Reports

Reports

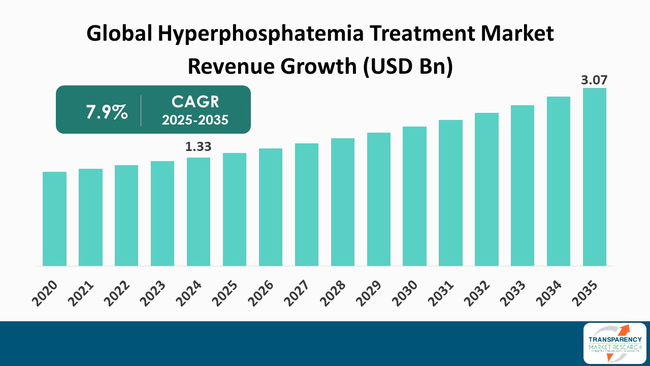

The global hyperphosphatemia treatment market size was valued at US$ 1.33 billion in 2024 and is projected to reach US$ 3.07 billion by 2035, expanding at a CAGR of 7.9% from 2025 to 2035. The market growth is driven primarily by the rising prevalence of chronic kidney disease and end-stage renal disease, which increase the number of patients experiencing elevated phosphate levels. Additionally, the ageing population and growing awareness of phosphate-related complications are boosting demand for effective therapies, including advanced phosphate binders and improved treatment formulations.

The global hyperphosphatemia treatment market is witnessing steadiness, basically as a consequence of the growing incidence of CKD (chronic kidney disease) and ESRD (end-stage renal disease), both of which result in elevated phosphate levels that need treatment.

Furthermore, patients are increasingly aware that hyperphosphatemia can lead to adverse events like bone disorders and cardiovascular disease, which increases the demand for phosphate binders and phosphate absorption inhibitors.

The market is dominated by phosphate binders including lanthanum carbonate, sevelamer, and highly-marketed new products like tenapanor. There remain market restraints including high costs of treatment, pill burden, and patient disinterest due to side-effects and complex dosage regimens.

Additionally, the realities of no clear cure and a limited number of treatment options for early-stage CKD patients continues to hamper acceptance among patients who are not currently on dialysis. Nonetheless, opportunities exist for development of drug discovery with improved efficacy and safety profiles while reducing pill burden. Funding for healthcare and new therapies through personalized medicine and scientific advances with drug delivery systems may extend the potential compliance behaviour

Emergent markets that support healthcare infrastructure will provide market growth opportunities and government-level support for CKD initiatives and treatments to consider and increase the overall acceptance of drug therapy options.

Hyperphosphatemia is a condition wherein one has excess phosphate (phosphorus) in their blood. Phosphate is a type of electrolyte that has a natural positive or negative charge when dissolved in water or the other body fluids, such as blood.

Anybody can get hyperphosphatemia. However, one is more likely to have hyperphosphatemia if they have advanced chronic kidney disease or kidney failure.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing rate of chronic kidney disease (CKD) and end-stage renal disease (ESRD) will be a key component that continues to expand the hyperphosphatemia treatment market as the ability to excrete excess phosphate diminishes with reduced kidney function and elevates the serum phosphate level. This condition is known as hyperphosphatemia and certainly more prevalent in patients at these stages of CKD and patients who are undergoing dialysis for ESRD.

The prevalence and risk for hyperphosphatemia will only continue to increase given the demographical and lifestyle changes associated with aging and the increasing health burdens of diabetes, hypertension, and chronic diseases.

At the ESRD stage of CKD, a new risk of worsening hyperphosphatemia will develop if the phosphate is not adequately managed and this poorly managed phosphate can lead to serious endpoints such as vascular calcification, cardiovascular disease, and bone disease.

This unmet need of managing hyperphosphatemia will result in the greater utilization of phosphate lowering therapy's, such as phosphate binders and dietary phosphate absorption inhibitors, and the utilization will be greater than years passed.

The approval of the new therapies and regulatory support are key factors driving the hyperphosphatemia treatment industry. Health authorities like the U.S. FDA, EMA, and the other global regulatory agencies are making more efforts and prioritizing action to approve new therapies that can overcome issues associated with classic phosphate binders.

Classic therapies often cater to high pill burdens, gastrointestinal side-effects, and risks associated with calcium overload. In response, pharmaceutical companies have developed new classes of therapies like iron based phosphate binders and non-binder treatments like tenapanor that utilize mechanisms never used before (non-binder mechanism tends to work by correlating the reducing absorption of phosphate from the gut).

As regulatory agencies have identified the unmet clinical need, some novel therapies have been given fast-track or priority review designations so that they can be made available more rapidly than the normal approval process. The expedited review pathways have the effect of fostering the development of novel treatments and enhancing patient access to better treatments.

As more number of novel therapies become available in the marketplace more patients will be able to benefit from the use of therapies that may improve adherence, neuropathy complications, and greatly increase the number of options available to patients with hyperphosphatemia and overall grow the hyperphosphatemia treatment market.

The phosphate binders is a dominating the drug type segment of the hyperphosphatemia treatment market owing to the important role played by it in the management of increased levels of phosphate in the blood, especially in patients with chronic kidney disease (CKD).

Hyperphosphatemia, which is identified as elevated quantity of phosphate in the blood, can develop into serious complications and health concerns such as cardiovascular disease and bone disease. Phosphate binders function by binding dietary phosphate in the gastrointestinal region and blocking absorption of phosphate into the bloodstream, providing a clear option in treatment of phosphate levels.

The prevalence of CKD has increased significantly around the world and further raised awareness as well as clinical recognition of the complications of hyperphosphatemia have facilitated the phosphate binders as safe and effective for treating elevated blood phosphate levels.

More specifically, the clinical recommendations through practice guidelines provided to healthcare providers in clinical practices recommend phosphate binders for treatment to enhance the clinical profile of phosphate binders segment of the hyperphosphatemia treatment market. Furthermore, new formulations of phosphate binders have entered the market from a development and health benefit perspective.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the largest share of the global hyperphosphatemia treatment, thanks to a blend of sophisticated healthcare infrastructure, high incidence of the disease, and robust market forces. The region boasts a large patient pool with chronic kidney disease (CKD) and end-stage renal disease (ESRD), conditions that direct toward hyperphosphatemia. This translates to high demand for successful phosphate-lowering therapies.

Moreover, North America has developed healthcare systems with early diagnosis and treatment being made possible with an extensive availability of innovative drugs like phosphate binders. Robust government policies, good reimbursement policies, and ongoing expenditure toward research and development activities are additional contributors to the market growth for the hyperphosphatemia treatment in this region. Collectively, these contribute to North America's market leadership position.

Sanofi, CSL, Akebia Therapeutics., Ardelyx, Unicycive, Takeda Pharmaceutical Company Limited., Lupin, Kyowa Kirin Co., Ltd. , ZERIA Pharmaceutical Co.,Ltd., Torii Pharmaceutical Co.,Ltd, Amgen, Novartis AG , Chugai Pharmaceutical Co., Ltd, Kissei Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd. are the key players governing the global hyperphosphatemia treatment market.

Each of these players has been profiled in the hyperphosphatemia treatment market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.33 Bn |

| Forecast Value in 2035 | More than US$ 3.07 Bn |

| CAGR | 7.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Drug Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.33 Bn in 2024

It is projected to cross US$ 3.07 Bn by the end of 2035

Rising prevalence of chronic kidney disease (CKD) and end‑stage renal disease (ESRD), and regulatory support & approvals of novel therapies

It is anticipated to grow at a CAGR of 7.9% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Sanofi, CSL, Akebia Therapeutics., Ardelyx, Unicycive, Takeda Pharmaceutical Company Limited., Lupin, Kyowa Kirin Co., Ltd., ZERIA Pharmaceutical Co., Ltd., Torii Pharmaceutical Co., Ltd., Amgen, Novartis AG, Chugai Pharmaceutical Co., Ltd, Kissei Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd. and Other Prominent Players are the key players governing the global Hyperphosphatemia Treatment Market.

Table 01: Global Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 02 Global Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 03: Global Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 04: Global Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 05: Global Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 08 North America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 09: North America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 10: North America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 11: Europe Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 12: Europe Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 13 Europe Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 14: Europe Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 15: Europe Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 16: Asia Pacific Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: Asia Pacific Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 18 Asia Pacific Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 19: Asia Pacific Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 20: Asia Pacific Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 21: Latin America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Latin America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 23 Latin America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 24: Latin America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 25: Latin America Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 26: Middle East & Africa Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 27: Middle East & Africa Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Drug Type, 2020 to 2035

Table 28 Middle East & Africa Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Phosphate Binders, 2020 to 2035

Table 29: Middle East & Africa Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Patient Type, 2020 to 2035

Table 30: Middle East & Africa Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Figure 01: Global Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 02: Global Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 03: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Phosphate Binders, 2020 to 2035

Figure 04: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by NHE3 Inhibitors, 2020 to 2035

Figure 05: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 06: Global Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 07: Global Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 08: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Hemodialysis Patients, 2020 to 2035

Figure 09: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Peritoneal Dialysis Patients, 2020 to 2035

Figure 10: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Non-Dialysis CKD (Stages 3-4), 2020 to 2035

Figure 11: Global Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 12: Global Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 13: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 14: Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 15 Global Hyperphosphatemia Treatment Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 16: Global Hyperphosphatemia Treatment Market Value Share Analysis, By Region, 2024 and 2035

Figure 17: Global Hyperphosphatemia Treatment Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 18: North America - Hyperphosphatemia Treatment Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 19: North America - Hyperphosphatemia Treatment Market Value Share Analysis, by Country, 2024 and 2035

Figure 20: North America - Hyperphosphatemia Treatment Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 21: North America Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 22: North America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 23: North America Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 24: North America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 25: North America Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 26: North America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 27: Europe - Hyperphosphatemia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: Europe - Hyperphosphatemia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: Europe Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 30: Europe Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 31: Europe Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 32: Europe Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 33: Europe Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 34: Europe Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 35: Asia Pacific - Hyperphosphatemia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Asia Pacific - Hyperphosphatemia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Asia Pacific Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 38: Asia Pacific Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 39: Asia Pacific Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 40: Asia Pacific Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 41: Asia Pacific Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 42: Asia Pacific Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 43: Latin America - Hyperphosphatemia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Latin America - Hyperphosphatemia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Latin America Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 46: Latin America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 47: Latin America Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 48: Latin America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 49: Latin America Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 50: Latin America Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 51: Middle East & Africa - Hyperphosphatemia Treatment Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Middle East & Africa - Hyperphosphatemia Treatment Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Middle East & Africa Hyperphosphatemia Treatment Market Value Share Analysis, By Drug Type, 2024 and 2035

Figure 54: Middle East & Africa Hyperphosphatemia Treatment Market Attractiveness Analysis, By Drug Type, 2025 to 2035

Figure 55: Middle East & Africa Hyperphosphatemia Treatment Market Value Share Analysis, By Patient Type, 2024 and 2035

Figure 56: Middle East & Africa Hyperphosphatemia Treatment Market Attractiveness Analysis, By Patient Type, 2025 to 2035

Figure 57: Middle East & Africa Hyperphosphatemia Treatment Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 58: Middle East & Africa Hyperphosphatemia Treatment Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035