Reports

Reports

Analyst Viewpoint

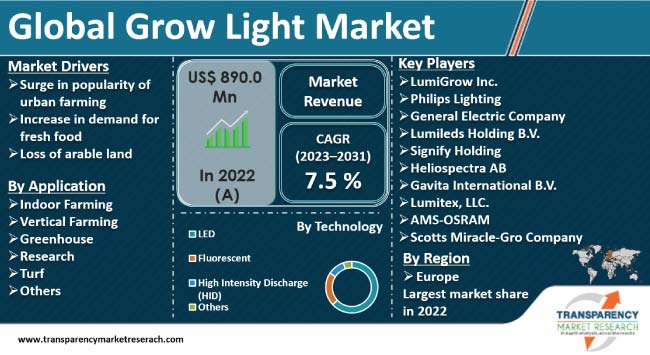

Increase in popularity of urban farming is a key factor that is boosting grow light market dynamics. Need for locally sourced organic food is rising, as individuals become more conscious about their eating habits and develop a sustainability focused mindset. Grow light is becoming a critical component of food production, as the society adapts to the evolving climate crisis. Urban farming solutions such as vertical farms and greenhouses utilize grow lights to cultivate healthy food year-round without constraints of the weather.

The trend of giving plants as gifts for houses and offices is also boosting market progress. Additionally, lack of arable land in urban centers is augmenting market statistics. Prominent grow light market manufacturers are investing significantly in advancements in grow light bulbs and grow light stands, and collaborating with other players to foster constant innovation and growth.

Grow light is an artificial alternative to sunlight that stimulates the growth of plants. This light mimics sunlight for photosynthesis by emitting electromagnetic radiation in the visible light spectrum.

Grow lights are utilized in indoor farms, vertical farms, or for individual plants in indoor spaces, including offices and homes that lack sunlight. They are especially useful during the winter months in several countries, as sunlight is available just for a few hours.

Grow lights offer several benefits to plants such as accelerated flowering, improved nutrition, and rapid growth. These lights utilize technologies ranging from LEDs to high-intensity discharges and are employed in greenhouses after sunset or in corners if sunlight during daytime is lacking for the plants.

The type of grow light employed depends on the needs of cultivating plants, as some plants require more red light while others require more blue light.

Increase in eco-conscious sentiment among individuals is leading to a rise in preference for organic locally sourced produce among the general population. This is augmenting the need for urban agriculture solutions such as indoor farms, vertical farms, or greenhouses.

Grow light is an essential feature of indoor farming, as it boosts the growth and health of the cultivation in all weather conditions, irrespective of exposure to the sun. As per a report by Accenture, indoor farming systems are capable of producing three times of food compared to traditional practices in less amount of time and while using 95% less water.

Of late, indoor plants in esthetic pots have gained traction as gifts for housing and office spaces. According to a survey conducted by Garden Pals, about 66% of American households own at least one houseplant, while a similar proportion of the American adult population is growing or plans to grow these plants as an organic food source.

Thus, surge in indoor farming and rise in plant gift-giving are creating lucrative grow light market opportunities for companies operating in the sector.

Surge in urbanization and significant rise in population are putting stress on food resources and supply. Demand for fresh food is rising significantly across the globe. On the other hand, availability of fertile land to cultivate commercial crops is decreasing, especially in urban centers. This, in turn, is bolstering the grow light market size.

Grow lights offer an innovative solution to mitigate the impact of resource scarcity on food production and security in urban areas by enabling year-round productive indoor agriculture practices. This is fueling the global grow light market.

Conventional agriculture is substantially dependent upon weather patterns and soil quality. This is not sustainable in the modern climate crisis-adapting society. As per Our World in Data, half of the world’s land is exploited for agriculture.

The United Nations also states that the world population is expected to reach 9.6 billion by 2050. This would require food producers to nearly double their current volume.

Thus, grow light is a critical component of a post-traditional agriculture economy, as the planet and society adapt to the evolving climate crisis.

According to the latest grow light market research, Europe held the largest share of the global landscape in 2022. Rise in agricultural spending, surge in popularity of floriculture, and presence of established horticulture and farming practices are propelling grow light industry share of the region.

As per a report by the Food and Agriculture Organization of the United Nations (FAO), around 405,000 hectares of glass and plastic-covered greenhouses are spread all around the EU. Countries such as the Netherlands, Spain, and France have large areas under greenhouse cultivation.

As per the grow light market forecast, the industry in North America is projected to grow at a prominent pace from 2023 to 2031. The U.S. has the highest number of vertical farms in North America owing to the legalization of medicinal plants such as marijuana and surge in demand for organic vegetables and fruits in the country.

According to Agri Farming, the U.S. accounts for about 35% of vertical and indoor farms in North America, with more than 2,300 farms growing hydroponic crops.

As per the current grow light market trends, prominent manufacturers of grow lights are investing significantly in the development of LED grow lights and greenhouse lights to meet the rising demand from indoor and vertical farming sectors.

Companies in the grow light sector are also striving to establish partnerships with other players to expand their product portfolio and increase their industry share.

LumiGrow Inc., Philips Lighting, General Electric Company, Lumileds Holding B.V., Signify Holding, Heliospectra AB, Gavita International B.V., Lumitex, LLC., AMS-OSRAM, and Scotts Miracle-Gro Company are leading players operating in the global grow light industry.

These firms have been summarized in the global grow light market report based on parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 890.0 Mn |

| Market Forecast Value in 2031 | US$ 1.2 Bn |

| Growth Rate (CAGR) | 7.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn/Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 890.0 Mn in 2022

It is projected to grow at a CAGR of 7.5% from 2023 to 2031

Rise in popularity of urban farming, increase in demand for fresh food, and lack of arable land in urban centers

The LED segment accounted for the largest share in 2022

Europe was the leading region in 2022

LumiGrow Inc., Philips Lighting, General Electric Company, Lumileds Holding B.V., Signify Holding, Heliospectra AB, Gavita International B.V., Lumitex, LLC., AMS-OSRAM, and Scotts Miracle-Gro Company

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Grow Light Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Grow Light Market Analysis, by Technology

5.1. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

5.1.1. LED

5.1.2. Fluorescent

5.1.3. High Intensity Discharge (HID)

5.1.4. Others

6. Global Grow Light Market Analysis, by Application

6.1. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Indoor Farming

6.1.2. Vertical Farming

6.1.3. Greenhouse

6.1.4. Research

6.1.5. Turf

6.1.6. Others

6.2. Market Attractiveness Analysis, by Application

7. Global Grow Light Market Analysis and Forecast, by Region

7.1. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Grow Light Market Analysis and Forecast

8.1. Market Snapshot

8.2. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

8.2.1. LED

8.2.2. Fluorescent

8.2.3. High Intensity Discharge (HID)

8.2.4. Others

8.3. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

8.3.1. Indoor Farming

8.3.2. Vertical Farming

8.3.3. Greenhouse

8.3.4. Research

8.3.5. Turf

8.3.6. Others

8.4. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Country, 2017–2031

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Technology

8.5.2. By Application

8.5.3. By Country/Sub-region

9. Europe Grow Light Market Analysis and Forecast

9.1. Market Snapshot

9.2. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

9.2.1. LED

9.2.2. Fluorescent

9.2.3. High Intensity Discharge (HID)

9.2.4. Others

9.3. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.3.1. Indoor Farming

9.3.2. Vertical Farming

9.3.3. Greenhouse

9.3.4. Research

9.3.5. Turf

9.3.6. Others

9.4. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.4.1. U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Technology

9.5.2. By Application

9.5.3. By Country/Sub-region

10. Asia Pacific Grow Light Market Analysis and Forecast

10.1. Market Snapshot

10.2. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

10.2.1. LED

10.2.2. Fluorescent

10.2.3. High Intensity Discharge (HID)

10.2.4. Others

10.3. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.3.1. Indoor Farming

10.3.2. Vertical Farming

10.3.3. Greenhouse

10.3.4. Research

10.3.5. Turf

10.3.6. Others

10.4. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. ASEAN

10.4.6. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Technology

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Middle East & Africa Grow Light Market Analysis and Forecast

11.1. Market Snapshot

11.2. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

11.2.1. LED

11.2.2. Fluorescent

11.2.3. High Intensity Discharge (HID)

11.2.4. Others

11.3. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.3.1. Indoor Farming

11.3.2. Vertical Farming

11.3.3. Greenhouse

11.3.4. Research

11.3.5. Turf

11.3.6. Others

11.4. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of Middle East & Africa

11.5. Market Attractiveness Analysis

11.5.1. By Technology

11.5.2. By Application

11.5.3. By Country/Sub-region

12. South America Grow Light Market Analysis and Forecast

12.1. Market Snapshot

12.2. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

12.2.1. LED

12.2.2. Fluorescent

12.2.3. High Intensity Discharge (HID)

12.2.4. Others

12.3. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.3.1. Indoor Farming

12.3.2. Vertical Farming

12.3.3. Greenhouse

12.3.4. Research

12.3.5. Turf

12.3.6. Others

12.4. Grow Light Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Technology

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Grow Light Market Competition Matrix - a Dashboard View

13.1.1. Global Grow Light Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. LumiGrow Inc.

14.1.1. Overview

14.1.2. Technology Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Philips Lighting

14.2.1. Overview

14.2.2. Technology Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. General Electric Company

14.3.1. Overview

14.3.2. Technology Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Lumileds Holding B.V.

14.4.1. Overview

14.4.2. Technology Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Signify Holding

14.5.1. Overview

14.5.2. Technology Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Heliospectra AB

14.6.1. Overview

14.6.2. Technology Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Gavita International B.V.

14.7.1. Overview

14.7.2. Technology Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Lumitex, LLC.

14.8.1. Overview

14.8.2. Technology Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. AMS-OSRAM

14.9.1. Overview

14.9.2. Technology Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Scotts Miracle-Gro Company

14.10.1. Overview

14.10.2. Technology Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 2: Global Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 3: Global Grow Light Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 4: North America Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 5: North America Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 6: North America Grow Light Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 7: Europe Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 8: Europe Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 9: Europe Grow Light Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 10: Asia Pacific Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 11: Asia Pacific Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 12: Asia Pacific Grow Light Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Middle East & Africa Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 14: Middle East & Africa Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 15: Middle East & Africa Grow Light Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: South America Grow Light Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 17: South America Grow Light Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 18: South America Grow Light Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Grow Light Market

Figure 02: Porter's Five Forces Analysis – Global Grow Light Market

Figure 03: Technology Road Map - Global Grow Light Market

Figure 04: Global Grow Light Market, Value (US$ Mn), 2017-2031

Figure 05: Global Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Grow Light Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 07: Global Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 08: Global Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 09: Global Grow Light Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 10: Global Grow Light Market, Incremental Opportunity, by Application, 2017‒2031

Figure 11: Global Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Grow Light Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 13: Global Grow Light Market, Incremental Opportunity, by Region, 2023‒2031

Figure 14: Global Grow Light Market Share Analysis, by Region, 2023 and 2031

Figure 15: North America Grow Light Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 16: North America Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 17: North America Grow Light Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 18: North America Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 19: North America Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 20: North America Grow Light Market, Incremental Opportunity, by Application, 2023‒2031

Figure 21: North America Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 22: North America Grow Light Market Projections, by Country, Value (US$ Mn), 2023‒2031

Figure 23: North America Grow Light Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 24: North America Grow Light Market Share Analysis, by Country, 2023 and 2031

Figure 25: Europe Grow Light Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 26: Europe Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 27: Europe Grow Light Market Projections, by Technology Value (US$ Mn), 2023‒2031

Figure 28: Europe Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 29: Europe Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 30: Europe Grow Light Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 31: Europe Grow Light Market, Incremental Opportunity, by Application, 2023‒2031

Figure 32: Europe Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 33: Europe Grow Light Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 34: Europe Grow Light Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 35: Europe Grow Light Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 36: Asia Pacific Grow Light Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 37: Asia Pacific Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 38: Asia Pacific Grow Light Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 39: Asia Pacific Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 40: Asia Pacific Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 41: Asia Pacific Grow Light Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 42: Asia Pacific Grow Light Market, Incremental Opportunity, by Application, 2023‒2031

Figure 43: Asia Pacific Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 44: Asia Pacific Grow Light Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 45: Asia Pacific Grow Light Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 46: Asia Pacific Grow Light Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 47: Middle East & Africa Grow Light Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 48: Middle East & Africa Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 49: Middle East & Africa Grow Light Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 50: Middle East & Africa Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 51: Middle East & Africa Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 52: Middle East & Africa Grow Light Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 53: Middle East & Africa Grow Light Market, Incremental Opportunity, by Application, 2023‒2031

Figure 54: Middle East & Africa Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 55: Middle East & Africa Grow Light Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 56: Middle East & Africa Grow Light Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 57: Middle East & Africa Grow Light Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 58: South America Grow Light Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 59: South America Grow Light Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2023‒2031

Figure 60: South America Grow Light Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 61: South America Grow Light Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 62: South America Grow Light Market Share Analysis, by Technology, 2023 and 2031

Figure 63: South America Grow Light Market Projections, by Application, Value (US$ Mn), 2017‒2031

Figure 64: South America Grow Light Market, Incremental Opportunity, by Application, 2023‒2031

Figure 65: South America Grow Light Market Share Analysis, by Application, 2023 and 2031

Figure 66: South America Grow Light Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 67: South America Grow Light Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 68: South America Grow Light Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 69: Global Grow Light Market Competition

Figure 70: Global Grow Light Market Company Share Analysis