Reports

Reports

The hydrogen electrolyzers market is expanding at a fast rate as the world is undergoing energy transition. The green hydrogen economy also requires electrolyzers, which must be able to decarbonize portions of the energy, transportation, and heavy-industrial sectors.

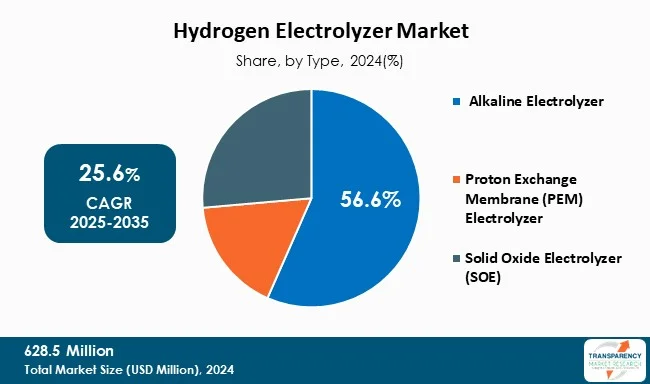

Renewable energy is now becoming more affordable, and technological innovations in the electrolysis process are making green hydrogen production at large scales feasible. Alkaline electrolyzers dominate the market with proven maturity and cost-effectiveness and PEM systems are rapidly following them due to their versatility and ability to work with renewable energy.

Asia Pacific leads due to the sound policy frameworks, infrastructure development, and national-level projects such as the Indian National Green Hydrogen Mission. This is a pointer to a greater global shift in adopting clean energy as a policy initiative, with Europe and North America also emerging as prime growth destinations. Simultaneously, the process of consolidation between the major players such as Nel ASA, Siemens Energy, Plug Power, and Cummins is oriented at a highly competitive environment, where strategic alliances, innovation, and manufacturing capacity scaling further expands the market.

The hydrogen electrolyzers market revolves around machines that synthesize hydrogen molecule by the process of electrolysis, which splits water molecules through electricity. These electrolyzers play a crucial role in the production of clean hydrogen, particularly when they use renewable energy as the source of power, thereby making it a “green hydrogen”.

Electrolyzers can be classified into three categories; namely alkaline electrolyzers that are less expensive and have already matured, proton exchange membrane (PEM) electrolyzers that are compact and responsive, and solid oxide electrolyzers that have high efficiency due to high temperatures. All these types differ in price, efficiency, and whether they are applicable to various scales and use.

Electrolytic production of hydrogen has become common in many industries such as in refineries, in the production of ammonia, in steel plants, and in clean transportation and electric power generation applications. It is also finding application in energy storage systems where the unwanted renewable energy is turned into hydrogen and stored to be utilized later.

The hydrogen electrolyzers market growth is fast-tracked by climate goals, incentives given by governments, and corporate decarbonization plans. With the improvement in technology and the falling costs, the market will grow in centralized industrial centers as well as decentralized energy systems. Strategic alliances, infrastructure building and material/design innovations will form the competitive scenario of the years to come.

| Attribute | Detail |

|---|---|

| Hydrogen Electrolyzers Market Drivers |

|

The increased demand for green hydrogen is one of the factors triggering the hydrogen electrolyzers market given that it is the fundamental technology to produce hydrogen. Green hydrogen refers to hydrogen produced by electrolysis using renewable energy sources (solar energy, wind power or hydropower). It is a clean energy alternative to hydrogen made by fossil fuels.

In contrast to conventional fuels, its use does not contribute to local air pollution, except where nitrous oxide is used as a propellant. Its distributed manufacturing capacity also helps to bring energy security, particularly in the remote areas with little connectivity to common energy grid infrastructures.

In addition, the flexibility of green hydrogen in the different sectors including transportation, power generation and heating; industrial purposes such as ammonia and steel production guarantee widespread demand, thus increasing the use of electrolyzers.

This need is also enhanced by the declining costs of renewable energy and electrolyzers as well as the development of electrolysis technologies that increase efficiency and durability. Due to economies of scale and the growing affordability of production, green hydrogen is edging closer to fossil fuel production. This transformation is being stimulated by government policies as well such as the National Green Hydrogen Mission in India, which hopes to create an end-to-end ecosystem to drive the use of green hydrogen products.

Pushing industries and countries to invest in electrolyzer capacity, the hydrogen electrolyzer sector is becoming a key driver in the industry-wide shift to a clean energy infrastructure.

The Hydrogen electrolyzer market has expanded as the result of the global efforts to achieve net-zero carbon emissions which is driving the demand of clean energy products in various sectors. To go net-zero, there is a need to deploy renewable energy, low-carbon fuels, and storage systems, in which green hydrogen plays an important role. Electrolyzers allow industries, power, and transportation systems to further reduce their carbon footprints and align to net-zero commitments as they help to generate hydrogen devoid of greenhouse gases.

This is supported by a large global contribution in the climate action programs. By June 2024, 107 countries (producing approximately 82 % of global greenhouse emissions) had made net-zero commitments by implementing laws, climate plans, or other official commitments. And, more than 9,000 corporations, 1,000 cities, 1,000 educational institutions, and 600 financial institutions have now signed up to the “Race to Zero”, committing to cut emissions by 50% by 2030 (UN, 2024).

These magnitude investments present massive opportunities to electrolyzer penetration as the governments and industries are making investments at a large scale to scale the hydrogen infrastructure in order to achieve their decarbonizing goals.

Currently, alkaline electrolyzers are a dominant force in the electrolyzers market, based on technological maturity, commercial dependability, and cost-effectiveness. They are reliable sources of continuous production due to their sturdy design and long service life.

In addition, alkaline electrolyzers employ inexpensive and various catalysts like nickel, as opposed to Proton Exchange Membrane (PEM) electrolyzers that require expensive precious metals like platinum and iridium. This effectively lowers the initial capital outlay and the operating cost, thereby making alkaline systems the most cost effective choice to large-scale projects.

Although PEM electrolyzers are the fastest-growing segment, they remain costlier owing to the high costs of raw materials and comparatively shorter history of commercial production. They are more efficient and also more flexible to integrate with intermittent renewable sources like solar and wind, but their economic barrier is a constraint to their large-scale use.

Whereas, solid oxide electrolyzers (SOE) achieve high efficiency at high temperatures, but are being deployed less currently. Alkaline electrolyzers take the market share as compared to these technologies due to a balance between performance and associated costs with lower scalability than the security of future global green hydrogen projects.

| Attribute | Detail |

|---|---|

| Leading Region | Asia- Pacific |

Asia- Pacific is the largest market in the hydrogen electrolyzers market, driven by the high level of government support, quick renewable energy adoption, and increasing demand in the various industries. China, Japan, South Korea, and Australia have been on the frontline in the implementation of hydrogen technologies to decarbonize transport, power, and heavy industries. For instance, India’s -National Green Hydrogen Mission that aims to turn the country into a primary green hydrogen manufacturing and export hub in the world.

These and similar initiatives underscore the way the region is becoming a leader in the hydrogen economy through policy-led initiatives. This, combined with a low cost production structure and massive infrastructure investment, keeps Asia Pacific at the top of the market.

Europe and North America are also making strides in terms of investments and technology development, but Asia Pacific region remains the most dominant shareholder based on the high growth rates, conducive ecosystem, and the high demand base of green hydrogen solutions.

The global hydrogen electrolyzers market is consolidated with a few large-scale vendors controlling a majority share. Companies operating in hydrogen electrolyzers are heavily investing in comprehensive research and development, primarily in advancing technology, product specifications, etc.

Nel ASA, ITM Power plc, Siemens Energy AG, Thyssenkrupp AG, Cummins Inc., Plug Power Inc., Linde plc, Sunfire GmbH, McPhy Energy S.A., Hydrogenics (part of Cummins Inc.), and Toshiba Energy Systems & Solutions Corporation., along with several other prominent regional and global manufacturers are the prominent entities operating in this market.

Each of these players has been profiled in the hydrogen electrolyzers market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

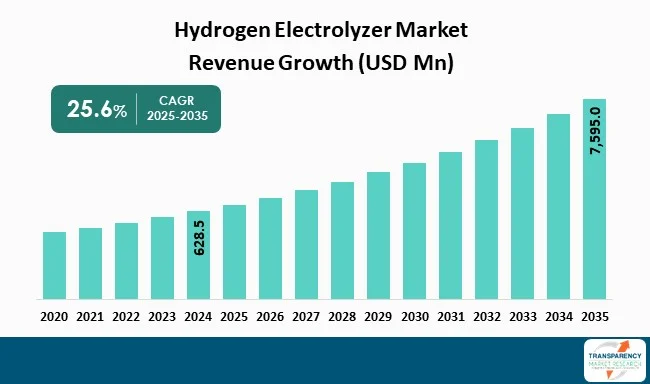

| Size in 2024 | US$ 628.5 Mn |

| Forecast Value in 2035 | US$ 7,595 Mn |

| CAGR | 25.6% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Mn for Value & Megawatt for Volume |

| Hydrogen Electrolyzers Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global hydrogen electrolyzers market was valued at US$ 628.5 Mn in 2024

The global hydrogen electrolyzers market is projected to reach at US$ 7,595.0 Mn by the end of 2035

Green hydrogen's increasing demand as a clean energy carrier, along with the global efforts to achieve net-zero emissions and decarbonization are some of the factors driving the expansion of hydrogen electrolyzers market.

The CAGR is anticipated to be 25.6% from 2025 to 2035

Nel ASA, ITM Power plc, Siemens Energy AG, Thyssenkrupp AG, Cummins Inc., Plug Power Inc., Linde plc, Sunfire GmbH, McPhy Energy S.A., Hydrogenics (part of Cummins Inc.), and Toshiba Energy Systems & Solutions Corporation., along with several other prominent regional and global manufacturers are the prominent entities operating in this market.

Figure 1: Global Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 2: Global Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 3: Global Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 4: Global Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 5: Global Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 6: Global Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 7: Global Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 8: Global Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 9: Global Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 10: Global Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 14: Global Market Volume (Megawatt) Projection, By Region 2020 to 2035

Figure 15: Global Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 16: North America Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 17: North America Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 18: North America Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 19: North America Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 20: North America Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 21: North America Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 22: North America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 23: North America Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 24: North America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 25: North America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 29: North America Market Volume (Megawatt) Projection, By Country 2020 to 2035

Figure 30: North America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 32: U.S. Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 33: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 34: U.S. Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 35: U.S. Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 36: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 37: U.S. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 38: U.S. Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 39: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 40: U.S. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 44: Canada Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 45: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 46: Canada Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 47: Canada Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 48: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 49: Canada Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 50: Canada Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 51: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 52: Canada Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 56: Europe Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 57: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 58: Europe Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 59: Europe Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 60: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 61: Europe Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 62: Europe Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 63: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 64: Europe Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 68: Europe Market Volume (Megawatt) Projection, By Country 2020 to 2035

Figure 69: Europe Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 71: U.K. Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 72: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 73: U.K. Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 74: U.K. Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 75: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 76: U.K. Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 77: U.K. Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 78: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 79: U.K. Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 83: Germany Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 84: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 85: Germany Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 86: Germany Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 87: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 88: Germany Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 89: Germany Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 90: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 91: Germany Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 95: France Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 96: France Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 97: France Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 98: France Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 99: France Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 100: France Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 101: France Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 102: France Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 103: France Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 107: Italy Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 108: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 109: Italy Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 110: Italy Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 111: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 112: Italy Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 113: Italy Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 114: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 115: Italy Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 119: Spain Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 120: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 121: Spain Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 122: Spain Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 123: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 124: Spain Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 125: Spain Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 126: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 127: Spain Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 131: The Netherlands Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 132: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 133: The Netherlands Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 134: The Netherlands Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 135: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 136: The Netherlands Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 137: The Netherlands Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 138: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 139: The Netherlands Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 143: Asia Pacific Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 144: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 145: Asia Pacific Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 146: Asia Pacific Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 147: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 148: Asia Pacific Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 149: Asia Pacific Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 150: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 151: Asia Pacific Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Market Volume (Megawatt) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 157: China Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 158: China Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 159: China Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 160: China Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 161: China Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 162: China Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 163: China Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 164: China Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 165: China Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 166: China Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 170: India Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 171: India Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 172: India Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 173: India Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 174: India Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 175: India Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 176: India Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 177: India Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 178: India Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 182: Japan Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 183: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 184: Japan Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 185: Japan Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 186: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 187: Japan Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 188: Japan Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 189: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 190: Japan Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 194: Australia Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 195: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 196: Australia Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 197: Australia Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 198: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 199: Australia Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 200: Australia Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 201: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 202: Australia Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 206: South Korea Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 207: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 208: South Korea Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 209: South Korea Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 210: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 211: South Korea Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 212: South Korea Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 213: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 214: South Korea Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 218: ASEAN Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 219: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 220: ASEAN Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 221: ASEAN Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 222: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 223: ASEAN Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 224: ASEAN Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 225: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 226: ASEAN Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 230: Middle East & Africa Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 231: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 232: Middle East & Africa Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 233: Middle East & Africa Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 234: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 235: Middle East & Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 236: Middle East & Africa Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 237: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 238: Middle East & Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Market Volume (Megawatt) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 245: GCC Countries Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 246: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 247: GCC Countries Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 248: GCC Countries Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 249: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 250: GCC Countries Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 251: GCC Countries Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 252: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 253: GCC Countries Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 257: South Africa Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 258: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 259: South Africa Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 260: South Africa Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 261: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 262: South Africa Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 263: South Africa Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 264: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 265: South Africa Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 269: Latin America Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 270: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 271: Latin America Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 272: Latin America Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 273: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 274: Latin America Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 275: Latin America Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 276: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 277: Latin America Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 281: Latin America Market Volume (Megawatt) Projection, By Country 2020 to 2035

Figure 282: Latin America Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 284: Brazil Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 285: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 286: Brazil Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 287: Brazil Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 288: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 289: Brazil Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 290: Brazil Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 291: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 292: Brazil Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Argentina Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 296: Argentina Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 297: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 298: Argentina Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 299: Argentina Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 300: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 301: Argentina Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 302: Argentina Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 303: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 304: Argentina Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Argentina Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 306: Argentina Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Mexico Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 308: Mexico Market Volume (Megawatt) Projection, By Type 2020 to 2035

Figure 309: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 310: Mexico Market Value (US$ Mn) Projection, By Hydrogen Production 2020 to 2035

Figure 311: Mexico Market Volume (Megawatt) Projection, By Hydrogen Production 2020 to 2035

Figure 312: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Hydrogen Production 2025 to 2035

Figure 313: Mexico Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 314: Mexico Market Volume (Megawatt) Projection, By Application 2020 to 2035

Figure 315: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 316: Mexico Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Mexico Market Volume (Megawatt) Projection, By Distribution Channel 2020 to 2035

Figure 318: Mexico Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035