Reports

Reports

The health and wellness sector is witnessing a record boom driven by global change toward preventive medicine and wellness. People are increasingly focusing on physical, emotional, and mental health, which allow one to live a healthy life. This can be seen across most sectors like nutrition, exercise, emotional and mental well-being, and alternative medicine, depicting a multi-dimensional strategy towards well-being.

Technological innovations are also paving the way for healthcare, thereby propelling this transformation. Wearables, health apps on mobile phones, and telemedicine platforms enable individuals to track their health indicators, adhere to personalized fitness routines, and have video calls with doctors. The COVID-19 pandemic has surged this health focus even more, and individuals desire to improve their immunity and get healthier.

.webp)

Nature and sustainability are on the rise, forcing business to be innovative and meet consumer values. As the sector continues to expand, success for companies will be by those who are people-centered, open, and truthful. In general, the health and wellness sector is poised for further expansion due to a new definition of wellness that goes beyond paradigms of healthcare that were mainstream and moves toward proactive as opposed to reactive health care.

Health and wellness industry is a fast-changing, fast-moving industry with a host of products and services that cater to overall well-being in life. The industry brings together nutrition, exercise, mental well-being, and prevention medicine, an intersectoral strategy to well-being.

Technology has also revolutionized the game with wearables, health apps, and telemedicine centers through which individuals are able to monitor their state of health and receive customized wellness solutions. The pandemic of COVID-19 had caused health-related problems, and therefore there was increased demand for immunity-boosting products and mental health services.

Ethics and sustainability are becoming increasingly sought-after as influencers, individuals want similar ethics and values in organizations. Increased awareness about mental illness disorders has also increased the demand for stress management and mindfulness-based products, increasing market diversification.

Overall, the industry for the health and wellness will continue to grow in the long run as customers will continuously prioritize physical, mental, and indeed emotional well-being highly and consider alternatives that are holistic in nature so that they can have equilibrium in life.

| Attribute | Detail |

|---|---|

| Health and Wellness Market Drivers |

|

Increased consumer health awareness is one of the major drivers that push the health and wellness sector to transform. The greater the awareness of people about the benefits of healthy living, the greater is the consumers' demand for products and services that would improve their well-being. Increased awareness is caused by many factors, including convenient access to information through the internet, social media, and public health initiatives targeting preventive care and healthy lifestyles.

Individuals are better informed about what they eat, exercise, and their mental health, and this has transformed the retailing of organic foods, exercise regimes, and therapy wellness. This is particularly prevalent in North America and Europe where well-informed health-conscious consumers will go the extra mile to obtain supplements, exercise equipment, and overall wellness solutions.

Furthermore, the awareness brought about by the COVID-19 pandemic has spurred this one, since health became the top priority for individuals in the pandemic. Hence, companies are more focused on ethics, transparency, and sustainability while attempting to come into alignment with consumers' values. Overall, increased awareness of consumers for health not only fuels market expansion but also product innovation, so health and ness market is a dynamic and fluid landscape.

Population aging is one of the key drivers across the industry for the health and wellness, and with changing demography, there is more demand for specially designed goods and services for aging population. Healthy aging comes into prominence as life expectancy is rising worldwide, especially in prosperous economies in North America and Europe.

Aging population is aspiring more for longer, healthier, and happier lives and looking for solutions that allow these individuals to maintain their physical, mental, and emotional well-being, thus driving the demand for health and wellness solutions.

This demographic shift has spurred development in the fields of such as nutrition supplements, health and fitness, and geriatric wellness therapy.

Moreover, higher awareness regarding the mental health of elderly people is fueling need for socialization and company. As a general rule, the elderly influence the health and wellness industry significantly, calling for innovation and a more global approach to dealing with every age.

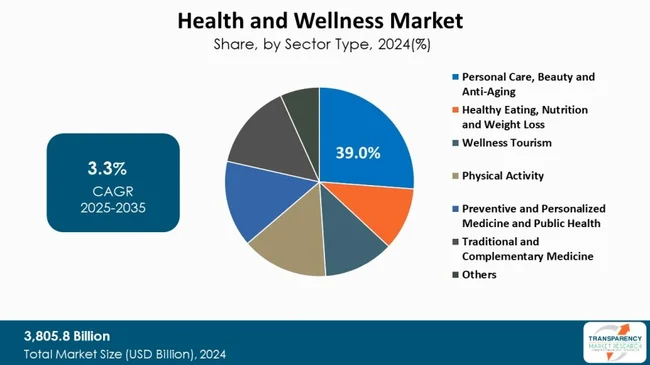

The anti-aging, beauty, and personal care market is leading the health and wellness market as a result of a mix of self-indulgence, appearance, and longevity-based consumer trends. As consumers are more concerned about good looks and health, the market has seen an explosive growth. The trend toward facial beauty products, particularly those with anti-aging properties, is a proof that times are rolling back to youth and healthy appearances.

Moreover, product and technology development has been evolving to serve more diversified effective solutions in the cream and serum forms to newer treatment forms like laser and injectables. More educated consumers have been driving demand for naturally, organically, and scientifically proven ingredient products.

Beauty trends become mainstream and popular with celebrities and social media too. Moreover, the increasing size of the aging segment cares most about remaining young and also stimulates anti-aging product demand. Coupled with the intersection of the value of personal care, beauty, and anti-aging business with the value of consumers' self-improvement and general well-being, it cements its leadership in the health and well-being category and ranks among the industries of high investment and innovation.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America leads the health and wellness industry due to a combination of attributes within the region that provide an ideal platform for growth and innovation. The region is blessed with a high percentage of health-conscious consumers who are concerned about physical health, mental well-being, and nutrition. The focus is supported by a strong healthcare system and high disposable incomes that allow individuals to invest in wellness products and services.

Also, the presence of advanced technology and research facilities encourages health-driven innovations such as fitness apps, wearables, and telemedicine. All of these technologies encourage consumers to become more independent of their health, further driving the market. The COVID-19 pandemic has also enlightened consumers about their well-being and health, and they have stepped up spending on supplements, exercise regimens, and mental health.

Apart from this, holistic living and preventive care are being trended further in cultural movements toward North America’s healthcare. Consumers are buying products adopting sustainable and ethical culture at a higher level, and therefore brands are changing to include them in it. As a result, companies in North America are evolving at a rapid rate and getting their pipelines filled with diversity and energy in their health and wellness market. Collectively, the synergy of consumer awareness, technological innovation, and health emphasis in North America positions it as a world leader in the health and wellness category.

Key players in the global health and wellness market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

The Estée Lauder Companies Inc., L'Oréal S.A., Unilever plc, BioThrive Sciences, Abbott Laboratories, Herbalife Nutrition Ltd., Amway Corp., THE BOUNTIFUL COMPANY, Jazzercise, Inc., Anytime Fitness LLC, Lift Brands, Healing Holidays (Cleveland Travel Ltd.) are some of the leading players for the market.

Each of these players has been profiled in the health and wellness market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 3,805.8 Bn |

| Forecast Value in 2035 | US$ 5,448.3 Bn |

| CAGR | 3.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Health and Wellness Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 3,805.8 Bn in 2024.

It is projected to cross US$ 5,448.3 Bn by the end of 2035.

Increasing consumer awareness of health and growing aging population.

It is anticipated to grow at a CAGR of 3.3% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

The Estée Lauder Companies Inc., L'Oréal S.A., Unilever plc, BioThrive Sciences, Abbott Laboratories, Herbalife Nutrition Ltd., Amway Corp., THE BOUNTIFUL COMPANY, Jazzercise, Inc., Anytime Fitness LLC, Lift Brands, Healing Holidays (Cleveland Travel Ltd.) and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Health and Wellness Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Health and Wellness Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario across Key Regions/Countries

5.3. Key Industry Events

5.4. Consumer Behavior Analysis

5.5. PESTEL Analysis

5.6. PORTER's Analysis

6. Global Health and Wellness Market Analysis and Forecast, by Sector Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Sector Type, 2020 to 2035

6.3.1. Personal Care, Beauty and Anti-Aging

6.3.2. Healthy Eating, Nutrition and Weight Loss

6.3.3. Wellness Tourism

6.3.4. Physical Activity

6.3.5. Preventive and Personalized Medicine and Public Health

6.3.6. Traditional and Complementary Medicine

6.3.7. Others

6.4. Market Attractiveness Analysis, by Sector Type

7. Global Health and Wellness Market Analysis and Forecast, by Availability

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Availability, 2020 to 2035

7.3.1. Online

7.3.1.1. e-commerce platforms

7.3.1.2. Company Websites

7.3.2. Offline

7.3.2.1. Wellness Centers

7.3.2.2. Direct-to-Consumer (D2C)

7.4. Market Attractiveness Analysis, by Availability

8. Global Health and Wellness Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Health and Wellness Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Sector Type, 2020 to 2035

9.2.1. Personal Care, Beauty and Anti-Aging

9.2.2. Healthy Eating, Nutrition and Weight Loss

9.2.3. Wellness Tourism

9.2.4. Physical Activity

9.2.5. Preventive and Personalized Medicine and Public Health

9.2.6. Traditional and Complementary Medicine

9.2.7. Others

9.3. Market Value Forecast, by Availability, 2020 to 2035

9.3.1. Online

9.3.1.1. e-commerce platforms

9.3.1.2. Company Websites

9.3.2. Offline

9.3.2.1. Wellness Centers

9.3.2.2. Direct-to-Consumer (D2C)

9.4. Market Value Forecast, by Country, 2020 to 2035

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Sector Type

9.5.2. By Availability

9.5.3. By Country

10. Europe Health and Wellness Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Sector Type, 2020 to 2035

10.2.1. Personal Care, Beauty and Anti-Aging

10.2.2. Healthy Eating, Nutrition and Weight Loss

10.2.3. Wellness Tourism

10.2.4. Physical Activity

10.2.5. Preventive and Personalized Medicine and Public Health

10.2.6. Traditional and Complementary Medicine

10.2.7. Others

10.3. Market Value Forecast, by Availability, 2020 to 2035

10.3.1. Online

10.3.1.1. e-commerce platforms

10.3.1.2. Company Websites

10.3.2. Offline

10.3.2.1. Wellness Centers

10.3.2.2. Direct-to-Consumer (D2C)

10.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

10.4.1. Germany

10.4.2. UK

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Switzerland

10.4.7. The Netherlands

10.4.8. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Sector Type

10.5.2. By Availability

10.5.3. By Country/Sub-region

11. Asia Pacific Health and Wellness Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Sector Type, 2020 to 2035

11.2.1. Personal Care, Beauty and Anti-Aging

11.2.2. Healthy Eating, Nutrition and Weight Loss

11.2.3. Wellness Tourism

11.2.4. Physical Activity

11.2.5. Preventive and Personalized Medicine and Public Health

11.2.6. Traditional and Complementary Medicine

11.2.7. Others

11.3. Market Value Forecast, by Availability, 2020 to 2035

11.3.1. Online

11.3.1.1. e-commerce platforms

11.3.1.2. Company Websites

11.3.2. Offline

11.3.2.1. Wellness Centers

11.3.2.2. Direct-to-Consumer (D2C)

11.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. South Korea

11.4.5. Australia & New Zealand

11.4.6. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Sector Type

11.5.2. By Availability

11.5.3. By Country/Sub-region

12. Latin America Health and Wellness Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Sector Type, 2020 to 2035

12.2.1. Personal Care, Beauty and Anti-Aging

12.2.2. Healthy Eating, Nutrition and Weight Loss

12.2.3. Wellness Tourism

12.2.4. Physical Activity

12.2.5. Preventive and Personalized Medicine and Public Health

12.2.6. Traditional and Complementary Medicine

12.2.7. Others

12.3. Market Value Forecast, by Availability, 2020 to 2035

12.3.1. Online

12.3.1.1. e-commerce platforms

12.3.1.2. Company Websites

12.3.2. Offline

12.3.2.1. Wellness Centers

12.3.2.2. Direct-to-Consumer (D2C)

12.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Sector Type

12.5.2. By Availability

12.5.3. By Country/Sub-region

13. Middle East & Africa Health and Wellness Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Sector Type, 2020 to 2035

13.2.1. Personal Care, Beauty and Anti-Aging

13.2.2. Healthy Eating, Nutrition and Weight Loss

13.2.3. Wellness Tourism

13.2.4. Physical Activity

13.2.5. Preventive and Personalized Medicine and Public Health

13.2.6. Traditional and Complementary Medicine

13.2.7. Others

13.3. Market Value Forecast, by Availability, 2020 to 2035

13.3.1. Online

13.3.1.1. e-commerce platforms

13.3.1.2. Company Websites

13.3.2. Offline

13.3.2.1. Wellness Centers

13.3.2.2. Direct-to-Consumer (D2C)

13.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Sector Type

13.5.2. By Availability

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2024)

14.3. Company Profiles

14.3.1. The Estée Lauder Companies Inc.

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Product Portfolio

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. L'Oréal S.A.

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Product Portfolio

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. Unilever plc

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Product Portfolio

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. BioThrive Sciences

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Product Portfolio

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. Abbott Laboratories

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Product Portfolio

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. Herbalife Nutrition Ltd.

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Product Portfolio

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. Amway Corp.

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Product Portfolio

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. THE BOUNTIFUL COMPANY

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Product Portfolio

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. Jazzercise, Inc.

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Product Portfolio

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. Anytime Fitness LLC

14.3.10.1. Company Overview

14.3.10.2. Financial Overview

14.3.10.3. Product Portfolio

14.3.10.4. Business Strategies

14.3.10.5. Recent Developments

14.3.11. Lift Brands

14.3.11.1. Company Overview

14.3.11.2. Financial Overview

14.3.11.3. Product Portfolio

14.3.11.4. Business Strategies

14.3.11.5. Recent Developments

14.3.12. Healing Holidays (Cleveland Travel Ltd.)

14.3.12.1. Company Overview

14.3.12.2. Financial Overview

14.3.12.3. Product Portfolio

14.3.12.4. Business Strategies

14.3.12.5. Recent Developments

List of Tables

Table 01: Global Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 02: Global Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 03: Global Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 04: Global Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 05: Global Health and Wellness Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Health and Wellness Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 08: North America Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 09: North America Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 10: North America Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 11: Europe - Health and Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 13: Europe Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 14: Europe Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 15: Europe Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 16: Asia Pacific - Health and Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 18: Asia Pacific Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 19: Asia Pacific Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 20: Asia Pacific Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 21: Latin America - Health and Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 23: Latin America Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 24: Latin America Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 25: Latin America Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

Table 26: Middle East & Africa - Health and Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Health and Wellness Market Value (US$ Bn) Forecast, By Sector Type, 2020 to 2035

Table 28: Middle East & Africa Health and Wellness Market Value (US$ Bn) Forecast, By Availability, 2020 to 2035

Table 29: Middle East & Africa Health and Wellness Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 30: Middle East & Africa Health and Wellness Market Value (US$ Bn) Forecast, By Online, 2020 to 2035

Table 31: Middle East & Africa Health and Wellness Market Value (US$ Bn) Forecast, By Offline, 2020 to 2035

List of Figures

Figure 01: Global Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 02: Global Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 03: Global Health and Wellness Market Revenue (US$ Bn), by Personal Care, Beauty and Anti-Aging, 2020 to 2035

Figure 04: Global Health and Wellness Market Revenue (US$ Bn), by Healthy Eating, Nutrition and Weight Loss, 2020 to 2035

Figure 05: Global Health and Wellness Market Revenue (US$ Bn), by Wellness Tourism, 2020 to 2035

Figure 06: Global Health and Wellness Market Revenue (US$ Bn), by Physical Activity, 2020 to 2035

Figure 07: Global Health and Wellness Market Revenue (US$ Bn), by Preventive and Personalized Medicine and Public Health, 2020 to 2035

Figure 08: Global Health and Wellness Market Revenue (US$ Bn), by Traditional and Complementary Medicine, 2020 to 2035

Figure 09: Global Health and Wellness Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 11: Global Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035

Figure 12: Global Health and Wellness Market Revenue (US$ Bn), by Online, 2020 to 2035

Figure 13: Global Health and Wellness Market Revenue (US$ Bn), by Offline, 2020 to 2035

Figure 14: Global Health and Wellness Market Value Share Analysis, By Region, 2024 and 2035

Figure 15: Global Health and Wellness Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 16: North America - Health and Wellness Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 17: North America - Health and Wellness Market Value Share Analysis, by Country, 2024 and 2035

Figure 18: North America - Health and Wellness Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 19: North America Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 20: North America Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 21: North America Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 22: North America Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035

Figure 23: Europe - Health and Wellness Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: Europe - Health and Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 25: Europe - Health and Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 26: Europe Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 27: Europe Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 28: Europe Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 29: Europe Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035

Figure 30: Asia Pacific - Health and Wellness Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Asia Pacific - Health and Wellness Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: Asia Pacific - Health and Wellness Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: Asia Pacific Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 34: Asia Pacific Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 35: Asia Pacific Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 36: Asia Pacific Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035

Figure 37: Latin America - Health and Wellness Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Latin America - Health and Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 39: Latin America - Health and Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 40: Latin America Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 41: Latin America Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 42: Latin America Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 43: Latin America Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035

Figure 44: Middle East & Africa - Health and Wellness Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Middle East & Africa - Health and Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 46: Middle East & Africa - Health and Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 47: Middle East & Africa Health and Wellness Market Value Share Analysis, By Sector Type, 2024 and 2035

Figure 48: Middle East & Africa Health and Wellness Market Attractiveness Analysis, By Sector Type, 2025 to 2035

Figure 49: Middle East & Africa Health and Wellness Market Value Share Analysis, By Availability, 2024 and 2035

Figure 50: Middle East & Africa Health and Wellness Market Attractiveness Analysis, By Availability, 2025 to 2035