Reports

Reports

The hot sauce market is portraying a considerable growth, and this is primarily a reflection of altering consumer preferences and increased demand for bold, flavorful food. The fast growth of this market is driven mainly by an increased interest in global cuisines such as Asian, Mexican, and Caribbean.

The consumers are looking for more sources of spices and sauces to improve the flavor of their everyday food choices, like tacos, pizza, and fries. At the same time, there is a shift in the food consumption behavior as several consumers are looking for hot sauces made from natural ingredients.

Moreover, another growth driver for the market is the expansion of the foodservice industry. Inclusion of spicy condiments and hot sauces in the menus of restaurants and quick-service food outlets is generating demand for these items in foodservice. For instance, established leaders such as McIlhenny Company (Tabasco) and Huy Fong Foods (Sriracha) are playing an active role in boosting the market. Their presence has also cultivated new buying habits amongst the consumers, thereby improving the foodservice and retail markets around hot sauces and their spicy condiment companions.

Besides, health-conscious consumers are prioritizing the possible health benefits of hot sauces’ metabolism-boosting effects and capsaicin’s anti-inflammatory characteristics. Overall, the hot sauce sector is expanding quickly, with new competitors and established players increasing their production.

Hot sauce implies spicy sauce that is basically made from chilies, vinegar, and spices. It is commonly used to season or add heat and flavor to food. The hot sauce Industry is inclusive of many other products such as chili pastes, salsas, and specialty sauces with local ingredients.

Three trends driving the hot sauce market demand are the popularity of spicy foods, growing inclination toward ethnic cuisines, and interest in innovation of flavor. Spicy foods have entered the mainstream venue, and their popularity has driven consumers to seek out meals with strong, bold flavors. One outcome is a further diversification of hot sauces, thereby producing opportunities for more products including milder sauces and products with extreme heat levels.

Furthermore, there is a strong preference for bolder, more adventurous flavors, especially with millennials and Gen Z across age groups. The advent of e-Commerce is a key factor, as it provides ready access to hot sauces, both - mainstream and niche.

Finally, consumers’ willingness to pay for artisanal, small-batch, organic, or unique flavor sauces does support innovation in the industry. However, all these elements are graduating hot sauce from a basic condiment on a restaurant table to a more versatile culinary enhancer, driving growth of the market and increasing application in the home kitchen as well as restaurants.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The ongoing trend of spicy and bold flavors is one of the growth drivers. More daring and unusual flavors are gaining popularity as consumers are adventurous when it comes to taste. This target consumer is also amenable to various degrees of heat and flavor profiles, from Mexican and Thai to Indian and beyond.

The emergence of "heat-seeking" food aficionados has led to more hot sauce choices for different levels of spice tolerance. The trend from standard mild flavors to more complex, spicy sauces is demonstrated by the sheer number of new sauces attracting food enthusiasts in the market. Hot sauces are now seen by many consumers as a passionate way to spice up their meals and expand their taste buds.

Additionally, the proliferation of hot sauce events and festivals across the globe, right from Australia to the U.S. and Europe further indicates growing cultural appreciation and a vibrant market for spicy condiments. From the Annual Fiery Foods Show in New Mexico to the Great Dorset Chilli Festival in the UK and the Philippine Chilli Festival in Manila, such gatherings showcase consumer enthusiasm for spicy flavors, innovation in sauces, and regional pepper varieties. The consistent increase in international participation highlights not only the cultural integration of spice but also increased demand for artisanal, gourmet, and exotic hot sauces at the global level.

The health-conscious consumer group is another major force helping to drive growth of the hot sauce market. Hot sauces, especially all-natural ones, are often viewed as healthier than conventional condiments that may contain sugars, fats, and preservatives. As wellness trends continue to become popular, consumers seek hot sauces that are devoid of artificial ingredients or preservatives. They instead want sauces that have a clean label that offer functional benefits.

Capsaicin, the active ingredient present in chili peppers, is associated with many health benefits such as promoting weight loss, increasing metabolism, and enhancing circulation. The health benefits related to capsaicin have led to rising interest in hot sauce, and there is more hot sauce consumption among health-conscious people. The health benefits associated with hot sauce, like reducing inflammation and aiding gut health, resonate with the increasing interest in functional food.

A recent report by the National Institute of Health has emphasized capsaicin consumption as a fat burner, thereby making hot sauces a favorite among consumers looking to elevate their diets. Brands including Cholula and Frank's RedHot have cleverly marketed these health trends and advertised the natural ingredients and metabolic advantage of their products, thereby positioning hot sauce as an essential component to a healthy meal.

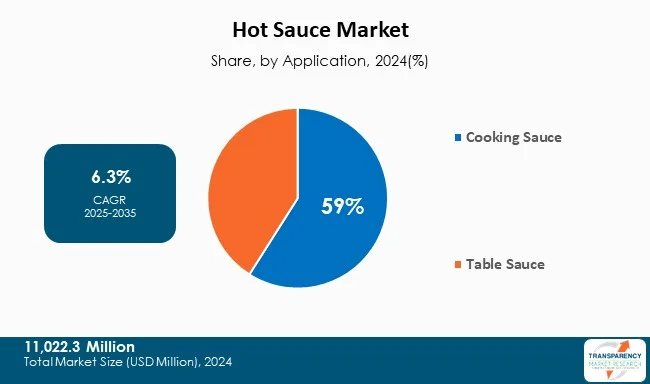

Cooking sauces, specifically, hot sauces, are leading the way in the hot sauce space due to their versatility, which is valuable in both - the professional kitchen and home cooking. Cooking sauces are incorporated into many different cuisines, from an Asian-style stir-fry to Western-style barbecue, and everything in between. Cooking sauces are considered crucial to the kitchen for adding flavor. The versatility of cooking sauces makes them a popular product, whether used as a marinade, a dipping sauce, or a condiment. Cooking sauces add value to any dish.

For instance, Tabasco and Frank's RedHot have established their presence in the cooking sauce category by expanding their product formats. Tabasco has strong relevance in the retail and foodservice industries and could be found in many cooking sauces for a variety of products used on everything, right from salads to grilled meats. The popularity of the cooking sauce category has also been driven by the continued consumer demand for easy, quick meal solutions that do not compromise on flavor.

Consumers can flavor their meals using pre-made hot sauces without having to do a lot of preparations or gather ingredients. As per study, the cooking sauce industry will hold the lead in the forecast period, as consumers’ interest continues to grow in various ways to prepare meals with high-quality cooking aids.

| Attribute | Detail |

|---|---|

|

Leading Region |

|

North America leads the hot sauce market owing to a confluence of cultural, retail, and supply factors. The region is known for embracing Chile-based condiments into mainstream diets, thereby providing an ongoing exposure to the incorporation of these flavor profiles. Supported by a high level of foodservice innovation and strong specialty-food channels, the region provides an environment ripe for retail adoption.

U.S. grocery assortment strategies, combined with fast-moving restaurant trends, compress regions and turn traditional flavor profiles into marketable packaged products that consumers can purchase for their own home use. Trade and export data for condiments and sauces confirm the region's significance as both - a producer and an important export market, indicating considerable commercially driven activity in packaged sauces. North America's broad retail and foodservice infrastructure, including national and expanding specialty chains and notable e-Commerce, can undoubtedly drive rapid scaling of successful product innovations.

Policy and institutional reporting not only strengthens the place of North America in the flow of condiment trade, but also in creating supply chains for inputs for pepper and spice. With continued support from both - flagship brands and boutique producers, North America's standing as a regional market leader is strengthened by a steady flow of product introduction and acquisition of distribution that fill mainstream shelves with various global hot sauces. Regional consumer demand for global flavors is strong and helps reinforce domestic producers and international suppliers' priority to include North America in their listings and marketing.

Baumer Foods, Inc., Conagra Brands, Inc., Del Monte Pacific Ltd., Hormel Foods Corporation, Huy Fong Foods, Inc., Kikkoman Sales USA, Inc., McCormick & Company, Incorporated, McIlhenny Company, The Kraft Heinz Company, TW Garner Food Company, Marie Sharp's Germany GmbH, Salsa Tamazula S.A. de C.V., Summit Hill Foods, The Campbell’s Company, Marshall's Haute Sauce and others are some of the leading manufacturers operating in the global hot sauce market.

Each of these companies has been profiled in the hot sauce market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 11,022.3 Mn |

| Market Forecast Value in 2035 | US$ 21,598.9 Mn |

| Growth Rate (CAGR 2025 to 2035) | 6.3 % |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Region Covered |

|

| Country Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global hot sauce market was valued at US$ 11,022.3 Mn in 2024

The global hot sauce industry is projected to reach US$ 21,598.9 Mn by the end of 2035

Rising trend of spicy and bold flavors in hot sauce and increasing demand for clean label hot sauces among health-conscious consumer groups are some of the factors driving the expansion of hot sauce market.

The CAGR is anticipated to be 6.3% from 2025 to 2035

Baumer Foods, Inc., Conagra Brands, Inc., Del Monte Pacific Ltd., Hormel Foods Corporation, Huy Fong Foods, Inc., Kikkoman Sales USA, Inc., McCormick & Company, Incorporated, McIlhenny Company, The Kraft Heinz Company, TW Garner Food Company, Marie Sharp's Germany GmbH, Salsa Tamazula S.A. de C.V., Summit Hill Foods, The Campbell’s Company, and Marshall's Haute Sauce.

Table 1: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 2: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 3: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 4: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 5: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 6: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 7: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 8: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 9: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 10: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 11: Global Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Region

Table 12: Global Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Region

Table 13: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 14: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 15: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 16: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 17: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 18: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 19: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 20: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 21: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 22: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 23: North America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Country

Table 24: North America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Country

Table 25: U.S. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 26: U.S. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 27: U.S. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 28: U.S. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 29: U.S. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 30: U.S. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 31: U.S. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 32: U.S. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 33: U.S. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 34: U.S. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 35: Canada Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 36: Canada Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 37: Canada Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 38: Canada Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 39: Canada Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 40: Canada Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 41: Canada Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 42: Canada Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 43: Canada Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 44: Canada Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 45: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 46: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 47: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 48: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 49: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 50: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 51: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 52: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 53: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 54: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 55: Europe Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Country

Table 56: Europe Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Country

Table 57: U.K. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 58: U.K. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 59: U.K. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 60: U.K. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 61: U.K. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 62: U.K. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 63: U.K. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 64: U.K. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 65: U.K. Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 66: U.K. Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 67: Germany Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 68: Germany Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 69: Germany Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 70: Germany Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 71: Germany Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 72: Germany Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 73: Germany Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 74: Germany Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 75: Germany Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 76: Germany Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 77: France Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 78: France Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 79: France Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 80: France Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 81: France Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 82: France Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 83: France Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 84: France Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 85: France Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 86: France Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 87: Italy Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 88: Italy Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 89: Italy Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 90: Italy Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 91: Italy Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 92: Italy Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 93: Italy Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 94: Italy Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 95: Italy Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 96: Italy Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 97: Spain Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 98: Spain Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 99: Spain Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 100: Spain Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 101: Spain Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 102: Spain Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 103: Spain Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 104: Spain Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 105: Spain Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 106: Spain Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 107: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 108: The Netherlands Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 109: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 110: The Netherlands Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 111: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 112: The Netherlands Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 113: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 114: The Netherlands Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 115: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 116: The Netherlands Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 117: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 118: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 119: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 120: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 121: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 122: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 123: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 124: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 125: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 126: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 127: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Country

Table 128: Asia Pacific Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Country

Table 129: China Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 130: China Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 131: China Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 132: China Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 133: China Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 134: China Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 135: China Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 136: China Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 137: China Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 138: China Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 139: India Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 140: India Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 141: India Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 142: India Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 143: India Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 144: India Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 145: India Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 146: India Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 147: India Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 148: India Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 149: Japan Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 150: Japan Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 151: Japan Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 152: Japan Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 153: Japan Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 154: Japan Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 155: Japan Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 156: Japan Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 157: Japan Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 158: Japan Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 159: Australia Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 160: Australia Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 161: Australia Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 162: Australia Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 163: Australia Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 164: Australia Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 165: Australia Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 166: Australia Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 167: Australia Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 168: Australia Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 169: South Korea Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 170: South Korea Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 171: South Korea Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 172: South Korea Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 173: South Korea Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 174: South Korea Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 175: South Korea Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 176: South Korea Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 177: South Korea Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 178: South Korea Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 179: ASEAN Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 180: ASEAN Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 181: ASEAN Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 182: ASEAN Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 183: ASEAN Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 184: ASEAN Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 185: ASEAN Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 186: ASEAN Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 187: ASEAN Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 188: ASEAN Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 189: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 190: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 191: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 192: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 193: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 194: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 195: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 196: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 197: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 198: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 199: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Country

Table 200: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Country

Table 201: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 202: GCC Countries Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 203: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 204: GCC Countries Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 205: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 206: GCC Countries Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 207: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 208: GCC Countries Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 209: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 210: GCC Countries Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 211: South Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 212: South Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 213: South Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 214: South Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 215: South Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 216: South Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 217: South Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 218: South Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 219: South Africa Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 220: South Africa Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 221: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 222: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 223: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 224: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 225: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 226: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 227: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 228: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 229: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 230: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 231: Latin America Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Country

Table 232: Latin America Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Country

Table 233: Brazil Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 234: Brazil Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 235: Brazil Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 236: Brazil Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 237: Brazil Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 238: Brazil Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 239: Brazil Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 240: Brazil Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 241: Brazil Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 242: Brazil Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 243: Argentina Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 244: Argentina Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 245: Argentina Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 246: Argentina Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 247: Argentina Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 248: Argentina Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 249: Argentina Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 250: Argentina Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 251: Argentina Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 252: Argentina Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Table 253: Mexico Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Product Type

Table 254: Mexico Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Product Type

Table 255: Mexico Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Packaging

Table 256: Mexico Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Packaging

Table 257: Mexico Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Application

Table 258: Mexico Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Application

Table 259: Mexico Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By End-use

Table 260: Mexico Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By End-use

Table 261: Mexico Hot Sauce Market Value (US$ Mn) Projection, 2020 to 2035, By Distribution Channel

Table 262: Mexico Hot Sauce Market Volume (Tons) Projection, 2020 to 2035, By Distribution Channel

Figure 1: Global Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 2: Global Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 3: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 4: Global Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 5: Global Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 6: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 7: Global Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 8: Global Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 9: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 10: Global Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 11: Global Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 12: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 13: Global Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 16: Global Hot Sauce Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 17: Global Hot Sauce Market Volume (Tons) Projection, By Region 2020 to 2035

Figure 18: Global Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Region 2025 to 2035

Figure 19: North America Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 20: North America Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 21: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 22: North America Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 23: North America Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 24: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 25: North America Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 26: North America Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 27: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 28: North America Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 29: North America Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 30: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 31: North America Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 34: North America Hot Sauce Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 35: North America Hot Sauce Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 36: North America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 37: U.S. Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 38: U.S. Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 39: U.S. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 40: U.S. Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 41: U.S. Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 42: U.S. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 43: U.S. Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 44: U.S. Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 45: U.S. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 46: U.S. Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 47: U.S. Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 48: U.S. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 49: U.S. Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 52: Canada Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 53: Canada Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 54: Canada Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 55: Canada Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 56: Canada Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 57: Canada Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 58: Canada Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 59: Canada Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 60: Canada Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 61: Canada Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 62: Canada Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 63: Canada Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 64: Canada Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 68: Europe Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 69: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 70: Europe Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 71: Europe Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 72: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 73: Europe Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 74: Europe Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 75: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 76: Europe Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 77: Europe Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 78: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 79: Europe Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 82: Europe Hot Sauce Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 83: Europe Hot Sauce Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 84: Europe Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 85: U.K. Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 86: U.K. Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 87: U.K. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 88: U.K. Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 89: U.K. Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 90: U.K. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 91: U.K. Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 92: U.K. Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 93: U.K. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 94: U.K. Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 95: U.K. Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 96: U.K. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 97: U.K. Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 100: Germany Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 101: Germany Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 102: Germany Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 103: Germany Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 104: Germany Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 105: Germany Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 106: Germany Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 107: Germany Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 108: Germany Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 109: Germany Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 110: Germany Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 111: Germany Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 112: Germany Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 115: France Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 116: France Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 117: France Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 118: France Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 119: France Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 120: France Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 121: France Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 122: France Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 123: France Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 124: France Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 125: France Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 126: France Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 127: France Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 130: Italy Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 131: Italy Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 132: Italy Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 133: Italy Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 134: Italy Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 135: Italy Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 136: Italy Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 137: Italy Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 138: Italy Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 139: Italy Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 140: Italy Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 141: Italy Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 142: Italy Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 145: Spain Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 146: Spain Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 147: Spain Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 148: Spain Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 149: Spain Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 150: Spain Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 151: Spain Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 152: Spain Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 153: Spain Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 154: Spain Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 155: Spain Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 156: Spain Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 157: Spain Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 160: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 161: The Netherlands Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 162: The Netherlands Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 163: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 164: The Netherlands Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 165: The Netherlands Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 166: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 167: The Netherlands Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 168: The Netherlands Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 169: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 170: The Netherlands Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 171: The Netherlands Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 172: The Netherlands Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 175: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 176: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 177: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 178: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 179: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 180: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 181: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 182: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 183: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 184: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 185: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 186: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 187: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 190: Asia Pacific Hot Sauce Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Hot Sauce Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 193: China Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 194: China Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 195: China Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 196: China Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 197: China Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 198: China Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 199: China Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 200: China Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 201: China Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 202: China Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 203: China Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 204: China Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 205: China Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 208: India Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 209: India Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 210: India Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 211: India Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 212: India Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 213: India Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 214: India Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 215: India Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 216: India Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 217: India Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 218: India Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 219: India Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 220: India Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 223: Japan Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 224: Japan Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 225: Japan Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 226: Japan Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 227: Japan Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 228: Japan Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 229: Japan Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 230: Japan Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 231: Japan Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 232: Japan Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 233: Japan Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 234: Japan Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 235: Japan Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 238: Australia Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 239: Australia Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 240: Australia Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 241: Australia Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 242: Australia Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 243: Australia Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 244: Australia Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 245: Australia Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 246: Australia Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 247: Australia Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 248: Australia Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 249: Australia Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 250: Australia Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 253: South Korea Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 254: South Korea Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 255: South Korea Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 256: South Korea Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 257: South Korea Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 258: South Korea Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 259: South Korea Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 260: South Korea Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 261: South Korea Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 262: South Korea Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 263: South Korea Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 264: South Korea Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 265: South Korea Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 268: ASEAN Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 269: ASEAN Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 270: ASEAN Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 271: ASEAN Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 272: ASEAN Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 273: ASEAN Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 274: ASEAN Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 275: ASEAN Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 276: ASEAN Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 277: ASEAN Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 278: ASEAN Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 279: ASEAN Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 280: ASEAN Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 283: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 284: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 285: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 286: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 287: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 288: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 289: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 290: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 291: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 292: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 293: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 294: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 295: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 298: Middle East & Africa Hot Sauce Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Hot Sauce Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 301: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 302: GCC Countries Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 303: GCC Countries Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 304: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 305: GCC Countries Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 306: GCC Countries Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 307: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 308: GCC Countries Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 309: GCC Countries Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 310: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 311: GCC Countries Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 312: GCC Countries Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 313: GCC Countries Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 316: South Africa Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 317: South Africa Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 318: South Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 319: South Africa Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 320: South Africa Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 321: South Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 322: South Africa Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 323: South Africa Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 324: South Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 325: South Africa Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 326: South Africa Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 327: South Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 328: South Africa Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 331: Latin America Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 332: Latin America Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 333: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 334: Latin America Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 335: Latin America Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 336: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 337: Latin America Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 338: Latin America Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 339: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 340: Latin America Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 341: Latin America Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 342: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 343: Latin America Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 346: Latin America Hot Sauce Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 347: Latin America Hot Sauce Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 348: Latin America Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 349: Brazil Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 350: Brazil Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 351: Brazil Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 352: Brazil Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 353: Brazil Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 354: Brazil Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 355: Brazil Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 356: Brazil Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 357: Brazil Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 358: Brazil Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 359: Brazil Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 360: Brazil Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 361: Brazil Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 362: Brazil Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 363: Brazil Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 364: Argentina Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 365: Argentina Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 366: Argentina Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 367: Argentina Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 368: Argentina Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 369: Argentina Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 370: Argentina Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 371: Argentina Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 372: Argentina Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 373: Argentina Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 374: Argentina Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 375: Argentina Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 376: Argentina Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 377: Argentina Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 378: Argentina Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 379: Mexico Hot Sauce Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 380: Mexico Hot Sauce Market Volume (Tons) Projection, By Product Type 2020 to 2035

Figure 381: Mexico Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 382: Mexico Hot Sauce Market Value (US$ Mn) Projection, By Packaging 2020 to 2035

Figure 383: Mexico Hot Sauce Market Volume (Tons) Projection, By Packaging 2020 to 2035

Figure 384: Mexico Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Packaging 2025 to 2035

Figure 385: Mexico Hot Sauce Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 386: Mexico Hot Sauce Market Volume (Tons) Projection, By Application 2020 to 2035

Figure 387: Mexico Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 388: Mexico Hot Sauce Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 389: Mexico Hot Sauce Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 390: Mexico Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By End-use 2025 to 2035

Figure 391: Mexico Hot Sauce Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 392: Mexico Hot Sauce Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 393: Mexico Hot Sauce Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035