Reports

Reports

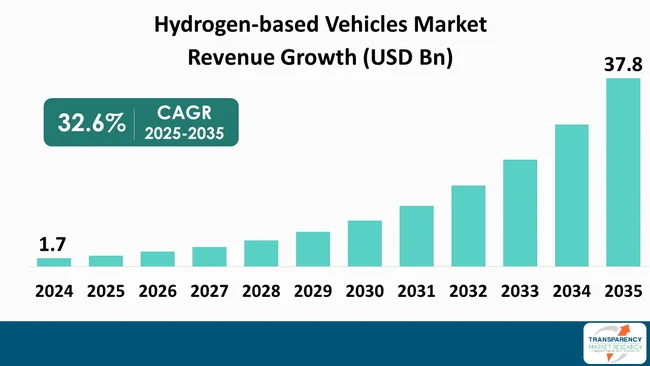

The global hydrogen-based vehicles market size was valued at US$ 1.7 billion in 2024 and is projected to reach US$ 37.8 billion by 2035, expanding at a CAGR of 32.6% from 2025 to 2035. The market growth is driven by stringent emission regulations & climate targets, growing focus on energy security & diversification, and advancements in hydrogen & fuel cell technology.

Rising global focus on decarbonization and the demand for zero-emission transport solutions have been the primary factors bolstering the growth of the hydrogen-based vehicles market. To develop fuel-cell vehicles, governments have set up attractive policies, given support, and shown the long-term hydrogen vision which has led the way by the organ of calling for the investments. The improvements in fuel-cell technology have increased the efficiency, the durability, and the range of the vehicles and so as to have hydrogen-powered vehicles economically more viable. The progress of hydrogen fueling infrastructure, particularly in developed areas, has lessened the worry of range and thus facilitated the opportunities for the adoption of the technology. Additionally, to battery vehicles, hydrogen-powered vehicles have the advantage of enabling much shorter times for fuel refilling, which can result them to be a competitive selection for long-haul trucking, heavy-duty fleet applications, and other commercial uses. A rise in corporate commitments to sustainability as well as more significant financial investments across all parts of the hydrogen supply chain will be the reasons behind the continuous expansion of this market segment.

The initial researches on hydrogen vehicles have shown a gradual movement to situate such vehicles in the real market and not as just a research entity. This is especially true for buses, trucks, and fleet applications. As a result, car manufacturers and energy providers have invested more resources in the segment of heavy-duty and long-range vehicles where hydrogen is more efficient than battery-electric ones. They have facilitated this growth by encouraging the number of strategic alliances involving car makers, hydrogen producers, and infrastructure companies to develop the ecosystem at a quicker pace. There has been a focus on the production of green hydrogen to make fuel cell vehicles more sustainable in nature. At the same time, governments in prominent markets have increased investments in the construction of hydrogen refueling stations, while technological advances have worked to decrease fuel cell costs.

Hydrogen vehicles are vehicles that uses hydrogen as the main fuel source in the production of power for propulsion. They mainly employ fuel cell propulsion, where hydrogen and oxygen are mixed in a fuel cell to create electricity with only water vapor being emitted through the exhaust pipe. The produced electricity powers an electric motor, just like electric vehicles, but without the use of large storage batteries. Moreover, hydrogen automobiles may comprise hydrogen-fuelled internal combustion engine cars, in which case hydrogen would be the energy carrier. They are equipped with benefits like a lengthy driving range, quick refuelling, and a very small emission level during the operational phase.

| Attribute | Detail |

|---|---|

| Hydrogen-based Vehicles Market Drivers |

|

The rising trend of focusing on decarbonization and meeting net-zero emission goals has been identified as a key factor contributing to the growth of the hydrogen-based vehicles market. As a result of the commitments shown by governments in the developed and the developing countries to meet the tough climate change targets set by international agreements like the Paris Agreement, there has been a massive change - a paradigm shift - in the strategies of the transport policy. The transport sector which is among the biggest emitters has seen the necessity for the use of zero-emission solutions that would cause a considerable change.

The advent of hydrogen-powered vehicles, especially fuel cell vehicles, has garnered much attention as a potential viable option for providing no tailpipe emissions while satisfying performance levels that would be nearly impossible to achieve with an electric battery powered vehicle only. This is especially important with heavy-duty, long-distance, and commercial vehicles where weight, extended driving range, and minimal refueling times are major concerns for fleet managers. Hydrogen is being pursued by federal and state governments as decarbonization strategies to achieve a greater degree of emissions reductions across multiple industries, including transportation.

Net-zero roadmaps along with national hydrogen strategies have been the key reasons behind the emergence of encouraging policies such as subsidies geared towards hydrogen vehicles, investments in refilling infrastructure, and the provision of money for research and development. All these actions have lowered the barriers to adoption and made hydrogen vehicles more commercially attractive. Besides that, fleet operators in the corporate world and logistics companies are turning to hydrogen-powered mobility solutions as a means of fulfilling their decarbonization commitments and, at the same time, achieving their environmental, social, and governance objectives. Together, these factors have accelerated the market transition, thus, placing hydrogen-powered vehicles as a vital element of future sustainable transportation systems.

Advances in fuel cell technology have had a major role to play in the development of the hydrogen vehicles market due to improvements in efficiency, longevity, and performance. The ongoing innovations in proton exchange membrane fuel cells have resulted in an escalation of power density, hence the extension of vehicle range with lesser amounts of hydrogen has become possible. Changes in the structure and cooling methods have also raised the efficiency levels, which make fuel cell-powered vehicles to be the most efficient ones.

Improved durability of fuel cells has been another factor that has enabled commercial users to adopt fuel cell technology since the introduction of fuel cells. The development of new materials used in fuel cell catalysts, membrane technologies and improved fuel cell stacks has enabled fuel cells to last longer than previously assumed based on field conditions by reducing their rate of degradation. The most significant impact was for commercial and heavy-duty applications, where vehicles operate on the road for long distances and operate continuously for long periods of time.

Durability improvements have also played a major role in the widespread adoption of the technology. Improvements in catalyst materials, membrane technology, and stack design have lengthened the lifetimes of fuel cells, thereby lessening their wear and tear even in operating conditions that simulate the real world. This has made a big difference especially in commercial and heavy-duty sectors, where the vehicles, as it is generally assumed, will be running for long distances and over long duty cycles. The decrease in the use of precious metals, like platinum, has contributed to the reduction of the costs while the performance has been kept at the same level.

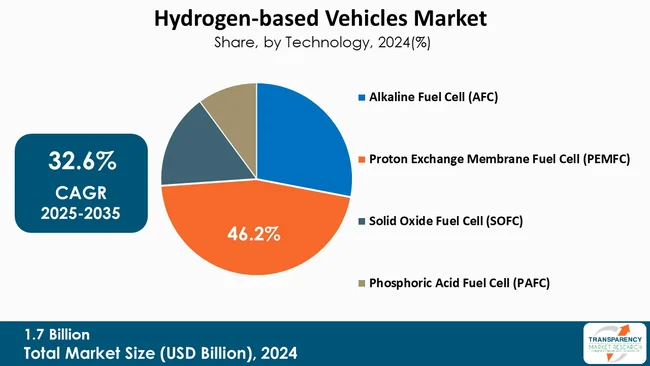

Proton Exchange Membrane Fuel Cells (PEMFCs) have occupied the dominant market for hydrogen-based vehicles because of their high power density, fast start-up time, and suitability for vehicle use. PEMFCs operate at lower temperature ranges which means that they can be very responsive to changing driving conditions in a short time. Also, due to their small size and good power-to-weight ratio, they can be easily used in passenger cars, buses, and trucks. In addition, the continuous developments in the membrane materials and the improvement of the catalyst have increased the life and decreased the cost, therefore, the pace of acceptance by the car manufacturers is also high. A high level of standardization in the industry and a significant OEM investment have, on top of that, consolidated PEMFCs as the most suitable fuel cell technology for mobility.

| Attribute | Detail |

|---|---|

| Leading Region |

|

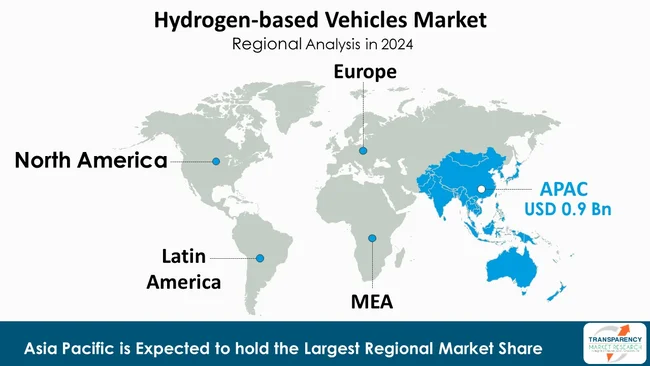

According to a new market outlook report for hydrogen vehicles, Asia Pacific currently constitutes approximately 51.6% of the overall market share in 2024. Asia Pacific has been able to dominate the major chunk of the hydrogen vehicle market due to a host of factors, including robust government policies, early mover advantage, and a well-structured hydrogen value chain across the biggest economies of Japan, South Korea, and China. The governments in this region have developed nationwide hydrogen strategies with substantial subsidies offered to consumers on the purchase of hydrogen vehicles.

One of the significant factors that have helped the Asia Pacific region to lead the market is the presence of big automotive and fuel cell companies. As a result, these companies have become active in the commercialization of fuel cell passenger cars, buses, and light and heavy commercial vehicles.

Some of the key moves by the companies operating in the hydrogen-based vehicles market to the companies include the establishment a joint venture for the development of fuel cells, setting up facilities for the production of hydrogen and refueling stations, and the development of passenger cars, commercial vehicles, and heavy-duty trucks. The companies are also undertaking various measures to bring down the cost of fuel cells, raise their efficiency and open up new markets for them.

Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., General Motors, Mercedes-Benz Group AG, Ballard Power Systems, Plug Power Inc., BMW AG, Kia Corporation, Volvo Group, Tata Motors Limited, Hydrogen Vehicle Systems, First Hydrogen Corp., Nikola Corporation and SAIC Motor Company are some of the leading players operating in the global hydrogen-based vehicles market.

Each of these players has been profiled in the hydrogen-based vehicles market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.7 Mn |

| Forecast Value in 2035 | US$ 37.8 Mn |

| CAGR | 32.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Hydrogen-based Vehicles Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Vehicle Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global hydrogen-based vehicles market was valued at US$ 1.7 Bn in 2024

The global hydrogen-based vehicles industry is projected to reach more than US$ 37.8 Bn by the end of 2035

Stringent emission regulations & climate targets, growing focus on energy security & diversification, advancements in hydrogen & fuel cell technology, rising corporate sustainability & ESG focus, and increasing air pollution concerns are some of the factors driving the expansion of hydrogen-based vehicles market.

The CAGR is anticipated to be 32.6% from 2025 to 2035

Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., General Motors, Mercedes-Benz Group AG, Ballard Power Systems, Plug Power Inc., BMW AG, Kia Corporation, Volvo Group, Tata Motors Limited, Hydrogen Vehicle Systems, First Hydrogen Corp., Nikola Corporation, and SAIC Motor Company

Table 01: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 02: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 04: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 05: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 06: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 09: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 10: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 11: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 12: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 13: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 14: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 15: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 16: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 17: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 18: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 19: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 20: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 21: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 22: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 23: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 24: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 25: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 26: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 27: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 28: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 29: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 30: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 31: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 32: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 33: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 34: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 35: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 36: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 37: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 38: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 39: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 40: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 41: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 42: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 43: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 44: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 45: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 46: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 47: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 48: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 49: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 50: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 51: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 52: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 53: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 54: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 55: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 56: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 57: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 58: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 59: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 60: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 61: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 62: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 63: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 64: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 65: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 66: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 67: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 68: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 69: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 70: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 71: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 72: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 73: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 74: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 75: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 76: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 77: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 78: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 79: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 80: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 81: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 82: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 83: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 84: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 85: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 86: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 87: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 88: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 89: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 90: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 91: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 92: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 93: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 94: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 95: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 96: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 97: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 98: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 99: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 100: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 101: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 102: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 103: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 104: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 105: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 106: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 107: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 108: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 109: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 110: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 111: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 112: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 113: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 114: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 115: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 116: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 117: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 118: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 119: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 120: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 121: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 122: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 123: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 124: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 125: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 126: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 127: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 128: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 129: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 130: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 131: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 132: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 133: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 134: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 135: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 136: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 137: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 138: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 139: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 140: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 141: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 142: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 143: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 144: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 145: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 146: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Table 147: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 148: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 149: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Range, 2020 to 2035

Table 150: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By Power Output, 2020 to 2035

Table 151: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, By End-use Application, 2020 to 2035

Figure 01: Global Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 03: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 04: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Passenger Cars, 2020 to 2035

Figure 05: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Commercial Vehicles, 2020 to 2035

Figure 06: Global Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 07: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 08: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Alkaline Fuel Cell (AFC), 2020 to 2035

Figure 09: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Proton Exchange Membrane Fuel Cell (PEMFC), 2020 to 2035

Figure 10: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Solid Oxide Fuel Cell (SOFC), 2020 to 2035

Figure 11: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Phosphoric Acid Fuel Cell (PAFC), 2020 to 2035

Figure 12: Global Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 13: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 14: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Short-range (<300 km), 2020 to 2035

Figure 15: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Medium-range (300-600 km), 2020 to 2035

Figure 16: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Long-range (>600 km), 2020 to 2035

Figure 17: Global Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 18: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 19: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by <100 kW, 2020 to 2035

Figure 20: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by 100-250 kW, 2020 to 2035

Figure 21: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by >250 kW, 2020 to 2035

Figure 22: Global Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 23: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 24: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Personal Mobility, 2020 to 2035

Figure 25: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Public Transportation, 2020 to 2035

Figure 26: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Logistics & Last-mile Delivery, 2020 to 2035

Figure 27: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Industrial Transportation, 2020 to 2035

Figure 28: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Defense & Military, 2020 to 2035

Figure 29: Global Hydrogen-based Vehicles Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 30: Global Hydrogen-based Vehicles Market Value Share Analysis, by Region, 2024 and 2035

Figure 31: Global Hydrogen-based Vehicles Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 32: North America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America Hydrogen-based Vehicles Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: North America Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 36: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 37: North America Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 38: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 39: North America Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 40: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 41: North America Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 42: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 43: North America Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 44: North America Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 45: U.S. Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: U.S. Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 47: U.S. Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 48: U.S. Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 49: U.S. Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 50: U.S. Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 51: U.S. Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 52: U.S. Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 53: U.S. Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 54: U.S. Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 55: U.S. Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 56: Canada Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Canada Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 58: Canada Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 59: Canada Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 60: Canada Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 61: Canada Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 62: Canada Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 63: Canada Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 64: Canada Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 65: Canada Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 66: Canada Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 67: Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Europe Hydrogen-based Vehicles Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 69: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 70: Europe Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 71: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 72: Europe Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 73: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 74: Europe Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 75: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 76: Europe Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 77: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 78: Europe Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 79: Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 80: Germany Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Germany Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 82: Germany Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 83: Germany Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 84: Germany Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 85: Germany Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 86: Germany Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 87: Germany Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 88: Germany Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 89: Germany Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 90: Germany Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 91: UK Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: UK Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 93: UK Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 94: UK Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 95: UK Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 96: UK Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 97: UK Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 98: UK Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 99: UK Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 100: UK Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 101: UK Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 102: France Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: France Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 104: France Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 105: France Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 106: France Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 107: France Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 108: France Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 109: France Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 110: France Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 111: France Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 112: France Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 113: Italy Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 114: Italy Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 115: Italy Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 116: Italy Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 117: Italy Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 118: Italy Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 119: Italy Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 120: Italy Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 121: Italy Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 122: Italy Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 123: Italy Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 124: Spain Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 125: Spain Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 126: Spain Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 127: Spain Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 128: Spain Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 129: Spain Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 130: Spain Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 131: Spain Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 132: Spain Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 133: Spain Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 134: Spain Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 135: The Netherlands Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: The Netherlands Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 137: The Netherlands Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 138: The Netherlands Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 139: The Netherlands Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 140: The Netherlands Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 141: The Netherlands Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 142: The Netherlands Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 143: The Netherlands Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 144: The Netherlands Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 145: The Netherlands Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 146: Rest of Europe Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 147: Rest of Europe Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 148: Rest of Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 149: Rest of Europe Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 150: Rest of Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 151: Rest of Europe Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 152: Rest of Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 153: Rest of Europe Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 154: Rest of Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 155: Rest of Europe Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 156: Rest of Europe Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 157: Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 158: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 159: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 160: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 161: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 162: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 163: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 164: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 165: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 166: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 167: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 168: Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 169: Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 170: China Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 171: China Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 172: China Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 173: China Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 174: China Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 175: China Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 176: China Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 177: China Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 178: China Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 179: China Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 180: China Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 181: India Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 182: India Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 183: India Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 184: India Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 185: India Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 186: India Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 187: India Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 188: India Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 189: India Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 190: India Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 191: India Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 192: Japan Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 193: Japan Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 194: Japan Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 195: Japan Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 196: Japan Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 197: Japan Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 198: Japan Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 199: Japan Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 200: Japan Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 201: Japan Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 202: Japan Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 203: South Korea Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 204: South Korea Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 205: South Korea Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 206: South Korea Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 207: South Korea Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 208: South Korea Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 209: South Korea Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 210: South Korea Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 211: South Korea Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 212: South Korea Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 213: South Korea Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 214: ASEAN Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: ASEAN Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 216: ASEAN Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 217: ASEAN Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 218: ASEAN Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 219: ASEAN Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 220: ASEAN Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 221: ASEAN Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 222: ASEAN Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 223: ASEAN Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 224: ASEAN Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 225: Australia & New Zealand Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 226: Australia & New Zealand Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 227: Australia & New Zealand Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 228: Australia & New Zealand Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 229: Australia & New Zealand Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 230: Australia & New Zealand Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 231: Australia & New Zealand Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 232: Australia & New Zealand Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 233: Australia & New Zealand Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 234: Australia & New Zealand Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 235: Australia & New Zealand Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 236: Rest of Asia Pacific Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 237: Rest of Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 238: Rest of Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 239: Rest of Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 240: Rest of Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 241: Rest of Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 242: Rest of Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 243: Rest of Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 244: Rest of Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 245: Rest of Asia Pacific Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 246: Rest of Asia Pacific Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 247: Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 248: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 249: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 250: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 251: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 252: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 253: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 254: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 255: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 256: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 257: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 258: Latin America Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 259: Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 260: Brazil Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 261: Brazil Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 262: Brazil Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 263: Brazil Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 264: Brazil Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 265: Brazil Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 266: Brazil Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 267: Brazil Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 268: Brazil Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 269: Brazil Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 270: Brazil Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 271: Argentina Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: Argentina Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 273: Argentina Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 274: Argentina Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 275: Argentina Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 276: Argentina Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 277: Argentina Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 278: Argentina Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 279: Argentina Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 280: Argentina Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 281: Argentina Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 282: Mexico Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 283: Mexico Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 284: Mexico Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 285: Mexico Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 286: Mexico Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 287: Mexico Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 288: Mexico Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 289: Mexico Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 290: Mexico Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 291: Mexico Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 292: Mexico Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 293: Rest of Latin America Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 294: Rest of Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 295: Rest of Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 296: Rest of Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 297: Rest of Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 298: Rest of Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 299: Rest of Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 300: Rest of Latin America Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 301: Rest of Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 302: Rest of Latin America Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 303: Rest of Latin America Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 304: Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 305: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 306: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 307: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 308: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 309: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 310: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 311: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 312: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 313: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 314: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 315: Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 316: Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 317: GCC Countries Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 318: GCC Countries Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 319: GCC Countries Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 320: GCC Countries Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 321: GCC Countries Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 322: GCC Countries Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 323: GCC Countries Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 324: GCC Countries Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 325: GCC Countries Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 326: GCC Countries Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 327: GCC Countries Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 328: South Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 329: South Africa Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 330: South Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 331: South Africa Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 332: South Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 333: South Africa Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 334: South Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 335: South Africa Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 336: South Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 337: South Africa Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 338: South Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035

Figure 339: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 340: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 341: Rest of Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 342: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Technology, 2024 and 2035

Figure 343: Rest of Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 344: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Range, 2024 and 2035

Figure 345: Rest of Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 346: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by Power Output, 2024 and 2035

Figure 347: Rest of Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by Power Output, 2025 to 2035

Figure 348: Rest of Middle East & Africa Hydrogen-based Vehicles Market Value Share Analysis, by End-use Application, 2024 and 2035

Figure 349: Rest of Middle East & Africa Hydrogen-based Vehicles Market Attractiveness Analysis, by End-use Application, 2025 to 2035