Reports

Reports

Analysts’ Viewpoint on Market Scenario

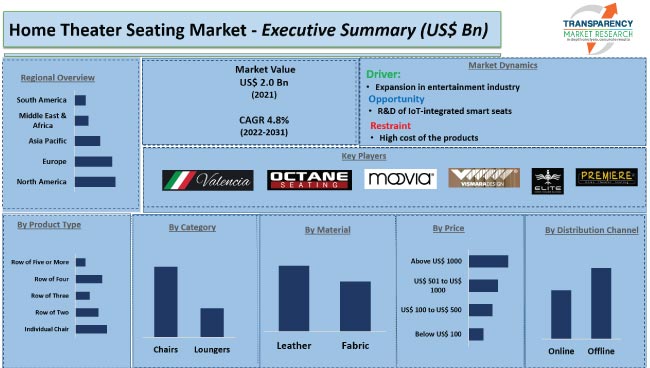

Expansion in the entertainment industry is expected to fuel the global home theater seating market development during the forecast period. Rise in disposable income among the populace has led to significant expenditure on luxury and entertainment. Chairs are gaining traction over lounges, as they occupy lesser space.

Surge in the trend of home entertainment is expected to offer lucrative growth opportunities for vendors in the industry. Emergence of the COVID-19 pandemic led to a massive shift toward indoor entertainment, as people avoided public gatherings. Vendors are focused on the R&D of IoT-integrated smart seats to increase their home theater seating market share.

Home theater seating usually has two seats with an armrest in between. It often has the option of reclining. Leather and fabrics are used to manufacture chairs and lounges. Home theater seating is known for its comfort and esthetic appeal.

Standard seating measurements, observing angles, and the distance from chairs to the screen are the various factors that play an important role in the design of home theater seating. Individual chairs, row of two, row of three, row of four, and row of five or more are some of the types of home theater seating available in the home theater seating industry.

R&D of innovative designs and the inclusion of technology have led to surge in demand for home theater seating worldwide. The global film industry is the primary end-user of chairs and lounges. According to the Motion Picture Association of America, the combined mobile entertainment/theatrical and home market in the U.S. was valued at US$ 36.8 Bn in 2021, recording a rise of 14% from 2020. Thus, expansion in the film industry is augmented to aid market growth in the near future.

Sporting events have gained immense popularity worldwide. A large number of people prefer to watch these events in the comfort of their homes. According to Viacom18 Media Private Limited, a media and entertainment company, the 2022 World Cup final match between Argentina and France played in December 2022 gained 32 million viewers on JioCinema in India. Therefore, rise in sports viewership is estimated to fuel the home theater seating market dynamics in the near future.

Awareness about and inclination toward different types of home theater seating products is increasing among people living in urban areas. According to a report from Redfin, a real-estate company, in February 2022, around 8.2% of U.S. homes (6 million) were valued at US$ 1 million or more, as compared to 4.8% (3.5 million) in 2020. Thus, growth in the urban population, increase in expenditure on home interiors, and surge in the construction of luxury homes are also projected to fuel market expansion in the next few years.

According to the latest home theater seating market trends, the individual chair product type segment is anticipated to hold leading share during the forecast period. Individual home theater chairs are increasingly preferred by single-income families and small-sized homes. Moreover, individual chairs are usually purchased to complement two or more row seaters.

According to the latest home theater seating market insights, the chairs category segment is expected to dominate the industry during the forecast period. Home theater chairs are available at a more reasonable price and occupancy lesser space than home theater lounges. Home theater chairs offer a relaxed viewing experience. They provide effective support to the lumbar region and the neck.

According to the latest home theater seating market forecast, North America is projected to hold largest share from 2022 to 2031. Expansion in the home entertainment sector and surge in expenditure on home interiors are boosting market progress in the region.

The industry in Europe is driven by high per capita income of several countries in the region and increase in expenditure on home entertainment. According to the World Bank, in 2021, the GDP per capita income of the European Union was US$ 68,369.7, which was a rise from US$ 61,452 in 2020.

Surge in inclination toward home entertainment and increase in sports viewership are likely to augment market statistics in Asia Pacific. Middle East & Africa has a larger consumer base for home theater seating than South America. Nevertheless, the industry in South America is expected to grow at a significant rate in the next few years.

The home theater seating market report profiles major vendors based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Cineak NV, Fortress Seating, Verona - Valencia Theater Seating, Octane Seating, Seatcraft, Moovia (VISIVO GmbH & Co. KG.), Vismara F.lli sas, ELITE HTS, and PREMIEREHTS, LLC are key entities operating in the market.

Vendors are focused on manufacturing products with the inclusion of mechanical technology to improve product attractiveness. In November 2022, Cineak NV launched HARV chairs with a 3-way motorized mechanism that enable the user to independently control the foot, back, and headrest to assure a comfortable seating position

|

Attribute |

Detail |

|

Market Value in 2021 |

US$ 2.0 Bn |

|

Market Forecast Value in 2031 |

US$ 3.1 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It global market was valued at US$ 2.0 Bn in 2021

It is estimated to be 4.8% from 2022 to 2031

Rise in construction of luxury homes and expansion in the entertainment industry

The offline segment is projected to hold largest share during the forecast period

North America is anticipated to dominate the industry from 2022 to 2031

Cineak NV, Fortress Seating, Verona - Valencia Theater Seating, Octane Seating, Seatcraft, Moovia (VISIVO GmbH & Co. KG.), Vismara F.lli sas, ELITE HTS, and PREMIEREHTS, LLC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Theater Seating Market

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Raw Material Analysis

5.9. Global Home Theater Seating Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Home Theater Seating Market Analysis and Forecast, by Product Type

6.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

6.1.1. Individual Chair

6.1.2. Row of Two

6.1.3. Row of Three

6.1.4. Row of Four

6.1.5. Row of Five or More

6.2. Incremental Opportunity, By Product Type

7. Global Home Theater Seating Market Analysis and Forecast, by Category

7.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

7.1.1. Chairs

7.1.2. Loungers

7.2. Incremental Opportunity, By Category

8. Global Home Theater Seating Market Analysis and Forecast, by Material

8.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

8.1.1. Leather

8.1.2. Fabric

8.2. Incremental Opportunity, By Material

9. Global Home Theater Seating Market Analysis and Forecast, by Price

9.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

9.1.1. Below US$ 100

9.1.2. US$ 100 to US$ 500

9.1.3. US$ 501 to US$ 1000

9.1.4. Above US$ 1000

9.2. Incremental Opportunity, By Price

10. Global Home Theater Seating Market Analysis and Forecast, by Distribution Channel

10.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Hypermarkets/Supermarkets

10.1.2.2. Specialty Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Global Home Theater Seating Market Analysis and Forecast, by Region

11.1. Global Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Home Theater Seating Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.2.1. Demand Side

12.2.2. Supply Side

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

12.6.1. Individual Chair

12.6.2. Row of Two

12.6.3. Row of Three

12.6.4. Row of Four

12.6.5. Row of Five or More

12.7. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

12.7.1. Chairs

12.7.2. Loungers

12.8. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

12.8.1. Leather

12.8.2. Fabric

12.9. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

12.9.1. Below US$ 100

12.9.2. US$ 100 to US$ 500

12.9.3. US$ 501 to US$ 1000

12.9.4. Above US$ 1000

12.10. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

12.10.1. Online

12.10.1.1. E-commerce Websites

12.10.1.2. Company-owned Websites

12.10.2. Offline

12.10.2.1. Hypermarkets/Supermarkets

12.10.2.2. Specialty Stores

12.10.2.3. Other Retail Stores

12.11. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 - 2031

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Home Theater Seating Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.2.1. Demand Side

13.2.2. Supply Side

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

13.6.1. Individual Chair

13.6.2. Row of Two

13.6.3. Row of Three

13.6.4. Row of Four

13.6.5. Row of Five or More

13.7. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

13.7.1. Chairs

13.7.2. Loungers

13.8. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

13.8.1. Leather

13.8.2. Fabric

13.9. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

13.9.1. Below US$ 100

13.9.2. US$ 100 to US$ 500

13.9.3. US$ 501 to US$ 1000

13.9.4. Above US$ 1000

13.10. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

13.10.1. Online

13.10.1.1. E-commerce Websites

13.10.1.2. Company-owned Websites

13.10.2. Offline

13.10.2.1. Hypermarkets/Supermarkets

13.10.2.2. Specialty Stores

13.10.2.3. Other Retail Stores

13.11. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 - 2031

13.11.1. Germany

13.11.2. U.K.

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Home Theater Seating Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.2.1. Demand Side

14.2.2. Supply Side

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

14.6.1. Individual Chair

14.6.2. Row of Two

14.6.3. Row of Three

14.6.4. Row of Four

14.6.5. Row of Five or More

14.7. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

14.7.1. Chairs

14.7.2. Loungers

14.8. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

14.8.1. Leather

14.8.2. Fabric

14.9. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

14.9.1. Below US$ 100

14.9.2. US$ 100 to US$ 500

14.9.3. US$ 501 to US$ 1000

14.9.4. Above US$ 1000

14.10. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-owned Websites

14.10.2. Offline

14.10.2.1. Hypermarkets/Supermarkets

14.10.2.2. Specialty Stores

14.10.2.3. Other Retail Stores

14.11. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Home Theater Seating Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Brand Analysis

15.4. Consumer Buying Behavior Analysis

15.4.1. Brand Awareness

15.4.2. Average Spend

15.4.3. Purchasing Factors

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. COVID-19 Impact Analysis

15.7. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

15.7.1. Individual Chair

15.7.2. Row of Two

15.7.3. Row of Three

15.7.4. Row of Four

15.7.5. Row of Five or More

15.8. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

15.8.1. Chairs

15.8.2. Loungers

15.9. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

15.9.1. Leather

15.9.2. Fabric

15.10. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

15.10.1. Below US$ 100

15.10.2. US$ 100 to US$ 500

15.10.3. US$ 501 to US$ 1000

15.10.4. Above US$ 1000

15.11. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

15.11.1. Online

15.11.1.1. E-commerce Websites

15.11.1.2. Company-owned Websites

15.11.2. Offline

15.11.2.1. Hypermarkets/Supermarkets

15.11.2.2. Specialty Stores

15.11.2.3. Other Retail Stores

15.12. Home Theater Seating Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

15.12.1. GCC

15.12.2. South Africa

15.12.3. Rest of Middle East & Africa

15.13. Incremental Opportunity Analysis

16. South America Home Theater Seating Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Brand Analysis

16.4. Consumer Buying Behavior Analysis

16.4.1. Brand Awareness

16.4.2. Average Spend

16.4.3. Purchasing Factors

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. COVID-19 Impact Analysis

16.7. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Product Type, 2017 - 2031

16.7.1. Individual Chair

16.7.2. Row of Two

16.7.3. Row of Three

16.7.4. Row of Four

16.7.5. Row of Five or More

16.8. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Category, 2017 - 2031

16.8.1. Chairs

16.8.2. Loungers

16.9. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Material, 2017 - 2031

16.9.1. Leather

16.9.2. Fabric

16.10. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Price, 2017 - 2031

16.10.1. Below US$ 100

16.10.2. US$ 100 to US$ 500

16.10.3. US$ 501 to US$ 1000

16.10.4. Above US$ 1000

16.11. Home Theater Seating Market Size (US$ Mn and Thousand Units) Forecast, by Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.1.1. E-commerce Websites

16.11.1.2. Company-owned Websites

16.11.2. Offline

16.11.2.1. Hypermarkets/Supermarkets

16.11.2.2. Specialty Stores

16.11.2.3. Other Retail Stores

16.12. Home Theater Seating Market Size (US$ Mn and Thousand Units), By Country, 2017 - 2031

16.12.1. Brazil

16.12.2. Rest of South America

16.13. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis (%), 2021

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

17.3.1. Cineak NV

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Size Portfolio

17.3.2. Fortress Seating

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Size Portfolio

17.3.3. Verona - Valencia Theater Seating

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Size Portfolio

17.3.4. ELITE HTS

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Size Portfolio

17.3.5. Octane Seating

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Size Portfolio

17.3.6. Seatcraft

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Size Portfolio

17.3.7. Moovia (VISIVO GmbH & Co. KG.)

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Size Portfolio

17.3.8. Vismara F.lli sas

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Size Portfolio

17.3.9. PREMIEREHTS, LLC

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Size Portfolio

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Category

18.1.3. Material

18.1.4. Price

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 2: Global Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 3: Global Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 4: Global Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 5: Global Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 6: Global Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Table 7: Global Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 8: Global Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 11: Global Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 12: Global Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 13: Global Home Theater Seating Market, by Region, Thousand Units, 2017-2031

Table 14: Global Home Theater Seating Market, by Region, US$ Mn, 2017-2031

Table 15: North America Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 16: North America Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 17: North America Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 18: North America Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 19: North America Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 20: North America Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Table 21: North America Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 22: North America Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 25: North America Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 26: North America Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 27: North America Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Table 28: North America Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Table 29: Europe Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 30: Europe Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 31: Europe Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 32: Europe Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 33: Europe Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 34: Europe Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Table 35: Europe Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 36: Europe Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 39: Europe Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 40: Europe Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 41: Europe Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Table 42: Europe Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Table 43: Asia Pacific Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 44: Asia Pacific Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 45: Asia Pacific Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 46: Asia Pacific Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 47: Asia Pacific Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 48: Asia Pacific Home Theater Seating Market, by Material US$ Mn, 2017-2031

Table 49: Asia Pacific Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 50: Asia Pacific Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 53: Asia Pacific Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 54: Asia Pacific Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 55: Asia Pacific Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Table 56: Asia Pacific Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Table 57: Middle East & Africa Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 58: Middle East & Africa Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 59: Middle East & Africa Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 60: Middle East & Africa Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 61: Middle East & Africa Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 62: Middle East & Africa Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Table 63: Middle East & Africa Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 64: Middle East & Africa Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 67: Middle East & Africa Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 68: Middle East & Africa Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 69: Middle East & Africa Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Table 70: Middle East & Africa Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Table 71: South America Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Table 72: South America Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Table 73: South America Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Table 74: South America Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Table 75: South America Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Table 76: South America Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Table 77: South America Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Table 78: South America Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Table 81: South America Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Table 82: South America Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Table 83: South America Home Theater Seating Market, by Region, Thousand Units, 2017-2031

Table 84: South America Home Theater Seating Market, by Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 2: Global Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 3: Global Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 4: Global Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 5: Global Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 6: Global Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 7: Global Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 8: Global Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 9: Global Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 10: Global Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 11: Global Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 12: Global Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 16: Global Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 17: Global Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 18: Global Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 19: Global Home Theater Seating Market, by Region, Thousand Units, 2017-2031

Figure 20: Global Home Theater Seating Market, by Region, US$ Mn, 2017-2031

Figure 21: Global Home Theater Seating Market Incremental Opportunity, by Region, US$ Mn, 2017-2031

Figure 22: North America Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 23: North America Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 24: North America Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 25: North America Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 26: North America Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 27: North America Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 28: North America Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 29: North America Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 30: North America Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 31: North America Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 32: North America Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 33: North America Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 37: North America Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 38: North America Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 39: North America Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 40: North America Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Figure 41: North America Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Figure 42: North America Home Theater Seating Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 43: Europe Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 44: Europe Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 45: Europe Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 46: Europe Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 47: Europe Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 48: Europe Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 49: Europe Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 50: Europe Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 51: Europe Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 52: Europe Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 53: Europe Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 54: Europe Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 58: Europe Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 59: Europe Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 60: Europe Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 61: Europe Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Figure 62: Europe Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Figure 63: Europe Home Theater Seating Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 64: Asia Pacific Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 65: Asia Pacific Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 66: Asia Pacific Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 67: Asia Pacific Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 68: Asia Pacific Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 69: Asia Pacific Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 70: Asia Pacific Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 71: Asia Pacific Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 72: Asia Pacific Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 73: Asia Pacific Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 74: Asia Pacific Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 75: Asia Pacific Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 79: Asia Pacific Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 80: Asia Pacific Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 81: Asia Pacific Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 82: Asia Pacific Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Figure 83: Asia Pacific Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Figure 84: Asia Pacific Home Theater Seating Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 85: Middle East & Africa Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 86: Middle East & Africa Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 87: Middle East & Africa Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 88: Middle East & Africa Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 89: Middle East & Africa Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 90: Middle East & Africa Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 91: Middle East & Africa Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 92: Middle East & Africa Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 93: Middle East & Africa Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 94: Middle East & Africa Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 95: Middle East & Africa Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 96: Middle East & Africa Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 100: Middle East & Africa Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 101: Middle East & Africa Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 102: Middle East & Africa Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 103: Middle East & Africa Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Figure 104: Middle East & Africa Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Figure 105: Middle East & Africa Home Theater Seating Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 106: South America Home Theater Seating Market, by Product Type, Thousand Units, 2017-2031

Figure 107: South America Home Theater Seating Market, by Product Type, US$ Mn, 2017-2031

Figure 108: South America Home Theater Seating Market Incremental Opportunity, By Product Type, US$ Mn, 2017-2031

Figure 109: South America Home Theater Seating Market, by Category, Thousand Units, 2017-2031

Figure 110: South America Home Theater Seating Market, by Category, US$ Mn, 2017-2031

Figure 111: South America Home Theater Seating Market Incremental Opportunity, By Category, US$ Mn, 2017-2031

Figure 112: South America Home Theater Seating Market, by Material, Thousand Units, 2017-2031

Figure 113: South America Home Theater Seating Market, by Material, US$ Mn, 2017-2031

Figure 114: South America Home Theater Seating Market Incremental Opportunity, By Material, US$ Mn, 2017-2031

Figure 115: South America Home Theater Seating Market, by Price, Thousand Units, 2017-2031

Figure 116: South America Home Theater Seating Market, by Price, US$ Mn, 2017-2031

Figure 117: South America Home Theater Seating Market Incremental Opportunity, By Price, US$ Mn, 2017-2031

Figure 121: South America Home Theater Seating Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 122: South America Home Theater Seating Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 123: South America Home Theater Seating Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 124: South America Home Theater Seating Market, by Country, Thousand Units, 2017-2031

Figure 125: South America Home Theater Seating Market, by Country, US$ Mn, 2017-2031

Figure 126: South America Home Theater Seating Market Incremental Opportunity, by Country, US$ Mn, 2017-2031