market Analysis, by Country/Sub-region

11.6.1 Market Value Share Analysis, by Country/Sub-region

11.6.2 Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

11.6.2.1 U.K.

11.6.2.2 Germany

11.6.2.3 France

11.6.2.4 Spain

11.6.2.5 Italy

11.6.2.6 Rest of Europe

11.7 Market Attractiveness Analysis

11.7.1 by Country/Sub-region

11.7.2 by Product

11.7.3 by Application

11.7.4 by End-user

Section 12 Asia Pacific Immunohematology Market Analysis

12.1 Regional Outlook

12.2 Market Overview

12.3 Market Analysis, by Product

12.3.1 Market Value Share Analysis, by Product

12.3.2 Market Size (US$ Mn) Forecast, by Product

12.3.2.1 Analyzers

12.3.2.1.1 Automatic

12.3.2.1.2 Semi-automatic/Non-automatic

12.3.2.2 Reagents

12.4 Market Analysis, by Application

12.4.1 Market Value Share Analysis, by Application

12.4.2 Market Size (US$ Mn) Forecast, by Application

12.4.2.1 Blood Typing

12.4.2.2 Antibody Screening

12.5 Market Analysis, by End-user

12.5.1 Market Value Share Analysis, by End-user

12.5.2 Market Size (US$ Mn) Forecast, by End-user

12.5.2.1 Hospitals

12.5.2.1.1 500+ Beds

12.5.2.1.2 200–499 Beds

12.5.2.1.3 Less Than 200 Beds

12.5.2.2 Academic & Research Institutes

12.5.2.3 Diagnostic & Reference Laboratories

12.5.2.4 Blood Banks

12.6 Market Analysis, by Country/Sub-region

12.6.1 Market Value Share Analysis, by Country/Sub-region

12.6.2 Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

12.6.2.1 Australia & New Zealand

12.6.2.2 Japan

12.6.2.3 China

12.6.2.4 India

12.6.2.5 Rest of Asia Pacific

12.7 Market Attractiveness Analysis

12.7.1 by Country/Sub-region

12.7.2 by Product

12.7.3 by Application

12.7.4 by End-user

Section 13 Latin America Immunohematology Market Analysis

13.1 Regional Outlook

13.2 Market Overview

13.3 Market Analysis, by Product

13.3.1 Market Value Share Analysis, by Product

13.3.2 Market Size (US$ Mn) Forecast, by Product

13.3.2.1 Analyzers

13.3.2.1.1 Automatic

13.3.2.1.2 Semi-automatic/Non-automatic

13.3.2.2 Reagents

13.4 Market Analysis, by Application

13.4.1 Market Value Share Analysis, by Application

13.4.2 Market Size (US$ Mn) Forecast, by Application

13.4.2.1 Blood Typing

13.4.2.2 Antibody Screening

13.5 Market Analysis, by End-user

13.5.1 Market Value Share Analysis, by End-user

13.5.2 Market Size (US$ Mn) Forecast, by End-user

13.5.2.1 Hospitals

13.5.2.1.1 500+ Beds

13.5.2.1.2 200–499 Beds

13.5.2.1.3 Less Than 200 Beds

13.5.2.2 Academic & Research Institutes

13.5.2.3 Diagnostic & Reference Laboratories

13.5.2.4 Blood Banks

13.6 Market Analysis, by Country/Sub-region

13.6.1 Market Value Share Analysis, by Country/Sub-region

13.6.2 Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

13.6.2.1 Brazil

13.6.2.2 Mexico

13.6.2.3 Rest of Latin America

13.7 Market Attractiveness Analysis

13.7.1 by Country/Sub-region

13.7.2 by Product

13.7.3 by Application

13.7.4 by End-user

Section 14 Middle East & Africa Immunohematology Market Analysis

14.1 Regional Outlook

14.2 Market Overview

14.3 Market Analysis, by Product

14.3.1 Market Value Share Analysis, by Product

14.3.2 Market Size (US$ Mn) Forecast, by Product

14.3.2.1 Analyzers

14.3.2.1.1 Automatic

14.3.2.1.2 Semi-automatic/Non-automatic

14.3.2.2 Reagents

14.4 Market Analysis, by Application

14.4.1 Market Value Share Analysis, by Application

14.4.2 Market Size (US$ Mn) Forecast, by Application

14.4.2.1 Blood Typing

14.4.2.2 Antibody Screening

14.5 Market Analysis, by End-user

14.5.1 Market Value Share Analysis, by End-user

14.5.2 Market Size (US$ Mn) Forecast, by End-user

14.5.2.1 Hospitals

14.5.2.1.1 500+ Beds

14.5.2.1.2 200–499 Beds

14.5.2.1.3 Less Than 200 Beds

14.5.2.2 Academic & Research Institutes

14.5.2.3 Diagnostic & Reference Laboratories

14.5.2.4 Blood Banks

14.6 Market Analysis, by Country/Sub-region

14.6.1 Market Value Share Analysis, by Country/Sub-region

14.6.2 Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

14.6.2.1 South Africa

14.6.2.2 GCC

14.6.2.3 South Africa

14.6.2.4 Israel

14.6.2.5 Rest of Middle East & Africa

14.7 Market Attractiveness Analysis

14.7.1 by Country/Sub-region

14.7.2 by Product

14.7.3 by Application

14.7.4 by End-user

Section 15 Company Profiles

15.1 Immunohematology Market Share Analysis, by Company (2016)

15.2 Company Profiles

15.2.1 Bio-Rad Laboratories, Inc.

15.2.1.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2 Financial Overview

15.2.1.3 Product Portfolio

15.2.1.4 SWOT Analysis

15.2.1.5 Strategic Overview

15.2.2 Grifols, S.A.

15.2.2.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2 Financial Overview

15.2.2.3 Product Portfolio

15.2.2.4 SWOT Analysis

15.2.2.5 Strategic Overview

15.2.3 Ortho Clinical Diagnostics

15.2.3.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2 Financial Overview

15.2.3.3 Product Portfolio

15.2.3.4 SWOT Analysis

15.2.3.5 Strategic Overview

15.2.4 IMMUCOR, INC.

15.2.4.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2 Financial Overview

15.2.4.3 Product Portfolio

15.2.4.4 SWOT Analysis

15.2.4.5 Strategic Overview

15.2.5 Abbott Laboratories

15.2.5.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2 Financial Overview

15.2.5.3 Product Portfolio

15.2.5.4 SWOT Analysis

15.2.5.5 Strategic Overview

15.2.6 Beckman Coulter, Inc.

15.2.6.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2 Financial Overview

15.2.6.3 Product Portfolio

15.2.6.4 SWOT Analysis

15.2.6.5 Strategic Overview

15.2.7 Thermo Fisher Scientific, Inc.

15.2.7.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2 Financial Overview

15.2.7.3 Product Portfolio

15.2.7.4 SWOT Analysis

15.2.7.5 Strategic Overview

15.2.8 Becton, Dickinson and Company

15.2.8.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2 Financial Overview

15.2.8.3 Product Portfolio

15.2.8.4 SWOT Analysis

15.2.8.5 Strategic Overview

15.2.9 Merck KGaA

15.2.9.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2 Financial Overview

15.2.9.3 Product Portfolio

15.2.9.4 SWOT Analysis

15.2.9.5 Strategic Overview

15.2.10 Siemens Healthineers14.2.5 Merck & Co., Inc.

15.2.10.1 Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2 Financial Overview

15.2.10.3 Product Portfolio

15.2.10.4 SWOT Analysis

15.2.10.5 Strategic Overview

List of Tables

Table 01: Global Immunohematology Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 02: Global Immunohematology Market Size (US$ Mn) Forecast, by Analyzers, 2015–2025

Table 03: Global Immunohematology Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 04: Global Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 05: Global Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 06: Global Immunohematology Market Size (US$ Mn) Forecast, by Region, 2017–2025

Table 07: North America Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 08: North America Immunohematology Market Size (US$ Mn) Forecast, by Analyzers, 2015–2025

Table 09: North America Immunohematology Market Size (US$ Mn) Forecast, by Application, 2017–2025

Table 10: North America Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 11: North America Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 12: North America Immunohematology Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 13: U.S. Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 14: U.S. Immunohematology Market Size (US$ Mn) Forecast, by Application, 2017–2025

Table 15: U.S. Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 16: U.S. Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 17: U.S. Immunohematology Market Size (US$ Mn) Forecast, by Hospitals (by Analyzers), 2015–2025

Table 18: Europe Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 19: Europe Immunohematology Market Size (US$ Mn) Forecast, by Analyzers, 2015–2025

Table 20: Europe Immunohematology Market Size (US$ Mn) Forecast, by Application, 2017–2025

Table 21: Europe Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 22: Europe Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 23: Europe Immunohematology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

Table 24: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 25: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by Analyzers, 2015–2025

Table 26: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by Application, 2017–2025

Table 27: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 28: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 29: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

Table 30: Latin America Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 31: Latin America Immunohematology Market Size (US$ Mn) Forecast, by Analyzer, 2015–2025

Table 32: Latin America Immunohematology Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 33: Latin America Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 34: Latin America Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 36: Latin America Immunohematology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 37: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 38: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by Analyzers, 2015–2025

Table 39: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 40: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 41: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by Hospitals, 2015–2025

Table 42: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

List of Figures

Figure 01: Global Immunohematology Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 02: Market Value Share, by Product (2016)

Figure 03: Market Value Share, by Application (2016)

Figure 04: Market Value Share, by Region (2016)

Figure 05: Global Immunohematology Market Value Share Analysis, by Product, 2016 and 2025

Figure 06: Global Immunohematology Market Value Share Analysis, by Analyzers, 2016 and 2025

Figure 07: Global Immunohematology Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Analyzers, 2015–2025

Figure 08: Global Immunohematology Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Reagents, 2015–2025

Figure 09: Global Immunohematology Market Attractiveness Analysis, by Product

Figure 10: Global Immunohematology Market Value Share, by Application, 2016 and 2025

Figure 11: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Blood Typing, 2015–2025

Figure 12: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Antibody Screening, 2015–2025

Figure 13: Global Immunohematology Market Attractiveness, by Application

Figure 14: Global Immunohematology Market Value Share, by End-user, 2016 and 2025

Figure 15: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2015–2025

Figure 16: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Academic & Research Institutes, 2015–2025

Figure 17: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostic & Reference Laboratories, 2015–2025

Figure 18: Global Immunohematology Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Blood Banks, 2015–2025

Figure 19: Global Immunohematology Market Attractiveness, by End-user

Figure 20: Global Immunohematology Market Value Share, by Region, 2016 and 2025

Figure 21: Global Immunohematology Market Attractiveness, by Region

Figure 22: North America Immunohematology Market Size (US$ Mn) Forecast, 2017–2025

Figure 23: North America Market Attractiveness Analysis, by Country

Figure 24: North America Immunohematology Market Value Share Analysis, by Product, 2016 and 2025

Figure 25: North America Immunohematology Market Value Share Analysis, by Application, 2016 and 2025

Figure 26: North America Immunohematology Market Value Share Analysis, by End-user, 2016 and 2024

Figure 27: North America Immunohematology Market Value Share Analysis, by Country, 2016 and 2025

Figure 28: North America Immunohematology Market Attractiveness Analysis, by Product

Figure 29: North America Immunohematology Market Attractiveness Analysis, by Application

Figure 30: North America Immunohematology Market Attractiveness Analysis, by End-user

Figure 31: Europe Immunohematology Market Size (US$ Mn) Forecast, 2017–2025

Figure 32: Europe Immunohematology Market Attractiveness, by Country/Sub-region

Figure 33: Europe Immunohematology Market Value Share, by Product, 2016 and 2025

Figure 34: Europe Immunohematology Market Value Share, by Application, 2016 and 2025

Figure 35: Europe Immunohematology Market Value Share, by End-user, 2016 and 2025

Figure 36: Europe Immunohematology Market Value Share, by Country/Sub-region, 2016 and 2025

Figure 37: Europe Immunohematology Market Attractiveness, by Product

Figure 38: Europe Immunohematology Market Attractiveness, by Application

Figure 39: Europe Immunohematology Market Attractiveness, by End-user

Figure 40: Asia Pacific Immunohematology Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 41: Asia Pacific Immunohematology Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 42: Asia Pacific Immunohematology Market Value Share, by Product, 2016 and 2025

Figure 43: Asia Pacific Immunohematology Market Value Share, by Application, 2016 and 2025

Figure 44: Asia Pacific Immunohematology Market Value Share, by End-user, 2016 and 2025

Figure 45: Asia Pacific Immunohematology Market Value Share, by Country/Sub-region, 2016 and 2025

Figure 46: Asia Pacific Immunohematology Market Attractiveness, by Product

Figure 47: Asia Pacific Immunohematology Market Attractiveness, by Application

Figure 48: Asia Pacific Immunohematology Market Attractiveness, by End-user

Figure 49: Latin America Immunohematology Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 50: Latin America Immunohematology Market Attractiveness Analysis, by Country/Sub-region, 2017-25

Figure 51: Latin America Immunohematology Market Value Share Analysis, by Product, 2016 and 2025

Figure 52: Latin America Immunohematology Market Value Share Analysis, by Application, 2016 and 2025

Figure 53: Latin America Immunohematology Market Value Share Analysis by End-user, 2016 and 2024

Figure 54: Latin America Immunohematology Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 55: Latin America Immunohematology Market Attractiveness Analysis, by Product

Figure 56: Latin America Immunohematology Market Attractiveness Analysis, by Application

Figure 57: Latin America Immunohematology Market Attractiveness Analysis, by End-user

Figure 58: Middle East & Africa Immunohematology Market Size (US$ Mn) Forecast, 2015–2025

Figure 59: Middle East & Africa Immunohematology Market Attractiveness, by Country/Sub-region

Figure 60: Middle East & Africa Immunohematology Market Value Share, by Product, 2016 and 2025

Figure 61: Middle East & Africa Immunohematology Market Value Share, by Application, 2016 and 2025

Figure 62: Middle East & Africa Immunohematology Market Value Share, by End-user, 2016 and 2024

Figure 63: Middle East & Africa Immunohematology Market Value Share, by Country/Sub-region, 2016 and 2025

Figure 64: Middle East & Africa Immunohematology Market Attractiveness, by Product

Figure 65: Middle East & Africa Immunohematology Market Attractiveness, by Application

Figure 66: Middle East & Africa Immunohematology Market Attractiveness, by End-user

Figure 67: Market Share of Prominent Key Players: Immunohematology Market, 2016