Reports

Reports

The HVDC (High Voltage Direct Current) cables market is witnessing a significant growth, driven by the requirement for efficient long-distance power transmission and the tendency toward integrating renewable energy. The HVDC technology, being more efficient with less transmission loss over longer distances as compared to HVAC systems, is increasingly being applied in submarine and subterranean power connections, connecting remote renewable sources such as offshore windfarms to onshore grids.

This technology also plays an important role in cross-border interconnects and city grid extensions where there is limited space available. The major market players are currently spending on technologies like advanced insulation material and flexible cable layout to improve reliability and transmission capacity.

Strategic partnerships and long-term supply contracts are also facilitating large-sized projects in North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Utilities and governments are also funding HVDC rollout through green energy objectives and regulatory changes. Together, these are making the uptake of HVDC cables a central part of energy infrastructure in the future.

| Attribute | Detail |

|---|---|

| Drivers |

|

The global trend of harnessing renewable energy sources has pushed the demand for HVDC cables since these cables are required to bring renewable power generation on the grid. Governments and the private sector have heavily invested in mass renewable energy projects such as offshore wind farms, solar parks, and hydroelectric dams. HVDC cables are the best choice for transferring electricity generated from these sources over long distances with minimal loss, thereby enhancing grid efficiency and sustainability.

One of the principal advantages of HVDC technology to integrate renewable power is that it can stabilize flows of power and enable the facilitation of accommodating intermittent patterns of generation.

For example, Europe has seen significant offshore wind development with Germany, the UK, and Denmark heavily investing in HVDC-based interconnectors. Projects such as the North Sea Wind Power Hub and Germany's SuedLink HVDC transmission corridor reflect the increasing reliance on HVDC technology for enabling the widespread use of renewable energy.

Similarly, Beijing's commitment regarding carbon neutrality has promoted bold investment in ultra-high-voltage (UHV) DC gridlines for conveying renewable energy-abundant western provinces' resources to resource-hungry densely populated eastern seaboard provinces with concentrated demand.

Moreover, governments are coming up with incentives, subsidies, and grid-friendly policies for enabling the buildout of renewable infrastructure. The European Union's "Green Deal" and the U.S. Inflation Reduction Act, for example, provide funding support to HVDC projects for deploying clean energy in greater volumes.

All these trends together emphasize the pivotal importance of HVDC cables in accelerating worldwide renewable energy transition initiatives.

The need for effective transmission of power across long distances is now a principal driver for the HVDC cables market, owing to the rising demand for electricity across the globe.

Conventional AC transmission lines are plagued with high electrical losses and need to have several substations along the transmission line, which makes them less efficient in transferring power across long distances. HVDC technology, nonetheless, significantly reduces power loss and enhances transmission efficiency to such an extent that it is the go-to solution for interregional and intercontinental power transmission.

One of the major benefits of HVDC transmission is that it can transfer incredible amounts of electricity over huge distances with minimal wastage of energy. Such a benefit proves vital in the case of countries having geographically dispersed energy producing and consuming nodes. For instance, in China, UHVDC transmission lines are facilitating hydropower supply from the southwestern provinces to industrial eastern zones at a decreased level of reliance on coal-powered electricity generation units as well as mitigating carbon footprints.

Another significant use of HVDC technology is in interconnecting remote power generation locations, including hydroelectric dams and solar farms, to national grids. In North America, initiatives such as the TransWest Express Transmission Line are employing HVDC technology to transmit renewable energy from the western United States to urban load centers. Similarly, India's Green Energy Corridor initiative employs HVDC cables to facilitate long-distance transmission of power from wind and solar farms to the major consumption points.

Besides, enhancements in HVDC converter technology have improved system reliability and efficiency for easy incorporation of high-voltage transmission networks. Voltage source converters (VSC-HVDC) are increasingly making HVDC systems more flexible and simpler to integrate with traditional AC grids. With energy consumption continuing to increase, and with nations seeking to decarbonize their power sectors, the need for HVDC cables will continue to be robust, fueled by their higher efficiency in long-distance electricity transmission.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

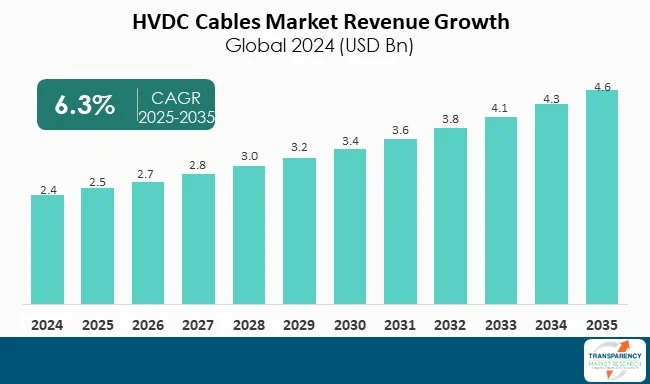

| Market Size Value in 2024 | US$ 2.4 Bn |

| Market Forecast Value in 2035 | US$ 4.6 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, HVDC Cables market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The HVDC cables market was valued at US$ 2.4 Bn in 2024

The HVDC cables industry is expected to grow at a CAGR of 6.3% from 2025 to 2035

Growing investments in renewable energy integration and increasing demand for high-efficiency power transmission over long distances.

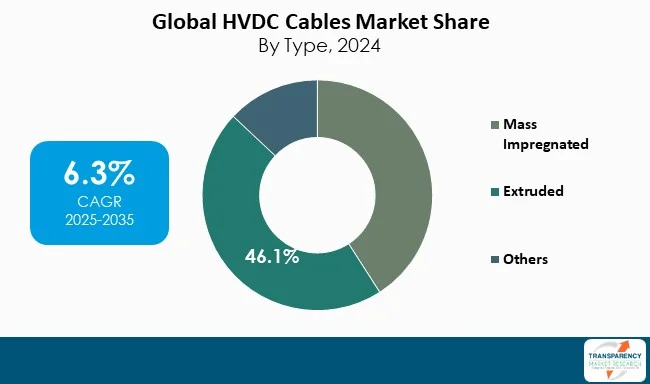

Extruded was the largest type segment and its value is anticipated to grow at a CAGR of 6.2% during the forecast period

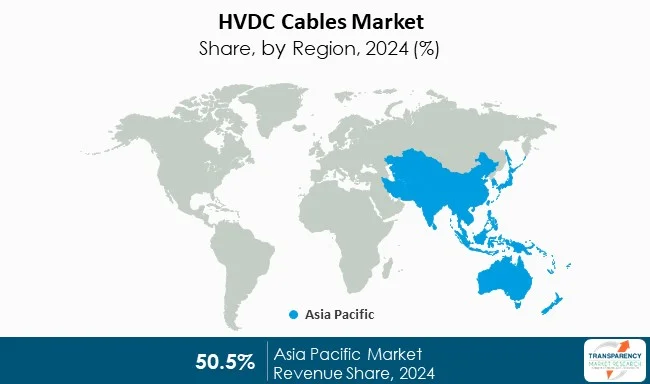

Asia Pacific was the most lucrative region in 2024

Prysmian Group, Nexans S.A., Sumitomo Electric Industries, Ltd., NKT A/S, ZTT Group, LS Cable & System, Shanghai QiFan Cable Co., Ltd., General Electric Company, Furukawa Electric Co., Ltd., FAR EAST Cable Co., Ltd. are the major players in the HVDC cables market

Table 1 Global HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 2 Global HVDC Cables Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 3 Global HVDC Cables Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 4 North America HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 5 North America HVDC Cables Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 6 North America HVDC Cables Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 7 U.S. HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 8 U.S. HVDC Cables Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Canada HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 10 Canada HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 11 Europe HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 12 Europe HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 13 Europe HVDC Cables Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 14 Germany HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 15 Germany HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 16 France HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 17 France HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 18 U.K. HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 19 U.K. HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 20 Italy HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 21 Italy HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 22 Spain HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23 Spain HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 24 Russia & CIS HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 25 Russia & CIS HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 26 Rest of Europe HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 27 Rest of Europe HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 28 Asia Pacific HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 29 Asia Pacific HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 30 Asia Pacific HVDC Cables Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 31 China HVDC Cables Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 32 China HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 33 Japan HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 34 Japan HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 35 India HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 36 India HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 37 ASEAN HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 38 ASEAN HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 39 Rest of Asia Pacific HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 40 Rest of Asia Pacific HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 41 Latin America HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 42 Latin America HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 43 Latin America HVDC Cables Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 44 Brazil HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 45 Brazil HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 46 Mexico HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 47 Mexico HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 48 Rest of Latin America HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 49 Rest of Latin America HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 50 Middle East & Africa HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51 Middle East & Africa HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 52 Middle East & Africa HVDC Cables Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 53 GCC HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 54 GCC HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 55 South Africa HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 56 South Africa HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 57 Rest of Middle East & Africa HVDC Cables Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 58 Rest of Middle East & Africa HVDC Cables Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Figure 1 Global HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 Global HVDC Cables Market Attractiveness, by Type

Figure 3 Global HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global HVDC Cables Market Attractiveness, by Application

Figure 5 Global HVDC Cables Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 6 Global HVDC Cables Market Attractiveness, by Region

Figure 7 North America HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 8 North America HVDC Cables Market Attractiveness, by Type

Figure 9 North America HVDC Cables Market Attractiveness, by Type

Figure 10 North America HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 11 North America HVDC Cables Market Attractiveness, by Application

Figure 12 North America HVDC Cables Market Attractiveness, by Country and Sub-region

Figure 13 Europe HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 14 Europe HVDC Cables Market Attractiveness, by Type

Figure 15 Europe HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 16 Europe HVDC Cables Market Attractiveness, by Application

Figure 17 Europe HVDC Cables Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 18 Europe HVDC Cables Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 20 Asia Pacific HVDC Cables Market Attractiveness, by Type

Figure 21 Asia Pacific HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 22 Asia Pacific HVDC Cables Market Attractiveness, by Application

Figure 23 Asia Pacific HVDC Cables Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Asia Pacific HVDC Cables Market Attractiveness, by Country and Sub-region

Figure 25 Latin America HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 26 Latin America HVDC Cables Market Attractiveness, by Type

Figure 27 Latin America HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Latin America HVDC Cables Market Attractiveness, by Application

Figure 29 Latin America HVDC Cables Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 30 Latin America HVDC Cables Market Attractiveness, by Country and Sub-region

Figure 31 Middle East & Africa HVDC Cables Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 32 Middle East & Africa HVDC Cables Market Attractiveness, by Type

Figure 33 Middle East & Africa HVDC Cables Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 34 Middle East & Africa HVDC Cables Market Attractiveness, by Application

Figure 35 Middle East & Africa HVDC Cables Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 36 Middle East & Africa HVDC Cables Market Attractiveness, by Country and Sub-region