Reports

Reports

Analysts’ Viewpoint

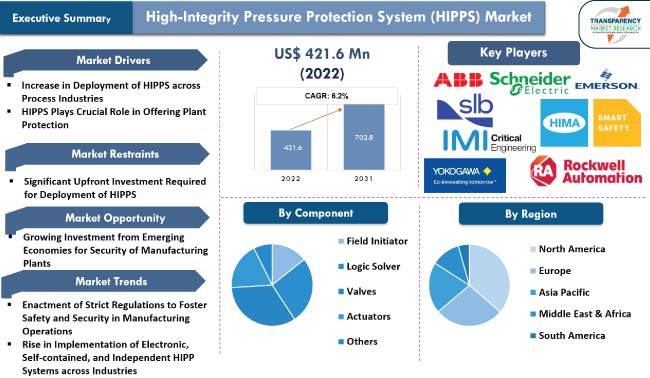

Excessive pressure can have harmful effects on the production field, including infrastructure, personnel, and the environment. High integrity pressure protection systems (HIPPS) are widely employed in both onshore and offshore operations to protect man and equipment and mitigate risks in production wells and flow lines. HIPPS are commonly used as alternatives to traditional flare systems and pressure relief valve manifolds in order to protect the environment from hazardous process fluids.

Key industry players are actively involved in the design and development of advanced safety instrumented systems and controllers, which are utilized in emergency shutdown (ESD) systems and HIPPS. Growing focus on enhancing industrial operations through the implementation of Industry 4.0, smart factories, and automated systems and machinery has further driven the high integrity pressure protection system market growth. Asia Pacific offers the most promising growth opportunities, in terms of revenue, driven by the expansion of midstream infrastructure, increasing deployment of industrial automation systems, and stringent government regulations concerning industrial safety.

High-integrity pressure protection system (HIPPS) is a specialized mechanical and electrical system that aims to minimize the potential dangers associated with excessive pressure. HIPPS is a specific implementation of the Safety Instrumented System (SIS).

The primary role of a HIPPS is to protect downstream equipment from the adverse effects of excessive pressure originating upstream. This is achieved by promptly isolating the source responsible for the overpressure. Herein, two dedicated safety shut-off valves, placed in series, rapidly close to halt the propagation of pressure in the downstream piping.

Increase in deployment of the high-integrity pressure protection system to protect wellhead flow lines, pipeline and compressor stations, and gas storage across oil & gas, chemical, and petrochemical industries, fuels the global high-integrity pressure protection system HIPPS industry.

Process industries, such as chemicals, oil & gas, and petrochemicals among others, require Safety Instrumented Systems (SIS) and HIPPS is the key subset of SIS. Conventional methods of pressure protection for equipment, such as mechanical safety relief valves, have drawbacks including the release of environmentally harmful substances into the air. This can result in issues such as spillage, pollution, environmental damage, or harm to personnel.

End-users are increasingly embracing the adoption of HIPPS or safety shutdown systems to avoid these concerns, which promptly closes off valves in the event of overpressure, effectively stopping the propagation of high pressure downstream. Consequently, HIPPS is extensive utilized in process industries such as offshore platforms, onshore oilfields, subsea pipelines, petroleum refining, gas processing, and chemical plants.

In March 2022, INTECH Process Automation Inc. was awarded a contract to supply a high integrity pressure protection system (HIPPS) for safeguarding the infield oil gathering infrastructure in a major oil field in the Middle East. INTECH is providing solar-powered HIPPS skids that are suitable for Zone-2 environments. These skids are equipped with 16" and 2" shut-down valves, SIL-3 logic solver cabinets, and remote telemetry controls.

A HIPPS is a safety-instrumented system specifically engineered to prevent the occurrence of over-pressurization in piping systems and processing facilities. When relief valves discharge, they release environmentally harmful substances into the surrounding air. In cases where the discharged material is explosive, the release of significant quantities can elevate the risk of fire or explosion.

Additionally, expansion or debottlenecking projects in plants often fail to accurately anticipate the added load on flare systems resulting from increased throughput. Consequently, there is a need for increased investment in flare headers and shutdown systems, but this solution is not cost-effective.

Therefore, the implementation of HIPPS is preferred to mitigate these issues. Instead of venting gases to relieve overpressure, a rapid-acting HIPPS effectively closes the inlet valves, thus preventing the accumulation of overpressure from occurring in the first place.

Major players are continuously engaged in developing innovative industrial safety systems, which can be used in oil and gas, petrochemicals, chemicals, and other process industries. This, in turn, is projected to boost the high-integrity pressure protection system (HIPPS) market demand in the next few years.

In terms of type, the global high-integrity pressure protection system (HIPPS) market segmentation comprises electronic HIPPS and mechanical HIPPS. The electronic HIPPS segment held largest high-integrity pressure protection system (HIPPS) market share in 2022. It is estimated to expand at a CAGR of 6.9% during the forecast period.

Electronic HIPPS employs advanced electronic sensors, control logic, and actuation mechanisms to continually monitor crucial process variables such as pressure, temperature, flow rates, and other relevant parameters. This system provides real-time monitoring, alerts, and automated responses to maintain pressure within safe operating limits. Thus, such systems are extensively employed in oil & gas pipelines, refineries, chemical plants, and power generation facilities.

According to the latest high-integrity pressure protection system (HIPPS) market analysis, in terms of component, the valves segment accounted for largest share in 2022. HIPPS valves are characterized by their high-performance capabilities, rapid closing speed, and ability to provide a tight shut-off. These fail-closed isolation valves are specifically designed to swiftly close and isolate a designated section of a pipeline or equipment in the event of high pressure.

They serve as the ultimate line of defense to prevent excessive pressure from reaching downstream components, ensuring the overall safety of the process. HIPPS valves effectively mitigate the risks associated with overpressure events, by acting as fast shut-off valves, thereby providing protection for personnel, equipment, and the environment.

Analysis of the latest region-wise high-integrity pressure protection system (HIPPS) market trends reveal that North America held a prominent share of the global market in 2022. The U.S. has successfully regained its status as the global leader in oil & gas production in the last few years. Currently, the U.S. produces 75% of its crude oil supply and meets 90% of its natural gas demand through domestic production. As of 2021, the country was producing approximately 11 million barrels of crude oil daily and around 100 billion cubic feet of gas per day. Thus, growth of the oil & gas, chemical, and petrochemical sectors in North America drives the HIPPS market outlook in the region.

Europe held second-largest share of the global high-integrity pressure protection business. Domestic production in Europe fulfills 40% of the region's natural gas demand. Additionally, the chemical sector is the fourth-largest manufacturing producer in Europe, which was valued at approximately US$ 9080.2 Bn in 2018. According to the European Chemical Industry Council (CEFIC), Europe ranked as the second-largest chemicals producer, globally, in 2021. Thus, robust growth in the chemical and oil & gas industries is driving the high-integrity pressure protection system (HIPPS) market dynamics in the region.

The global high-integrity pressure protection system (HIPPS) market is consolidated with a large number of vendors controlling majority share. Majorities of the firms are spending significantly on comprehensive new product developments, research, and launches in the global market. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Emerson Electric Co., ABB, Schlumberger Limited, Mokveld Valves BV, Schneider Electric SE, Rockwell Automation, Inc., HIMA Paul Hildebrandt GmbH, IMI Critical Engineering, and Yokogawa Electric Corp., are a few leading players engaged in the global high-integrity pressure protection system (HIPPS) business.

Key players in the high-integrity pressure protection system (HIPPS) market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 421.6 Mn |

|

Market Forecast Value in 2031 |

US$ 702.8 Mn |

|

Growth Rate 2023-2031 (CAGR) |

6.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 421.6 Mn in 2022

It is expected to expand at a CAGR of 6.2% by 2031

The global business is expected to reach a value of US$ 702.8 Mn in 2031

Emerson Electric Co., ABB, Schlumberger Limited, Mokveld Valves BV, Schneider Electric SE, Rockwell Automation, Inc., HIMA Paul Hildebrandt GmbH, IMI Critical Engineering, and Yokogawa Electric Corp.

In 2022, the U.S. accounted for 29.1% share of total global demand for high-integrity pressure protection system

Based on type, the electronic HIPPS segment held 52.4% share in 2022

Enactment of stringent regulations to foster safety and security in manufacturing operations and rise in implementation of electronic, self-contained, and independent HIPP systems across industries

North America was more lucrative for vendors of high-integrity pressure protection systems

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global High-Integrity Pressure Protection System (HIPPS) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Industrial Automation and Control Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global High-Integrity Pressure Protection System (HIPPS) Market Analysis, by Type

5.1. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

5.1.1. Electronic HIPPS

5.1.2. Mechanical HIPPS

5.2. Market Attractiveness Analysis, by Type

6. Global High-Integrity Pressure Protection System (HIPPS) Market Analysis, by Component

6.1. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

6.1.1. Field Initiator

6.1.2. Logic Solver

6.1.3. Valves

6.1.4. Actuators

6.1.5. Others

6.2. Market Attractiveness Analysis, by Component

7. Global High-Integrity Pressure Protection System (HIPPS) Market Analysis, by Service

7.1. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

7.1.1. Training & Consulting

7.1.2. Installation, Repair, and Maintenance

7.1.3. Inspection and Certification

7.2. Market Attractiveness Analysis, by Service

8. Global High-Integrity Pressure Protection System (HIPPS) Market Analysis, by End-use Industry

8.1. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

8.1.1. Oil & Gas

8.1.2. Chemicals & Petrochemicals

8.1.3. Energy & Power

8.1.4. Food & Beverage

8.1.5. Metals & Mining

8.1.6. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast, by Region

9.1. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast

10.1. Market Snapshot

10.2. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

10.2.1. Electronic HIPPS

10.2.2. Mechanical HIPPS

10.3. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

10.3.1. Field Initiator

10.3.2. Logic Solver

10.3.3. Valves

10.3.4. Actuators

10.3.5. Others

10.4. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

10.4.1. Training & Consulting

10.4.2. Installation, Repair, and Maintenance

10.4.3. Inspection and Certification

10.5. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

10.5.1. Oil & Gas

10.5.2. Chemicals & Petrochemicals

10.5.3. Energy & Power

10.5.4. Food & Beverage

10.5.5. Metals & Mining

10.5.6. Others

10.6. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Component

10.7.3. By Service

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast

11.1. Market Snapshot

11.2. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

11.2.1. Electronic HIPPS

11.2.2. Mechanical HIPPS

11.3. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

11.3.1. Field Initiator

11.3.2. Logic Solver

11.3.3. Valves

11.3.4. Actuators

11.3.5. Others

11.4. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

11.4.1. Training & Consulting

11.4.2. Installation, Repair, and Maintenance

11.4.3. Inspection and Certification

11.5. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

11.5.1. Oil & Gas

11.5.2. Chemicals & Petrochemicals

11.5.3. Energy & Power

11.5.4. Food & Beverage

11.5.5. Metals & Mining

11.5.6. Others

11.6. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Component

11.7.3. By Service

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast

12.1. Market Snapshot

12.2. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

12.2.1. Electronic HIPPS

12.2.2. Mechanical HIPPS

12.3. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

12.3.1. Field Initiator

12.3.2. Logic Solver

12.3.3. Valves

12.3.4. Actuators

12.3.5. Others

12.4. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

12.4.1. Training & Consulting

12.4.2. Installation, Repair, and Maintenance

12.4.3. Inspection and Certification

12.5. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

12.5.1. Oil & Gas

12.5.2. Chemicals & Petrochemicals

12.5.3. Energy & Power

12.5.4. Food & Beverage

12.5.5. Metals & Mining

12.5.6. Others

12.6. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Component

12.7.3. By Service

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast

13.1. Market Snapshot

13.2. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

13.2.1. Electronic HIPPS

13.2.2. Mechanical HIPPS

13.3. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

13.3.1. Field Initiator

13.3.2. Logic Solver

13.3.3. Valves

13.3.4. Actuators

13.3.5. Others

13.4. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

13.4.1. Training & Consulting

13.4.2. Installation, Repair, and Maintenance

13.4.3. Inspection and Certification

13.5. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

13.5.1. Oil & Gas

13.5.2. Chemicals & Petrochemicals

13.5.3. Energy & Power

13.5.4. Food & Beverage

13.5.5. Metals & Mining

13.5.6. Others

13.6. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Component

13.7.3. By Service

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America High-Integrity Pressure Protection System (HIPPS) Market Analysis and Forecast

14.1. Market Snapshot

14.2. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017-2031

14.2.1. Electronic HIPPS

14.2.2. Mechanical HIPPS

14.3. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017-2031

14.3.1. Field Initiator

14.3.2. Logic Solver

14.3.3. Valves

14.3.4. Actuators

14.3.5. Others

14.4. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by Service, 2017-2031

14.4.1. Training & Consulting

14.4.2. Installation, Repair, and Maintenance

14.4.3. Inspection and Certification

14.5. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017-2031

14.5.1. Oil & Gas

14.5.2. Chemicals & Petrochemicals

14.5.3. Energy & Power

14.5.4. Food & Beverage

14.5.5. Metals & Mining

14.5.6. Others

14.6. High-Integrity Pressure Protection System (HIPPS) Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Component

14.7.3. By Service

14.7.4. By End-use Industry

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global High-Integrity Pressure Protection System (HIPPS) Market Competition Matrix - a Dashboard View

15.1.1. Global High-Integrity Pressure Protection System (HIPPS) Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. ABB

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Emerson Electric Co.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. HIMA Paul Hildebrandt GmbH

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. IMI Critical Engineering

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. L&T Valves Limited

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. MICA Controls Ltd.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Mokveld Valves BV

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. MV Nederland BV

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Rockwell Automation, Inc.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Schlumberger Limited

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Schneider Electric SE

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Yokogawa Electric Corp.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 2: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 3: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 4: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 5: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 6: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 7: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Table 8: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 9: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 10: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 11: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 12: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 13: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 14: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 15: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 16: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 17: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 18: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 19: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 20: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 21: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 22: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 23: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 24: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 25: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 26: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 27: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 28: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 29: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 30: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 31: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 32: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 33: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 34: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 35: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 36: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 37: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 38: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 39: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 40: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 41: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 42: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Volume (Million Units), 2017-2031

Table 43: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Table 44: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 45: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Table 46: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Table 47: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Table 48: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

List of Figures

Figure 1: Global High-Integrity Pressure Protection System (HIPPS) Price Trend Analysis (Average Price in US$)

Figure 2: Global High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 3: Global High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 4: Global High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value (US$ Mn), 2017-2031

Figure 5: Global High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume (Million Units), 2017-2031

Figure 6: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 7: Global High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 8: Global High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 9: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 10: Global High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 11: Global High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 12: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 13: Global High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 14: Global High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 15: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 16: Global High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 17: Global High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 18: Global High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Region, Value (US$ Mn), 2017-2031

Figure 19: Global High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Region, Value (US$ Mn), 2023-2031

Figure 20: Global High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 22: North America High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 23: North America High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value, 2017-2031

Figure 24: North America High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume, 2017-2031

Figure 25: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 26: North America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 27: North America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 28: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 29: North America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 30: North America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 31: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 32: North America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 33: North America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 34: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 35: North America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 36: North America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 37: North America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 38: North America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 39: North America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Country, 2023 and 2031

Figure 40: Europe High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 41: Europe High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 42: Europe High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value, 2017-2031

Figure 43: Europe High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume, 2017-2031

Figure 44: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 45: Europe High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 46: Europe High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 47: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 48: Europe High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 49: Europe High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 50: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 51: Europe High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 52: Europe High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 53: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 54: Europe High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 55: Europe High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 56: Europe High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 57: Europe High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 58: Europe High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Country, 2023 and 2031

Figure 59: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 60: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 61: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value, 2017-2031

Figure 62: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume, 2017-2031

Figure 63: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 64: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 65: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 66: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 67: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 68: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 69: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 70: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 71: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 72: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 73: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 74: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 75: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 76: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 77: Asia Pacific High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Country, 2023 and 2031

Figure 78: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 79: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 80: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value, 2017-2031

Figure 81: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume, 2017-2031

Figure 82: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 83: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 84: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 85: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 86: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 87: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 88: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 89: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 90: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 91: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 92: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 93: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 94: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 95: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 96: Middle East & Africa High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Country, 2023 and 2031

Figure 97: South America High-Integrity Pressure Protection System (HIPPS) Market, Value (US$ Mn), 2017-2031

Figure 98: South America High-Integrity Pressure Protection System (HIPPS) Market, Volume (Million Units), 2017-2031

Figure 99: South America High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Value, 2017-2031

Figure 100: South America High-Integrity Pressure Protection System (HIPPS) Market Growth Rate, Volume, 2017-2031

Figure 101: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Figure 102: South America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Type, Value (US$ Mn), 2023-2031

Figure 103: South America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Type, 2023 and 2031

Figure 104: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Component, Value (US$ Mn), 2017-2031

Figure 105: South America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Component, Value (US$ Mn), 2023-2031

Figure 106: South America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Component, 2023 and 2031

Figure 107: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Service, Value (US$ Mn), 2017-2031

Figure 108: South America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Service, Value (US$ Mn), 2023-2031

Figure 109: South America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Service, 2023 and 2031

Figure 110: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017-2031

Figure 111: South America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by End-use Industry, Value (US$ Mn), 2023-2031

Figure 112: South America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 113: South America High-Integrity Pressure Protection System (HIPPS) Market Size & Forecast, by Country, Value (US$ Mn), 2017-2031

Figure 114: South America High-Integrity Pressure Protection System (HIPPS) Market Attractiveness, by Country, Value (US$ Mn), 2023-2031

Figure 115: South America High-Integrity Pressure Protection System (HIPPS) Market Share Analysis, by Country, 2023 and 2031