Reports

Reports

Analysts’ Viewpoint

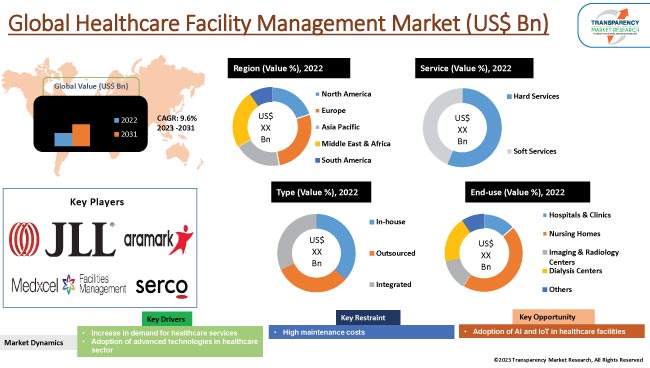

The global healthcare facility management market is expected to witness strong growth in the near future owing to increase in investment in healthcare infrastructure and rise in adoption of advanced technologies in the healthcare sector. The COVID-19 outbreak led to a sudden surge in demand for management of medical waste, cleaning, catering, and other services.

Healthcare facility management services help improve patient experience in various healthcare environments. Emerging economies, such as India, South Korea, and Thailand, are heavily relying on healthcare facility management to lower their healthcare expenditure. Major medical facilities in these countries are outsourcing their healthcare facility management requirements to independent, qualified vendors.

Healthcare Facility Management (HFM) involves overseeing and coordinating the various operations of a healthcare facility to ensure that it runs smoothly and efficiently. This includes managing the physical infrastructure of the facility, such as the buildings, equipment, and grounds, as well as overseeing the day-to-day operations of the facility, including scheduling appointments, managing staff, and ensuring compliance with regulations. HFM offers various advantages such as high ROI and flexibility, better data management, enhanced overall performance, transparency, and the availability of assets at a reasonable cost.

Rise in the global population, increase in number of geriatric people, and growth in focus on health and well-being are boosting the need for robust healthcare services. Healthcare facility management services help meet this rise in demand by optimizing various operations and reducing operational costs.

Healthcare facility management ensures compliance with regulatory requirements, which aids in enhancing patient safety and supporting environmental sustainability. These advantages are likely to positively impact the healthcare facility management market growth in the near future.

Changing lifestyles and environmental factors are contributing to rise in cases of such non-communicable diseases. Thus, surge in prevalence of chronic diseases has put pressure on healthcare providers to deliver high-quality care while managing costs. Demand for healthcare facility management services is projected to increase in the near future in order to achieve these goals.

The healthcare sector is undergoing a rapid transformation due to advancements in various technologies such as AI, IoT, and big data analytics. Healthcare facility management services are leveraging these technologies to improve operational efficiency, reduce costs, and enhance patient outcomes.

New technologies are being developed and implemented to improve the efficiency and effectiveness of healthcare facility management. For instance, smart building technology can help automate various tasks required to manage a healthcare facility. It can also be employed to monitor energy usage and identify areas where cost savings can be made.

Healthcare facilities are increasingly using digital platforms to manage various tasks such as patient scheduling, electronic health records, and billing. These platforms help reduce the amount of paper-based documentation required and improve the accuracy and accessibility of patient information. Thus, adoption of advanced technologies in the healthcare sector is augmenting the healthcare facility management market value.

Advancements in technology are also driving the development of new medical equipment and devices including remote patient monitoring systems and robotic surgery machines. These technologies aid to improve patient outcomes and reduce the need for inpatient stays, which can have a positive impact on the efficiency and cost-effectiveness of healthcare facilities.

According to the latest healthcare facility management market forecast, North America is expected to hold largest share from 2023 to 2031, followed by Europe. Presence of well-established healthcare infrastructure and increase in prevalence of chronic diseases are boosting market dynamics in the region. The U.S. is a major growth engine of the industry in North America due to surge in investment in healthcare infrastructure, early adoption of advanced technologies, and growth in demand for cost-effective healthcare services.

The industry in Europe is projected to grow at a significant pace in the near future. Rise in need for advanced and cost-effective healthcare services and presence of major vendors are driving the healthcare facility management market statistics in the region.

The market in Asia Pacific is estimated to grow at a prominent CAGR during the forecast period. Growth of the industry can be ascribed to increase in healthcare expenditure, rise in investment in healthcare infrastructure, and surge in adoption of advanced healthcare technologies.

The healthcare facility management market report profiles major vendors based on various parameters such as financials, key product offerings, market development, and strategies. ABM Industries Inc., Aramark Corporation, Compass Group plc, Ecolab Inc., Serco Group plc, ISS A/S, OCS Group, Medxcel, Jones Lang LaSalle IP, Inc., and Vanguard Resources are major players operating in this industry.

Healthcare facility management service providers are offering customized solutions tailored to the specific needs of each healthcare facility. This may involve conducting a comprehensive assessment of the facility's operations and infrastructure to identify areas for improvement and develop a tailored plan to address those areas. They are also leveraging technology to improve the efficiency and effectiveness of their services and increase their healthcare facility management market share.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 323.9 Bn |

|

Market Forecast in 2031 |

US$ 735.2 Bn |

|

Growth Rate (CAGR) |

9.6% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, technology analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis, demographic overview. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 323.9 Bn in 2022.

It is estimated to reach US$ 735.2 Bn by the end of 2031.

It is projected to be 9.6% from 2023 to 2031.

Increase in demand for healthcare services and adoption of advanced technologies in healthcare sector.

Hospitals & clinics was the largest end-use segment in 2022.

North America is likely to be a highly lucrative region for vendors during the forecast period.

ABM Industries Inc., Aramark Corporation, Compass Group plc, Ecolab Inc., Serco Group plc, ISS A/S, OCS Group, Medxcel, Jones Lang LaSalle IP, Inc., and Vanguard Resources.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Facility Management Industry Analysis

5.3.2. Global Healthcare Facility Management Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Key Suppliers Analysis

5.9. Global Healthcare Facility Management Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

6. Global Healthcare Facility Management Market Analysis and Forecast, by Service

6.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

6.1.1. Hard Services

6.1.1.1. Plumbing, Air Conditioning Maintenance

6.1.1.2. Fire Protection Systems

6.1.1.3. Mechanical & Electrical Maintenance

6.1.1.4. Others (Fabric Maintenance, etc.)

6.1.2. Soft Services

6.1.2.1. Cleaning & Pest Control

6.1.2.2. Laundry

6.1.2.3. Catering

6.1.2.4. Waste Management

6.1.2.5. Security

6.1.2.6. Others (Administrative Services, etc.)

6.2. Incremental Opportunity, by Service

7. Global Healthcare Facility Management Market Analysis and Forecast, by Type

7.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

7.1.1. In-house

7.1.2. Outsourced

7.1.3. Integrated

7.2. Incremental Opportunity, by Type

8. Global Healthcare Facility Management Market Analysis and Forecast, by End-use

8.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

8.1.1. Hospitals & Clinics

8.1.2. Nursing Homes

8.1.3. Imaging & Radiology Centers

8.1.4. Dialysis Centers

8.1.5. Others (Hospice Homes, Rehabs, etc.)

8.2. Incremental Opportunity, by End-use

9. Global Healthcare Facility Management Market Analysis and Forecast, by Region

9.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Healthcare Facility Management Market Analysis and Forecast

10.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

10.1.1. Hard Services

10.1.1.1. Plumbing, Air Conditioning Maintenance

10.1.1.2. Fire Protection Systems

10.1.1.3. Mechanical & Electrical Maintenance

10.1.1.4. Others (Fabric Maintenance, etc.)

10.1.2. Soft Services

10.1.2.1. Cleaning & Pest Control

10.1.2.2. Laundry

10.1.2.3. Catering

10.1.2.4. Waste Management

10.1.2.5. Security

10.1.2.6. Others (Administrative Services, etc.)

10.2. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

10.2.1. In-house

10.2.2. Outsourced

10.2.3. Integrated

10.3. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

10.3.1. Hospitals & Clinics

10.3.2. Nursing Homes

10.3.3. Imaging & Radiology Centers

10.3.4. Dialysis Centers

10.3.5. Others (Hospice Homes, Rehabs, etc.)

10.4. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Country, 2017 - 2031

10.4.1. U.S.

10.4.2. Canada

10.4.3. Rest of North America

10.5. Incremental Opportunity Analysis

11. Europe Healthcare Facility Management Market Analysis and Forecast

11.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

11.1.1. Hard Services

11.1.1.1. Plumbing, Air Conditioning Maintenance

11.1.1.2. Fire Protection Systems

11.1.1.3. Mechanical & Electrical Maintenance

11.1.1.4. Others (Fabric Maintenance, etc.)

11.1.2. Soft Services

11.1.2.1. Cleaning & Pest Control

11.1.2.2. Laundry

11.1.2.3. Catering

11.1.2.4. Waste Management

11.1.2.5. Security

11.1.2.6. Others (Administrative Services, etc.)

11.2. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

11.2.1. In-house

11.2.2. Outsourced

11.2.3. Integrated

11.3. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

11.3.1. Hospitals & Clinics

11.3.2. Nursing Homes

11.3.3. Imaging & Radiology Centers

11.3.4. Dialysis Centers

11.3.5. Others (Hospice Homes, Rehabs, etc.)

11.4. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Country, 2017 - 2031

11.4.1. U.K.

11.4.2. Germany

11.4.3. France

11.4.4. Rest of Europe

11.5. Incremental Opportunity Analysis

12. Asia Pacific Healthcare Facility Management Market Analysis and Forecast

12.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

12.1.1. Hard Services

12.1.1.1. Plumbing, Air Conditioning Maintenance

12.1.1.2. Fire Protection Systems

12.1.1.3. Mechanical & Electrical Maintenance

12.1.1.4. Others (Fabric Maintenance, etc.)

12.1.2. Soft Services

12.1.2.1. Cleaning & Pest Control

12.1.2.2. Laundry

12.1.2.3. Catering

12.1.2.4. Waste Management

12.1.2.5. Security

12.1.2.6. Others (Administrative Services, etc.)

12.2. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

12.2.1. In-house

12.2.2. Outsourced

12.2.3. Integrated

12.3. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

12.3.1. Hospitals & Clinics

12.3.2. Nursing Homes

12.3.3. Imaging & Radiology Centers

12.3.4. Dialysis Centers

12.3.5. Others (Hospice Homes, Rehabs, etc.)

12.4. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Country, 2017 - 2031

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. Rest of Asia Pacific

12.5. Incremental Opportunity Analysis

13. Middle East & Africa Healthcare Facility Management Market Analysis and Forecast

13.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

13.1.1. Hard Services

13.1.1.1. Plumbing, Air Conditioning Maintenance

13.1.1.2. Fire Protection Systems

13.1.1.3. Mechanical & Electrical Maintenance

13.1.1.4. Others (Fabric Maintenance, etc.)

13.1.2. Soft Services

13.1.2.1. Cleaning & Pest Control

13.1.2.2. Laundry

13.1.2.3. Catering

13.1.2.4. Waste Management

13.1.2.5. Security

13.1.2.6. Others (Administrative Services, etc.)

13.2. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

13.2.1. In-house

13.2.2. Outsourced

13.2.3. Integrated

13.3. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

13.3.1. Hospitals & Clinics

13.3.2. Nursing Homes

13.3.3. Imaging & Radiology Centers

13.3.4. Dialysis Centers

13.3.5. Others (Hospice Homes, Rehabs, etc.)

13.4. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Country, 2017 - 2031

13.4.1. GCC

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Incremental Opportunity Analysis

14. South America Healthcare Facility Management Market Analysis and Forecast

14.1. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Service, 2017 - 2031

14.1.1. Hard Services

14.1.1.1. Plumbing, Air Conditioning Maintenance

14.1.1.2. Fire Protection Systems

14.1.1.3. Mechanical & Electrical Maintenance

14.1.1.4. Others (Fabric Maintenance, etc.)

14.1.2. Soft Services

14.1.2.1. Cleaning & Pest Control

14.1.2.2. Laundry

14.1.2.3. Catering

14.1.2.4. Waste Management

14.1.2.5. Security

14.1.2.6. Others (Administrative Services, etc.)

14.2. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Type, 2017 - 2031

14.2.1. In-house

14.2.2. Outsourced

14.2.3. Integrated

14.3. Healthcare Facility Management Market Size (US$ Mn) Forecast, by End-use, 2017 - 2031

14.3.1. Hospitals & Clinics

14.3.2. Nursing Homes

14.3.3. Imaging & Radiology Centers

14.3.4. Dialysis Centers

14.3.5. Others (Hospice Homes, Rehabs, etc.)

14.4. Healthcare Facility Management Market Size (US$ Mn) Forecast, by Country, 2017 - 2031

14.4.1. Brazil

14.4.2. Rest of South America

14.5. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player – Competition Dashboard

15.2. Market Share Analysis-2021 (%)

15.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Service Portfolio)

15.3.1. ABM Industries Inc.

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Financial/Revenue (Segmental Revenue)

15.3.1.4. Strategy & Business Overview

15.3.1.5. Sales Channel Analysis

15.3.1.6. Service Portfolio

15.3.2. Aramark Corporation

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Financial/Revenue (Segmental Revenue)

15.3.2.4. Strategy & Business Overview

15.3.2.5. Sales Channel Analysis

15.3.2.6. Service Portfolio

15.3.3. Compass Group plc

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Financial/Revenue (Segmental Revenue)

15.3.3.4. Strategy & Business Overview

15.3.3.5. Sales Channel Analysis

15.3.3.6. Service Portfolio

15.3.4. Ecolab, Inc.

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Financial/Revenue (Segmental Revenue)

15.3.4.4. Strategy & Business Overview

15.3.4.5. Sales Channel Analysis

15.3.4.6. Service Portfolio

15.3.5. Serco Group plc

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Financial/Revenue (Segmental Revenue)

15.3.5.4. Strategy & Business Overview

15.3.5.5. Sales Channel Analysis

15.3.5.6. Service Portfolio

15.3.6. ISS A/S

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Financial/Revenue (Segmental Revenue)

15.3.6.4. Strategy & Business Overview

15.3.6.5. Sales Channel Analysis

15.3.6.6. Service Portfolio

15.3.7. OCS Group

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Financial/Revenue (Segmental Revenue)

15.3.7.4. Strategy & Business Overview

15.3.7.5. Sales Channel Analysis

15.3.7.6. Service Portfolio

15.3.8. Medxcel

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Financial/Revenue (Segmental Revenue)

15.3.8.4. Strategy & Business Overview

15.3.8.5. Sales Channel Analysis

15.3.8.6. Service Portfolio

15.3.9. Jones Lang LaSalle IP, Inc.

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Financial/Revenue (Segmental Revenue)

15.3.9.4. Strategy & Business Overview

15.3.9.5. Sales Channel Analysis

15.3.9.6. Service Portfolio

15.3.10. Vanguard Resources

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Financial/Revenue (Segmental Revenue)

15.3.10.4. Strategy & Business Overview

15.3.10.5. Sales Channel Analysis

15.3.10.6. Service Portfolio

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. Service

16.1.2. Type

16.1.3. End-use

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 2 Global Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 3: Global Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 4: Global Healthcare Facility Management Market Projections, by Region, US$ Mn 2017-2031

Table 5: North America Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 6: North America Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 7: North America Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 8: North America Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Table 9: Europe Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 10: Europe Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 11: Europe Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 12: Europe Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Table 13: Asia Pacific Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 14: Asia Pacific Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 15: Asia Pacific Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 16: Asia Pacific Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Table 17: Middle East & Africa Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 18: Middle East & Africa Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 19: Middle East & Africa Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 20: Middle East & Africa Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Table 21: South America Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Table 22: South America Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Table 23: South America Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Table 24: South America Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

List of Figures

Figure 1: Global Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 2: Global Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 3: Global Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 4: Global Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 5: Global Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 6: Global Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 7: Global Healthcare Facility Management Market Projections, by Region, US$ Mn 2017-2031

Figure 8: Global Healthcare Facility Management Market, Incremental Opportunity, by Region, US$ Mn 2021 -2031

Figure 9: North America Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 10: North America Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 11: North America Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 12: North America Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 13: North America Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 14: North America Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 15: North America Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Figure 16: North America Healthcare Facility Management Market, Incremental Opportunity, by Country, US$ Mn 2021 -2031

Figure 17: Europe Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 18: Europe Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 19: Europe Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 20: Europe Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 21: Europe Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 22: Europe Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 23: Europe Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Figure 24: Europe Healthcare Facility Management Market, Incremental Opportunity, by Country, US$ Mn 2021 -2031

Figure 25: Asia Pacific Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 26: Asia Pacific Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 27: Asia Pacific Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 28: Asia Pacific Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 29: Asia Pacific Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 30: Asia Pacific Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 31: Asia Pacific Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Figure 32: Asia Pacific Healthcare Facility Management Market, Incremental Opportunity, by Country, US$ Mn 2021 -2031

Figure 33: Middle East & Africa Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 34: Middle East & Africa Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 35: Middle East & Africa Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 36: Middle East & Africa Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 37: Middle East & Africa Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 38: Middle East & Africa Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 39: Middle East & Africa Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Figure 40: Middle East & Africa Healthcare Facility Management Market, Incremental Opportunity, by Country, US$ Mn 2021 -2031

Figure 41: South America Healthcare Facility Management Market Projections, by Service, US$ Mn 2017-2031

Figure 42: South America Healthcare Facility Management Market, Incremental Opportunity, by Service, US$ Mn 2021 -2031

Figure 43: South America Healthcare Facility Management Market Projections, by Type, US$ Mn 2017-2031

Figure 44: South America Healthcare Facility Management Market, Incremental Opportunity, by Type, US$ Mn 2021 -2031

Figure 45: South America Healthcare Facility Management Market Projections, by End-use, US$ Mn 2017-2031

Figure 46: South America Healthcare Facility Management Market, Incremental Opportunity, by End-use, US$ Mn 2021 -2031

Figure 47: South America Healthcare Facility Management Market Projections, by Country, US$ Mn 2017-2031

Figure 48: South America Healthcare Facility Management Market, Incremental Opportunity, by Country, US$ Mn 2021 -2031