Reports

Reports

Analysts’ Viewpoint

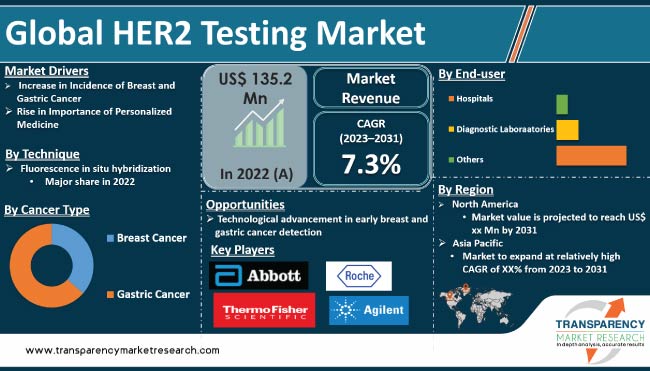

Increase in incidence of breast cancer is driving the demand for HER2 testing across the globe. Approval of new products with advanced technology by various companies contributes to the global HER2 testing market development. For instance, Roche reported that the U.S. FDA has granted approval for the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody. This antibody can be used to identify metastatic breast cancer patients who have low HER2 expression, and it helps determine whether Enhertu could be a suitable targeted treatment option for them.

Moreover, technological advancements, surge in healthcare spending, and growing awareness about the benefits of early detection and treatment are expected to be key growth drivers of the HER2 testing market. Additionally, increase in geriatric population and growing importance of personalized medicine are expected to further boost the HER2 testing market demand.

HER2 testing is a medical procedure used to determine the level of human epidermal growth factor receptor 2 (HER2) protein or the presence of HER2 gene amplification in certain types of cancer, particularly breast cancer. The HER2 protein plays a crucial role in regulating cell growth and division. However, in about 15% to 20% of breast cancer cases, there is an overexpression or amplification of the HER2 gene, which leads to increased production of the HER2 protein.

HER2 testing helps identify breast cancer patients who may benefit from targeted therapies that specifically target the HER2 protein. The most commonly used tests for HER2 status assessment include immunohistochemistry (IHC) and fluorescence in situ hybridization (FISH). These tests are performed on a tissue sample obtained from a biopsy or surgical specimen.

Immunohistochemistry (IHC) involves staining the tissue sample with specific antibodies that bind to the HER2 protein. The staining intensity is then assessed, and the results are scored on a scale of 0 to 3+. A score of 0 or 1+ indicates a negative HER2 status, while scores of 2+ are considered equivocal and may require further testing. A score of 3+ indicates positive HER2 status.

Fluorescence in situ hybridization (FISH) involves using fluorescent probes that bind to the HER2 gene. This test determines the number of HER2 gene copies present in the tumor cells. A ratio of more than 2.0 is considered positive for HER2 gene amplification.

If a patient is HER2-positive, she may be eligible for targeted therapies such as trastuzumab (Herceptin), pertuzumab (Perjeta), ado-trastuzumab emtansine (Kadcyla), or other HER2-targeted drugs. These therapies have been shown to improve outcomes for patients with HER2-positive breast cancer.

The market dynamics of HER2 testing have been greatly influenced by the rising prevalence of breast cancer and gastric cancer across the globe. HER2, a protein that plays a critical role in the progression and development of specific types of cancer, particularly breast and gastric cancers, is responsible for this association.

Breast cancer is the most commonly diagnosed cancer among women worldwide, and its incidence rates have been steadily increasing. According to the World Health Organization (WHO), approximately 2.3 million new cases of breast cancer and 685,000 deaths occurred globally in 2020. A significant portion of breast cancer cases demonstrate HER2 overexpression, underscoring the importance of HER2-targeted therapies as a crucial component of treatment strategies. The enhanced awareness, early detection methods, and improved diagnostic techniques have contributed to the improved identification of HER2-positive breast cancer cases.

Gastric cancer, also known as stomach cancer, ranks as the fifth-most prevalent cancer worldwide. The International Agency for Research on Cancer (IARC) reported approximately 1 million new cases of gastric cancer and 769,000 deaths attributed to it in 2020. Within the subset of gastric cancers, known as HER2-positive gastric cancer, HER2 overexpression is observed. Targeted therapies aimed at HER2 have exhibited promising outcomes in treating HER2-positive gastric cancer, leading to enhanced survival rates and therapeutic results.

The goal of personalized medicine is to customize medical treatments and interventions to individual patients, taking into account their unique characteristics such as genetic makeup, molecular profiles, and specific disease markers. This approach is particularly relevant in the case of HER2-positive cancers, including breast and gastric cancers, where HER2 testing plays a crucial role in guiding treatment choices and optimizing patient outcomes.

The introduction of HER2-targeted therapies, such as trastuzumab (Herceptin) and pertuzumab (Perjeta), has transformed the treatment landscape for HER2-positive cancers. These therapies specifically target and inhibit the activity of the HER2 protein, leading to improved clinical outcomes. However, it's important to note that HER2-targeted therapies are effective only in patients with HER2-positive tumors. Therefore, accurate and reliable HER2 testing is essential for identifying patients who can benefit from these treatments.

Innovations in immunohistochemistry (IHC), fluorescence in situ hybridization (FISH), and other molecular diagnostic techniques have enhanced the accuracy and reliability of HER2 testing. These developments enable healthcare professionals to precisely determine a patient's tumor's HER2 status and make well-informed decisions regarding treatment.

In terms of technique, the global HER2 testing market segmentation comprises fluorescence in situ hybridization, dual-probe, single-probe, chromogenic in situ hybridization (CISH) & silver-enhanced in situ hybridization. The fluorescence in situ hybridization segment held a major share of the global market in 2022. Fluorescence in situ hybridization (FISH) is a molecular biology technique used to detect and locate specific DNA sequences within cells or tissue samples.

It allows researchers to visualize the presence and location of specific genes or chromosomal regions. FISH offers high sensitivity and specificity in detecting HER2 gene amplification, providing accurate information about HER2 status. It has undergone extensive clinical validation and is widely accepted as a reliable method.

In terms of the end-user, the hospitals segment held a notable global HER2 testing market share in 2022. Hospitals typically have a broader range of specialized medical equipment and infrastructure as compared to diagnostic laboratories. HER2 testing may require specific instruments and technologies that are more commonly found in hospital settings, such as fluorescence in situ hybridization (FISH) machines.

According to the latest region-wise HER2 testing market forecast, the North America market is likely to expand at a high CAGR from 2023 to 2031. As per the Center for Disease Control & Prevention (CDC), in 2019, 264,121 new breast cancers were reported in the females & 42,280 females died due to the breast cancer. Moreover, favorable reimbursement policies and advancements in the diagnostic technology have created significant HER2 testing market opportunities for key vendors in the region.

Asia Pacific is the fastest growing market for HER2 testing in 2022. The industry in the region is likely to grow at a rapid pace from 2023 to 2031. As per the Novotech, breast cancer is the most commonly detected cancer among patients in China, with approximately 300,000 new cases diagnosed annually. When considering the age-standardized incidence rate per 100,000 people using the Chinese standard population, urban areas exhibit a rate 1.4 times higher than that of rural areas. In India, breast cancer accounts for approximately 30% of all newly diagnosed cancers each year. The country records over 150,000 new cases of breast cancer annually.

The global HER2 testing business is consolidated, with presence of a small number of large companies. Majority of companies are making significant investment in research and development, primarily to develop environment-friendly products. Expansion of product portfolio and mergers & acquisitions are prominent strategies adopted by key players. Leading players in the global market are Abbott, Hoffmann-La Roche Ltd, Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Leica Biosystems (Danaher Corporation), Empire Genomics, Inc. (Biocare Medical, LLC), Bio-Genex Laboratories, Abnova Corporation, Oxford Gene Technology IP Limited (Sysmex Corporation).

The HER2 testing market report includes profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 135.2 Mn |

|

Market Forecast Value in 2031 |

US$ 259.4 Mn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 135.2 Mn in 2022

It is projected to reach a value of more than US$ 259.4 Mn by 2031

The global business is anticipated to advance at a CAGR of 7.3% from 2023 to 2031

Rise in importance of personalized medicine and increase in incidence of breast and gastric cancer

North America is expected to account for largest share during the forecast period

Abbott, Hoffmann-La Roche Ltd, Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Leica Biosystems (Danaher Corporation), Empire Genomics, Inc. (Biocare Medical, LLC), Bio-Genex Laboratories, Abnova Corporation, Oxford Gene Technology IP Limited (Sysmex Corporation)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global HER2 Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global HER2 Testing Market Analysis and Forecasts, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Detailed Analysis of HER2 Expression in Gastric & Gastroesophageal Cancer

5.2. Breast and Gastric Cancer Prevalence & Incidence Rate globally with key countries

5.3. Regulatory Scenario

5.4. Key Industry Developments

5.5. Pipeline Analysis for Gastric Cancer

5.6. COVID-19 Pandemic Impact on Industry (Value Chain and Short-/Mid-/Long-term Impact)

6. Global HER2 Testing Market Analysis and Forecast, by Technique

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Technique, 2017-2031

6.3.1. Fluorescence in situ hybridization

6.3.2. Dual-probe

6.3.3. Single-probe

6.3.4. Chromogenic in situ hybridization (CISH)

6.3.5. Silver-enhanced in situ hybridization

6.4. Market Attractiveness, by Technique

7. Global HER2 Testing Market Analysis and Forecast, by Cancer Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Cancer Type, 2017-2031

7.3.1. Breast Cancer

7.3.2. Gastric Cancer

7.4. Market Attractiveness, by Cancer Type

8. Global HER2 Testing Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Diagnostic Laboratories

8.3.3. Others

8.4. Market Attractiveness, by End-user

9. Global HER2 Testing Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America HER2 Testing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Technique, 2017-2031

10.2.1. Fluorescence in situ hybridization

10.2.2. Dual-probe

10.2.3. Single-probe

10.2.4. Chromogenic in situ hybridization (CISH)

10.2.5. Silver-enhanced in situ hybridization

10.3. Market Value Forecast, by Cancer Type, 2017-2031

10.3.1. Breast Cancer

10.3.2. Gastric Cancer

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Diagnostic Laboratories

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Technique

10.6.2. By Cancer Type

10.6.3. By End-user

10.6.4. By Country

11. Europe HER2 Testing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Technique, 2017-2031

11.2.1. Fluorescence in situ hybridization

11.2.2. Dual-probe

11.2.3. Single-probe

11.2.4. Chromogenic in situ hybridization (CISH)

11.2.5. Silver-enhanced in situ hybridization

11.3. Market Value Forecast, by Cancer Type, 2017-2031

11.3.1. Breast Cancer

11.3.2. Gastric Cancer

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Diagnostic Laboratories

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Technique

11.6.2. By Cancer Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific HER2 Testing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Technique, 2017-2031

12.2.1. Fluorescence in situ hybridization

12.2.2. Dual-probe

12.2.3. Single-probe

12.2.4. Chromogenic in situ hybridization (CISH)

12.2.5. Silver-enhanced in situ hybridization

12.3. Market Value Forecast, by Cancer Type, 2017-2031

12.3.1. Breast Cancer

12.3.2. Gastric Cancer

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Diagnostic Laboratories

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Technique

12.6.2. By Cancer Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America HER2 Testing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Technique, 2017-2031

13.2.1. Fluorescence in situ hybridization

13.2.2. Dual-probe

13.2.3. Single-probe

13.2.4. Chromogenic in situ hybridization (CISH)

13.2.5. Silver-enhanced in situ hybridization

13.3. Market Value Forecast, by Cancer Type, 2017-2031

13.3.1. Breast Cancer

13.3.2. Gastric Cancer

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Diagnostic Laboratories

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Technique

13.6.2. By Cancer Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa HER2 Testing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Technique, 2017-2031

14.2.1. Fluorescence in situ hybridization

14.2.2. Dual-probe

14.2.3. Single-probe

14.2.4. Chromogenic in situ hybridization (CISH)

14.2.5. Silver-enhanced in situ hybridization

14.3. Market Value Forecast, by Cancer Type, 2017-2031

14.3.1. Breast Cancer

14.3.2. Gastric Cancer

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Diagnostic Laboratories

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Technique

14.6.2. By Cancer Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2022)

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Hoffmann-La Roche Ltd

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Agilent Technologies, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Thermo Fisher Scientific, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Leica Biosystems (Danaher Corporation)

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Empire Genomics, Inc. (Biocare Medical, LLC)

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Bio-Genex Laboratories

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Abnova Corporation

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Oxford Gene Technology IP Limited (Sysmex Corporation)

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

List of Tables

Table 01: Global HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 02: Global HER2 Testing Market Size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 03: Global HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 04: Global HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 05: Global HER2 Testing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America HER2 Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 08: North America HER2 Testing Market size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 09: North America HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 10: North America HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 11: Europe HER2 Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 12: Europe HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 13: Europe HER2 Testing Market Size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 14: Europe HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 15: Europe HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Asia-Pacific HER2 Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 17: Asia-Pacific HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 18: Asia-Pacific HER2 Testing Market Size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 19: Asia-Pacific HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 20: Asia-Pacific HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Latin America HER2 Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 22: Latin America HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 23: Latin America HER2 Testing Market Size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 24: Latin America HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 25: Latin America HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 26: Middle East & Africa HER2 Testing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 27: Middle East & Africa HER2 Testing Market Size (US$ Mn) Forecast, by Technique, 2017-2031

Table 28: Middle East & Africa HER2 Testing Market Size (US$ Mn) Forecast, by Fluorescence in situ hybridization, 2017-2031

Table 29: Middle East & Africa HER2 Testing Market Size (US$ Mn) Forecast, by Cancer Type, 2017-2031

Table 30: Middle East & Africa HER2 Testing Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global HER2 Testing Market Value Share, by Technique, 2022

Figure 03: Global HER2 Testing Market Value Share, by Cancer Type, 2022

Figure 04: Global HER2 Testing Market Value Share, by End-user, 2022

Figure 05: Global HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 06: Global HER2 Testing Market Revenue (US$ Mn), by Fluorescence in situ hybridization, 2017-2031

Figure 07: Global HER2 Testing Market Revenue (US$ Mn), by Chromogenic in situ hybridization (CISH), 2017-2031

Figure 08: Global HER2 Testing Market Revenue (US$ Mn), by Silver-enhanced in situ hybridization, 2017-2031

Figure 09: Global HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 10: Global HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 11: Global HER2 Testing Market Revenue (US$ Mn), by Breast Cancer, 2017-2031

Figure 12: Global HER2 Testing Market Revenue (US$ Mn), by Gastric Cancer, 2017-2031

Figure 13: Global HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 14: Global HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global HER2 Testing Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 16: Global HER2 Testing Market Revenue (US$ Mn), by Diagnostic Laboratories, 2017-2031

Figure 17: Global HER2 Testing Market Revenue (US$ Mn), by Others, 2017-2031

Figure 18: Global HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 19: Global HER2 Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 20: Global HER2 Testing Market Attractiveness Analysis, by Region, 2023-2031

Figure 21: North America HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 22: North America HER2 Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 23: North America HER2 Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 24: North America HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 25: North America HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 26: North America HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 27: North America HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 28: North America HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: North America HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 30: Europe HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 31: Europe HER2 Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: Europe HER2 Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 33: Europe HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 34: Europe HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 35: Europe HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 36: Europe HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 37: Europe HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 38: Europe HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 39: Asia-Pacific HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 40: Asia-Pacific HER2 Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 41: Asia-Pacific HER2 Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 42: Asia-Pacific HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 43: Asia-Pacific HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 44: Asia-Pacific HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 45: Asia-Pacific HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 46: Asia-Pacific HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Asia-Pacific HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 48: Latin America HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 49: Latin America HER2 Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 50: Latin America HER2 Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 51: Latin America HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 52: Latin America HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 53: Latin America HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 54: Latin America HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 55: Latin America HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 56: Latin America HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 57: Middle East & Africa HER2 Testing Market Value (US$ Mn) Forecast, 2017-2031

Figure 58: Middle East & Africa HER2 Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 59: Middle East & Africa HER2 Testing Market Attractiveness Analysis, by Country, 2023-2031

Figure 60: Middle East & Africa HER2 Testing Market Value Share Analysis, by Technique, 2022 and 2031

Figure 61: Middle East & Africa HER2 Testing Market Attractiveness Analysis, by Technique, 2023-2031

Figure 62: Middle East & Africa HER2 Testing Market Value Share Analysis, by Cancer Type, 2022 and 2031

Figure 63: Middle East & Africa HER2 Testing Market Attractiveness Analysis, by Cancer Type, 2023-2031

Figure 64: Middle East & Africa HER2 Testing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 65: Middle East & Africa HER2 Testing Market Attractiveness Analysis, by End-user, 2023-2031