Reports

Reports

Analyst Viewpoint

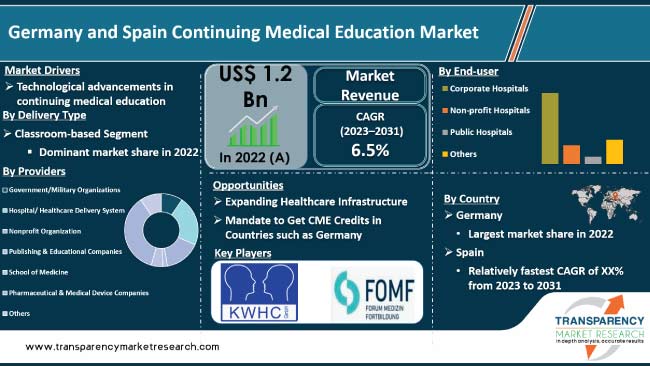

Continuing Medical Education (CME) in Europe has seen significant developments and plays a crucial role in maintaining the competence and professional development of healthcare professionals. Several countries have mandatory CME requirements, where healthcare professionals must accrue a certain number of credits or hours of education to maintain their licenses or professional certifications. These requirements are often set by regulatory bodies or professional associations and are likely to fuel continuing medical education market progress in countries such as Germany and Spain.

Furthermore, collaboration between CME providers is common in Germany and Spain. Universities, medical schools, professional associations, and healthcare institutions often work together to develop and deliver CME programs. This allows for a broader range of expertise and resources to be brought together, resulting in high-quality educational offerings.

Continuing medical education (CME) is a long established means for medical professionals to maintain and update competence and learn about new and developing areas in their field, such as therapeutic advances. CME activities may take place as live events, written publications, online programs, and audio, video, or other electronic media.

Funding of these programs has been largely provided by pharmaceutical and medtech companies. The CME market has experienced steady growth over the years, driven by factors such as the rapid advancement of medical knowledge, technological innovations, increase in regulatory requirements, and the need for healthcare professionals to maintain their licensure and certifications.

The CME market development is expected to be influenced by the fact that demand for continuous professional development remains high. Advancements in technology, increase in emphasis on competency-based education, and integration of CME into healthcare systems are likely to be major market catalysts.

Healthcare professionals are encouraged to stay updated with the latest research findings, technological advancements, and evidence-based practices. Medical education is increasingly adopting curriculums that are based on cognitive, psychomotor, and affective domains of learning. These reforms are directed toward best standards of care, patient safety & error management, patient autonomy, and resource allocation. There is a dramatic shift across the world in the method of medical education toward hands on/experiential medical learning even in Germany and Spain.

Several medical apps are available for iPhones and Android devices; many of these focus on anatomy and physiology, while others address medical problem solving, diagnosis, and treatment. For instance, Stanford University has a “Student App” webpage and Stanford apps that can be obtained from the Apple store. A number of medical apps are also available to be used on tablets as well as phones.

Recent Germany and Spain continuing medical education market trends include the surge in application of digital games to train medical professionals. Digital games provide training tools that offer challenging simulated environments, and are used to train future surgeons.

Based on delivery mode, the Germany and Spain continuing medical education market segmentation includes classroom-based, e-learning, and others.

While digital and online formats have gained significant traction in recent years, it is true that classroom-based learning still dominates the market in terms of the delivery of lessons in continuing medical education in the year 2022.

Classroom-based CME allows for direct interaction between learners and instructors. It provides an opportunity for healthcare professionals to engage in discussions, ask questions, and participate in hands-on activities or simulations. Additionally, it facilitates networking and collaboration among participants, enabling the exchange of experiences and best practices.

In a classroom setting, instructors can observe learners' reactions, body language, and engagement levels, allowing them to adjust their teaching methods and content delivery accordingly. Learners can receive immediate feedback on their understanding of the material and address any misconceptions or gaps in knowledge promptly. All these factors are expected to drive the segment during the forecast period.

According to the latest Germany and Spain continuing medical education market forecast, Germany holds dominant share. Emphasis on research and innovation in the healthcare system drives the market share in the country.

Germany is the largest pharmaceutical market in Europe and the fourth-largest in the world. The country has a highly-developed healthcare system, and demand for pharmaceuticals is driven by its aging population and high prevalence of chronic diseases. These factors are driving the need for continuing medical education in the country.

As per the Germany and Spain continuing medical education market analysis, the sector is fragmented, with the presence of several players in these countries. Leading companies are focusing on collaborations with other players to increase market share.

KWHC GmbH, Sciarc GmbH, GE Healthcare (General Electric Company), Kenes Group, MEDAHCON GmbH, FomF GmbH, Zimmer Biomet Holdings, Inc., Relias LLC, Medscape, and The France Foundation are the prominent players in the Germany and Spain continuing medical education market.

Key players in the continuing medical education market report have been profiled based on parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.2 Bn |

| Market Forecast (Value) in 2031 | More than US$ 2.2 Bn |

| Growth Rate (CAGR) | 6.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, and key trends. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.2 Bn in 2022

It is projected to reach more than US$ 2.2 Bn by 2031

The CAGR is anticipated to be 6.5% from 2023 to 2031

Rise in adoption of online programs and technological advancements in continuing medical education

The pharmaceutical & medical device companies segment accounted for major share in 2022

Germany is expected to account for major share during the forecast period

KWHC GmbH, Sciarc GmbH, GE Healthcare (General Electric Company), Kenes Group, MEDAHCON GmbH, FomF GmbH, Zimmer Biomet Holdings, Inc., Relias LLC, Medscape, and The France Foundation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Germany and Spain Continuing Medical Education Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.3.4. 4.4.4. Germany and Spain Continuing Medical Education Market Analysis and Forecasts, 2017–2031

5. Key Insights

5.1. Regulatory Context of CME

5.2. Population of Healthcare Professionals - Overview

5.3. Overview of CME Contents

5.4. Preference Analysis of Healthcare Profession - CME System

5.5. Events Sponsorship: CME Market

5.6. Technological Overview

5.7. Some Key CME Events Providers

5.8. B2B and B2C Providers: CME Market

5.9. CME-Trend Overview

6. Germany Continuing Medical Education Market Analysis and Forecast

6.1. Introduction

6.1.1. Key Findings

6.2. Market Value Forecast, by Delivery Mode, 2017–2031

6.2.1. Class Room Based

6.2.2. E-Learning

6.2.3. Others

6.3. Market Value Forecast, by Specialty, 2017–2031

6.3.1. Cardiothoracic Training

6.3.2. Neurology Training

6.3.3. Orthopedic Training

6.3.4. Oral and Maxillofacial Training

6.3.5. Pediatric Training

6.3.6. Radiology Training

6.3.7. Others

6.4. Market Value Forecast, by Provider, 2017–2031

6.4.1. Government/Military Organizations

6.4.2. Hospital/Healthcare Delivery System

6.4.3. Nonprofit Organization

6.4.4. Publishing & Educational Companies

6.4.5. School of Medicine

6.4.6. Pharmaceutical & Medical Device Companies

6.4.7. Others

6.5. Market Value Forecast, by End-user, 2017–2031

6.5.1. Corporate Hospitals

6.5.2. Nonprofit Hospitals

6.5.3. Public Hospitals

6.5.4. Others

6.6. Market Attractiveness Analysis

6.6.1. By Delivery Mode

6.6.2. By Specialty

6.6.3. By Provider

6.6.4. By End-user

7. Spain Continuing Medical Education Market Analysis and Forecast

7.1. Introduction

7.1.1. Key Findings

7.2. Market Value Forecast, by Delivery Mode, 2017–2031

7.2.1. Class Room Based

7.2.2. E-Learning

7.2.3. Others

7.3. Market Value Forecast, by Specialty, 2017–2031

7.3.1. Cardiothoracic Training

7.3.2. Neurology Training

7.3.3. Orthopedic Training

7.3.4. Oral and Maxillofacial Training

7.3.5. Pediatric Training

7.3.6. Radiology Training

7.3.7. Others

7.4. Market Value Forecast, by Provider, 2017–2031

7.4.1. Government/Military Organizations

7.4.2. Hospital/Healthcare Delivery System

7.4.3. Nonprofit Organization

7.4.4. Publishing & Educational Companies

7.4.5. School of Medicine

7.4.6. Pharmaceutical & Medical Device Companies

7.4.7. Others

7.5. Market Value Forecast, by End-user, 2017–2031

7.5.1. Corporate Hospitals

7.5.2. Nonprofit Hospitals

7.5.3. Public Hospitals

7.5.4. Others

7.6. Market Attractiveness Analysis

7.6.1. By Delivery Mode

7.6.2. By Specialty

7.6.3. By Provider

7.6.4. By End-user

8. Competition Landscape

8.1. Germany and Spain Continuing Medical Education Market : Company Share Analysis (2022)

8.2. Company Profiles

8.2.1. KWHC GmbH

8.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.1.2. Product Portfolio

8.2.1.3. Financial Overview

8.2.1.4. SWOT Analysis

8.2.1.5. Strategic Overview

8.2.2. Sciarc GmbH

8.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.2.2. Product Portfolio

8.2.2.3. Financial Overview

8.2.2.4. SWOT Analysis

8.2.2.5. Strategic Overview

8.2.3. GE Healthcare

8.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.3.2. Product Portfolio

8.2.3.3. Financial Overview

8.2.3.4. SWOT Analysis

8.2.3.5. Strategic Overview

8.2.4. Kenes Group

8.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.4.2. Product Portfolio

8.2.4.3. Financial Overview

8.2.4.4. SWOT Analysis

8.2.4.5. Strategic Overview

8.2.5. MEDAHCON GmbH

8.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.5.2. Product Portfolio

8.2.5.3. Financial Overview

8.2.5.4. SWOT Analysis

8.2.5.5. Strategic Overview

8.2.6. FomF GmbH

8.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.6.2. Product Portfolio

8.2.6.3. Financial Overview

8.2.6.4. SWOT Analysis

8.2.6.5. Strategic Overview

8.2.7. Zimmer Biomet Holdings, Inc.

8.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.7.2. Product Portfolio

8.2.7.3. Financial Overview

8.2.7.4. SWOT Analysis

8.2.7.5. Strategic Overview

8.2.8. Relias LLC

8.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.8.2. Product Portfolio

8.2.8.3. Financial Overview

8.2.8.4. SWOT Analysis

8.2.8.5. Strategic Overview

8.2.9. Medscape

8.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.9.2. Product Portfolio

8.2.9.3. Financial Overview

8.2.9.4. SWOT Analysis

8.2.9.5. Strategic Overview

8.2.10. The France Foundation

8.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

8.2.10.2. Product Portfolio

8.2.10.3. Financial Overview

8.2.10.4. SWOT Analysis

8.2.10.5. Strategic Overview

List of Tables

Table 01: Germany Continuing Medical Education Delivery Mode Market Value (US$ Mn) Forecast, Delivery Mode, 2017-2031

Table 02: Germany Continuing Medical Education Market Value (US$ Mn) Forecast, by Training Type, 2017-2031

Table 03: Germany Continuing Medical Education Market Value (US$ Mn) Forecast, by Provider, 2017-2031

Table 04: Germany Continuing Medical Education Delivery Mode Market Value (US$ Mn) Forecast, End-user, 2017-2031

Table 05: Spain Continuing Medical Education Delivery Mode Market Value (US$ Mn) Forecast, Delivery Mode, 2017-2031

Table 06: Spain Continuing Medical Education Market Value (US$ Mn) Forecast, by Training Type, 2017-2031

Table 07: Spain Continuing Medical Education Market Value (US$ Mn) Forecast, by Provider, 2017-2031

Table 08: Spain Continuing Medical Education Delivery Mode Market Value (US$ Mn) Forecast, End-user, 2017-2031

List of Figures

Figure 01: Germany Continuing Medical Education Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Germany Continuing Medical Education Market Value Share Analysis, by Delivery Mode, 2022 and 2031

Figure 03: Germany Continuing Medical Education Market Attractiveness Analysis, by Delivery Mode, 2023–2031

Figure 04: Germany Continuing Medical Education Market Value Share Analysis, by Training Type, 2022 and 2031

Figure 05: Germany Continuing Medical Education Market Attractiveness Analysis, by Training Type, 2023–2031

Figure 06: Germany Continuing Medical Education Market Value Share Analysis, by Provider, 2022 and 2031

Figure 07: Germany Continuing Medical Education Market Attractiveness Analysis, by Provider, 2023–2031

Figure 08: Germany Continuing Medical Education Market Value Share Analysis, by End-user, 2022 and 2031

Figure 09: Germany Continuing Medical Education Market Attractiveness Analysis, by End-user, 2023–2031

Figure 10: Spain Continuing Medical Education Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: Spain Continuing Medical Education Market Value Share Analysis, by Delivery Mode, 2022 and 2031

Figure 12: Spain Continuing Medical Education Market Attractiveness Analysis, by Delivery Mode, 2023–2031

Figure 13: Spain Continuing Medical Education Market Value Share Analysis, by Training Type, 2022 and 2031

Figure 14: Spain Continuing Medical Education Market Attractiveness Analysis, by Training Type, 2023–2031

Figure 15: Spain Continuing Medical Education Market Value Share Analysis, by Provider, 2022 and 2031

Figure 16: Spain Continuing Medical Education Market Attractiveness Analysis, by Provider, 2023–2031

Figure 17: Spain Continuing Medical Education Market Value Share Analysis, by End-user, 2022 and 2031

Figure 18: Spain Continuing Medical Education Market Attractiveness Analysis, by End-user, 2023–2031