Reports

Reports

Analysts’ Viewpoint

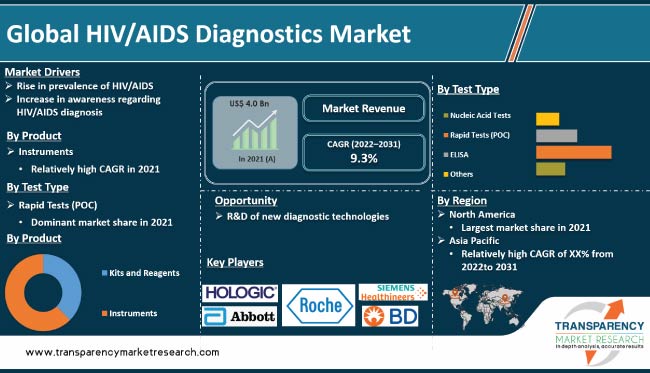

Rise in prevalence of HIV/AIDS is expected to propel the HIV/AIDS diagnostics market size during the forecast period. HIV/AIDS tests identify antibodies in blood or oral fluids. Most assays that are used to detect Nucleic Acids (NAT) are complex and technically demanding.

Increase in awareness about HIV/AIDS diagnosis is expected to augment market expansion in the near future. Over-the-counter HIV self-tests are gaining traction, as they help overcome the stigma associated with HIV testing. R&D of new diagnostic technologies is likely to offer lucrative growth opportunities for vendors in the industry. Key players are launching advanced rapid diagnostic tests in order to increase their HIV/AIDS diagnostics market share.

Human Immunodeficiency Virus (HIV) is a virus that attacks the immune system, specifically CD4 cells (T cells). Untreated HIV can lead to Acquired Immunodeficiency Syndrome (AIDS), a condition in which the immune system is severely damaged and incapable of fighting infections and diseases.

HIV is primarily transmitted through the exchange of bodily fluids such as blood, semen, vaginal secretions, and breast milk. Sexual contact, injection drug use, and mother-to-child transmission (during birth or breastfeeding) are the most common modes of transmission.

HIV can also be transmitted through the use of contaminated needles or equipment for tattooing, body piercing, or acupuncture. Organ transplantation or blood transfusion can also transmit HIV to a recipient. Stringent screening of blood and organ donors can limit this type of transmission.

The ongoing global HIV/AIDS epidemic and the need for accurate disease diagnosis and monitoring are estimated to boost the demand for HIV/AIDS diagnostics. According to the World Health Organization (WHO), approximately 38.8 million people worldwide suffered from HIV in 2021. The number of cases is increasing steadily, as the virus continues to spread. As per the Centers for Disease Control and Prevention (CDC), around 38,000 new HIV infections were reported in the U.S. in 2019.

According to the same source, HIV affects certain groups disproportionately in the U.S., including men who have had intercourse with men, people who inject drugs, and transgender women. In 2019, it was estimated that approximately 1.2 million people in the country were living with HIV, with men constituting the vast majority. Thus, high incidence of HIV/AIDS is anticipated to contribute to HIV/AIDS diagnostics market growth in the near future.

Development of new diagnostic technologies and surge in accessibility of testing in emerging economies are expected to offer lucrative growth opportunities for vendors in HIV/AIDS diagnostics industry. Key players are launching advanced products such as rapid tests and nucleic acid-based assay (Simple Amplification-based Assay (SAMBA) to broaden their customer base.

Implementation of POC diagnostic standards is also expected to augment the market size in the next few years. According to the WHO, an ideal POC diagnostic must be Affordable, Sensitive, Specific, User-friendly, Rapid/Robust, Equipment-free, and Deliverable (ASSURED). As per the WHO, in 2021, approximately 76% of people living with HIV globally were aware of their HIV-positive status. This represents an increase from previous years and demonstrates the success of efforts to raise awareness and testing for HIV/AIDS.

Implementation of HIV testing programs in several healthcare settings has led to a significant rise in awareness about the disease and testing of HIV/AIDS. These programs are designed to increase the number of people being tested for HIV and make testing more accessible.

The CDC recommends that everyone between the ages of 13 and 64 be tested for HIV at least once as part of routine health care. It also encourages more frequent testing for those at higher risk of HIV infection. According to the CDC, approximately 85% of people living with HIV in the U.S. received an HIV diagnosis in 2019.

According to the European Centre for Disease Prevention and Control (ECDC), in 2021, approximately 78% of HIV-positive people in the European Union and the European Economic Area were aware of their HIV status. This can be ascribed to the successful efforts of various governments in Europe to raise HIV/AIDS awareness and testing in the region. Thus, growth in awareness about HIV/AIDS is projected to boost the HIV/AIDS diagnostics market progress in the near future.

According to the latest HIV/AIDS diagnostics market trends, the instruments product segment held major share of the industry in 2021. Rise in number of HIV patients is expected to drive the demand for HIV diagnostic instruments.

HIV diagnostic testing employs a variety of instruments, including ELISA and Western Blot. Some instrument-based tests, such as Polymerase Chain Reaction (PCR), are extremely sensitive and can detect very low levels of HIV in a person's blood.

Vendors in the HIV/AIDS diagnostics business are launching new products in the instruments product segment. In August 2022, Molbio Diagnostics launched the Truenat RT-PCR Test for HIV diagnosis. Truenat is a portable, battery-powered, IoT-enabled, real-time PCR platform for Point-of-Care (POC) testing with a sample-to-result time of less than an hour.

Based on test type, the rapid tests (POC) segment is likely to dominate the industry during the forecast period, as per the latest HIV/AIDS diagnostics market analysis. Rapid HIV tests can be performed at POC, which is a more convenient option for patients than having to go to a separate laboratory. Furthermore, rapid tests are less expensive than traditional laboratory tests.

North America is expected to hold the largest share of the HIV/AIDS diagnostics industry during the forecast period. The region dominated the market with 30.0% share in 2021. Increase in incidence of HIV/AIDS, presence of key vendors, and rise in investment in R&D are boosting market statistics in the region.

The industry in Asia Pacific is projected to grow at the fastest rate during the forecast period due to high incidence of HIV/AIDS in the region.

The global industry is fragmented, with the presence of a large number of vendors. Most of the companies are increasing their market share through significant investment in R&D of new tests. Expansion of product portfolio and mergers & acquisitions are key strategies adopted by vendors.

Hologic, Inc. Abbott, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., OraSure Technologies, Inc., Siemens Healthcare GmbH, Chembio Diagnostics, Inc., Danaher Corporation, and Becton, Dickinson and Company are prominent market entities.

Each of these players has been profiled in the market report based on parameters such as company overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.0 Bn |

|

Market Forecast Value in 2031 |

More than US$ 9.6 Bn |

|

Growth Rate (CAGR) |

9.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.0 Bn in 2021.

It is projected to reach more than US$ 9.6 Bn by 2031.

The CAGR is anticipated to be 9.3% from 2022 to 2031.

Rise in prevalence of HIV/AIDS and increase in awareness about HIV/AIDS diagnosis.

North America is likely to account for major share from 2022 to 2031.

Hologic, Inc. Abbott, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., OraSure Technologies, Inc., Siemens Healthcare GmbH, Chembio Diagnostics, Inc., Danaher Corporation, and Becton, Dickinson and Company.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global HIV/AIDS Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global HIV/AIDS Diagnostics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projection

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. HIV Disease Epidemiology

5.2. Technological Advancements

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. Global HIV/AIDS Diagnostics Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Kits and Reagents

6.3.2. Instruments

6.4. Market Attractiveness Analysis, by Product

7. Global HIV/AIDS Diagnostics Market Analysis and Forecast, by Test Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Test Type, 2017–2031

7.3.1. Nucleic Acid Tests

7.3.2. Rapid Tests (POC)

7.3.3. ELISA

7.3.4. Others

7.4. Market Attractiveness Analysis, by Test Type

8. Global HIV/AIDS Diagnostics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Diagnostic Laboratories

8.3.3. Academic and Research Institutes

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global HIV/AIDS Diagnostics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America HIV/AIDS Diagnostics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Kits and Reagents

10.2.2. Instruments

10.3. Market Value Forecast, by Test Type, 2017–2031

10.3.1. Nucleic Acid Tests

10.3.2. Rapid Tests (POC)

10.3.3. ELISA

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Diagnostic Laboratories

10.4.3. Academic and Research Institutes

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Test Type

10.6.3. By End-user

10.6.4. By Country

11. Europe HIV/AIDS Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Kits and Reagents

11.2.2. Instruments

11.3. Market Value Forecast, by Test Type, 2017–2031

11.3.1. Nucleic Acid Tests

11.3.2. Rapid Tests (POC)

11.3.3. ELISA

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories

11.4.3. Academic and Research Institutes

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Test Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific HIV/AIDS Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Kits and Reagents

12.2.2. Instruments

12.3. Market Value Forecast, by Test Type, 2017–2031

12.3.1. Nucleic Acid Tests

12.3.2. Rapid Tests (POC)

12.3.3. ELISA

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories

12.4.3. Academic and Research Institutes

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Test Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America HIV/AIDS Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Kits and Reagents

13.2.2. Instruments

13.3. Market Value Forecast, by Test Type, 2017–2031

13.3.1. Nucleic Acid Tests

13.3.2. Rapid Tests (POC)

13.3.3. ELISA

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories

13.4.3. Academic and Research Institutes

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Test Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa HIV/AIDS Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Kits and Reagents

14.2.2. Instruments

14.3. Market Value Forecast, by Test Type, 2017–2031

14.3.1. Nucleic Acid Tests

14.3.2. Rapid Tests (POC)

14.3.3. ELISA

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Diagnostic Laboratories

14.4.3. Academic and Research Institutes

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Test Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. Hologic, Inc

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Abbott

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Bio-Rad Laboratories, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. F. Hoffmann-La Roche Ltd.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. OraSure Technologies, Inc.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.6. Siemens Healthcare GmbH

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.7. Chembio Diagnostics, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.8. Danaher Corporation

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.9. Becton, Dickinson and Company

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

List of Tables

Table 01: Global HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 03: Global HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 08: North America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 12: Europe HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 16: Asia Pacific HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 20: Latin America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 24: Middle East & Africa HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Market Share, By Product

Figure 02: Market Share, By Test Type

Figure 03: Market Share, By End-user

Figure 04: Market Share, By Region

Figure 05: Figure 05: Global HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 06: Figure 06: Global HIV/AIDS Diagnostics Market Value Share, by Product (2021)

Figure 07: Figure 07: Global HIV/AIDS Diagnostics Market Value Share, by End-user (2021)

Figure 08: Global HIV/AIDS Diagnostics Market Value Share, by Test Type (2021)

Figure 09: Global HIV/AIDS Diagnostics Market Value Share, by Region (2021)

Figure 10: Global HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 11: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Kits and Reagents, 2017–2031

Figure 12: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Instruments, 2017–2031

Figure 13: Global HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 14: Global HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 15: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Nucleic Acid Tests, 2017–2031

Figure 16: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Rapid Tests (POC), 2017–2031

Figure 17: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by ELISA, 2017–2031

Figure 18: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Others, 2017–2031

Figure 19: Global HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 20: Global HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 21: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 22: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Diagnostic Laboratories, 2017–2031

Figure 23: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Academic and Research Institutes, 2017–2031

Figure 24: Global HIV/AIDS Diagnostics Market Revenue (US$ Mn), by Others, 2017–2031

Figure 25: Global HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 26: Global HIV/AIDS Diagnostics Market Value Share Analysis, by Region, 2021 and 2031

Figure 27: Global HIV/AIDS Diagnostics Market Attractiveness, by Region, 2022-2031

Figure 28: North America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: North America HIV/AIDS Diagnostics Market Value Share (%), by Country, 2021 and 2031

Figure 30: North America HIV/AIDS Diagnostics Market Attractiveness, by Country, 2022–2031

Figure 31: North America HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 32: North America HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 33: North America HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 34: North America HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 35: North America HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 36: North America HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 37: Europe HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 38: Europe HIV/AIDS Diagnostics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 39: Europe HIV/AIDS Diagnostics Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 40: Europe HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 41: Europe HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 42: Europe HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 43: Europe HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 44: Europe HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 45: Europe HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 46: Asia Pacific HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 47: Asia Pacific HIV/AIDS Diagnostics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 48: Asia Pacific HIV/AIDS Diagnostics Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 49: Asia Pacific HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 50: Asia Pacific HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 51: Asia Pacific HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 52: Asia Pacific HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 53: Asia Pacific HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 54: Asia Pacific HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 55: Latin America HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 56: Latin America HIV/AIDS Diagnostics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 57: Latin America HIV/AIDS Diagnostics Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 58: Latin America HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 59: Latin America HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 60: Latin America HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 61: Latin America HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 62: Latin America HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 63: Latin America HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 64: Middle East & Africa HIV/AIDS Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 65: Middle East & Africa HIV/AIDS Diagnostics Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 66: Middle East & Africa HIV/AIDS Diagnostics Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 67: Middle East & Africa HIV/AIDS Diagnostics Market Value Share Analysis, by Product, 2021 and 2031

Figure 68: Middle East & Africa HIV/AIDS Diagnostics Market Attractiveness, by Product, 2022–2031

Figure 69: Middle East & Africa HIV/AIDS Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 70: Middle East & Africa HIV/AIDS Diagnostics Market Attractiveness, by Test Type, 2022–2031

Figure 71: Middle East & Africa HIV/AIDS Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 72: Middle East & Africa HIV/AIDS Diagnostics Market Attractiveness, by End-user, 2022–2031

Figure 73: Global HIV/AIDS Diagnostics Market Share Analysis, by Company, 2021