Reports

Reports

Analysts’ Viewpoint on Hydration Containers Market Scenario

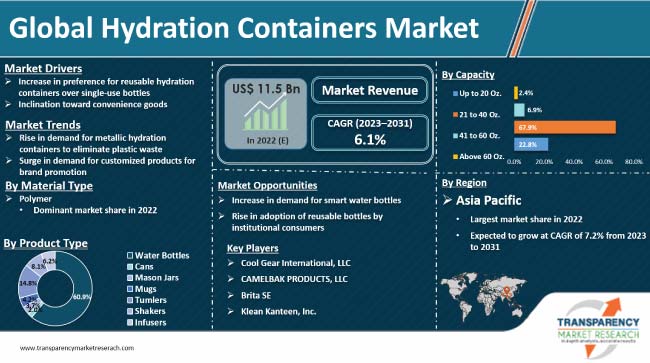

Demand for hydration containers is increasing steadily among institutional clients, including schools, hotels, railways, hospitals, and corporate & fitness companies. Hydration containers such as water bottles, mason jars, cans, mugs, infusers, tumblers, and shakers are gaining traction among the general public as well. Rise in disposable income, changing lifestyle, ban on single-use plastic bottles in several countries, and increase in awareness about health are key factors that are expected to fuel global hydration containers market growth during the forecast period.

Manufacturers are gaining lucrative hydration containers market opportunities by developing customized products for branding purposes. Rise in preference for convenience products is further contributing to market expansion. Prominent players are focusing on creating technologically advanced products such as smart water bottles to increase their market share.

Hydration containers are made from materials such as polymer, metal, glass, and silicon. Rise in awareness about the importance of health and nutrition among the people is fueling market statistics. As per hydration containers market growth forecast report, the industry is expected to grow at a steady pace during the forecast period, owing to the rise in inclination toward reusable drinking water bottles and tumblers among the people.

Hydration containers are being widely preferred over single-use plastic water bottles in many regions across the world. This can be ascribed to the reusable and eco-friendly characteristics of hydration containers. Increase in awareness about protecting the environment from harmful plastic products is boosting the demand for eco-friendly products.

Every day, more than 60 million single-use plastic bottles are discarded in the U.S. This leads to significant accumulation of plastic waste. Half a billion bottles are discarded in Britain every year. Approximately 12.0% of household waste is estimated to be plastic, while 40.0% of it is plastic bottles. Several governments and other organizations are taking initiatives to minimize hazardous plastic waste. For instance, most national parks in the U.S. have restricted the use of single-use plastic water bottles inside their premises.

Widespread global concern regarding harmful plastic waste is driving the demand for metallic reusable water bottles. Companies such as Contigo, Nalgene, and Thermos L.L.C. are investing significantly in the innovation of reusable water bottles. These containers are a little more expensive than plastic bottles. Several companies are also focusing on lowering the cost of these bottles. They are planning to increase awareness about the ill-effects of single-use plastic water bottles on the environment among the people.

Generally, metallic reusable water bottles are made up of aluminum/stainless steel. Both these metallic materials are found in abundance in nature and can be recycled repeatedly with a minimum loss of energy during production.

Rise in inclination toward the usage of metallic reusable water bottles is leading to a decrease in consumption of petrochemicals. Metallic reusable water bottles are more durable and stronger than plastic bottles. Metal also acts as a better shielding barrier than any plastic material. The U.S., Germany, and the U.K. are encouraging people to give up plastic packaging products in order to create a sustainable and pollution-free environment.

Growth in consumer inclination toward the usage of convenience products is boosting the demand for hydration containers such as reusable water bottles, tumblers, and other hydration containers. This can be ascribed to the fast-paced lifestyle and improvement in standard of living of middle-class households across the world.

Consumers are spending more on convenience products owing to the rise in their disposable income. This has led to an increase in demand for reusable water bottles and other hydration containers. Demand for products with unique dispensing options, carrying solutions, and esthetic features is high demand among consumers.

Growth of the nutrition industry is a major factor driving the demand for hydration containers with health-enhancing features. The global market for hydration containers has witnessed a shift from conventional water bottles to hydration containers with filters, infusers, and mist sprayers. Reusable water bottles with filters provide pure and clean water. These bottles with infusers offer a hassle-free drinking experience for users.

Usage of mist sprayers embedded in bottles is the latest technological advancement in the hydration containers market. The mist could be easily sprayed with the press of a trigger present on the bottle. Companies are also investing significantly in designing cost-effective and attractive hydration containers.

Adoption rate of smart bottles has increased significantly in the last few years, owing to the rise in consumer interest in convenience products. Changing lifestyle and increase in number of tech-savvy individuals are fueling the demand for smart water bottles, which can track an individual’s water intake throughout the day.

These bottles can be connected to smartphones via Bluetooth. Thus, they can send notifications about water consumption to the user. Smart water bottles also use time-temperature indicators to track the temperature of the water stored in the bottle. Demand for smart bottles is estimated to increase among millennials in the near future. However, high prices of these bottles are likely to hamper sales in the next few years.

Tritan (BPA-free polymer) material is increasingly being used in the manufacture of reusable water bottles due to its high heat resistance, toughness, and durability. This material is considered safe for usage in hydration containers.

Several global manufacturers are facing issues related to the usage of BPA in polymer-based reusable water bottles due to the rise in health concerns among consumers. This has led to an increase in usage of Tritan-based reusable water bottles.

The market for hydration containers is fragmented, with large presence of small and medium-sized manufacturers. These manufacturers are focusing on developing innovative products as per the requirements of institutional clients. In addition to this, prices are also widely dispersed in terms of material, type, and features.

Reusable water bottles are widely adopted by institutional clients including those in fitness centers, corporates, and educational institutions. Tumblers, shakers, infusers, and other hydration containers are gaining traction among these clients. Institutional clients are avoiding single-use plastic water bottles. Therefore, manufacturers need to to increase their production of hydration containers to meet the rising demand among institutional clients.

Manufacturers of hydration containers are increasingly offering customized solutions to their customers. People across the globe prefer customized water bottles with information such as company names and logos.

Manufacturers are also offering hydration containers for special occasions and festivals. They are collaborating with players providing printable solutions in order to capitalize on the opportunity of customization.

Brand owners can also use hydration containers for promotional activities. They can imprint their logos or messages and distribute them to their target market in order to attract customers.

Asia Pacific is projected to be the leading market for hydration containers in the next few years. The business in the region is expected to expand at a CAGR of 7.2% during 2023 to 2031. Growth of the retail industry in India and China is one of the key hydration containers market drivers. China is anticipated to hold the leading position in Asia Pacific during the forecast period, owing to the high production capacity of reusable hydration containers in the country.

Hydration containers market demand is steadily growing in India due to the rise in popularity of non-alcoholic beverages in the country. Increase in disposable income, growth in population, and product innovation are some of the key factors fueling hydration containers market aspects in India.

Leading players analyzed in the report include Cool Gear International, LLC, CAMELBAK PRODUCTS, LLC, Brita SE, Klean Kanteen, Inc., Hydro Flask, S’well Corporation, Tupperware Brands Corporation, Nalge Nunc International Corp (Thermo Fisher Scientific Inc.), Contigo, AQUASANA, INC., Bulletin Brands, Inc., Thermos L.L.C., O2COOL, LLC, Nathan Sports, Inc., SIGG Switzerland AG, Emsa GmbH, and Ee-Lian Enterprise (M) Sdn. Bhd.

Each of these companies has been summarized in the hydration containers market assessment report based on factors such as financial overview, company overview, business strategies, business segments, application portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 11.5 Bn |

|

Market Forecast Value in 2031 |

US$ 19.6 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023–2031 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 11.5 Bn in 2022.

It is anticipated to grow at a CAGR of 6.1% during the forecast period.

It is anticipated to be valued at US$ 19.6 Bn in 2031.

Increase in preference for reusable hydration containers over single-use bottles and inclination toward convenience goods.

Polymer is primarily preferred by hydration container manufacturers.

Asia Pacific is projected to showcase high demand for hydration containers during the forecast period.

Cool Gear International, LLC, CAMELBAK PRODUCTS, LLC, Brita SE, Klean Kanteen, Inc., Hydro Flask, S’well Corporation, Nalge Nunc International Corp. (Thermo Fisher Scientific Inc.), Contigo, AQUASANA, INC., Bulletin Brands, Inc., Thermos L.L.C., O2COOL, LLC, Nathan Sports, Inc., SIGG Switzerland AG, and Tupperware Brands Corporation.

The market in China is anticipated to grow 2.0 times the current value during the forecast period.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Hydration Containers Market Overview

3.1. Introduction

3.2. Global Hydration Containers Market Overview

3.3. Hydration Containers Market (US$ Mn) and Forecast

3.4. Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Material Suppliers

3.4.1.2. Hydration Containers Manufacturers/Distributor

3.4.1.3. End Use/Customers

3.4.2. Profitability Margins

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on the Target Market

5. Hydration Containers Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Hydration Containers Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Hydration Containers Market Analysis and Forecast, By Material Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Material Type

7.1.2. Y-o-Y Growth Projections, By Material Type

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

7.2.1. Metal

7.2.2. Polymer

7.2.3. Glass

7.2.4. Silicon

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Material Type

7.3.1. Metal

7.3.2. Polymer

7.3.3. Glass

7.3.4. Silicon

7.4. Market Attractiveness Analysis, By Material Type

8. Global Hydration Containers Market Analysis and Forecast, By Capacity

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

8.1.2. Y-o-Y Growth Projections, By Capacity

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

8.2.1. Up to 20 Oz.

8.2.2. 21 to 40 Oz.

8.2.3. 41 to 60 Oz.

8.2.4. Above 60 Oz.

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Capacity

8.3.1. Up to 20 Oz.

8.3.2. 21 to 40 Oz.

8.3.3. 41 to 60 Oz.

8.3.4. Above 60 Oz.

8.4. Market Attractiveness Analysis, By Capacity

9. Global Hydration Containers Market Analysis and Forecast, By Product Type

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Product Type

9.1.2. Y-o-Y Growth Projections, By Product Type

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

9.2.1. Water Bottles

9.2.2. Cans

9.2.3. Mugs

9.2.4. Mason Jars

9.2.5. Tumblers

9.2.6. Shakers

9.2.7. Infusers

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

9.3.1. Water Bottles

9.3.2. Cans

9.3.3. Mugs

9.3.4. Mason Jars

9.3.5. Tumblers

9.3.6. Shakers

9.3.7. Infusers

9.4. Market Attractiveness Analysis, By Product Type

10. Global Hydration Containers Market Analysis and Forecast, By Distribution Network

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Distribution Network

10.1.2. Y-o-Y Growth Projections, By Distribution Network

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

10.2.1. Direct Sales

10.2.2. Retailers

10.2.2.1. Hypermarkets

10.2.2.2. Supermarkets

10.2.2.3. Convenience Stores

10.2.2.4. Specialty Stores

10.2.2.5. Others

10.2.3. E-Retail

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Distribution Network

10.3.1. Direct Sales

10.3.2. Retailers

10.3.2.1. Hypermarkets

10.3.2.2. Supermarkets

10.3.2.3. Convenience Stores

10.3.2.4. Specialty Stores

10.3.2.5. Others

10.3.3. E-Retail

10.4. Market Attractiveness Analysis, By Distribution Network

11. Global Hydration Containers Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific

11.2.5. Middle East & Africa

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 By Region

11.3.1. North America

11.3.2. Latin America

11.3.3. Europe

11.3.4. Asia Pacific

11.3.5. Middle East & Africa

11.4. Market Attractiveness Analysis By Region

12. North America Hydration Containers Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Country

12.3.1. U.S.

12.3.2. Canada

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Material Type

12.5.1. Metal

12.5.2. Polymer

12.5.3. Glass

12.5.4. Silicon

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Capacity

12.7.1. Up to 20 Oz.

12.7.2. 21 to 40 Oz.

12.7.3. 41 to 60 Oz.

12.7.4. Above 60 Oz.

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

12.9.1. Water Bottles

12.9.2. Cans

12.9.3. Mugs

12.9.4. Mason Jars

12.9.5. Tumblers

12.9.6. Shakers

12.9.7. Infusers

12.10. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

12.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Distribution Network

12.11.1. Direct Sales

12.11.2. Retailers

12.11.2.1. Hypermarkets

12.11.2.2. Supermarkets

12.11.2.3. Convenience Stores

12.11.2.4. Specialty Stores

12.11.2.5. Others

12.11.3. E-Retail

12.12. Market Attractiveness Analysis

12.12.1. By Country

12.12.2. By Material Type

12.12.3. By Capacity

12.12.4. By Product Type

12.12.5. By Distribution Channel

13. Latin America Hydration Containers Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Country

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Argentina

13.3.4. Rest of Latin America

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Material Type

13.5.1. Metal

13.5.2. Polymer

13.5.3. Glass

13.5.4. Silicon

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Capacity

13.7.1. Up to 20 Oz.

13.7.2. 21 to 40 Oz.

13.7.3. 41 to 60 Oz.

13.7.4. Above 60 Oz.

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

13.9.1. Water Bottles

13.9.2. Cans

13.9.3. Mugs

13.9.4. Mason Jars

13.9.5. Tumblers

13.9.6. Shakers

13.9.7. Infusers

13.10. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

13.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Distribution Network

13.11.1. Direct Sales

13.11.2. Retailers

13.11.2.1. Hypermarkets

13.11.2.2. Supermarkets

13.11.2.3. Convenience Stores

13.11.2.4. Specialty Stores

13.11.2.5. Others

13.11.3. E-Retail

13.12. Market Attractiveness Analysis

13.12.1. By Country

13.12.2. By Material Type

13.12.3. By Capacity

13.12.4. By Product Type

13.12.5. By Distribution Channel

14. Europe Hydration Containers Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Country

14.3.1. Germany

14.3.2. Italy

14.3.3. France

14.3.4. Spain

14.3.5. Nordics

14.3.6. U.K.

14.3.7. Benelux

14.3.8. Russia

14.3.9. Poland

14.3.10. Rest of Europe

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Material Type

14.5.1. Metal

14.5.2. Polymer

14.5.3. Glass

14.5.4. Silicon

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Capacity

14.7.1. Up to 20 Oz.

14.7.2. 21 to 40 Oz.

14.7.3. 41 to 60 Oz.

14.7.4. Above 60 Oz.

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

14.9.1. Water Bottles

14.9.2. Cans

14.9.3. Mugs

14.9.4. Mason Jars

14.9.5. Tumblers

14.9.6. Shakers

14.9.7. Infusers

14.10. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

14.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Distribution Network

14.11.1. Direct Sales

14.11.2. Retailers

14.11.2.1. Hypermarkets

14.11.2.2. Supermarkets

14.11.2.3. Convenience Stores

14.11.2.4. Specialty Stores

14.11.2.5. Others

14.11.3. E-Retail

14.12. Market Attractiveness Analysis

14.12.1. By Country

14.12.2. By Material Type

14.12.3. By Capacity

14.12.4. By Product Type

14.12.5. By Distribution Channel

15. Asia Pacific Hydration Containers Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Country

15.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Country

15.3.1. China

15.3.2. India

15.3.3. ASEAN

15.3.4. Australia & New Zealand

15.3.5. Japan

15.3.6. Rest of APAC

15.4. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

15.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Material Type

15.5.1. Metal

15.5.2. Polymer

15.5.3. Glass

15.5.4. Silicon

15.6. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

15.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Capacity

15.7.1. Up to 20 Oz.

15.7.2. 21 to 40 Oz.

15.7.3. 41 to 60 Oz.

15.7.4. Above 60 Oz.

15.8. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

15.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

15.9.1. Water Bottles

15.9.2. Cans

15.9.3. Mugs

15.9.4. Mason Jars

15.9.5. Tumblers

15.9.6. Shakers

15.9.7. Infusers

15.10. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

15.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Distribution Network

15.11.1. Direct Sales

15.11.2. Retailers

15.11.2.1. Hypermarkets

15.11.2.2. Supermarkets

15.11.2.3. Convenience Stores

15.11.2.4. Specialty Stores

15.11.2.5. Others

15.11.3. E-Retail

15.12. Market Attractiveness Analysis

15.12.1. By Country

15.12.2. By Material Type

15.12.3. By Capacity

15.12.4. By Product Type

15.12.5. By Distribution Channel

16. Middle East & Africa Hydration Containers Market Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Country

16.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Country

16.3.1. Northern Africa

16.3.2. GCC Countries

16.3.3. South Africa

16.3.4. Rest of MEA

16.4. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Material Type

16.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Material Type

16.5.1. Metal

16.5.2. Polymer

16.5.3. Glass

16.5.4. Silicon

16.6. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Capacity

16.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031 Analysis 2023–2031, By Capacity

16.7.1. Up to 20 Oz.

16.7.2. 21 to 40 Oz.

16.7.3. 41 to 60 Oz.

16.7.4. Above 60 Oz.

16.8. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Product Type

16.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Product Type

16.9.1. Water Bottles

16.9.2. Cans

16.9.3. Mugs

16.9.4. Mason Jars

16.9.5. Tumblers

16.9.6. Shakers

16.9.7. Infusers

16.10. Historical Market Value (US$ Mn) and Volume (Units), 2014–2022, By Distribution Network

16.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023–2031, By Distribution Network

16.11.1. Direct Sales

16.11.2. Retailers

16.11.2.1. Hypermarkets

16.11.2.2. Supermarkets

16.11.2.3. Convenience Stores

16.11.2.4. Specialty Stores

16.11.2.5. Others

16.11.3. E-Retail

16.12. Market Attractiveness Analysis

16.12.1. By Country

16.12.2. By Material Type

16.12.3. By Capacity

16.12.4. By Product Type

16.12.5. By Distribution Channel

17. Country wise Hydration Containers Market Analysis, 2023–2031

17.1. U.S. Hydration Containers Market Analysis

17.1.1. By Material Type

17.1.2. By Capacity

17.1.3. By Product Type

17.1.4. By Distribution Network

17.2. Canada Hydration Containers Market Analysis

17.2.1. By Material Type

17.2.2. By Capacity

17.2.3. By Product Type

17.2.4. By Distribution Network

17.3. Brazil Hydration Containers Market Analysis

17.3.1. By Material Type

17.3.2. By Capacity

17.3.3. By Product Type

17.3.4. By Distribution Network

17.4. Mexico Hydration Containers Market Analysis

17.4.1. By Material Type

17.4.2. By Capacity

17.4.3. By Product Type

17.4.4. By Distribution Network

17.5. Germany Hydration Containers Market Analysis

17.5.1. By Material Type

17.5.2. By Capacity

17.5.3. By Product Type

17.6. Spain Hydration Containers Market Analysis

17.6.1. By Material Type

17.6.2. By Capacity

17.6.3. By Product Type

17.6.4. By Distribution Network

17.7. France Hydration Containers Market Analysis

17.7.1. By Material Type

17.7.2. By Capacity

17.7.3. By Product Type

17.7.4. By Distribution Network

17.8. U K Hydration Containers Market Analysis

17.8.1. By Material Type

17.8.2. By Capacity

17.8.3. By Product Type

17.8.4. By Distribution Network

17.9. Italy Hydration Containers Market Analysis

17.9.1. By Material Type

17.9.2. By Capacity

17.9.3. By Product Type

17.9.4. By Distribution Network

17.10. Russia Hydration Containers Market Analysis

17.10.1. By Material Type

17.10.2. By Capacity

17.10.3. By Product Type

17.10.4. By Distribution Network

17.11. China Hydration Containers Market Analysis

17.11.1. By Material Type

17.11.2. By Capacity

17.11.3. By Product Type

17.11.4. By Distribution Network

17.12. India Hydration Containers Market Analysis

17.12.1. By Material Type

17.12.2. By Capacity

17.12.3. By Product Type

17.12.4. By Distribution Network

17.13. Japan Hydration Containers Market Analysis

17.13.1. By Material Type

17.13.2. By Capacity

17.13.3. By Product Type

17.13.4. By Distribution Network

17.14. GCC Countries Hydration Containers Market Analysis

17.14.1. By Material Type

17.14.2. By Capacity

17.14.3. By Product Type

17.14.4. By Distribution Network

17.15. South Africa Hydration Containers Market Analysis

17.15.1. By Material Type

17.15.2. By Capacity

17.15.3. By Product Type

17.15.4. By Distribution Network

18. Competitive Landscape

18.1. Market Structure

18.2. Competition Dashboard

18.3. Company Market Share Analysis

18.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

18.5. Competition Deep Dive(Key Global Market Players)

18.5.1. Cool Gear International, LLC

18.5.1.1. Overview

18.5.1.2. Financials

18.5.1.3. Strategy

18.5.1.4. Recent Developments

18.5.1.5. SWOT Analysis

18.5.2. CAMELBAK PRODUCTS, LLC

18.5.2.1. Overview

18.5.2.2. Financials

18.5.2.3. Strategy

18.5.2.4. Recent Developments

18.5.2.5. SWOT Analysis

18.5.3. Brita SE

18.5.3.1. Overview

18.5.3.2. Financials

18.5.3.3. Strategy

18.5.3.4. Recent Developments

18.5.3.5. SWOT Analysis

18.5.4. Klean Kanteen, Inc.

18.5.4.1. Overview

18.5.4.2. Financials

18.5.4.3. Strategy

18.5.4.4. Recent Developments

18.5.4.5. SWOT Analysis

18.5.5. Hydro Flask

18.5.5.1. Overview

18.5.5.2. Financials

18.5.5.3. Strategy

18.5.5.4. Recent Developments

18.5.5.5. SWOT Analysis

18.5.6. S’well Corporation

18.5.6.1. Overview

18.5.6.2. Financials

18.5.6.3. Strategy

18.5.6.4. Recent Developments

18.5.6.5. SWOT Analysis

18.5.7. Tupperware Brands Corporation

18.5.7.1. Overview

18.5.7.2. Financials

18.5.7.3. Strategy

18.5.7.4. Recent Developments

18.5.7.5. SWOT Analysis

18.5.8. Nalge Nunc International Corp (Thermo Fisher Scientific Inc.)

18.5.8.1. Overview

18.5.8.2. Financials

18.5.8.3. Strategy

18.5.8.4. Recent Developments

18.5.8.5. SWOT Analysis

18.5.9. Contigo

18.5.9.1. Overview

18.5.9.2. Financials

18.5.9.3. Strategy

18.5.9.4. Recent Developments

18.5.9.5. SWOT Analysis

18.5.10. AQUASANA, INC.

18.5.10.1. Overview

18.5.10.2. Financials

18.5.10.3. Strategy

18.5.10.4. Recent Developments

18.5.10.5. SWOT Analysis

18.5.11. Bulletin Brands, Inc.

18.5.11.1. Overview

18.5.11.2. Financials

18.5.11.3. Strategy

18.5.11.4. Recent Developments

18.5.11.5. SWOT Analysis

18.5.12. Thermos L.L.C.

18.5.12.1. Overview

18.5.12.2. Financials

18.5.12.3. Strategy

18.5.12.4. Recent Developments

18.5.12.5. SWOT Analysis

18.5.13. O2COOL, LLC

18.5.13.1. Overview

18.5.13.2. Financials

18.5.13.3. Strategy

18.5.13.4. Recent Developments

18.5.13.5. SWOT Analysis

18.5.14. Nathan Sports, Inc.

18.5.14.1. Overview

18.5.14.2. Financials

18.5.14.3. Strategy

18.5.14.4. Recent Developments

18.5.14.5. SWOT Analysis

18.5.15. SIGG Switzerland AG

18.5.15.1. Overview

18.5.15.2. Financials

18.5.15.3. Strategy

18.5.15.4. Recent Developments

18.5.15.5. SWOT Analysis

18.5.16. Emsa GmbH

18.5.16.1. Overview

18.5.16.2. Financials

18.5.16.3. Strategy

18.5.16.4. Recent Developments

18.5.16.5. SWOT Analysis

18.5.17. Ee-Lian Enterprise (M) Sdn. Bhd.

18.5.17.1. Overview

18.5.17.2. Financials

18.5.17.3. Strategy

18.5.17.4. Recent Developments

18.5.17.5. SWOT Analysis

18.5.18. ZHE JIANG HAERS VACUUM CONTAINERS CO., LTD.

18.5.18.1. Overview

18.5.18.2. Financials

18.5.18.3. Strategy

18.5.18.4. Recent Developments

18.5.18.5. SWOT Analysis

18.5.19. Lock & Lock Co., Ltd.

18.5.19.1. Overview

18.5.19.2. Financials

18.5.19.3. Strategy

18.5.19.4. Recent Developments

18.5.19.5. SWOT Analysis

18.5.20. Bubba Brands, Inc.

18.5.20.1. Overview

18.5.20.2. Financials

18.5.20.3. Strategy

18.5.20.4. Recent Developments

18.5.20.5. SWOT Analysis

19. Assumptions and Acronyms Used

20. Research Methodology

List of Tables

Table 01: Global Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 02: Global Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 03: Global Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 04: Global Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 05: Global Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 06: Global Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 07: Global Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 08: Global Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 09: Global Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 10: Global Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 11: Global Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 12: Global Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 13: Global Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 14: Global Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 15: Global Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 16: Global Hydration Containers Market Forecast Volume (Units), By P Distribution Network 2023(E)-2031(F)

Table 17: Global Hydration Containers Market Historic Value (US$ Mn), By Region 2014(H)-2022(A)

Table 18: Global Hydration Containers Market Forecast Value (US$ Mn), By Region 2023(E)-2031(F)

Table 19: Global Hydration Containers Market Historic Volume (Units), By Region 2014(H)-2022(A)

Table 20: Global Hydration Containers Market Forecast Volume (Units), By Region 2023(E)-2031(F)

Table 21: North America Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 22: North America Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 23: North America Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 24: North America Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 25: North America Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 26: North America Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 27: North America Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 28: North America Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 29: North America Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 30: North America Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 31: North America Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 32: North America Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 33: North America Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 34: North America Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 35: North America Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 36: North America Hydration Containers Market Forecast Volume (Units), By Distribution Network 2023(E)-2031(F)

Table 37: North America Hydration Containers Market Historic Value (US$ Mn), By Country 2014(H)-2022(A)

Table 38: North America Hydration Containers Market Forecast Value (US$ Mn), By Country 2023(E)-2031(F)

Table 39: North America Hydration Containers Market Historic Volume (Units), By Country 2014(H)-2022(A)

Table 40: North America Hydration Containers Market Forecast Volume (Units), By Country 2023(E)-2031(F)

Table 41: Latin America Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 42: Latin America Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 43: Latin America Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 44: Latin America Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 45: Latin America Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 46: Latin America Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 47: Latin America Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 48: Latin America Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 49: Latin America Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 50: Latin America Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 51: Latin America Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 52: Latin America Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 53: Latin America Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 54: Latin America Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 55: Latin America Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 56: Latin America Hydration Containers Market Forecast Volume (Units), By Distribution Network 2023(E)-2031(F)

Table 57: Latin America Hydration Containers Market Historic Value (US$ Mn), By Country 2014(H)-2022(A)

Table 58: Latin America Hydration Containers Market Forecast Value (US$ Mn), By Country 2023(E)-2031(F)

Table 59: Latin America Hydration Containers Market Historic Volume (Units), By Country 2014(H)-2022(A)

Table 60: Latin America Hydration Containers Market Forecast Volume (Units), By Country 2023(E)-2031(F)

Table 61: Europe Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 62: Europe Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 63: Europe Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 64: Europe Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 65: Europe Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 66: Europe Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 67: Europe Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 68: Europe Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 69: Europe Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 70: Europe Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 71: Europe Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 72: Europe Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 73: Europe Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 74: Europe Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 75: Europe Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 76: Europe Hydration Containers Market Forecast Volume (Units), By Distribution Network 2023(E)-2031(F)

Table 77: Europe Hydration Containers Market Historic Value (US$ Mn), By Country 2014(H)-2022(A)

Table 78: Europe Hydration Containers Market Forecast Value (US$ Mn), By Country 2023(E)-2031(F)

Table 79: Europe Hydration Containers Market Historic Volume (Units), By Country 2014(H)-2022(A)

Table 80: Europe Hydration Containers Market Forecast Volume (Units), By Country 2023(E)-2031(F)

Table 81: Asia Pacific Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 82: Asia Pacific Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 83: Asia Pacific Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 84: Asia Pacific Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 85: Asia Pacific Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 86: Asia Pacific Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 87: Asia Pacific Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 88: Asia Pacific Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 89: Asia Pacific Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 90: Asia Pacific Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 91: Asia Pacific Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 92: Asia Pacific Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 93: Asia Pacific Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 94: Asia Pacific Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 95: Asia Pacific Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 96: Asia Pacific Hydration Containers Market Forecast Volume (Units), By Distribution Network 2023(E)-2031(F)

Table 97: Asia Pacific Hydration Containers Market Historic Value (US$ Mn), By Country 2014(H)-2022(A)

Table 98: Asia Pacific Hydration Containers Market Forecast Value (US$ Mn), By Country 2023(E)-2031(F)

Table 99: Asia Pacific Hydration Containers Market Historic Volume (Units), By Country 2014(H)-2022(A)

Table 100: Asia Pacific Hydration Containers Market Forecast Volume (Units), By Country 2023(E)-2031(F)

Table 101: Middle East & Africa Hydration Containers Market Historic Value (US$ Mn), By Material Type 2014(H)-2022(A)

Table 102: Middle East & Africa Hydration Containers Market Forecast Value (US$ Mn), By Material Type 2023(E)-2031(F)

Table 103: Middle East & Africa Hydration Containers Market Historic Volume (Units), By Material Type 2014(H)-2022(A)

Table 104: Middle East & Africa Hydration Containers Market Forecast Volume (Units), By Material Type 2023(E)-2031(F)

Table 105: Middle East & Africa Hydration Containers Market Historic Value (US$ Mn), By Capacity 2014(H)-2022(A)

Table 106: Middle East & Africa Hydration Containers Market Forecast Value (US$ Mn), By Capacity 2023(E)-2031(F)

Table 107: Middle East & Africa Hydration Containers Market Historic Volume (Units), By Capacity 2014(H)-2022(A)

Table 108: Middle East & Africa Hydration Containers Market Forecast Volume (Units), By Capacity 2023(E)-2031(F)

Table 109: Middle East & Africa Hydration Containers Market Historic Value (US$ Mn), By Product Type 2014(H)-2022(A)

Table 110: Middle East & Africa Hydration Containers Market Forecast Value (US$ Mn), By Product Type 2023(E)-2031(F)

Table 111: Middle East & Africa Hydration Containers Market Historic Volume (Units), By Product Type 2014(H)-2022(A)

Table 112: Middle East & Africa Hydration Containers Market Forecast Volume (Units), By Product Type 2023(E)-2031(F)

Table 113: Middle East & Africa Hydration Containers Market Historic Value (US$ Mn), By Distribution Network 2014(H)-2022(A)

Table 114: Middle East & Africa Hydration Containers Market Forecast Value (US$ Mn), By Distribution Network 2023(E)-2031(F)

Table 115: Middle East & Africa Hydration Containers Market Historic Volume (Units), By Distribution Network 2014(H)-2022(A)

Table 116: Middle East & Africa Hydration Containers Market Forecast Volume (Units), By Distribution Network 2023(E)-2031(F)

Table 117: Middle East & Africa Hydration Containers Market Historic Value (US$ Mn), By Country 2014(H)-2022(A)

Table 118: Middle East & Africa Hydration Containers Market Forecast Value (US$ Mn), By Country 2023(E)-2031(F)

Table 119: Middle East & Africa Hydration Containers Market Historic Volume (Units), By Country 2014(H)-2022(A)

Table 120: Middle East & Africa Hydration Containers Market Forecast Volume (Units), By Country 2023(E)-2031(F)

List of Figures

Figure 01: Global Hydration Containers Market Share Analysis by Material Type, 2023E & 2031F

Figure 02: Global Hydration Containers Market Attractiveness Analysis by Material Type, 2023E-2031F

Figure 03: Global Hydration Containers Market Y-o-Y Analysis by Material Type, 2014H-2031F

Figure 04: Global Hydration Containers Market Share Analysis by Capacity, 2023E & 2031F

Figure 05: Global Hydration Containers Market Attractiveness Analysis by Capacity, 2023E-2031F

Figure 06: Global Hydration Containers Market Y-o-Y Analysis by Capacity, 2014H-2031F

Figure 07: Global Hydration Containers Market Share Analysis by Product Type, 2023E & 2031F

Figure 08: Global Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 09: Global Hydration Containers Market Y-o-Y Analysis by Product Type, 2014H-2031F

Figure 10: Global Hydration Containers Market Share Analysis by Distribution Network, 2023E & 2031F

Figure 11: Global Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 12: Global Hydration Containers Market Y-o-Y Analysis by Distribution Network, 2014H-2031F

Figure 13: Global Hydration Containers Market Share Analysis by Region, 2023E & 2031F

Figure 14: Global Hydration Containers Market Attractiveness Analysis by Region, 2023E-2031F

Figure 15: Global Hydration Containers Market Y-o-Y Analysis by Region, 2014H-2031F

Figure 16: North America Hydration Containers Market Value Share Analysis by Material Type 2023(E)

Figure 17: North America Hydration Containers Market Value Share Analysis by Capacity 2023(E)

Figure 18: North America Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 19: North America Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 20: North America Hydration Containers Market Value Share Analysis by Country 2023(E)

Figure 21: Latin America Hydration Containers Market Value Share Analysis by Material Type 2023(E)

Figure 22: Latin America Hydration Containers Market Value Share Analysis by Capacity 2023(E)

Figure 23: Latin America Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 24: Latin America Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 25: Latin America Hydration Containers Market Value Share Analysis by Country 2023(E)

Figure 26: Europe Hydration Containers Market Value Share Analysis by Material Type 2023(E)

Figure 27: Europe Hydration Containers Market Value Share Analysis by Capacity 2023(E)

Figure 28: Europe Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 29: Europe Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 30: Europe Hydration Containers Market Value Share Analysis by Country 2023(E)

Figure 31: Asia Pacific Hydration Containers Market Value Share Analysis by Material Type 2023(E)

Figure 32: Asia Pacific Hydration Containers Market Value Share Analysis by Capacity 2023(E)

Figure 33: Asia Pacific Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 34: Asia Pacific Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 35: Asia Pacific Hydration Containers Market Value Share Analysis by Country 2023(E)

Figure 36: Middle East & Africa Hydration Containers Market Value Share Analysis by Material Type 2023(E)

Figure 37: Middle East & Africa Hydration Containers Market Value Share Analysis by Capacity 2023(E)

Figure 38: Middle East & Africa Hydration Containers Market Attractiveness Analysis by Product Type, 2023E-2031F

Figure 39: Middle East & Africa Hydration Containers Market Attractiveness Analysis by Distribution Network, 2023E-2031F

Figure 40: Middle East & Africa Hydration Containers Market Value Share Analysis by Country 2023(E)

Figure 41: U.S. Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 42: U.S. Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 43: U.S. Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 44: U.S. Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 45: Canada Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 46: Canada Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 47: Canada Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 48: Canada Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 49: Brazil Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 50: Brazil Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 51: Brazil Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 52: Brazil Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 53: Mexico Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 54: Mexico Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 55: Mexico Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 56: Mexico Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 57: Germany Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 58: Germany Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 59: Germany Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 60: Germany Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 61: Spain Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 62: Spain Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 63: Spain Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 64: Spain Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 65: France Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 66: France Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 67: France Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 68: France Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 69: U.K. Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 70: U.K. Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 71: U.K. Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 72: U.K. Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 73: Italy Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 74: Italy Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 75: Italy Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 76: Italy Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 77: Russia Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 78: Russia Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 79: Russia Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 80: Russia Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 81: China Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 82: China Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 83: China Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 84: China Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 85: India Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 86: India Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 87: India Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 88: India Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 89: Japan Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 90: Japan Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 91: Japan Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 92: Japan Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 93: GCC Countries Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 94: GCC Countries Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 95: GCC Countries Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 96: GCC Countries Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F

Figure 97: South Africa Hydration Containers Market Value Share Analysis, by Material Type, 2023E

Figure 98: South Africa Hydration Containers Market Value Share Analysis, by Capacity, 2023E

Figure 99: South Africa Hydration Containers Market Value Share Analysis, by Product Type, 2023E & 2031F

Figure 100: South Africa Hydration Containers Market Value Share Analysis, by Distribution Network, 2023E & 2031F