Reports

Reports

Analysts’ Viewpoint

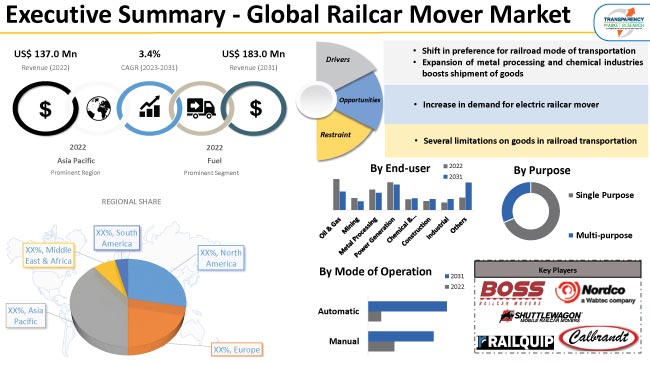

Rise in demand for railcar movers from manufacturing, mining, oil & gas, and related industries coupled with surge in railroad transportation, or shipment of goods, is a key factor that drives the railcar mover industry. Additionally, support from government associations to enhance railway tracks through modernization or new establishment of rail tracks further boosts the railcar mover market growth. Rising investments on rail freight corridors to augment logistics operation is also anticipated to drive the railcar mover market size in the upcoming years.

Development of infrastructure in the railroad sector is driving advancements in terms of locomotive efficiency and safety. For instance, in July 2019, the Indian Railways announced plans to spend around US$ 43.53 Bn on establishing three specific corridor networks to improve passenger train operations and streamline national freight transportation. However, issues such as varying or fluctuating prices of rail line corridors and time-sensitive transport of goods have been creating negative impact on the railcar mover market dynamics.

Railcar movers are road and rail vehicles that can travel on both rail tracks and roads. They have couplers fitted at one end to attach small railroad vehicles in order to maneuver around a small yard or in rail siding. These railcar movers offer cost-effective operation, wide range of maneuverability, and possess multi-directional capabilities. Railcar movers are widely used by railroad customers, as these vehicles are comparatively less expensive than paying a railroad operator.

Rise in demand for passenger and freight capacity along with global concerns about climate change is boosting the demand for high-speed and safer railway infrastructure. This change can be observed in the major developed economies such as France, Japan, South Korea, Italy, Australia, and New Zealand.

Key manufacturers of railcar movers are focusing on the development of new technologies in railroad vehicles that significantly enhance operations and reduce operation cost. For instance, in January 2018, Konux GmbH developed a technology called Smart Point, which is capable of creating holistic view of railway infrastructure health by analyzing data from different sensors on its software platform. This technology is advantageous, as it reduces cost by 25%. Moreover, this technology provides real-time monitoring of all critical points, and prompts a shift toward predictive maintenance.

Rise in demand for fuel-efficient railroad vehicles has boosted the necessity for electric railcar movers. Moreover, these electric railcar movers have minimum operational cost as compared to diesel powered railcars. Furthermore, electric railcar movers offer noise-free operation and higher performance.

Key players operating in global railcar mover market are engaged in development and introduction of advanced electric railcar movers, which in turn is estimated to significantly propel the demand for railcar movers during the forecast period. For instance, in January 2020, Shuttlewagon announced the enhancement of product offering through the addition of the SWXe Series Compact Electric railcar mover. This SWXe Series Compact Electric Series states to add seven variants of all-electric models to its growing portfolio of Shuttlewagon all-electric NVXe and diesel railcar movers.

Increase in population fuels the demand for public transportation, which in turn drives the need for safer and faster transportation. Accordingly, advanced railcar movers have been introduced to enhance the efficiency in operations and maximize uptime.

In 2016, 196 nations signed an agreement called as Paris Climate Accord, which is an agreement to keep the global temperature rise well below 2 degree Celsius. In order to meet the agreement, governments of several nations have announced ban on use of diesel powered railroad vehicles.

Governing bodies across the globe are focused on the development of railway infrastructure. Railroad vehicles are a prominent mode of transportation, which contributes to significantly lower amounts of carbon dioxide emission as compared to air and vehicle transportation. These factors are projected to positively impact the railcar mover market forecast in the next few years.

According to the latest market analysis, in terms of end-use, the metal processing segment is anticipated to account for highest railcar mover market share during the forecast period. This can be attributed to several factors such as increase in plant expenses and rise in cost of scrap products and recycling processes. These are driving the requirement for cost-efficient and highly secure material handling tools or machinery.

Use of railcar movers helps metal and steel manufacturers to increase their reliability, revenues, and energy efficiency coupled with fewer production delays or interruptions. Moreover, railcar movers help to boost mobility and flexibility, workplace safety, speed up rail yard movements.

Metal processing companies are choosing efficient locomotive transport to ensure timely delivery of metals for use in construction and other industry verticals across the globe. Moreover, demand for various metals, such as steel, iron, and copper, has been rising consistently for the last few years. These factors are anticipated to drive the demand for railcar movers in the next few years.

Analysis of the regional railcar mover market trends reveal that Asia Pacific accounts for major share of the global business owing to investments in enhancing logistics services across sectors and rapid industrialization in the region. Moreover, expansion of rail networks in major economies, such as India and China, supported by government initiatives is expected to boost the railcar mover industry applications in the region during the forecast period.

Major India-based steel producers including Jindal Steel & Power, JSW Steel, and Tata Steel are planning to expand operations, which are estimated to increase total production capacity up to 29 million tons by 2024. These measures are anticipated to significantly enhance the demand for railcar mover in the near future.

The global railcar mover market is fragmented by the presence of a few recognized companies and new technology entrants. Several major players are focusing on long-term partnership with governments, strategic alliances with suppliers, and continuous research and developments. These are likely to offer rewarding opportunities for key players operating in the global railcar mover industry. Some of the key manufacturers of railcar movers across the globe include BOSS RAILCAR MOVERS, Brandt Road Rail Corporation, Calbrandt, DJ Products Inc., Leaf Automotive, Mitchell Equipment Corporation, Nordco Inc., Rail King, Railquip Inc., Shuttlewagon Inc., Stewart & Stevenson LLC, Trackmobile Inc., Unilokomotive, Wolter Group LLC, and Zephir S.p.A.

Key players in the railcar mover market report have been profiled based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 137.0 Mn |

|

Market Forecast Value in 2031 |

US$ 183.0 Mn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 137.0 Mn in 2022.

It is expected to expand at a CAGR of 3.4 % by 2031.

The business would be worth US$ 183.0 Mn in 2031.

Increase in demand from oil & gas, mining, manufacturing, and other related industries coupled with surge in railroad transportation or shipment of goods.

The fuel propulsion type segment accounted for the majority share in 2022.

Asia Pacific is anticipated to be the highly lucrative region.

BOSS RAILCAR MOVERS, Brandt Road Rail Corporation, Calbrandt, DJ Products Inc., Leaf Automotive, Mitchell Equipment Corporation, Nordco Inc., Rail King, Railquip Inc., Shuttlewagon Inc., Stewart & Stevenson LLC, Trackmobile Inc., Unilokomotive, Wolter Group LLC, and Zephir S.p.A.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Railcar Mover Market, by Purpose

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

3.2.1. Single Purpose

3.2.2. Multi-purpose

4. Global Railcar Mover Market, by Mode of Operation

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

4.2.1. Manual

4.2.2. Automatic

5. Global Railcar Mover Market, by Track Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

5.2.1. Narrow

5.2.2. Standard

5.2.3. Wide gauge

6. Global Railcar Mover Market, by Propulsion Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

6.2.1. Fuel

6.2.2. Hybrid & Electric

7. Global Railcar Mover Market, by Tractive Effort

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

7.2.1. Low (Up to 45,000 lbs.)

7.2.2. High (More than 45,000 lbs.)

8. Global Railcar Mover Market, by Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Application

8.2.1. Loading, Unloading and Repositioning

8.2.2. Forklift Trucks

8.2.3. Railroad Track work Designing & Construction

8.2.4. Locomotive Maintenance

8.2.5. Repair & Overhaul

8.2.6. Raw Material Transportation and Distribution

8.2.7. Freight Transport

8.2.8. Others

9. Global Railcar Mover Market, by Number of Coupling

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

9.2.1. Single

9.2.2. Dual

10. Global Railcar Mover Market, by End User

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by End User

10.2.1. Oil & Gas

10.2.2. Mining

10.2.3. Metal Processing

10.2.4. Power Generation

10.2.5. Chemical & Plastics

10.2.6. Construction

10.2.7. Industrial

10.2.8. Others

11. Global Railcar Mover Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Railcar Mover Market Size & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Railcar Mover Market

12.1. Market Snapshot

12.2. North America Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

12.2.1. Single Purpose

12.2.2. Multi-purpose

12.3. North America Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

12.3.1. Manual

12.3.2. Automatic

12.4. North America Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

12.4.1. Narrow

12.4.2. Standard

12.4.3. Wide gauge

12.5. North America Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

12.5.1. Fuel

12.5.2. Hybrid & Electric

12.6. North America Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

12.6.1. Low (Up to 45,000 lbs.)

12.6.2. High (More than 45,000 lbs.)

12.7. North America Railcar Mover Market Size & Forecast, 2017-2031, by Application

12.7.1. Loading, Unloading and Repositioning

12.7.2. Forklift Trucks

12.7.3. Railroad Track work Designing & Construction

12.7.4. Locomotive Maintenance

12.7.5. Repair & Overhaul

12.7.6. Raw Material Transportation and Distribution

12.7.7. Freight Transport

12.7.8. Others

12.8. North America Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

12.8.1. Single

12.8.2. Dual

12.9. North America Railcar Mover Market Size & Forecast, 2017-2031, by End User

12.9.1. Oil & Gas

12.9.2. Mining

12.9.3. Metal Processing

12.9.4. Power Generation

12.9.5. Chemical & Plastics

12.9.6. Construction

12.9.7. Industrial

12.9.8. Others

12.10. North America Railcar Mover Market Size & Forecast, 2017-2031, by Country

12.10.1. The U. S.

12.10.2. Canada

12.10.3. Mexico

13. Europe Railcar Mover Market

13.1. Market Snapshot

13.2. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

13.2.1. Single Purpose

13.2.2. Multi-purpose

13.3. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

13.3.1. Manual

13.3.2. Automatic

13.4. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

13.4.1. Narrow

13.4.2. Standard

13.4.3. Wide gauge

13.5. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

13.5.1. Fuel

13.5.2. Hybrid & Electric

13.6. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

13.6.1. Low (Up to 45,000 lbs.)

13.6.2. High (More than 45,000 lbs.)

13.7. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Application

13.7.1. Loading, Unloading and Repositioning

13.7.2. Forklift Trucks

13.7.3. Railroad Track work Designing & Construction

13.7.4. Locomotive Maintenance

13.7.5. Repair & Overhaul

13.7.6. Raw Material Transportation and Distribution

13.7.7. Freight Transport

13.7.8. Others

13.8. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

13.8.1. Single

13.8.2. Dual

13.9. Europe Railcar Mover Market Size & Forecast, 2017-2031, by End User

13.9.1. Oil & Gas

13.9.2. Mining

13.9.3. Metal Processing

13.9.4. Power Generation

13.9.5. Chemical & Plastics

13.9.6. Construction

13.9.7. Industrial

13.9.8. Others

13.10. Europe Railcar Mover Market Size & Forecast, 2017-2031, by Country

13.10.1. Germany

13.10.2. U. K.

13.10.3. France

13.10.4. Italy

13.10.5. Spain

13.10.6. Nordic Countries

13.10.7. Russia & CIS

13.10.8. Rest of Europe

14. Asia Pacific Railcar Mover Market

14.1. Market Snapshot

14.2. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

14.2.1. Single Purpose

14.2.2. Multi-purpose

14.3. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

14.3.1. Manual

14.3.2. Automatic

14.4. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

14.4.1. Narrow

14.4.2. Standard

14.4.3. Wide gauge

14.5. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

14.5.1. Fuel

14.5.2. Hybrid & Electric

14.6. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

14.6.1. Low (Up to 45,000 lbs.)

14.6.2. High (More than 45,000 lbs.)

14.7. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Application

14.7.1. Loading, Unloading and Repositioning

14.7.2. Forklift Trucks

14.7.3. Railroad Track work Designing & Construction

14.7.4. Locomotive Maintenance

14.7.5. Repair & Overhaul

14.7.6. Raw Material Transportation and Distribution

14.7.7. Freight Transport

14.7.8. Others

14.8. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

14.8.1. Single

14.8.2. Dual

14.9. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by End User

14.9.1. Oil & Gas

14.9.2. Mining

14.9.3. Metal Processing

14.9.4. Power Generation

14.9.5. Chemical & Plastics

14.9.6. Construction

14.9.7. Industrial

14.9.8. Others

14.10. Asia Pacific Railcar Mover Market Size & Forecast, 2017-2031, by Country

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. ASEAN Countries

14.10.5. South Korea

14.10.6. ANZ

14.10.7. Rest of Asia Pacific

15. Middle East & Africa Railcar Mover Market

15.1. Market Snapshot

15.2. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

15.2.1. Single Purpose

15.2.2. Multi-purpose

15.3. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

15.3.1. Manual

15.3.2. Automatic

15.4. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

15.4.1. Narrow

15.4.2. Standard

15.4.3. Wide gauge

15.5. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

15.5.1. Fuel

15.5.2. Hybrid & Electric

15.6. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

15.6.1. Low (Up to 45,000 lbs.)

15.6.2. High (More than 45,000 lbs.)

15.7. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Application

15.7.1. Loading, Unloading and Repositioning

15.7.2. Forklift Trucks

15.7.3. Railroad Track work Designing & Construction

15.7.4. Locomotive Maintenance

15.7.5. Repair & Overhaul

15.7.6. Raw Material Transportation and Distribution

15.7.7. Freight Transport

15.7.8. Others

15.8. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

15.8.1. Single

15.8.2. Dual

15.9. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by End User

15.9.1. Oil & Gas

15.9.2. Mining

15.9.3. Metal Processing

15.9.4. Power Generation

15.9.5. Chemical & Plastics

15.9.6. Construction

15.9.7. Industrial

15.9.8. Others

15.10. Middle East & Africa Railcar Mover Market Size & Forecast, 2017-2031, by Country

15.10.1. GCC

15.10.2. South Africa

15.10.3. Turkey

15.10.4. Rest of Middle East & Africa

16. South America Railcar Mover Market

16.1. Market Snapshot

16.2. South America Railcar Mover Market Size & Forecast, 2017-2031, by Purpose

16.2.1. Single Purpose

16.2.2. Multi-purpose

16.3. South America Railcar Mover Market Size & Forecast, 2017-2031, by Mode of Operation

16.3.1. Manual

16.3.2. Automatic

16.4. South America Railcar Mover Market Size & Forecast, 2017-2031, by Track Type

16.4.1. Narrow

16.4.2. Standard

16.4.3. Wide gauge

16.5. South America Railcar Mover Market Size & Forecast, 2017-2031, by Propulsion Type

16.5.1. Fuel

16.5.2. Hybrid & Electric

16.6. South America Railcar Mover Market Size & Forecast, 2017-2031, by Tractive Effort

16.6.1. Low (Up to 45,000 lbs.)

16.6.2. High (More than 45,000 lbs.)

16.7. South America Railcar Mover Market Size & Forecast, 2017-2031, by Application

16.7.1. Loading, Unloading and Repositioning

16.7.2. Forklift Trucks

16.7.3. Railroad Track work Designing & Construction

16.7.4. Locomotive Maintenance

16.7.5. Repair & Overhaul

16.7.6. Raw Material Transportation and Distribution

16.7.7. Freight Transport

16.7.8. Others

16.8. South America Railcar Mover Market Size & Forecast, 2017-2031, by Number of Coupling

16.8.1. Single

16.8.2. Dual

16.9. South America Railcar Mover Market Size & Forecast, 2017-2031, by End User

16.9.1. Oil & Gas

16.9.2. Mining

16.9.3. Metal Processing

16.9.4. Power Generation

16.9.5. Chemical & Plastics

16.9.6. Construction

16.9.7. Industrial

16.9.8. Others

16.10. South America Railcar Mover Market Size & Forecast, 2017-2031, by Country

16.10.1. Brazil

16.10.2. Argentina

16.10.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. BOSS RAILCAR MOVERS

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Brandt Road Rail Corporation

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. Calbrandt

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. DJ Products Inc.

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. Leaf Automotive

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. Mitchell Equipment Corporation

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Nordco Inc.

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Rail King

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. Railquip Inc.

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. Shuttlewagon Inc.

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Stewart & Stevenson LLC

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Trackmobile Inc.

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Unilokomotive

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. Wolter Group LLC

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. Zephir S.p.A

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. Other Key Players

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

List of Tables

Table 1: Global Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 2: Global Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 3: Global Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 4: Global Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 5: Global Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 6: Global Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 7: Global Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 8: Global Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 9: Global Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 10: Global Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 11: Global Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 12: Global Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 13: Global Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 14: Global Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 15: Global Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 16: Global Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 17: Global Railcar Mover Market Volume (Units) Forecast, by Region, 2017-2031

Table 18: Global Railcar Mover Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 19: North America Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 20: North America Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 21: North America Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 22: North America Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 23: North America Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 24: North America Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 25: North America Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 26: North America Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 27: North America Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 28: North America Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 29: North America Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 30: North America Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 31: North America Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 32: North America Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 33: North America Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 34: North America Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 35: North America Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Table 36: North America Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Europe Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 38: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 39: Europe Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 40: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 41: Europe Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 42: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 43: Europe Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 44: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 45: Europe Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 46: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 47: Europe Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 48: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 49: Europe Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 50: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 51: Europe Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 52: Europe Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 53: Europe Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Table 54: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 55: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 56: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 57: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 58: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 59: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 60: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 61: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 62: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 63: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 64: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 65: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 66: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 67: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 68: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 69: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 70: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 71: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Table 72: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 73: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 74: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 75: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 76: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 77: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 78: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 79: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 80: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 81: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 82: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 83: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 84: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 85: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 86: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 87: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 88: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 89: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Table 90: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 91: South America Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Table 92: South America Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Table 93: South America Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Table 94: South America Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Table 95: South America Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Table 96: South America Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Table 97: South America Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Table 98: South America Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Table 99: South America Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Table 100: South America Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Table 101: South America Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Table 102: South America Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 103: South America Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Table 104: South America Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Table 105: South America Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Table 106: South America Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Table 107: South America Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Table 108: South America Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 2: Global Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 3: Global Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 4: Global Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 5: Global Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 6: Global Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 7: Global Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 8: Global Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 9: Global Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 10: Global Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 11: Global Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 12: Global Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 13: Global Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 14: Global Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 15: Global Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 16: Global Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 17: Global Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 18: Global Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 19: Global Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 20: Global Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 21: Global Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 22: Global Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 23: Global Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 24: Global Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 25: Global Railcar Mover Market Volume (Units) Forecast, by Region, 2017-2031

Figure 26: Global Railcar Mover Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 27: Global Railcar Mover Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 28: North America Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 29: North America Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 30: North America Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 31: North America Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 32: North America Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 33: North America Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 34: North America Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 35: North America Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 36: North America Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 37: North America Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 38: North America Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 39: North America Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 40: North America Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 41: North America Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 42: North America Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 43: North America Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 44: North America Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 45: North America Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 46: North America Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 47: North America Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 48: North America Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 49: North America Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 50: North America Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 51: North America Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 52: North America Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Figure 53: North America Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: North America Railcar Mover Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Europe Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 56: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 57: Europe Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 58: Europe Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 59: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 60: Europe Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 61: Europe Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 62: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 63: Europe Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 64: Europe Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 65: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 66: Europe Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 67: Europe Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 68: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 69: Europe Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 70: Europe Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 71: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 72: Europe Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 73: Europe Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 74: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 75: Europe Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 76: Europe Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 77: Europe Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 78: Europe Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 79: Europe Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Figure 80: Europe Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 81: Europe Railcar Mover Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 83: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 84: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 85: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 86: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 87: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 88: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 89: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 90: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 91: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 92: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 93: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 94: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 95: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 96: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 97: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 98: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 99: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 100: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 101: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 102: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 103: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 104: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 105: Asia Pacific Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 106: Asia Pacific Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Figure 107: Asia Pacific Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: Asia Pacific Railcar Mover Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 109: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 110: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 111: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 112: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 113: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 114: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 115: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 116: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 117: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 118: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 119: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 120: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 121: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 122: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 123: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 124: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 125: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 126: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 127: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 128: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 129: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 130: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 131: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 132: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 133: Middle East & Africa Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Figure 134: Middle East & Africa Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 135: Middle East & Africa Railcar Mover Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 136: South America Railcar Mover Market Volume (Units) Forecast, by Purpose, 2017-2031

Figure 137: South America Railcar Mover Market Value (US$ Bn) Forecast, by Purpose, 2017-2031

Figure 138: South America Railcar Mover Market, Incremental Opportunity, by Purpose, Value (US$ Bn), 2023-2031

Figure 139: South America Railcar Mover Market Volume (Units) Forecast, by Mode of Operation, 2017-2031

Figure 140: South America Railcar Mover Market Value (US$ Bn) Forecast, by Mode of Operation, 2017-2031

Figure 141: South America Railcar Mover Market, Incremental Opportunity, by Mode of Operation, Value (US$ Bn), 2023-2031

Figure 142: South America Railcar Mover Market Volume (Units) Forecast, by Track Type, 2017-2031

Figure 143: South America Railcar Mover Market Value (US$ Bn) Forecast, by Track Type, 2017-2031

Figure 144: South America Railcar Mover Market, Incremental Opportunity, by Track Type, Value (US$ Bn), 2023-2031

Figure 145: South America Railcar Mover Market Volume (Units) Forecast, by Propulsion Type, 2017-2031

Figure 146: South America Railcar Mover Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 147: South America Railcar Mover Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2023-2031

Figure 148: South America Railcar Mover Market Volume (Units) Forecast, by Tractive Effort, 2017-2031

Figure 149: South America Railcar Mover Market Value (US$ Bn) Forecast, by Tractive Effort, 2017-2031

Figure 150: South America Railcar Mover Market, Incremental Opportunity, by Tractive Effort, Value (US$ Bn), 2023-2031

Figure 151: South America Railcar Mover Market Volume (Units) Forecast, by Application, 2017-2031

Figure 152: South America Railcar Mover Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 153: South America Railcar Mover Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 154: South America Railcar Mover Market Volume (Units) Forecast, by Number of Coupling, 2017-2031

Figure 155: South America Railcar Mover Market Value (US$ Bn) Forecast, by Number of Coupling, 2017-2031

Figure 156: South America Railcar Mover Market, Incremental Opportunity, by Number of Coupling, Value (US$ Bn), 2023-2031

Figure 157: South America Railcar Mover Market Volume (Units) Forecast, by End User, 2017-2031

Figure 158: South America Railcar Mover Market Value (US$ Bn) Forecast, by End User, 2017-2031

Figure 159: South America Railcar Mover Market, Incremental Opportunity, by End User, Value (US$ Bn), 2023-2031

Figure 160: South America Railcar Mover Market Volume (Units) Forecast, by Country, 2017-2031

Figure 161: South America Railcar Mover Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 162: South America Railcar Mover Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031