Reports

Reports

Analysts’ Viewpoint

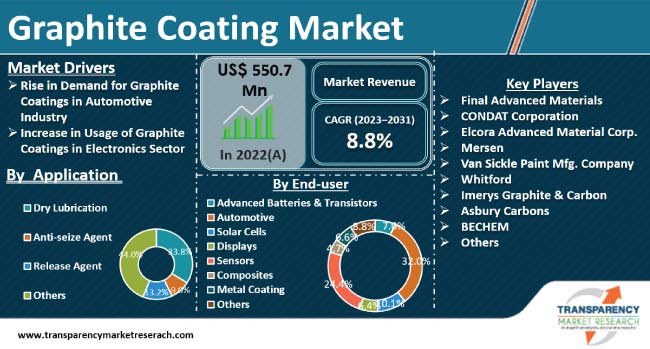

Graphite coatings are highly preferred for their outstanding heat conductivity and lubricating qualities. These properties are boosting graphite coating applications in automotive, electronics, and aerospace industries and consequently, driving the graphite coating industry growth.

Furthermore, emphasis on environmentally friendly and sustainable solutions is projected to fuel the graphite coating market value in the near future. The non-toxic and low environmental impact properties of graphite coating are in line with changing regulatory norms and industry sustainability aims. This offers significant graphite coating market opportunities for businesses seeking to comply with stringent environmental regulations.

Additionally, continuous R&D efforts are projected to generate various graphite-based coating solutions customized to specific industrial requirements. Therefore, the U.S. is expected to witness rapid graphite coating market growth, providing numerous chances for market participants to pioneer, grow, and establish themselves as key players in this expanding industry.

The graphite coating industry, a booming specialty coatings sector, employs tiny graphite particles inside a binding medium to impart specific properties to diverse surfaces. It has several uses in the automotive, aerospace, metallurgy, and electronics sectors. Rise in demand stems from the necessity for tough protective and lubricating coatings in hostile environments. Furthermore, advances in coating technology and increased industrialization contribute to the increasing need for graphite coatings.

Increasing preference for graphite coatings over ceramic ones is fueling the graphite coating market demand. These coatings are applied in two ways: mechanical mixing and solvent coating.

Graphite coatings offer enhanced durability and scratch resistance as compared to other coatings. They can last anywhere from six months to four years. Graphite coatings are employed in diverse industries, including aerospace, automotive, electronics, manufacturing, oil and gas, textiles, and food processing.

Thermal stress does not cause graphite coatings to absorb moisture, distort, rupture, or shrink. Graphite coatings are in high demand in the industrial machining industry because of their exceptional isostatic properties and optimum uniformity. These coatings are employed as dry lubricants on pistons, gears, and other engine components in order to minimize friction.

Graphite coatings reduce heat losses, improve thermal conduction, and act as excellent lubricants for diverse materials. They inhibit oxidation by limiting reactivity and oxygen permeability. This need is expected to increase in the automobile industry, further influencing the graphite coating market dynamics.

Graphite coatings, made with tiny graphite particles, possess excellent lubrication, corrosion resistance, and thermal conductivity. These properties make them extremely important for various automotive applications. One of the key graphite coating market trends witnessed across the globe is the increase in demand for high-performance coatings, such as graphite, in the automotive sector. This rise in demand is being driven by the need to improve efficiency and durability in vehicle production.

Graphite, a mineral composed entirely of carbon, is sought for its high conductivity, making it an important component in the manufacturing of conductive products. Graphite powder is widely used as an effective conductive filler. According to Elcora Advanced Materials Corp., a vertically integrated graphite and graphene firm, conductive graphite coatings are used in mobile phones, tablets, laptops, television screens, and other displays. Graphite coatings also serve as useful protective layers due to their exceptional resistance to chemicals, moisture, corrosion, UV, and fire.

In March 2018, The University of Bristol collaborated with Microsemi, a chip manufacturing firm, to increase the dependability of micro machined relays using graphite coatings. The graphite coating is expected to preserve the relay tips from deterioration over millions of switching cycles, while also providing a dependable electrical contact.

Graphite coatings are gaining popularity in the electronics industry. These unique coatings, which are impregnated with graphite particles, provide several benefits for electrical components and gadgets. They excel in heat dissipation, electrical conductivity, and electromagnetic interference shielding. This increase in use highlights the growing importance of graphite coatings in improving the performance of electronic equipment.

Continual improvements and shrinking of electronic equipment has fuelled the need for high-performance coatings, such as graphite. Rise in preference for graphite coatings to improve the efficacy and dependability of electrical goods is estimated to positively impact the graphite coating market forecast in the next few years.

According to the latest graphite coating market analysis, prominent companies have employed various techniques to preserve their leading positions and enhance their graphite coating market share. The global graphite coating industry landscape is robust, with several chances for expansion and innovation. Some of the notable players operating in the global market include Final Advanced Materials, CONDAT Corporation, Elcora Advanced Material Corp., Mersen, Van Sickle Paint Mfg. Company, Whitford, Imerys Graphite & Carbon, Asbury Carbon, and BECHEM.

Key companies in the graphite coating industry research report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 550.7 Mn |

| Forecast (Value) in 2031 | US$ 1.1 Bn |

| Growth Rate (CAGR) | 8.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Tons | US$ Mn/Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope |

Available upon request |

| Pricing | Available upon request |

The market was valued at US$ 550.7 Mn in 2022

It is expected to expand at a CAGR of 8.8% from 2023 to 2031

Rise in demand for graphite coatings in automotive industry and increase in usage of graphite coatings in electronics sector

In terms of end-user, the automotive segment held largest share in 2022

Final Advanced Materials, CONDAT Corporation, Elcora Advanced Material Corp., Mersen, Van Sickle Paint Mfg. Company, Whitford, Imerys Graphite & Carbon, Asbury Carbon, BECHEM.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Graphite Coating Market Analysis and Forecasts, 2023-2031

2.6.1. Graphite Coating Market Volume (Kilo Tons)

2.6.2. Graphite Coating Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Component Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealer/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Graphite Coating

3.2. Impact on the Demand of Graphite Coating– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. U.S.

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Region

7. Graphite Coating Market Analysis and Forecast, by Application, 2023-2031

7.1. Introduction and Definitions

7.2. Graphite Coating Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

7.2.1. Dry Lubrication

7.2.2. Anti-seize Agents

7.2.3. Release Agents

7.2.4. Others

7.3. Graphite Coating Market Attractiveness, by Application

8. Graphite Coating Market Analysis and Forecast, by End-user, 2023-2031

8.1. Introduction and Definitions

8.2. Graphite Coating Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023-2031

8.2.1. Advanced Batteries & Transistors

8.2.2. Automotive

8.2.3. Solar Cells

8.2.4. Displays

8.2.5. Sensors

8.2.6. Composites

8.2.7. Metal coating

8.2.8. Others

8.3. Graphite Coating Market Attractiveness, by End-user

9. U.S. Graphite Coating Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.1.1. U.S. Graphite Coating Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

9.1.2. U.S. Graphite Coating Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2023-2031

9.2. U.S Graphite Coating Market Attractiveness Analysis

10. Competition Landscape

10.1. Market Players - Competition Matrix (by Tier and Size of Companies)

10.2. Market Share Analysis, 2021

10.3. Market Footprint Analysis

10.3.1. By Application

10.3.2. By End-user

10.4. Company Profiles

10.4.1. Final Advanced Materials

10.4.1.1. Company Revenue

10.4.1.2. Business Overview

10.4.1.3. Product Segments

10.4.1.4. Geographic Footprint

10.4.1.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.1.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.2. CONDAT Corporation

10.4.2.1. Company Revenue

10.4.2.2. Business Overview

10.4.2.3. Product Segments

10.4.2.4. Geographic Footprint

10.4.2.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.2.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.3. Elcora Advanced Materials Corp.

10.4.3.1. Company Revenue

10.4.3.2. Business Overview

10.4.3.3. Product Segments

10.4.3.4. Geographic Footprint

10.4.3.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.3.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.4. Mersen

10.4.4.1. Company Revenue

10.4.4.2. Business Overview

10.4.4.3. Product Segments

10.4.4.4. Geographic Footprint

10.4.4.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.4.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.5. Van Sickle Paint Mfg. Company

10.4.5.1. Company Revenue

10.4.5.2. Business Overview

10.4.5.3. Product Segments

10.4.5.4. Geographic Footprint

10.4.5.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.5.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.6. Whitford

10.4.6.1. Company Revenue

10.4.6.2. Business Overview

10.4.6.3. Product Segments

10.4.6.4. Geographic Footprint

10.4.6.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.6.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.7. Imerys Graphite & Carbon

10.4.7.1. Company Revenue

10.4.7.2. Business Overview

10.4.7.3. Product Segments

10.4.7.4. Geographic Footprint

10.4.7.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.7.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.8. Asbury Carbons

10.4.8.1. Company Revenue

10.4.8.2. Business Overview

10.4.8.3. Product Segments

10.4.8.4. Geographic Footprint

10.4.8.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.8.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

10.4.9. BECHEM

10.4.9.1. Company Revenue

10.4.9.2. Business Overview

10.4.9.3. Product Segments

10.4.9.4. Geographic Footprint

10.4.9.5. Production Type/Plant Details, etc. (*As Applicable)

10.4.9.6. Strategic Partnership, Coat Type Expansion, New Product Innovation, etc.

11. Primary Research: Key Insights

12. Appendix

List of Tables

Table 1: Graphite Coating Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 2: Graphite Coating Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 3: Graphite Coating Market Volume (Kilo Tons) Forecast, by End-user, 2023-2031

Table 4: Graphite Coating Market Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 5: U.S. Graphite Coating Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 6: U.S. Graphite Coating Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 7: U.S. Graphite Coating Market Volume (Kilo Tons) Forecast, by End-user, 2023-2031

Table 8: U.S. Graphite Coating Market Value (US$ Mn) Forecast, by End-user, 2023-2031

List of Figures

Figure 1: Graphite Coating Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 2: Graphite Coating Market Attractiveness, by Application

Figure 3: Graphite Coating Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 4: Graphite Coating Market Attractiveness, by End-user

Figure 5: U.S. Graphite Coating Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: U.S. Graphite Coating Market Attractiveness, by Application

Figure 7: U.S. Graphite Coating Market Volume Share Analysis, by End-user, 2022, 2027, and 2031

Figure 8: U.S. Graphite Coating Market Attractiveness, by End-user